SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For August, 2024

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

CONTENT

1.1.

The purpose of this Institutional

Indemnity Policy (“Policy”) is to establish principles, guidelines, limits, and procedures that must be observed to

indemnify and hold harmless the Beneficiaries (as defined below) through the execution of indemnity agreements with Companhia de Saneamento

Básico do Estado de São Paulo (“Sabesp” or “Company”).

1.2.

This Policy applies to the Board

of Directors members, Fiscal Council members, Executive Board members, members of statutory and non-statutory committees, managers, and

all other employees and agents legally acting by delegation of the Company’s Administrators and/or Company’s Investees, as

defined below.

| · | Sabesp’s Code of Conduct and Integrity; |

| · | CVM Guidance Opinion no. 38; |

| · | Sabesp’s Institutional Policies; and |

3.1.

Settlement(s):

Judicial

or extrajudicial agreements, terms of commitment, terms of cessation or conduct adjustment, and/or any other settlement or transaction

to terminate a Proceeding.

3.2.

Regular Management Act:

Any act

performed by the Beneficiary, in the regular exercise of their function, within the scope of their responsibilities and under applicable

legislation, the legal and regulatory conduct standards to which the Beneficiary is subject, the Company's Bylaws, and the policies of

the Company or the Investee, as applicable, and that have not been performed in their own interest or that of third parties to the detriment

of the Company's best interest or with bad faith, intent, gross negligence, or fraud.

As defined in Clause 5.1.

3.4.

Asset Blocking:

Judicial

restraint or blocking of the Beneficiary's assets, their spouse's, or their first-degree relatives' assets due to Proceedings, small-estate

probate, attachment, levy, court bail, rights restrictions, encumbrances, or debt registration as an overdue tax liability.

3.5.

Indemnity Commitment:

The Company's

obligation towards the Beneficiary to indemnify and hold them harmless regarding Indemnifiable Losses, under the terms and limits of this

Policy and the Indemnity Agreement that may be effectively entered into between the Company and the Beneficiary.

3.6.

Indemnity Agreement:

A

private instrument executed between the Company and the Beneficiary, under this Policy and in the form of Attachment I of

this Policy, through which the Company grants the Beneficiary the Indemnity Commitment.

3.7.

Investee:

A company

or entity in which the Company holds a stake as a shareholder or partner.

3.8.

Indemnifiable Losses:

Any costs,

expenses, or liabilities provenly incurred, assumed by, or attributed to the Beneficiary under Proceedings, in connection with the regular

performance of the functions of their position. The Company will not have any obligation to indemnify the Beneficiary for loss of profits,

loss of business opportunities, business interruption, pain and suffering, or indirect damages that may be claimed by the Beneficiary.

3.9.

Proceedings:

Any judicial,

arbitral, or administrative proceedings, investigations, complaints, and/or procedures of any nature, in Brazil or abroad, arising from

or in connection with the regular performance of the Beneficiary's position and related to the Company's or its Investee's business that

involve the Beneficiary due to their position.

3.10.

Indemnity Request:

Requests

for acknowledgment of the initiation of Proceedings, indemnification, advance, and/or reimbursement of costs and expenses related to Indemnifiable

Losses, which must be submitted within the deadlines provided in this Policy.

3.11.

D&O Insurance:

Civil

liability insurance (Directors & Officers), contracted by the Company, intended to protect the insured parties under the terms of

the current policy.

3.12.

Monthly Maintenance Fee:

The amount

corresponding to the value of the last fixed monthly compensation received by the Beneficiary, excluding any direct and indirect benefits,

charges, gratuities, bonuses, profit sharing, and any other variable compensation, representing the maximum amount that may be monthly

paid to the Beneficiary in case of Asset Blocking, under this Policy.

4.1.

To regulate the cases in which the Company will indemnify and hold harmless the Beneficiaries for Indemnifiable Losses experienced by

such Beneficiaries due to the exercise of their functions in the Company or its Investee;

4.2.

To establish guidelines, limits, and procedures that will govern the Company's Indemnity Agreements; and

4.3.

To regulate the request, analysis, and granting of payments, reimbursements, or advances under the Indemnity Commitments.

5.1.

The Board of Directors members, Fiscal Council

members, Executive Board members, members of statutory and non-statutory committees, managers, and all other employees and agents legally

acting by the delegation of the Company’s Administrators and Company’s Investees (“Eligible Persons”) are

eligible to be Beneficiaries of this Indemnity Policy.

| 5.1.1. | It is the responsibility

of the Board of Directors to determine, among the Eligible Persons, who will be the Beneficiaries of this Policy. |

| 5.1.2. | The Company shall execute an Indemnity Agreement

with each of the Eligible Persons who are qualified as Beneficiaries by the Board of Directors. |

5.2.

