Innergex Renewable Energy Inc. (TSX: INE) (“Innergex” or the

“Corporation”) announces it has entered into an agreement to

acquire 100% of the ordinary shares of Aela Generación S.A. and

Aela Energía SpA (together “Aela”), a 332 MW portfolio of three

newly-built operating wind assets in Chile, for a purchase price of

US$686 million ($871 million) (the “Acquisition”), including the

assumption of US$386 million ($490 million) of existing debt,

subject to customary closing adjustments.2

Aela’s portfolio consists of the Sarco wind

farm (170 MW), the Aurora wind farm (129 MW) and the Cuel wind

farm (33 MW) (collectively, the “Facilities”). Revenues from these

facilities are anchored by two forms of power purchase agreements

(“PPAs”) with 25 Chilean distribution companies, maturing at the

end of 2036 and 2041.

“I am very excited to announce today the

acquisition of Aela, a leading wind power portfolio in Chile, which

will significantly expand our overall presence in the country to

655 MW with meaningful technological and geographical

diversification. The Acquisition will extend our leadership

position in Chile, an attractive energy market” said Michel

Letellier, President and Chief Executive Officer of Innergex. “The

Acquisition is a continuation of Innergex’s disciplined growth

strategy in Chile that we’ve executed on since we entered the

market in 2018 and offers an opportunity to unlock the full value

of our current Chilean portfolio as these newly-constructed,

high-quality assets combined with our current portfolio yield

accretive refinancing opportunities, additional flexibility to

service our clients under PPAs, and other operational

enhancements.”

Chile: An Attractive Renewable Energy

MarketChile represents an attractive market for

investment. It is the first South American country to become a

member of the Organization for Economic Co-operation and

Development and maintains a strong investment grade rating as

assessed by S&P (A), Moody’s (A1) and Fitch (A-). Chile leads

Latin American countries with the highest Gross Domestic Product

(“GDP”) per capita and lowest public debt to GDP when compared to

the largest economies in the region.

The Chilean government has set national

decarbonization plans including the complete phase-out of

coal-fired generation with an initial step of retiring 3.5 GW by

2025 and the objective of achieving carbon neutrality by 2050. The

Chilean national power grid coordinator, Coordinador Eléctrico

Nacional (“CEN”), forecasts electricity demand will increase at a

3.4% cumulative average growth rate from 2021 to 2041, and the

average power price at the major Polpaico node in Chile has

averaged US$80/MWh over 2021. These decarbonization goals and

positive market fundamentals will require significant investment in

the renewable energy sector in the coming years and Innergex is

well positioned to participate in the ensuing growth.

Portfolio Underpinned by

Newly-Constructed Long-Term USD Contracted AssetsThe

Acquisition adds 332 MW of operational wind capacity with over 90%

of the capacity installed in 2020. The Facilities have a long-term

average (“LTA”) of 954 GWh per year and diversified revenue streams

anchored by two attractive forms of long-term PPAs for up to 856

GWh per year, which can be settled on a portfolio-basis including

Innergex’s other Chilean assets. The 20-year PPAs, awarded in 2015

and 2016 and effective in 2017 and 2022 respectively, have 16 years

of remaining weighted average contracted life. The US-denominated

contracts have an average rate for the first twelve months

following closing of US$93/MWh and benefit from full US consumer

price index (“CPI”) escalation, providing an inflation hedge.

Sales under the PPAs are with 25 local

distribution companies (“DisCos”), 97% of which are represented by

three investment grade blue-chip offtakers with investment grade

credit profiles. Amounts sold under the PPAs are dependent on the

regulated demand from the DisCos. In the first twelve months

following closing, volumes sold under the PPAs are expected to be

approximately 58% of the maximum output available under the PPA.

Volumes sold under the PPAs are expected to increase to nearly 90%

in the coming years due to a combination of higher demand and lower

supply of the remaining PPAs, as some will expire before 2027. The

CEN expects regulated electricity demand growth to increase at a

3.4% cumulative average growth rate from 2021 to 2041. The Comisión

Nacional de Energía (“CNE”) expects regulated supply serving DisCos

to decline by 37% from 2022 to 2027 as legacy supply contracts

reach the end of their terms, and has communicated that no new

DisCo PPA supply will be procured until 2027.

