Reports Preliminary Third Quarter Fiscal Year

2025 Results

Highlights Continued Strong Operational

Performance

Files Form 12b-25, Delays Third Quarter 2025

Earnings Release and Conference Call

Universal Corporation (NYSE:UVV) (“Universal” or the “Company”),

a global business-to-business agriproducts company, today is

providing a financial and operational update for the third quarter

of fiscal year 2025, including preliminary results for the

quarter.

Preston D. Wigner, Chairman, President, and Chief Executive

Officer of Universal Corporation, stated, “Universal achieved solid

results for the third quarter of fiscal year 2025, primarily driven

by the strength of our Tobacco Operations segment. Demand from our

tobacco customers remained robust, and our global procurement

efforts have been successful in securing the tobacco to meet this

need. Our Ingredients Operations segment also continued to perform

in line with our strategic plans, with sales of newly produced and

developed value-added products largely offsetting market-driven

pricing pressures experienced by certain of our traditional product

lines. The progress we are making in our ingredients business is a

direct result of the investments we have made over the last two

fiscal years, including in our enhanced ingredients facility.

Mr. Wigner continued, “Looking ahead, we are confident that

Universal is well positioned to finish fiscal year 2025 on a strong

footing. We will continue to maximize and optimize our tobacco

business, expand our ingredients business, and seek possible

opportunities in the future for both segments to work together and

provide even more value for our customers and shareholders.”

Preliminary Unaudited Financial Results

(in millions of dollars, except per

share data)

Three Months Ended December

31, 2024

Consolidated Results

Sales and other operating revenue

$

937.2

Operating income

100.7

Net Income attributable to Universal

Corporation

57.1

Basic earnings per share

2.28

Diluted earnings per share

2.27

Segment Results

Tobacco operations sales and other

operating revenues

$

854.8

Tobacco operations operating income

99.2

Ingredients operations sales and other

operating revenues

83.3

Ingredients operations operating

income

3.7

Highlights of the Quarter

Consolidated Results

- Revenues and operating income driven by increased tobacco and

ingredients sales volumes.

Tobacco Operations Segment

- Tobacco Operations segment results benefited from:

- Positive momentum due to increased customer demand and

successful tobacco procurement and marketing efforts;

- Higher quality, better yielding crops in Africa;

- Strong trading volumes combined with higher shipment volumes

and better-quality crops in Asia; and

- Accelerated shipment timing in the United States per certain

customers’ requests.

- Selling, general, and administrative expenses for the Tobacco

Operations segment included approximately $11 million in currency

remeasurement losses.

- Uncommitted tobacco inventory levels remained low at about 10%

at quarter end.

Ingredients Operations Segment

- Higher revenues on increased sales volumes.

- Margins for certain traditional products were strained by high

raw material costs and inflation-driven increases in consumer food

prices.

- Continued high level of interest in value-added products,

reflecting effectiveness of platform investments.

Select Balance Sheet Items, Liquidity, and Debt

- Cash and cash equivalents were approximately $215 million,

accounts receivable were approximately $651 million, total

inventories were approximately $1.1 billion, notes payable and

overdrafts were approximately $539 million, and long-term debt

(including any current portion) was approximately $618 million at

quarter end.

- Approximately $270 million was available under revolving credit

facility as of quarter end.

- Given strong leaf tobacco demand, tobacco shipments are

currently progressing in line with the Company's expectations.

Additionally, the Company expects larger flue-cured and burley

tobacco crops, as compared to last year in certain key origins,

particularly in Brazil, and therefore is not seeing the early,

accelerated green tobacco purchasing it saw in the prior season.

Cash collection from tobacco shipments and more normalized working

capital requirements support the Company's intention to reduce net

debt levels.

The preliminary unaudited financial results for the quarter

ended December 31, 2024, included in this press release represent

the most current information available to management and are not a

comprehensive statement of the financial results for this period.

Consequently, the preliminary unaudited financial results do not

present all necessary information for a complete understanding of

the Company’s financial condition as of December 31, 2024, or its

results of operations for the quarter ended December 31, 2024.

