false

0000102037

0000102037

2025-02-10

2025-02-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 10, 2025

UNIVERSAL

CORPORATION

(Exact Name of Registrant as Specified in its

Charter)

Virginia

(State or Other Jurisdiction of Incorporation)

| 001-00652 |

|

54-0414210 |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 9201 Forest Hill Avenue, Richmond, Virginia |

23235 |

| (Address of Principal Executive Offices) |

(Zip code) |

(804) 359-9311

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

UVV |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

¨ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

¨ |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 10, 2025, Universal

Corporation (the “Company”) issued a press release (the “Press Release”) discussing certain preliminary unaudited

financial results for the quarter ended December 31, 2024. These preliminary financial results are unaudited, based on currently available

information and are not a comprehensive statement of the financial results for this period. Consequently, the preliminary unaudited financial

results do not present all necessary information for a complete understanding of the Company’s financial condition as of December

31, 2024 or its results of operations for the quarter ended December 31, 2024. Actual results may differ from these preliminary unaudited

financial results due to developments that may arise between the date of the press release and the time that financial results for the

quarter ended December 31, 2024 are finalized. A copy of this release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

| Item 2.04 | Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

The Company previously disclosed

in a Current Report on Form 8-K (the “Form 8-K”) that was filed with the Securities and Exchange Commission (the “SEC”)

on November 12, 2024, that it entered into a Consent with respect to that certain Credit Agreement, dated December 15, 2022, among the

Company, the lenders party thereto from time to time and JPMorgan Chase Bank, N.A., as Administrative Agent (the “Credit Agreement”).

Under the Credit Agreement the Company covenants to deliver its quarterly financial statements within 45 days following quarter end (the

“Quarterly Financials Covenant”). The Consent provided for, among other things, an extension until December 31, 2024 for delivery

by the Company of its quarterly financial statements for the quarter ended September 30, 2024 (the “Second Quarter 2025 Financials”).

The Company also previously disclosed

in a Current Report on Form 8-K that was filed with the SEC on December 26, 2024 that it entered into a further Consent with respect to

the Credit Agreement that provided for, among other things, an extension until February 14, 2025, for delivery by the Company of the Second

Quarter 2025 Financials.

On February 10, 2025, the Company

entered into a further Consent (“February Consent”) with respect to the Credit Agreement that provided for, among other things,

an extension until June 16, 2025, for delivery by the Company of the Second Quarter 2025 Financials and the financials for the quarter

ended December 31, 2024. In connection with the February Consent, the Company paid to each of the lenders who executed such February Consent

a consent fee in an amount equal to 0.05% of the sum of (x) such lender’s Commitment (as defined in the Credit Agreement) and (y)

the aggregate principal amount of such lender’s outstanding Term Loans (as defined in the Credit Agreement), in each case on February

10, 2025.

In

August 2024, shortly before filing the Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, the Company’s management

was made aware of embezzlement by a former senior finance employee at the Company’s Mozambique subsidiary, Mozambique Leaf Tobacco

Ltda. (“MLT”). The Company promptly commenced an internal investigation regarding these allegations and related matters. As

previously reported, with the assistance of outside advisors, the Company’s internal investigation identified approximately $7 million

in the aggregate of unauthorized payments during fiscal years 2022 through 2025. In total, the Company has identified approximately $16.7

million in the aggregate of unauthorized payments during fiscal years 2016 through 2025.

With

the assistance of outside advisors, the Company continues to work diligently to complete the investigation, including a review of the

circumstances and timing around the discovery of the embezzlement, as soon as possible. The Company is currently unable to predict the

outcome or time frame for completion of the investigation.

As

of the date of this press release, the Company does not believe material adjustments to its previously issued financial statements will

be necessary or that the investigation will have a material impact on its financial results for fiscal year 2025. The Company is pursuing

sources of recovery, including insurance.

As

a result of the ongoing investigation, the process of finalizing financial statements for the second and third quarters of fiscal year

2025 could not be completed on a timely basis. The Company intends to file all required reports as soon as practicable after the conclusion

of the investigation. As part of the investigation, management is evaluating its design and effectiveness of internal control over financial

reporting. The Company expects to report one or more material weaknesses in its internal control over financial reporting, and the status

of its related remediation plan, in its filings to be made after the completion of the investigation.

