Form 425 - Prospectuses and communications, business combinations

12 Septembre 2024 - 11:15PM

Edgar (US Regulatory)

Filed by John Bean Technologies Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Companies:

John Bean

Technologies Corporation

(Commission File No. 001-34036)

Marel hf.

The following is an excerpt from a

memo sent to all JBT and Marel employees.

Dear Team,

As we continue our journey towards the proposed combination of JBT and Marel, we remain committed to transparency and sharing updates as we progress. In that

spirit, we have news to share on our proposed future organization design. None of these changes are effective until the proposed transaction closes, which is still expected to occur near year-end.

Preparing for Success

Our goal in bringing JBT and Marel

together is to create a leading food and beverage technology company that plays an instrumental role in fortifying and transforming the way food is processed. As part of that, it has also been about deepening the strengths and complementarity of our

portfolios to create an even fuller range of products and services that meet customers’ needs, provide a seamless experience, and expand our global footprint. Together, as a world-class team of experts across technology, markets, products, and

processes we will have the opportunity to provide industry-leading solutions and services.

Our Proposed Organizational Structure

We approached our combined organizational design to ensure that we have a platform in which we can achieve great success together, with a clear focus on our

customers. To this end, the details below reflect the extensive work we have undertaken to best combine our businesses and portfolios in a manner designed to harness our distinctive strengths, provide the most benefit to those we serve, and allow

our teams to thrive.

Divisions

Through

thoughtful consideration of our combined value proposition, we have outlined four key divisions. Our leaders have been deeply involved throughout this process, working together to align on the structures that will best serve our current and future

customers, and strengthen how we go to market. Below is a high-level view of some of the thinking that went into these decisions.

| |

• |

|

Poultry: We are combining our greatest strengths to serve poultry customers better than anyone else in the

world. |

| |

• |

|

Fish and Retail & Foodservice Solutions (RFS): We are building what we believe to

be the most comprehensive primary and secondary fish business in the market and strengthening our foothold in fresh processing. |

| |

• |

|

Meat and Prepared Foods: We are leveraging strong track records and respected brand names with trusted

leadership to drive excellence in primary, cut-up/debone and prepared processing. |

| |

• |

|

Diversified Food & Health: Diversified Food & Health already has a strong

global portfolio across a diverse set of end markets, and this integration opens the opportunity for industry leadership in the high-growth pet food market. |

As it relates to the divisions there are few things to note for now:

Customer Care/Service: Service is key to our customer relationships. Our joint Service IPT, with support of divisional and service leaders, are working

together to design our future service model. Currently, JBT operates in a decentralized model while Marel operates more centrally. We are making efforts to design a future service model that ensures the highest quality customer experience.

Digital & Software: Our Digital & Software team will concentrate on creating innovative solutions for our

customers and delivering cutting-edge products that enhance their success. The Integration Planning Team (IPT) work will further outline the path forward as Marel currently organizes more as a business unit while JBT organizes more as a function.

Functions

The full function design is still being

refined by our leadership team. We are excited by this opportunity to leverage our broad, deep, and diverse expertise for a more sustainable, stronger food supply. Detail further mapped below.

| |

• |

|

Finance: We’re bringing together our financial teams to streamline processes, optimize resources, and

support our long-term growth objectives. Finance will also work closely with strategy to ensure we are fulfilling our objectives effectively. |

| |

• |

|

Human Resources: Our HR teams are uniting to foster a culture of growth, inclusion, and engagement.

Together, we are creating a cohesive strategy that supports our employees’ development, ensures a thriving, collaborative workplace, and drives change. |

| |

• |

|

Legal: Our Legal teams are coming together to ensure seamless integration and compliance across all

regions. By combining our expertise, we’re building a robust legal framework that supports our business goals and protects our shared interests. |

| |

• |

|

Information Technology: We’re refining our focus to best support both internal operations and

customer needs. Our IT team will be dedicated to participating and delivering in strategic enterprise and technology planning, optimizing internal systems and infrastructure, ensuring productive and efficient company-wide operations.

|

| |

• |

|

Supply Chain: We’re aligning our supply chain operations to enhance efficiency and resilience. By

driving continuous improvement and integrating our manufacturing, logistics and procurement efforts, we’re ensuring a smooth, reliable flow of products and services to meet our customers’ needs. |

| |

• |

|

Strategy & Innovation: We’re creating a strong strategic role that will focus

on areas such as global marketing, strategy, M&A, sustainability and innovation. Aligning how we approach innovation, creating a global team to lead this work while keeping innovation as core to our strategy and close to our product business and

customer needs will enhance our leading portfolio even further. |

Regional Structures

Regional, division and service leaders, with input from the IPT, will collaborate closely to define the best structures in all regions. The role our

teams in the regions play in driving business on the ground will continue to be core to our success. We recognize that markets and customers can look different between regions, and we’ll continue to serve them with empowered local teams.

To reiterate, none of these changes are effective until the proposed transaction is finalized. Look out for invitations to upcoming town halls, where you will

have the chance to learn more information and ask questions.

In Progress

Working closely with the IPT, our corporate and division leaders will oversee the design of their respective structures going forward.

JBT + Marel Information Site:

We encourage you to visit

our information site regularly to learn more about the integration, ask questions, and stay up to date on the latest news.

Important to

Remember

Until the combination of our companies is finalized, we’re still two separate entities. Please continue conducting business as usual, and

do not engage in any informal communications or planning for a future combination outside of any direct support that you are asked to provide to the appointed integration planning team.

We are grateful for your continued flexibility, dedication, and engagement as we take these next critical

steps forward together.