The Facilities also benefit from other sources

of contracted revenues, including entitlement to receive annual

capacity revenue payments based on capacity eligibility and pricing

calculated by the CNE. The Facilities also generate

Non-Conventional Renewable Energy credits, and a portion of these

credits are sold under a 15-year offtake contract. Remaining

non-contracted energy is sold on the spot market.

Enhances Innergex’s Portfolio in

ChileThe Acquisition marks Innergex’s sixth investment in

Chile since 2018, initially with the acquisition of a 50% interest

in Energía Llaima and the 140 MW Duqueco hydroelectric complex.

Since acquiring full control of Energía Llaima in 2021, Innergex

has been focused on increasing operational efficiency, adding

technological and geographical diversification to be better

positioned to seize opportunities and further advancing greenfield

project development and M&A opportunities. Over time, Innergex

has developed a full complement of in-country operating and

development capabilities in Chile through a team of over 80

employees, overseeing the operations of its portfolio of assets.

The acquisition of Aela will reinforce Innergex as one of the

country’s leading pure play renewable power producers with 655 MW

of multi-technology operating capacity and several avenues for

growth.

The Acquisition diversifies Innergex’s portfolio

in Chile with multi-technology assets including wind, hydro and

solar, and an increased geographical reach. In addition, the

Facilities and PPAs increase the overall contractedness of

Innergex’s Chilean portfolio from 61% to 69%, with all of the PPAs

benefiting from full CPI escalation.

The increased size and breadth of Innergex’s

Chilean portfolio creates opportunities to realize scale benefits

for its operations, including operational synergies. Innergex’s

existing Chilean generation profile also complements the generation

profile of the Facilities providing greater supply optionality and

portfolio-effect diversification benefits. In addition, by having

access to a large and growing diversified generation mix, Innergex

is able to supply large industrial customers on a 24/7 basis using

clean renewable power, unlocking potential contracting and

recontracting opportunities on existing assets and new development

opportunities in hydro, solar and storage through its growing

portfolio of development assets.

Strong Financial

ContributionThe Facilities have an attractive cash flow

profile and are expected to generate revenues of US$67 million ($85

million) for the first twelve months following closing based on the

expected LTA generation of 954 GWh, sales under the PPAs of 498 GWh

(representing 58% of the maximum output available under the PPAs)

and operating, general and administrative expenses of US$23 million

($29 million) during the same period. Sales under the PPAs are

expected to increase to nearly 90% of the maximum output available

under the PPAs over the next five years, which, in conjunction with

US CPI-linked price escalation, is expected to underpin incremental

total annual revenues of US$24 million ($30 million), compared to

the expected revenues for the first twelve months following

closing.

Assuming the implementation of the financing

plan described below, the Acquisition is expected to be immediately

accretive to Free Cash Flow per Share3 with mid to high single

digit accretion in the first twelve months post-closing and further

upside through increased sales under the PPAs in the coming years

as noted above.

Prudent Financing

PlanInnergex’s financing plan for the Acquisition is

designed to be consistent with Innergex’s investment grade

corporate credit rating, while optimizing the mix of corporate

equity and corporate and portfolio-level non-recourse debt. The net

purchase price of US$300 million ($381 million) after assumption of

US$386 million ($490 million) of existing debt, will be financed as

follows:

- $150 million of gross proceeds via

a concurrent bought deal equity offering, before the over-allotment

option;

- $37 million of gross proceeds via a

concurrent private placement to an affiliate of Hydro-Québec;

and

- The remaining financing

requirements will be financed by net proceeds from a combined

refinancing of the non-recourse debt at the Facilities and at

Innergex’s existing Chilean projects, expected to be arranged in Q2

2022.

A portion of the financing plan is supported by

acquisition debt facilities provided by CIBC.Approvals and

TimelineThe Acquisition is expected to close in Q2 2022

and is subject to the regulatory approval of the Chilean Antitrust

Agency (Fiscalía Nacional Económica), as well as customary closing

conditions.

