0000799195

false

N-CSRS

N-2

LIBERTY ALL STAR EQUITY FUND

0000799195

2023-01-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment

Company Act file number: 811-04809

Liberty

All-Star Equity Fund

(exact

name of registrant as specified in charter)

1290

Broadway, Suite 1000, Denver, Colorado 80203

(Address

of principal executive offices) (Zip code)

ALPS

Fund Services, Inc.

1290

Broadway, Suite 1000

Denver,

Colorado 80203

(Name

and address of agent for service)

Registrant’s

telephone number, including area code: 303-623-2577

Date

of fiscal year end: December 31

Date

of reporting period: January 1, 2023– June 30, 2023

Item

1. Report of Shareholders.

(a)

Contents

| 1 |

President’s Letter |

| 5 |

Table of Distributions, Rights Offerings and Tax Credits |

| 6 |

Stock Changes in the Quarter and Distribution Policy |

| 7 |

Top 20 Holdings and Economic Sectors |

| 8 |

Investment Managers/Portfolio Characteristics |

| 9 |

Manager Interview |

| 11 |

Schedule of Investments |

| 18 |

Statement of Assets and Liabilities |

| 19 |

Statement of Operations |

| 20 |

Statements of Changes in Net Assets |

| 22 |

Financial Highlights |

| 24 |

Notes to Financial Statements |

| 33 |

Description of Lipper Benchmark and Market Indices |

| Inside Back Cover: Fund Information |

A

SINGLE INVESTMENT...

A

DIVERSIFIED CORE PORTFOLIO

A

single fund that offers:

| ● | A

diversified, multi-managed portfolio of growth and value stocks |

| ● | Exposure

to many of the industries that make the U.S. economy one of the world’s most dynamic |

| ● | Access

to institutional quality investment managers |

| ● | Objective

and ongoing manager evaluation |

| ● | Active

portfolio rebalancing |

| ● | A

quarterly fixed distribution policy |

| ● | Actively

managed, exchange-traded, closed-end fund listed on the New York Stock Exchange (ticker

symbol: USA) |

LIBERTY

ALL-STAR® EQUITY FUND

| Liberty All-Star®

Equity Fund |

President’s

Letter |

(Unaudited)

| Fellow Shareholders: |

July 2023 |

In

April, upbeat earnings reports from tech giants Alphabet, Amazon, Meta Platforms and Microsoft were fueled by surging interest

in artificial intelligence (AI). Then, just before Memorial Day, NVIDIA, a key AI player, supercharged the rally with strong earnings

and a forecast that exceeded expectations. With AI as the new catalyst, a small group of mega-cap stocks led the S&P 500®

Index and the NASDAQ Composite Index, both of which posted strong gains in the first quarter, to continued leadership of

the market in the second quarter.

The

chief beneficiary of the AI rally, the NASDAQ Composite Index, ended the second quarter with a return of 13.05 percent and a first

half return of 32.32 percent—its best first half in 40 years. The S&P 500® Index returned 8.74 percent

for the quarter and 16.89 percent for the first half. The Dow Jones Industrial Average (DJIA) was the laggard; the index was void

of many of the market leaders and returned 3.97 percent for the quarter and 4.94 percent for the first half.

Returns

through the half were at odds with factors that would generally weigh on equity markets. Early in the second quarter, the Department

of Labor reported that first quarter GDP slowed more than expected—falling to 1.1 percent from 2.6 percent in 4Q22 (the

1.1 percent reading was revised to 2.0 percent later in the quarter). Meanwhile, interest rates continued to rise. In May, the

Federal Reserve increased the fed funds rate by a quarter-point; the move took the rate to a range of 5.00 to 5.25 percent and

was the Fed’s 10th consecutive rate increase. While data indicated that inflation was moderating, the deceleration was not

fast or sufficient enough to please the Federal Reserve. Midway through the quarter, for example, data showed the personal consumption

expenditures (PCE) price index, the Fed’s preferred inflation gauge, rose a faster-than-expected 0.4 percent in April. From

a year ago, the measure climbed 4.4 percent compared with 4.2 percent in March. Excluding food and energy, the core PCE index

increased 0.4 percent from the prior month and 4.7 percent from April 2022.

In

June, the Fed paused its interest rate increases, which was widely anticipated in the equity markets. At the same time, however,

the Fed left the door open to future increases, observing that decisions would be driven by fresh data as it is received. As the

third quarter began, a growing consensus favored the Fed resuming rate increases at its meeting in late July.

As

it has been for months, the U.S. labor market was a double-edged sword: a positive for the economy in that unemployment remained

low and job creation high, while that low unemployment along with a steady advance in wages was seen as a negative in the inflation

fight (in the eyes of the Federal Reserve). Conflicting signals in May, when payrolls surged along with joblessness, serve as

an example. Nonfarm payrolls increased 339,000 in that month versus a median estimate of 195,000; at the same time the unemployment

rate increased 0.3 percent to 3.7 percent.

First

quarter earnings reports for S&P 500® companies generally exceeded analysts’ expectations in both their

size and breadth (first quarter earnings being reported during the second quarter). JPMorgan Chase agreed to acquire First Republic

Bank in a government-led deal, putting to rest one of the biggest troubled banks remaining after turmoil engulfed the banking

industry in March. On June 1, the U.S. Senate approved a bill that would allow the government to avoid a potentially disastrous

default on its debt after an acrimonious battle in the House of Representatives. President Biden signed the bill, granting final

approval. On June 8, the stock market officially entered a bull market, as the S&P 500® gained 20 percent since

its October 2022 low. Surveys of consumer confidence were generally positive, e.g., late in the half the Conference Board reported

that its June survey rose to the highest level since early 2022. And AI—with its promises and perils—was headline

news. Some likened it to the dot.com bubble a quarter century ago. This time, however, it wasn’t start-up and IPO valuations

soaring, but the shares of some of the largest enterprises in the world.

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

1 |

| Liberty

All-Star® Equity Fund |

President’s

Letter |

(Unaudited)

As

to how stocks fared by style, growth stocks outperformed value stocks for both the second quarter and the first half. The broad

market Russell 3000® Growth Index returned 12.47 percent for the quarter and 28.05 percent for the first half.

Respective figures for the Russell 3000® Value Index were 4.03 percent and 4.98 percent. Viewed from a longer-term

perspective, among large cap stocks (as measured by the Russell 1000® Growth and Value indexes) the first half

of 2023 represented the second-widest dispersion in returns between growth and value styles, exceeded only by the first half of

2020.

Liberty

All-Star® Equity Fund

Liberty

All-Star Equity Fund delivered good absolute returns in the second quarter and for the first half of the year. For the second

quarter the Fund returned 6.99 percent when shares are valued at net asset value (NAV) with dividends reinvested and 6.95 percent

when shares are valued at market price with dividends reinvested. (Fund returns are net of expenses.) Both returns lagged the

8.10 percent return of the Fund’s primary benchmark, the Lipper Large-Cap Core Mutual Fund Average. Fund returns also trailed

the strong returns posted by the NASDAQ Composite and the S&P 500® but were well ahead of the DJIA’s

quarterly return.

For

the first half the Fund returned 14.21 percent when shares are valued at NAV with dividends reinvested and 19.13 percent when

shares are valued at market price with dividends reinvested. Compared with the Lipper Large-Cap Core benchmark return of 15.03

percent the Fund’s NAV return was modestly lower but the market price return was well ahead. Relative to the S&P 500®

Fund returns were mixed—lower than the index for the NAV return but higher for the market price return. Once again,

Fund returns trailed that of the NASDAQ Composite while both measures of return, NAV and market price, were significantly higher

than that of the DJIA.

In

terms of return attribution for the first half, while the Fund performed well on an absolute basis an attribute that in most market

environments is a strength—namely, greater diversification—meant the Fund could not keep pace with the extreme concentration

evidenced by the S&P 500® and the NASDAQ Composite. Outside of those relatively few market-leading mega-cap

stocks, the Fund generally outperformed. To illustrate: The Fund underperformed the top 20 percent of stocks in the S&P 500®

with the largest market capitalizations because, being more diversified, the Fund had a smaller allocation to these names.

However, the Fund outperformed the remaining 80 percent of stocks in the index.