With enthusiasm and optimism,

Brian Deck

President & CEO

JBT Corporation

Forward-Looking Statements

This communication contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are

information of a non-historical nature and are subject to risks and uncertainties that are beyond JBT’s ability to control. These forward-looking statements include, among others, statements relating to

our business and our results of operations, a potential transaction with Marel, our strategic plans, our restructuring plans and expected cost savings from those plans, and our liquidity. The factors that could cause our actual results to differ

materially from expectations include, but are not limited to, the following factors: the occurrence of any event, change or other circumstances that could give rise to the termination or abandonment of the voluntary takeover offer to acquire all

issued and outstanding shares of Marel (the “Offer”); the expected timing and likelihood of completion of the proposed transaction with Marel, including the timing, receipt and terms and conditions of any required governmental and

regulatory approvals for the Offer that could reduce anticipated benefits or cause the parties to abandon the transaction; the risk that Marel and/or JBT may not be able to satisfy the conditions to the Offer in a timely manner or at all; the risk

that the Offer and its announcement could have an adverse effect on the ability of JBT and Marel to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers, and on their operating results and

businesses generally; the risk that problems may arise in successfully integrating the businesses of Marel and JBT, which may result in the combined company not operating as effectively and efficiently as expected; the risk that the combined company

may be unable to achieve cost-cutting synergies or that it may take longer than expected to achieve those synergies; fluctuations in our financial results; unanticipated delays or accelerations in our sales cycles; deterioration of economic

conditions, including impacts from supply chain delays and reduced material or component availability; inflationary pressures, including increases in energy, raw material, freight and labor costs; disruptions in the political, regulatory, economic

and social conditions of the countries in which we conduct

business; changes to trade regulation, quotas, duties or tariffs; fluctuations in currency exchange rates; changes in food consumption patterns; impacts of pandemic illnesses, food borne

illnesses and diseases to various agricultural products; weather conditions and natural disasters; the impact of climate change and environmental protection initiatives; acts of terrorism or war, including the ongoing conflicts in Ukraine and the

Middle East; termination or loss of major customer contracts and risks associated with fixed-price contracts, particularly during periods of high inflation; customer sourcing initiatives; competition and innovation in our industries; our ability to

develop and introduce new or enhanced products and services and keep pace with technological developments; difficulty in developing, preserving and protecting our intellectual property or defending claims of infringement; catastrophic loss at any of

our facilities and business continuity of our information systems; cyber-security risks such as network intrusion or ransomware schemes; loss of key management and other personnel; potential liability arising out of the installation or use of our

systems; our ability to comply with U.S. and international laws governing our operations and industries; increases in tax liabilities; work stoppages; fluctuations in interest rates and returns on pension assets; a systemic failure of the banking

system in the United States or globally impacting our customers’ financial condition and their demand for our goods and services; availability of and access to financial and other resources; the risk factors discussed in our proxy

statement/prospectus filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”), on June 25, 2024 (the “Proxy Statement/Prospectus”), forming part of the Registration Statement on Form S-4 (File No. 333-279438) (the “Registration Statement”), initially filed by us on May 15, 2024 and declared effective on June 25, 2024; and other

factors described under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in JBT’s most recent Annual Report on Form

10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) and in any subsequently filed Quarterly Reports on Form 10-Q. JBT cautions shareholders

and prospective investors that actual results may differ materially from those indicated by the forward-looking statements. JBT undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new

information, future developments, subsequent events or changes in circumstances or otherwise.

Important Notices

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any

sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In particular, this presentation is not an offer of

securities for sale in the United States, Iceland, the Netherlands or Denmark.

Note to U.S. Shareholders

It is important that U.S. shareholders understand that the Offer and any related offer documents are subject to disclosure and takeover laws and regulations in

Iceland and other European jurisdictions, which may be different from those of the United States. The Offer will be made in compliance with the U.S. tender offer rules, including Regulation 14E under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and any exemption available to JBT in respect of securities of foreign private issuers provided by Rule 14d-1(d) under the Exchange Act.

Important Additional Information

No offer of JBT

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption from registration, and applicable European regulations, including the Icelandic Prospectus Act no. 14/2020

and the Icelandic Takeover Act no. 108/2007 on takeovers. In connection with the Offer, JBT filed with the SEC the Registration Statement that included the Proxy Statement/Prospectus. The Registration Statement was declared effective by the SEC on

June 25, 2024. Additionally, JBT filed with the Financial Supervisory Authority of the Central Bank of Iceland (the “FSA”) an offer document and a prospectus, which have been approved by the FSA and which have been published.

SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE PROSPECTUS, AND THE OFFER DOCUMENT, AS APPLICABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC OR THE FSA CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION.

Shareholders may obtain a free copy of the Proxy Statement/Prospectus, as well as other filings containing information about JBT, without charge, at the

SEC’s website at www.sec.gov, and on JBT’s website at https://ir.jbtc.com/overview/default.aspx. You may obtain a free copy of the prospectus on the FSA’s website at www.fme.is and on JBT’s website at https://www.jbtc.com/jbt-marel-offer-launch/ as well as a free copy of the offer document.

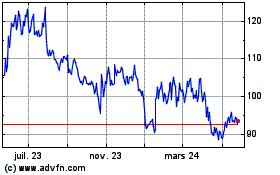

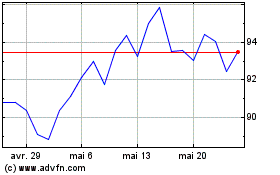

John Bean Technologies (NYSE:JBT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

John Bean Technologies (NYSE:JBT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024