CAUTIONARY

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This

Form 8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Among other things, these statements include statements regarding

the ongoing internal investigation including descriptions of its scope, duration and impact, expectations about the Company’s reporting

of its results and filing its Forms 10-Q for the quarters ended September 30, 2024 and December 31, 2024, the potential financial statement

impact of the investigated matter, and the preliminary unaudited financial information for the quarter ending December 31, 2024. These

forward-looking statements are generally identified by the use of words such as we “expect,” “believe,” “anticipate,”

“could,” “should,” “may,” “plan,” “will,” “predict,” “estimate,”

and similar expressions or words of similar import. These forward-looking statements are based upon management’s current knowledge

and assumptions about future events and involve risks and uncertainties that could cause actual results, performance, or achievements

to be materially different from any anticipated results, prospects, performance, or achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties include, but are not limited to, the uncertainty of the ultimate findings of the ongoing internal

investigation, as well as the timing of its completion and costs and expenses arising out of the ongoing internal investigation process

and its results; the impact of the ongoing internal investigation on us, our management and operations, including financial impact as

well as any litigation or regulatory action that may arise from the ongoing internal investigation; the impact of the internal investigation

on our conclusions regarding the design and effectiveness of our internal control over financial reporting and our disclosure controls

and procedures; our ability to timely and adequately remediate any internal control failures identified from the results of the internal

investigation; our ability to regain compliance with the NYSE listing requirements; success in pursuing strategic investments or acquisitions

and integration of new businesses and the impact of these new businesses on future results; product purchased not meeting quality and

quantity requirements; our reliance on a few large customers; our ability to maintain effective information technology systems and safeguard

confidential information; anticipated levels of demand for and supply of our products and services; costs incurred in providing these

products and services including increased transportation costs and delays attributed to global supply chain challenges; timing of shipments

to customers; higher inflation rates; changes in market structure; government regulation and other stakeholder expectations; economic

and political conditions in the countries in which we and our customers operate, including the ongoing impacts from international conflicts;

product taxation; industry consolidation and evolution; changes in exchange rates and interest rates; impacts of regulation and litigation

on its customers; industry-specific risks related to its plant-based ingredient businesses; exposure to certain regulatory and financial

risks related to climate change; changes in estimates and assumptions underlying our critical accounting policies; the promulgation and

adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations; and general

economic, political, market, and weather conditions. Actual results, therefore, could vary from those expected. Please also refer to such

other factors as discussed in Part I, Item 1A. “Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal

year ended March 31, 2024 and related disclosures in other filings, which have been filed with the SEC and are available on the SEC’s

website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking

statements, and all of the forward-looking statements are expressly qualified by the cautionary statements contained or referred to herein

and therein. The Company cautions investors not to place undue reliance on any forward-looking statements as these statements speak only

as of the date when made, and it undertakes no obligation to update any forward-looking statements made, except as required by law.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

UNIVERSAL CORPORATION |

| |

|

| Date: February 10, 2025 |

By: |

/s/ Preston D. Wigner |

| |

|

Preston D. Wigner |

| |

|

Chairman, President and Chief Executive Officer |

Exhibit 99.1

P.O. Box 25099 ~ Richmond, VA 23260 ~ Phone: (804)

359-9311 ~ Fax: (804) 254-3584

______________________________________________________________________________________________________

P R E S S R E L E A S E

| CONTACT: |

Universal Corporation Investor Relations |

RELEASE: |

4:15 p.m. ET |

| |

Phone: (804) 359-9311 |

|

|

| |

Fax: (804) 254-3584 |

|

|

| |

Email: investor@universalleaf.com

|

|

|

Universal Corporation Provides Third Quarter

Fiscal Year 2025

Financial and Operational Update

Reports Preliminary Third Quarter Fiscal Year

2025 Results

Highlights Continued Strong Operational Performance

Files Form 12b-25, Delays Third Quarter 2025

Earnings Release and Conference Call

Richmond, VA / February 10, 2025 / BUSINESSWIRE

Universal Corporation (NYSE:UVV) (“Universal”

or the “Company”), a global business-to-business agriproducts company, today is providing a financial and operational update

for the third quarter of fiscal year 2025, including preliminary results for the quarter.

