Dream Unlimited Corp. Announces Voting Results of Annual and Special Meeting of Shareholders and Determination to Proceed Wit...

30 Juin 2020 - 10:54PM

DREAM UNLIMITED CORP. (“Dream” or the “Company”) (TSX:

DRM) announced that, all resolutions considered by

shareholders at its annual and special meeting of shareholders (the

“

Meeting”) of the Company held today have been

approved.

Election of Directors & Appointment

of Auditor

At the Meeting, all of the nominees for election

as directors of Dream referred to in the Management Information

Circular of the Company dated May 15, 2020 (the

“Circular”) were elected. Votes cast on this

matter were as follows:

|

Nominee |

Votes For |

% Votes For |

VotesWithheld |

% Votes Withheld |

|

Michael J. Cooper |

390,240,961 |

99.82 |

708,147 |

0.18 |

|

James Eaton |

390,790,061 |

99.96 |

159,047 |

0.04 |

|

Joanne Ferstman |

390,146,216 |

99.79 |

802,892 |

0.21 |

|

Richard N. Gateman |

390,503,839 |

99.89 |

445,269 |

0.11 |

|

Jane Gavan |

390,050,881 |

99.77 |

898,227 |

0.23 |

|

Duncan Jackman |

367,109,998 |

93.90 |

23,839,110 |

6.10 |

|

Jennifer Lee Koss |

390,789,498 |

99.96 |

159,610 |

0.04 |

|

Vincenza Sera |

390,530,188 |

99.89 |

418,920 |

0.11 |

At the Meeting, PricewaterhouseCoopers LLP was

appointed as the auditor of Dream, and the directors of Dream were

authorized to fix the remuneration of the auditor.

Announcement of Share

Consolidation

Dream is also pleased to announce that the

shareholders approved a special resolution (the

“Consolidation Resolution”) authorizing an

amendment to the articles of the Company to effect a consolidation

(the “Share Consolidation”) of all of the issued

and outstanding Class A subordinate voting shares in the capital of

Dream (the “Subordinate Voting Shares”) on the

basis of one (1) post-consolidation Subordinate Voting Share for

every two (2) pre-consolidation Subordinate Voting Shares, and all

of the issued and outstanding Class B common shares in the capital

of Dream (the “Common Shares”) on the basis of one

(1) post-consolidation Common Share for every two (2)

pre-consolidation Common Shares, as more particularly described in

the Circular.

In order to be effective, the Consolidation

Resolution was required to be approved by: (i) not less than

two-thirds of the votes cast by the shareholders represented at the

Meeting, (ii) not less than two-thirds of the votes cast by the

holders of Subordinate Voting Shares at the Meeting, voting

separately as a class, and (iii) not less than two-thirds of the

votes cast by holders of Common Shares at the Meeting, voting

separately as a class. Votes cast on this matter were as

follows:

|

|

Votes For |

% Votes For |

Votes Against |

% Votes Against |

|

Holders of Subordinate Voting Shares |

81,287,625 |

99.97 |

23,083 |

0.03 |

|

Holders of Common Shares |

309,615,900 |

99.99 |

22,500 |

0.01 |

|

All Shareholders |

390,903,525 |

99.99 |

45,583 |

0.01 |

Dream today announces that the board of

directors have determined to implement the Share Consolidation. The

Company intends to implement the Share Consolidation with effect on

or about July 2, 2020 (the “Effective Date”).

It is expected that upon completion of the Share

Consolidation, the number of Subordinate Voting Shares issued and

outstanding will be consolidated from 91,675,747 to approximately

45,837,873, and the number of Common Shares issued and outstanding

will be consolidated from 3,114,848 to approximately 1,557,424. The

exact number of outstanding Subordinate Voting Shares and Common

Shares outstanding after the Share Consolidation will vary based on

the elimination of fractional shares. No fractional Subordinate

Voting Shares or Common Shares will be issued in connection with

the Share Consolidation. All fractions of post-consolidation

Subordinate Voting Shares and Common Shares, will be rounded down

to the nearest whole number.

The Share Consolidation is expected to affect

shareholders uniformly, including holders of outstanding securities

convertible or exercisable for Subordinate Voting Shares or Common

Shares on the Effective Date, except for minor changes or

adjustments resulting from the treatment of fractional shares. On

the Effective Date, the exercise prices and the number of

Subordinate Voting Shares issuable upon the exercise or deemed

exercise of any options, performance share units or deferred share

units or other convertible or exchangeable securities of the

Company will be automatically proportionately adjusted based on the

consolidation ratio to reflect the Share Consolidation.

Further details on the Share Consolidation are

contained in the Circular, which has been filed and is available

under the Company’s profile on SEDAR at www.sedar.com. Please

review the Circular for the specific terms and conditions of the

Share Consolidation.

About Dream Unlimited Corp.

Dream is a leading developer of exceptional

office and residential assets in Toronto, owns stabilized income

generating assets in both Canada and the U.S., and has an

established and successful asset management business, inclusive of

$9 billion of assets under management across three Toronto Stock

Exchange listed trusts and numerous partnerships. We also develop

land and residential assets in Western Canada for immediate sale.

Dream expects to generate more recurring income in the future as

its urban development properties are completed and held for the

long term. Dream has a proven track record for being innovative and

for our ability to source, structure and execute on compelling

investment opportunities. For more information please visit:

www.dream.ca.

Forward Looking Information

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, including, but not limited to, statements with respect

to the timing and completion of the Share Consolidation as well as

statement relating to our future shareholder base. Forward-looking

information is based on a number of assumptions and is subject to a

number of risks and uncertainties, many of which are beyond Dream’s

control, which could cause actual results to differ materially from

those that are disclosed in or implied by such forward-looking

information. These assumptions include but are not limited to:

anticipated positive general economic and business conditions,

Dream’s business and investment strategy, performance of Dream’s

underlying business segments. Risks and uncertainties include, but

are not limited to, general and local economic and business and

market conditions, interest rates, capital market conditions and

regulatory risks. All forward looking information in this press

release speaks as of June 30, 2020. Dream does not undertake to

update any such forward looking information whether as a result of

new information, future events or otherwise, except as required by

law.

For further information, please contact:

Dream Unlimited Corp.

|

Meaghan Peloso |

Kim Lefever |

| VP & Chief Accounting

Officer |

Director, Investor Relations |

| (416) 365-6322 |

(416) 365-6339 |

| mpeloso@dream.ca |

klefever@dream.ca |

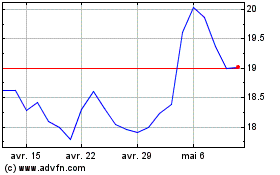

DREAM Unlimited (TSX:DRM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

DREAM Unlimited (TSX:DRM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024