The

Challenges Facing Today's Largest Beverage Companies - Innovation

& Sustainable Growth. Where Will It Come

From?

History shows that every once

in awhile a disruptive technology, product, or service appears on

the horizon that has the potential to create a paradigm shift in

consumer thinking and behavior. At first, most people dismiss it as

a fad; thinking that it can't gain much traction in the

marketplace, and that it will never last. Oftentimes, they are

correct.

In the case of the food &

beverage industry, the landscape is littered with companies that

have attempted to offer innovative new products to consumers, but

ultimately failed. It goes without saying that the odds of success,

in developing, manufacturing and marketing a new beverage brand are

not very favorable.

But for those companies that

succeed in achieving the improbable, if not impossible, their early

investors are often significantly rewarded as word-of-mouth

spreads, brand recognition increases, sales momentum builds and

investor awareness takes hold.

The only

thing you have to do is find the right company, at the right time,

with the right product, the right strategic business plan, the

right kind of capital structure and funding mechanism, and the

right management team to execute on the plan ----- and, most

importantly, deliver results.

But does such a company exist

today?

In recent years, some of the

biggest stock market winners have come from the beverage industry.

Just go back and look at the longer term charts of Monster (MNST),

Cott (COT), and Jones Soda (JSDA). Each of these companies, at some

point in their history, experienced a surge in share price.

Investors, with lasting memories of the investment power that

underlies a new consumer beverage trend, continue to search for the

next big winner in this sector.

Remember, Glaceau the maker of

Vitamin Water, which was purchased by Coca-Cola in 2003 for $4.2

billion dollars in cash?

http://www.nytimes.com/2007/05/26/business/26drink-web.html?_r=0

Some have opined that Coca-Cola

overpaid for ownership of Glaceau's Vitamin Water brand, which some

have called nothing more than filtered water, sweetener, and

vitamins along with some coloring.

I only point this out to show

that at six times expected 2007 revenues, Coke paid a pretty penny

for a brand with no real proprietary formula, or intellectual

property protection. It simply quenches thirst and provides a few

vitamins.

Coke and Pepsi, the beverage

market leaders, are in a unique position. Because of their size and

structure, they find it much easier, cheaper, and more desirable to

purchase small companies that already have proven success in

launching an innovative new product.

As Tom Pirko, president of

Bevmark, a consulting firm to the food and beverage industry,

including Coke, says, in the NY Times article above

"When you

look at what's happening with Coke, they can't innovate their way

out. They have to buy their way out."

The question then becomes, at

what point is a small start-up beverage company worthy of the

attention of the big boys?

Well, in the case of Coca-Cola,

their VEB (Venture & Emerging Brands) Team looks for those

"brands that have achieved approximately $10 million in

revenue".

This $10 million bogey appears to be the critical threshold before

any small beverage company with a new, innovative, product will

even begin to merit consideration by Coke's VEB group.

Another criterion that I found

interesting was that in evaluating the growth of a brand, the VEB

group in Atlanta, pays particular attention to those company

executives that “understand the value of

going deep before going wide by targeting specific regions,

channels, or customer segments, versus trying to be everywhere at

once”.

http://www.coca-colacompany.com/stories/the-next-big-thing-how-cokes-venturing-emerging-brands-unit-stays-a-step-ahead-of-tomorrows-thirsts

Judging from recent trade

magazine articles, it also appears that a big priority for

Coca-Cola, as they move forward, is in the health and wellness

area; providing beverages with ingredients that are natural and

good for you. Lower calorie, healthy alternatives seem to be a

logical first step to achieving this newly-formed corporate

mandate.

Coke's chief procurement

officer Ron Lewis has even gone so far as to say:

"We can't

ignore the small, entrepreneurial brands popping up in

unconventional outlets --- such as health and beauty spas, natural

food stores, gyms, yoga studios and other places our red trucks

don't visit."

http://www.beveragedaily.com/Manufacturers/Coca-Cola-A-third-of-beverage-industry-growth-could-come-from-disruptive-brands-in-categories-that-do-not-exist-today

http://www.foodnavigator-usa.com/Manufacturers/Coca-Cola-on-thinking-like-a-start-up-open-innovation-and-avoiding-Kodak-moments

The future direction of

Coca-Cola (KO) and PepsiCo (PEP), for that matter, seems fairly

obvious. The question becomes, where will they find the next new

beverage product worthy of their attention?

