Equinox Gold Corp. (TSX: EQX, NYSE American: EQX)

is pleased to announce that it has entered into a binding share

purchase agreement (the “SPA”) with certain funds managed by Orion

Mine Finance Management LP (“Orion”) to acquire Orion’s 40%

interest in Greenstone Gold Mine GP Inc., giving Equinox Gold 100%

ownership of the Greenstone Mine (“Greenstone”) in Ontario, Canada

(the “Transaction”).

Under the terms of the SPA, Equinox Gold will

pay $995 million to acquire Orion’s 40% interest in Greenstone,

payable as follows:

- 42.0 million common

shares of Equinox Gold valued at $250 million;

- $705 million in

cash payable on closing; and

- $40 million in cash

payable by December 31, 2024.

Equinox Gold will fund the cash consideration

with net proceeds from both a new $500 million three-year term loan

and a bought deal equity financing of common shares of Equinox Gold

for approximately $260 million.

Anticipated Benefits to Equinox Gold

Shareholders

- Rare

opportunity to consolidate a world-class gold mine –

Consolidates 100% ownership of Greenstone, one of the largest and

highest-grade open pit gold mines in Canada, a top mining

jurisdiction, at the beginning of its expected 14+ year mine life

and into a historically strong gold price environment.

- Increases

production and is significantly accretive to near-term EBITDA and

cash flow – Increases the Company’s annual gold production

by an expected 160,000 low-cost ounces per year with significant

near-term EBITDA and cash flow per share accretion. Consolidated

Greenstone will be Equinox Gold’s largest mine, producing an

expected average of 400,000 ounces of gold per year over the first

five years, and is expected to be one of the world’s lowest-cost

open-pit gold mines, with cash costs in the industry’s lower

quartile.

- Delivers

substantial growth and exploration potential –

Consolidates the Greenstone underground deposit, a key expansion

opportunity at Greenstone, as well as multiple gold deposits in a

highly prospective land package over a 100-km trend to the west of

Greenstone, enhancing the Company’s long-term growth profile with

both expansion and exploration potential.

Ross Beaty, Chairman of Equinox Gold, stated:

“When we acquired our 60% interest in Greenstone in 2021, our goal

was to ultimately own the whole mine. Consolidating 100% of

Greenstone into Equinox Gold delivers our shareholders full

exposure to a mine of outstanding scale and quality, in one of the

best mining jurisdictions in the world, while meaningfully growing

our expected production, cash flow and reserves.”

Greg Smith, President and CEO of Equinox Gold,

commented: “Opportunities to own gold mines like Greenstone are

incredibly rare in our industry, and the Greenstone Mine will now

be the foundation for long-term value creation in our company. I

also welcome Orion as a shareholder of Equinox Gold and thank them

for being a great partner over the last few years, as together with

the Greenstone team we have executed a very successful mine build.

Greenstone is well into hot commissioning, with first gold in

sight. Now, as full owners, we remain focused on advancing

Greenstone to commercial production and look forward to surfacing

its full potential.”

Istvan Zollei, Managing Partner of Orion,

stated: “Orion has been an investor in the Greenstone gold project

since 2016, and collaborative joint venture partners with Equinox

Gold since 2021. We’ve been very pleased to see the crucial

construction and operational milestones being delivered by the team

and look forward to seeing the mine achieve its full potential. Our

partnership with Equinox Gold has been outstanding and synergistic,

and we look forward to our ongoing cooperation with the Equinox

Gold team as a supportive shareholder.”

Transaction Funding

A syndicate of banks comprising The Bank of Nova

Scotia, Bank of Montreal, ING Capital LLC and National Bank of

Canada have provided underwritten commitments for a term loan of

$500 million to be used to partially fund the cash consideration

pursuant to the SPA (the “Term Loan”). The Term Loan will have a

three-year term with no principal payments during the first two

years. Commencing two years after the closing date, the Term Loan

will be repaid in quarterly installments equal to 10% of the then

outstanding principal amount of the Term Loan, with the remaining

principal amount to be repaid at maturity. Interest, covenants and

other terms are substantially consistent with the Company’s

existing revolving credit facility. The Term Loan is expected to be

completed in connection with closing of the Transaction.

In addition, Equinox Gold has entered into an

agreement with a syndicate of underwriters led by BMO Capital

Markets, National Bank Financial Inc. and Scotiabank as joint

book-runners (collectively, the “Underwriters”), pursuant to which

the Underwriters have agreed to purchase, on a bought deal basis,

49,060,000 common shares of Equinox Gold (the “Common Shares”) at a

price of $5.30 per Common Share (the “Offering Price”), for

aggregate gross proceeds of approximately $260 million (the

“Offering”).