To

underscore the very narrow nature of the market in the first half, three of the 11 S&P sectors delivered double-digit returns,

led by information technology’s 45.6 percent. Of the remaining eight sectors, three had negative returns and the remaining

five sectors underperformed the S&P 500® return by an average of 12.0 percentage points. Another perspective:

the median first half return for stocks in the S&P 500® was 4.9 percent.

| Liberty

All-Star® Equity Fund |

President’s

Letter |

(Unaudited)

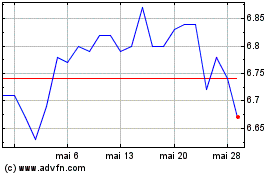

During

the second quarter the range over which Fund shares traded relative to their underlying NAV narrowed compared to the first quarter.

The range extended from a premium of 1.3 percent to a discount of -1.8 percent. That compared with a premium of 2.3 percent and

a discount of -2.2 percent in the first quarter.

In

accordance with the Fund’s distribution policy, the Fund paid a distribution of $0.15 per share in the second quarter. The

Fund’s distribution policy has been in place since 1988 and is a major component of the Fund’s total return. The Fund

has paid distributions of $29.98 per share for a total of more than $3.6 billion since 1987 (the Fund’s first full calendar

year of operations). We continue to emphasize that shareholders should include these distributions when determining the total

return on their investment in the Fund.

As

noted, the Fund turned in solid results through the first half but on a relative basis lagged benchmarks—most notably the

NASDAQ Composite—that reflected the meteoric performance of a handful of stocks. While it may be tempting to chase the returns

of a few mega-cap stocks in the current environment the Fund will maintain its multi-management discipline which has proven effective

through the history of the Fund. Fund portfolio decisions are made by highly skilled, experienced managers employing rigorous

analysis, all of whom we at ALPS monitor on an ongoing basis. We believe that in ever-evolving markets this is a more consistent

and reliable way to build a sound portfolio for the long term.

Sincerely,

Mark

T. Haley, CFA

President

Liberty

All-Star® Equity Fund

The

views expressed in the President’s letter and the Manager Interview reflect the views of the President and Manager as of

July 2023 and may not reflect their views on the date this report is first published or anytime thereafter. These views are not

guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual

outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon

economic, market or other conditions and the Fund disclaims any responsibility to update such views. These views may not be relied

on as investment advice and, because investment decisions for the Fund are based on numerous factors, may not be relied on as

an indication of trading intent.

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

3 |

| Liberty

All-Star® Equity Fund |

President’s

Letter |

(Unaudited)

| Fund

Statistics (Periods ended June 30, 2023) |

|

| Net Asset Value (NAV) |

$6.42 |

| Market Price |

$6.47 |

| Premium |

0.8% |

| |

Quarter |

Year-to-Date |

| Distributions* |

$0.15 |

$0.30 |

| Market Price Trading

Range |

$5.82

to $6.49 |

$5.72

to $6.52 |

| Premium/(Discount)

Range |

1.3%

to -1.8% |

2.3%

to -2.2% |

| Performance

(Periods ended June 30, 2023) |

|

|

| Shares Valued at NAV

with Dividends Reinvested |

6.99% |

14.21% |

| Shares Valued at Market

Price with Dividends Reinvested |

6.95% |

19.13% |

| Dow Jones Industrial

Average |

3.97% |

4.94% |

| Lipper Large-Cap Core

Mutual Fund Average |

8.10% |

15.03% |

| NASDAQ Composite Index |

13.05% |

32.32% |

| S&P

500® Index |

8.74% |

16.89% |

| * | Sources

of distributions to shareholders may include ordinary dividends, long-term capital gains

and return of capital. The final determination of the source of all distributions in

2023 for tax reporting purposes will be made after year end. The actual amounts and sources

of the amounts for tax reporting purposes will depend upon the Fund’s investment

experience during its fiscal year and may be subject to changes based on tax regulations.

Based on current estimates a portion of the distributions consist of a return of capital.

Pursuant to Section 852 of the Internal Revenue Code, the taxability of these distributions

will be reported on Form 1099-DIV for 2023. |

Performance

returns for the Fund are total returns, which include dividends. Returns are net of management fees and other Fund expenses.

The

returns shown for the Lipper Large-Cap Core Mutual Fund Average are based on open-end mutual funds’ total returns, which

include dividends, and are net of fund expenses. Returns for the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index

and the S&P 500 ® Index are total returns, including dividends. A description of the Lipper benchmark and the

market indices can be found on page 33.

Past

performance cannot predict future results. Performance will fluctuate with market conditions. Current performance may be lower

or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would

pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

Closed

-end funds raise money in an initial public offering and shares are listed and traded on an exchange. Open-end mutual funds continuously

issue and redeem shares at net asset value. Shares of closed-end funds frequently trade at a discount to net asset value. The

price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore,

the Fund cannot predict whether its shares will trade at, below or above net asset value.

| Liberty All-Star®

Equity Fund |

Table

of Distributions,

Rights Offerings and Tax Credits |

(Unaudited)

| |

|

Rights Offerings |

|

| Year |

Per Share

Distributions |

Month

Completed |

Shares

Needed to Purchase

One Additional Share |

Subscription

Price |

Tax Credits1 |

| 1987 |

$1.18 |

|

|

|

|

| 1988 |

0.64 |

|

|

|

|

| 1989 |

0.95 |

|

|

|

|

| 1990 |

0.90 |

|

|

|

|

| 1991 |

1.02 |

|

|

|

|

| 1992 |

1.07 |

April |

10 |

$10.05 |

|

| 1993 |

1.07 |

October |

15 |

10.41 |

$0.18 |

| 1994 |

1.00 |

September |

15 |

9.14 |

|

| 1995 |

1.04 |

|

|

|

|

| 1996 |

1.18 |

|

|

|

0.13 |

| 1997 |

1.33 |

|

|

|

0.36 |

| 1998 |

1.40 |

April |

20 |

12.83 |

|

| 1999 |

1.39 |

|

|

|

|

| 2000 |

1.42 |

|

|

|

|

| 2001 |

1.20 |

|

|

|

|

| 2002 |

0.88 |

May |

10 |

8.99 |

|

| 2003 |

0.78 |

|

|

|

|

| 2004 |

0.89 |

July |

102 |

8.34 |

|

| 2005 |

0.87 |

|

|

|

|

| 2006 |

0.88 |

|

|

|

|

| 2007 |

0.90 |

December |

10 |

6.51 |

|

| 2008 |

0.65 |

|

|

|

|

| 20093 |

0.31 |

|

|

|

|

| 2010 |

0.31 |

|

|

|

|

| 2011 |

0.34 |

|

|

|

|

| 2012 |

0.32 |

|

|

|

|

| 2013 |

0.35 |

|

|

|

|

| 2014 |

0.39 |

|

|

|

|

| 20154 |

0.51 |

|

|

|

|

| 2016 |

0.48 |

|

|

|

|

| 20175 |

0.56 |

|

|

|

|

| 2018 |

0.68 |

|

|

|

|

| 2019 |

0.66 |

|

|

|

|

| 2020 |

0.63 |

|

|

|

|

| 2021 |

0.81 |

November |

102 |

7.78 |

|

| 2022 |

0.69 |

|

|

|

|

| 2023 |

|

|

|

|

|

| 1st Quarter |

0.15 |

|

|

|

|

| 2nd

Quarter |

0.15 |

|

|

|

|

| Total |

$29.98 |

|

|

|

|

| 1 | The

Fund’s net investment income and net realized capital gains exceeded the amount

to be distributed under the Fund’s distribution policy. In each case, the Fund

elected to pay taxes on the undistributed income and passed through a proportionate tax

credit to shareholders. |

| 2 | The

number of shares offered was increased by an additional 25 percent to cover a portion

of the over-subscription requests. |

| 3 | Effective

with the second quarter distribution, the annual distribution rate was changed from 10

percent to 6 percent. |

| 4 | Effective

with the second quarter distribution, the annual distribution rate was changed from 6

percent to 8 percent. |

| 5 | Effective

with the fourth quarter distribution, the annual distribution rate was changed from 8

percent to 10 percent. |

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

5 |

| Liberty All-Star®

Equity Fund |

Stock

Changes in the Quarter and Distribution Policy |

(Unaudited)

The

following are the largest ($5 million or more) stock changes - both purchases and sales - that were made in the Fund’s portfolio

during the second quarter of 2023.

