High Arctic Energy Services Inc. (TSX: HWO) ("High Arctic" or the

"Corporation") is pleased to announce that its Board of Directors

(“Board”) has unanimously approved the reorganization of High

Arctic to separate the Corporation's North American and Papua New

Guinea ("PNG") businesses, by way of a court-approved plan of

arrangement (the "Arrangement"), as well as a distribution of

surplus cash to shareholders by way of a return of capital of up to

$38.2 million (up to $0.76 per common share) of High Arctic (the

"Return of Capital"). The Arrangement will transfer High Arctic's

PNG business to a separate, dedicated, and independent, publicly

traded company named "High Arctic Overseas Holdings Corp."

("SpinCo"), while High Arctic will continue to own and operate the

Corporation's existing North American Business. Each of the two

companies will have its own management and operational teams and

separate Board of Directors.

Under the proposed Arrangement, each shareholder

of High Arctic ("Shareholder") will receive one-quarter of one

(1/4) common share of SpinCo ("SpinCo Common Share") and

one-quarter of one (1/4) common share of post-Arrangement High

Arctic for each common share of High Arctic held. The Arrangement,

the Return of Capital, and other resolutions related to the

reorganization, as well as annual meeting matters, will be put to

the Shareholders for approval at an annual general and special

meeting of shareholders of the Corporation to be held in Calgary,

Alberta on June 17, 2024 (the "Meeting"). As a result of the

Arrangement, each Shareholder will continue to own its pro rata

portion of both SpinCo and post-Arrangement High Arctic.

Strategic Rationale

High Arctic’s Board and management are of the

view that the Corporation has historically been unable to derive

appropriate value from the market that represents the sum of the

parts. The Corporation has also found a lack of synergy between

the businesses in PNG and Canada. In separating the PNG business

from the Corporation, High Arctic’s Board and management believe

value can be created for the Shareholders. For the holders of

SpinCo Common Shares, separation provides the opportunity for

SpinCo to consider transactions with a wider group of PNG focused

companies, and greater flexibility to relocate in the future to a

market that better understands PNG and is likely to ascribe

greater value to SpinCo. For the holders of post-Arrangement High

Arctic common shares, the transaction opens-up opportunities for

High Arctic to participate in Canadian M&A activity where the

PNG business may have been perceived as an impediment to accretive

transactions.

For years the Corporation has both pursued or

entertained potential business combination transactions. The

distinctly different profiles of the North American and PNG

businesses have proven to be the main impediment to identifying

transactions acceptable to all parties and in the best interests of

Shareholders. Finding unique companies desirous of being linked to

both distinct businesses has proven unsuccessful. Companies to

whom association with our North American Business may be attractive

are a distinctly broader group and do not overlap with the

international companies with whom the PNG business and its risk

profile may fit well.

Board and management unanimously agree that the

separation of these two businesses will ensure that management is

dedicated to enhancing the value of each business and accessing new

pathways to transformative and accretive transactions that are

currently inaccessible.

Benefits to Shareholders

Certain of the expected benefits to Shareholders

of the Arrangement are as follows:

- The benefits of

dividing the Corporation into its distinct businesses;

- Each company

will be owned by Shareholders on a pro rata basis with reference to

the number of High Arctic Common Shares held prior to the

Arrangement;

- The Arrangement

is expected to improve the market’s identification and valuation of

each company and allow Shareholders, investors and analysts to

more accurately compare, evaluate and value each of the companies

on a stand-alone basis against appropriate peers, benchmarks and

performance criteria specific to that company;

- Each company

will have independent access to capital (equity and debt) which

management believes will result in optimal capital

allocation;

- The procedures

by which the Arrangement is to be approved, including the

requirement for approval of the Arrangement by the Court after a

hearing at which fairness to the Corporation’s securityholders

will be considered;

- The Corporation

has received the financial Fairness Opinion (defined below);

- The availability

of rights of dissent to Shareholders with respect to the

Arrangement; and

- The tax

treatment of the Arrangement is expected to be tax efficient for

Canadian tax purposes for most shareholders.

Board and Management of High Arctic and

SpinCo

The Hon. Joe Oliver has informed the Corporation

that he does not intend to stand for re-election as a director at

the Meeting and will resign on May 15, 2024. Mr. Oliver has served

as a director of High Arctic for eight years, and his intention to

resign coincides with the Arrangement and the setting of a new

strategic direction for the remaining Corporation, which he

supports.

Michael Binnion, High Arctic’s Chairman stated:

“On behalf of the Board, I would like to thank the Honorable Joe

Oliver for his dedication and commitment to High Arctic during his

tenure. Joe has played an important role in the evolution of High

Arctic including the challenges of a global pandemic and a

rebuilding of the businesses that sets the stage for a new and

independent future. We wish Joe all the very best.”

