Victoria’s Secret & Co. Announces CFO Transition and Provides Positive Update on Holiday Sales and 2024 Earnings Expectations

29 Janvier 2025 - 1:00PM

Victoria’s Secret & Co. (“VS&Co” or the “Company”) (NYSE:

VSCO) today announced that Chief Financial and Administrative

Officer Timothy (TJ) Johnson is retiring in June 2025. Scott

Sekella has been appointed Chief Financial Officer.

VS&Co Chief Executive Officer Hillary Super said, “We are

excited to welcome Scott to VS&Co. He is a transformational

leader with extensive and diverse retail experience delivering

results, driving operational efficiencies, and executing growth

strategies. He has a strong retail background and record of

identifying and accelerating strategies that strengthen performance

and enhance profitability which I believe make him the right

partner to help lead the next chapter of growth for the

company.”

Sekella most recently served as CFO of fabric and crafts

retailer Joann and previously held financial leadership roles at

Under Armour and Crocs.

“I want to thank TJ for his partnership and support throughout

my first several months as CEO and for staying on with the business

until June to ensure a smooth transition with Scott,” Super

added.

VS&Co Board Chair Donna James said, “The Board wants to

thank TJ for his leadership during one of the most critical periods

of the company’s history, including the separation of the business

from our former parent company and establishing an independent,

publicly traded VS&Co. He helped us develop new strategies,

drove disciplined cost and inventory management, built credibility

with our stakeholders and was a consistent and strong leader. TJ is

leaving the company in a strong position with a long runway for

growth.”

"It has been an incredible experience to serve alongside this

leadership team and Board of Directors,” said Johnson. “I am proud

of what we have accomplished together and am confident the best

days for Victoria’s Secret still lie ahead under Hillary’s

leadership. I have enjoyed getting to know Scott and I am certain

he is the right person for the role. I will work diligently to make

his transition to VS&Co as smooth as possible.”

Updated Fourth Quarter 2024 Financial

Guidance

In conjunction with today’s announcement of CFO retirement and

transition plans, the Company is providing updated financial

guidance for the fourth quarter 2024 ending February 1, 2025. Net

sales, adjusted operating income, and adjusted diluted earnings per

share for the fourth quarter are expected to fall within or near

the top end of previously issued guidance ranges as highlighted in

the table below.

|

|

Q4 2024 Guidance |

|

|

Updated 1/29/25 |

Previous |

|

Net Sales (excluding the extra week last

year) |

+3% to +4% |

+2% to +4% |

|

Adjusted Operating Income |

$260 - $270 million |

$240 - $270 million |

|

Adjusted Diluted Earnings Per Share |

$2.20 to $2.30 |

$2.00 to $2.30 |

|

|

|

|

Hillary continued, “We are pleased with our holiday results and

our improved outlook for the fourth quarter. The momentum of our

sales results for North America continued from third quarter

through November and December across both our stores and digital

channels, and our international business growth is also delivering

on expectations. From a merchandise perspective, newness of product

is winning and resonating with customers across both the Victoria’s

Secret and PINK brands and our beauty business was a winner again

this holiday season. We are experiencing increased levels of

traffic to our stores and our digital site which we believe is

reflective of our improved merchandise offering and the positive

impact of the VS Fashion Show in late October. We exited the

holiday and our January semi-annual sale in a good inventory

position and ready for Valentine’s Day and first quarter selling.

We look forward to sharing more details on our fourth quarter

results and our expectations for 2025 on our upcoming earnings call

in March.”

Forecasted adjusted operating income and adjusted diluted

earnings per share for the fourth quarter exclude the financial

impact of purchase accounting items related to the Adore Me

acquisition, including expense (income) related to changes in the

estimated fair value of contingent consideration and

performance-based payments, as well as the amortization of

intangible assets. The Company is not able to provide a

reconciliation of forward-looking adjusted operating income or

adjusted diluted earnings per share to the most directly comparable

forward-looking GAAP measures because the Company is unable to

provide a meaningful or accurate reconciliation or estimation of

certain reconciling items without unreasonable effort, due to the

inherent difficulty in forecasting the timing of, and quantifying,

the various purchase accounting items that are necessary for such

reconciliation.

About Victoria’s Secret &

Co. Victoria’s Secret & Co. (NYSE: VSCO) is a

specialty retailer of modern, fashion-inspired collections

including signature bras, panties, lingerie, casual sleepwear,

athleisure and swim, as well as award-winning prestige fragrances

and body care. VS&Co is comprised of market leading brands,

Victoria’s Secret and Victoria’s Secret PINK, that share a common

purpose of supporting women in all they do, and Adore Me, a

technology-led, digital first innovative intimates brand serving

women of all sizes and budgets at all phases of life. We are

committed to empowering our approximately 30,000 associates across

a global footprint of more than 1,380 retail stores in nearly 70

countries. We strive to provide the best products to help women

express their confidence, sexiness and power and use our platform

to celebrate the extraordinary diversity of women’s

experiences.