Concurrent Equity Offering and Private

PlacementInnergex has entered into an agreement with a

syndicate of underwriters led by CIBC Capital Markets, National

Bank Financial Inc., BMO Capital Markets and TD Securities Inc.

(collectively the “Underwriters”), pursuant to which the

Underwriters have agreed to purchase on a bought deal basis, an

aggregate of 8,451,000 common shares at an offering price of $17.75

per share (the “Offering Price”) for aggregate gross proceeds to

the Corporation of approximately $150 million (the “Offering”). In

connection with the Offering, Innergex has granted the Underwriters

an over-allotment option, exercisable in whole or in part, at any

time for a period of 30 days following the closing of the Offering,

to purchase up to an aggregate of an additional 1,267,650

common shares at the Offering Price.

Innergex has also entered into a subscription

agreement with HQI Canada Holding Inc., a subsidiary of

Hydro-Québec (“HQI”) to purchase 2,100,000 common shares at the

Offering Price, for gross proceeds to the Corporation of

approximately $37 million through a private placement (the “Private

Placement”) as part of HQI’s rights contained in the Investor

Rights Agreement between Innergex and HQI, dated February 6, 2020.

As part of the Private Placement, HQI has the option, exercisable

following the exercise of the over-allotment option by the

Underwriters and prior to the expiry of the Underwriters’

over-allotment option, to purchase additional common shares under

the Private Placement at the Offering Price as to allow HQI to

maintain a 19.9% ownership of the common shares following the

exercise of the Underwriters’ over-allotment option. The common

shares offered in the Private Placement are being sold directly to

HQI without an underwriter or placement agent.

The net proceeds of the Offering and Private

Placement will be used to fund a portion of the purchase price of

the Acquisition. Should the Acquisition not successfully close, the

net proceeds of the Offering and Private Placement will be used for

general corporate purposes including future growth initiatives.

In connection with the Offering, Innergex will

file via SEDAR (www.sedar.com) a preliminary short form prospectus

in all provinces of Canada by February 9, 2022. The Offering and

Private Placement are subject to all standard regulatory approvals,

including that of the Toronto Stock Exchange, and are expected to

close on or about February 22, 2022.

The securities referred to herein have not been

and will not be registered under the United States Securities Act

of 1933, as amended, and may not be offered or sold in the United

States absent registration or an applicable exemption from

registration requirements. This news release does not constitute an

offer to sell or the solicitation of any offer to buy, nor will

there be any sale of these securities, in any province, state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such province, state or jurisdiction.

Reaffirmation of Projected Financial

PerformanceOn February 23, 2022, Innergex is expected to

release its financial results for the quarter and year ending

December 31, 2021. Based on currently available, preliminary

information, results are estimated to be in line with Innergex’s

November 2021 projections for revenues, Adjusted EBITDA and

Adjusted EBITDA Proportionate and ahead on Free Cash Flow per

Share4 for 2021, excluding the impacts of the February 2021 Texas

events.

Financial AdvisorsSMBC Nikko

Securities Americas, Inc. and CIBC Capital Markets acted as

financial advisors to Innergex.

Conference Call and

PresentationInnergex will make available an audio

conference and support material relative to this announcement on

its website at www.innergex.com/investors/.

About Innergex Renewable Energy

Inc.For over 30 years, Innergex has believed in a world

where abundant renewable energy promotes healthier communities and

creates shared prosperity. As an independent renewable power

producer which develops, acquires, owns and operates hydroelectric

facilities, wind farms, solar farms and energy storage facilities,

Innergex is convinced that generating power from renewable sources

will lead the way to a better world. Innergex conducts operations

in Canada, the United States, France and Chile and manages a large

portfolio of high-quality assets currently consisting of interests

in 80 operating facilities with an aggregate net installed capacity

of 3,152 MW (gross 3,852 MW) and an energy storage capacity of 150

MWh, including 40 hydroelectric facilities, 32 wind farms and 8

solar farms. Innergex also holds interests in 9 projects under

development, two of which are under construction, with a net

installed capacity of 171 MW (gross 209 MW) and an energy storage

capacity of 329 MWh, as well as prospective projects at different

stages of development with an aggregate gross capacity totaling

7,281 MW. Its approach to building shareholder value is to generate

sustainable cash flows, provide an attractive risk-adjusted return

on invested capital and to distribute a stable dividend.

