- Diluted earnings per common share of $0.79; diluted adjusted*

earnings per common share of $0.79

- Annualized return on average common equity (“ROCE”) of 31.7%,

annualized adjusted* return on average common equity of 23.9%

- Direct premiums written of $410.1 million, up 3.4% from the

prior year quarter

- Book value per share of $10.57, up 11.6% from fourth quarter

2022; adjusted book value per share of $13.52, up 4.9% from fourth

quarter 2022

Universal Insurance Holdings (NYSE: UVE) (“Universal” or the

“Company”) reported first quarter 2023 results.

“It was a strong quarter, including a 23.9% annualized adjusted

return on common equity and 23.4% adjusted diluted EPS growth

year-on-year,” said Stephen J. Donaghy, Chief Executive Officer.

“There are multiple factors benefiting our business and I’m

optimistic as I look towards the future - the Florida legislature

passed meaningful reforms at the December special session, which we

believe will improve the long-term stability and profitability of

our core business, while rate adequacy improves and higher fixed

income yields boost the productivity of our investment portfolio.

Additionally, as we sit here today, we already have our core all

states property catastrophe reinsurance tower for the 2023-2024

period fully supported and secured with no material changes to our

historical reinsurance partners or our terms and conditions, while

the costs are well within our budget parameters. We are very

pleased with the progress we have made in the current environment,

which is a testament to the strength of our business.”

*Reconciliations of GAAP to non-GAAP financial measures are

provided in the attached tables.

Quarterly Financial Results

Summary Financial Results

($thousands, except per share data)

Three Months Ended March

31,

2023

2022

Change

GAAP

comparison

Total revenues

$

316,508

$

287,482

10.1

%

Operating income

$

34,427

$

24,079

43.0

%

Operating income margin

10.9

%

8.4

%

2.5 pts

Net income available to common

stockholders

$

24,170

$

17,534

37.8

%

Diluted earnings per common share

$

0.79

$

0.56

41.1

%

Annualized ROCE

31.7

%

17.0

%

14.7 pts

Book value per share, end of period

$

10.57

$

12.80

(17.4

)%

Non-GAAP

comparison1

Core revenue

$

316,339

$

290,820

8.8

%

Adjusted operating income

$

34,258

$

27,417

25.0

%

Adjusted operating income margin

10.8

%

9.4

%

1.4 pts

Adjusted net income available to common

stockholders

$

24,043

$

20,049

19.9

%

Adjusted diluted earnings per common

share

$

0.79

$

0.64

23.4

%

Annualized adjusted ROCE

23.9

%

17.8

%

6.1 pts

Adjusted book value per share, end of

period

$

13.52

$

14.69

(8.0

)%

Underwriting

Summary

Premiums:

Premiums in force

$

1,862,716

$

1,703,151

9.4

%

Policies in force

827,981

916,745

(9.7

)%

Direct premiums written

$

410,102

$

396,481

3.4

%

Direct premiums earned

$

455,368

$

414,603

9.8

%

Ceded premiums earned

$

(173,144

)

$

(145,539

)

19.0

%

Ceded premium ratio

38.0

%

35.1

%

2.9 pts

Net premiums earned

$

282,224

$

269,064

4.9

%

Net ratios:

Loss ratio

73.1

%

68.8

%

4.3 pts

Expense ratio

26.9

%

29.1

%

(2.2) pts

Combined ratio

100.0

%

97.9

%

2.1 pts

1 Reconciliation of GAAP to non-GAAP

financial measures are provided in the attached tables. Adjusted

net income available to common stockholders, adjusted diluted

earnings per common share and core revenue exclude net realized

gains (losses) on investments and net change in unrealized gains

(losses) of equity securities. Adjusted operating income excludes

the items above and interest and amortization of debt issuance

costs. Adjusted book value per share excludes accumulated other

comprehensive income, net of taxes. Adjusted ROCE is calculated by

dividing annualized adjusted net income available to common

stockholders by average adjusted book value per share, with the

denominator further excluding current period after-tax net realized

gains (losses) on investments and net change in unrealized gains

(losses) of equity securities.