| |

SHARES |

| Security

Name |

Purchases

(Sales) |

Held

as of 6/30/23 |

| Purchases |

|

|

| Carrier Global Corp. |

221,598 |

221,598 |

| Sales |

|

|

| Adobe, Inc. |

(12,615) |

59,422 |

| Booking Holdings,

Inc. |

(3,149) |

7,706 |

| General Electric Co. |

(95,130) |

75,902 |

| Intuitive Surgical,

Inc. |

(20,156) |

42,634 |

| PACCAR, Inc. |

(134,420) |

0 |

DISTRIBUTION

POLICY

The

current policy is to pay distributions on its shares totaling approximately 10 percent of its net asset value per year, payable

in four quarterly installments of 2.5 percent of the Fund’s net asset value at the close of the New York Stock Exchange

on the Friday prior to each quarterly declaration date. Sources of distributions to shareholders may include ordinary dividends,

long-term capital gains and return of capital. The final determination of the source of all distributions in 2023 for tax reporting

purposes will be made after year end. The actual amounts and sources of the amounts for tax reporting purposes will depend upon

the Fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. If a distribution

includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate of its distribution

sources at that time. These estimates may not match the final tax characterization (for the full year’s distributions) contained

in shareholder 1099-DIV forms after the end of the year. If the Fund’s ordinary dividends and long-term capital gains for

any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute

capital gains and pay income tax thereon to the extent of such excess.

| Liberty All-Star®

Equity Fund |

Top 20

Holdings & Economic Sectors |

June

30, 2023 (Unaudited)

| Top

20 Holdings* |

Percent

of Net Assets |

| Microsoft

Corp. |

3.39% |

| Alphabet,

Inc. |

2.96 |

| Amazon.com,

Inc. |

2.34 |

| NVIDIA

Corp. |

2.25 |

| UnitedHealth

Group, Inc. |

2.13 |

| Visa,

Inc. |

2.10 |

| ServiceNow,

Inc. |

1.93 |

| S&P

Global, Inc. |

1.73 |

| Adobe,

Inc. |

1.67 |

| Sony

Group Corp. |

1.40 |

| Salesforce,

Inc. |

1.28 |

| Danaher

Corp. |

1.23 |

| Capital

One Financial Corp. |

1.22 |

| Ecolab,

Inc. |

1.20 |

| Booking

Holdings, Inc. |

1.20 |

| Fresenius

Medical Care AG & Co. KGaA |

1.18 |

| IQVIA

Holdings, Inc. |

1.18 |

| Charles

Schwab Corp. |

1.14 |

| Dollar

General Corp. |

1.12 |

| Autodesk,

Inc. |

1.00 |

| |

33.65% |

| Economic

Sectors* |

Percent

of Net Assets |

| Financials |

20.69% |

| Information

Technology |

19.81 |

| Health

Care |

14.13 |

| Consumer

Discretionary |

13.31 |

| Industrials |

7.50 |

| Materials |

5.75 |

| Communication

Services |

5.56 |

| Consumer

Staples |

4.67 |

| Energy |

2.22 |

| Real

Estate |

1.95 |

| Utilities |

1.48 |

| Other

Net Assets |

2.93 |

| |

100.00% |

| * | Because

the Fund is actively managed, there can be no guarantee that the Fund will continue to

hold securities of the indicated issuers and sectors in the future. |

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

7 |

| Liberty All-Star®

Equity Fund |

Investment

Managers/Portfolio Characteristics |

(Unaudited)

THE

FUND’S ASSETS ARE APPROXIMATELY EQUALLY DISTRIBUTED AMONG THREE VALUE MANAGERS AND TWO GROWTH MANAGERS:

ALPS

Advisors, Inc., the investment advisor to the Fund, has the ultimate authority (subject to oversight by the Board of Trustees)

to oversee the investment managers and recommend their hiring, termination and replacement.

MANAGERS’

DIFFERING INVESTMENT STRATEGIES ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The

portfolio characteristics table below is a regular feature of the Fund’s shareholder reports. It serves as a useful tool

for understanding the value of a multi-managed portfolio. The characteristics are different for each of the Fund’s five

investment managers. These differences are a reflection of the fact that each pursues a different investment style. The shaded

column highlights the characteristics of the Fund as a whole, while the final column shows portfolio characteristics for the S&P

500® Index.

PORTFOLIO

CHARACTERISTICS As of June 30, 2023 (Unaudited)

| |

Investment Style Spectrum |

|

|

| |

Value |

|

|

Growth |

|

|

| |

|

TOTAL |

S&P

500® |

| |

PZENA |

FIDUCIARY |

ARISTOTLE |

SUSTAINABLE |

TCW |

FUND |

INDEX |

| Number

of Holdings |

37 |

29 |

43 |

30 |

31 |

145* |

503 |

| Percent

of Holdings in Top 10 |

41% |

45% |

34% |

44% |

54% |

22% |

31% |

| Weighted Average Market

Capitalization (billions) |

$69 |

$182 |

$193 |

$407 |

$567 |

$291 |

$682 |

| Average Five-Year

Earnings Per Share Growth |

8% |

6% |

17% |

17% |

18% |

14% |

17% |

| Dividend

Yield |

2.4% |

1.2% |

2.0% |

0.7% |

0.5% |

1.3% |

1.5% |

| Price/Earnings

Ratio** |

14x |

21x |

18x |

38x |

49x |

23x |

23x |

| Price/Book Value Ratio |

1.4x |

3.3x |

3.1x |

6.5x |

5.5x |

3.1x |

4.0x |

| * | Certain

holdings are held by more than one manager. |

| ** | Excludes

negative earnings |

| Liberty

All-Star® Equity Fund |

Manager

Interview |

(Unaudited)

|

Gregory

Padilla, CFA

Portfolio

Manager, Senior Global Research Analyst

Aristotle

Capital Management, LLC |

A

LONG-TERM PERSPECTIVE HELPS ARISTOTLE IDENTIFY COMPANIES ABLE TO CONTROL THEIR OWN DESTINIES EVEN AS MARKETS FLUCTUATE

Aristotle

Capital Management seeks to invest in high quality companies that it believes are selling at a significant discount to their intrinsic

value and where catalysts exist that will lead to a realization by the market of this true value. Aristotle practices a fundamental,

bottom-up, research-driven process and invests with a long-term perspective. We recently had the opportunity to talk with Aristotle

Portfolio Manager and Senior Global Research Analyst Gregory Padilla, CFA. The Fund’s Investment Advisor, ALPS Advisors,

Inc., conducted the interview.

Aristotle

looks past short-term uncertainties—and there have been many of them in the first half of 2023—to focus on the business

fundamentals of potential and existing portfolio companies. What are the primary business fundamentals on which you focus?

We

prefer to buy good or improving companies at attractive valuations as opposed to mediocre companies at fire sale prices. We are

focused on long-term investments in companies with sustainable competitive advantages, run by experienced management teams, with

the ability to generate free cash flow through various market cycles. Over time our team develops strong relationships with management

and a deep understanding of the business. If our analysis of the quality and durability of the company is correct, and we have

been disciplined on the price we pay, time should work in our favor. This benefit of time is particularly important for those

with a long-term perspective as it also allows investors to sleep soundly at night knowing that the portfolio companies control

their destiny, regardless of market fluctuations.

Despite

those uncertainties, some areas of the market had a good first half. Performance was heavily dependent on just a small group of

sectors and stocks while the great majority of stocks—regardless of style or capitalization—have lagged. Do you recall

the market ever being so concentrated? Do you see risk when investors overlook the fundamental tenet of diversification and significantly

overweight a handful of stocks?

As

measured by the S&P 500® Index, the market is likely at or near its highest-ever level of concentration. Over

time we have seen different cohorts of companies dominate headlines, from the “four horsemen” to “FAANG”

then “FAANGM” and now “the magnificent

“As

measured by the S&P 500® Index, the market is likely at or near its highest-ever level of

concentration.”

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

9 |

| Liberty All-Star® Equity Fund |

Manager Interview |

(Unaudited)

seven.”1

These recent leaders have propelled the S&P 500®, a market capitalization-weighted index, higher by 16.9

percent while the equal-weighted index rose 7.0 percent for the first half of 2023. History has shown that the comfort of running

with the herd is a behavioral bias that often leads to poor outcomes. We believe the benefits of thinking independently are as

fruitful today as in any time in recent history.