Subject to the limits, conditions, and procedures

established in this Policy and the respective Indemnity Agreement, the Company commits to guarantee, reimburse, or make payment or advance

of the Indemnifiable Losses that are provenly incurred or attributed to the Beneficiary in the context of the Proceedings, as long as

they are related to their duties in the Company or its Investees. If the expense has not yet been incurred by the Beneficiary, the Company

may, at its sole discretion, instead of reimbursing the expense to the Beneficiary, pay it directly to the rightful party, observing the

procedures and deadlines provided in this Policy.

5.3.

The Beneficiary will be indemnified by the Company for Indemnifiable Losses

related to the Proceedings provided that:

| (i) | the Indemnifiable Losses originate or are related

to Regular Management Acts performed during the period when the Beneficiary held a position or function in the Company or in the Company's

Investees (to which they were appointed by the Company); |

| (ii) | the Indemnifiable Losses are linked to acts performed

by the previous administration and have been attributed to the Beneficiary due to their position or function in the Company or in the

Company's Investees (to which they were appointed by the Company), provided the Beneficiary was not complicit or negligent concerning

such acts; and |

| (iii) | the Beneficiary promptly notifies the Company

of the existence of the Proceeding and, subsequently, of each Indemnifiable Loss related to it. If the deadlines for notifying the Company

as provided in this Policy and the Indemnity Agreement are not observed, the Beneficiary will not be entitled to indemnity. |

5.4.

Provided that the other terms and conditions of this Policy and the respective

Indemnity Agreement are observed, the Company will bear the Indemnifiable Losses arising from a Proceeding that results in Asset Blocking

aimed at the dismissal, reversal, modification, or annulment of the Asset Blocking.

| 5.4.1. | While the Asset Blocking lasts, the Company will

make the payment (i) of the value of the Asset Blocking in a single installment, if it is less than the Monthly Maintenance Fee, or (ii)

of the Monthly Maintenance Fee, monthly, until the value of the Asset Blocking is reached, if the Asset Blocking exceeds the Monthly Maintenance

Fee, as established in this Policy and/or the applicable Indemnity Agreement, into an account indicated by the Beneficiary. |

| 5.4.2. | The amounts corresponding to the Monthly Maintenance

Fee that have been paid to the Beneficiary must be refunded to the Company within 15 (fifteen) days after the lifting of the Asset Blockage.

In the case of a partial lifting, the Beneficiary must refund only the equivalent value to what has been effectively lifted. |

5.5.

The Company will bear Indemnifiable Losses related to Settlements, provided

that the Settlement proposal is previously approved by the Company, as established in this Policy and/or the applicable Indemnity Agreement

and/or the Company's Bylaws and/or the Company's internal regulations.

5.6. The Indemnity Commitment

with each Beneficiary will be formalized through the execution of the Indemnity Agreement, in the form of Attachment I of this

Policy, and the provisions of this Policy will apply to it.

| 5.6.1. | The Company's obligations regarding the Beneficiary's

Indemnity Commitment will be provided in the respective Indemnity Agreement, which must be complied with according to its respective terms

and conditions, without prejudice to the procedures and mechanisms provided in this Policy and other applicable policies, practices, and

rules approved by the Company's management. |

5.7.

The maximum and global annual indemnity limit due to the Indemnity Agreements

under this policy is R$ 200,000,000.00 (two hundred million reais), adjusted annually by the Extended National Consumer Price Index (IPCA),

from the date of approval of this policy. The maximum annual limit must cover all indemnities paid to all Beneficiaries.

5.8.

The Indemnity Commitment is complementary to the insurance coverage under

the then-current D&O Insurance policy and should be triggered when the Minimum Global Value of the D&O Insurance is exhausted

and/or if there is no coverage under the policy, except as provided in Clauses 5.8.1 and 5.8.2, ensuring that the insurance activation

and the consequent interactions with the respective insurance company must always be conducted by the Company, allowing the Beneficiaries

to monitor the claims regulation process.

| 5.8.1. | In case of justified urgency, such as to meet

deadlines, including those imposed by regulatory or self-regulatory entities, or exercise of rights in Proceedings, the Company may make

advances to the Beneficiaries, provided that the payment of such advances is previously evaluated and approved, and the D&O Insurance

is triggered before the advance payment by the Company. |

| 5.8.2. | If an indemnity or advance is made available by

the insurance company after any indemnity or advance has been made by the Company to the Beneficiary (or to third parties on their behalf),

(i) the Company and the Beneficiary must request the insurance company to make the indemnity or advance under the D&O Insurance directly

to the Company, or (ii) if the Beneficiary (or third party on their behalf) receives the indemnity or advance directly under the D&O