Upon completion of the Arrangement and election

or re-election by Shareholders at the Meeting, the Board of High

Arctic will consist of:

Simon Batcup (Chair)Douglas StrongMichael BinnionCraig

Nieboer

The management of High Arctic will consist

of:

Michael Maguire (Interim CEO)Lonn Bate (CFO)Trevor Barker (GM

Operations)Justin Morrical (Business Development Manager)

High Arctic is actively pursuing permanent CEO

placement options. If the Arrangement is approved, Mr. Maguire will

assume the role in an interim capacity and transition duties to a

new CEO appointed by the Board.

The management of SpinCo will consist of:

Mike Maguire (CEO)Lonn Bate (Interim CFO)Stephen Lambert

(COO)Chris Fraser (VP Strategy & Growth)Matthew Cocks (VP

Finance)

The Board of SpinCo, upon completion of the

Arrangement, will consist of:

Michael Binnion (Chair)Mike MaguireBruce Apana

Summary of the Arrangement

The Corporation and SpinCo have entered into an

arrangement agreement providing for the Arrangement (the

"Arrangement Agreement"). A copy of the Arrangement Agreement will

be filed under High Arctic's profile on SEDAR+ at www.sedarplus.ca.

Full details of the Arrangement, the Return of Capital, and the

other items to be approved by the Shareholders at the Meeting will

be included in the management information circular of High Arctic

to be mailed to Shareholders on or about May 13, 2024.

The Arrangement will require approval by a

minimum of 66 2/3% of the votes cast by High Arctic Shareholders,

voting in person or by proxy, at the Meeting. The Arrangement is

also subject to the approval of the TSX and the Court of King's

Bench of Alberta, and applicable regulatory approvals and the

satisfaction of certain other closing conditions customary for

transactions of this nature. It is anticipated that the Return of

Capital will be distributed to Shareholders on or about July 24,

2024, and the closing of the Arrangement will take place on or

about July 31, 2024, assuming that the required Shareholder, Court

and regulatory approvals have been received by such time, and

subject to the other terms and conditions set out in the

Arrangement Agreement.

Application has been made to the TSX Venture

Exchange for the listing of the SpinCo Common Shares upon

completion of the Arrangement. It is a condition of the completion

of the Arrangement that the new common shares of High Arctic and

the SpinCo Common Shares will be listed on either the Toronto Stock

Exchange or will be listed on the TSX Venture Exchange.

Lightyear Capital Inc. has provided to the

Board of Directors an opinion ("Fairness Opinion") that, as of the

date of the Fairness Opinion and based upon and subject to the

assumptions, limitations, qualifications and conditions described

therein, the consideration to be received by Shareholders

pursuant to the Arrangement was fair, from a financial point of

view, to such Shareholders.

Summary of the Return of

Capital

In July 2022 the Corporation made a strategic

decision to divest certain well servicing and snubbing assets in

Canada, to two separate purchasers, and in July 2023 the

Corporation sold its Canadian nitrogen pumping business

(collectively, the “Sale Transactions”).

As a result of receiving the cash proceeds of

the Sale Transactions, the Corporation had working capital of

approximately $62.7 million which included a cash balance of

approximately $50.4 million as at December 31, 2023. Although

the Corporation reviewed opportunities to redeploy its excess

working capital in North America and elsewhere, the High Arctic

Board has determined to seek shareholder approval for the

Arrangement and the Return of Capital.

Pursuant to the provisions of the Alberta

Business Corporations Act, the Corporation proposes to reduce the

capital account maintained by the Corporation in respect of the

High Arctic Common Shares in an amount up to $0.76 multiplied by

the number of High Arctic Common Shares issued and outstanding,

such amount to be determined by the Board. Approval of the Stated

Capital Reduction enables High Arctic to distribute the same

amount to Shareholders as a Return of Capital. High Arctic

anticipates that the aggregate amount of the return of Capital will

be a maximum of $38.2 million. The Return of Capital is expected

to be completed immediately prior to the completion of the

transactions contemplated by the Arrangement.

The Return of Capital will require approval by a

minimum of 66 2/3% of the votes cast by High Arctic shareholders,

voting in person or by proxy, at the Meeting.

Board Recommendation

The Board of Directors of High Arctic, including

the Hon. Joe Oliver, has unanimously approved the Arrangement and

the Return of Capital and has determined that the Arrangement and

the Return of Capital are in the best interests of High Arctic, and

recommends that the High Arctic shareholders vote in favour of the

Arrangement and the Return of Capital.

Other Matters to be Approved at the

Meeting

At the Meeting, provided that the Arrangement is

approved by the Shareholders, the Shareholders will also be asked

to approve the accelerated redemption of all outstanding units

under the Corporation’s deferred share unit plan, as well as an

equity incentive plan for SpinCo. Shareholders will also be asked

to approve various annual matters, including fixing the number of

directors to be elected at the meeting, election of the directors

of the Corporation, and appointment of the auditors of the

Corporation.

About High Arctic

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada High Arctic provides

pressure control and other oilfield equipment on a rental basis to

exploration and production companies, from its bases in Whitecourt

and Red Deer, Alberta.