Aristotle

seeks to invest in companies that are selling at a significant discount to their intrinsic value and where a catalyst or catalysts

exist that may lead to a fuller realization of true market value. Please give us two examples of holdings in the portion of the

Liberty All-Star Equity Fund that you manage where a catalyst played such a role and identify what the catalyst was.

Lennar

(LEN) is a stock we have owned since 2011. The catalysts we saw in 2011 are very different from the catalysts today. In 2011,

Lennar owned land that was carried on its balance sheet significantly below what we believed was fair market value. This positioned

the company for future margin expansion as Lennar delivered homes at increasingly higher prices. In recent years as land prices

have increased, the company shifted from owned land to optioned land. This catalyst has allowed Lennar to be less capital intensive

and more nimble, paving the way for higher and more consistent returns on equity.

A

more recent addition to the portfolio is Activision (ATVI). We purchased shares of Activision earlier this year and while the

pending acquisition by Microsoft would be a positive for shareholders, this is not a catalyst for Aristotle. Rather, a key catalyst

in our eyes is Activision’s continued potential to generate increased cash flows from in-game purchases and advertising,

two revenue streams that were immaterial contributors several years ago.

Is

there a typical holding period for an Aristotle portfolio company? If your expectations are not realized within a certain

timeframe is the stock simply sold or is it reevaluated? Same question in the case of a stock that exceeds

expectations.

We

evaluate companies over rolling three- and five-year periods. Our long-term focus has resulted in annual turnover of

roughly 15 percent, suggesting our average holding period is closer to seven years. We do not target a low turnover rate.

Rather, we choose to spend our time paying attention to the investments we currently own. When a company changes its

strategy or loses key executive talent, we’ll take action. Also, if a stock reaches or exceeds our estimates of

intrinsic value, we will protect our clients’ capital and find what we believe to be more compelling investments.

“We

do not target a low turnover rate. Rather, we choose to spend our time paying attention to the investments we currently own.”

Thank

you for the insights into Aristotle’s thinking on topics that are timely in today’s market environment.

1

“The magnificent seven” are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

| Liberty All-Star®

Equity Fund |

Schedule

of Investments |

June

30, 2023 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (97.07%) | |

| | | |

| | |

| COMMUNICATION SERVICES (5.56%) | |

| | | |

| | |

| Entertainment (0.96%) | |

| | | |

| | |

| Activision Blizzard, Inc. | |

| 91,000 | | |

$ | 7,671,300 | |

| Netflix, Inc.(a) | |

| 20,491 | | |

| 9,026,081 | |

| | |

| | | |

| 16,697,381 | |

| Interactive Media & Services (2.96%) | |

| | | |

| | |

| Alphabet, Inc., Class A(a) | |

| 135,960 | | |

| 16,274,412 | |

| Alphabet, Inc., Class C(a) | |

| 291,401 | | |

| 35,250,779 | |

| | |

| | | |

| 51,525,191 | |

| Media (1.64%) | |

| | | |

| | |

| Charter Communications, Inc., Class A(a) | |

| 22,843 | | |

| 8,391,833 | |

| Omnicom Group, Inc. | |

| 119,330 | | |

| 11,354,249 | |

| Trade Desk, Inc., Class A(a) | |

| 112,616 | | |

| 8,696,208 | |

| | |

| | | |

| 28,442,290 | |

| CONSUMER DISCRETIONARY (13.31%) | |

| | | |

| | |

| Automobile Components (1.85%) | |

| | | |

| | |

| Cie Generale des Etablissements Michelin SCA(b) | |

| 433,000 | | |

| 6,382,420 | |

| Lear Corp. | |

| 109,726 | | |

| 15,751,167 | |

| Magna International, Inc., Class A | |

| 178,072 | | |

| 10,050,384 | |

| | |

| | | |

| 32,183,971 | |

| Broadline Retail (2.34%) | |

| | | |

| | |

| Amazon.com, Inc.(a) | |

| 312,436 | | |

| 40,729,157 | |

| | |

| | | |

| | |

| Hotels, Restaurants & Leisure (2.52%) | |

| | | |

| | |

| Booking Holdings, Inc.(a) | |

| 7,706 | | |

| 20,808,743 | |

| Starbucks Corp. | |

| 109,542 | | |

| 10,851,231 | |

| Yum! Brands, Inc. | |

| 87,088 | | |

| 12,066,042 | |

| | |

| | | |

| 43,726,016 | |

| Household Durables (2.86%) | |

| | | |

| | |

| Lennar Corp., Class A | |

| 93,500 | | |

| 11,716,485 | |

| Mohawk Industries, Inc.(a) | |

| 67,297 | | |

| 6,942,359 | |

| Newell Brands, Inc. | |

| 783,352 | | |

| 6,815,162 | |

| Sony Group Corp.(b) | |

| 269,855 | | |

| 24,297,744 | |

| | |

| | | |

| 49,771,750 | |

| Specialty Retail (2.00%) | |

| | | |

| | |

| CarMax, Inc.(a) | |

| 146,723 | | |

| 12,280,715 | |

| Home Depot, Inc. | |

| 29,260 | | |

| 9,089,326 | |

| TJX Cos., Inc. | |

| 67,379 | | |

| 5,713,065 | |

| Ulta Beauty, Inc.(a) | |

| 16,342 | | |

| 7,690,464 | |

| | |

| | | |

| 34,773,570 | |

See

Notes to Financial Statements.

| Semi-Annual

Report (Unaudited) | June 30, 2023 |

11 |

| Liberty All-Star®

Equity Fund |

Schedule

of Investments |

June

30, 2023 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Textiles, Apparel & Luxury Goods (1.74%) | |

| | | |

| | |

| Gildan Activewear, Inc.(c) | |

| 322,869 | | |

$ | 10,409,297 | |

| NIKE, Inc., Class B | |

| 68,005 | | |

| 7,505,712 | |

| PVH Corp. | |

| 77,568 | | |

| 6,590,953 | |

| Skechers U.S.A., Inc., Class A(a) | |

| 107,237 | | |

| 5,647,100 | |

| | |

| | | |

| 30,153,062 | |

| CONSUMER STAPLES (4.67%) | |

| | | |

| | |

| Beverages (0.87%) | |

| | | |

| | |

| Coca-Cola Co. | |

| 135,500 | | |

| 8,159,810 | |

| Constellation Brands, Inc., Class A | |

| 28,400 | | |

| 6,990,092 | |

| | |

| | | |

| 15,149,902 | |

| Consumer Staples Distribution & Retail (1.67%) | |

| | | |

| | |

| Costco Wholesale Corp. | |

| 21,319 | | |

| 11,477,723 | |

| Dollar Tree, Inc.(a) | |

| 76,177 | | |

| 10,931,400 | |

| SYSCO Corp. | |

| 87,800 | | |

| 6,514,760 | |

| | |

| | | |

| 28,923,883 | |

| Household Products (0.44%) | |

| | | |

| | |

| Procter & Gamble Co. | |

| 50,700 | | |

| 7,693,218 | |

| | |

| | | |

| | |

| Multiline Retail (1.12%) | |

| | | |

| | |

| Dollar General Corp. | |

| 114,510 | | |

| 19,441,508 | |

| | |

| | | |

| | |

| Personal Care Products (0.57%) | |

| | | |

| | |

| Unilever PLC(b) | |

| 191,331 | | |

| 9,974,085 | |

| | |

| | | |

| | |

| ENERGY (2.22%) | |

| | | |

| | |

| Energy Equipment & Services (0.94%) | |

| | | |

| | |

| Halliburton Co. | |

| 159,764 | | |

| 5,270,614 | |

| NOV, Inc. | |

| 316,776 | | |

| 5,081,087 | |

| Schlumberger NV | |

| 120,475 | | |

| 5,917,732 | |

| | |

| | | |

| 16,269,433 | |

| Oil, Gas & Consumable Fuels (1.28%) | |

| | | |

| | |

| Coterra Energy, Inc. | |

| 326,100 | | |

| 8,250,330 | |

| Phillips 66 | |

| 61,100 | | |

| 5,827,718 | |

| Shell PLC(b) | |

| 134,846 | | |

| 8,142,002 | |

| | |

| | | |

| 22,220,050 | |

| FINANCIALS (20.69%) | |

| | | |

| | |

| Banks (4.07%) | |

| | | |

| | |

| Bank of America Corp. | |

| 343,426 | | |

| 9,852,892 | |

| Citigroup, Inc. | |

| 311,076 | | |

| 14,321,939 | |

| Commerce Bancshares, Inc. | |

| 73,710 | | |

| 3,589,677 | |

See

Notes to Financial Statements.