Cautionary Statement Regarding

Forward-Looking InformationTo inform readers of the

Corporation's future prospects, this press release contains

forward-looking information within the meaning of applicable

securities laws (“Forward-Looking Information”), including

anticipated completion of the Aela Acquisition, the Offering and

the Private Placement and timing for such completion, the

integration of Aela and the resulting synergies including in light

of the contemplated Chilean projects debt refinancing, the

performance of the Aela wind facilities, the Corporation’s targeted

financial performance (including by taking into account the

targeted financial performance of Aela), sources and impact of

funding, project acquisitions, financial benefits and accretion

expected to result from such acquisitions, business strategy,

future development and growth prospects, business integration, and

other statements that are not historical facts. Forward-Looking

Information can generally be identified by the use of words such as

“approximately”, “may”, “will”, "could”, “believes”, “expects”,

“intends”, "should”, "would”, “plans”, “potential”, "project”,

“anticipates”, “estimates”, “scheduled” or “forecasts”, or other

comparable terms that state that certain events will or will not

occur. It represents the projections and expectations of the

Corporation relating to future events or results as of the date of

this press release.

Future oriented financial information:

Forward-Looking Information includes future-oriented financial

information or financial outlook within the meaning of securities

laws including information regarding the Corporation's expected

production, targeted Free Cash Flow and targeted Free Cash Flow per

Share (including on a combined basis with Aela), Aela’s expected

production, expected electricity demand, targeted revenues,

targeted operating, general and administrative expenses and other

statements that are not historical facts. Such information is

intended to inform readers of expected results, of the potential

financial impact of completed and future acquisitions and of the

Corporation's ability to sustain current dividends and to fund its

growth. Such information may not be appropriate for other

purposes.

Assumptions: Forward-looking Information is

based on certain key assumptions made by the Corporation,

including, without restrictions, assumptions concerning project

performance, economic, financial and financial market conditions,

expectations and assumptions concerning availability of capital

resources and timely performance by third-parties of contractual

obligations, receipt of regulatory approvals, the expected closing

of the Aela Acquisition, of the Offering and the Private Placement,

the expected performance of the Aela wind facilities (including in

light of electricity production and demand under the PPAs) and the

resulting synergies from its integration.

Risks and uncertainties: Forward-Looking

Information involves risks and uncertainties that may cause actual

results or performance to be materially different from those

expressed, implied or presented by the Forward-Looking Information.

These are referred to in the "Risks and Uncertainties" section of

the Annual Report and include, without limitation: the improper

assessment of wind resources and associated electricity production,

the variability in wind resources; the equipment supply risk,

including failure or unexpected operations and maintenance

activity; the natural disasters and force majeure; the regulatory

and political risks affecting production; the health, safety and

environmental risks affecting production; the variability of

installation performance and related penalties; the availability

and reliability of transmission systems; litigation; the unexpected

maintenance expenditures, the possibility that the Corporation may

not declare or pay a dividend; the reliance on PPAs and ability to

secure new PPAs or renew any PPA; the fact that revenues from

certain facilities will vary based on the market (or spot) price of

electricity; the fluctuations affecting prospective power prices,

changes in general economic conditions, availability of the

capital, regulatory and political risks, performance of

counterparties, the ability of the Corporation to complete the

successful integration of its acquisitions (including the Aela

Acquisition) and to achieve the contemplated synergies.

Although the Corporation believes that the

expectations and assumptions on which Forward-Looking Information

is based are reasonable under the current circumstances, readers

are cautioned not to rely unduly on this Forward-Looking

Information, as no assurance can be given that it will prove to be

correct. Forward-Looking Information contained herein is provided

as at the date of this press release, and the Corporation Principal

Risks and Uncertainties does not undertake any obligation to update

or revise any Forward-Looking Information, whether as a result of

events or circumstances occurring after the date hereof, unless so

required by law.