Insurance, the Beneficiary must, within 3 (three) business days, reimburse the Company an amount equivalent to the amount effectively

received from the respective insurance company. |

| 5.9.1. | The Beneficiary will not be entitled to the protection

provided in this Policy when the act that gave rise to the Proceeding in question is directly or indirectly related to any of the following

situations: |

| a. | Active or passive conduct of the Beneficiary outside

the regular exercise of their duties or powers, or even within their duties or powers, with bad faith, gross negligence, deviation of

purpose, or through fraud; |

| b. | Disclosure of strategic and confidential information

(understood as any financial, operational, technical, accounting, commercial, legal information, or even related to know-how, technology,

and any other industrial property) of Sabesp to third parties, against Sabesp's interests, except in cases where disclosure is required

by law, regulation, or decision of judicial, arbitral, or administrative authority; |

| c. | An act committed by the Beneficiary that has been

attributed to them through a conviction in a final and unappealable decision, whether judicial or administrative, and is also classified

as a crime; |

| d. | Act performed in their own interest or in the

interest of third parties, to the detriment of Sabesp's interests; |

| e. | Legal or arbitral proceedings initiated by the

Beneficiary against Sabesp or the Investee, except to the extent that such proceedings or arbitration initiated by the Beneficiary aim

to enforce the terms of this Policy and/or the respective Indemnity Agreement and are judged in favor of the Beneficiary by a final and

unappealable judicial decision or an arbitral award that has not been annulled by a subsequent decision, in which case Sabesp will only

indemnify the Beneficiary after the final and unappealable decision or arbitral award; |

| f. | Practice of (i) serious and repeated acts of indiscipline

or insubordination or those that caused the commitment to indemnify or (ii) abandonment of the position; |

| g. | If the Beneficiary enters into or adheres to any

unauthorized Settlement under the terms of this Policy and the Indemnity Agreement or fails to enter into or adhere to any recommended

Settlement; |

| h. | The Beneficiary does not cooperate with the defense

or preservation of rights in the context of the applicable Proceedings, including in the case of abandoning the defense, failing to attend

hearings, or any other conduct that may hinder the preparation, conduct, or support of the defense and the applicable arguments; |

| i. | The Beneficiary does not promptly inform the Company

and/or their appointed attorneys of any communication received regarding the applicable Proceedings, including any notification, summons,

citation, decision, judgment, or any other document received; and |

| j. | The Beneficiary confesses the illegality or irregularity

of the act or conduct. |

| 5.9.2. | Indemnity agreements will not cover

indemnities resulting from the social action provided for in Article 159 of Federal Law 6,404/1976 or from the reimbursement of losses referred to in paragraph

5, II of Article 11 of Law 6,385, of December 07, 1976. |

| 5.10.1. | Beneficiaries wishing to receive the benefit regarding

a specific demand seeking to hold them responsible for Management Acts and involving or potentially involving any Indemnifiable Loss must

submit an Indemnity Request to the Company regarding the specific demand. |

5.10.1.1. Indemnity

Requests must be submitted to the Company:

(i)

Initially, within 5 (five) calendar days from the date the Beneficiary

becomes aware of the initiation of the Proceedings that may lead to Indemnifiable Losses, even if, at first, there is no materialization

of any Indemnifiable Loss that requires disbursements by the Company, and

(ii)

Subsequently, within 5 (five) calendar days from the start of the deadline

to perform a certain act that results in costs, expenses, or liabilities assumed or attributed to the Beneficiary in the context of the

demand already notified to the Company under item (i) above.

| 5.10.1.2. | In the case of Settlements, except for Clause

5.10.1.1(ii) above, the Indemnity Request must be submitted to the Company within 2 (two) business days after becoming aware of any Settlement

proposal received or, as soon as the intention to present one is defined, describing the terms and conditions intended for the Settlement.

|

| 5.10.1.3. | The failure to timely submit the Indemnity Request

under Clauses 5.10.1.1 and 5.10.1.2 above will prevent the Beneficiary from being entitled to the indemnity provided by the Company under

this Policy and the respective Indemnity Agreement regarding that demand, in the case of item (i), or that act to be performed, in the

case of item (ii), along with Clause 5.10.1.2. |

| 5.10.2. | Indemnity Requests must be sent to the Compliance

and Risk Management Area along with all documents and information available to the potential Beneficiary related to the demand (including

a copy of the official letter, summons, notification, action, or summons received, and other available documents) and with an indication

of the specific expense and the amount the Beneficiary intends the Company to guarantee, pay, or reimburse, ensuring that the Company

may request additional information and documents from the potential Beneficiary, which must be presented to the Company within the deadline

indicated by the Company. |

| 5.10.2.1. | The Compliance and Risk Management Area will necessarily

rely on the support of the Company's legal and insurance departments in analyzing the Indemnity Requests, without prejudice to requesting

technical support from other departments. |

| 5.10.2.2. | If the Beneficiary intends for the Company to

bear or indemnify them regarding costs incurred in hiring defense or advisory services in the Proceedings, the Indemnity Request must

be accompanied by 3 (three) service proposals from different professionals or firms and the indication of the Beneficiary's preferred

service provider. |

| 5.10.3. | Upon receiving the Request, it is the responsibility

of the head of the Compliance and Risk Management Area to verify if the Beneficiary's act is eligible for coverage under the Policy and/or

the Indemnity Agreement, including whether it unequivocally falls within any of the Exclusions. If the Beneficiary is the head of the

