0001842556

false

0001842556

2023-11-13

2023-11-13

0001842556

HNRA:CommonStockParValue0.0001PerShareMember

2023-11-13

2023-11-13

0001842556

HNRA:RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfCommonStockAtExercisePriceOf11.50PerShareMember

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 13, 2023

HNR ACQUISITION CORP

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41278 |

|

85-4359124 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(Address of principal executive offices, including

zip code)

(713) 834-1145

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading symbol |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

HNRA |

|

NYSE American |

| Redeemable warrants, exercisable for three quarters of one share of common stock at an exercise price of $11.50 per share |

|

HNRAW |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement

Non-Redemption

Agreement

As previously reported,

on August 28, 2023, HNR Acquisition Corp (the “Company” or “HNRA”) entered into an Amended and Restated Membership

Interest Purchase Agreement, dated August 28, 2023 (the “MIPA”), by and among HNRA, HNRA Upstream, LLC, a newly formed Delaware

limited liability company which is managed by HNRA, and is a subsidiary of HNRA (“OpCo”), and HNRA Partner, Inc., a newly

formed Delaware corporation and wholly owned subsidiary of HNRA (“SPAC Subsidiary”, and together with the us and OpCo, “Buyer”

and each a “Buyer”), CIC Pogo LP, a Delaware limited partnership (“CIC”), DenCo Resources, LLC, a Texas limited

liability company (“DenCo”), Pogo Resources Management, LLC, a Texas limited liability company (“Pogo Management”),

4400 Holdings, LLC, a Texas limited liability company (“4400” and, together with CIC, DenCo and Pogo Management, collectively,

“Seller” and each a “Seller”), and, solely with respect to Section 6.20 of the MIPA, HNRAC Sponsors LLC,

a Delaware limited liability company (“Sponsor”).

On November 13, 2023,

HNRA entered into an agreement with (i) Meteora Capital Partners, LP (“MCP”), (ii) Meteora Select Trading Opportunities Master,

LP (“MSTO”), and (iii) Meteora Strategic Capital, LLC (“MSC” and, collectively with MCP and MSTO, “Backstop

Investor”) (the “Non-Redemption Agreement”) pursuant to which Backstop Investor agreed to reverse the redemption of

up to the lesser of (i) 600,000 shares of common stock, par value $0.0001 per share, of HNRA (“Common Stock”), and (ii) such

number of shares of Common Stock such that the number of shares beneficially owned by Backstop Investor and its affiliates and any other

persons whose beneficial ownership of Common Stock would be aggregated with those of Backstop Investor for purposes of Section 13(d) of

the Securities Exchange Act of 1934, as amended, does not exceed 9.99% of the total number of issued and outstanding shares of Common

Stock (such number of shares, the “Backstop Investor Shares”).

Immediately upon consummation

of the closing of the transactions contemplated by the MIPA (the “Closing”), HNRA will pay Backstop Investor, in respect of

the Backstop Investor Shares, an amount in cash equal to (x) the Backstop Investor Shares, multiplied by (y) the Redemption Price (as

defined in HNRA’s amended and restated certificate of incorporation) minus $5.00.

Exchange Agreements

On November 13, 2023, HNRA

entered into exchange agreements (“Exchange Agreements”) with certain holders (the “Noteholders”) of promissory

notes issued by HNRA for working capital purposes which accrued interest at a rate of 15% per annum (the “Notes”). Pursuant

to the Exchange Agreements, HNRA agreed to exchange, in consideration of the surrender and termination of the Notes in an aggregate principal

amount (including interest accrued thereon) of $2,099,545, for 419,909 shares of Common Stock at a price per share equal to $5.00 per

share (the “Exchange Shares”). Pursuant to the Exchange Agreements, HNRA also granted to the Noteholders piggyback registration

rights with regard to the Exchange Shares.

The Noteholders include

JVS Alpha Property, LLC, a company which is controlled by Joseph Salvucci, Jr., a current member of the HNRA board of directors, Byron

Blount, nominee member of the HNRA board of directors following the Closing, and Mitchell B. Trotter, the designated Chief Financial Officer

and a nominee member of the HNRA board of directors following the Closing.

The foregoing summary

of the Non-Redemption Agreement and the Exchange Agreements is qualified in its entirety by reference to the text of the form of Non-Redemption

Agreement and form of Exchange Agreement, which are filed hereto as Exhibit 10.1 and Exhibit 10.2, respectively, and are incorporated

herein by reference.

