0001856525false00018565252024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

___________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024 (February 7, 2024)

__________________________

Core & Main, Inc.

(Exact name of registrant as specified in its charter)

_________________________

| | | | | | | | |

| Delaware | 001-40650 | 86-3149194 |

(State or other jurisdiction

of incorporation) | (Commission

File Number | (IRS Employer

Identification No.) |

| | | | | | | | |

| 1830 Craig Park Court | | |

St. Louis, Missouri | | 63146 |

| (Address of principal executive offices) | | (Zip Code) |

(314) 432-4700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

___________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Each Exchange

on Which Registered |

| Class A common stock, par value $0.01 per share | | CNM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers

Departure of Directors affiliated with Clayton, Dubilier & Rice, LLC

On February 7, 2024, James G. Berges informed Core & Main, Inc. (the “Company”) of his decision to resign from his position as Chair of the board of directors (the “Board”) of the Company, various committees of the Board and as a member of the Board, effective immediately. Further, on February 7, 2024, Ian A. Rorick, Nathan K. Sleeper and Jonathan L. Zrebiec each informed the Company of their decision to resign from their positions as members of the Board, effective immediately. Messrs. Berges, Rorick, Sleeper and Zrebiec are affiliated with the private equity firm Clayton, Dubilier & Rice, LLC (“CD&R”), and have resigned as members of the Board in connection with the successful exit of CD&R’s investment in the Company, which was completed on January 25, 2024.

Appointment of Stephen O. LeClair as Chairman of the Board and James G. Castellano as Lead Independent Director

On February 7, 2024, the Board, upon the recommendation of the Nominating and Governance Committee of the Board, appointed Stephen O. LeClair to replace James G. Berges as Chair of the Board. Mr. LeClair is and will continue to be the Chief Executive Officer (“CEO”) of the Company and has served as CEO and a member of the Board since 2021.

In addition, the Board, upon the recommendation of the Nominating and Governance Committee of the Board, appointed James G. Castellano to the newly created position of Lead Independent Director of the Board. Mr. Castellano, who joined the Board in 2021, will continue to serve as Chair of the Board’s Audit Committee.

Item 8.01. Other Events

On February 7, 2024, the Board resolved to reduce the Board size from twelve members to eight members by eliminating the vacancies resulting from the resignations of Messrs. Berges, Sleeper, Rorick and Zrebiec.

On February 8, 2024, the Company issued a press release announcing, among other things, the resignations of Messrs. Berges, Rorick, Sleeper and Zrebiec as directors, the appointment of Mr. LeClair as Chair of the Board and appointment of Mr. Castellano as Lead Independent Director, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document)* |

* Filed herewith.

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Core & Main, Inc. |

| | |

| By: | /s/ Mark G. Whittenburg |

| Name: | Mark G. Whittenburg |

| Title: | General Counsel and Secretary |

Date: February 8, 2024

FOR IMMEDIATE RELEASE

Core & Main Elects Stephen LeClair as Chairman of Board as

Clayton, Dubilier & Rice Sells Remaining Stake

ST. LOUIS, Feb. 8, 2024—Core & Main Inc. (NYSE: CNM), a leader in advancing reliable infrastructure with local service, nationwide, today announced that its board of directors has elected Stephen O. LeClair as the new chairman of the board, effective immediately. LeClair will continue serving as chief executive officer of Core & Main. James G. Castellano will serve as lead independent director, in addition to his responsibilities as the audit committee chair, and Kathleen M. Mazzarella will serve as chair of the nominating and governance committee.

In addition to these changes, James G. Berges, Nathan L. Sleeper, Jonathan L. Zrebiec and Ian A. Rorick, all affiliates of Clayton, Dubilier & Rice (CD&R), have resigned from Core & Main’s board after serving since 2017, when CD&R assumed a majority stake in Core & Main. CD&R sold its remaining stake in Core & Main in January 2024.

“I would like to thank Jim, Nate, J.L. and Ian for serving on the board for the last several years. Their leadership helped guide Core & Main into what it is today,” said LeClair. “I am honored to have been appointed chairman of the board and I have never been more excited about the opportunities that lie ahead for Core & Main. Our focus continues to be on delivering local service, nationwide, while driving profitable growth, generating strong cash flow and delivering superior value to our shareholders.”

“It has been a privilege serving as Core & Main’s chairman of the board and helping the business become an independent public company,” said Berges. “During this time, Core & Main generated significant growth and expanded their products, services and capabilities to provide more value to their customers.”

About Core & Main

Based in St. Louis, Core & Main is a leader in advancing reliable infrastructure™ with local service, nationwide®. As a leading specialized distributor with a focus on water, wastewater, storm drainage and fire protection products, and related services, Core & Main provides solutions to municipalities, private water companies and professional contractors across municipal, non-residential and residential end markets, nationwide. With approximately 320 locations across the U.S., the company provides its customers local expertise backed by a national supply chain. Core & Main’s 4,500 associates are committed to helping their communities thrive with safe and reliable infrastructure. Visit coreandmain.com to learn more.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this press release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Core & Main’s financial and operating outlook, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements.

Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

Investor Relations:

Robyn Bradbury, 314-995-9116

InvestorRelations@CoreandMain.com

Core & Main Announces Changes to Board of Directors

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

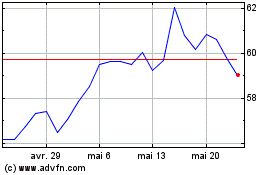

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024