Preston D. Wigner, Chairman, President, and Chief

Executive Officer of Universal Corporation, stated, “Universal achieved solid results for the third quarter of fiscal year 2025,

primarily driven by the strength of our Tobacco Operations segment. Demand from our tobacco customers remained robust, and our global

procurement efforts have been successful in securing the tobacco to meet this need. Our Ingredients Operations segment also continued

to perform in line with our strategic plans, with sales of newly produced and developed value-added products largely offsetting market-driven

pricing pressures experienced by certain of our traditional product lines. The progress we are making in our ingredients business is a

direct result of the investments we have made over the last two fiscal years, including in our enhanced ingredients facility.

Universal Corporation

Page 2

Mr. Wigner continued, “Looking ahead, we are confident that Universal

is well positioned to finish fiscal year 2025 on a strong footing. We will continue to maximize and optimize our tobacco business, expand

our ingredients business, and seek possible opportunities in the future for both segments to work together and provide even more value

for our customers and shareholders.”

Preliminary Unaudited Financial Results

| (in millions of dollars,except per share data) |

|

|

Three Months Ended December 31, 2024 |

|

| |

|

|

|

|

| Consolidated Results |

|

|

|

|

| Sales and other operating revenue |

|

$ |

937.2 |

|

| Operating income |

|

|

100.7 |

|

| Net Income attributable to Universal Corporation |

|

|

57.1 |

|

| Basic earnings per share |

|

|

2.28 |

|

| Diluted earnings per share |

|

|

2.27 |

|

| Segment Results |

|

|

|

|

| Tobacco operations sales and other operating revenues |

|

$ |

854.8 |

|

| Tobacco operations operating income |

|

|

99.2 |

|

| Ingredients operations sales and other operating revenues |

|

|

83.3 |

|

| Ingredients operations operating income |

|

|

3.7 |

|

Highlights of the Quarter

Consolidated Results

| · | Revenues and operating income driven by increased tobacco and ingredients sales volumes. |

Tobacco Operations Segment

| · | Tobacco Operations segment results benefited from: |

| o | Positive momentum due to increased customer demand and successful tobacco procurement and marketing efforts; |

| o | Higher quality, better yielding crops in Africa; |

| o | Strong trading volumes combined with higher shipment volumes and better-quality crops in Asia; and |

| o | Accelerated shipment timing in the United States per certain customers’ requests. |

| · | Selling, general, and administrative expenses for the Tobacco Operations segment included approximately

$11 million in currency remeasurement losses. |

| · | Uncommitted tobacco inventory levels remained low at about 10% at quarter end. |

Universal Corporation

Page 3

Ingredients Operations Segment

| · | Higher revenues on increased sales volumes. |

| · | Margins for certain traditional products were strained by high raw material costs and inflation-driven

increases in consumer food prices. |

| · | Continued high level of interest in value-added products, reflecting effectiveness of platform investments. |

Select Balance Sheet Items, Liquidity, and

Debt

| · | Cash and cash equivalents were approximately $215 million, accounts receivable were approximately $651

million, total inventories were approximately $1.1 billion, notes payable and overdrafts were approximately $539 million, and long-term

debt (including any current portion) was approximately $618 million at quarter end. |

| · | Approximately $270 million was available under revolving credit facility as of quarter end. |

| · | Given strong leaf tobacco demand, tobacco shipments are currently progressing in line with the Company's

expectations. Additionally, the Company expects larger flue-cured and burley tobacco crops, as compared to last year in certain key origins,

particularly in Brazil, and therefore is not seeing the early, accelerated green tobacco purchasing it saw in the prior season. Cash collection

from tobacco shipments and more normalized working capital requirements support the Company's intention to reduce net debt levels. |

The preliminary unaudited financial results

for the quarter ended December 31, 2024, included in this press release represent the most current information available to management

and are not a comprehensive statement of the financial results for this period. Consequently, the preliminary unaudited financial results

do not present all necessary information for a complete understanding of the Company’s financial condition as of December 31, 2024,

or its results of operations for the quarter ended December 31, 2024. Actual results may differ from these preliminary unaudited results

due to developments that may arise between the date of this press release and the time that financial results for the quarter ended December

31, 2024 are finalized.

Sustainability Update

On December 19, 2024, Universal released its 2024

Sustainability Report (the “Report”), highlighting its efforts in advancing energy efficiency, strengthening supply chain

resiliency and continuing to be a strong partner for its farming communities. Responsible business practices are integrated into Universal’s

business strategy, allowing the Company to cultivate sustainable growth as good stewards of the environment. As a result of the Company’s

transition to cleaner fuels for its operations, 93.5% of the tobacco Universal processes is coal-free as of 2024. This positive change

supports the Company’s goal of reducing its greenhouse gas (GHG) emissions by 30% by 2030 from its 2020 baseline year. In 2024,

the Company also trained over 175,000 farmers on Good Agricultural Practices and Agricultural Labor Practices to advance human rights

standards throughout its supply chain. Universal also adopted a Behavior-Based Safety program to cultivate a proactive safety culture

in its operations. The Report, with additional details related to the Company’s responsible operations, can be found on Universal’s

website, www.universalcorp.com.

Universal Corporation

Page 4

Other Corporate Developments

The Company has filed a Form 12b-25, Notification

of Late Filing, with the U.S. Securities and Exchange Commission (“SEC”) in connection with its inability to timely file the

Form 10-Q for its third quarter of fiscal year 2025 ended December 31, 2024.

In August 2024, shortly before filing the Quarterly

Report on Form 10-Q for the quarter ended June 30, 2024, the Company’s management was made aware of embezzlement by a former senior

finance employee at the Company’s Mozambique subsidiary, Mozambique Leaf Tobacco Ltda. (“MLT”). The Company promptly

commenced an internal investigation regarding these allegations and related matters. As previously reported, with the assistance of outside

advisors, the Company’s internal investigation identified approximately $7 million in the aggregate of unauthorized payments during

fiscal years 2022 through 2025. In total, the Company has identified approximately $16.7 million in the aggregate of unauthorized payments

during fiscal years 2016 through 2025.

With the assistance of outside advisors, the Company

continues to work diligently to complete the investigation, including a review of the circumstances and timing around the discovery of

the embezzlement, as soon as possible. The Company is currently unable to predict the outcome or time frame for completion of the investigation.

As of the date of this press release, the Company

does not believe material adjustments to its previously issued financial statements will be necessary or that the investigation will have

a material impact on its financial results for fiscal year 2025. The Company is pursuing sources of recovery, including insurance.

As a result of the ongoing investigation,

the process of finalizing financial statements for the second and third quarters of fiscal year 2025 could not be completed on a

timely basis. The Company intends to file all required reports as soon as practicable after the conclusion of the investigation. As

part of the investigation, management is evaluating its design and effectiveness of internal control over financial reporting. The

Company expects to report one or more material weaknesses in its internal control over financial reporting, and the status of its

related remediation plan, in its filings to be made after the completion of the investigation.

On February 10, 2025, the Company entered into

a further consent with respect to its revolving credit agreement that provided for, among other things, an extension until June 16, 2025,

for delivery by the Company to the lenders of its quarterly financial statements for the quarter ended September 30, 2024, and its quarterly

financial statements for the quarter ended December 31, 2024.

Earnings Release and Investor Conference Call

The Company is postponing its third quarter earnings

release and conference call to allow additional time to complete the Form 10-Q for its third quarter of fiscal year 2025 ended December

31, 2024. The Company intends to make a subsequent announcement to schedule a date and time to discuss its quarterly earnings reports

for the second and third quarters of fiscal year 2025, once the filing date of its Forms 10-Q is confirmed.

Universal Corporation

Page 5

About Universal Corporation

Universal Corporation (NYSE: UVV) is a global

agricultural company with over 100 years of experience supplying products and innovative solutions to meet our customers’ evolving

needs and precise specifications. Through our diverse network of farmers and partners across more than 30 countries on five continents,

we are a trusted provider of high-quality, traceable products. We leverage our extensive supply chain expertise, global reach, integrated

processing capabilities, and commitment to sustainability to provide a range of products and services designed to drive efficiency and

deliver value to our customers. For more information, visit www.universalcorp.com.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This release includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Among other things, these statements include statements made in Mr. Wigner’s quotations, statements regarding expectations

with respect to our fiscal year 2025 performance, our strategic plans, ingredients business, tobacco business, including expectations

with respect to shipments and sales and purchases of tobacco crops, the ongoing internal investigation including descriptions of its scope,

duration and impact, expectations about the Company’s reporting of its results and filing its Forms 10-Q for the quarters ended

September 30, 2024 and December 31, 2024, the potential financial statement impact of the investigated matter, and the preliminary unaudited

financial information for the quarters ending September 30, 2024 and December 31, 2024. These forward-looking statements are generally

identified by the use of words such as we “expect,” “believe,” “anticipate,” “could,”

“should,” “may,” “plan,” “will,” “predict,” “estimate,” and similar

expressions or words of similar import. These forward-looking statements are based upon management’s current knowledge and assumptions

about future events and involve risks and uncertainties that could cause actual results, performance, or achievements to be materially

different from any anticipated results, prospects, performance, or achievements expressed or implied by such forward-looking statements.

Such risks and uncertainties include, but are not limited to, the uncertainty of the ultimate findings of the ongoing internal investigation,

as well as the timing of its completion and costs and expenses arising out of the ongoing internal investigation process and its results;

the impact of the ongoing internal investigation on us, our management and operations, including financial impact as well as any litigation

or regulatory action that may arise from the ongoing internal investigation; the impact of the internal investigation on our conclusions

regarding the design and effectiveness of our internal control over financial reporting and our disclosure controls and procedures; our

ability to timely and adequately remediate any internal control failures identified from the results of the internal investigation; our

ability to regain compliance with New York Stock Exchange listing requirements; success in pursuing strategic investments or acquisitions

and integration of new businesses and the impact of these new businesses on future results; product purchased not meeting quality and

quantity requirements; our reliance on a few large customers; our ability to maintain effective information technology systems and safeguard

confidential information; anticipated levels of demand for and supply of our products and services; costs incurred in providing these

products and services including increased transportation costs and delays attributed to global supply chain challenges; timing of shipments

to customers; higher inflation rates; changes in market structure; government regulation and other stakeholder expectations; economic

and political conditions in the countries in which we and our customers operate, including the ongoing impacts from international conflicts;

product taxation; industry consolidation and evolution; changes in exchange rates and interest rates; impacts of regulation and litigation

on its customers; industry-specific risks related to its plant-based ingredient businesses; exposure to certain regulatory and financial

risks related to climate change; changes in estimates and assumptions underlying our critical accounting policies; the promulgation and

adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations; and general

economic, political, market, and weather conditions. Actual results, therefore, could vary from those expected. Please also refer to such

other factors as discussed in Part I, Item 1A. “Risk Factors” of Universal’s Annual Report on Form 10-K for the fiscal

year ended March 31, 2024, and related disclosures in other filings which have been filed with the SEC and are available on the SEC’s

website at www.sec.gov. All risk factors and uncertainties described herein and therein should be considered in evaluating forward-looking

statements, and all of the forward-looking statements are expressly qualified by the cautionary statements contained or referred to herein

and therein. Universal cautions investors not to place undue reliance on any forward-looking statements as these statements speak only

as of the date when made, and it undertakes no obligation to update any forward-looking statements made, except as required by law.

###

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

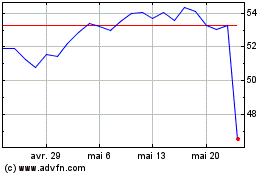

Universal (NYSE:UVV)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Universal (NYSE:UVV)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025