D-BOX Technologies Reports Fourth Quarter and Fiscal 2022 Results

02 Juin 2022 - 11:00PM

D-BOX Technologies Inc. (“D-BOX” or the "Corporation") (TSX: DBO),

a world leader in haptic and immersive experiences, today announced

results for the fourth quarter and fiscal year ended March 31,

2022. All dollar amounts are expressed in Canadian currency.

“We are pleased with our revenue growth and

profitability generated in fiscal 2022, while continuing to build

on our leadership position in haptics technology,” said Sébastien

Mailhot, President and CEO of D-BOX Technologies. “Despite a

challenging environment marked by the COVID-19 pandemic,

supply-chain disruptions and rising component costs, we delivered

revenue growth of 92% and a positive adjusted EBITDA in 2022.

Projecting our fourth quarter results over a 12-month period would

bring our financial performance above pre-pandemic levels. We

announced strategic partnerships with diverse market leaders (LADB,

eNASCAR, BMW), launched new products and concepts (Cooler Master,

Razer), increased our theatrical footprint by more than 40 screens,

enhanced our sales team and positioned D-BOX leadership within the

influential Haptic Industry Forum. Looking ahead to fiscal 2023, we

intend to invest in selected high-growth areas to support our

profitable growth strategy, while delivering the best immersive

haptic experience for consumers.”

“We are upbeat about our strong financial

performance and positive industry trends witnessed in fiscal 2022,”

said David Montpetit, Chief Financial Officer of D-BOX

Technologies. “The fourth quarter and fiscal year were highlighted

by significant increases in revenues related to system sales, which

grew 105% and 54%, respectively, and by rights for use revenues

which surged 530% in the fourth quarter and four-fold for the year.

The box office performance, led by ‘The Batman’ and ‘Spider-Man’

movies, generated record sales of D-BOX tickets, while upcoming

blockbusters like ‘Top Gun: Maverick’ and ‘Doctor Strange’ bode

well for the first quarter of 2023.”

“The solid performance of our commercial segment

is expected to continue in the upcoming year, and we anticipate

recognizing revenues from our home entertainment initiatives in the

second quarter. With a cash position and undrawn credit facility

totaling $6.9 million, D-BOX has adequate funds to finance its

current operations and execute its product development

strategy.”

|

Fiscal Year and Fourth Quarter Ended March

31(in thousands of dollars, except per share data) |

|

|

Fiscal Year |

Fourth Quarter |

|

2022 |

2021 |

2022 |

2021 |

|

Revenues |

21,313 |

11,080 |

6,972 |

2,936 |

|

Net income (loss) |

(1,867) |

(6,192) |

238 |

(2,491) |

|

Adjusted EBITDA* |

922 |

(3,549) |

972 |

(1,592) |

|

Basic and diluted net income (loss) per share |

(0.009) |

(0.035) |

0.001 |

(0.014) |

|

Information from the Consolidated Balance

Sheets |

|

|

As at March 31, 2022 |

As at March 31, 2021 |

|

Cash and cash equivalents |

3,937 |

9,134 |

* See the “Non-IFRS” measures section in the

Management’s Discussion and Analysis dated June 2, 2022

FY 2022 Q4 OPERATIONAL

HIGHLIGHTS

- D-BOX, BMW and Sim-Lab combined

forces to create the new BMW Motion Platform.

- Advanced SimRacing, a fast-growing

North American racing simulation chassis manufacturer and digital

motorsport equipment retailer, became an official distributor of

D-BOX sim racing solutions.

- Metropolitan Theatres installed

their first D-BOX screen with 23 high-fidelity haptic recliner

seats located at Metropolitan Theatres’ flagship luxury cinema

MetroLux Theatres in South Orange County, California.

- John Deere introduces new forestry

full-tree training simulator designed and supported by D-BOX

long-time partner, CM-Labs.

- In March 2022, the Corporation

executed an amendment agreement with the BDC for the repayment of

the outstanding principal balance of $1.2 million as at May 31,

2023 over 36 monthly instalments of $33 thousand, until June

1, 2026.