Actual results may differ from these preliminary unaudited results

due to developments that may arise between the date of this press

release and the time that financial results for the quarter ended

December 31, 2024 are finalized.

Sustainability Update

On December 19, 2024, Universal released its 2024 Sustainability

Report (the “Report”), highlighting its efforts in advancing energy

efficiency, strengthening supply chain resiliency and continuing to

be a strong partner for its farming communities. Responsible

business practices are integrated into Universal’s business

strategy, allowing the Company to cultivate sustainable growth as

good stewards of the environment. As a result of the Company’s

transition to cleaner fuels for its operations, 93.5% of the

tobacco Universal processes is coal-free as of 2024. This positive

change supports the Company’s goal of reducing its greenhouse gas

(GHG) emissions by 30% by 2030 from its 2020 baseline year. In

2024, the Company also trained over 175,000 farmers on Good

Agricultural Practices and Agricultural Labor Practices to advance

human rights standards throughout its supply chain. Universal also

adopted a Behavior-Based Safety program to cultivate a proactive

safety culture in its operations. The Report, with additional

details related to the Company’s responsible operations, can be

found on Universal’s website, www.universalcorp.com.

Other Corporate Developments

The Company has filed a Form 12b-25, Notification of Late

Filing, with the U.S. Securities and Exchange Commission (“SEC”) in

connection with its inability to timely file the Form 10-Q for its

third quarter of fiscal year 2025 ended December 31, 2024.

In August 2024, shortly before filing the Quarterly Report on

Form 10-Q for the quarter ended June 30, 2024, the Company’s

management was made aware of embezzlement by a former senior

finance employee at the Company’s Mozambique subsidiary, Mozambique

Leaf Tobacco Ltda. (“MLT”). The Company promptly commenced an

internal investigation regarding these allegations and related

matters. As previously reported, with the assistance of outside

advisors, the Company’s internal investigation identified

approximately $7 million in the aggregate of unauthorized payments

during fiscal years 2022 through 2025. In total, the Company has

identified approximately $16.7 million in the aggregate of

unauthorized payments during fiscal years 2016 through 2025.

With the assistance of outside advisors, the Company continues

to work diligently to complete the investigation, including a

review of the circumstances and timing around the discovery of the

embezzlement, as soon as possible. The Company is currently unable

to predict the outcome or time frame for completion of the

investigation.

As of the date of this press release, the Company does not

believe material adjustments to its previously issued financial

statements will be necessary or that the investigation will have a

material impact on its financial results for fiscal year 2025. The

Company is pursuing sources of recovery, including insurance.

As a result of the ongoing investigation, the process of

finalizing financial statements for the second and third quarters

of fiscal year 2025 could not be completed on a timely basis. The

Company intends to file all required reports as soon as practicable

after the conclusion of the investigation. As part of the

investigation, management is evaluating its design and

effectiveness of internal control over financial reporting. The

Company expects to report one or more material weaknesses in its

internal control over financial reporting, and the status of its

related remediation plan, in its filings to be made after the

completion of the investigation.

On February 10, 2025, the Company entered into a further consent

with respect to its revolving credit agreement that provided for,

among other things, an extension until June 16, 2025, for delivery

by the Company to the lenders of its quarterly financial statements

for the quarter ended September 30, 2024, and its quarterly

financial statements for the quarter ended December 31, 2024.

Earnings Release and Investor Conference Call

The Company is postponing its third quarter earnings release and

conference call to allow additional time to complete the Form 10-Q

for its third quarter of fiscal year 2025 ended December 31, 2024.

The Company intends to make a subsequent announcement to schedule a

date and time to discuss its quarterly earnings reports for the

second and third quarters of fiscal year 2025, once the filing date

of its Forms 10-Q is confirmed.