Item 3.02 Unregistered Sales of Equity

Securities

The information disclosed under Item 1.01 of this

Report is incorporated into this Item 3.02 to the extent required herein.

Item 5.07 Submission of Matters to a Vote of

Security Holders

On November 13, 2023,

the Company, reconvened, its special meeting of its stockholders (the “Special Meeting”) that was originally convened on October

30, 2023 and subsequently adjourned. The Special Meeting was held in connection with: (i) a proposal to approve and adopt the MIPA, and

the transactions contemplated thereby (the “Purchase” and such proposal, the “Purchase Proposal”), (ii) a proposal

to approve and adopt the HNR Acquisition Corp 2023 Omnibus Incentive Plan, a copy of which is attached to the Proxy Statement (as defined

below) as Annex B (the “Incentive Plan Proposal”), (iii) a proposal to approve, for purposes of complying with NYSE American

Rule 713(a), the potential and likely issuance of more than 19.99% of the Company’s issued and outstanding shares of common stock

including securities convertible into common stock pursuant to the Purchase transactions and issuances which may be made pursuant to a

potential private offering (the “NYSE American Proposal”), and (iv) a proposal to approve and adopt, the second amended and

restated certificate of, a copy of the form of which is attached to the Proxy Statement as Annex I (the “Charter Proposal”),

as each is further described in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (the

“SEC”) on October 13, 2023 (the “Proxy Statement”).

The record date for the

stockholders entitled to notice of, and to vote at, the Special Meeting was October 10, 2023. At the close of business on that date, the

Company had 7,515,653 shares of common stock issued and outstanding and entitled to be voted at the Special Meeting. Of the 7,515,653

shares of common stock issued and outstanding and entitled to be voted at the Special Meeting, 6,700,328 shares (or 89.15%), constituting

a quorum, were represented in person or by proxy at the Special Meeting.

The Company’s stockholders

approved the Purchase Proposal, the Incentive Plan Proposal, the NYSE American Proposal, and the Charter Proposal. The voting results

were as follows:

Purchase Proposal

| Votes For | | |

Votes Against | | |

Votes Abstained | | |

Broker Non-Votes |

| |

6,091,858 | | |

608,470 | | |

0 | | |

0 |

Incentive Plan

Proposal

| Votes For | | |

Votes Against | | |

Votes Abstained | | |

Broker Non-Votes |

| |

6,595,797 | | |

104,521 | | |

10 | | |

0 |

NYSE American Proposal

| Votes For | | |

Votes Against | | |

Votes Abstained | | |

Broker Non-Votes |

| |

6,091,858 | | |

608,470 | | |

0 | | |

0 |

Purchase Proposal

| Votes For | | |

Votes Against | | |

Votes Abstained | | |

Broker Non-Votes |

| |

6,091,858 | | |

608,470 | | |

0 | | |

0 |

Based upon the preliminary

reports that have been provided to the Company, the holders of an aggregate of 4,063,777 public shares of the Company’s common stock

have submitted requests that their public shares be redeemed in connection with the Special Meeting, with these redemptions only taking

effect upon the closing of the closing of the MIPA.

Item 8.01. Other Events

On November 13, 2023,

the Company issued a press release announcing the postponement of the Special Meeting, which is filed herewith as Exhibit 99.1 to this

report and which is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibits are being filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| November 13, 2023 |

HNR Acquisition Corp |

| |

|

|

| |

By: |

/s/ Donald H. Goree |

| |

Name: |

Donald H. Goree |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

NON-REDEMPTION

AGREEMENT

This

NON-REDEMPTION AGREEMENT (this “Agreement”), dated as of November 13, 2023 is made by and among HNR Acquisition Corp,

a Delaware limited liability company (the “Company”), and Meteora Capital Partners, LP (“MCP”),

(ii) Meteora Select Trading Opportunities Master, LP (“MSTO”) and (iii) Meteora Strategic Capital, LLC (“MSC”)

(with MCP, MSTO and MSC collectively as “Backstop Investor”).

