American Hotel Income Properties REIT LP (“

AHIP”)

(TSX: HOT.UN, TSX: HOT.U, TSX: HOT.DB. V), today announced

increased liquidity under its revolving credit facility (the

“

RCF”) following the completion of new hotel

appraisals obtained in accordance with the terms of AHIP’s

previously announced amendment to its RCF completed on November 7,

2023 (the “

Sixth Amendment”).

AHIP has now satisfied the conditions to extend

the maturity of the RCF to December 3, 2024 with no paydown being

required as a result of the property values set forth in the

appraisals.

“We are pleased with the outcome of the

independent appraisals. These appraisals recognize the significant

value of our portfolio with per key values for the subject

properties being significantly higher than the implied value per

key based on the recent trading price of our units. Further, the

incremental liquidity under the RCF allows us to patiently pursue

the disposition of non-core assets, using proceeds to pay down debt

and recycle capital into new acquisitions.” said Jonathan Korol,

CEO.

The total appraised value of the 20 hotel

properties (the "Borrowing Base Properties") is

$286.2 million. This results in maximum borrowing availability

under the RCF of $193.2 million, which is 67.5% of the total

appraised value of the Borrowing Base Properties. Based on the

current balance owing of $183.2 million, the available liquidity

under the RCF (which had previously been reduced to zero pending

the outcome of the appraisals) is currently $10.0 million.

The appraised value of $286.2 million for the 20

Borrowing Base Properties (2,070 keys) is equivalent to $138

thousand per key, which is significantly higher than AHIP’s

enterprise value per key(1) of $96 thousand, based on the U.S.

dollar closing price of US$0.49 per unit on the TSX on November 30,

2023.

For further details, see a copy of the Sixth

Amendment, which has been filed under AHIP’s profile on SEDAR+ at

www.sedarplus.com.

ABOUT AMERICAN HOTEL INCOME PROPERTIES REIT

LP

American Hotel Income Properties REIT LP (TSX:

HOT.UN, TSX: HOT.U, TSX: HOT.DB.V), or AHIP, is a limited

partnership formed to invest in hotel real estate properties across

the United States. AHIP’s portfolio of premium branded,

select-service hotels are located in secondary metropolitan markets

that benefit from diverse and stable demand. AHIP hotels operate

under brands affiliated with Marriott, Hilton, IHG and Choice

Hotels through license agreements. AHIP’s long-term objectives are

to build on its proven track record of successful investment,

deliver monthly U.S. dollar denominated distributions to

unitholders, and generate value through the continued growth of its

diversified hotel portfolio. More information is available at

www.ahipreit.com.

NON-IFRS AND OTHER FINANCIAL

MEASURESManagement believes the following supplementary

financial measures are relevant measures to monitor and evaluate

AHIP’s financial and operating performance. These measures do not

have any standardized meaning prescribed by IFRS and are therefore

unlikely to be comparable to similar measures presented by other

issuers. These measures are included to provide investors and

management additional information and alternative methods for

assessing AHIP’s financial and operating results and should not be

considered in isolation or as a substitute for performance measures

prepared in accordance with IFRS.

Enterprise Value: is a

supplementary financial measure and is calculated as (i) the sum of

total debt obligations as reflected on the September 30, 2023

balance sheet, AHIP’s market capitalization (which is calculated as

the U.S. dollar closing price of the units on the TSX as of

November 30, 2023, multiplied by the total number of units issued

and outstanding), and face value of series C preferred shares, less

(ii) the amount of cash and cash equivalents reflected on the

September 30, 2023 balance sheet.

Enterprise Value per Key: is a

supplementary financial measure and is calculated as enterprise

value divided by the total number of hotel keys/rooms in the

portfolio.

