Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

21 Octobre 2024 - 3:17PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For October, 2024

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

COMPANHIA DE SANEAMENTO BÁSICO

DO ESTADO DE SÃO PAULO – SABESP

COMPANHIA ABERTA

CNPJ 43.776.517/0001-80

NIRE nº 35.3000.1683-1

MATERIAL FACT

Companhia de Saneamento Básico do Estado

de São Paulo – Sabesp (“Company” or “Sabesp”), in compliance with Resolution 44

of the Brazilian Securities and Exchange Commission (CVM – Comissão de Valores Mobiliários), of August 23, 2021, hereby

informs its shareholders and the market in general that the Registered Warrants Conciliation Chamber of the São Paulo Municipal Attorney General Office, partially approved the

proposed agreements formulated by Sabesp (“Agreements”) for the settlement of Registered Warrants within the scope of the

Call Notice for agreement No. 1/2024 (“Notice”), with effect as of today.

The updated amounts of Registered

Warrants, which are the subject of the agreements now approved, total the amount of R$701 million (base date Sep/2024). The discount percentage

provided for in item 1 of the Notice will be applied to these amounts, according to the calculations to be carried out by the Board of

Registered Warrants Executions and Calculations of the São Paulo State Court of Justice (“DEPRE TJSP”).

Considering the expected parameters, an estimated

amount of R$455 million (base date Sep/2024) is expected to be paid to Sabesp, over an approximate period of 4 months. It is worth noting

that this estimated amount may vary due to DEPRE TJSP calculations.

Sabesp will keep the market informed about the

resolution on the other proposed agreements already formulated by the Company for the settlement of the remaining Registered Warrants.

São Paulo, October 21, 2024.

Daniel Szlak

Chief Financial Officer and Investor Relations

Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: October 21, 2024

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Daniel Szlak

|

|

| |

Name: Daniel Szlak

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

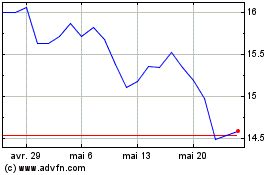

Companhia Sanea (NYSE:SBS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Companhia Sanea (NYSE:SBS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024