I believe the answer lies in

Boca Raton, Florida, at a small company named Celsius Holdings,

Inc. (CELH).

Celsius Holdings, Inc. first

came to my attention in the summer of 2007 when I read an article

by Herb Greenberg, currently of CNBC notariety, who at the time was

writing a column on the Market Watch web site of the Wall Street

Journal.

http://blogs.marketwatch.com/greenberg/2006/10/coke_formally_i/

http://blogs.marketwatch.com/greenberg/2006/10/more_on_cokes_c/

While I was impressed with what

Coca-Cola was doing, I was more intrigued with the fact that Coke

was not the first to market with this new innovative product; a

company in Florida called Elite FX already had a calorie-burning

beverage named Celsius. Elite FX even went so far as to conduct a

placebo-controlled, double blind cross-over clinical study, to

substantiate its calorie-burning marketing claims. This study

validated the efficacy of Celsius and the "thermogenesis", i.e.,

the raising of the body's metabolism, which takes place shortly

after drinking the product, and lasts for approximately three

hours.

Those clinical studies, which

were done at the request of then CEO Steve Haley, proved to be

instrumental in giving Celsius a distinct scientific advantage over

Coca-Cola (KO) and Nestle's (NSRGY) Enviga product. Mr. Haley’s

foresight and vision would provide a critical step forward in the

marketing of his company’s products. For this decision alone, he

deserves much credit and recognition.

The introduction of

calorie-burning beverages creates a whole new category in the

industry; one that more than a few beverage company executives and

outside consultants feel is in its early stages of

development.

If you think about it, the

industry has gone from high-fructose corn syrup products, where

calorie counts typically range from around 140-160 calories, to

lower calorie beverages (light beers for example) and other light

beverages, to zero-calorie beverages. The question then becomes

where do we go from here?

Why Stop

at Zero Calories? – The Negative-Calorie Category Comes of

Age:

Since the initial study in

2005, Celsius has conducted six additional studies, many at the

prestigious University of Oklahoma Health Sciences Center, under

Dr. Jeffrey Stout, PhD, Director of Metabolic and Body Composition.

Many of these studies have been published by the ISSN

(International Society of Sports Nutrition) in the Journal of the

International Society of Sports Nutrition, and the Journal of

Strength and Conditioning Research. Links to the various scientific

studies may be found here:

http://www.celsius.com/thermogenic-scientific-studies

These types of studies have

become increasingly important in today's age of scrutiny by

regulators and legislators. In fact, it was because Coca-Cola and

Nestle's Enviga product had no underlying proof for its

calorie-burning claims, that they were ultimately forced into a

$650,000 settlement with 27 state attorneys, including Connecticut

Attorney General Richard Blumenthal, and ultimately wound up

pulling their product from the marketplace.

http://www.bevnet.com/news/2009/2-27-2009-enviga

It's important to note that

there is a huge difference between conducting a study on the

efficacy of one or two ingredients in a product versus the actual

product as delivered to consumers. Some have attempted to apply the

efficacy of a single ingredient (such as caffeine) to a product

consisting of many ingredients. The problem with this approach is

that it is not all-inclusive or comprehensive enough to validate a

marketing claim. All of Celsius' scientific studies were conducted

on the actual Celsius product

formula,

as delivered in Ready-to-Drink cans, or powders that simply

dissolve when added to water.

The Enviga settlement also

served to tighten up what could and could not be said with regard

to claims for calorie-burning beverages.

This was also part of the

approval by the National Advertising Division (NAD) of The Better

Business Bureau, as a comprehensive review of the marketing claims

made by Celsius. Here is a direct quote from the NAD ---

Specifically,

"NAD found that the advertiser (Celsius) could support claims that

referenced the taste of Celsius and the product's ingredients, as

well as claims Celsius supplementation results in 'increased

metabolism,' 'calorie burning,' 'fat loss,' 'decrease in body fat,'

'greater endurance performance' and 'greater resistance to fatigue

(increased energy)'."

To my knowledge, there is no

other brand that has gone through this kind of exhaustive process

to validate their marketing claims.

http://www.cspnet.com/category-management-news-data/beverages-news-data/articles/bbb-advertising-division-confirms-celsius

To take things one step

further, Celsius was even challenged in the courts regarding their

marketing claims, and the efficacy of their product's

calorie-burning properties. Their victory, pursuant to Judge Terry

A. Green's ruling, was a precedent, in my opinion, for any other

potential future challenges to the brand.