| Liberty All-Star®

Equity Fund |

Schedule

of Investments |

June

30, 2023 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Banks (continued) | |

| | | |

| | |

| Cullen/Frost Bankers, Inc. | |

| 52,400 | | |

$ | 5,634,572 | |

| JPMorgan Chase & Co. | |

| 69,655 | | |

| 10,130,623 | |

| Mitsubishi UFJ Financial Group, Inc.(b)(c) | |

| 724,500 | | |

| 5,339,565 | |

| PNC Financial Services Group, Inc. | |

| 45,800 | | |

| 5,768,510 | |

| U.S. Bancorp | |

| 29,572 | | |

| 977,059 | |

| Wells Fargo & Co. | |

| 357,023 | | |

| 15,237,742 | |

| | |

| | | |

| 70,852,579 | |

| Capital Markets (5.97%) | |

| | | |

| | |

| Ameriprise Financial, Inc. | |

| 29,500 | | |

| 9,798,720 | |

| BlackRock, Inc. | |

| 9,656 | | |

| 6,673,648 | |

| Blackstone Group LP | |

| 75,400 | | |

| 7,009,938 | |

| Charles Schwab Corp. | |

| 350,821 | | |

| 19,884,534 | |

| Goldman Sachs Group, Inc. | |

| 16,458 | | |

| 5,308,363 | |

| MSCI, Inc. | |

| 23,530 | | |

| 11,042,394 | |

| Northern Trust Corp. | |

| 120,542 | | |

| 8,936,984 | |

| S&P Global, Inc. | |

| 75,161 | | |

| 30,131,293 | |

| UBS Group AG | |

| 242,844 | | |

| 4,922,448 | |

| | |

| | | |

| 103,708,322 | |

| Consumer Finance (1.75%) | |

| | | |

| | |

| American Express Co. | |

| 52,531 | | |

| 9,150,900 | |

| Capital One Financial Corp. | |

| 194,392 | | |

| 21,260,653 | |

| | |

| | | |

| 30,411,553 | |

| Financial Services (5.55%) | |

| | | |

| | |

| Berkshire Hathaway, Inc., Class B(a) | |

| 47,034 | | |

| 16,038,594 | |

| Equitable Holdings, Inc. | |

| 371,413 | | |

| 10,087,577 | |

| FleetCor Technologies, Inc.(a) | |

| 38,829 | | |

| 9,749,185 | |

| Mastercard, Inc., Class A | |

| 33,523 | | |

| 13,184,596 | |

| PayPal Holdings, Inc.(a) | |

| 62,945 | | |

| 4,200,320 | |

| Visa, Inc., Class A | |

| 153,827 | | |

| 36,530,836 | |

| Voya Financial, Inc. | |

| 92,584 | | |

| 6,639,199 | |

| | |

| | | |

| 96,430,307 | |

| Insurance (3.35%) | |

| | | |

| | |

| American International Group, Inc. | |

| 85,780 | | |

| 4,935,781 | |

| Aon PLC, Class A | |

| 42,427 | | |

| 14,645,800 | |

| Arch Capital Group, Ltd.(a) | |

| 99,774 | | |

| 7,468,084 | |

| Axis Capital Holdings, Ltd. | |

| 129,401 | | |

| 6,965,656 | |

| Cincinnati Financial Corp. | |

| 57,489 | | |

| 5,594,830 | |

| MetLife, Inc. | |

| 187,494 | | |

| 10,599,036 | |

| Progressive Corp. | |

| 60,912 | | |

| 8,062,921 | |

| | |

| | | |

| 58,272,108 | |

See

Notes to Financial Statements.

| Semi-Annual

Report (Unaudited) | June 30, 2023 |

13 |

| Liberty All-Star®

Equity Fund |

Schedule

of Investments |

June

30, 2023 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| HEALTH CARE (14.13%) | |

| | | |

| | |

| Biotechnology (0.97%) | |

| | | |

| | |

| Amgen, Inc. | |

| 36,600 | | |

$ | 8,125,932 | |

| Regeneron Pharmaceuticals, Inc.(a) | |

| 12,214 | | |

| 8,776,248 | |

| | |

| | | |

| 16,902,180 | |

| Health Care Equipment & Supplies (4.70%) | |

| | | |

| | |

| Alcon, Inc. | |

| 100,000 | | |

| 8,211,000 | |

| Align Technology, Inc.(a) | |

| 13,852 | | |

| 4,898,621 | |

| Boston Scientific Corp.(a) | |

| 164,469 | | |

| 8,896,128 | |

| Dexcom, Inc.(a) | |

| 74,242 | | |

| 9,540,839 | |

| GE HealthCare Technologies, Inc. | |

| 40,428 | | |

| 3,284,371 | |

| Intuitive Surgical, Inc.(a) | |

| 42,634 | | |

| 14,578,270 | |

| Koninklijke Philips NV(c) | |

| 416,546 | | |

| 9,034,883 | |

| Medtronic PLC | |

| 161,322 | | |

| 14,212,468 | |

| Smith & Nephew PLC(b)(c) | |

| 283,558 | | |

| 9,144,746 | |

| | |

| | | |

| 81,801,326 | |

| Health Care Providers & Services (3.59%) | |

| | | |

| | |

| Cardinal Health, Inc. | |

| 52,166 | | |

| 4,933,339 | |

| Fresenius Medical Care AG & Co. KGaA(b) | |

| 854,142 | | |

| 20,439,618 | |

| UnitedHealth Group, Inc. | |

| 77,035 | | |

| 37,026,102 | |

| | |

| | | |

| 62,399,059 | |

| Life Sciences Tools & Services (3.10%) | |

| | | |

| | |

| Danaher Corp. | |

| 89,309 | | |

| 21,434,160 | |

| IQVIA Holdings, Inc.(a) | |

| 90,900 | | |

| 20,431,593 | |

| Thermo Fisher Scientific, Inc. | |

| 22,908 | | |

| 11,952,249 | |

| | |

| | | |

| 53,818,002 | |

| Pharmaceuticals (1.77%) | |

| | | |

| | |

| Bristol-Myers Squibb Co. | |

| 115,431 | | |

| 7,381,812 | |

| Merck & Co., Inc. | |

| 81,700 | | |

| 9,427,363 | |

| Pfizer, Inc. | |

| 76,452 | | |

| 2,804,259 | |

| Zoetis, Inc. | |

| 64,574 | | |

| 11,120,289 | |

| | |

| | | |

| 30,733,723 | |

| INDUSTRIALS (7.50%) | |

| | | |

| | |

| Aerospace & Defense (0.36%) | |

| | | |

| | |

| General Dynamics Corp. | |

| 29,400 | | |

| 6,325,410 | |

| | |

| | | |

| | |

| Building Products (2.00%) | |

| | | |

| | |

| Carlisle Cos., Inc. | |

| 41,584 | | |

| 10,667,543 | |

| Carrier Global Corp. | |

| 221,598 | | |

| 11,015,637 | |

| Masco Corp. | |

| 228,029 | | |

| 13,084,304 | |

| | |

| | | |

| 34,767,484 | |

See

Notes to Financial Statements.