Company's Compliance and Risk Management Area, they will not participate in the evaluation of their claim and will submit the evaluation

to their immediate superior. |

| 5.10.3.1. | If an Indemnity Request is related to the execution

or proposal of an Agreement, the Compliance and Risk Management Area must consult the Company's legal department to analyze the reasonableness

of the proposed terms and conditions in light of the case's specifics. |

| 5.10.4. | The head of the Compliance and Risk Management

Area, after the Company's legal department's opinion, may, in exceptional cases where there is doubt about the application of this Policy

(e.g., omission or ambiguity of this Policy or the Indemnity Agreement), submit the claim to the Board of Directors for analysis and decision,

observing the applicable procedures for potential conflicts of interest established in the Policy on Related-Party Transactions and Conflicts

of Interest. |

| 5.10.5. | Decisions regarding submitted requests must be

substantiated and consider the Beneficiary's act that initiated the Proceedings, as well as all information and elements available at

the time of the decision. Such decisions may be reviewed by the Company at any time if new elements

or evidence emerge that could change the outcome of the evaluation conducted. |

| 5.10.6. | If it is proven by a final arbitral, judicial,

or administrative decision that the Beneficiary's act is not eligible for indemnification under any of the Exclusions provided in the

Policy, the Company's obligations related to the Proceedings will immediately cease, and the Beneficiary will be required to reimburse

the Company for all amounts disbursed or incurred during the course of the Proceedings or for their resolution, within 10 (ten) business

days after Sabesp's notification to that effect. |

5.10.7.

The reimbursement or payment of any Indemnifiable Losses must comply with

the rules and value limits outlined in the Company’s internal policies and standards and is subject to the decision regarding the

Indemnity Request by the Compliance and Risk Management Area.

| 5.10.7.1. | Under the provisions of item 5.10.2.2, the formal

approval of the hiring of service providers, when applicable for the defense and/or advisory services to the Beneficiary in the Proceedings,

must be approved by the competent body and is subject to the decision regarding the Indemnity Request by the Compliance and Risk Management

Area. In the event of the formalization of hiring a service provider for defense and/or advisory services to the Beneficiary in the Proceedings,

if the competent body for approving the hiring concludes, with proper justification, that the values presented by the service provider

prioritized by the Beneficiary are incompatible with usual market practices and values, it may reject their hiring and proceed with the

hiring of one of the other service providers whose proposals were submitted under Clause 5.10.2.2. If the three service proposals submitted

under Clause 5.10.2.2 are deemed incompatible with usual market practices and values, the Company may proceed with the hiring of a service

provider of its choice, provided it presents, with proper justification, proof that the received proposals are substantially above market

practice. |

| 5.10.7.2. | If the Beneficiary is a member of the competent

body for resolving on the claim provided in item 5.10.2.2, they will not participate in the respective resolution. |

| 5.10.8. | The Board of Directors must be informed within

3 (three) business days after receiving the Indemnity Request about any indemnity request involving a Board of Directors member, Fiscal

Council member, Executive Board member, or member of statutory and non-statutory committees, and must periodically receive reports on

the amounts spent on indemnities supported under this Policy. |

| 5.11.1. | Beneficiary: Without prejudice to other

obligations provided in this policy and the Indemnity Agreement, as a condition for any indemnification under this Policy, the Beneficiary

must: |

| a) | Be fully compliant with all obligations and responsibilities

assigned to them in this Policy, Indemnity Agreement, other contracts executed with the Company (including employment or service contracts),

the Company's Bylaws, and other regulations issued by the Company. |

| b) | Immediately transfer to the Company any amount

eventually refunded directly to the Beneficiary or any related person, if the Company makes any payments to the Beneficiary under this

Policy, agreeing to promptly request all and any refund requests that may be requested by the Company and/or its advisors, providing a

copy of the respective requests. |

| c) | Maintain confidentiality of all information related

to the Company's business that they become aware of, as well as any information related to an indemnifiable event under this policy, including

regarding the demand and its respective defense. |

| d) | Provide the Company with the justifications and

documents requested under this Policy and the Indemnity Agreement. |

| 5.11.2. | Board of Directors: Without prejudice to

other duties provided in this policy, it is the responsibility of the Board of Directors to: |

a)