WHEREAS,

the Company is a special purpose acquisition company whose Class A Common Stock (“Common Stock”) is traded on the

NYSE American under the symbol “HNRA”, and whose warrants (“Warrants”) are traded under the symbol “HNRAW”,

among other securities of the Company;

WHEREAS,

the Company, HNRAC Sponsors LLC, a Delaware limited liability company (“Sponsor”), CIC Pogo LP, a Delaware limited

partnership (“CIC”), DenCo Resources, LLC, a Texas limited liability company (“DenCo”), Pogo Resources

Management, LLC, a Texas limited liability company (“Pogo Management”), 4400 Holdings, LLC, a Texas limited liability

company (“4400” and, together with CIC, DenCo and Pogo Management, collectively, “Target”) have

entered into a Membership Interest Purchase Agreement, dated as of December 27, 2022, as amended and restated on August 28, 2023 (as

may be further amended or restated from time to time, the “Transaction Agreement”);

WHEREAS,

the Company and Backstop Investor, on behalf of certain funds, investors, entities or accounts that are managed, sponsored or advised

by Backstop Investor or its affiliates (collectively, “Backstop Investor”) are entering into this Agreement in anticipation

of the closing (the “Closing”) of the purchase and sale contemplated by the Transaction Agreement (the “Purchase

& Sale”);

WHEREAS,

as of the date hereof in respect of the Common Stock, Backstop Investor shall acquire from redeeming shareholder(s), or, in the event

Backstop Investor has made redemption requests for the Company Common Stock, previously had voting and investment power over the number

of shares of Common Stock set out in Exhibit A hereto (the “Backstop Investor Shares”). For the avoidance

of doubt, Backstop Investor may not have voting and investment power over any additional shares of Common Stock (such shares, “Non-Backstop

Investor Shares”) which are not subject to this Agreement;

WHEREAS,

pursuant to the Company’s Amended and Restated Certificate of Incorporation (the “COI”), in its capacity as

a holder of Common Stock, Backstop Investor has the right to require that the Company redeem Backstop Investor Shares held by Backstop

Investor (if applicable) in connection with the Purchase & Sale, for the Redemption Price (as defined in the COI), representing the

right to receive the Backstop Investor portion of the funds currently in the Company’s trust account, to the extent Backstop Investor

exercises such redemption right;

WHEREAS,

the Company has filed a definitive proxy with a deadline to exercise the redemption rights of shares of Common Stock of 5:00 p.m., Eastern

Daylight time on November 9, 2023 (the “Redemption Deadline”), which is two (2) business days before the

originally scheduled special meeting (the “Meeting”) of stockholders of the Company to approve the initial business

combination described in the definitive proxy, and which is scheduled to be held on November 13, 2023;

WHEREAS,

pursuant to the terms of this Agreement, Backstop Investor desires to agree to refrain from exercising such redemption right or reverse

previously submitted redemption requests with respect to the Backstop Investor Shares; and

WHEREAS

all capitalized terms used but not defined herein shall have the respective meanings specified in the Transaction Agreement.

NOW,

THEREFORE, in consideration of the mutual agreements set forth herein, the parties agree as follows:

1. Non-Redemption

Agreement. Subject to the conditions set forth in this Agreement, Backstop Investor irrevocably and unconditionally hereby agrees

that it will beneficially own not greater than the lesser of (i) 600,000 Backstop Investor Shares and (ii) the Blocker Amount (as defined

in Section 22 herein), and shall not elect to redeem or otherwise tender or submit for redemption any of such Backstop Investor Shares

in connection with the Purchase & Sale; provided, however, that in the event Backstop Investor has previously elected

to redeem, tendered or submitted any Backstop Investor Shares for redemption, Backstop Investor shall rescind or reverse such redemption

prior to Closing and the Company shall accept such request(s) promptly once submitted by Backstop Investor.

2. Non-Redemption

Payment. Immediately upon Closing, the Company shall pay Backstop Investor a payment in respect of Backstop Investor Shares (the

“Non-Redemption Cash”) in cash released from the Trust Account directly to Backstop Investor (as defined below) equal

to (x) the number of Backstop Investor Shares multiplied by (y) the Redemption Price minus $5.00.