The Company has granted the Underwriters an

over-allotment option, exercisable in whole or in part at any time

at the Offering Price up to 30 days after closing of the Offering,

to purchase up to an additional 15% of the number of Common Shares

issued pursuant to the Offering.

The Company intends to use the net proceeds of

the Offering to fund a portion of the cash consideration pursuant

to the SPA due at closing of the Transaction with any excess net

proceeds used for general working capital and corporate purposes,

including repayment of certain indebtedness.

Closing of the Offering is expected to occur on

or about April 26, 2024, subject to customary closing conditions,

including the receipt of all necessary approvals of the Toronto

Stock Exchange (the “TSX”) and the NYSE American in accordance with

their applicable listing requirements.

The Offering will be made in each of the

provinces and territories of Canada, other than Quebec, by way of a

prospectus supplement (the “Prospectus Supplement”) to the

Company’s short form base shelf prospectus dated November 21, 2022

(the “Base Shelf Prospectus”). The Company has filed a registration

statement on Form F-10 (the “Registration Statement”) (including

the Base Shelf Prospectus) and the Prospectus Supplement with the

U.S. Securities and Exchange Commission (the “SEC”) in

accordance with the multi-jurisdictional disclosure system

established between Canada and the United States for the Offering.

The Offering may also be made on a private placement basis in other

international jurisdictions in reliance on applicable private

placement exemptions. Before investing, prospective investors

should read the Base Shelf Prospectus, the Prospectus Supplement,

when available, the documents incorporated by reference therein,

the Registration Statement containing such documents and other

documents the Company has filed with the SEC for more complete

information about the Company and the Offering.

When available, these documents may be accessed

for free on the System for Electronic Document Analysis and

Retrieval (“SEDAR+”) at www.sedarplus.ca and on the SEC’s

Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”)

at www.sec.gov. Alternatively, copies of these documents, when

available, may be obtained upon request by contacting BMO Nesbitt

Burns Inc. by mail at Brampton Distribution Centre c/o The Data

Group of Companies, 9195 Torbram Road, Brampton, ON, L6S 6H2, by

telephone at 905-791-3151 Ext 4312, or by email at

torbramwarehouse@datagroup.ca, and in the United States by

contacting BMO Capital Markets Corp. by mail at 151 W 42nd Street,

32nd Floor, New York, NY 10036, Attn: Equity Syndicate Department,

by telephone at 1-800-414-3627, or by email at

bmoprospectus@bmo.com.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any province, state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such province, state or jurisdiction.

Additional Transaction

Details

Completion of the Transaction is expected to

occur in Q2 2024 and is subject to customary closing conditions and

receipt of certain regulatory and other approvals. The Transaction

does not require shareholder approval.

Pursuant to and in compliance with U.S.

securities laws, the Company is restricted from marketing

activities related to the Transaction prior to closing of the

Offering.

Advisors and Counsel

GenCap Mining Advisory Ltd. is acting as

financial and debt advisor and Blake, Cassels & Graydon LLP and

Paul, Weiss, Rifkind, Wharton & Garrison LLP are serving as

legal counsel to Equinox Gold.

RBC Capital Markets is acting as financial

advisor and Torys LLP is serving as legal counsel to Orion.

Equinox Gold Contacts

Greg Smith, President & CEORhylin Bailie,

Vice President, Investor RelationsTel: +1 604-558-0560Email:

ir@equinoxgold.com

About Equinox Gold

Equinox Gold is a growth-focused Canadian mining

company with seven operating gold mines, commissioning underway at

a new mine, and a plan to achieve more than one million ounces of

annual gold production by advancing a pipeline of expansion

projects. Equinox Gold’s common shares are listed on the TSX and

the NYSE American under the trading symbol EQX.