Resolve on who will be the Beneficiaries;

| b) | Resolve on amendments or revocation of this Policy

and its attachments and ensure its proper compliance, decide on omitted cases, criteria and exceptional treatments, and resolve on its

interpretation and application. |

| c) | Resolve on specific terms and conditions of the

Indemnity Agreement and decide on any amendments. |

| d) | Ensure that the Company's procedures guarantee

that decisions are made independently and in the Company's interest, including considering the interest in attracting and retaining qualified

and capable professionals in its management and staff. |

| e) | If an Indemnity Request is submitted for analysis

by the Board of Directors under Clause 5.10.4, where a Board of Directors member has a conflicting interest, assess the situation to ensure

the removal of the respective Board member from the related decision-making process. |

| f) | Take measures to ensure that any other beneficiaries

in a conflict of interest are removed from the analysis related to their respective Indemnity Requests. |

5.12.

The indemnity commitment with each Beneficiary will be formalized through

the signing of the Indemnity Agreement in the form of Appendix I on the date the Beneficiary takes office in their respective positions

or within 30 (thirty) days from being characterized as a Beneficiary as approved by the Board of Directors.

5.13.

This Policy will become effective as of the date of its approval by the

Company’s Board of Directors and shall remain in force for an indefinite period.

5.14.

This Policy shall be revised at least every 3 (three) years or whenever

necessary to keep its content updated, whether to ensure the continuous improvement of corporate governance practices or due to statutory,

legislative, or regulatory amendments, and shall be reviewed, approved, and recorded in the minutes of the Board of Directors’ meetings.

5.15.

It is the responsibility of all members of the Administration, executives,

and employees of the Company to comply with the provisions of this Policy.

5.16.

Individuals who violate this Policy will be subject to applicable legal

and/or disciplinary measures, which will be determined by the competent administrators of Sabesp.

5.17.

Omitted cases in this Policy will be decided by the Board of Directors,

following the conflict of interest procedures established in the Company's Policy on Related-Party Transactions and Conflicts of Interest.

| a) | Electronic Documentation Manager; |

| Referenced Attachments (Attachment Base) |

Referenced Documents |

Registration Information |

| --- |

--- |

--- |

| Attached Files (Supplementary Files of the Organizational Instrument) |

| PI0042 - V.1 - Indemnity - Appendix 01- Indemnity Agreement Template.pdf |

Appendix I

Appendix I – Indemnity Policy

[Indemnity Agreement Template]

INDEMNITY AGREEMENT

By this private instrument, on one side,

COMPANHIA DE SANEAMENTO BÁSICO

DO ESTADO DE SÃO PAULO - SABESP, a publicly-held company headquartered in the City and State of São Paulo, at Rua Costa

Carvalho, n.º 300, CEP 05.429-000, enrolled in the register of corporate taxpayer’s ID (CNPJ/MF) under number 43.776.517/0001-80,

duly represented herein under its Bylaws (“Company” or “Sabesp”),

and on the other side,

[NAME OF THE BENEFICIARY], [nationality], [marital status],

holder of identity card number [=] issued by [=], and holder of individual taxpayer’s ID (CPF/MF) number [=], resident and domiciled

at [=], CEP [=], in the City [=], State [=] (“Beneficiary”).

Company and Beneficiary, together referred

to as “Parties” and, individually, as “Party”.

CONSIDERING THAT:

(a)

The regular exercise of activities and functions held by the Beneficiary may result in the assumption of risks and attribution

of responsibilities that imply the imposition of payment obligations of various natures;

(b)

Article 51 of the Company's Bylaws authorizes Sabesp to execute Indemnity Agreements with Board of Directors members,

Fiscal Council members, Executive Board members, members of statutory and non-statutory committees, managers, and all other employees

and agents who legally act by the delegation of the Company's Management, to regulate the rules for the asset protection of its employees

for acts performed in the regular exercise of their functions, ensuring the Beneficiary conditions to perform them safely, under the Indemnity

Policy;

(c)

On [=], the Company's Board of Directors approved the Indemnity Policy regulating Article 51 of the Company's Bylaws,

and on [=], included the Beneficiary in the Indemnity Commitment;

(d)

Although the Company contracts directors' and officers' liability insurance ("D&O"), the D&O has limited

coverage and, on its own, may not be sufficient to provide the asset security sought by the Company for the D&O beneficiaries in the

regular exercise of their functions; and

(e)

To attract and retain qualified professionals, ensuring market conditions compatible with the role performed and the

associated risks, the Company wishes to provide certain professionals with supplementary protection to the D&O insurance, if necessary,

in the face of extraordinary circumstances that may cause them damage under the regular exercise of their functions, in line with the

assumptions presented in CVM Guidance Opinion 38/2018;

The Parties hereby resolve, in the

best legal form, to enter into this Indemnity Agreement (“Agreement"), which shall be governed by the following clauses

and conditions, under the terms and conditions of the Indemnity Policy:

1.