The following table outlines the Forward-Looking

Information contained in this press release, which the Corporation

considers important to better inform readers about its potential

financial performance, together with the principal assumptions used

to derive this information and the principal risks and

uncertainties that could cause actual results to differ materially

from this information.

|

Principal Assumptions |

Principal Risks and Uncertainties |

|

Expected ProductionThe Corporation determines a

long-term average annual level of electricity production (“LTA”)

over the expected life of the facility, based on engineers’ studies

that take into consideration a number of important factors

including for wind energy the historical wind and meteorological

conditions and turbine technology. Other factors considered

include, without limitation, site topography, installed capacity,

energy losses, operational features and maintenance. Although

production will fluctuate from year to year, over an extended

period it should approach the estimated LTA. |

Improper assessment of wind resources and associated electricity

production Variability in wind regimesEquipment supply risk,

including failure or unexpected operations and maintenance

activityNatural disasters and force majeureRegulatory and political

risks affecting productionHealth, safety and environmental risks

affecting productionVariability of installation performance and

related penaltiesAvailability and reliability of transmission

systemsLitigation |

|

Targeted RevenuesFor each facility, expected

annual revenues are estimated by multiplying the LTA by a pricefor

electricity stipulated in the PPA secured with a public utility or

other creditworthy counterparty. In most cases, these PPAs

stipulate a base price for electricity produced and, in some cases,

a price adjustment depending on the month, day and hour of its

delivery. In most cases, PPAs also contain an annual inflation

adjustment based on a portion of the Consumer Price Index. This

excludes facilities that receive revenues based on the market (or

spot) price for electricity. For these facilities, expected annual

revenues are estimated by multiplying the LTA with forward market

prices, which are based on observable market data or constructed

using various assumptions depending on historical market prices,

supply, demand and congestion volumes observed, as well as

econometric models.In the context of the Aela Acquisition, the

average sale price under the PPAs for the next twelve months

following closing is established at US$93/MWh. The sales increase

estimates under the PPAs are based on market assumptions and a CPI

indexed between 2 and 3.5% and at 58% to nearly 90% of the maximum

output available under the PPAs. PPA volumes are demand-driven, but

are sculpted to avoid production deficits under normal operating

circumstances. In addition, the projects are subject to price

differential adjustments between the point of injection on the grid

and the point of withdrawal under the PPAs. Approximately 12% of

the revenues are expected to be exposed the merchant market for the

2022-2031 period. |

See principal assumptions, risks and uncertainties identified under

“Expected Production” Revenues from certain facilities will vary

based on the market (or spot) price of electricityFluctuations

affecting prospective power pricesChanges in general economic

conditionsAbility to secure new PPAs or renew any PPA |

|

Targeted Free Cash Flow per Share The Corporation

estimates Targeted Free Cash Flow as projected cash flows from

operating activities before changes in non-cash operating working

capital items, less estimated maintenance capital expenditures net

of proceeds from disposals, scheduled debt principal payments,

preferred share dividends declared and the portion of Free Cash

Flow attributed to non-controlling interests, plus or minus other

elements that are not representative of the Corporation's long-term

cash generating capacity, such as transaction costs related to

realized acquisitions (which are financed at the time of the

acquisition), realized losses or gains on derivative financial

instruments used to hedge the interest rate on project-level debt

or the exchange rate on equipment purchases. Targeted Free Cash

Flow per Share is obtained by dividing Targeted Free Cash Flow by

the weighted average number of common shares. |

See principal assumptions, risks and uncertainties identified under

“Expected Production” and “Targeted Revenues”Unexpected maintenance

expenditures |

|

Expected closing of the Aela Acquisition, of the Offering

and the Private PlacementThe Corporation reasonably

expects that the closing conditions will be completed within the

deadlines |

Availability of the capitalRegulatory and political

risksPerformance of counterparties |

Cautionary Statement Regarding Non-IFRS

measuresInnergex reports its financial results in

accordance with International Financial Reporting Standards

(“IFRS”). This press release contains references to certain

financial measures which do not have a standardized meaning under

IFRS and are not likely to be comparable to similarly designated

measures reported by other issuers. Innergex believes that these

indicators are important, as they provide management and the reader

with additional information about the Corporation's production and

cash generation capabilities, its ability to sustain current

dividends and dividend increases and its ability to fund its

growth. These indicators also facilitate the comparison of results

over different periods. Adjusted EBITDA, Adjusted EBITDA

Proportionate and Free Cash Flow per Share are not measures

recognized by IFRS and have no standardized meaning prescribed by

IFRS. Please refer to the "Non-IFRS Measures" section of the

Management's Discussion and Analysis for the three- and nine-month

periods ended September 30, 2021 which is available on

www.innergex.com and have been filed with SEDAR at

www.sedar.com.

In this press release, references to “Free Cash

Flow” are to cash flows from operating activities before changes in

non-cash operating working capital items, less maintenance capital

expenditures net of proceeds from disposals, scheduled debt

principal payments, the portion of Free Cash Flow attributed to

non-controlling interests, and preferred share dividends declared,

plus or minus other elements that are not representative of the

Corporation's long-term cash-generating capacity, such as gains and

losses on the Phoebe basis hedge due to their limited occurrence

over the next 12 months, realized gains and losses on contingent

considerations related to past business acquisitions, transaction

costs related to realized acquisitions, realized losses or gains on

derivative financial instruments used to hedge the interest rate on

project-level debt or the exchange rate on equipment purchases.

References to Free Cash Flow per Share is obtained by dividing the

Free Cash Flow by the weighted average number of common shares. The

determination of the accretion to Free Cash Flow per Share in the

first twelve months following the closing is based on the financial

synergies to be unlocked by the expected refinancing of the Chilean

debt portfolio.

Additional information about Innergex, the

Forward-Looking Information contained in this press release and the

non-IFRS measures used in this press release are available in its

audited consolidated financial statements for the fiscal year ended

December 31, 2020 and related Management’s Discussion and Analysis,

its unaudited condensed interim consolidated financial statements

for the three- and nine-month periods ended September 30, 2021 and

related Management’s Discussion and Analysis and its Annual

Information Form for the fiscal year ended December 31, 2020 at

www.innergex.com and on Innergex’s SEDAR profile at

www.sedar.com.

External DataThis press release

includes political engagement, external data and other statistical

information that we have obtained from political sources,

independent industry publications and other independent sources.

Some data is also based on management’s good faith estimates. Such

publications and reports generally state that the information

contained therein has been obtained from sources believed to be

reliable. Although management of Innergex believes these

publications and reports to be reliable, we have not independently

verified any of the data or other statistical information contained

therein, nor have we ascertained the underlying economic or other

assumptions relied upon by these sources. Innergex does not provide

any representation or assurance as to the accuracy or completeness

of the information or data, or appropriateness of the information

or data for any particular analytical purpose and, accordingly,

disclaims any liability in relation to such information and data.

We have no intention and undertake no obligation to update or

revise any information or data, whether as a result of new

information, future events or otherwise.

CurrencyIn this press release,

unless otherwise specified or the context requires otherwise, all

dollar amounts are expressed in Canadian dollars.

For information

Jean-François Neault

Chief

Financial Officer

450 928-2550, ext. 1207

investorrelations@innergex.com

www.innergex.com

Karine VachonSenior Director – Communications450

928-2550, ext. 1222kvachon@innergex.com

1 Free Cash Flow per Share is a non-IFRS ratio. See “Cautionary

Statement Regarding Non-IFRS Measures”.2 Based on CAD / USD rate of

1.27.3 Free Cash Flow per Share is a non-IFRS ratio. See

“Cautionary Statement Regarding Non-IFRS Measures”.4 Adjusted

EBITDA and Adjusted EBITDA Proportionate are non-IFRS measures and

Free Cash Flow per Share is a non-IFRS ratio. See “Cautionary

Statement Regarding Non-IFRS Measures”.

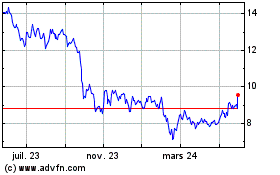

Innergex Renewable Energy (TSX:INE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

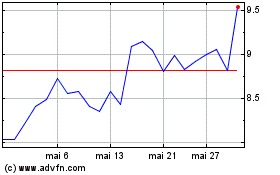

Innergex Renewable Energy (TSX:INE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025