Net Income and Adjusted Net

Income

Net income available to common stockholders was $24.2 million,

up from $17.5 million in the prior year quarter, and adjusted net

income available to common stockholders was $24.0 million, up from

$20.0 million in the prior year quarter. The increase in adjusted

net income available to common stockholders mostly stems from

higher net premiums earned, net investment income and commission

revenue and a lower net expense ratio, partly offset by a higher

net loss ratio.

Revenues

Revenue was $316.5 million, up 10.1% from the prior year quarter

and core revenue was $316.3 million, up 8.8% from the prior year

quarter. The increase in core revenue primarily stems from higher

net premiums earned, net investment income and commission

revenue.

Direct premiums written were $410.1 million, up 3.4% from the

prior year quarter. The increase stems from 0.9% growth in Florida

and 17.2% growth in other states. Growth reflects rate increases,

partly offset by lower policies in force.

Direct premiums earned were $455.4 million, up 9.8% from the

prior year quarter. The increase stems from rate-driven direct

premiums written growth over the past twelve months.

The ceded premium ratio was 38.0%, up from 35.1% in the prior

year quarter. The increase primarily reflects reinstatement

premiums associated with Hurricane Ian, which were partly offset by

reinsurance brokerage commissions earned on those reinstatement

premiums, as referenced in the commissions, policy fees and other

revenue section below. Additionally, the higher ceded premium ratio

reflects higher reinsurance pricing and higher reinsurance costs

associated with the increase in insured values, partly offset by

direct premiums earned growth associated with primary rate

increases and reinsurance savings associated with leveraging our

self-insured captive to a greater degree than the prior year.

Net premiums earned were $282.2 million, up 4.9% from the prior

year quarter. The increase is primarily attributable to higher

direct premiums earned, partly offset by a higher ceded premium

ratio, as described above.

Net investment income was $10.7 million, up from $4.0 million in

the prior year quarter. The increase primarily stems from higher

fixed income reinvestment yields and higher yields on cash.

Commissions, policy fees and other revenue were $23.4 million,

up 32.2% from the prior year quarter. The increase primarily

reflects higher reinsurance brokerage commission revenue, which

benefited from higher ceded premiums, including reinstatement

premiums associated with Hurricane Ian, and the difference in our

reinsurance program’s structure relative to the prior year quarter,

partly offset by a decline in policy fees associated with lower

policies in force.

Margins

The GAAP operating income margin was 10.9%, up from a GAAP

operating income margin of 8.4% in the prior year quarter and the

adjusted operating income margin was 10.8%, up from an adjusted

operating income margin of 9.4% in the prior year quarter. The

higher adjusted operating income margin primarily reflects higher

net investment income and commission revenue and a lower net

expense ratio, partly offset by a higher net loss ratio.

The net loss ratio was 73.1%, up 4.3 points compared to the

prior year quarter. The increase primarily reflects a higher

attritional initial accident year loss pick and higher prior year

reserve development as a percentage of net premiums earned, partly

offset by lower weather losses as a percentage of net premiums

earned.

The net expense ratio was 26.9%, down 2.2 points from 29.1% in

the prior year quarter. The reduction primarily reflects lower

renewal commission rates paid to distribution partners.

The net combined ratio was 100.0%, up 2.1 points compared to the

prior year quarter. The increase reflects a higher net loss ratio,

partly offset by a lower net expense ratio, as described above.

Capital Deployment

On April 12, 2023, the Board of Directors declared a quarterly

cash dividend of 16 cents per share of common stock, payable on May

19, 2023, to shareholders of record as of the close of business on

May 12, 2023.

Conference Call and Webcast

- Friday, April 28, 2023 at 10:00 a.m. ET

- Investors and other interested parties may listen to the call

by accessing the online, real-time webcast at

universalinsuranceholdings.com/investors or by registering in

advance via teleconference at

https://register.vevent.com/register/BI602cbc3e0b814bbda9b9d8a759ea4a58.

Once registration is completed, participants will be provided with

a dial-in number containing a personalized conference code to

access the call. An online replay of the call will be available at

universalinsuranceholdings.com/investors soon after the investor

call concludes.