For further information, please contact:

Lonn BateInterim Chief Financial

Officer1.587.318.22181.800.668.7143

High Arctic Energy Services Inc.Suite 2350, 330–5th Avenue

SWCalgary, Alberta, Canada T2P 0L4website: www.haes.ca Email:

info@haes.ca

Forward-Looking Statements

Forward-Looking Statements. Certain statements

contained in this press release may constitute forward-looking

statements. These statements relate to future events or High

Arctic's and SpinCo's future performance. All statements other than

statements of historical fact may be forward-looking statements.

Forward-looking statements are often, but not always, identified

by the use of words such as "seek", "anticipate", "plan",

"continue", "estimate", "expect", "may", "will", "project",

"predict", "potential", "targeting", "intend", "could", "might",

"should", "believe" and similar expressions. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. High Arctic

believes that the expectations reflected in those forward-looking

statements are reasonable, but no assurance can be given that

these expectations will prove to be correct and such

forward-looking statements included in this press release should

not be unduly relied upon by investors. These statements speak

only as of the date of this press release and are expressly

qualified, in their entirety, by this cautionary statement.

In particular, this press release contains

forward-looking statements, pertaining to the following: the

anticipated benefits of the Arrangement to High Arctic and its

Shareholders; the timing and anticipated receipt of required

regulatory (including stock exchange), court, and shareholder

approvals for the Arrangement; the ability of High Arctic to

satisfy the other conditions to, and to complete, the Arrangement;

the anticipated timing of the mailing of the information circular

regarding the Arrangement, the closing of the Arrangement, the

approval by the Board and the amount and payment of the Return of

Capital, and the composition of the management teams and Board of

Directors of SpinCo and post-Arrangement High Arctic.

In respect of the forward-looking statements and

information concerning the anticipated completion of the proposed

Arrangement, the anticipated timing for completion of the

Arrangement and related transactions, High Arctic has provided

them in reliance on certain assumptions that it believe are

reasonable at this time, including assumptions as to the time

required to prepare and mail shareholder meeting materials,

including the required management information circular; the

ability of the parties to receive, in a timely manner, the

necessary regulatory, court, shareholder and other third party

approvals; and the ability of the parties to satisfy, in a timely

manner, the other conditions to the closing of the Arrangement.

These dates may change for a number of reasons, including

unforeseen delays in preparing meeting material; inability to

secure necessary shareholder, regulatory, court or other third

party approvals in the time assumed or the need for additional

time to satisfy the other conditions to the completion of the

Reorganization. Accordingly, readers should not place undue

reliance on the forward-looking statements and information

contained in this news release concerning these times.

With respect to forward-looking statements

contained in this press release related to High Arctic’s business

and operations, High Arctic has made assumptions regarding, among

other things: (i) there being no significant disruptions affecting

operations, whether due to labour disruptions, supply disruptions,

damage to equipment or otherwise during the balance of 2024; (ii)

that the exchange rate between the Canadian dollar and the U.S.

dollar will be approximately consistent with current levels;

(iii) the ability of the Corporation and SpinCo to maintain

ongoing relationships with major customers and successfully market

their services to current and new customers; (iv) the ability of

High Arctic and SpinCo to successfully manage, operate, and thrive

in an environment which is facing much uncertainty; and (v) the

ability of High Arctic and SpinCo to obtain equity and debt

financing when needed on satisfactory terms.

The actual results of High Arctic and SpinCo

could differ materially from those anticipated in these

forward-looking statements as a result of risk factors that may

include, but are not limited to: volatility in the worldwide

demand for oilfield services; impact on industry activity levels

due to such factors as volatility in oil and natural gas prices and

the ability of customers to raise capital for exploration and

development; change in legislation and the regulatory environment;

changes in PNG government policy on resource development; risks

inherent in operating in foreign jurisdictions; and geohazards and

meteorological hazards associated with operating in PNG.

This forward-looking information represents High

Arctic’s views as of the date of this document and such

information should not be relied upon as representing its views as

of any date subsequent to the date of this document. High Arctic

has attempted to identify important factors that could cause

actual results, performance or achievements to vary from those

current expectations or estimates expressed or implied by the

forward-looking information. However, there may be other factors

that cause results, performance or achievements not to be as

expected or estimated and that could cause actual results,

performance or achievements to differ materially from current

expectations. There can be no assurance that forward-looking

information will prove to be accurate, as results and future events

could differ materially from those expected or estimated in such

statements. Accordingly, readers should not place undue reliance

on forward-looking information. Except as required by law, High

Arctic undertakes no obligation to publicly update or revise any

forward-looking statements.

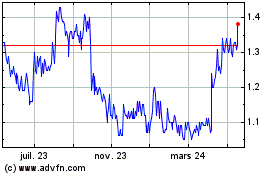

High Arctic Energy Servi... (TSX:HWO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

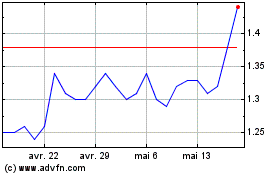

High Arctic Energy Servi... (TSX:HWO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024