3. Reserved.

4. Representations

and Warranties. Each of the parties hereto represents and warrants to the other party that: (a) it is a validly existing company,

partnership or corporation, in good standing under the laws of the jurisdiction of its formation or incorporation; (b) this Agreement

constitutes a valid and legally binding obligation on it in accordance with its terms, subject to laws relating to bankruptcy, insolvency

and relief of debtors, and laws governing specific performance, injunctive relief and other equitable remedies; (c) the execution, delivery

and performance of this Agreement by it has been duly authorized by all necessary corporate action, and (d) the execution, delivery and

performance of this Agreement will not result in a violation of its certificate of formation, articles or certificate of incorporation,

as applicable, or conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default)

under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement or instrument to which

it is a party or by which it is bound. Backstop Investor represents and warrants to the Company that, as of the date hereof, Backstop

Investor beneficially owns the number of shares of Common Stock set forth opposite Backstop Investor’s name on Exhibit A

hereto.

5. Additional

Covenants. Backstop Investor hereby covenants and agrees that, except for this Agreement, Backstop Investor shall not, at any time

while this Agreement remains in effect, (i) enter into any voting agreement or voting trust with respect to Backstop Investor Shares

(or any securities received in exchange therefore) inconsistent with Backstop Investor’s obligations pursuant to this Agreement,

(ii) grant a proxy, a consent or power of attorney with respect to the Backstop Investor Shares (or any securities received in exchange

therefore), (iii) enter into any agreement or take any action that would make any representation or warranty of Backstop Investor contained

herein untrue or inaccurate in any material respect or have the effect of preventing or disabling Backstop Investor from performing any

of its obligations under this Agreement, (iv) purchase the Backstop Investor Shares at a price higher than the price offered through

the Company’s redemption process or (v) take any action which would cause Backstop Investor’s beneficial ownership to exceed

the Blocker Amount (as defined in Section 22 herein).

6. Expenses.

Each party shall be responsible for its own fees and expenses related to this Agreement and the transactions contemplated hereby; provided

that the Company shall reimburse Backstop Investor for expenses actually incurred in connection with the acquisition of the Backstop

Investor Shares in an amount not to exceed $0.07 per share.

7. Termination.

This Agreement and all of its provisions shall terminate and be of no further force or effect upon the earliest to occur of (a) the termination

of the Transaction Agreement in accordance with its terms, (b) the mutual written consent of the parties hereto, (c) the later of (i)

November 15, 2023 or (ii) January 15, 2024 if the Company further amends and restates the COI to extend the Termination Date (as defined

in the COI) to such date if the Purchase & Sale has not been consummated by such applicable date, and (d) the payment of the Non-Redemption

Cash to Backstop Investor following the consummation of the Purchase & Sale. Upon such termination of this Agreement, all obligations

of the parties under this Agreement will terminate, without any liability or other obligation on the part of any party hereto to any

person in respect hereof or the transactions contemplated hereby; provided that, notwithstanding the foregoing or anything to

the contrary in this Agreement, the termination of this Agreement pursuant to clauses (a) and (d) above shall not affect any liability

on the part of any party for an intentional breach of this Agreement. Section 2 and Sections 6 through and including Section 27

of this Agreement will survive the termination of this Agreement. Furthermore, for the avoidance of doubt, should Backstop Investor hold

Backstop Investor Shares after the Redemption Deadline by refraining from redeeming the Backstop Investor Shares or reversing previously

submitted redemption requests, the Company shall pay to Backstop Investor the Non-Redemption Cash irrespective of the termination of

this Agreement.

8. Trust

Account Waiver. Backstop Investor acknowledges that the Company has established a trust account (the “Trust Account”)

containing the proceeds of its initial public offering (“IPO”) and certain proceeds of a private placement (including

interest accrued from time to time thereon) for the benefit of its public stockholders and certain other parties (including the underwriters

of the IPO). For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Backstop Investor hereby

agrees (on its own behalf and on behalf of its related parties) that it does not now and shall not at any time hereafter have any right,

title, interest or claim of any kind in or to any assets held in the Trust Account, and it shall not make any claim against the Trust

Account, regardless of whether such claim arises as a result of, in connection with or relating in any way to this Agreement or any other

matter, and regardless of whether such claim arises based on contract, tort, equity or any other theory of legal liability (any and all

such claims are collectively referred to hereafter as the “Released Claims”); provided, that the Released Claims

shall not include any rights or claims of Backstop Investor or any of its related parties as a shareholder of the Company to the extent

related to or arising from any Backstop Investor Shares. Backstop Investor hereby irrevocably waives (on its own behalf and on behalf

of its related parties) any Released Claims that it may have against the Trust Account now or in the future as a result of, or arising

out of, this Agreement and will not seek recourse against the Trust Account with respect to the Released Claims. For the avoidance of

doubt, this provision shall not restrict Backstop Investor’s Redemption Rights (as defined in the COI) with respect to the Non-Backstop

Investor Shares.

