Athabasca Minerals Inc. (the "Corporation" or "Athabasca") (TSX VENTURE:ABM) is

pleased to announce the filing of its Q3 financial results for the three months

ended August 31, 2013. Athabasca reports the following highlights from Q3 2013:

-- Aggregate management fees earned in the amount of $3,620,506 compared

with $3,582,344 during Q3 2012;

-- Earnings per share of $0.038 compared to $0.074 per share in Q3 2012;

-- Net aggregate sales from corporate-owned operations in the amount of

$1,954,643 compared with $Nil during Q3 2012;

-- Significant enhancement of de-watering program with related improvement

in aggregate extraction at Kearl aggregate operation;

-- Total aggregate tonnes sold exceeds comparative quarter for first time

during fiscal 2013;

-- Continued progress with the silica sand Firebag Project;

-- Appointments subsequent to Q3 2013:

-- Ms. Pamela Strand, P.Geol., M.Sc. to the role of Vice President,

Business Development and Communications;

-- Mr. Craig Styles, B. Comm. as advisor to management; and

-- Changes to the Corporations' Board of Directors.

During Q3 the Corporation earned net income of $1,059,462 compared to $2,044,148

in the comparative period. Q3 2013 YTD net income, adjusted for non-cash items,

was $4,273,890 compared to $4,412,129 in the comparative period, a decrease of

3.1%. Non-cash items primarily included depreciation, amortization, share-based

compensation and loss on land use agreement.

During fiscal Q3 and Q3 YTD, Susan Lake sales have been strong with over 6.7

million tonnes sold over nine months. While fiscal Q3 YTD tonnage sales are

10.2% less than in the comparable period they are above Q3 2011 YTD sales by

40.1%. Contractor activity within the Susan Lake pit is currently at a high

level in advance of the winter season, with strong aggregate demand expected to

continue in Q4.

While maintaining management activities at the Susan Lake aggregate operation,

the Corporation continued its transition to supplying sand and gravel from

corporate-owned aggregate operations. Two important and positive developments

have recently occurred at the Kearl pit that are expected to contribute to

future improved productivity and reduced costs of production. Firstly, the

Corporation has implemented an improved dewatering method, which has

substantially increased operating access for aggregate extraction. Secondly, the

Corporation is currently mining at a depth in the pit where a significantly

richer proportion of gravel to sand ratio is being extracted. Previously, a

higher sand content with typically less product value was encountered nearer to

surface. As a combined result, increased extraction and processing of higher

value aggregate is now being realized. Over 63% of the approximate total 248,000

tonnes of aggregate processed at the Kearl pit during Q3 occurred during the

month of August alone.

The Corporation has maintained this improved efficiency in its aggregate

extraction and processing since August and is expected to continue throughout

fiscal 2013. Unusually heavy rainfall during much of the first two months of Q3

2013, hampered aggregate extraction at the Kearl pit and required the

Corporation to focus largely on dewatering activities. During this time, as a

result the Corporation was temporarily unable to fulfill all demand for

processed gravel.

At our other corporate-owned pits, operations at Logan and House River are

expected to resume at such time that winter roads can be accessed and product is

deliverable.

As is evidenced by the significant increase in the amount of inventory of the

Corporation as at August 31, 2013 of $ 5,642,328, Athabasca has successfully

processed a variety of high quality aggregates that have been stockpiled in

strategic locations. These are now available to service oil sand operations and

infrastructure demands. With Athabasca's current and increasing stockpile supply

coupled with recent improvements in production efficiency, the Corporation is

focused on greater marketing of its products and its services within its market

area. The Corporation's inventory arose through a combination of factors

throughout the course of the year. Firstly, Logan pit aggregate had been

processed for a contract that was only partially fulfilled before spring breakup

with the remaining portion of the contract to be delivered once hauling

conditions permit. Secondly, the Corporation has stockpiled a significant

quantity of processed sand at Kearl as a direct result of the geological

formation in the upper levels of the Kearl pit. The market continues to demand

sand from Kearl as it comprised 38% of YTD tonnage sales at Kearl.

At our corporate-owned silica sand Firebag Project, approval in principle from

the government for the 80 acre Surface Material Lease application is anticipated

this calendar year. The Corporation has engaged consultants to assist with the

reclamation strategy for the Firebag project which is one of the regulatory

requirements to obtain approval.

Q3 (Three months ended August 31, 2013 and August 31, 2012)

----------------------------------------------------------------------------

Q3 August 31, 2013 Q3 August 31, 2012

----------------------------------------------------------------------------

Aggregate management fees $3,620,506 $3,582,344

----------------------------------------------------------------------------

Net aggregate sales $1,954,643 $-

----------------------------------------------------------------------------

Total revenue $5,575,149 $3,582,344

----------------------------------------------------------------------------

Total aggregate tonnes sold 3,333,079 tonnes 3,315,751 tonnes

----------------------------------------------------------------------------

Net income from aggregate

operations $1,023,558 $1,454,248

----------------------------------------------------------------------------

Net income (including lodging land

use agreement) $1,059,462 $2,044,148

----------------------------------------------------------------------------

Basic income per common share $0.038 $0.074

----------------------------------------------------------------------------

Q3 YTD (Nine months ended August 31, 2013 and August 31, 2012)

----------------------------------------------------------------------------

Q3 YTD August 31, 2013 Q3 YTD August 31, 2012

----------------------------------------------------------------------------

Aggregate management fees $7,536,545 $8,370,631

----------------------------------------------------------------------------

Net aggregate sales $11,000,678 $2,050,815

----------------------------------------------------------------------------

Total revenue $18,537,223 $10,421,446

----------------------------------------------------------------------------

Total aggregate tonnes sold 7,207,081 tonnes 7,812,633 tonnes

----------------------------------------------------------------------------

Net income from aggregate

operations $1,765,433 $2,959,908

----------------------------------------------------------------------------

Net income (including

lodging land use agreement) $1,532,325 $3,549,808

----------------------------------------------------------------------------

Basic income per common

share $0.054 $0.130

----------------------------------------------------------------------------

Appointment to Management

Athabasca continues to grow and expand our business and as a result we are

pleased to announce the appointment of Ms. Pamela Strand, P. Geo to the role of

Vice President, Business Development and Communications effective October 25,

2013. Ms. Strand is a Professional Geologist and holds a Master of Science in

Economic Geology. With over 25 years' experience in the exploration and mining

industry, Ms. Strand has been involved in several corporate transactions. Since

1997 Ms. Strand has held the position of President with different public mineral

exploration companies, and has served as past President of the NWT & Nunavut

Chamber of Mines and was past director on the Alberta Chamber of Resources. Ms.

Strand was recently profiled as a Deloitte Woman of Influence in 2011 and was a

nominee for the Ernst & Young Entrepreneur of the Year in 2010, as well as

receiving recognition for her organization's environmental and community work.

Ms. Strand will assist with all geological aspects of Athabasca's projects,

specifically with the advancement of exploration projects such as the silica

sand Firebag Project and Richardson granite and dolomite projects. In addition

to increasing communications with Athabasca's stakeholders in Northeast Alberta,

as well as with the Alberta government, Ms. Strand will assist in the evaluation

and execution of various opportunities such as marketing of aggregates and

strategic initiatives.

Changes in Board of Directors

Athabasca announces the retirement of Mr. Wylie Hamilton and Mr. Ted Rousseau

from the Board effective November 30, 2013. Messrs. Rousseau and Hamilton have

served as valued members of the Board since the Corporation's inception.

President Dom Kriangkum states, "We are grateful to both Ted and Wylie for their

contributions to the Corporation. Their efforts have been instrumental in

growing Athabasca to its current stage. Both the Corporation and I wish both Ted

and Wylie well in their respective future endeavors."

In conjunction Athabasca is pleased to announce the appointment of Mr. Edward

Bereznicki, MBA, P.Eng. to the Board of Directors effective November 30, 2013.

Mr. Bereznicki has over 24 years of capital markets and industry experience,

both domestically and internationally. Mr. Bereznicki has served as Vice

President, Partner and Managing Director with a number of Canadian-based

investment banking firms where he focussed on the energy industry, and was most

recently Executive Vice President and Chief Financial Officer of Lone Pine

Resources Inc. Mr. Bereznicki has a diverse background with proven management

and advisory experience in the energy and financial sectors. Mr. Bereznicki's

broad energy industry background includes mid-stream operations, large scale

project development, marketing and risk management, and exploration and

production. Mr. Bereznicki holds an MBA from the Ivey School of Business, and a

Civil Engineering degree from the University of Alberta. He is a Professional

Engineer and a member of the Association of Professional Engineers, Geologists

and Geophysicists of Alberta.

Douglas Stuve, Chairman of the Corporation states, "We are delighted with the

addition of Ed to our Board and welcome the vast experience in management and in

the capital markets he brings to the Corporation."

Mr. Bereznicki's and Ms. Strand's appointments are subject to TSX Venture

Exchange approval.

Appointment of Advisor to Management

Athabasca is pleased to announce the appointment of Mr. Craig Styles, B. Comm.

as an advisor to management. Mr. Styles is the current Vice President of Real

Estate for The Brick. With a strong background in designing and executing real

estate development and investment in Northern Alberta, Mr. Styles possesses

well-honed leadership abilities, developed during his 31 years' experience with

The Brick. As well, Mr. Styles was former director of Junior Achievement and has

served on the capital board for the Stars Ambulance Vision Critical Campaign.

The complete financial statements for Athabasca for the three months ended

August 31, 2013 and Management's Discussion & Analysis including the

Corporation's Outlook for the same period are available for viewing on the

Corporation's website at www.athabascaminerals.com

(http://www.athabascaminerals.com) and on SEDAR at www.sedar.com

(http://www.sedar.com).

About Athabasca Minerals

Athabasca Minerals Inc. is a resource company involved in the management,

exploration and development of aggregate projects. These activities include

contracts work, aggregate pit management, new aggregate development and

acquisitions of sand and gravel operations. The Corporation also has industrial

mineral land holdings in the vicinity of Fort McMurray and Peace River, Alberta

for the purpose of locating and developing sources of industrial minerals and

aggregates essential to high growth economic development.

Neither the TSX Venture nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture) accepts responsibility for the

adequacy or accuracy of this release.

This news release contains forward-looking statements that involve risks and

uncertainties. Forward-looking statements or information are based on current

expectations, estimates and projections that involve a number of risks and

uncertainties which could cause actual results to differ materially from those

anticipated by the Corporation. The forward-looking statements or information

contained in this news release are made as of the date hereof and the

Corporation does not undertake any obligation to update publicly or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

The securities of Athabasca have not been, nor will be, registered under the

United States Securities Act of 1933, as amended, and may not be offered or sold

within the United States or to, or for the account or benefit of, U.S. persons

absent U.S. registration or an applicable exemption from U.S. registration

requirements. This release does not constitute an offer for sale of securities

in the United States.

FOR FURTHER INFORMATION PLEASE CONTACT:

Boardmarker Group

Dean Stuart

403-517-2270

dean@boardmarker.net

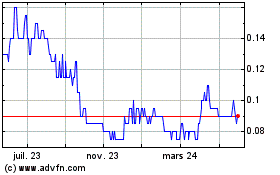

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

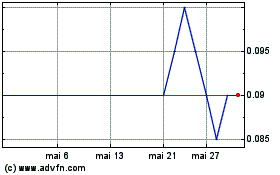

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025