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc. (NYSE: UVE) is a holding

company providing property and casualty insurance and value-added

insurance services. We develop, market, and write insurance

products for consumers predominantly in the personal residential

homeowners lines of business and perform substantially all other

insurance-related services for our primary insurance entities,

including risk management, claims management and distribution. We

provide insurance products through both our appointed independent

agents and through our direct online distribution channels in the

United States across 19 states (primarily Florida). Learn more at

universalinsuranceholdings.com.

Non-GAAP Financial Measures and Key Performance

Indicators

This press release contains non-GAAP financial measures within

the meaning of Regulation G promulgated by the U.S. Securities and

Exchange Commission (“SEC”), including core revenue, adjusted net

income available to common stockholders and diluted adjusted

earnings (loss) per common share, which exclude the impact of net

realized gains (losses) on investments and net change in unrealized

gains (losses) of equity securities. Adjusted operating income and

adjusted operating income margin exclude the impact of net realized

gains (losses) on investments and net change in unrealized gains

(losses) of equity securities and interest and amortization of debt

issuance costs. Adjusted common stockholders’ equity and adjusted

book value per share exclude accumulated other comprehensive income

(AOCI), net of taxes. Adjusted return on common equity excludes

after-tax net realized gains (losses) on investments and net change

in unrealized gains (losses) of equity securities from the

numerator and AOCI, net of taxes, and current period after-tax net

realized gains (losses) on investments and net change in unrealized

gains (losses) of equity securities from the denominator. A

“non-GAAP financial measure” is generally defined as a numerical

measure of a company’s historical or future performance that

excludes or includes amounts, or is subject to adjustments, so as

to be different from the most directly comparable measure

calculated and presented in accordance with generally accepted

accounting principles (“GAAP”). UVE management believes that these

non-GAAP financial measures are meaningful, as they allow investors

to evaluate underlying revenue and profitability trends and enhance

comparability across periods. When considered together with the

GAAP financial measures, management believes these metrics provide

information that is useful to investors in understanding

period-over-period operating results separate and apart from items

that may, or could, have a disproportionately positive or negative

impact on results in any particular period. UVE management also

believes that these non-GAAP financial measures enhance the ability

of investors to analyze UVE’s business trends and to understand

UVE’s operational performance. UVE’s management utilizes these

non-GAAP financial measures as guides in long-term planning.

Non-GAAP financial measures should be considered in addition to,

and not as a substitute for or superior to, financial measures

presented in accordance with GAAP. For more information regarding

our key performance indicators, please refer to the section titled

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations – Key Performance Indicators” in our

forthcoming Quarterly Report on Form 10-Q for the quarter ended

March 31, 2023.

Forward-Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. The words “believe,” “expect,” “anticipate,” “will,”

“plan,” and similar expressions identify forward-looking

statements, which speak only as of the date the statement was made.

Such statements may include commentary on plans, products and lines

of business, marketing arrangements, reinsurance programs and other

business developments and assumptions relating to the foregoing.

Forward-looking statements are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified,

including those risks and uncertainties described under the heading

“Risk Factors” and “Liquidity and Capital Resources” in our 2022

Annual Report on Form 10-K, and supplemented in our subsequent

Quarterly Reports on Form 10-Q. Future results could differ

materially from those described, and the Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise. For further information regarding risk factors that

could affect the Company’s operations and future results, refer to

the Company’s reports filed with the Securities and Exchange

Commission, including the Company’s Annual Report on Form 10-K and

the most recent quarterly reports on Form 10-Q.

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except per

share data)

March 31,

December 31,

2023

2022

ASSETS:

Invested Assets

Fixed maturities, at fair value

$

1,026,555

$

1,014,626

Equity securities, at fair value

92,906

85,469

Investment real estate, net

5,665

5,711

Total invested assets

1,125,126

1,105,806

Cash and cash equivalents

330,155

388,706

Restricted cash and cash equivalents

2,635

2,635

Prepaid reinsurance premiums

124,308

282,427

Reinsurance recoverable

678,094

808,850

Premiums receivable, net

64,844

69,574

Property and equipment, net

50,193

51,404

Deferred policy acquisition costs

97,893

103,654

Goodwill

2,319

2,319

Other assets

75,453

74,779

TOTAL ASSETS

$

2,551,020

$

2,890,154

LIABILITIES AND STOCKHOLDERS'