OBJECT

1.1.

Through this Contract, the Company commits to guarantee, reimburse, or make payments or advances for any costs, expenses, or

liabilities that are proven to be incurred or assumed by the Beneficiary under judicial, arbitral, or administrative proceedings, investigations,

complaints, and/or procedures of any nature in Brazil or abroad (“Proceedings”), arising from or in connection with

the regular performance of the Beneficiary’s position. The Company will not have any obligation to indemnify the Beneficiary for

loss of profits, loss of business opportunities, business interruption, pain and suffering, or indirect damages that may be claimed by

the Beneficiary (“Indemnifiable Losses”).

1.2.

The Company’s obligation indicated in Clause 1.1 above will only be enforceable if the Beneficiary is compliant with

all of their obligations with the Company and provided that:

(i)

the Indemnifiable Losses originate or are related to Regular Management Acts performed during the period when the Beneficiary held

a position or function in the Company or in the Company's Investees (to which they were appointed by the Company);

(ii) the Indemnifiable

Losses are linked to acts performed by the previous administration and have been attributed to the Beneficiary due to their position or

function in the Company or in the Company's Investees (to which they were appointed by the Company), provided the Beneficiary was not

complicit or negligent concerning such acts; and

(iii)

the Beneficiary promptly notifies the Company of the existence of the Proceeding and, subsequently, of each Indemnifiable Loss

related to it. If the deadlines for notifying the Company as provided in the Policy and in this Indemnity Agreement are not observed,

the Beneficiary will not be entitled to indemnity.

1.3.

The Beneficiary's right to the payments established in this Agreement is subject to and must observe the global and annual

maximum indemnity limit established in the Indemnity Policy (“Policy”), which, in any scenario, will be the one in

effect at the time of the act performed by the Beneficiary that resulted in the Indemnifiable Loss in question.

1.3.1.

If the maximum indemnity amount provided for in the Policy is reached, any right to indemnity by the Beneficiary will cease and

the Company may require the Beneficiary to assume the costs and obligations arising from the Proceedings.

1.4.

If the Beneficiary undergoes any type of Asset Blocking due to the payment of Indemnifiable Losses, the Company will make the

payment (i) of the value of the Asset Blocking in a single installment, if it is less than the Monthly Maintenance Fee, or (ii) of the

Monthly Maintenance Fee, monthly, until the value of the Asset Blocking is reached, if the Asset Blocking exceeds the Monthly Maintenance

Fee.

1.4.1.

The sum of the monthly installments related to the Monthly Maintenance Fee cannot exceed the global maximum limit established

in the Policy.

1.5.

The amounts corresponding to the Monthly Maintenance Fee that have been paid to the Beneficiary must be refunded to the Company

within 15 (fifteen) days after the lifting of the Asset Blocking. In the case of a partial lifting, the Beneficiary must refund only the

equivalent value to what has been effectively lifted.

2.

EXCLISIONS

2.1

The Beneficiary will not be entitled to the indemnity rights provided in this Agreement when, provenly, any of the following

situations occur:

a.

Active or passive conduct of the Beneficiary outside the regular exercise

of their duties or powers, or even within their duties or powers, with bad faith, gross negligence, deviation of purpose, or through fraud;

b.

Disclosure of strategic and confidential information (understood as

any financial, operational, technical, accounting, commercial, legal information, or even related to know-how, technology, and any other

industrial property) of Sabesp to third parties, against Sabesp's interests, except in cases where disclosure is required by law, regulation,

or decision of judicial, arbitral, or administrative authority;

c.

An act committed by the Beneficiary that has been attributed to them

through a conviction in a final decision, whether judicial or administrative, and is also classified as a crime;

d.

Act performed in their own interest or in the interest of third parties,

to the detriment of Sabesp's interests;

e.

Legal or arbitral proceedings initiated by the Beneficiary against

Sabesp or the Investee, except to the extent that such proceedings or arbitration initiated by the Beneficiary aim to enforce the terms

of this Policy and/or the respective Agreement and are judged in favor of the Beneficiary by a final and unappealable judicial decision

or an arbitral award that has not been annulled by a subsequent decision, in which case Sabesp will only indemnify the Beneficiary after

the final and unappealable decision or arbitral award;

f.

Practice of (i) serious and repeated acts of indiscipline or insubordination

or those that caused the commitment to indemnify or (ii) abandonment of the position;

g.

If the Beneficiary enters into or adheres to any unauthorized Settlement

under the terms of this Policy and the Indemnity Agreement or fails to enter into or adhere to any recommended Settlement;

h.