NON-IFRS RECONCILIATION

|

(thousands of dollars) |

September 30, 2023 |

|

|

|

| Unrestricted

cash – (D) |

17,386 |

| |

|

| Term loans and revolving

credit facility |

636,282 |

| Face

value of convertible debenture |

50,000 |

|

Total debt – (A) |

686,282 |

|

|

|

| Number of units outstanding –

(a) |

78,893 |

| Unit

price at November 30, 2023 – (b) |

0.49 |

|

Market capitalization – (B) = (a) * (b) |

38,658 |

|

|

|

| Face value of Series C

preferred shares – (C) |

50,000 |

| |

|

|

Total Capitalization = (A) + (B) + (C) |

774,940 |

|

|

|

| Total Enterprise Value

= (A) + (B) + (C) – (D) |

757,554 |

| |

|

| Number

of keys |

7,917 |

|

Enterprise Value per key |

96 |

FORWARD-LOOKING INFORMATION

Certain statements in this news release may

constitute “forward-looking information” within the meaning of

applicable securities laws. Forward-looking information generally

can be identified by words such as “anticipate”, “believe”,

“continue”, “expect”, “estimates”, “intend”, “may”, “outlook”,

“objective”, “plans”, “should”, “will” and similar expressions

suggesting future outcomes or events. Forward-looking information

includes, but is not limited to, statements made or implied

relating to the objectives of AHIP, AHIP’s strategies to achieve

those objectives and AHIP’s beliefs, plans, estimates, projections

and intentions and similar statements concerning anticipated future

events, results, circumstances, performance, or expectations that

are not historical facts. Forward-looking information in this news

release includes, but is not limited to, statements with respect

to: the incremental liquidity under the RCF allowing AHIP to

patiently pursue the disposition of non-core assets, using proceeds

to pay down debt and recycle capital into new acquisitions; and

AHIP’s stated long-term objectives.

Although the forward-looking information

contained in this news release is based on what AHIP’s management

believes to be reasonable assumptions, AHIP cannot assure investors

that actual results will be consistent with such information.

Forward-looking information is based on a number of key

expectations and assumptions made by AHIP, including, without

limitation: inflation, labor shortages, and supply chain

disruptions will negatively impact the U.S. economy, U.S. hotel

industry and AHIP’s business; AHIP will continue to have sufficient

funds to meet its financial obligations; AHIP’s strategies with

respect to completion of capital projects, liquidity, addressing

near-term debt maturities, divestiture of non-core assets and

acquisitions will be successful and achieve their intended effects;

AHIP will continue to have good relationships with its hotel brand

partners; capital markets will provide AHIP with readily available

access to equity and/or debt financing on terms acceptable to AHIP,

including the ability to refinance maturing debt as it becomes due

on terms acceptable to AHIP; AHIP’s future level of indebtedness

and its future growth potential will remain consistent with AHIP’s

current expectations; and AHIP will achieve its long term

objectives.

Forward-looking information involves significant

risks and uncertainties and should not be read as a guarantee of

future performance or results as actual results may differ

materially from those expressed or implied in such forward-looking

information, accordingly undue reliance should not be placed on

such forward-looking information. Those risks and uncertainties

include, among other things, risks related to: AHIP may not achieve

its expected performance levels in 2023 and beyond; inflation,

labor shortages, supply chain disruptions; AHIP’s brand partners

may impose revised service standards and capital requirements which

are adverse to AHIP; AHIP’s strategic initiatives with respect to

liquidity, addressing near-term debt maturities and providing AHIP

with financial stability may not be successful and may not achieve

their intended outcomes; AHIP’s strategies for divesting assets to

recycle proceeds into new acquisitions and reduce debt may not be

successful; AHIP may not be successful in reducing its leverage;

AHIP may not be able to refinance debt obligations as they become

due or may do so on terms less favorable to AHIP than under AHIP’s

existing loan agreements; general economic conditions and consumer

confidence; the growth in the U.S. hotel and lodging industry;

prices for AHIP’s units and its debentures; liquidity; tax risks;

ability to access debt and capital markets; financing risks;

changes in interest rates; the financial condition of, and AHIP’s

relationships with, its external hotel manager and franchisors;

real property risks, including environmental risks; the degree and

nature of competition; ability to acquire accretive hotel

investments; ability to integrate new hotels; environmental

matters; increased geopolitical instability; and changes in

legislation and AHIP may not achieve its long term objectives.

Management believes that the expectations reflected in the

forward-looking information are based upon reasonable assumptions

and information currently available; however, management can give

no assurance that actual results will be consistent with the

forward-looking information contained herein. Additional

information about risks and uncertainties is contained in AHIP’s

management’s discussion and analysis for the three and nine months

ended September 30, 2023 and 2022, and AHIP’s annual information

form for the year ended December 31, 2022, copies of which are

available on SEDAR+ at www.sedarplus.com.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management's

current beliefs and is based on information currently available to

AHIP. The forward-looking information is made as of the date of

this news release and AHIP assumes no obligation to update or

revise such information to reflect new events or circumstances,

except as may be required by applicable law.

For additional information, please

contact:

Investor Relationsir@ahipreit.com

(1) Non-IFRS and other financial measures. See “NON-IFRS AND

OTHER FINANCIAL MEASURES” section of this news release.

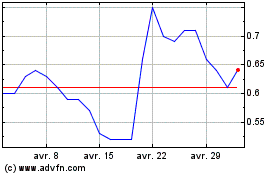

American Hotel Income Pr... (TSX:HOT.UN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

American Hotel Income Pr... (TSX:HOT.UN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025