EQUITY

LIABILITIES:

Unpaid losses and loss adjustment

expenses

$

870,407

$

1,038,790

Unearned premiums

898,588

943,854

Advance premium

92,235

54,964

Reinsurance payable, net

91,932

384,504

Long-term debt, net

102,578

102,769

Other liabilities

173,474

77,377

Total liabilities

2,229,214

2,602,258

STOCKHOLDERS' EQUITY:

Cumulative convertible preferred stock

($0.01 par value)2

—

—

Common stock ($0.01 par value)3

472

472

Treasury shares, at cost - 16,790 and

16,790

(238,758

)

(238,758

)

Additional paid-in capital

113,425

112,509

Accumulated other comprehensive income

(loss), net of taxes

(89,991

)

(103,782

)

Retained earnings

536,658

517,455

Total stockholders' equity

321,806

287,896

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

2,551,020

$

2,890,154

Notes:

2 Cumulative convertible preferred stock

($0.01 par value): Authorized - 1,000 shares; Issued - 10 and 10

shares; Outstanding - 10 and 10 shares; Minimum liquidation

preference - $9.99 and $9.99 per share.

3 Common stock ($0.01 par value):

Authorized - 55,000 shares; Issued - 47,230 and 47,179 shares;

Outstanding 30,440 and 30,389 shares.

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME (UNAUDITED)

(in thousands)

Three Months Ended

March 31,

2023

2022

REVENUES

Net premiums earned

$

282,224

$

269,064

Net investment income

10,698

4,042

Net realized gains (losses) on

investments

(788

)

58

Net change in unrealized gains (losses) of

equity securities

957

(3,396

)

Commission revenue

17,282

11,161

Policy fees

4,167

4,779

Other revenue

1,968

1,774

Total revenues

316,508

287,482

EXPENSES

Losses and loss adjustment expenses

206,154

185,106

Policy acquisition costs

51,691

54,723

Other operating expenses

24,236

23,574

Total operating costs and

expenses

282,081

263,403

Interest and amortization of debt issuance

costs

1,636

1,608

Income before income tax

expense

32,791

22,471

Income tax expense

8,618

4,934

NET INCOME

$

24,173

$

17,537

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

SHARE AND PER SHARE

INFORMATION

(in thousands, except per

share data)

Three Months Ended

March 31,

2023

2022

Weighted average common shares outstanding

- basic

30,382

31,147

Weighted average common shares outstanding

- diluted

30,626

31,227

Shares outstanding, end of period

30,440

30,946

Basic earnings per common share

$

0.80

$

0.56

Diluted earnings per common share

$

0.79

$

0.56

Cash dividend declared per common

share

$

0.16

$

0.16

Book value per share, end of period

$

10.57

$

12.80

Annualized return on average common equity

(ROCE)

31.7

%

17.0

%

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

SUPPLEMENTARY

INFORMATION

(in thousands, except for

Policies In Force data)

Three Months Ended

March 31,

2023

2022

Premiums

Direct premiums written - Florida

$

337,365

$

334,437

Direct premiums written - Other States

72,737

62,044

Direct premiums written - Total

$

410,102

$

396,481

Direct premiums earned

$

455,368

$

414,603

Net premiums earned

$

282,224

$

269,064

Underwriting Ratios - Net

Loss and loss adjustment expense ratio

73.1

%

68.8

%

Policy acquisition cost ratio

18.3

%

20.3

%

Other operating expense ratio

8.6

%

8.8

%

Expense ratio

26.9

%

29.1

%

Combined ratio

100.0

%

97.9

%

Other Items

Net prior years’ reserve development

$

3,318

$

655

Points on the net loss and loss adjustment

expense ratio

1.2 pts

0.2 pts

As of

March 31,

2023

2022

Policies in force

Florida

595,327

672,029

Other States

232,654

244,716

Total

827,981

916,745

Premiums in force

Florida

$

1,543,967

$

1,416,185

Other States

318,749

286,966

Total

$

1,862,716

$

1,703,151

Total Insured Value

Florida

$

197,085,882

$

201,091,861

Other States

123,651,801

118,041,945

Total

$

320,737,683

$

319,133,806

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(in thousands, except for per

share data)

