Sulliden Mining Capital Inc. (TSX: SMC)

(“

Sulliden” or the “

Company”) is

pleased to announce it has entered into a share purchase and

subscription agreement dated July 9, 2023, pursuant to which the

Company has agreed to purchase and subscribe for up to 70% of the

total issued and authorised ordinary par value shares of a Namibian

private company (“

Privco”), subject to the terms

and conditions set out in the agreement (the

“

Transaction”).

Privco holds, either directly or through option

agreements, 14 exclusive prospecting licenses representing 307,778

hectares of exploration licenses, including the Khorixas Gold

Project, the Omatjete Gold and Lithium Project, and the Outjo Gold

Project (collectively, the “Damara Project”). The

Damara Project is anticipated to provide Sulliden access to three

distinct project areas that are highly prolific for gold and

lithium deposits within Namibia.

Khorixas Gold The

168,759-hectare Khorixas Gold Project is located approximately 350

km northeast of Walvis Bay within the Northern Zone of the Damara

Orogenic Belt, a geological setting that hosts orogenic gold

deposits such as QKR’s Navachab deposit, B2Gold’s Otjikoto deposit

(see B2Gold’s website at

https://www.b2gold.com/projects/producing/otjikoto/#updates), and

Osino’s Twin Hill gold discovery (3.1 Moz – see Osino’s website at

https://osinoresources.com/projects/twin-hills-discovery/).

The vendor has identified three exploration

targets within the Khorixas Gold Project.

The Belmont target covers an area of 12

kilometres by 6 kilometres and is covered by 1 to 5-metre thick

calcrete and scree cover. Gold mineralisation appears to be

associated with sulphide-rich quartz veins in stacked shears

associated with silicification and ankerite alteration. Previous

exploration activities by the vendor included the collection of

several visible gold samples that returned significant gold assays

with the highest rock chip sample assaying 49.9 g/t of gold,

as well as several areas with anomalous gold-in-soil samples, and a

small maiden exploratory percussion drilling campaign to depths as

deep as 50 m from surface. The reader is cautioned that the Company

and the Qualified Person have not validated the analytical or assay

results reported by the vendor, nor have they been able to confirm

and validate any quality control/quality assurance procedures or

processes used by the vendor when it reported its results from the

Belmont target.

The vendor’s K17 target is characterized by

highly altered albitised zones following both bedding and regional

foliation along the southern nose of the Dagbreek syncline and

located on the western edge of an interpreted intrusive body.

Mineralisation is commonly associated with gold, copper, silver,

bismuth, molybdenum & uranium. The vendor has reported

collecting and assaying multiple anomalous polymetallic rock chip

samples ranging up to 21 g/t gold, 16.25% copper and 37.8 g/t

silver.

The vendor has collected multiple high anomalous

rock chip samples from their K15 target area, assaying up to 1.1

g/t gold. K15 mineralisation appears to be controlled by a

North-Northwest trending fault zone and is associated with

sulphide-rich quartz veins.

The reader is cautioned that the Company and the

Qualified Person have not validated the analytical or assay results

reported by the vendor, nor have they been able to confirm and

validate any quality control/quality assurance procedures or

processes used by the vendor when it reported its results from the

K17 and K15 target areas.

Omatjete Gold and LithiumThe

93,105-hectare Omatjete Gold/Lithium Project is located

approximately 80 km Southeast of the Khorixas Project and within

the Northern Central Zone of the Damara Orogenic Belt which

encapsulates the Uis Lithium/Tin/Tantalum belt. The North Central

Zone hosts a number of significant deposits such as WIA’s recently

discovered Kokoseb Gold deposit (1.3 Moz – see WIA Gold’s website

at https://wiagold.com.au/kokoseb-gold-project-namibia/), the Uis

Lithium/Tin/Tantalum mine (81Mt @ 0.73% Li2O – see Andrada Mining’s

website at https://andradamining.com/assets/uis/) and the recently

commissioned Xingfeng’s Lithium/Tin/Tantalum operation.

The Omatjete Gold/Lithium Project is transected

by two regional shear zones, one crossing the northern part of the

property and one crossing the southern part. Both shear zones are

known to host orogenic gold deposits. The northern shear zone hosts

the Kokoseb Deposit approximately 20 km west of the property,

whereas the southern shear zone hosts the Gross Okangjou Gold

Occurence and Epako Gold Prospect located 5 km and 30 km east of

the property, respectively.

The recently commissioned Xingfeng

Lithium/Tin/Tantalum Operation which mines lithium-cesium-tantalum

pegmatites is located immediately adjacent to the western property

boundary. The mine pegmatites have been traced along strike to the

east onto the Omatjete Property in preliminary prospecting and

mapping work by the vendor. However, the Omatjete property has not

seen any significant exploration for lithium in its history.

Outjo Gold ProjectThe

45,914-hectare Outjo Gold Project is located approximately 80 km

East of the Khorixas Project and on the same Northern Zone of the

Damara Orogenic Belt. Outjo comprises a greenfields project with no

historical work done on the Kuiseb formation. The geology of the

Outjo basin is consistent with other known basins that host major

gold deposits in Namibia.

The Transaction

As consideration for a 51% interest in the

Damara Project, Sulliden has agreed to pay to the vendor and fund

Privco up to the Namibian dollar equivalent of an aggregate of

US$2.86m, as follows:

(i) for a 25%

equity interest in Privco, Sulliden shall pay:

- US$60,000 to the vendor on closing;

and

- US$1.4m to Privco to fund

exploration costs over the 24-month period following closing,

provided that if the full amount is not paid to Privco during such

period the Company shall be required to relinquish its 25% interest

back to the vendor; and

(ii) for up

to an additional 26% equity interest in Privco (for a total of

51%), Sulliden shall pay US$1.4m to Privco to fund exploration

costs during the 12-month period ended 36 months after

closing.Under the agreement, Sulliden is further entitled to

increase its interest in Privco and the Damara Project by an

additional 19% (for a total of 70%), by paying the Namibian dollar

equivalent of US$4m to Privco to fund exploration costs during the

36-month period ended 72 months after closing.

To the extent that the amounts set out in items

(i) and (ii) above are not paid to Privco by Sulliden within the

periods specified in the agreement, Privco will only be obliged to

issue and allot to the Company so many of its shares as is

proportionate to the amounts actually paid.

The Transaction is an arm’s length transaction

for purposes of the policies of the Toronto Stock Exchange

(“TSX”) and remains subject to customary closing

conditions, including the transfer of certain exclusive prospecting

licences to Privco. No finder fees are payable in connection with,

and no change of control of Sulliden will result from, the

Transaction. The acquisition of the initial 25% equity interest in

Privco from the vendor is expected to close in late 2023.

Qualified Person

The scientific and technical information

contained herein has been reviewed and approved by Roger Lemaitre,

P. Eng., P.Geo., the Company’s Vice President (Uranium) a

non-independent “qualified person” as defined in National

Instrument 43-101 – Standards of Disclosure for Mineral

Projects.

About Sulliden Mining Capital

Inc.

Sulliden is a mining company focused on

acquiring and advancing brownfield, development-stage and early

production-stage mining projects in the Americas, Australia and

Africa.

Mr. Rennie Morkel, Chief Executive Officer of

Sulliden, commented, “We are delighted by this acquisition

announcement which reinforces our continued commitment to investing

in strategic metals, and which also brings about what we anticipate

will be a great future opportunity in Namibia. Closing this

transaction will further increase our portfolio to add gold and

lithium metals in a stable and well governed region, consolidating

Sulliden’s ability to leverage expected profitable projects

depending on market trends. Together with our other international

projects, the lithium component of the transaction will cement our

position in the supply of future global energy transition metal

demands. I wish to thank all of my colleagues at Sulliden and the

Privco leadership who have been working tirelessly to get this

exciting Namibian transaction agreement executed".

Sulliden Mining Capital Inc.On behalf of the

Board“Rennie Morkel”Chief Executive Officer

For more information:info@sulliden.com

Cautionary statements

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, the proposed transaction to acquire up to a 70% equity

interest in Privco, including the conditions to closing and the

timing to complete the Transaction, and the Company’s plans for and

expectations of the Damara Project. Forward-looking information is

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of the Company to be materially different from

those expressed or implied by such forward-looking information,

including receipt of necessary approvals, risks inherent in the

mining industry and the other risks described in the public

disclosure of the Company which is available under the profile of

the Company on SEDAR at www.sedar.com. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

THE TSX HAS NOT REVIEWED AND DOES NOT

ACCEPT RESPONSIBILITY FOR THE ACCURACY OF THIS NEWS

RELEASE.

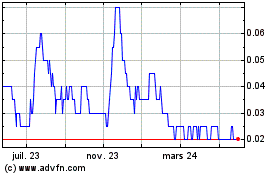

Sulliden Mining Capital (TSX:SMC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

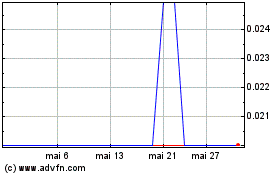

Sulliden Mining Capital (TSX:SMC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025