The Beneficiary does not cooperate with the defense or preservation

of rights in the context of the applicable Proceedings, including in the case of abandoning the defense, failing to attend hearings, or

any other conduct that may hinder the preparation, conduct, or support of the defense and the applicable arguments;

i.

The Beneficiary does not promptly inform the Company and/or their appointed

attorneys of any communication received regarding the applicable Proceedings, including any notification, summons, citation, decision,

judgment, or any other document received; or

j.

The Beneficiary confesses the illegality or irregularity of the act

or conduct.

2.2

Indemnity agreements will not cover indemnities resulting from the social action provided for in Article 159 of Federal Law

6,404/1976 or arising from the reimbursement of losses referred to in paragraph 5, II of Article 11 of Law 6,385, of December 07, 1976.

3.

INDEMNITY REQUIREMENT

3.1

Upon becoming aware of any Proceeding or claim that may result in a potential Indemnifiable Loss, the Beneficiary must send,

via email (=), a request to the Compliance and Risk Management Department, presenting all available documents and information related

to the claim (including a copy of the official letter, citation, notification, assessment or citation received, and any other available

documents) and, if applicable, indicating the specific expense and the amount that the Beneficiary intends the Company to guarantee, pay,

or reimburse (“Indemnity Request”), being understood that the Company may request any additional information and documents

from the potential Beneficiary, which must be provided by the Beneficiary within the specified deadline.

3.1.1

Under the Indemnity Policy, Indemnity Requests must be submitted to the Company:

(i)

Initially, within 5 (five) calendar days from the date the Beneficiary becomes aware of the initiation of the Proceedings that

may lead to Indemnifiable Losses, even if, at first, there is no materialization of any Indemnifiable Loss that requires disbursements

by the Company, and

(ii)

Subsequently, within 5 (five) calendar days from the start of the deadline to perform a certain act or the notification on

a decision that results or may result in costs, expenses, or liabilities assumed or attributed to the Beneficiary in the context of the

demand already notified to the Company under item (i) above.

3.1.2

In the case of Settlements, except for Clause 3.1.1. (ii) above, the Indemnity Request must be submitted to the Company within

2 (two) business days after becoming aware of any Settlement proposal received or, as soon as the intention to present one is defined,

describing the terms and conditions intended for the Settlement.

3.1.3

The failure to timely submit the Indemnity Request under Clauses 3.1.1 and 3.1.2 above will prevent the Beneficiary from being

entitled to the indemnity provided by the Company under the Indemnity Policy and this Agreement regarding that demand, in the case of

item (i), or that act to be performed, in the case of item (ii), along with Clause 3.1.2.

3.1.4

For the Beneficiary to be entitled to direct payment or reimbursement from the Company regarding the costs incurred with service

providers for the exercise of defense or their advisory services in the Proceedings, the Indemnity Request must be accompanied by three

service proposals from different professionals or firms and the indication of the Beneficiary's preferred service provider.

3.2

It will be the responsibility of the Compliance and Risk Management Department, with the support of representatives from at

least the legal and insurance departments, to analyze the Beneficiary's Indemnity Request according to the Policy, taking into account

all the documentation provided to verify the alignment of the situation with the Policy, in a reasoned decision. The decisions may be

reviewed by Sabesp at any time if new elements or evidence emerge that could change the outcome of the evaluation conducted.

3.2.1.

If an Indemnity Request is related to the execution or proposal of an Agreement, the Compliance and Risk Management Area must consult

the Company's legal department to analyze the reasonableness of the proposed terms and conditions in light of the case's specifics.

3.3

The head of the Compliance and Risk Management Area, after the Company's legal department's opinion, may, in exceptional cases

where there is doubt about the application of this Policy (e.g., omission or ambiguity of this Policy or the Indemnity Agreement), submit

the claim to the Board of Directors for analysis and decision, observing the procedures for conflicts of interest established in the Policy

on Related-Party Transactions.

3.4

The reimbursement or payment of any Indemnifiable Losses must comply with the rules and value limits outlined in the Company’s

internal policies and standards, and is subject to the decision regarding the Indemnity Request by the Compliance and Risk Management

Area. In the case of a specific expenditure for the purposes of defense in any Proceeding, the approval of the service provider's hiring

must take into account the prices usually practiced in the market.

3.4.1.

If the Beneficiary intends for the Company to bear or indemnify them regarding costs incurred in hiring a service provider for

their defense or advisory services in the Proceedings, the Indemnity Request must be accompanied by three service proposals from different

professionals or firms and the indication of the Beneficiary's preferred service provider.

3.4.2.