As Celsius attorney Joel B.

Rothman said "We shut down the plaintiff's class action litigation

by showing that the plaintiff did not have standing to pursue a

case against Celsius," Rothman said. "It's a big win in a state

that's known as a haven for class-action

lawsuits."

http://www.naturalproductsinsider.com/news/2011/10/judge-rules-in-favor-of-celsius-holdings-in-claim.aspx

http://www.arnstein.com/15DCB1/assets/files/documents/8-11-11_RothmanLaw360_CelsiusArticle.pdf

Okay, so I think that we have

established that the Celsius brand is on solid-footing regarding

both the legitimacy of its marketing claims, and the efficacy of

those claims to "burn more calories and provide lasting

energy."

So now the question is how does

the product resonate with consumers and how will management go

about building the brand?

The first question is a

relatively easy one. You need do nothing more that click on over to

Amazon.com to see what people who use the product are

saying:

http://www.amazon.com/Celsius-Raspberry-Acai-Green-12-Ounce/product-reviews/B007R8XGKY/ref=cm_cr_pr_top_recent?ie=UTF8&showViewpoints=0&sortBy=bySubmissionDateDescending

Celsius products enjoy an

average 4.2 out of 5.0 stars rating, with about 325 people weighing

in with their opinion of the product.

Celsius made a decision in the

fall of 2013 to stop taking direct orders for Celsius products on

their web site, and decided to contract out to Amazon to be their

primary direct on-line retailer.

http://www.celsius.com/live-healthy/celsius-announces-a-new-way-to-shop-online

I believe that this was a smart

move for a couple of reasons. First, everybody knows and trusts

Amazon as an on-line retailer. Their prices are very competitive,

and for those that use Celsius products on a regular basis, there

are even ways to reduce shipping costs. Secondly, Celsius

management was able to reduce their overall costs (something they

have been focusing on for awhile) by eliminating the labor and

materials to handle orders and the shipment of those orders out to

customers.

The management team at Celsius

has even recently implemented production of Celsius products in

Dusseldorf, Germany as another way to reduce shipping costs to

international distributors in the European Union, Middle East and

African regions of the world. They have future plans to do the same

for distribution already announced in China &

Brazil.

http://www.marketwatch.com/story/celsiusr-commences-production-in-dusseldorf-germany-2014-01-13

It's not just consumers who

feel that the products are deserving of strong reviews for taste,

innovation and proven results. The beverage industry has also given

Celsius products numerous accolades. Celsius has garnered thirteen

(13) international awards in the functional beverage category,

including "Best New Natural Functional Beverage", "Best New Fitness

and Sports Beverage" and "#1 Food & Beverage Trend".

That last award, won in 2007,

is especially interesting because that same year the

highly-respected international research company Datamonitor named

the category of calorie-burning beverages as the number one food

and beverage trend for 2007.

http://www.gizmag.com/go/6831/

While the folks over at

Datamonitor might have been a bit ahead of the curve, and premature

on their call, they certainly are not without a good deal of market

research, industry databases, relevant information and expert

analysis to arrive at such a conclusion. In my opinion, their

thesis is correct; they just have miscalculated the timing of the

trend.

So who are the people behind

Celsius, and can they build this venture into a successful and

profitable company?

First and foremost, I believe

that one of the keys to how Celsius got this far has been the

result of the personal commitment

and capital of Carl DeSantis.

http://www.celsius.com/live-healthy/calorie-burning-celsius-announces-strategic-partnership-with-former-rexall-sundown-chairman-carl-desantis

http://www.businesswire.com/news/home/20090406005367/en

http://www.prnewswire.com/news-releases/calorie-burning-celsius-announces-strategic-partnership-with-former-rexall-sundown-chairman-carl-desantis-64887052.html

http://www.marketwired.com/press-release/carl-desantis-increases-investment-to-153-million-in-celsius-1210014.htm

http://www.marketwired.com/press-release/Celsius-Expands-Marketing-Through-Additional-Financing-From-Desantis-NASDAQ-CELH-1289070.htm

For those who may not be

familiar with Mr. DeSantis, he is the founder, and former Chairman

& CEO of Rexall-Sundown, a vitamin and supplement company that

was sold in 2000 to Royal Numico for $1.8

billion.

http://www.prnewswire.com/news-releases/royal-numico-to-acquire-rexall-sundown-for-us18-billion-72875007.html

Carl started Sundown, as a

mail-order vitamin business out of his house, at a very young age,

working along with his wife. He eventually merged the company with

Rexall, a chain of drugstores mostly located throughout the

mid-western part of the United States, which he purchased, and the

rest, as they say is history.

