Pearson 2024 Q1 Trading Update (Unaudited)

26 Avril 2024 - 8:39AM

Business Wire

Pearson is on track to achieve 2024 guidance with expected Q1

result and growth momentum for the second half

Highlights

- Underlying sales growth excluding OPM1 and Strategic Review2

of 3%.

- Strong operational progress in all divisions and continued

execution momentum across our 2024 strategic priorities.

- Continuing to infuse our products with AI and on-track to

include AI features in more than 40 Higher Education titles for the

Fall semester.

- Initial £300m share buyback completed; the previously

announced £200m buyback extension has commenced.

Omar Abbosh, Pearson’s Chief Executive, said: “The year

has started well. Financial performance was in line with our

expectations, thanks to strong execution across the business, and

we maintain a sharp focus on delivering against the priorities that

I outlined. The year is unfolding as we anticipated, and we

continue to expect an acceleration of growth in the second half,

which will see us achieve our guidance for the full year. We look

forward to providing an update on our strategic progress with our

half year results in July.”

Underlying sales growth of 3%, excluding OPM1 and Strategic

Review2; 2% in aggregate

- Assessment & Qualifications sales grew 2% after a

particularly strong prior-year performance. VUE, UK &

International Qualifications, and Clinical Assessment all

contributed to growth. US Student Assessment was impacted by

reduced scope, and phasing of some contracts which will normalise

in the second half. Pearson VUE won several new contracts,

supporting pipeline growth, including university entrance tests in

the UK and the teacher licence contract in Georgia. We also renewed

two key contracts with the Project Management Institute and the

American Registry of Radiologic Technologists. Clinical Assessment

saw solid trends and has several product launches planned for the

second half. UK & International Qualifications secured a

contract with the UK Government for England’s national curriculum

assessment tests.

- Virtual Schools sales increased 4%, due to the timing of

funding upsides, which is expected to dissipate in Q2. We will be

opening another virtual school in Missouri, in addition to those

previously announced as secured in Pennsylvania and California. We

are also on-track to open 19 additional Career Programmes this

year. Virtual Learning sales decreased 4%. As a reminder, this

included the previously announced OPM ASU contract loss, which

benefited sales through the first half of 2023.

- Higher Education sales were down 4%, in line with our phasing

guidance. Digital registrations increased 3% versus the prior year,

and we are pleased with the engagement we are seeing from both

students and faculty on our AI study tools. We remain on-track to

add this AI feature to more than 40 new titles for the key Fall

sales season, which, along with our partnership with Forage, is

supporting an improvement in our takeaway wins.

- English Language Learning sales increased 22%, with

inflationary pricing in Argentina having a positive impact which

will dissipate through the year as comparative FX rates normalise3.

Excluding this, sales increased high single digits, in line with

full year expectations. Institutional delivered a very strong

quarter. Pearson Test of English declined slightly due to a strong

comparator, and we expect performance will ramp through the

year.

- Workforce Skills sales grew 9%, in line with our expectations,

with growth of 13% in Workforce Solutions. Vishaal Gupta joined

Pearson on April 15th to lead the division.

On track to achieve 2024 guidance

- Expect growth momentum in the second half of 2024 with the

growth of Higher Education and normalised comparators for the

assessments businesses.

- In Assessment & Qualifications, we continue to expect low

to mid-single digit sales growth for the year, with sales growth

weighted to H2.

- In Virtual Schools, we continue to expect sales to decline at a

similar rate to 2023, given the previously cited loss of a larger

partner school for the 2024/25 academic year. As a reminder, there

was a weighting of sales to Q1 from Q2 due to the timing of state

funding. We expect to return to growth in 2025.

- In Higher Education, we remain confident we will return to

growth in the second half and for the full year. We continue to

expect H1 to mirror H2 2023 before the return to growth.

- In English Language Learning, we continue to expect high single

digit sales growth with growth weighted to the second half given

the outstanding performance in the first half of 2023.

- In Workforce Skills, we continue to expect to achieve high

single digit sales growth.

Strong financial position

- Pearson’s financial position remains robust, with low leverage

and strong liquidity.

- Moody’s improved its outlook for Pearson from Baa3 Stable to

Baa3 Positive outlook.

Share buyback

- We completed the £300m share buyback programme that was

initiated last year and have since commenced the previously

announced £200m buyback extension with £88m purchased up to 24

April 2024.

Financial summary

Underlying growth

Sales

Assessment & Qualifications

2%

Virtual Learning

(4)%

Higher Education

(4)%

English Language Learning

22%

Workforce Skills

9%

Strategic Review2

(100)%

Total

2%

Total, excluding OPM1 and Strategic

Review2

3%

Throughout this announcement growth rates are stated on an

underlying basis unless otherwise stated. Underlying growth rates

exclude currency movements and portfolio changes.

1 In 2023, we completed the sale of the POLS business and as

such have removed from underlying measures throughout. Within this

specific measure we exclude our entire OPM business (POLS and ASU)

to aid comparison to guidance. As expected, there are no sales in

the OPM business in 2024.

2 Strategic Review is revenues in international courseware local

publishing businesses which have been wound down. As expected,

there are no sales in these businesses in 2024.

3 In the second half of 2023, the Argentinian peso devalued

significantly to the pound sterling. Pearson instituted

inflationary pricing, primarily in English Language Learning, to

offset this impact. As we annualise the devaluation in the

Argentinian peso the inflationary pricing benefit will reduce in

GBP terms.

Notes

Forward looking statements: Except for the historical

information contained herein, the matters discussed in this

statement include forward-looking statements. In particular, all

statements that express forecasts, expectations and projections

with respect to future matters, including trends in results of

operations, margins, growth rates, overall market trends, the

impact of interest or exchange rates, the availability of

financing, anticipated cost savings and synergies and the execution

of Pearson’s strategy, are forward-looking statements. By their

nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that will

occur in future. They are based on numerous assumptions regarding

Pearson’s present and future business strategies and the

environment in which it will operate in the future. There are a

number of factors which could cause actual results and developments

to differ materially from those expressed or implied by these

forward-looking statements, including a number of factors outside

Pearson’s control. These include international, national and local

conditions, as well as competition. They also include other risks

detailed from time to time in Pearson’s publicly-filed documents

and you are advised to read, in particular, the risk factors set

out in Pearson’s latest annual report and accounts, which can be

found on its website (www.pearsonplc.com). Any forward-looking

statements speak only as of the date they are made, and Pearson

gives no undertaking to update forward-looking statements to

reflect any changes in its expectations with regard thereto or any

changes to events, conditions or circumstances on which any such

statement is based. Readers are cautioned not to place undue

reliance on such forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425374546/en/

Investor Relations Jo Russell +44 (0) 7785 451 266 Gemma

Terry +44 (0) 7841 363 216 Brennan Matthews +1 (332) 238-8785

Media Teneo: Ed Cropley +44 (0) 7492 949 346 Pearson:

Laura Ewart +44 (0) 7798 846 805

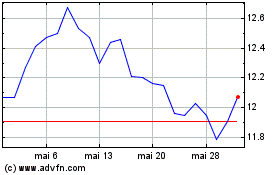

Pearson (NYSE:PSO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

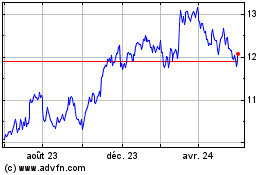

Pearson (NYSE:PSO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024