Cenovus announces repurchase of 84% of its outstanding warrants

14 Juin 2023 - 12:01PM

Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has reached separate

agreements with each of Hutchison Whampoa Europe Investments S.à

r.l. (HWEI) and L.F. Investments S.à r.l. (LFI) to purchase

for cancellation all of the warrants held by HWEI and LFI,

respectively, representing an aggregate of 45,484,672 warrants

(CVE.WT), for $711 million in the aggregate (the Warrant Repurchase

Transactions). As part of Cenovus’s combination with Husky Energy

Inc., each Husky shareholder received 0.7845 of a Cenovus common

share plus 0.0651 of a Cenovus common share purchase warrant in

exchange for each Husky common share, with each whole warrant

having an exercise price of $6.54 per common share, expiring

January 1, 2026.

The price to be paid for each warrant pursuant to each Warrant

Repurchase Transaction represents a price of $22.18 per common

share, less the warrant exercise price of $6.54 per common share.

The warrants will be cancelled at close, which is expected to occur

later today. The company has negotiated payment terms that provide

flexibility to work within its shareholder returns framework, with

no expected impact to Cenovus’s ability to achieve its $4.0 billion

net debt target. At its discretion, Cenovus has the option to pay

the aggregate warrant purchase price of $711 million for the

combined Warrant Repurchase Transactions through the remainder of

2023, within each quarter’s excess free funds flow, with full

payment being made no later than January 5, 2024.

The 45,484,672 warrants cancelled as part of the Warrant

Repurchase Transactions would, if exercised, represent

approximately 2.4% of Cenovus’s total common shares outstanding.

This transaction represents a repurchase of 84.1% of the warrants

that remain outstanding. HWEI and LFI will continue to own

316,927,051 common shares (16.7%) and 231,194,699 common shares

(12.2%), respectively, of Cenovus’s issued and outstanding common

shares.

“This is a unique opportunity for Cenovus to continue to enhance

shareholder returns by acquiring these warrants at a discount to

the market price,” said Jon McKenzie, Cenovus President & Chief

Executive Officer. “The agreements reached separately with HWEI and

LFI benefit all Cenovus shareholders. Both HWEI and LFI are

committed, long-term Cenovus shareholders and we continue to value

each entity’s support and confidence in our company.”

Board review processThe Warrant Repurchase

Transactions were overseen by Cenovus’s Board of Directors, other

than certain directors who recused themselves from Board meetings,

or portions thereof, as applicable, at which the Warrant Repurchase

Transactions were considered, due to past and/or ongoing

relationships with CK Hutchison Holdings Limited and its

affiliates, of which HWEI is an indirect wholly-owned subsidiary.

The Board undertook a deliberate and full consideration of the

Warrant Repurchase Transactions with the assistance of its advisors

outlined below, and determined that the Warrant Repurchase

Transactions are in the best interests of Cenovus.

Advisors RBC Capital Markets provided an

opinion to the Board stating that, subject to the assumptions,

limitations and qualifications therein, as of the date thereof, the

consideration to be paid under each of the Warrant Repurchase

Transactions is fair, from a financial point of view, to the

company. RBC Capital Markets was paid a fixed fee for its services.

Blake, Cassels & Graydon LLP is acting as Cenovus’s legal

advisor.

Advisory Forward-looking

information This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to as “forward-looking information”) about

Cenovus’s current expectations, estimates and projections about the

future, based on certain assumptions made in light of experience

and perception of historical trends. Forward-looking information in

this news release is identified by words such as “expect”, “will”

or similar expressions, including, but not limited to, statements

about: the Warrant Repurchase Transactions, including the timing

and anticipated benefits of each, the anticipated closing date of

each and the effects of such transactions on Cenovus, including on

Cenovus’s shareholder returns framework and its ability to achieve

its net debt target.

Although Cenovus believes that the expectations represented by

such forward-looking information are reasonable, readers are

cautioned not to place undue reliance on forward-looking

information as actual results may differ materially from those

expressed or implied. This forward-looking information is current

only as of the date indicated above. Cenovus undertakes no

obligation to update or revise any forward-looking information

except as required by law. Developing forward-looking information

involves reliance on a number of assumptions and consideration of

certain risks and uncertainties, including those assumptions stated

and inherent in Cenovus’s 2023 Corporate Guidance available on

cenovus.com, some of which are specific to Cenovus and others that

apply to the industry generally.

Additional information about risks, assumptions, uncertainties

and other factors that could cause Cenovus’s actual results to

differ materially from those expressed or implied by its

forward-looking information is contained under “Risk Management and

Risk Factors” in Cenovus’s annual Management’s Discussion and

Analysis (MD&A) for the year ended December 31, 2022, as

supplemented by updates in our most recent quarterly MD&A, each

of which is available on SEDAR at sedar.com, on EDGAR at sec.gov

and at cenovus.com.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

Cenovus contacts:

|

Investors |

|

Media |

| Investor Relations general

line403-766-7711 |

|

Media Relations general

line403-766-7751 |

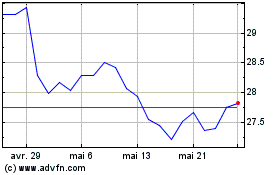

Cenovus Energy (TSX:CVE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Cenovus Energy (TSX:CVE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025