Carl even penned an

autobiography titled "Vitamin Enriched", which provides a history

of his entrepreneurial spirit, strong work ethic and determination

to succeed. These attributes ultimately led to the pinnacle of his

career; building a multi-billion dollar business, and selling it to

a large international corporation. You can find Mr. DeSantis' book

at Amazon.com. If nothing else, you'll get a sense of Carl

DeSantis' resolve and fortitude in business matters, and his strong

moral character.

http://www.amazon.com/Vitamin-Enriched-Prescription-Founder-DeSantis/dp/1890819034/ref=sr_1_2?ie=UTF8&qid=1392335539&sr=8-2&keywords=vitamin+enriched+books

Carl has always been an

entrepreneur, and his South Florida Company, CDS Ventures, has

multiple holding of various public and private companies. They

first started financing Celsius Holdings when Steve Haley was the

CEO, and most recently added another $2.2 million in funds, this

past September, after seeing the progress made by his

newly-appointed management team brought in during late 2011 to

replace Steve Haley, the founding CEO (more about this

later).

http://www.marketwatch.com/story/cds-ventures-of-south-florida-llc-increases-stake-in-celsius-holdings-inc-and-extends-debt-instruments-on-results-2013-09-10

However, don't think that

because Carl is wealthy he just decided to invest in Celsius on a

whim. Before making the decision to invest in this company, Carl

and his group performed extensive and thorough due diligence on the

product and its claims. This was to avoid a rather embarrassing

situation that occurred with a Rexall-Sundown product called

Cellasene.

http://www.palmbeachpost.com/news/business/delray-beach-based-company-dives-into-crowded-en-1/nL64z/

Celsius

During Steve Haley's 7-Year Tenure as CEO. What Went Wrong &

Why?:

Under former CEO Steve Haley,

the company conducted its first clinical study of Celsius in 2005,

and afterwards, the company began to slowly market its products

through traditional distribution channels.

As a result of the company

receiving unexpected national attention, a false-sense of

grandiosity suddenly appeared in the C-suite and the Board Room.

Out of that, the "build-it-and-they-will-come" mentality grew, and

the costly decision to go national with distribution was

made.

Celsius, the calorie-burning

beverage, appeared on literally hundreds of local CBS, NBC and ABC

affiliate news channels, as well as appearances on Food Network's

Unwrapped, NBC's Today Show with Matt Lauer and hit-show The

Doctors.

http://www.youtube.com/watch?v=GO5ztWClww4&playnext=1&list=PLA05173E858256AD2&feature=results_video

Using a distribution model

which required the payment of high-cost slotting fees to retailers

in exchange for shelf space, the company quickly found that the

"pay-to-play" strategy was resulting in excessive and exorbitant

marketing costs.

Without having first

established the brand, with strong reorders and customer

sell-through, the company quickly found itself burning through cash

at an alarming rate. After the company raised $13 million in

capital through an offering of shares in May of 2010, and secured a

listing on the NASDAQ after affecting a 1:20 reverse split, the

company embarked on an aggressive marketing campaign and wound up

squandering just about all of the capital raised in the May 2010

stock offering.

http://articles.sun-sentinel.com/2010-05-07/business/fl-desantis-drink-20100507_1_nasdaq-capital-market-rexall-sundown-carl-desantis

Looking back, it appears that

not properly laying the groundwork for the brand resulted in slower

than expected sales, while marketing expenses, in the form of

slotting fees, ballooned. The company found itself in the position

of losing huge amounts of money on a quarterly basis. In addition,

almost half of the company's revenues were coming from Costco

Wholesale Clubs, where margins were razor thin, and consumers had

to make a commitment to purchase Costco's only Celsius offering; a

15-pack of Outrageous Orange or Raspberry-Acai Green Tea

flavor.