| Liberty All-Star®

Equity Fund |

Schedule

of Investments |

June

30, 2023 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Commercial Services & Supplies (0.43%) | |

| | | |

| | |

| Waste Connections, Inc. | |

| 52,689 | | |

$ | 7,530,839 | |

| | |

| | | |

| | |

| Electrical Equipment (0.47%) | |

| | | |

| | |

| Eaton Corp. PLC | |

| 40,272 | | |

| 8,098,699 | |

| | |

| | | |

| | |

| Industrial Conglomerates (0.95%) | |

| | | |

| | |

| General Electric Co. | |

| 75,902 | | |

| 8,337,834 | |

| Honeywell International, Inc. | |

| 39,000 | | |

| 8,092,500 | |

| | |

| | | |

| 16,430,334 | |

| Machinery (2.02%) | |

| | | |

| | |

| Oshkosh Corp. | |

| 55,100 | | |

| 4,771,109 | |

| Parker-Hannifin Corp. | |

| 29,900 | | |

| 11,662,196 | |

| Wabtec Corp. | |

| 92,513 | | |

| 10,145,901 | |

| Xylem, Inc. | |

| 75,500 | | |

| 8,502,810 | |

| | |

| | | |

| 35,082,016 | |

| Professional Services (0.33%) | |

| | | |

| | |

| TransUnion | |

| 74,151 | | |

| 5,808,248 | |

| | |

| | | |

| | |

| Trading Companies & Distributors (0.94%) | |

| | | |

| | |

| Ferguson PLC | |

| 103,790 | | |

| 16,327,205 | |

| | |

| | | |

| | |

| INFORMATION TECHNOLOGY (19.81%) | |

| | | |

| | |

| Electronic Equipment & Instruments (0.41%) | |

| | | |

| | |

| TE Connectivity Ltd. | |

| 51,086 | | |

| 7,160,214 | |

| | |

| | | |

| | |

| Electronic Equipment, Instruments & Components (0.69%) | |

| | | |

| | |

| CDW Corp. | |

| 65,742 | | |

| 12,063,657 | |

| | |

| | | |

| | |

| IT Services (1.31%) | |

| | | |

| | |

| Amdocs, Ltd. | |

| 67,795 | | |

| 6,701,536 | |

| Cognizant Technology Solutions Corp., Class A | |

| 183,958 | | |

| 12,008,778 | |

| Snowflake, Inc., Class A(a) | |

| 23,216 | | |

| 4,085,552 | |

| | |

| | | |

| 22,795,866 | |

| Semiconductors & Semiconductor Equipment (4.91%) | |

| | | |

| | |

| ASML Holding N.V. | |

| 14,114 | | |

| 10,229,122 | |

| Enphase Energy, Inc.(a) | |

| 24,857 | | |

| 4,163,050 | |

| Microchip Technology, Inc. | |

| 125,600 | | |

| 11,252,504 | |

| Micron Technology, Inc. | |

| 199,535 | | |

| 12,592,654 | |

| NVIDIA Corp. | |

| 92,449 | | |

| 39,107,776 | |

See

Notes to Financial Statements.

| Semi-Annual

Report (Unaudited) | June 30, 2023 |

15 |

| Liberty All-Star®

Equity Fund |

Schedule

of Investments |

June

30, 2023 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Semiconductors & Semiconductor Equipment (continued) | |

| | | |

| | |

| QUALCOMM, Inc. | |

| 66,400 | | |

$ | 7,904,256 | |

| | |

| | | |

| 85,249,362 | |

| Software (12.49%) | |

| | | |

| | |

| Adobe, Inc.(a) | |

| 59,422 | | |

| 29,056,764 | |

| ANSYS, Inc.(a) | |

| 31,500 | | |

| 10,403,505 | |

| Autodesk, Inc.(a) | |

| 84,854 | | |

| 17,361,977 | |

| Crowdstrike Holdings, Inc., Class A(a) | |

| 50,159 | | |

| 7,366,852 | |

| Intuit, Inc. | |

| 23,914 | | |

| 10,957,156 | |

| Microsoft Corp. | |

| 172,845 | | |

| 58,860,636 | |

| Salesforce, Inc.(a) | |

| 105,382 | | |

| 22,263,001 | |

| SAP SE(b) | |

| 94,229 | | |

| 12,891,470 | |

| ServiceNow, Inc.(a) | |

| 59,757 | | |

| 33,581,641 | |

| Workday, Inc., Class A(a) | |

| 63,714 | | |

| 14,392,355 | |

| | |

| | | |

| 217,135,357 | |

| MATERIALS (5.75%) | |

| | | |

| | |

| Chemicals (3.81%) | |

| | | |

| | |

| Corteva, Inc. | |

| 217,400 | | |

| 12,457,020 | |

| Dow, Inc. | |

| 299,505 | | |

| 15,951,636 | |

| Ecolab, Inc. | |

| 112,000 | | |

| 20,909,280 | |

| RPM International, Inc. | |

| 80,400 | | |

| 7,214,292 | |

| Sherwin-Williams Co. | |

| 36,371 | | |

| 9,657,228 | |

| | |

| | | |

| 66,189,456 | |

| Construction Materials (0.67%) | |

| | | |

| | |

| Martin Marietta Materials, Inc. | |

| 25,300 | | |

| 11,680,757 | |

| | |

| | | |

| | |

| Containers & Packaging (1.27%) | |

| | | |

| | |

| Avery Dennison Corp. | |

| 79,339 | | |

| 13,630,440 | |

| Ball Corp. | |

| 146,405 | | |

| 8,522,235 | |

| | |

| | | |

| 22,152,675 | |

| REAL ESTATE (1.95%) | |

| | | |

| | |

| Residential REITs (0.32%) | |

| | | |

| | |

| Equity LifeStyle Properties, Inc. | |

| 81,739 | | |

| 5,467,522 | |

| | |

| | | |

| | |

| Specialized REITs (1.63%) | |

| | | |

| | |

| American Tower Corp. | |

| 51,747 | | |

| 10,035,813 | |

| Crown Castle, Inc. | |

| 50,600 | | |

| 5,765,364 | |

| Equinix, Inc. | |

| 16,028 | | |

| 12,564,990 | |

| | |

| | | |

| 28,366,167 | |

See

Notes to Financial Statements.

| Liberty

All-Star® Equity Fund |

Schedule

of Investments |

June

30, 2023 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| UTILITIES (1.48%) | |

| | | |

| | |

| Electric Utilities (0.99%) | |

| | | |

| | |

| Edison International | |

| 143,112 | | |

$ | 9,939,128 | |

| Xcel Energy, Inc. | |

| 118,000 | | |

| 7,336,060 | |

| | |

| | | |

| 17,275,188 | |

| Gas Utilities (0.49%) | |

| | | |

| | |

| Atmos Energy Corp. | |

| 72,300 | | |

| 8,411,382 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (COST OF $1,402,259,015) | |

| | | |

| 1,687,321,464 | |

| | |

| | | |

| | |

| SHORT TERM INVESTMENTS (3.99%) | |

| | | |

| | |

| MONEY MARKET FUND (2.73%) | |

| | | |

| | |

| State Street Institutional US Government Money Market Fund, 5.02%(d) | |

| | | |

| | |

| (COST OF $47,524,025) | |

| 47,524,025 | | |

| 47,524,025 | |

| | |

| | | |

| | |

| INVESTMENTS PURCHASED WITH COLLATERAL FROM | |

| | | |

| | |

| SECURITIES LOANED (1.26%) | |

| | | |

| | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 5.11% | |

| | | |

| | |

| (COST OF $21,852,827) | |

| 21,852,827 | | |

| 21,852,827 | |

| | |

| | | |

| | |

| TOTAL SHORT TERM INVESTMENTS | |

| | | |

| | |

| (COST OF $69,376,852) | |

| | | |

| 69,376,852 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS (101.06%) | |

| | | |

| | |

| (COST OF $1,471,635,867) | |

| | | |

| 1,756,698,316 | |

| | |

| | | |

| | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-1.06%) | |

| | | |

| (18,489,238 | ) |

| | |

| | | |

| | |

| NET ASSETS (100.00%) | |

| | | |

$ | 1,738,209,078 | |

| | |

| | | |

| | |

| NET ASSET VALUE PER SHARE | |

| | | |

| | |

| (270,856,813 SHARES OUTSTANDING) | |

| | | |

$ | 6.42 | |

| (a) | Non-income

producing security. |

| (b) | American

Depositary Receipt. |

| (c) | Security,

or a portion of the security position, is currently on loan. The total market value of

securities on loan is $26,099,172. |

| (d) | Rate

reflects seven-day effective yield on June 30, 2023. |

See

Notes to Financial Statements.