About Universal Corporation

Universal Corporation (NYSE: UVV) is a global agricultural

company with over 100 years of experience supplying products and

innovative solutions to meet our customers’ evolving needs and

precise specifications. Through our diverse network of farmers and

partners across more than 30 countries on five continents, we are a

trusted provider of high-quality, traceable products. We leverage

our extensive supply chain expertise, global reach, integrated

processing capabilities, and commitment to sustainability to

provide a range of products and services designed to drive

efficiency and deliver value to our customers. For more

information, visit www.universalcorp.com.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING

INFORMATION

This release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Among other things, these statements include statements made in Mr.

Wigner’s quotations, statements regarding expectations with respect

to our fiscal year 2025 performance, our strategic plans,

ingredients business, tobacco business, including expectations with

respect to shipments and sales and purchases of tobacco crops, the

ongoing internal investigation including descriptions of its scope,

duration and impact, expectations about the Company’s reporting of

its results and filing its Forms 10-Q for the quarters ended

September 30, 2024 and December 31, 2024, the potential financial

statement impact of the investigated matter, and the preliminary

unaudited financial information for the quarters ending September

30, 2024 and December 31, 2024. These forward-looking statements

are generally identified by the use of words such as we “expect,”

“believe,” “anticipate,” “could,” “should,” “may,” “plan,” “will,”

“predict,” “estimate,” and similar expressions or words of similar

import. These forward-looking statements are based upon

management’s current knowledge and assumptions about future events

and involve risks and uncertainties that could cause actual

results, performance, or achievements to be materially different

from any anticipated results, prospects, performance, or

achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties include, but are not

limited to, the uncertainty of the ultimate findings of the ongoing

internal investigation, as well as the timing of its completion and

costs and expenses arising out of the ongoing internal

investigation process and its results; the impact of the ongoing

internal investigation on us, our management and operations,

including financial impact as well as any litigation or regulatory

action that may arise from the ongoing internal investigation; the

impact of the internal investigation on our conclusions regarding

the design and effectiveness of our internal control over financial

reporting and our disclosure controls and procedures; our ability

to timely and adequately remediate any internal control failures

identified from the results of the internal investigation; our

ability to regain compliance with New York Stock Exchange listing

requirements; success in pursuing strategic investments or

acquisitions and integration of new businesses and the impact of

these new businesses on future results; product purchased not

meeting quality and quantity requirements; our reliance on a few

large customers; our ability to maintain effective information

technology systems and safeguard confidential information;

anticipated levels of demand for and supply of our products and

services; costs incurred in providing these products and services

including increased transportation costs and delays attributed to

global supply chain challenges; timing of shipments to customers;

higher inflation rates; changes in market structure; government

regulation and other stakeholder expectations; economic and

political conditions in the countries in which we and our customers

operate, including the ongoing impacts from international

conflicts; product taxation; industry consolidation and evolution;

changes in exchange rates and interest rates; impacts of regulation

and litigation on its customers; industry-specific risks related to

its plant-based ingredient businesses; exposure to certain

regulatory and financial risks related to climate change; changes

in estimates and assumptions underlying our critical accounting

policies; the promulgation and adoption of new accounting

standards, new government regulations and interpretation of

existing standards and regulations; and general economic,

political, market, and weather conditions. Actual results,

therefore, could vary from those expected. Please also refer to

such other factors as discussed in Part I, Item 1A. “Risk Factors”

of Universal’s Annual Report on Form 10-K for the fiscal year ended

March 31, 2024, and related disclosures in other filings which have

been filed with the SEC and are available on the SEC’s website at

www.sec.gov. All risk factors and uncertainties described herein

and therein should be considered in evaluating forward-looking

statements, and all of the forward-looking statements are expressly

qualified by the cautionary statements contained or referred to

herein and therein. Universal cautions investors not to place undue

reliance on any forward-looking statements as these statements

speak only as of the date when made, and it undertakes no

obligation to update any forward-looking statements made, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210221691/en/

Universal Corporation Investor Relations Phone: (804) 359-9311

Fax: (804) 254-3584 Email: investor@universalleaf.com

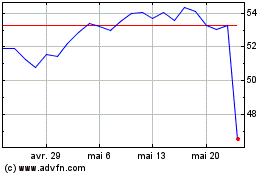

Universal (NYSE:UVV)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Universal (NYSE:UVV)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025