The formal approval of the hiring of service providers, when applicable for the defense and/or advisory services to the Beneficiary

in the Proceedings, must be approved by the competent body and is subject to the decision regarding the Indemnity Request by the Compliance

and Risk Management Area. If, under the analysis and approval of hiring a service provider for defense and/or advisory services to the

Beneficiary in the Proceedings, if the competent body for approving the hiring concludes, with proper justification, that the values presented

by the service provider prioritized by the Beneficiary are incompatible with usual market practices and values, it may reject their hiring

and proceed with the hiring of one of the other service providers whose proposals were submitted under Clause 3.4.1. If the three service

proposals submitted under Clause 3.4.1 are deemed incompatible with usual market practices and values, the Company may proceed with the

hiring of a service provider of its choice, provided it presents, with proper justification, proof that the received proposals are substantially

above market practice.

3.5

The Company will only indemnify Indemnifiable Losses related to Agreements that have been previously approved by Sabesp, under

Clause 6.4 of the Policy. The execution of any Agreement without the previous consent of the Company by the Beneficiary terminates the

Company's obligation to cover the Indemnifiable Losses related to such Agreement.

3.6

If it is proven by a final arbitral, judicial, or administrative decision that the Beneficiary's act is not subject to indemnification

under any of the Exclusions provided in the Policy, the Company will not indemnify the Beneficiary, and if it has already done so, the

Beneficiary must return, within up to 10 (ten) business days from the date the Company was notified of the final decision, all amounts

incurred by Sabesp related to the Beneficiary's Management Acts.

4.

SUBROGATION

4.1

If the Company makes any payment directly to the Beneficiary or to third parties based on this Agreement, Sabesp will be immediately

subrogated to any and all reimbursement that the Beneficiary or the third party is entitled to receive, including any D&O policy.

The Beneficiary must perform all necessary acts to guarantee such rights to the Company, including signing any documents that enable the

Company to file a lawsuit on behalf of the Beneficiary.

4.2

The Beneficiary or the third party must reimburse the Company within up to 3 (three) business days from the receipt of the

amounts.

5.

TERM

5.1.

The indemnity obligation covers all acts performed by the Beneficiary during their tenure under the terms of this Agreement

and the Policy, including any ongoing Proceedings and any other Proceedings that may be initiated after the termination of their position

or function in the Company or its Investees, always observing the procedures, conditions, and exclusions provided in the Policy and this

Agreement.

6.

GENERAL PROVISIONS

6.1.

Definitions. The terms and expressions capitalized in this Agreement should have the meaning attributed to them the

first time they are mentioned or should follow their definition as stated in the Policy.

6.2.

Adherence to the Policy. The Beneficiary declares that they are aware of and expressly adhere to the terms and conditions

of the Policy, as well as the Company's Bylaws and its regulations, policies, codes, manuals, and other current regulations, committing

to fully comply with them, including future updates.

6.3.

Amendments to the Policy. The terms and conditions established in the Policy in effect on the date of the execution

of this Agreement will apply to this Agreement. Any amendments and additions to the Policy that occur after the date of execution of this

Agreement will automatically apply to this Agreement, provided that such amendments do not harm the Beneficiaries.

6.4.

Independence of Contractual Provisions. If any provision of this Agreement is deemed null, unenforceable, invalid, or

inoperative, no other provision will consequently be affected. Likewise, all other provisions of this Agreement shall remain valid and

enforceable as if such null, unenforceable, invalid, or inoperative provisions were not part of this Agreement. In this case, the Board

of Directors will be responsible for establishing the rules for replacing such null, unenforceable, invalid, or inoperative provision

with another that best represents the original intent of the Parties.

6.5.

Assignment. This Agreement, with all the rights and obligations contained herein, cannot be assigned or transferred

by the Beneficiary, in whole or in part, for any reason, without previous and express consent of the Company.

6.6.

Interpretation: In case of doubts between the provisions of this Agreement and the provisions of the Policy, the provisions

of the Policy will prevail.

6.7.

Jurisdiction. The central jurisdiction of the District Court of the central district of the City of São Paulo

– SP is chosen, excluding any other, no matter how privileged it may be or may become, to resolve issues arising from this Agreement.

6.8.

Electronic Signature. The Parties acknowledge the truthfulness, authenticity, integrity, validity, and effectiveness

of this Agreement and its terms, under Article 219 of the Civil Code, in electronic format and/or signed by the Parties through electronic

certificates, even if they are electronic certificates not issued by ICP-Brazil, under paragraph 2 of Article 10 of Provisional Measure

2,200-2, of August 24, 2001, such as, for example, through the upload and existence of this instrument, as well as the affixing of the

respective electronic signatures to this Agreement, on the platform to be indicated by the Company.

São Paulo, [=] [=], 2024

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

Witnesses

___________________________

___________________________

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: August 29, 2024

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

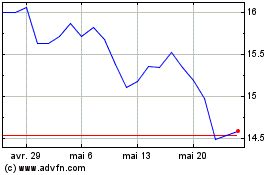

Companhia Sanea (NYSE:SBS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Companhia Sanea (NYSE:SBS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024