9. Public

Disclosure. The Company shall file a Current Report on Form 8-K with the SEC (the “Current Report”) reporting

the material terms of this Agreement but not including the names of Backstop Investor and its affiliates and/or advised funds, unless

required by law, within one (1) Business Day following the execution of this Agreement. The Company shall not, and shall cause its representatives

to not, disclose any material non-public information to other investors concerning the Company, the Common Stock or the Purchase &

Sale, other than the existence of this Agreement, such that other investors shall not be in possession of any such material non-public

information from and after the filing of the Current Report. Notwithstanding anything in this Agreement to the contrary, Backstop Investor

agrees that the Company shall have the right to publicly disclose the nature of Backstop Investor’s commitments, arrangements and

understandings under and relating to this Agreement in any filing by the Company with the SEC.

10. Governing

Law. This Agreement, the rights and duties of the parties hereto, and any disputes (whether in contract, tort or statute) arising

out of, under or in connection with this Agreement will be governed by and construed and enforced in accordance with the laws of the

State of Delaware, without giving effect to its principles or rules of conflict of laws to the extent such principles or rules would

require or permit the application of the laws of another jurisdiction. The parties irrevocably and unconditionally submit to the exclusive

jurisdiction of the United States District Court for the District of Delaware or, if such court does not have jurisdiction, the Delaware

state courts located in Wilmington, Delaware, in any action arising out of or relating to this Agreement. The parties irrevocably agree

that all such claims shall be heard and determined in such a Delaware federal or state court, and that such jurisdiction of such courts

with respect thereto will be exclusive. Each party hereby waives, and agrees not to assert, as a defense in any action, suit or proceeding

arising out of or relating to this Agreement that it is not subject to such jurisdiction, or that such action, suit or proceeding may

not be brought or is not maintainable in such courts or that the venue thereof may not be appropriate or that this Agreement may not

be enforced in or by such courts. The parties hereby consent to and grant any such court jurisdiction over the person of such parties

and over the subject matter of any such dispute and agree that mailing of process or other papers in connection with any such action,

suit or proceeding in the manner provided in Section 23 hereof or in such other manner as may be permitted by law, will be valid

and sufficient service thereof.

11. Waiver

of Jury Trial. To the extent not prohibited by applicable law that cannot be waived, each of the parties hereto irrevocably waives

any right it may have to trial by jury in respect of any litigation based on, arising out of, under or in connection with this Agreement

or any course of conduct, course of dealing, verbal or written statement or action of any party hereto or thereto, in each case, whether

now existing or hereafter arising, and whether in contract, tort, statute, equity or otherwise. Each party hereby further agrees and

consents that any such litigation shall be decided by court trial without a jury and that the parties to this Agreement may file a copy

of this Agreement with any court as written evidence of the consent of the parties to the waiver of their right to trial by jury.

12. Freely

Tradable. The Company confirms that Backstop Investor Shares will be freely tradeable without restrictive legends following the Purchase

& Sale; Backstop Investor Shares will not require re-registration pursuant to a registration statement filed pursuant to the Securities

Act of 1933, as amended, following the Purchase & Sale due to any action of the Company; and that Backstop Investor shall not be

identified as a statutory underwriter in any registration statement filed with the SEC pursuant to the Securities Act of 1933, as amended,

by the Company.

13. Form

W-9 or W-8. Backstop Investor shall, upon or prior to the consummation of the Purchase & Sale, execute and deliver to the Company

a completed IRS Form W-9 or Form W-8, as applicable.

14. Withholding.

Notwithstanding any other provision of this Agreement, the Company and any of its agents and representatives, as applicable, shall be

entitled to deduct and withhold from any amount payable hereunder any such taxes as may be required to be deducted and withheld from

such amounts (and any other amounts treated as paid for applicable tax law) under the Internal Revenue Code of 1986, as amended, or any

other applicable tax law (as determined in good faith by the party so deducting or withholding in its sole discretion). To the extent

that any amounts are so deducted and withheld, such deducted and withheld amounts shall be treated for all purposes of this Agreement

as having been paid to the person in respect of which such deduction and withholding was made.