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

17 |

| Liberty

All-Star® Equity Fund |

Statement

of Assets and Liabilities |

June

30, 2023 (Unaudited)

| ASSETS: | |

| |

| Investments at value (Cost $1,471,635,867)(a) | |

$ | 1,756,698,316 | |

| Receivable for investment securities sold | |

| 8,227,695 | |

| Dividends and interest receivable | |

| 1,309,563 | |

| Tax reclaim receivable | |

| 334,186 | |

| Prepaid and other assets | |

| 65,054 | |

| TOTAL ASSETS | |

| 1,766,634,814 | |

| | |

| | |

| LIABILITIES: | |

| | |

| Payable for investments purchased | |

| 4,930,195 | |

| Investment advisory fee payable | |

| 950,030 | |

| Payable for administration, pricing and bookkeeping fees | |

| 243,876 | |

| Payable for collateral upon return of securities loaned | |

| 21,852,827 | |

| Accrued expenses | |

| 448,808 | |

| TOTAL LIABILITIES | |

| 28,425,736 | |

| NET ASSETS | |

$ | 1,738,209,078 | |

| | |

| | |

| NET ASSETS REPRESENTED BY: | |

| | |

| Paid-in capital | |

$ | 1,502,575,883 | |

| Total distributable earnings | |

| 235,633,195 | |

| NET ASSETS | |

$ | 1,738,209,078 | |

| | |

| | |

| Shares of common stock outstanding | |

| | |

| (unlimited number of shares of beneficial interest without

par value authorized) | |

| 270,856,813 | |

| NET ASSET VALUE PER SHARE | |

$ | 6.42 | |

| (a) | Includes

securities on loan of $26,099,172. |

See

Notes to Financial Statements.

| Liberty All-Star®

Equity Fund |

Statement

of Operations |

For

the Six Months Ended June 30, 2023 (Unaudited)

| INVESTMENT INCOME: | |

| |

| Dividends (Net of foreign taxes withheld at source which amounted to $385,830) | |

$ | 12,716,612 | |

| Securities lending income | |

| 33,624 | |

| TOTAL INVESTMENT INCOME | |

| 12,750,236 | |

| | |

| | |

| EXPENSES: | |

| | |

| Investment advisory fee | |

| 5,568,891 | |

| Administration, pricing and bookkeeping fees | |

| 1,389,307 | |

| Audit fee | |

| 10,144 | |

| Custodian fee | |

| 41,172 | |

| Insurance expense | |

| 26,618 | |

| Legal fees | |

| 80,526 | |

| NYSE fee | |

| 142,413 | |

| Proxy fees | |

| 61,888 | |

| Shareholder communication expenses | |

| 43,399 | |

| Transfer agent fees | |

| 68,230 | |

| Trustees' fees and expenses | |

| 167,686 | |

| Miscellaneous expenses | |

| 10,886 | |

| TOTAL EXPENSES | |

| 7,611,160 | |

| NET INVESTMENT INCOME | |

| 5,139,076 | |

| | |

| | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | |

| | |

| Net realized gain on investment transactions | |

| 67,224,413 | |

| Net realized gain on foreign currency transactions | |

| 214 | |

| Net change in unrealized appreciation on investments | |

| 146,870,237 | |

| Net change in unrealized depreciation on foreign currency transactions | |

| (787 | ) |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | |

| 214,094,077 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

$ | 219,233,153 | |

See

Notes to Financial Statements.

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

19 |

| Liberty

All-Star® Equity Fund |

Statements

of Changes in Net Assets |

| | |

For the Six | | |

| |

| | |

Months Ended | | |

For the | |

| | |

June 30, 2023 | | |

Year Ended | |

| | |

(Unaudited) | | |

December 31, 2022 | |

| FROM OPERATIONS: | |

| | | |

| | |

| Net investment income | |

$ | 5,139,076 | | |

$ | 8,782,609 | |

| Net realized gain on investment transactions | |

| 67,224,627 | | |

| 100,504,941 | |

| Net change in unrealized appreciation/(depreciation) on investments | |

| 146,869,450 | | |

| (521,449,789 | ) |

| Net Increase/(Decrease) in Net Assets From Operations | |

| 219,233,153 | | |

| (412,162,239 | ) |

| | |

| | | |

| | |

| DISTRIBUTIONS TO SHAREHOLDERS: | |

| | | |

| | |

| From distributable earnings | |

| (80,040,153 | ) | |

| (103,640,065 | ) |

| Return of capital | |

| – | | |

| (74,499,904 | ) |

| Total Distributions | |

| (80,040,153 | ) | |

| (178,139,969 | ) |

| | |

| | | |

| | |

| CAPITAL SHARE TRANSACTIONS: | |

| | | |

| | |

| Proceeds from rights offering, net of offering cost | |

| – | | |

| (224,764 | )(a) |

| Dividend reinvestments | |

| 33,017,073 | | |

| 72,897,203 | |

| Net increase resulting from Capital Share Transactions | |

| 33,017,073 | | |

| 72,672,439 | |

| Total Increase/(Decrease) in Net Assets | |

| 172,210,073 | | |

| (517,629,769 | ) |

| | |

| | | |

| | |

| NET ASSETS: | |

| | | |

| | |

| Beginning of period | |

| 1,565,999,005 | | |

| 2,083,628,774 | |

| End of period | |

$ | 1,738,209,078 | | |

$ | 1,565,999,005 | |

| (a) | Offering

expenses in the 2022 fiscal year relate to an offering from the prior fiscal year. |

See

Notes to Financial Statements.

Intentionally

Left Blank

Liberty

All-Star® Equity Fund

Financial

Highlights

| |

| PER SHARE OPERATING PERFORMANCE: |

| Net asset

value at beginning of period |

| INCOME FROM INVESTMENT OPERATIONS: |

| Net investment income(a) |

| Net realized

and unrealized gain/(loss) on investments |

| Total

from Investment Operations |

| |

| LESS DISTRIBUTIONS TO SHAREHOLDERS: |

| Net investment income |

| Net realized gain on investments |

| Return

of capital |

| Total

Distributions |

| Change

due to rights offering(b) |

| Net

asset value at end of period |

| Market

price at end of period |

| |

| TOTAL INVESTMENT RETURN FOR SHAREHOLDERS:(c) |

| Based on net asset value |

| Based on market price |

| |

| RATIOS AND SUPPLEMENTAL DATA: |

| Net assets at end of period (millions) |

| Ratio of expenses to average net assets |

| Ratio of net investment income to average net

assets |

| Portfolio turnover rate |

| (a) | Calculated

using average shares outstanding during the period. |

| (b) | Effect

of Fund's rights offering for shares at a price below net asset value, net of costs. |

| (c) | Calculated

assuming all distributions are reinvested at actual reinvestment prices and all primary rights in the Fund's rights offering were

exercised. The net asset value and market price returns will differ depending upon the level of any discount from or premium to

net asset value at which the Fund's shares traded during the period. Past performance is not a guarantee of future results. |

See

Notes to Financial Statements.

Financial

Highlights

For the Six

Months Ended

June 30, 2023 | | |

For the Year Ended December 31, | |

| (Unaudited) | | |

2022 | | |

2021 | | |

2020 | | |

2019 | | |

2018 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| $ | 5.90 | | |

$ | 8.20 | | |

$ | 7.37 | | |

$ | 6.90 | | |

$ | 5.89 | | |

$ | 6.87 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | 0.02 | | |

| 0.03 | | |

| 0.02 | | |

| 0.03 | | |

| 0.05 | | |

| 0.05 | |

| | 0.80 | | |

| (1.64 | ) | |

| 1.67 | | |

| 1.07 | | |

| 1.62 | | |

| (0.35 | ) |

| | 0.82 | | |

| (1.61 | ) | |

| 1.69 | | |

| 1.10 | | |

| 1.67 | | |

| (0.30 | ) |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | (0.30 | ) | |

| (0.03 | ) | |

| (0.02 | ) | |

| (0.03 | ) | |

| (0.05 | ) | |

| (0.05 | ) |

| | – | | |

| (0.37 | ) | |

| (0.74 | ) | |

| (0.60 | ) | |

| (0.59 | ) | |

| (0.51 | ) |

| | – | | |

| (0.29 | ) | |

| (0.05 | ) | |

| – | | |

| (0.02 | ) | |

| (0.12 | ) |

| | (0.30 | ) | |

| (0.69 | ) | |

| (0.81 | ) | |

| (0.63 | ) | |

| (0.66 | ) | |

| (0.68 | ) |

| | – | | |

| – | | |

| (0.05 | ) | |

| – | | |

| – | | |

| – | |

| $ | 6.42 | | |

$ | 5.90 | | |

$ | 8.20 | | |

$ | 7.37 | | |

$ | 6.90 | | |

$ | 5.89 | |

| $ | 6.47 | | |

$ | 5.70 | | |

$ | 8.38 | | |

$ | 6.90 | | |

$ | 6.77 | | |

$ | 5.38 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | 14.2 | %(d) | |

| (20.1 | %) | |

| 24.0 | % | |

| 18.0 | % | |

| 30.1 | % | |

| (4.5 | %) |

| | 19.1 | %(d) | |

| (24.5 | %) | |

| 35.3 | % | |

| 12.6 | % | |

| 39.7 | % | |

| (4.9 | %) |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| $ | 1,738 | | |

$ | 1,566 | | |

$ | 2,084 | | |

$ | 1,599 | | |

$ | 1,440 | | |

$ | 1,183 | |

| | 0.94 | %(e) | |

| 0.93 | % | |

| 0.93 | % | |

| 1.02 | % | |

| 0.99 | % | |

| 1.00 | % |

| | 0.63 | %(e) | |

| 0.52 | % | |

| 0.23 | % | |

| 0.44 | % | |

| 0.73 | % | |

| 0.72 | % |

| | 11 | %(d) | |

| 23 | % | |

| 22 | % | |

| 45 | % | |

| 23 | % | |

| 22 | % |

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

23 |

| Liberty All-Star® Equity Fund |

Notes to Financial Statements |

June

30, 2023 (Unaudited)

NOTE

1. ORGANIZATION

Liberty

All-Star® Equity Fund (the “Fund”) is a Massachusetts business trust registered under the Investment

Company Act of 1940 (the “1940 Act”), as amended, as a diversified, closed-end management investment company.