Cautionary Notes

This news release contains certain

forward-looking information and forward-looking statements within

the meaning of applicable securities legislation. Forward-looking

statements and forward-looking information in this news release

relate to, among other things: the Company’s ability to

successfully complete the Transaction and the timing thereof,

including receipt of all required regulatory approvals and

financing; the proposed benefits of the Transaction to the

Company’s business, financial condition, cash flows and results of

operations and to its shareholders being attained, including with

respect to life of mine, production, cash flow, EBITDA and cash

costs estimates, and with respect to exploration and growth

opportunities; the completion of the Offering, including the

receipt of TSX and NYSE American; approval; the intended use of net

proceeds from the Offering; the completion and closing of the Term

Loan; the use of funds available pursuant to the Term Loan; the

anticipated costs of the Transaction; the Company’s expectations

for the operation of Greenstone, including production capabilities

and future financial or operating performance; the strategic vision

for the Company and expectations regarding exploration potential,

production capabilities and future financial or operating

performance; and the Company’s ability to successfully advance its

growth and development projects. Forward-looking statements or

information generally identified by the use of the words “will”,

“advance”, “plan”, “expect”, “achieve”, “on track”, “on schedule”,

“target”, “continue”, and similar expressions and phrases or

statements that certain actions, events or results “could”, “would”

or “should”, or the negative connotation of such terms, are

intended to identify forward-looking statements and information.

Although the Company believes that the expectations reflected in

such forward-looking statements and information are reasonable,

undue reliance should not be placed on forward-looking statements

as the Company can give no assurance that such expectations will

prove to be correct. The Company has based these forward-looking

statements and information on the Company’s current expectations

and projections about future events and these assumptions include,

but are not limited to: commissioning at Greenstone being completed

and performed in accordance with current expectations, including

estimated capital costs remaining as expected; availability of

funds for the Company’s projects and future cash requirements;

Greenstone Mineral Reserve and Mineral Resource estimates and the

assumptions on which they are based; Equinox Gold’s ability to

achieve the production, cost and development expectations for its

respective operations and projects; prices for gold remaining as

estimated; currency exchange rates remaining as estimated; no

labour-related disruptions and no unplanned delays or interruptions

in scheduled commissioning, construction, development and

production, including by blockade; the expansion projects at Los

Filos, Castle Mountain and Aurizona being completed and performed

in accordance with current expectations; tonnage of ore to be mined

and processed; ore grades and recoveries remaining consistent with

mine plans; all necessary permits, licenses and regulatory

approvals are received in a timely manner; successful relationships

between the Company and its joint venture partner and between the

Company and its Indigenous partners at Greenstone; and the

Company’s ability to comply with environmental, health and safety

laws. While the Company considers these assumptions to be

reasonable based on information currently available, they may prove

to be incorrect. Accordingly, readers are cautioned not to put

undue reliance on the forward-looking statements or information

contained in this news release.

The Company cautions that forward-looking

statements and information involve known and unknown risks,

uncertainties and other factors that may cause actual results and

developments to differ materially from those expressed or implied

by such forward-looking statements and information contained in

this news release and the Company has made assumptions and

estimates based on or related to many of these factors. Such

factors include, without limitation: fluctuations in gold prices;

fluctuations in prices for energy inputs, labour, materials,

supplies and services; fluctuations in currency markets;

operational risks and hazards inherent with the business of mining

(including environmental risks, geotechnical failures, industrial

accidents, equipment breakdown, unusual or unexpected geological or

structural formations, cave-ins, flooding and severe weather);

inadequate insurance, or inability to obtain insurance to cover

these risks and hazards; employee relations; relationships with,

and claims by, local communities and Indigenous partners; the

Company’s ability to obtain all necessary permits, licenses and

regulatory approvals in a timely manner or at all; changes in laws,

regulations and government practices, including environmental,

export and import laws and regulations; legal restrictions relating

to mining; increased competition in the mining industry; and those

factors identified in the section titled “Risks and Uncertainties”

in Equinox Gold’s Management’s Discussion & Analysis dated

February 21, 2024 for the year ended December 31, 2023, and in the

section titled “Risks Related to the Business” in Equinox Gold’s

most recently filed Annual Information Form, both of which are

available on SEDAR+ at www.sedarplus.ca and on EDGAR at

www.sec.gov. Forward-looking statements and information are

designed to help readers understand management’s views with respect

to future events and speak only as of the date they are made.

Except as required by applicable law, Equinox Gold assumes no

obligation to update or to publicly announce the results of any

change to any forward-looking statement or information contained or

incorporated by reference to reflect actual results, future events

or developments, changes in assumptions or changes in other factors

affecting the forward-looking statements and information. If

Equinox Gold updates any one or more forward-looking statements, no

inference should be drawn that Equinox Gold will make additional

updates with respect to those or other forward-looking statements.

All forward-looking statements and information contained in this

news release are expressly qualified in their entirety by this

cautionary statement.

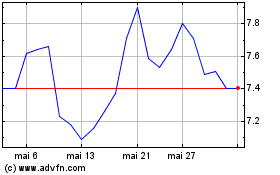

Equinox Gold (TSX:EQX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Equinox Gold (TSX:EQX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025