Carl, in an attempt, to stop

the bleeding took steps to remedy the situation by reducing the

salaries of those in the executive suite, and establishing a

special board committee to evaluate strategic alternatives. The

company also implemented a new strategic operating plan aimed at

right-sizing the company. Translation: cut all but the most

essential expenses on both the marketing and operation side of the

business.

http://www.sec.gov/Archives/edgar/data/1341766/000121390010005096/f8k120210_celsius.htm

At that point in time, things

looked very bleak. However, much to the surprise of many, sales

continued to show resiliency despite the cutting off of all

marketing and advertising by the company. The stock, on the other

hand, languished and slowly drifted lower, from a high of $14, and

a market cap of north of $100 million, as investor expectations

were dashed.

The last official 10-Q was

filed on May 10, 2011. The Company also announced its intention to

deregister as a reporting company under the Securities Exchange Act

of 1934, as amended. The company said in an 8-K Filing

"The Company

believes that given its downsized level of operations, it is in the

best interests of its shareholders not to incur the expenses

associated with being a reporting company. It's the company's

intention to continue to issue quarterly financial information. The

Company's shares and warrants will continue to trade in the

over-the-counter market following

deregistration."

Nine days later the company

filed a Form 15-12B effectively withdrawing its requirement to file

reports with the Securities & Exchange Commission. In my

opinion, this move officially ushered in the end of the Steve Haley

era, and paved the way for Carl to bring in a fresh and focused

management team with experience in turning around troubled

companies.

In November of 2011 it was

announced that Steve Haley was stepping down as the CEO of Celsius

Holdings, Inc. and being replaced by Gerry David, a seasoned

executive with extensive experience in corporate turnarounds,

start-up companies and those companies with fast growth prospects.

As part of Steve Haley's exit, Carl DeSantis agreed to buy a

substantial portion of the equity position held by Mr. Haley, thus

increasing his ownership to a majority of 52 percent of the common

stock of Celsius Holdings, Inc.

http://www.bevnet.com/news/2011/changes-roiling-functional-beverage-category

http://www.bevnet.com/magazine/issue/2012/big-changes-at-o-n-e-celsius-and-starbucks-buys-evolution-juice

Celsius

Redux. The Rebuilding and Rebranding Process Begins Under New

Management:

Gerry David wasted no time in

executing a comprehensive strategic business plan to turn around

the struggling fortunes of this once promising little beverage

company. One of Mr. David's first initiatives was to re-brand the

Celsius product by changing the marketing strategy, as well as

changing the look and feel of the product.

He also scaled down the number

of flavors to a more manageable, SKU-friendly, number of five. The

five flavors that remained were Sparkling Cola, Sparkling Berry,

Sparkling Orange, a non-carbonated Peach-Mango Green Tea, and a

non-carbonated Raspberry-Acai Green Tea flavor. Gone were a

non-carbonated Outrageous Orange flavor, non-carbonated Lemon Iced

Tea and non-carbonated Strawberry-Kiwi.

Celsius' new management team

felt that having a fresh, exciting and upscale look with enhanced

graphics and a look of continuity across the five flavors was

critical to the re-branding of the product. Focus groups conducted

with beverage distributors agreed.

http://www.bevnet.com/news/2012/celsius-gets-a-makeover-and-unveils-new-packaging

http://www.healthcarepackaging.com/package-design/structural/redesigned-can-energizes-celsius

If you ever have a chance to

see the old look of the cans, you will find that their look

resembled a PowerPoint presentation with too many different fonts,

italics and bold type scattered about. I've heard it described as

being very noisy looking and very unappealing to the eye; not

something desirable when you are on a shelf competing for the

consumer's attention with hundreds of other beverages.

Another key component of Mr.

David's new marketing strategy was to move from a business model of

selling four packs of Celsius to new consumers, to one of selling

refrigerated single cans, to allow consumers to sample the product

first without having to make a commitment to purchase volume of

something they had never tried before. As part of this strategy,

the company ended its distribution relationship with Costco. That

was a bold move, considering the revenue generated from having a

presence in 316 of Costco's signature outlets was hefty.

The decision to drop Costco

from the ranks of Celsius' distribution partners, in early 2012,

was a difficult choice, but one that ultimately strengthens the

company for two reasons. First, it removes the frightening

dependence on a single source for almost fifty-percent of annual

revenues. Second, the very thin margins from the Costco

relationship were a drag; pulling down the overall, blended margins

across all distribution channels.