15. Non-Reliance.

Backstop Investor has had the opportunity to consult its own advisors, including financial and tax advisors, regarding this Agreement

or the arrangements contemplated hereunder and Backstop Investor hereby acknowledges that neither the Company nor any representative

or affiliate of the Company has provided or will provide Backstop Investor with any financial, tax or other advice relating to this Agreement,

or the arrangements contemplated hereunder.

16. No

Third-Party Beneficiaries. This Agreement shall be for the sole benefit of the parties, Target and their respective successors and

permitted assigns. Except as expressly named in this Section 16, this Agreement is not intended, nor shall be construed, to give any

Person, other than the parties, Target and their respective successors and assigns, any legal or equitable right, benefit or remedy of

any nature whatsoever by reason this Agreement.

17. Assignment.

This Agreement and all of the provisions hereof will be binding upon and inure to the benefit of the parties hereto and their respective

successors and permitted assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder will be assigned (including

by operation of law) without the prior written consent of the non-assigning party hereto (not to be unreasonably withheld, conditioned

or delayed). Notwithstanding the foregoing, Backstop Investor may transfer its rights, interests and obligations hereunder to one or

more investment funds or accounts managed or advised by Backstop Investor (or a related party or affiliate) and to the extent such transferee

is not a party to this Agreement, such transferee shall agree to be bound by the terms hereof prior to any such transfer being effectuated.

18. Specific

Performance. The parties agree that irreparable damage may occur in the event that any of the provisions of this Agreement are not

performed in accordance with their specific terms or are otherwise breached. It is accordingly agreed that monetary damages may not be

an adequate remedy for such breach and the non-breaching party shall be entitled to seek injunctive relief, in addition to any other

remedy that such party may have in law or in equity, and to enforce specifically the terms and provisions of this Agreement in the chancery

court or any other state or federal court within the State of Delaware.

19. Amendment.

This Agreement may not be amended, changed, supplemented, waived or otherwise modified, except upon the execution and delivery of a written

agreement executed by the parties hereto.

20. Severability.

If any provision of this Agreement is held invalid or unenforceable by any court of competent jurisdiction, the other provisions of this

Agreement will remain in full force and effect. Any provision of this Agreement held invalid or unenforceable only in part or degree

will remain in full force and effect to the extent not held invalid or unenforceable.

21. No

Partnership, Agency or Joint Venture. This Agreement is intended to create a contractual relationship between Backstop Investor,

on the one hand, and the Company, on the other hand, and is not intended to create, and does not create, any agency, partnership, joint

venture or any like relationship between the parties.

22. Blocker

Provision. Notwithstanding anything to the contrary contained herein, Backstop Investor shall not own a number of Backstop Investor

Shares such that the total number of shares of Common Stock beneficially owned by Backstop Investor and its affiliates and any other

persons whose beneficial ownership of Common Stock would be aggregated with those of Backstop Investor for purposes of Section 13(d)

of the Exchange Act, exceeds 9.99% of the total number of issued and outstanding shares of Common Stock (including for such purpose the

shares of Common Stock issuable upon such exercise) (such amount, the “Blocker Amount”). For such purposes, beneficial

ownership shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder.

Backstop Investor and the Company will use reasonable best efforts to cooperate with each other with respect to determination of the

Blocker Amount.

23. Notices.

All notices, consents, waivers and other communications under this Agreement must be in writing and will be deemed to have been duly

given (a) if personally delivered, on the date of delivery; (b) if delivered by express courier service of national standing for next

day delivery (with charges prepaid), on the Business Day following the date of delivery to such courier service; (c) if delivered by

electronic mail, on the date of transmission if on a Business Day before 5:00 p.m. local time of the business address of the recipient

party (otherwise on the next succeeding Business Day), provided the sender receives no bounce-back or similar message indicating non-delivery;

in each case to the appropriate addresses set forth below (or to such other addresses as a party may designate by notice to the other

parties in accordance with this Section 23):

If

to the Company:

HNR

Acquisition Corp

3730

Kirby Drive, Suite 1200

Houston,

Texas 77098

Attention:

Mitchell B. Trotter, CFO

Email:

mbtrotter@comcast.net

with

a copy to (which shall not constitute notice):

Pryor

Cashman LLP

7

Times Square

New

York, New York 10036

Attention

Matthew Ogurick

Email:

mogurick@pryorcashman.com

HNR

Acquisition Corp

3730

Kirby Drive, Suite 1200

Houston,

Texas 77098

Attention:

David M. Smith, General Counsel

Email:

dmsmith@hnra-nyse.com

If

to Backstop Investor:

Meteora

Capital, LLC

1200

N Federal Hwy, Ste 200

Boca

Raton, FL 33432

Email:

notices@meteoracapital.com

24. Counterparts.

This Agreement may be executed in two or more counterparts (any of which may be delivered by electronic transmission), each of which

shall constitute an original, and all of which taken together shall constitute one and the same instrument, and shall include images

of manually executed signatures transmitted by electronic format (including, without limitation, “pdf”, “tif”

or “jpg”) and other electronic signatures (including, without limitation, DocuSign and AdobeSign). The use of electronic

signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated,

received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature

or use of a paper-based record-keeping system to the fullest extent permitted by applicable law.

25. Entire

Agreement. This Agreement and the agreements referenced herein constitute the entire agreement and understanding of the parties hereto

in respect of the subject matter hereof and supersede all prior understandings, agreements or representations by or among the parties

hereto to the extent that they relate in any way to the subject matter hereof.

IN

WITNESS WHEREOF, this Agreement has been duly executed by the parties hereto as of the date first above written.

| HNR

ACQUISITION CORP |

|

| |

|

| By: |

|

|

| |

|

| METEORA

CAPITAL PARTNERS, LP; |

|

| |

|

| METEORA SELECT TRADING OPPORTUNITIES MASTER, LP; and |

| |

|

| METEORA

STRATEGIC CAPITAL, LLC |

|

| |

|

| By: |

|

|

| |

|

| Title: |

|

EXHIBIT

A

| Backstop Investor | |

Backstop Investor Shares | |

| | |

| | |

| Total | |

| | |

9

Exhibit 10.2

EXCHANGE AGREEMENT

THIS EXCHANGE AGREEMENT (the “Agreement”), dated

as of November __, 2023, is entered into by and between HNR Acquisition Corp, a Delaware corporation (the “Company”) and ___________________(the

“Holder”). As used herein, the term “Parties” shall be used to refer to the Company and Holder jointly.

RECITALS:

A. Holder is in

possession of an Promissory Note dated ___________, attached hereto as Exhibit A (the “Note”) in the principal amount of

$____ and $_____ of interest accumulated thereon as of the date hereof, for a total of balance of $_____________ .

B. The Parties desire to exchange the full amounts due under the Note

for ________ shares of common stock of the Company, par value $0.0001 per share, at a price per share equal to $5.00 per share (the “Exchange

Shares”).

C. The Holder warrants and represents that it is sophisticated and

experienced in acquiring the securities of small public companies that has allowed it to evaluate the risks and uncertainties involved

in acquiring said securities and thereby make an informed investment decision.

NOW THEREFORE THE PARTIES

AGREE AS FOLLOWS:

1.00 Exchange of Note. The Parties agree that, in consideration

of the surrender and termination of the Note, the Company shall issue to the Holder, and the Holder shall acquire from the Company, the

Exchange Shares.

2.00 Piggyback Registration Rights.

2.01 Piggyback

Registration Rights. The Company will notify the Holder in writing at least thirty (30) days prior to filing any registration

statement under the Securities Act of 1933, as amended (the “Securities Act”) for purposes of effecting a public

offering of securities of the Company (including, but not limited to, registration statements relating to secondary offerings of

securities of the Company, but excluding registration statements relating to any demand or Form S-3 registration or to any employee

benefit plan or a corporate reorganization) and will afford the Holder an opportunity to include in such registration statement all

or any part of the Exchange Shares then held by the Holder. The Holder, if they desire to include in any such registration statement

all or any part of the Exchange Shares held by the Holder will, within twenty (20) days after receipt of the above-described notice

from the Company, so notify the Company in writing, and in such notice will inform the Company of the number of Exchange Shares such

Holder wishes to include in such registration statement. If the Holder decides not to include all of its Exchange Shares in any

registration statement thereafter filed by the Company, such Holder will nevertheless continue to have the right to include any

Exchange Shares in any subsequent registration statement or registration statements as may be filed by the Company with respect to

offerings of its securities, all upon the terms and conditions set forth herein.