Safe Harbor Statement Under the Private Securities

Litigation Reform Act of 1995We caution that any

forward-looking statements (as such term is defined in the U.S.

Private Securities Litigation Reform Act of 1995) contained in this

press release or made by us, our management, or our spokespeople

involve risks and uncertainties and are subject to change based on

various factors, many of which are beyond our control. Accordingly,

our future performance and financial results may differ materially

from those expressed or implied in any such forward-looking

statements, and any future performance or financial results

expressed or implied by such forward-looking statements are not

guarantees of future performance. Forward-looking statements

include, without limitation, statements regarding our future

operating results, the implementation and impact of our strategic

plans, and our ability to meet environmental, social, and

governance goals. Words such as “estimate,” “commit,” “will,”

“target,” “goal,” “project,” “plan,” “believe,” “seek,” “strive,”

“expect,” “anticipate,” “intend,” “continue,” “potential” and any

similar expressions are intended to identify forward-looking

statements. Risks associated with the following factors, among

others, could affect our results of operations and financial

performance and cause actual results to differ materially from

those expressed or implied in any forward-looking statements:

- we may not realize all of the expected benefits of the spin-off

from Bath & Body Works, Inc. (f/k/a L Brands, Inc.);

- general economic conditions, inflation, and changes in consumer

confidence and consumer spending patterns;

- market disruptions including pandemics or significant health

hazards, severe weather conditions, natural disasters, terrorist

activities, financial crises, political crises or other major

events, or the prospect of these events;

- our ability to successfully implement our strategic plan;

- difficulties arising from turnover in company leadership or

other key positions;

- our ability to attract, develop and retain qualified associates

and manage labor-related costs;

- our dependence on traffic to our stores and the availability of

suitable store locations on satisfactory terms;

- our ability to successfully operate and expand internationally

and related risks;

- the operations and performance of our franchisees, licensees,

wholesalers and joint venture partners;

- our ability to successfully operate and grow our direct channel

business;

- our ability to protect our reputation and the image and value

of our brands;

- our ability to attract customers with marketing, advertising

and promotional programs;

- the highly competitive nature of the retail industry and the

segments in which we operate;

- consumer acceptance of our products and our ability to manage

the life cycle of our brands, remain current with fashion trends,

and develop and launch new merchandise, product lines and brands

successfully;

- our ability to realize the potential benefits and synergies

sought with the acquisition of AdoreMe, Inc.;

- our ability to incorporate artificial intelligence into our

business operations successfully and ethically while effectively

managing the associated risks;

- our ability to source materials and produce, distribute and

sell merchandise on a global basis, including risks related to:

- political instability and geopolitical conflicts;

- environmental hazards and natural disasters;

- significant health hazards and pandemics;

- delays or disruptions in shipping and transportation and

related pricing impacts; and

- disruption due to labor disputes;

- our geographic concentration of production and distribution

facilities in central Ohio and Southeast Asia;

- the ability of our vendors to manufacture and deliver products

in a timely manner, meet quality standards and comply with

applicable laws and regulations;

- fluctuations in freight, product input and energy costs;

- our and our third-party service providers’ ability to implement

and maintain information technology systems and to protect

associated data and system availability;

- our ability to maintain the security of customer, associate,

third-party and company information;

- stock price volatility;

- shareholder activism matters;

- our ability to maintain our credit rating;

- our ability to comply with regulatory requirements; and

- legal, tax, trade and other regulatory matters.

Except as may be required by law, we assume no obligation and do

not intend to make publicly available any update or other revisions

to any of the forward-looking statements contained in this press

release to reflect circumstances existing after the date of this

press release or to reflect the occurrence of future events, even

if experience or future events make it clear that any expected

results expressed or implied by those forward-looking statements

will not be realized. Additional information regarding these and

other factors can be found in “Item 1A. Risk Factors” in our Annual

Report on Form 10-K filed with the Securities and Exchange

Commission on March 22, 2024.

For further information, please contact:

|

Victoria’s Secret & Co.: |

|

|

Investor Relations: |

Media

Relations: |

| Kevin Wynkinvestorrelations@victoria.com |

Brooke Wilsoncommunications@victoria.com |

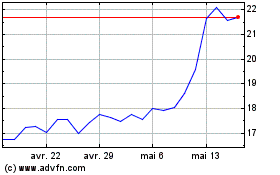

Victoria's Secret (NYSE:VSCO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Victoria's Secret (NYSE:VSCO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025