Looking at the revenue numbers

over the past few years, it seems that the broadening out of the

distribution base has stabilized revenues, and created a more

predictable stream of income for the company.

Here is a breakdown of the

financial results reported by the company over the past four

years:

Period Revenues Net

Gain/(Loss)

Q4 2013 $2.93 million

($494,000)

Q3 2013 $2.33 million

($698,000)

Q2 2013 $3.02 million

($228,000)

Q1 2013 $2.34 million

($405,000)

Q4 2012 $1.93 million

($329,000)

Q3 2012 $1.4 million

($764,000)

Q2 2012 $1.8 million

($1,119,000)

Q1 2012 $2.5 million

($536,000)

Q4 2011 $1.8 million

($716,000)

Q3 2011 $2.5 million

($278,000)

Q2 2011 $2.0 million

($456,000)

Q1 2011 $2.2 million

($459,632)

Q4 2010 $135,000

($5,581,748)

Q3 2010 $1.8 million

($5,036,886)

Q2 2010 $4.1 million

($3,026,284)

Q1 2010 $2.3 million

($5,852,484)

Q4 2009 $2.4 million

($7,759,029)

However, the new strategic

focus didn't end there. Mr. David decided to partner with one of

the country's most aggressive distributors, GBS Smash Brands, to

expand distribution in a new direction which included health clubs,

colleges and universities and other non-traditional distribution

outlets.

http://www.bevnet.com/news/2012/celsius-enlists-gbs-smash-brands-to-pump-up-new-growth-strategy

In addition, Mr. David beefed

up the Celsius Ambassador Program, whereby free samples of Celsius

were given out, along with an incentive to buy-one-get-one-free

with the retail purchase of a single can. Taste is one of the most

important consumer criteria in any beverage, and it has been shown

that most people who try Celsius enjoy the taste and will purchase

the product. He also made the Ambassador Program profitable,

something that was never done under Mr. Haley.

Sampling is a big part of

getting consumers to try and eventually buy Celsius. The company

has used a number of sampling programs, partnering with

subscription box companies such a Bulu Box and Goodies Co. (a

Wal-Mart affiliate), among others.

I mentioned how under Celsius'

previous management, thousands of dollars were spent on slotting

fees and marketing expenses, resulting in an unusually high-cost

structure to bring in each new customer. A new, less expensive and

creative way to find and secure new customers was necessary, and

Gerry David found it in digital marketing and social

media.

http://www.bevnet.com/news/2013/celsius-growth-led-by-refined-distribution-digital-marketing

A very important and

instrumental part of developing a digital marketing and social

media strategy was to partner with a public relations firm that had

all the right characteristics necessary to launch, manage and

monitor an effective PR campaign. For this extremely important

task, Celsius chose 5WPR with offices in New York and Los Angeles,

as their PR Agency of Record.

http://www.prnewswire.com/news-releases/5w-public-relations-named-pr-agency-of-record-for-celsius-inc-143289876.html

In his most recent commentary

on FY 2013 results, CEO Gerry David had this to say:

"as a result

of our marketing initiatives we are attracting new daily consumers

and industry-wide brand recognition. Celsius Public Relations

efforts have generated over 750 million impressions in 2013 while

our digital radio campaign continues to deliver 7.8 million ads

each month that are focused in our "Drill Deep"

markets."

Perhaps the most important

change that was made to the Celsius marketing strategy was to

eliminate the previously held notion that the company needed to

take distribution nationwide, versus concentrating on a few markets

where the idea was to "drill deep"; penetrate and concentrate on

establishing a repeat customer base by achieving product

"sell-through". The use of Pandora has been very instrumental in

helping Celsius attract and retain new customers who are encouraged

to visit the company web site where they can purchase the product

and see the results that others are achieving in terms of

weight-loss, increased energy, along with more stamina and

endurance when exercising.

Some of the success stories

achieved by ordinary people are truly amazing. I'm sure these

personal testimonials convince many who visit the company web site

to try the product. Celsius also has its own team of sponsored

athletes who compete in a number of different sports.

http://www.celsius.com/live-healthy/weight-loss-success

You will remember earlier in my

report I quoted executives at Coca-Cola's VEB unit who said

that "the VEB group in Atlanta,

pays particular attention to those company executives that

understand the value of "going deep before going wide" by targeting

specific regions, channels, or customer segments, versus trying to

be everywhere at once.

This new multi-layered

strategy, of doing just that, appears to be yielding significant

results.

http://www.bevnet.com/news/2014/multi-layered-strategy-catalyzes-celsius

While there has certainly been

significant progress made by the C-suite at Celsius, some of the

most powerful and influential changes may have recently taken place

at the Board Level. In April of 2013, it was announced that three

new individuals had joined the Celsius Board of Directors; Kevin

Harrington, Kathleen M. Dwyer and Nick Castaldo.

http://www.marketwatch.com/story/celsius-holdings-inc-appoints-three-new-board-members-2013-04-15

These three individuals have

very strong credentials, and each has demonstrated a track-record

of success in their respective careers. Kevin Harrington's desire

to join the Board is based on his ability to recognize growing

consumer trends, and products that meet the needs of the

marketplace. He was one of the original members of the hit

television show "Shark Tank", and has successfully helped launch

over 500 new consumer products.

http://upstart.bizjournals.com/entrepreneurs/hot-shots/2013/08/07/kevin-harrington-shark-tank-advice.html?page=all

His presence on the Celsius

Board has caused some to speculate that "with Kevin Harrington on

board, the competition will heat up, and the big boys (Coke and

Pepsi) will pay close attention".

http://www.palmbeachlwp.com/news/work/celsius-drinks-adds-harrington-to-board/

If, in the case of Coca-Cola,

their VEB (Venture & Emerging Brands) Team looks for those

"brands that have achieved approximately $10 million in

revenue",

the boys in Atlanta may, in fact, have begun watching this upstart

little beverage company very closely.

Most recent Q4 and FY 2103

results show continued strong revenue growth (topping $10 million

for the first time in the company’s history), improving margins,

and double-digit growth in multiple channels, while international

expansion plans are gaining traction.

http://www.nasdaq.com/press-release/celsius-holdings-inc-reports-fourth-quarter-and-yearend-2013-results-20140206-00221

http://www.nasdaq.com/press-release/celsiusr-partners-with-dubai-franchising-of-uae-international-investments-for-exclusive-20140225-00279

Investors might find the shares

of Celsius Holdings, Inc. particularly compelling, given its

potential growth prospects and most recent quarterly results. The

company is currently selling for roughly 0.7x annual revenue, well

below the industry average of 1.5x - 2.0x, and substantially below

the 6x number that Coca-Cola paid for Glaceau in 2007.

Shares of Celsius Holdings,

Inc. are very thinly traded as a result of having only 20,179,032

shares outstanding as of 12/31/2013.

Approximately, 52%, or

10,493,096 of the outstanding shares are held by majority

stakeholder, Carl DeSantis, through his corporate entity CDS

Ventures of South Florida, LLC, leaving only approximately

9,685,935 for purchase in the public float.

CDS Ventures of South Florida,

LLC also owns debt instruments totaling approximately $7.6 million,

some of which are convertible into shares of Celsius Holdings, Inc.

common stock. Potential investors are strongly encouraged to review

the company filings for details regarding the terms and conditions

of these instruments, along with conversion privileges as they

relate to these various debt obligations.

Disclaimer: The principals of

Altitrade Partners are long shares of Celsius Holdings, Inc.

(CELH). This report expresses only those opinions of individuals

who are affiliated with Altitrade Partners. Altitrade

Partners has not

received any form of

compensation from Celsius Holdings, Inc., or any other third-party

in exchange for writing this report.

Altitrade Partners

has paid Investors Hub a fee of $1,600.00 to disseminate

this independent

report. None of the

companies mentioned in this report have paid any promotional fees

to Altitrade Partners or Investors Hub. Altitrade Partners

has no business

arrangement with any company discussed in this

research report. Please see the additional disclaimer below

for more complete details.

Additional

Disclaimer: Altitrade Partners,

herein referred to as (AP), is not an investment

advisory service, and is not a registered investment advisor or

broker/dealer. Investors should base any buy and sell decisions on

their own due diligence and preferably with the advice of their own

financial, tax and investment advisors.

The views and

opinions expressed in this report are purely those of Altitrade

Partners. No views or opinions should be misconstrued as advice as

to whether or not to buy or sell any securities. Altitrade Partners

does not offer advice or investment services, and

is not

compensated to provide opinions,

write research reports, or to comment on news of any publicly

traded or privately-held companies. AP has no liability in any

personal investment decisions made by readers based any AP report,

or reports written by any of its affiliates.

Statements

posted, and opinions expressed are made as of the date of the

report, and are subject to change without notice. All information

is believed to be accurate and reliable, but there can be no

assurance of same. We suggest that you do your own research and due

diligence, and not rely on the information posted on this, or any,

Internet web site.

Do not rely

on information contained within this report as the basis for any

buy or sell decisions. The opinions expressed here are provided as

informational only and should not be construed as investment

advice. Each investor is responsible for making his or her own

investment decisions, with the assistance of a licensed financial

advisor, investment advisor or tax professional to determine

whether or not an investment is suitable based on their personal

financial goals, circumstances and risk-profile. Readers must

understand and acknowledge that there is a very high degree of risk

involved in trading securities and any investment decision should

not be based solely on what is read in a research report, viewed on

a web site, or seen on an Internet page.

The employees

and/or affiliates of Altitrade Partners may hold positions in the

equity securities of companies or industries discussed here;

including, but not limited to common stock, preferred stock,

convertible debt, as well as listed put and call options. Any such

positions are disclosed to readers, so that they may be aware of

any potential conflicts of interest as a result of the author's

position (long or short) in a security which they are writing

about. Understand that such disclosure is made at the time that the

opinion is posted, and is subject to change. Such changes may

include increasing or decreasing the number of shares held,

increasing or decreasing the number of options which may be

exercised into common stock, along with hedging strategies designed

around taking an offsetting position in the same security, or

convertible securities, to manage risk.

Altitrade

Partners does not issue buy or sell

recommendations, and only discusses

relevant public information on specific companies, sectors or

subjects. We make every attempt to verify and authenticate the

information presented, by providing readers with hyperlinks to

articles we have researched from sources such as trade magazines,

various news services, industry journals, company web sites, press

releases, SEC Filings, etc.

All

information is believed to be accurate and reliable, but there can

be no assurance of same. Accordingly, you should not rely solely on

this information in making any investment decision. Rather, you

should use the information only as the beginning of a due diligence

process, which, we believe, every investor should engage in before

deciding on an appropriate course of action. You are encouraged to

perform your own additional independent research in order to allow

you to form your own opinion regarding any investment. You should

always check with your licensed financial advisor and tax

professional to determine the suitability of any investment you are

considering.

The

information and services contained within this report may include

or incorporate by reference "forward looking statements" including

certain information with respect to business results, plans and

strategies of publicly-traded companies. For this purpose, any

statements on the site or incorporated by reference that are not

statements of historical fact may be deemed to be forward-looking

statements. Without limiting or forgoing the words "should",

"could", "may" "believe", "anticipate", "plan", "expect", "project"

and similar expressions are intended to identify forward-looking

statements. Such statements are subject to risks, uncertainties,

and assumptions about each company, economic and market factors in

industries in which the companies do business, among other factors.

These statements are in no way guarantees of future performances

and actual events, and results may differ materially from those

expressed or forecasted by the companies due to many

factors.

The

information contained herein contains forward-looking information

within the meaning of Section 27A of the Securities Act of 1993 and

Section 21E of the Securities Exchange Act of 1934 including

statements regarding expected continual growth of the company and

the value of its securities. In accordance with the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

it is hereby noted that statements contained herein that look

forward in time which include everything other than historical

information, involve risk and uncertainties that may affect the

company's actual results of operation. Factors that could cause

actual results to differ include the size and growth of the market

for the company's products, the company's ability to fund its

capital requirements in the near term and in the long term, pricing

pressures, unforeseen and/or unexpected circumstances in

happenings, pricing pressures, etc. Investing in securities is

speculative and carries risk.

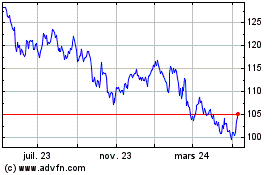

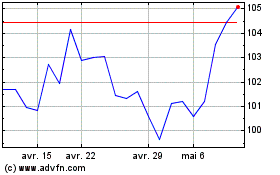

Nestle (PK) (USOTC:NSRGY)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Nestle (PK) (USOTC:NSRGY)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025