ADDITIONAL INFORMATION REGARDING THE

FOURTH QUARTER ENDED MARCH 31, 2022

The financial information relating to the fourth

quarter and fiscal year ended March 31, 2022 should be read in

conjunction with the Corporation’s audited consolidated financial

statements and the Management’s Discussion and Analysis dated June

2, 2022. These documents are available at www.sedar.com.

RECONCILIATION OF ADJUSTED EBITDA TO NET

INCOME (LOSS)*

Adjusted EBITDA provides useful and

complementary information, which can be used, in particular, to

assess profitability and cash flows provided by operations. It

consists of net income (loss) excluding amortization, financial

expenses net of income, income taxes, write-off of property and

equipment and intangible assets, share-based payments, foreign

exchange loss (gain) and non-recurring expenses related to

restructuring costs.

The following table reconciles adjusted EBITDA to net loss

(amounts are in thousands of Canadian dollars):

|

|

Fourth Quarterended March 31 |

Twelve-month periodended March

31 |

|

|

2022 |

2021 |

|

2022 |

|

2021 |

|

|

Net loss |

238 |

|

(2,491 |

) |

(1,867 |

) |

(6,192 |

) |

|

Amortization of property and equipment |

277 |

|

267 |

|

1,124 |

|

1,530 |

|

|

Amortization of intangible assets |

211 |

|

211 |

|

848 |

|

819 |

|

|

Write-offs of property and equipment |

— |

|

24 |

|

— |

|

24 |

|

|

Impairment of property and equipment |

— |

|

235 |

|

— |

|

235 |

|

|

Impairment of intangible assets |

— |

|

— |

|

179 |

|

— |

|

|

Impairment (reversal) of finance lease receivable |

— |

|

(26 |

) |

— |

|

(26 |

) |

|

Financial expenses |

99 |

|

150 |

|

396 |

|

488 |

|

|

Income taxes (recovery) |

— |

|

(32 |

) |

— |

|

(34 |

) |

|

Share-based payments |

48 |

|

58 |

|

192 |

|

154 |

|

|

Foreign exchange (gain) loss |

99 |

|

12 |

|

50 |

|

(133 |

) |

|

Restructuring costs |

— |

|

— |

|

— |

|

(414 |

) |

|

Adjusted EBITDA |

972 |

|

(1,592 |

) |

922 |

|

(3,549 |

) |

* See the “Non-IFRS” measures section in the Management’s

Discussion and Analysis dated June 2, 2022

ABOUT D-BOX

D-BOX creates and redefines realistic, immersive

entertainment experiences by moving the body and sparking the

imagination through effects: motion, vibration and texture. D-BOX

has collaborated with some of the best companies in the world to

deliver new ways to enhance great stories. Whether it’s movies,

video games, music, relaxation, virtual reality applications,

metaverse experience, themed entertainment or professional

simulation, D-BOX creates a feeling of presence that makes life

resonate like never before. D-BOX Technologies Inc. (TSX: DBO) is

headquartered in Montreal with offices in Los Angeles, USA and

Beijing, China. Visit D-BOX.com.

DISCLAIMER REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements included herein, including

those that express management’s expectations or estimates of our

future performance, constitute “forward-looking statements” within

the meaning of applicable securities laws. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management at this

time, are inherently subject to significant business, economic and

competitive uncertainties and contingencies. Investors are

cautioned not to place undue reliance on forward-looking

statements. D-BOX disclaims any intent or obligation to publicly

update these forward-looking statements, whether as a result of new

information, future events or otherwise.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| David Montpetit Chief Financial

OfficerD-BOX Technologies

Inc.450-999-3216dmontpetit@d-box.com |

Steve Li Vice President Investor

Relations andCorporate StrategyD-BOX Technologies

Inc.450-912-2036sli@d-box.com |

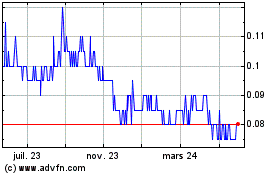

D Box Technologies (TSX:DBO)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

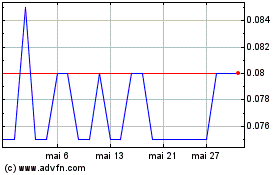

D Box Technologies (TSX:DBO)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025