Investment

Goal

The

Fund seeks total investment return comprised of long-term capital appreciation and current income through investing primarily

in a diversified portfolio of equity securities.

Fund

Shares

The

Fund may issue an unlimited number of shares of beneficial interest.

NOTE

2. SIGNIFICANT ACCOUNTING POLICIES

The

following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial

statements. The Fund is considered an investment company under U.S. generally accepted accounting principles (“GAAP”)

and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board

Accounting Standards Codification Topic 946 Financial Services - Investment Companies.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial

statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual

results could differ from these estimates.

Security

Valuation

Equity

securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities

listed on the NASDAQ Stock Market LLC (“NASDAQ”), which are valued at the NASDAQ official closing price. Unlisted

securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges

or over-the-counter markets.

Cash

collateral from securities lending activity is reinvested in the State Street Navigator Securities Lending Government Money Market

Portfolio (“State Street Navigator”), a registered investment company under the 1940 Act, which operates as a money

market fund in compliance with Rule 2a-7 under the 1940 Act. Shares of registered investment companies are valued daily at that

investment company’s net asset value ("NAV") per share.

The

Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities,

at fair value according to procedures adopted by the Fund's Board of Trustees (the "Board"). The Board has designated

ALPS Advisors, Inc. (the "Advisor") as the Fund's Valuation Designee. The Valuation Designee is responsible for determining

fair value in good faith for all Fund investments, subject to oversight by the Board. When market quotations are not readily available,

or in management’s judgment they do not accurately reflect fair value of a security, or an event occurs after the market

close but before the Fund is priced that materially affects the value of a security, the security

will be valued by the Advisor’s Valuation Committee using fair valuation procedures established by the Valuation Designee.

Examples of potentially significant events that could materially impact a Fund’s net asset value include, but are not limited

to: single issuer events such as corporate actions, reorganizations, mergers, spin-offs, liquidations, acquisitions and buyouts;

corporate announcements on earnings or product offerings; regulatory news; and litigation and multiple issuer events such as governmental

actions; natural disasters or armed conflicts that affect a country or a region; or significant market fluctuations. Potential

significant events are monitored by the Advisor, Sub-Advisers and/or the Valuation Committee through independent reviews of market

indicators, general news sources and communications from the Fund’s custodian. As of June 30, 2023, the Fund held no securities

that were fair valued.

| Liberty All-Star® Equity Fund |

Notes to Financial Statements |

June

30, 2023 (Unaudited)

Security

Transactions

Security

transactions are recorded on trade date. Cost is determined and gains/(losses) are based upon the specific identification method

for both financial statement and federal income tax purposes.

Income

Recognition

Interest

income is recorded on the accrual basis. Corporate actions are recorded on the ex-date.

Dividend

income is recognized on the ex-dividend date, or for certain foreign securities, as soon as information is available to the Fund.

Withholding taxes on foreign dividends are paid (a portion of which may be reclaimable) or provided for in accordance with the

applicable country’s tax rules and rates and are disclosed in the Statements of Operations.

The

Fund estimates components of distributions from real estate investment trusts (“REITs”). Distributions received in

excess of income are recorded as a reduction of the cost of the related investments. Once the REIT reports annually the tax character

of its distributions, the Fund revises its estimates. If the Fund no longer owns the applicable securities, any distributions

received in excess of income are recorded as realized gains.

Lending

of Portfolio Securities

The

Fund may lend its portfolio securities only to borrowers that are approved by the Fund’s securities lending agent, State

Street Bank & Trust Co. (“SSB”). The Fund will limit such lending to not more than 30% of the value of its total

assets. The borrower pledges and maintains with the Fund collateral consisting of cash (U.S. Dollar only), securities issued or

guaranteed by the U.S. government or its agencies or instrumentalities, or by irrevocable bank letters of credit issued by a person

other than the borrower or an affiliate of the borrower. The initial collateral received by the Fund is required to have a value

of no less than 102% of the market value of the loaned securities for securities traded on U.S. exchanges and a value of no less

than 105% of the market value for all other securities. The collateral is maintained thereafter, at a market value equal to no

less than 100% of the current value of the securities on loan. The market value of the loaned securities is determined at the

close of each business day and any additional required collateral is delivered to the Fund on the next business day. During the

term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities

are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time

period for settlement of securities transactions.

| Semi-Annual Report (Unaudited)

| June 30, 2023 |

25 |

| Liberty All-Star® Equity Fund |

Notes to Financial Statements |

June

30, 2023 (Unaudited)

Any

cash collateral received is reinvested in State Street Navigator. Non-cash collateral, in the form of securities issued or guaranteed

by the U.S. government or its agencies or instrumentalities, is not disclosed in the Fund’s Statement of Assets and Liabilities

or the contractual maturity table below as it is held by the lending agent on behalf of the Fund and the Fund does not have the

ability to re-hypothecate these securities. Income earned by the Fund from securities lending activity is disclosed in the Statement

of Operations.

The

following is a summary of the Fund's securities lending positions and related cash and non-cash collateral received as of June

30, 2023:

| Market Value of | | |

Cash Collateral | | |

Non-Cash Collateral | | |

Total Collateral | |

| Securities on Loan | | |

Received | | |

Received | | |

Received | |

| $ | 26,099,172 | | |

$ | 21,852,827 | | |

$ | 4,351,849 | | |

$ | 26,204,676 | |

The

risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not

return the securities when due. To mitigate these risks, the Fund benefits from a borrower default indemnity provided by SSB.

SSB’s indemnity allows for full replacement of securities lent wherein SSB will purchase the unreturned loaned securities

on the open market by applying the proceeds of the collateral, or to the extent such proceeds are insufficient or the collateral

is unavailable, SSB will purchase the unreturned loan securities at SSB’s expense. However, the Fund could suffer a loss

if the value of the investments purchased with cash collateral falls below the value of the cash collateral received.

The

following table reflects a breakdown of transactions accounted for as secured borrowings, the gross obligation by the type of

collateral pledged or securities loaned, and the remaining contractual maturity of those transactions as of June 30, 2023:

| | |

Remaining contractual maturity of the agreements |

Securities Lending

Transactions | |

Overnight &

Continuous | |

Up to 30 days | | |

30-90

days | | |

Greater than

90 days | | |

Total | |

| State Street Navigator | $ |

21,852,827 | |

$ | – | | |

$ | – | | |

$ | – | | |

$ | 21,852,827 | |

| Total Borrowings | |

| |

| | | |

| | | |

| | | |

$ | 21,852,827 | |

| Gross amount of recognized liabilities for securities lending (collateral received) | | |

$ | 21,852,827 | |

Fair

Value Measurements

The

Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to

measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability,

including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants

would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting

entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would

use in pricing the asset or liability that are developed based on the best information available.

| Liberty All-Star® Equity Fund |

Notes to Financial Statements |

June

30, 2023 (Unaudited)

Valuation

techniques used to value the Fund’s investments by major category are as follows:

Equity

securities that are valued based on unadjusted quoted prices in active markets are categorized as Level 1 in the hierarchy. In

the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most

recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Investments in open-end

mutual funds are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

Various

inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used

fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls