0001441082false--06-30FY2023100000000.00178000000.001262000046600002900000000.0014400492055199920144000000262000046600000028812503.750031662500309125013752500.0010.001P7Y7M6D000014410822022-07-012023-06-300001441082hlco:CommonStocksMemberus-gaap:SubsequentEventMember2023-07-012023-07-050001441082us-gaap:SubsequentEventMember2023-07-012023-07-070001441082us-gaap:SubsequentEventMember2023-08-012023-08-240001441082us-gaap:SubsequentEventMember2023-07-012023-07-060001441082hlco:DRFAltheaMember2023-06-012023-06-300001441082hlco:DRFAltheaMember2023-06-300001441082us-gaap:SubsequentEventMember2023-07-070001441082hlco:CommonStocksMemberus-gaap:SubsequentEventMember2023-07-050001441082us-gaap:SubsequentEventMemberhlco:LitigationMember2023-07-012023-07-250001441082us-gaap:SubsequentEventMemberhlco:SuperfoodsIncMember2023-08-300001441082hlco:VestedAwardMember2023-06-300001441082hlco:UponAchievingFirstTargetMemberus-gaap:RestrictedStockMember2023-06-300001441082hlco:UponAchievingFirstTargetMemberus-gaap:RestrictedStockMember2022-07-012023-06-300001441082hlco:CertaionEmployeesMember2023-06-300001441082hlco:VestedAwardMember2022-07-012023-06-300001441082hlco:VestedAwardMember2021-07-012022-06-300001441082hlco:CertaionEmployeesMember2022-07-012023-06-300001441082hlco:ThreeMonthsAnniversaryMember2022-07-012023-06-300001441082hlco:FourThreeMonthsAnniversaryMember2022-07-012023-06-300001441082hlco:SecondThreeMonthsAnniversaryMember2022-07-012023-06-300001441082hlco:FirstThreeMonthsAnniversaryMember2022-07-012023-06-300001441082us-gaap:RestrictedStockMember2022-07-012023-06-3000014410822022-01-012022-01-100001441082hlco:StockOptionElevenMember2023-06-300001441082hlco:StockOptionNineMember2023-06-300001441082hlco:StockOptionTenMember2023-06-300001441082hlco:StockAwardSevenMember2023-06-300001441082hlco:StockAwardSixMember2023-06-300001441082hlco:StockAwardEightMember2023-06-300001441082hlco:StockAwardFiveMember2023-06-300001441082hlco:StockAwardFourMember2023-06-300001441082hlco:StockAwardThreeMember2023-06-300001441082hlco:StockAwardTwoMember2023-06-300001441082hlco:StockAwardTwelveMember2023-06-300001441082hlco:StockAwardElevenMember2023-06-300001441082hlco:StockAwardTenMember2023-06-300001441082hlco:StockAwardNineMember2023-06-300001441082hlco:StockAwardOneMember2023-06-300001441082hlco:StockOptionSevenMember2022-07-012023-06-300001441082hlco:StockOptionElevenMember2022-07-012023-06-300001441082hlco:StockOptionNineMember2022-07-012023-06-300001441082hlco:StockOptionEightMember2022-07-012023-06-300001441082hlco:StockOptionTenMember2022-07-012023-06-300001441082hlco:StockOptionSixMember2022-07-012023-06-300001441082hlco:StockOptionFiveMember2022-07-012023-06-300001441082hlco:StockOptionFourMember2022-07-012023-06-300001441082hlco:StockOptionThreeMember2022-07-012023-06-300001441082hlco:StockOptionTwoMember2022-07-012023-06-300001441082hlco:StockOptionOneMember2022-07-012023-06-300001441082hlco:StockAwardEightMember2022-07-012023-06-300001441082hlco:StockAwardSevenMember2022-07-012023-06-300001441082hlco:StockAwardSixMember2022-07-012023-06-300001441082hlco:StockAwardFiveMember2022-07-012023-06-300001441082hlco:StockAwardFourMember2022-07-012023-06-300001441082hlco:StockAwardThreeMember2022-07-012023-06-300001441082hlco:StockAwardTwoMember2022-07-012023-06-300001441082hlco:StockAwardTwelveMember2022-07-012023-06-300001441082hlco:StockAwardElevenMember2022-07-012023-06-300001441082hlco:StockAwardTenMember2022-07-012023-06-300001441082hlco:StockAwardNineMember2022-07-012023-06-300001441082hlco:StockAwardOneMember2022-07-012023-06-300001441082hlco:StockOptionAggregateMember2023-06-300001441082hlco:StockOptionEightMember2023-06-300001441082hlco:StockOptionSevenMember2023-06-300001441082hlco:StockOptionSixMember2023-06-300001441082hlco:StockOptionFiveMember2023-06-300001441082hlco:StockOptionFourMember2023-06-300001441082hlco:StockOptionThreeMember2023-06-300001441082hlco:StockOptionTwoMember2023-06-300001441082hlco:StockOptionOneMember2023-06-300001441082hlco:DrLindaFriedlandMember2023-02-012023-02-140001441082hlco:PeterKashMember2023-02-012023-02-140001441082hlco:DeepakChopraLLCMember2021-12-280001441082hlco:DeepakChopraLLCMember2021-12-012021-12-280001441082hlco:MintPerformanceMarketingMember2023-03-230001441082hlco:LeeForesterMember2022-07-012023-06-300001441082hlco:RayRosHoldingLLCMember2022-07-012023-06-300001441082hlco:DeepakChopraLLCMember2022-07-012023-06-300001441082hlco:LeeForesterMember2022-08-272022-09-010001441082hlco:MintPerformanceMarketingMember2022-03-012022-03-230001441082hlco:KETConsultingLLCMemberhlco:EquityIncentivePlanMember2022-07-012023-06-300001441082hlco:RayRosHoldingLLCMember2022-08-012022-08-030001441082hlco:LeeForesterMember2022-09-010001441082hlco:RayRosHoldingLLCMember2022-08-010001441082hlco:KETConsultingLLCMember2022-01-010001441082hlco:WarrantstopurchaseCommonStockOneMember2023-06-300001441082hlco:WarrantstopurchaseCommonStockMember2022-08-040001441082hlco:WarrantstopurchaseCommonStockOneMember2022-09-022022-09-090001441082hlco:WarrantstopurchaseCommonStockMember2022-08-022022-08-040001441082hlco:WarrantstopurchaseCommonStockOneMember2022-11-012022-11-100001441082hlco:WarrantstopurchaseCommonStockOneMember2022-07-012023-06-300001441082hlco:WarrantstopurchaseCommonStockOneMember2022-11-100001441082hlco:WarrantstopurchaseCommonStockOneMember2022-09-090001441082hlco:WarrantstopurchaseCommonStockMember2022-06-300001441082hlco:WarrantstopurchaseCommonStockMember2023-06-300001441082hlco:WarrantstopurchaseCommonStockMember2022-07-012023-06-300001441082hlco:WarrantsMember2022-06-300001441082hlco:WarrantsMember2023-06-300001441082hlco:WarrantsMember2022-07-012023-06-300001441082hlco:InvestorsMember2022-07-012023-06-300001441082hlco:InvestorsMember2023-06-300001441082hlco:SeedPreferredStock1Member2021-07-012022-06-300001441082hlco:SeedPreferredStock1Member2023-06-300001441082hlco:SeedPreferredStockTwoSubscriberMember2022-06-300001441082hlco:SeedPreferredStockTwoSubscriberMember2022-07-012023-06-300001441082hlco:SeedPreferredStock1Member2022-07-012023-06-300001441082hlco:SeedPreferredStock1Member2022-06-300001441082hlco:FinancialIndustryRegulatoryAuthorityMember2021-04-2900014410822022-07-080001441082hlco:FinancialIndustryRegulatoryAuthorityMember2021-10-070001441082hlco:MaturityOneMemberhlco:NOEOMember2023-06-300001441082hlco:WAOWAdvisoryGroupGmbhMember2022-07-012023-06-300001441082hlco:WAOWAdvisoryGroupGmbhMember2021-07-012022-06-300001441082hlco:WAOWAdvisoryGroupGmbhMember2022-05-012022-05-220001441082hlco:WAOWAdvisoryGroupGmbhMember2023-06-300001441082hlco:NOEOGmbHMemberhlco:AnabelOlemannDirectorMember2022-03-012022-03-100001441082hlco:NOEOGmbHMemberhlco:AnabelOlemannDirectorMember2023-06-300001441082hlco:KayKoplovitzChairpersonoftheBoardMember2022-07-012023-06-300001441082hlco:MichaelKuechAndKristelDeGrootMember2022-10-012022-10-140001441082hlco:StevenBartlettDirectorMember2022-01-012022-01-100001441082hlco:JustinFigginsCFOMember2022-07-012023-06-300001441082hlco:StevenBartlettDirectorMember2022-07-012023-06-300001441082srt:MaximumMember2022-08-0400014410822022-10-012022-10-2700014410822022-08-0400014410822022-08-022022-08-0400014410822023-03-0300014410822022-10-130001441082hlco:DigitalMember2022-07-012023-06-300001441082hlco:RetreatLicensingMember2022-07-012023-06-300001441082hlco:WholesaleMember2022-07-012023-06-300001441082hlco:AmazonMember2022-07-012023-06-300001441082hlco:DirectToConsumerMember2022-07-012023-06-300001441082hlco:UsMember2022-07-012023-06-300001441082hlco:EuropesMember2022-07-012023-06-300001441082us-gaap:FurnitureAndFixturesMember2022-06-300001441082us-gaap:FurnitureAndFixturesMember2023-06-300001441082us-gaap:ComputerEquipmentMember2022-06-300001441082us-gaap:ComputerEquipmentMember2023-06-300001441082hlco:SuperIncMember2022-07-012023-06-300001441082hlco:SuperIncMember2022-09-022022-09-090001441082hlco:ChopraGlobalLLCMember2023-03-310001441082hlco:ChopraGlobalLLCMember2022-07-012023-06-300001441082hlco:NOEOGmbHMemberhlco:AnabelOlemannDirectorMember2022-03-100001441082hlco:NOEOGmbHMember2022-03-100001441082hlco:YourSuperIncMember2021-07-012022-06-300001441082hlco:YourSuperIncMember2022-07-012023-06-300001441082hlco:YourSuperIncMember2022-09-300001441082hlco:YourSuperIncMember2023-03-310001441082hlco:PeriodAverageEuroMember2021-07-012022-06-300001441082hlco:PeriodAverageEuroMember2022-07-012023-06-300001441082hlco:PeriodEndEuroMember2021-07-012022-06-300001441082hlco:PeriodEndEuroMember2022-07-012023-06-300001441082us-gaap:LeaseholdImprovementsMember2022-07-012023-06-300001441082srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-07-012023-06-300001441082srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2022-07-012023-06-300001441082srt:MaximumMemberus-gaap:ComputerEquipmentMember2022-07-012023-06-300001441082srt:MinimumMemberus-gaap:ComputerEquipmentMember2022-07-012023-06-300001441082hlco:ChopraHLCOMember2022-07-012023-06-300001441082hlco:ChopraHLCOMember2023-03-012023-03-030001441082hlco:ChopraHLCOMember2023-03-030001441082hlco:LoanPurchaseAndSaleAgreementMemberhlco:CircleUpCreditAdvisorsLLCMember2022-07-012023-06-300001441082hlco:LoanPurchaseAndSaleAgreementMemberhlco:CircleUpCreditAdvisorsLLCMember2022-09-090001441082hlco:LoanPurchaseAndSaleAgreementMemberhlco:CircleUpCreditAdvisorsLLCMember2022-09-022022-09-090001441082us-gaap:RetainedEarningsMember2023-06-300001441082us-gaap:ComprehensiveIncomeMember2023-06-300001441082hlco:DeferredCompensationMember2023-06-300001441082us-gaap:AdditionalPaidInCapitalMember2023-06-300001441082us-gaap:CommonStockMember2023-06-300001441082hlco:SeedPreferredStockMember2023-06-300001441082us-gaap:RetainedEarningsMember2022-07-012023-06-300001441082us-gaap:ComprehensiveIncomeMember2022-07-012023-06-300001441082hlco:DeferredCompensationMember2022-07-012023-06-300001441082us-gaap:AdditionalPaidInCapitalMember2022-07-012023-06-300001441082us-gaap:CommonStockMember2022-07-012023-06-300001441082hlco:SeedPreferredStockMember2022-07-012023-06-300001441082us-gaap:RetainedEarningsMember2022-06-300001441082us-gaap:ComprehensiveIncomeMember2022-06-300001441082hlco:DeferredCompensationMember2022-06-300001441082us-gaap:AdditionalPaidInCapitalMember2022-06-300001441082us-gaap:CommonStockMember2022-06-300001441082hlco:SeedPreferredStockMember2022-06-300001441082us-gaap:RetainedEarningsMember2021-07-012022-06-300001441082us-gaap:ComprehensiveIncomeMember2021-07-012022-06-300001441082hlco:DeferredCompensationMember2021-07-012022-06-300001441082us-gaap:AdditionalPaidInCapitalMember2021-07-012022-06-300001441082us-gaap:CommonStockMember2021-07-012022-06-300001441082hlco:SeedPreferredStockMember2021-07-012022-06-3000014410822021-06-300001441082us-gaap:RetainedEarningsMember2021-06-300001441082us-gaap:ComprehensiveIncomeMember2021-06-300001441082hlco:DeferredCompensationMember2021-06-300001441082us-gaap:AdditionalPaidInCapitalMember2021-06-300001441082us-gaap:CommonStockMember2021-06-300001441082hlco:SeedPreferredStockMember2021-06-3000014410822021-07-012022-06-3000014410822022-06-3000014410822023-06-3000014410822023-10-1900014410822022-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2023

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from__________ to ____________

Commission file number 333-152805

THE HEALING COMPANY INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 26-2862618 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

135 W 50th Street, 2nd Floor, New York, New York | | 10020 |

(Address of principal executive offices) | | (Zip Code) |

(866) 241-0670

Registrant's telephone number

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

N/A | | N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Yes ☐ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter was $142,518,000.

As of October 19, 2023, the Issuer had 57,474,920 common shares issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains predictions, estimates and other forward-looking statements that relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our management's beliefs and assumptions only as of the date of this Annual Report. You should read this Report and the documents that we have filed as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect.

All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made, except as required by federal securities and any other applicable law.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

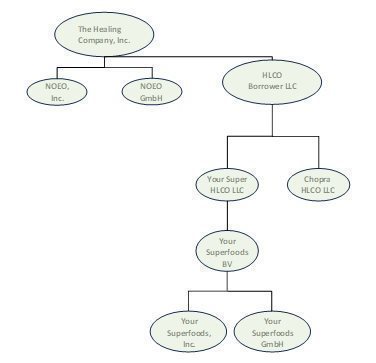

| · | the “Company,” “we,” “us,” and “our” refer to the combined business of The Healing Company Inc., a Nevada corporation, and its wholly owned subsidiaries, NOEO GmbH, NOEO, Inc., HLCO Borrower LLC, Your Super HLCO LLC, Chopra HLCO LLC and the Your Super HLCO LLC subsidiaries. |

| · | “Exchange Act” refers the Securities Exchange Act of 1934, as amended; |

| · | “NOEO” refers to NOEO GmbH, a German company; |

| · | “EUR” refer to the legal currency of the European Union; |

| · | “SEC” refers to the Securities and Exchange Commission; |

| · | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| · | “U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States. |

AVAILABLE INFORMATION

We file annual, quarterly and special reports and other information with the SEC. You can read these SEC filings and reports over the Internet at the SEC's website at www.sec.gov. We will provide a copy of our annual report to security holders, including audited financial statements, at no charge upon receipt of a written request to us at The Healing Company Inc., 135 W 50th Street, 2nd Floor, New York, New York 10020.

PART I

ITEM 1. BUSINESS

Overview

We are entrepreneurs, storytellers, operators, healers, humans—united by a common vision: Bring integrated healing to the world.

Our mission and vision is to bring integrative healing to the world.

We are an emerging health and wellness company that has identified the need for a change in healthcare, where conventional medicine and alternative healing can co-exist to provide a world of integrated healing.

Compelled by the global healthcare crisis and a deep belief in a different way—one which draws on conventional medicine and ancient wisdom, science and nature—we look to democratize access to integrated healing methods, while helping the world evolve how it thinks about health and healthcare.

Our Strategy

To achieve our objectives, we are building a community of integrated wellness focused, healing brands committed to a more sustainable, healthy and joyful world. We identify and acquire early stage, high potential brands within selected health and wellness categories, such as supplements and nutraceuticals, to help grow their healing practices and products.

Our Brands

Your Super

Your Super is a leading plant-based superfoods brand featuring organic, delicious, and functional superfood blends to help women eat more plants and thrive. Born out of a mission to improve people’s health through the power of super plants, Your Super manufactures and sells products that are nutritionally formulated with only five to six ingredients and nothing else added—no additives, fillers, gums, artificial sweeteners, or preservatives. Containing just the good stuff, every ingredient is certified organic, non-GMO certified, glyphosate-free, plant based, and gluten free. Your Super’s effective superfood blends are designed to unlock vibrant health—from glowing skin to mental focus.

Your Super, prior to its acquisition by us in 2022, had sold more than 5,000,000 products and served more than 1,000,000 customers across the United States and in Europe through retail and DTC (direct to consumer) channels such as Amazon. In 2021, Your Super ranked 25th on Inc. magazine’s fastest growing companies list and first in the food and beverage category.

Our Your Super brand is focused on two high-growth wellness sectors, superfoods and plant-based nutrition, representing more than $200 billion1 in of global market potential.

Your Super - Products

Our Your Super brand currently offers twelve superfood blends covering five different categories: Detox and Energize, Calm and Clarity, Digest and Reset, Radiance and Vitality, and Balance and Flow. Each blend is formulated specifically around a functional need. Each of our Your Super blends is categorized under one of the five categories as indicated in the chart below:

_________________

1Statista for superfoods market, Research and Markets for plant-based food market

Chopra

We purchased our Chopra line of products from Chopra Group, founded by the world-renowned pioneer integrative medicine, Dr. Deepak Chopra, MD. As the original integrative health experts Chopra blends modern well-being practices with Ayurveda - a centuries-old system of health and healing - to offer a whole-self approach. By focusing on physical, mental, and spiritual health, with our Chopra products we empower people to create self-care routines as unique as they are, unlocking their body’s natural healing abilities.

Chopra – Products

Our Chopra products and services listed below provide our customers the tools and confidence to help them take control of their health:

| · | Chopra Meditation and Wellbeing App: Developed by Dr. Deepak Chopra MD, the Chopra App puts personalized support in the hands of its users. This subscription-based app includes more than 500 streaming self-care practices, including the Chopra 21-Day Meditation Experiences, and more than 2000 hours of meditation and self-care practices across a range of topics such as better sleep, stress relief, improved health, increased focus and spiritual growth. The Chopra app has been downloaded more than 1,000,000 times and has a 4.9 star rating in the iOS app store. The Chopra App’s unique original content, recorded from Dr. Deepak Chopra and educators in the Ayurvedic, meditation and health space, also includes: |

| ○ | In-app dosha quiz that delivers a unique mind-body type report along with personalized ayurvedic practices to help keep users in balance |

| | |

| ○ | 5, 10, 20 & 30 minute sessions for beginner and experienced meditators |

| | |

| ○ | Daily and monthly releases of new programs and collections |

| | |

| ○ | Personalized tracking to help users build their practice |

| · | Editorial + Social: Our Chopra brand operates the chopra.com website where we offer thousands of resources, including articles written by Dr Chopra and other health and wellness experts on topics such as Ayurvedic medicine, meditation, and alternative health. |

| | |

| · | Chopra Consumer Products: In our Chopra consumer products line we are currently offering the following products: |

| ○ | Chopra Detox Kit: Our Chopra consumer products line was initially launched with the Chopra Renew and Restore Detox Kit - a 7-day program to completely detoxify the body bringing ancient Ayurvedic principles and modern science to bear. |

| | |

| ○ | Chopra Body Oils. Rooted in the Ayurvedic principles of self-care, the Chopra body oils combine essentials herbs that connect with a user’s individual dosha. |

In addition to our Chopra Detox Kit and Chopra body oils, we have a significant number of Chopra consumer products in development for launching later in 2023 and in early 2024. Many of these are being developed as part of our strategic partnership with Althea Life Sciences, the R&D division of the world’s largest Ayurvedic producer, Dabur.

| · | Chopra Wellness Experiences: Chopra licensed experiences are our Chopra health retreats that are offered through carefully selected partners including the CIVANA wellness resort in Carefree, Arizona and the Lake Nona Performance Club in Lake Nona, Florida that hosts our Chopra Mond-Body Zone and Spa. These multi-day wellness retreats are geared at fostering a life-changing, well-rounded approach to well-being and include meditation and yoga, educational sessions and workshops, multi-step detoxification processes including meal programs designed to promote detoxification, personalized massage therapy, ayurvedic spa treatments and access to other Chopra healing and health programs. |

Our Segments

We use the so called “management approach” to identify our reportable segments. The management approach designates the internal organization used by management for making operating decisions and assessing performance as the basis for identifying our reportable segments. Using this approach, we have determined that we currently do business in three operating segments:

| · | E-commerce sales of health and wellness products, |

| · | Sales of memberships to our wellness app, and |

| · | Support for our licensed wellness experiences. |

Our Corporate History and Structure

We were incorporated as Lake Forest Minerals Inc. in the State of Nevada on June 23, 2008. We were originally formed to engage in the acquisition, exploration and development of natural resource properties of merit; however; our former management was not successful in those endeavors and discontinued that business. With the acquisition of NOEO on March 10, 2022, and the onboarding of a new management team, we commenced operations in the health and wellness sector. We changed our name to The Healing Company Inc. in April 2021 and we changed our ticker symbol to “HLCO” on June 23, 2022.

Our Acquisition Credit Facility

To facilitate our acquisitions program, in August 2022, we entered into a credit agreement with certain lenders who agreed to extend a credit facility to us consisting of up to $150,000,000 (under certain circumstances) in aggregate principal amount of term loan commitments which we can use to acquire assets that meet certain criteria specified in the agreement. Individual term loans under this facility will be in a minimum principal amount of at least $400,000, bear an annual interest rate of the Secured Overnight Financing Rate (SOFR) plus 12% and will mature in 12 months or less. We have established a wholly owned subsidiary, HLCO Borrower LLC, which will be the “borrower” under this term loan facility. When we acquire a business whose acquisition is to be funded, in part, through this credit facility, the term loan is made to HLCO Borrower LLC which, in turn disburses the borrowed funds at our instruction and the acquired assets are held in, and operated through, a newly formed wholly owned subsidiary of HLCO Borrower LLC. The term loans will be secured by a first priority lien on the assets of HLCO Borrower LLC, including all of the assets of the operating subsidiaries owned by HLCO Borrower LLC and funded through the term loan facility.

Our Acquisitions under the Credit Facility

On October 14, 2022, we acquired all of the assets of Your Super, Inc., a super foods company founded by Michael Kuech and Kristel De Groot. Included in the Your Super, Inc. assets we acquired three Your Super operating subsidiaries - Your Superfoods B.V., Your Superfoods GmbH and Your Superfoods, Inc. The total consideration we paid for this acquisition consisted of (i) 3,200,000 shares of our restricted common stock valued at $2.50 per share for an aggregate value of $8 million and (ii) the forgiveness of $7,614,444.40 of outstanding debt of Your Super, Inc. owed to us. The outstanding debt was originally an obligation of Your Super, Inc. to a third-party lender. We acquired this loan obligation from the lender on September 9, 2022, for cash consideration of $2,000,000 and a seven-year warrant to purchase up to 1,500,000 shares of our common stock at an exercise price of $2.00 per share. In connection with our acquisition of the Your Super assets, we borrowed $3,000,000 under the term loan credit facility. Our Your Super business is now operated through Your Super HLCO, LLC, a Delaware limited liability company that we established to hold and operate the Your Super acquired assets. Your Super HLCO LLC is a wholly owned subsidiary of HLCO Borrower LLC and all of the Your Super HLCO assets are now pledged to the term loan lenders under the credit facility agreement.

On March 3, 2023, we acquired certain assets of Chopra Global, LLC, a health and wellness company founded by Dr. Deepak Chopra, MD. These assets were components of Chopra Global’s digital, licensing and consumer products divisions. The consideration paid and payable by us for the Chopra assets we purchased is an aggregate purchase price of up to $5,000,000 in cash plus newly issued shares of our restricted common stock. $1,000,000 of the cash portion of the purchase price was paid to Chopra Global on March 3, 2023, along with the issuance of 1,400,000 shares of our restricted common stock. A deferred cash payment of $2,500,000 was paid to Chopra Global during the three months ended March 31, 2023. Additionally, we may pay to Chopra Global up to three (3) earnout payments of $1,000,000 in value each, subject to and payable in accordance with earnout thresholds specified in the purchase agreement with Chopra Global. Each of these earnout payments will be comprised of 50% in cash and 50% in shares of our restricted common stock. These earnout payments will be earned (i) for the period starting March 1, 2023 and ending December 31, 2023 if net revenue generated by the Chopra business operated by us exceeds $5,900,000; (ii) for the calendar year ending December 31, 2024 if such net revenue for that year exceeds $11,000,000; and (iii) for the calendar year ending December 31, 2025 if such net revenue for that year exceeds $15,000,000. The earnout shares will be valued at the market price at the time of issuance based on the five-day volume weighted average price of our common stock prior to the last day of the applicable measurement year. If we are taken private or undergo a change of control (as defined in our agreement with Chopra Global), any subsequent earnout payment(s) will be paid 100% in cash. In connection with our acquisition of the Chopra Global assets, we borrowed $1,582,000 under the term loan credit facility. Our Chopra business is now operated through Chopra HLCO, LLC, a Delaware limited liability company that we established to hold and operate the Chopra acquired assets. Chopra HLCO LLC is a wholly owned subsidiary of HLCO Borrower LLC and all of the Chopra HLCO assets are now pledged to the term loan lenders under the credit facility agreement.

The following charts depict our organization structure.

NOEO

On March 10, 2022, we acquired NOEO GmbH (“NOEO”) from our director and co-founder, Anabel Oelmann, for cash consideration of EUR 25,000. Ms. Oelmann founded NOEO to manufacture and market direct to consumers in Europe NOEO branded adaptogen herbal supplements. We have determined not to pursue the NOEO line of business and we are winding down our NOEO operations.

For Further Information

For a more detailed discussion of our development during our fiscal year ended June 30, 2022, including relating to our NOEO business, we direct you to our annual report on Form 10-K for the fiscal year ended June 30, 2022, which we filed with the SEC on October 12, 2022, available at the following link:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001441082/000147793222007571/hlco_10k.htm

Our Industry

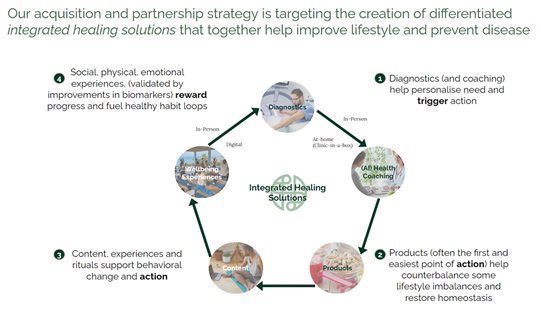

Our strategy, to first build a community of powerful healing brands, and second, connect them into a closed loop wellness system that prevents disease & unlocks thriving wellbeing, places us at the intersection of three vast & growing industries:

We’ve opted to place our primary focus initially on investments in the supplements & nutraceuticals market, which is characterized by high fragmentation and vague & changing regulation, but also strong unit economics and the opportunity to be the foundation of consumer habit building. The supplements & nutraceuticals industry is $165 billion globally, and projected to grow at a 9% CAGR through 2030.

Historically, the supplements & nutraceuticals market has been recession buoyant, with the industry growing 8% during the 2008-09 economic crisis, and recent study showing the last area consumers will cut spending is on health & wellness.

Each of the markets in which we operate are characterized by rapid technological changes, frequent new product introductions, fragmentation, extensive intellectual property disputes and litigation, price competition, aggressive marketing practices, evolving industry standards, and changing customer preferences. Accordingly, our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies operating in rapidly changing and competitive markets.

Equally, the lack of an established, leading player operating at the intersection of these sectors creates immense opportunity to foster consumer trust & credibility, benefit from shared resource & data, and the higher impact, stickier experience generated from an ecosystem model.

Supplements & Nutraceutical Industry

The supplements & nutraceutical industry focuses on nutritional supplements intended to improve longevity, sports fitness, and provide health benefits in addition to the basic nutritional value present in food. Most people are familiar with various supplement and nutraceutical products—and have likely used them—even if they are unfamiliar with the industry name. Supplements and nutraceuticals comprise such commonly used items as herbal products, specific diet products, vitamins, processed foods.

The Superfoods Market

The global superfoods market reached a value of $162.6 billion in 2022. As per the analysis by IMARC Group, the leading manufacturers in the superfoods market are focusing on product improvements to expand their product portfolio and increase their existing sales. They are consequently launching plant-based food variants to meet the nutritional requirements of the vegan population. Product manufacturers are also financing advertising campaigns, such as celebrity endorsements and social media campaigns. Moreover, cafes, restaurants, hotels, and quick-service restaurants (QSRs) are incorporating superfoods in their dishes to expand their consumer base. In addition, the advent of superfood powders that can be added to prepare smoothies, juices, and shakes is influencing the market positively. In addition, leading players are introducing ready-to-eat (RTE) superfood products on account of rapid urbanization, busy lifestyles, and expanding purchasing power of consumers. They are also extensively using superfoods in the production of dietary supplements, such as capsules and gummies, to meet the daily nutritional requirements of individuals. Looking forward, the market value is expected to reach $226.3 billion by 2028, growing at a CAGR of 5.5% during the forecast period (2023-2028).2

Our Manufacturing and Distribution

Manufacturing. We rely on contract manufacturers to manufacture our products. The contract manufacturers schedule and receive ingredient and packaging inventory according to parameters set in their contracts and forecasts we provide. Some ingredients and packaging are purchased by our contract manufacturers pursuant to framework contracts we have with the applicable suppliers. Our contract manufacturers are regularly audited by third parties and are required to follow rigorous food safety guidelines. We believe our contract manufacturers have capacity to meet our anticipated supply needs, although short-term high demand can cause disruptions. We monitor both near-term and long-term capacity as well as fulfillment rates and overall performance of our manufacturing partners and qualify alternate suppliers as needed. In general, we purchase finished products from our contract manufacturers, which includes all packaging and ingredients used, as well as an agreed-upon tolling charge for each item produced. These finished products are then shipped directly to our distribution centers or shipped directly from the contract manufacturer to the customer.

Sales and Marketing

We employ many different techniques and strategies within our marketing initiatives. These include direct-to-consumer outreach, use of influencers through social media, Facebook targeting, focused e-mail campaigns, and traditional media. Our marketing goal is always to increase visibility and relevance of our brands in the minds of our customers and potential customers. We hope to expand our programs to include experimental marketing techniques in the future.

With our Chopra and Your Super brands, we leverage a full-funnel, multi-channel strategy across owned, earned, and paid market resources, with a focus on strategies that fuel organic growth.

Your Super Marketing

Our Your Super owned channels include email, SMS, app, social (Instagram, TikTok, Facebook group, LinkedIn), blog, and our YourSuper.com website; our paid channels include Meta, Google, our Your Super store on Amazon, and influencers.

Our marketing messaging typically centers around need (functional and/or emotional) + benefit, though central to our strategy is continual creative + message testing.

An example of our full-funnel marketing approach for our Your Super clinically-proven hormonal health and PMS product, Moon Balance starts with paid creative advertising on various social media platforms, which attracts potential consumers to our YourSuper.com website landing page where we provide additional Moon Balance product information leading to a call-to-action product purchase option.

Chopra Marketing

Our Chopra product marketing typically leverages the very large “owned” audiences that Chopra has – a more that 4,000,000 emailable data base contact list, 20,000,000 social media followers on @chopra and @deepakchopra handles across Facebook, Instagram, Twitter, LinkedIn, Medium and other social medium channels as well as the 7,000,000 engaged unique visitors to chopra.com annually. Chopra.com and the Chopra blog command significant domain authority with more than 300,000 important health and wellbeing related keywords and topics. We believe that his natural organic SEO and social reach is equivalent to tens of millions of dollars of marketing spend for this standalone brand.

_________________

2IMARC Impactful Insights

Customers

Your Super – Customer Focus

Your Super has a focused customer target: health motivated, though not health expert, suburban middle to upper class mothers who shop for Your Super primarily for the health benefits she will experience from the products. The demographic is middle age, middle-class females that live in suburban or rural communities.

Chopra – Customer Focus

While the US and North America are the anchor markets for our Chopra brand, Chopra reaches far around the world including Europe, South America, Southern Africa, India and Australia.

The Chopra consumer is predominantly female and typically over the age of 40. The prime motivations for coming to Chopra are for seeking ways to manage stress and tension, emotional balance, general health and wellness and for deepening the experience with meditation and exploring further health and wellness related teachings. People often come to the Chopra brand after reading one of Deepak’s books or seeing his teachings on social media or elsewhere. We categorize three core psychographics:

| · | The Spiritualists: motivated by their interests in to tapping into something deeper; |

| · | The Improvers: driven by a sense to personally grow and become more effective; and |

| · | The Recoverers: having experienced some kind of trauma, seeking help recovering from that trauma. |

Together these three psychographics represent about 10% of the US population.

Seasonality

The market for our Your Super and Chopra products displays some underlying seasonality, with the first half of the calendar year, January through June, typically outpacing the second half of the calendar year, July through December, and the most notable peak and trough months being January and December, respectively. Accordingly, we architect both campaigns designed to ride market tailwinds, such as community live detoxes and new product releases around new year and spring/early summer market peaks, as well as campaigns designed to stem troughs (e.g. limited edition re-releases of popular products around holiday, promotions, and/or challenges through summer months).

Competition

We are not aware of any other public companies that are acquiring health and wellness brands and building a community of businesses in this space. At the brand level, we consider the following factors in analyzing our competition:

Your Super

Due to the fragmented nature of the supplements, nutraceuticals, and superfoods spaces, as well as the functional design of our products, each formulated to address a single health need, we believe that our Your Super brand faces a broad range of competitors from manufacturers and marketers of superfood, protein, and collagen powder based products - from large agri-industry public companies with almost unlimited resources, such as Archer-Daniels-Midland Company, to small private start-up companies just entering our markets.

Chopra

We breakdown the competition to our Chopra brand along functional lines relating to our individual Chopra product offerings as follows:

| · | Chopra App. There are numerous app offerings in the health, wellness and mindfulness categories offering a variety of yoga, meditation and relaxation exercises and techniques with practices relating to, for example, stress and anxiety reduction, insomnia and addiction recovery. Additionally, over the past five years a number of apps promoting an Ayurvedic lifestyle have entered the market with information, exercises, detox programs and diet regimes. |

| | |

| · | Chopra Signature Products. Currently, the health and wellness product market is highly fragmented and, for example, there are no significant Ayurvedic product competitors of scale in the West. However, our greatest competition comes from the fact that many brands and products in the health, wellness and nutrition space are starting to use more traditional Ayurvedic herbs such as aswhaganda, turmeric, boswella, brahmi and bitter melon in their formulations. In the beauty and cosmetics markets, a number of market participants are beginning to follow Ayurvedic principles and include Ayurvedic ingredients in their products. |

| | |

| · | Chopra Wellness Experiences. The market for health and wellness retreats and related workshop and class offerings is very fragmented with thousands of yoga studios and an increasing number of breathwork, meditation and Ayurvedic massage studios and workshop offerings throughout the United States. Additionally, integrative health and functional medicine practices and related programmatic offerings have begun to emerge as a growing phenomenon across the country. Some of these offerings are led by well-known and respected industry experts such as Tony Robbins, David Asprey and Mark Hyman. At this time, however, given the size and growth in these markets, no brand has yet to dominate the health and wellness space. |

Due to Chopra’s vast product and service lines, it faces a variety of different competitors. For its meditation app, Chopra’s largest competitors are Calm, Headspace, and Betterup, all apps that focus on promoting mental health through different provided services. All three companies are high profile and thus are large competitors to Chopra. For Chopra’s products, its largest competitors are Ritual and Goop. Both companies provide products that incorporate Ayurvedic herbs in their products that rival the products that Chopra produces. For Chopra’s blog, its largest competitors include well+good and mindbodygreen, both companies that blog about health.

Competitive Strengths

Our Overarching Strategic Advantage

In a highly competitive acquisitions market, we are building what we believe to be a focused and effective competitive advantage which makes us an attractive acquisition partner for smaller companies operating in the health and wellness space.

We are building a team bringing deep expertise in S-commerce (social media commerce), marketing, brand development, distribution, and international operations, with a track record of building & growing thriving consumer products companies, adding value in three key areas:

| · | Growth: Our in-house and partner experts in storytelling, growth and retention marketing, customer strategy, and conversion rate optimization will help catalyze efficient growth. Further we will help expand distribution through retail, internationally as well as through partnerships that we can uniquely bring to the table. |

| | |

| · | Resources: We provide the capital, technology stack, distribution network, and operational support that allows the acquired business team to focus on product development. |

| | |

| · | Community: For our acquisition partners, being part of a community of integrated healing brands creates synergies and unlocks scale benefits & learnings for all member brands. |

Based on management’s belief and experience in the industry, we believe that the following competitive strengths enable us to compete effectively.

Your Super

| · | Ingredients. Your Super produces and manufactures its products with only the best ingredients and nothing else. Each product contains only five to six superfoods with zero fillers, sweeteners, Stevia, artificial flavors, preservatives, or additives. This allows for one of the most vibrant, functional superfood powders on the market. Your Super sources its ingredients from all over the world to ensure that it obtains and utilizes the most nutrient dense, bio-available superfoods on the planet. The ingredients are harvested and naturally dried, which preserves maximum nutritional value and allows its consumers to access the power of nourishment from the depths of the Amazon to the highlands of China every day. |

| | |

| · | Established and trusted brands. Your Super is a well-established brand in the health and wellness industry. In particular, Your Super has been in the space for ten years and has over 30,000 5-star reviews on its products, with over one million customers. Additionally, its products are sold through online channels such as Amazon. Your Super’s customers are impassioned advocates and therefore its customer testimonials and reviews give it an advantage over competitors in storytelling in-market and driving potential customers from considerations to conversion. |

Your Super - Brand Differentiators

Our Your Super brand is characterized by two primary differentiators:

| 1) | Ingredients – We use the best ingredients, that is, the most vibrant, functional, superfood powders: |

| | o | are sourced from all over the world to ensure we get the most nutrient dense, bio-available superfoods on the planet; and |

| | | |

| | o | are harvested and naturally dried, preserving maximum nutritional value, allowing access to the power of nourishment from the depths of the Amazon to the highlands of China, every day. |

| · | Each of our products contains only 5 to 6 superfoods—zero fillers, sweeteners, Stevia, artificial flavors, preservatives, or additives. Just whole foods. |

We are committed to creating superfood mixes and plant protein powders without additives, fillers, sweeteners, or artificial ingredients to help our customers improve their health.

| 2) | Customer Testimonials – While there are many new market entrants, Your Super has a 10-year track record with more than 30,000 5-star reviews and a community of more than 1,000,000 customers who have used our products to unlock their most vibrant health & lives. Many of these customers are impassioned advocates, and our customer testimonials and reviews give us an advantage in telling a compelling story in-market, driving potential customers from consideration to conversion. |

We are committed to creating superfood mixes and plant protein powders without additives, fillers, sweeteners, or artificial ingredients to help you improve our customers’ health.

Chopra

| · | Unique Information and History. Chopra’s teachings combine over thirty years of Deepak’s wisdom and scientific research coupled with the 5,000-year-old healing system of Ayurveda designed to unlock your body’s natural healing abilities. Chopra is thus uniquely positioned to provide timeless and proven well-being solutions to health issues, better than other wellness companies can. |

| | |

| · | Education. Chopra is a pioneer of integrated health in the western hemisphere, therefore Chopra has become an expert at distilling information and teaching our community simple self-care tools to address the stressors of modern life. |

| | |

| · | Engaging through Journeys. Chopra has created guided journeys for spiritual and personal expansion and thus it has become its forte. By providing step by step guidance, Chopra teaches people how to build healthy habits for life, whatever stage the individual is in. Each habit is personalized to the individual’s “triggers”, therefore it will help unlock the “algorithm of life”. |

Chopra - Brand Differentiators

Our Chopra brand is characterized by the following key differentiators:

| · | Unique Wisdom & Lineage. Our Chopra teachings combine more than 30 years of Dr. Deepak Chopra’s wisdom and scientific research coupled with the 5,000 year-old healing system of Ayurveda designed to unlock one’s body’s natural healing abilities. Through this accumulated knowledge, wee are uniquely positioned to provide timeless and proven well-being solutions. |

| | |

| · | Anchored in Education. As pioneers of integrated health in the west, the Chopra brand offering has become expert at distilling information and teaching our community simple self-care tools to address the stressors of modern life. |

| | |

| · | Engaging through Journeys. Creating guided journeys for spiritual and personal expansion is the Chopra forte. By providing step by step guidance we teach people how to build healthy habits for life, whatever stage they’re in, personalized to their triggers to help unlock the “algorithm of life.” |

Growth Strategies

We will strive to grow our business by pursuing the following growth strategies:

| · | Acquisition of Additional Businesses. The health and wellness industry is highly fragmented with a large pool of companies representing significant opportunity for industry consolidation. We plan to continue our strategy of acquisition over the next 12 months. We expect to pay for any additional businesses that we might acquire through a combination of share capital and cash, some of which we expect to be provided through our credit facility in place for this purpose. We do not currently have sufficient capital internally to complete any additional acquisitions. We expect to raise capital for additional acquisitions primarily through debt financing and equity offerings by us. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. There is no guarantee that we will be able to acquire additional businesses under the terms outlined above or that we will be able to find additional acquisition candidates in our target health and wellness sector. |

Our overarching strategic objectives are:

| o | Initially target the acquisition of scientifically backed companies in the $165 billion supplement and nutraceutical product segment. |

| | |

| o | Operate our acquisitions as individual brands under the Healing Company umbrella. |

| | |

| o | Create portfolio synergies, cross sell, upsell, and, over time, add diagnostics, content and coaching. |

| | |

| o | Yield more health and healing impact, greater loan to value, lower customer acquisition costs and lower operating expenses. |

| · | Increase Sales from Existing and New Customers. We expect to continue to drive growth for our consumer products branded businesses through our increased focus on our existing brands and the acquisition of new brands and our continued expansion in various health and wellness categories. We expect these efforts to result in incremental sales growth with existing customers plus new customer additions. We expect that our focus on delivering tangible benefits to consumers through product innovation will not only benefit us but also benefit our customers. |

We intend to grow our existing brands through the following strategies:

Growing our Your Super Brand

Our growth strategy for our Your Super brand is grounded in three tenets:

| · | New Product Development: Creating a steady pipeline of new products, formulated to meet our customers’ most important health needs, and that meet our standards of being easy, healthy, and delicious to use is critical to continue engaging our existing base and bringing in new customers. Consumer response to the launch of our nootropic coffee creamer alternative, Coco Clarity, in May of 2023, which was the first new product for Your Super in more than two years and which has become our number three SKU with a 4.8 star rating, is evidence of the existing demand for new Your Super products. Currently, in our Your Super product development pipeline we are working on a mix to promote hydration and we expect to be developing new products relating to, among other things, lactation and sleep. |

| · | Multi-Channel Distribution: Our primary goals in our distribution efforts continue to be focused on |

| o | Continuing to cultivate our retail channels, including our Your Super store on Amazon, as strong complements to our D2C, direct to consumer, core; |

| | |

| o | Driving profitable growth through both investment in targeted marketing to drive retail velocity and other third-party distribution channels; and |

| | |

| o | Minimizing complexity and distraction to our core business while getting a jumpstart in the channel. |

| · | Organic-Focused Growth Engine: Your Super utilizes powerful storytelling and positioning that creates, we believe, a rising tide across all of our marketing channels; we will continue to invest in SEO, CRO, and content marketing to both generate organic traffic and convert that traffic to sales; and we will continue to operationalize and optimize a rapid creative and funnel testing engine that will allows us to test, learn, and exploit the most efficient growth funnels across multiple marketing channels. Additionally, we intend to cultivate other organic and/or fixed-customer acquisition cost channels through the cultivation of brand partnerships and the launch of a brand ambassador program. |

Growing our Chopra Brand

Our Chopra brand’s growth strategy is based around four core pillars:

| · | Daily Nourishing Rituals: Chopra will provide a combination of products and content to meet daily needs and to help build healthy living habits during the different times of the day – from wake-up, to nutrition, to stress management, to sleep. |

| | |

| · | Seasonal Cleanses: It often occurs where there is an alignment to the annual equinoxes and solstices and the Ayurvedic calendar to complete detoxification rituals that will help cleanse and reset from physical, mental, and emotional toxification. The Chopra detox kit, meditation, and breathwork programs will form core parts of these rituals. |

| | |

| · | In Person Immersions: Through our current Chopra retreats or future experiences in development, we will expand opportunities for like-minded people to connect and experience a full 360-degree change through education, massage, breathwork, meditation, diet, and community support. |

| | |

| · | Community and Connection: Building our Chopra community of educators, teachers, and those seeking to learn and grow, the Chopra community has always been, and will continue to be, a thriving and essential part of the Chopra brand around the world. |

Intellectual Property

We believe trademark protection is particularly important to the maintenance of the recognized brand names under which we market our products.

We protect our intellectual property rights through a variety of methods, including trademark, patent and trade secret laws, as well as confidentiality agreements and proprietary information agreements with vendors, employees, consultants and others who have access to our proprietary information. Protection of our intellectual property often affords us the opportunity to enhance our position in the marketplace by precluding our competitors from using or otherwise exploiting our brands. We are also a party to several intellectual property license agreements relating to certain of our products. The duration of our trademark registrations is generally 10, 15 or 20 years, depending on the country in which the marks are registered, and we can renew the registrations. The scope and duration of our intellectual property protection varies throughout the world by jurisdiction and by individual product. Our global trademark portfolio, with the aforementioned registration durations, consists of our core marks for our business and our proprietary product brands which drive significant brand awareness for all of our businesses. Our proprietary product formulas and recipes, maintained as trade secrets, are significant to our growth and success as they form the foundation for our production and sales of effective, high quality products.

Employees

We currently have twenty employees including our Chief Executive Officer. We have also retained various independent consultants to serve in key operational roles, such as Chief Financial Officer, and other executives in marketing, strategy and implementation. Further, we have engaged advisors to assist our executive management with the ongoing execution of our business plan and expansion of our current product lines.

Regulation

The supplement and nutrition sector of the health and wellness industry, in general, is subject to varying degrees of regulation by a number of government authorities in the United States, including the FDA, the Federal Trade Commission, or the FTC, the Consumer Product Safety Commission, or the CPSC, the U.S. Department of Agriculture, or the USDA, and U.S. Environmental Protection Agency, or the EPA. Various agencies of the state and localities in which we operate and in which our products are sold also regulate our business.

The areas of our business that these and other authorities regulate include, among others:

| · | product claims and advertising; |

| | |

| · | product labels; |

| | |

| · | product ingredients; and |

| | |

| · | how our products are manufactured, packaged, distributed, imported, exported, sold and stored. |

In addition, our products sold in foreign countries are also subject to regulation under various national, local and international laws that include provisions governing, among other things, the formulation, manufacturing, packaging, labeling, advertising and distribution of dietary supplements and over-the-counter drugs.

Particular Regulations Applicable to our Your Super Brand

Overview

Your Super is subject to health claim regulations that differ in each of its major markets, including the US, EU, and UK, and which dictate if and how we are able to speak to the benefits of our Your Super products. Currently, we are generally able to speak to structure/functional benefits of our Your Super product formulations, in certain cases subject to meeting minimum nutrient thresholds.

Details

The regulatory environment for the supplements, nutraceuticals, superfoods, and plant-based nutrition industries varies across the US, UK, and Europe. While there are similarities, there are also notable differences in how regulations impact the sale and marketing of products in these industries.

The United States

In the US, the regulation of these industries primarily falls under the purview of the Food and Drug Administration (FDA). Dietary supplements are regulated under the Dietary Supplement Health and Education Act (DSHEA) of 1994. Under DSHEA, supplements are considered a category of food and are not subject to pre-market approval by the FDA. Whether a supplement or a food product, companies are responsible for ensuring the safety and labeling compliance of their products. The FDA can take action against products that are deemed unsafe or misbranded.

Regarding marketing, companies are prohibited from making certain specific health claims about their products unless they have been approved by the FDA. However, they can make general structure/function claims that do not claim to diagnose, treat, cure or prevent specific disease, which is what Your Super does today. The FDA has the authority to take action against companies making false or misleading claims.

The Federal Food, Drug and Cosmetic Act, or the FDA Act, permits structure/function claims to be included in labels and labeling which are truthful and not misleading. Permissible structure/function claims may describe how a particular nutrient or dietary ingredient affects the structure, function or general well-being of the body, or characterize the documented mechanism of action by which a nutrient or dietary ingredient acts to maintain such structure or function. The label or labeling of a product marketed as a dietary supplement may not expressly or implicitly represent that a dietary supplement will diagnose, cure, mitigate, treat or prevent a disease (i.e. a disease claim). If the FDA determines that a particular structure/function claim is an unacceptable disease claim that causes the product to be regulated as a drug, a conventional food claim or an unauthorized version of a “health claim,” or, if the FDA determines that a particular claim is not adequately supported by existing scientific data or is false or misleading in any particular, we would be prevented from using the claim and would have to update our product labels and labeling accordingly. We take a number of actions to ensure that our labeling complies with this regulatory framework, including, undertaking third-party review of our labeling.

United Kingdom

In the UK, the regulation of these industries is overseen by several authorities, including the Food Standards Agency (FSA) and the Medicines and Healthcare products Regulatory Agency (MHRA). The FSA primarily regulates food safety and labeling, while the MHRA oversees medicines and medical devices.

Supplements and nutraceuticals are generally classified as food products in the UK. Companies must comply with food safety regulations and ensure accurate labeling. Health claims made on products must be authorized by the European Food Safety Authority (EFSA) or be on the list of permitted claims. The MHRA regulates products that are considered medicinal, and these require specific authorization. Currently all of the Your Super products are classified as food products in the UK.

Europe

In Europe, the regulation of these industries is governed by the European Union (EU) and its member states. The EU has established regulations for food safety, labeling, and health claims through various directives and regulations. The EFSA plays a crucial role in evaluating health claims and determining their scientific substantiation.

Companies must comply with EU regulations on food safety and labeling. Health claims must be authorized by the EFSA, and only those on the authorized list can be used. The EU also has specific regulations for novel foods, including superfoods and plant-based products, which require pre-market authorization.

Federal Trade Commission and State Authorities

The FTC exercises jurisdiction over the advertising of all consumer products and requires that all advertising to consumers be truthful and non-misleading. The FTC actively monitors the advertising of dietary supplements, nutraceuticals and health-related products and has instituted numerous enforcement actions against companies for failure to have adequate substantiation for claims made in advertising or for the use of false or misleading advertising claims. FTC enforcement actions may result in consent decrees, cease and desist orders, judicial injunctions and the payment of fines with respect to advertising claims that are found to be unsubstantiated.

Additionally, U.S. State consumer protection authorities prohibit deceptive and unfair practices and may take action against companies deemed to defraud or deceive consumers.

We take a number of actions to ensure that our advertising and marketing is not false or misleading, including, undertaking third-party review of our labeling.

New Legislation or Regulation

Legislation may be introduced which, if passed, would impose substantial new regulatory requirements on dietary supplements and other health products. We cannot determine what effect additional domestic or international governmental legislation, regulations, or administrative orders, when and if promulgated, would have on our business in the future. New legislation or regulations may require the reformulation of certain products to meet new standards, require the recall or discontinuance of certain products not capable of reformulation, impose additional record keeping or require expanded documentation of the properties of certain products, expanded or different labeling or scientific substantiation.

ITEM 1A. RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this report, before purchasing our securities. We have listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this report, including statements in the following risk factors, constitute forward-looking statements. [Please refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements.”]

Risks Related to our Business and Industry

We are an early-stage company with a limited operating history.

While we were incorporated in Nevada in 2008, we have a limited operating history upon which you can evaluate our business and prospects. Our prospects must be considered in light of the risks encountered by companies in the early stages of development in highly competitive markets, particularly the markets for health and wellness products. You should consider the frequency with which early-stage businesses encounter unforeseen expenses, difficulties, complications, delays and other adverse factors. These risks are described in more detail below.

We have a history of losses and may continue to incur losses in the future.

We have incurred both operating and net losses in each of our last two fiscal years and current fiscal year and may continue to incur losses in the future as we continue to build our brand and invest in our products and acquisitions. This lack of profitability limits the resources available to us to fund our operations and to invest in new products and services and otherwise improve our business operations. We cannot assure you that we will be able to operate profitably or generate positive cash flows. If we cannot achieve profitability, we may be forced to cease operations and you may suffer a total loss of your investment.

We have limited revenues, are currently experiencing operating losses and we may not be able to manage our businesses on a profitable basis.

We had no revenues prior to our acquisition of Your Super in October 2022. Since then, and taking into account our acquisition of the Chopra Assets in March 2023, our revenues have been limited and we have generated losses. To support our operations, we have relied on proceeds from sale of stock and a credit facility dedicated to support the acquisition of new brands. For the year ended June 30, 2023, we generated an operating loss of $24,238,407 and a net loss of $21,308,823. For the year ended June 30, 2022, we generated an operating loss of $8,261,868 and a net loss of $8,264,200. We cannot assure you that we will achieve profitably, that we will have adequate working capital to meet our obligations as they become due or that any revenues generated will be sufficient to fund our current and planned operations. Management believes that our success will depend on our ability to successfully complete additional acquisitions of profitable health and wellness product companies. We cannot guarantee that we will be successful in completing acquisitions of any other companies or that we will successfully integrate acquired companies. We cannot assure you that even if we are successful in completing the acquisitions, we will be successful in profitably managing such companies’ acquired assets and brands. We cannot assure you that we will achieve or maintain profitability for any period of time or that investors will not lose their entire investment.

If we fail to implement our business plan and complete acquisitions as planned, our business will suffer accordingly.

Our mission is the creation of a world-class health and wellness company engaged in the development, manufacture and sales of quality health, wellness and lifestyle products for distribution to an expanding global marketplace. We expect that our holding company strategy through which we plan to acquire profitable but undervalued target companies and products will enable us to accelerate the development and expansion of our brand and product portfolio and distribution channels. If we are unable execute our strategy of completing acquisitions as planned, we will not be able to fulfill our mission or grow our business as fast as we expected.

We are a holding company and thus dependent, in part, on acquired businesses to fund operations.

Our business plan is based on our finding and acquiring high potential health and wellness product companies. We define high potential as companies that have significant growth, profit and health and wellness impact potential.

If we are unable to find appropriate companies that we define as high potential in an adequate time period it may mean that we will be unable to sustain operations. Further, in addition to third-party funding sources, which may not be available to us on favorable terms, it at all, we will be dependent on revenues generated by our acquired businesses which may not be sufficient to sustain operations and may make it more difficult to acquire additional targeted business opportunities. This may put us under operational pressure to reduce costs or raise more financing.

Our acquisitions may result in significant transaction expenses and integration and consolidation risks, and we may be unable to profitably operate our consolidated company.

We are engaged in the business of acquisition, operation and management of health and wellness companies and brands. Our acquisitions may result in significant transaction expenses and present new risks associated with entering additional markets or offering new products and services and integrating the acquired companies or brands. We may not have sufficient management, financial and other resources to integrate companies we acquire or to successfully operate new businesses and we may be unable to profitably operate our expanded company. Moreover, any new businesses that we may acquire, once integrated with our existing operations, may not produce expected or intended results.

If the large consumer goods businesses or investment funds make substantial investments in the market sector in which we operate, this could push up asset prices making acquisitions harder to complete and more expensive for us.

Our growth is dependent on management’s ability to identify and acquire suitable companies for acquisition.

Management will be working to identify business acquisitions and to negotiate purchase agreements favorable to the Company. These potential acquisitions, once identified, will require financial, legal and operational due diligence. If management fails to perform this due diligence adequately, there is a risk that the acquired businesses may unfavorably impact our operations.

Our recently completed acquisitions are subject to uncertainties and risks.

We recently completed the acquisition of the Your Super superfoods business and a suite of operating assets from Chopra Group under the Chopra brand. There is no assurance that we will realize the benefits anticipated from our acquisition of these two businesses. There is no assurance that we will be able to successfully integrate these two new business lines into our management and organizational structure. The process of combining the operations of Your Super and the Chopra business lines that we acquired could prove difficult or unsuccessful and this could have a material adverse effect on us and our financial condition.

The growth of our acquired businesses will be dependent on the management of those businesses as well as our ability to support their growth.

Our business model is reliant, in part, on the founders or executives of the companies we acquire continuing to operate the business and working with us to grow their businesses. If these founders or executives choose to leave unexpectedly post-acquisition it will create operational pressures on us to operate in their absence, and could negatively impact the culture, operation and performance of the acquired company. This could have a material negative impact on sales and profitability.

We may not be able to manage future growth effectively.

We expect to continue to experience significant growth. Should we keep growing rapidly, our financial, management and operating resources may not expand sufficiently to adequately manage our growth. If we are unable to manage our growth, our costs may increase disproportionately, our future revenues may not grow or may decline, and we may face dissatisfied customers. Our failure to manage our growth may adversely impact our business and the value of your investment.

Our success depends on the experience and skill of our board of directors, executive officers, and key personnel, whom we may not be able to retain, and we may not be able to hire enough additional personnel to meet our needs.

We are very dependent on Simon Belsham, our co-founder, Chief Executive Officer, President and Director, and Justin Figgins, our Chief Financial Officer, Treasurer, Secretary and Head of Strategy and Mergers and Acquisitions. We are also very reliant on our board of directors, to set policy and provide strategic guidance, and to the rest of our management team and other partners who provide marketing, product development, technology, sales distribution and general management services to our acquired businesses to support their integration and growth. There can be no assurance that any of these persons will continue to be employed with or engaged by us for a particular period of time. The loss of any member of our board of directors or executive officer or any of our senior management team or advisors could harm our business, financial condition, cash flow and results of operations.

The success of our strategy will depend on a well-defined management structure and the availability of a management team with proven competencies in the identification, acquisition and integration of complementary companies and assets. To implement our business plan, we will need to keep the personnel that we currently have and, if our business is to grow as planned, we will need additional personnel. We cannot assure you that we will be successful in retaining our present team or in attracting and retaining additional personnel. If we are unable to attract and retain key personnel or are unable to do so in a cost-effective manner, our business may be materially and adversely affected.

Our management is domiciled in the United State and Europe which may present some limited risk to operations.

Our management team is spread out geographically across the US and Europe and so any further restrictions in travel due to a pandemic may present some limited risk to our ability to operate, build a team culture and effectively operate our business.

Although dependent on certain key personnel, we do not have any key man life insurance policies on any such people.

We are dependent on our executive officers and management team to conduct our operations and execute our business plan, however, we have not purchased any insurance policies with respect to our executives and senior managers in the event of the death or disability of any of these persons. Therefore, if any of our executive officers or other members of our management team dies or becomes disabled, we will not receive any compensation to assist with any such created absence.

Our ability to obtain continued financing is critical to the growth of our business. We will need additional financing to fund operations, which additional financing may not be available on reasonable terms or at all.

Our future growth, including the potential for future market expansion will require additional capital. We will consider raising additional funds through various financing sources, including the procurement of commercial debt financing. However, there can be no assurance that such funds will be available on commercially reasonable terms, if at all. If such financing is not available on satisfactory terms, we may be unable to execute our growth strategy, and operating results may be adversely affected. Any additional debt financing will increase expenses and must be repaid regardless of operating results and may involve restrictions limiting our operating flexibility.

Our ability to obtain financing may be impaired by such factors as the capital markets, both generally and specifically in our industry, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, are not sufficient to satisfy our capital needs, we may be required to decrease the pace of, or eliminate, our future product offerings and market expansion opportunities and potentially curtail operations.