Report of Foreign Issuer (6-k)

05 Décembre 2019 - 5:29PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2019

Commission File Number: 001-37723

Enel Chile S.A.

(Translation of Registrant’s Name into English)

Santa Rosa 76

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [X]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [X]

Indicate by check mark whether by furnishing the information

ontained in this Form, the Registrant is also thereby furnishing the

information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes [ ] No [X]

If °;Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

SIGNIFICANT EVENT

Enel Chile S.A.

Securities Registration Record N° 1139

Santiago, December 05, 2019

Ger. Gen. Nº29/2019

Mr. Joaquín Cortés Huerta

Chairman

Financial Market Commission

1449 Libertador Bernardo O’Higgins Ave.

Santiago, Chile

Ref.: SIGNIFICANT EVENT

Dear Sir,

In accordance with articles 9 and 10, paragraph 2 under Securities Market Law No. 18,045, and as established under General Norm No. 30 of said Commission, I, duly authorized, hereby attach as the following Significant Event, the press release issued today by our parent company, Enel SpA, in which the Italian company informs the market that it has entered into two agreements with a financial institution to increase its shareholding in Enel Chile S.A. ("Enel Chile") by up to 3%, in addition to its current stake of 61.9%. More details can be found in the attached press release.

The financial effects of this transaction are not quantifiable as of today.

Sincerely,

Paolo Pallotti

Chief Executive Officer

c.c.: Banco Central de Chile (Central Bank of Chile)

Bolsa de Comercio de Santiago (Santiago Stock Exchange)

Bolsa Electrónica de Chile (Chile Electronic Stock Exchange)

Banco Santander Santiago - Representantes Tenedores de Bonos (Bondholders Representative)

Depósito Central de Valores (Central Securities Depositary)

Comisión Clasificadora de Riesgos (Risk Rating Commission)

|

|

Media Relations

T +39 06 8305 5699

ufficiostampa@enel.com

enel.com

|

Investor Relatios

T +39 06 8305 7975

investor.relations@enel.com

enel.com

|

ENEL TO INCREASE ITS STAKE IN ENEL CHILE BY UP TO 3%

· Enel has entered into two share swap transactions with a financial institution to increase its shareholding in Enel Chile from the current 61.9% stake

Rome, December 5th, 2019 – Enel S.p.A. (“Enel”) has entered into two share swap transactions (the “Swap Transactions”) with a financial institution to increase its shareholding in its listed Chilean subsidiary Enel Chile S.A. (“Enel Chile”) by up to 3% from the current 61.9% stake. Pursuant to the Swap Transactions, Enel may acquire, on dates that are expected to occur no later than the fourth quarter of 2020:

· up to 1,763,747,209 shares of Enel Chile’s common stock; and

· up to 6,224,990 of Enel Chile’s American Depositary Shares (“ADSs”), each representing 50 shares of Enel Chile’s common stock.

The above-mentioned shares of Enel Chile’s common stock and ADSs represent up to 3.0% of the company’s entire share capital.

The number of shares of Enel Chile’s common stock and Enel Chile’s ADSs actually acquired by Enel, pursuant to the Swap Transactions, will depend on the ability of the financial institution to establish its hedge positions with respect to the Swap Transactions.

The amount payable for any shares of Enel Chile’s common stock acquired will be based on the prices at which the financial institution establishes its hedge with respect to the corresponding Swap Transaction. The amount payable for any of Enel Chile’s ADSs acquired will be based on the volume-weighted average prices of Enel Chile’s ADSs during the period in which the financial institution establishes its hedge with respect to the corresponding Swap Transaction.

Prior to settlement, Enel will not have any right to dispose of or vote any shares of Enel Chile’s common stock or Enel Chile’s ADSs acquired or held by the financial institution as a hedge in connection with the corresponding Swap Transaction.

Enel’s payment obligations under the Swap Transactions will be funded through internal cash flow generation.

These transactions are in line with the Enel Group’s 2020-2022 Strategic Plan announced to the markets, which foresees the buyout of minorities in South America.

1

Enel SpA – Registered Office: 00198 Rome – Italy - Viale Regina Margherita 137 – Companies Register of Rome and Tax I.D. 00811720580 - R.E.A. 756032 – VAT Code 00934061003 – Stock Capital Euro 10,166,679,946 fully paid-in.

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

Enel Chile S.A.

|

|

|

|

|

|

By: /s/ Paolo Pallotti

|

|

|

--------------------------------------------------

|

|

|

|

|

|

Title: Chief Executive Officer

|

Date: December 5, 2019

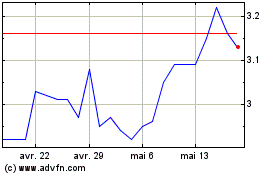

Enel Chile (NYSE:ENIC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

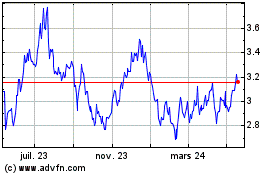

Enel Chile (NYSE:ENIC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025