GAAP revenue to core revenue

Three Months Ended

March 31,

2023

2022

GAAP revenue

$

316,508

$

287,482

less: Net realized gains (losses) on

investments

(788

)

58

less: Net change in unrealized gains

(losses) of equity securities

957

(3,396

)

Core revenue

$

316,339

$

290,820

GAAP operating income to adjusted

operating income

Three Months Ended

March 31,

2023

2022

GAAP income before income tax

expense

$

32,791

$

22,471

add: Interest and amortization of debt

issuance costs

1,636

1,608

GAAP operating income

34,427

24,079

less: Net realized gains (losses) on

investments

(788

)

58

less: Net change in unrealized gains

(losses) of equity securities

957

(3,396

)

Adjusted operating income

$

34,258

$

27,417

GAAP operating income margin to

adjusted operating income margin

Three Months Ended

March 31,

2023

2022

GAAP operating income (a)

$

34,427

$

24,079

GAAP revenue (b)

316,508

287,482

GAAP operating income margin

(a÷b)

10.9

%

8.4

%

Adjusted operating income (c)

34,258

27,417

Core revenue (d)

316,339

290,820

Adjusted operating income margin

(c÷d)

10.8

%

9.4

%

GAAP net income (NI) to adjusted NI

available to common stockholders

Three Months Ended

March 31,

2023

2022

GAAP NI

$

24,173

$

17,537

less: Preferred dividends

3

3

GAAP NI available to common

stockholders (e)

24,170

17,534

less: Net realized gains (losses) on

investments

(788

)

58

less: Net change in unrealized gains

(losses) of equity securities

957

(3,396

)

add: Income tax effect on above

adjustments

42

(823

)

Adjusted NI available to common

stockholders (f)

$

24,043

$

20,049

Weighted average diluted common shares

outstanding (g)

30,626

31,227

Diluted earnings per common share

(e÷g)

$

0.79

$

0.56

Diluted adjusted earnings per common share

(f÷g)

$

0.79

$

0.64

GAAP stockholders’ equity to adjusted

common stockholders’ equity

As of

March 31,

March 31,

December 31,

2023

2022

2022

GAAP stockholders’ equity

$

321,806

$

396,341

$

287,896

less: Preferred equity

100

100

100

Common stockholders’ equity (h)

321,706

396,241

287,796

less: Accumulated other comprehensive

(loss), net of taxes

(89,991

)

(58,478

)

(103,782

)

Adjusted common stockholders’ equity

(i)

$

411,697

$

454,719

$

391,578

Shares outstanding (j)

30,440

30,946

30,389

Book value per common share (h÷j)

$

10.57

$

12.80

$

9.47

Adjusted book value per common share

(i÷j)

$

13.52

$

14.69

$

12.89

GAAP return on common equity (ROCE) to

adjusted ROCE

Three Months Ended

Year Ended

March 31,

December 31,

2023

2022

2022

Actual or Annualized NI available to

common stockholders (k)

$

96,680

$

70,136

$

(22,267

)

Average common stockholders’ equity

(l)

304,751

412,922

358,699

ROCE (k÷l)

31.7

%

17.0

%

(6.2

) %

Actual or Annualized adjusted NI available

to common stockholders (m)

$

96,172

$

80,196

$

(12,618

)

Adjusted average common stockholders’

equity4 (n)

401,574

451,202

423,199

Adjusted ROCE (m÷n)

23.9

%

17.8

%

(3.0

) %

4 Adjusted average common stockholders’

equity excludes current period after-tax net realized gains

(losses) on investments and net change in unrealized gains (losses)

of equity securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230427005316/en/

Arash Soleimani, CFA, CPA, CPCU Chief Strategy Officer

954-804-8874 asoleimani@universalproperty.com

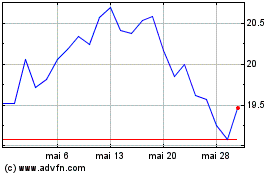

Universal Insurance (NYSE:UVE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Universal Insurance (NYSE:UVE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024