2.02 Underwriting. If

a registration statement under which the Company gives notice under Section 2.01 is for an underwritten offering, then the Company

will so advise the Holder. In such event, the right of any of the Holder’s Exchange Shares to be included in a registration

pursuant to Section 2.01 will be conditioned the such Holder’s participation in such underwriting and the inclusion of the

Holder’s Exchange Shares in the underwriting to the extent provided herein. The Holder, if proposing to distribute their

Exchange Shares through such underwriting, will enter into an underwriting agreement in customary form with the managing underwriter

or underwriter(s) selected for such underwriting. Notwithstanding any other provision of this Agreement, if the managing

underwriter(s) determine(s) in good faith that marketing factors require a limitation of the number of shares to be underwritten,

then the managing underwriter(s) may exclude shares (including Exchange Shares) from the registration and the underwriting, and the

number of shares that may be included in the registration and the underwriting will be allocated, first, to the Company, and second,

to the Holder, if requesting inclusion of their Exchange Shares in such registration statement. If the Holder disapproves of the

terms of any such underwriting, the Holder may elect to withdraw therefrom by written notice to the Company and the underwriter,

delivered at least ten (10) business days prior to the effective date of the registration statement. Any Exchange Shares excluded or

withdrawn from such underwriting will be excluded and withdrawn from the registration.

2.03 Furnish Information. It will be a condition precedent to

the obligations of the Company to take any action pursuant to Section this Section 2.00 hereof that the Holder will furnish to the Company

such information regarding themselves, the Exchange Shares held by them and the intended method of disposition of such securities as will

be required to timely effect the registration of their Exchange Shares.

2.04 Delay of Registration. The Holder will have no right to

obtain or seek an injunction restraining or otherwise delaying any such registration as the result of any controversy that might arise

with respect to the interpretation or implementation of this Section 2.00.

3.00 Representations of the Company. The Company hereby represents

and warrants to the Holder that:

3.01 Organization and Corporate Power. The Company is a corporation,

which is duly organized, validly existing and in good standing under the laws of Delaware and is qualified to do business in every jurisdiction

in which its ownership of property or conduct of business requires it to qualify. The Company has all requisite power and authority and

all material licenses, permits and authorizations necessary to own and operate its properties and to carry on its business as now conducted

and presently proposed to be conducted, and all requisite power and authority to carry out the transactions contemplated by this Agreement.

3.02 No Conflicts. The execution, delivery and performance of

this Agreement and the consummation by the Company of the transactions contemplated hereby do not violate, conflict with or constitute

a default under (i) the Certificate of Incorporation or Bylaws of the Company, (ii) any agreement, indenture or instrument to which the

Company is a party, or (iii) any law, statute, rule or regulation to which the Company is subject, or any agreement, order, judgment or

decree to which the Company is subject.

3.03 Title to Exchange Shares. Upon issuance in accordance with

the terms hereof, the Holder will have or receive good title to the Exchange Shares, free and clear of all liens, claims and encumbrances

of any kind, other than (a) transfer restrictions hereunder and other agreements to which the Exchange Shares may be subject which have

been notified to the Holder in writing, (b) transfer restrictions under federal and state securities laws, and (c) liens, claims or encumbrances

imposed due to the actions of the Holder.

3.04 No Adverse Actions.

There are no actions, suits, investigations or proceedings pending, threatened against or affecting the Company which: (i) seek to

restrain, enjoin, prevent the consummation of or otherwise affect the transactions contemplated by this Agreement or (ii) question the

validity or legality of any transactions contemplated by this Agreement or seeks to recover damages or to obtain other relief in connection

with such transactions.

4.00 Representations of the Holder. As a material inducement

to the Company to enter into this Agreement, the Holder hereby represents and warrants to the Company and agrees with the Company as follows:

4.01 No Government Recommendation or Approval. The Holder understands

that no federal or state agency has passed upon or made any recommendation or endorsement of the offering of the Exchange Shares.

4.02 No Conflicts. The execution, delivery and performance of

this Agreement and the consummation by Holder of the transactions contemplated hereby do not violate, conflict with or constitute a default

under (i) the formation and governing documents of Holder, if applicable, (ii) any agreement, indenture or instrument to which Holder

is a party or (iii) any law, statute, rule or regulation to which Holder is subject, or any agreement, order, judgment or decree to which

Holder is subject.

4.03 Organization and Authority. The Holder possesses all requisite

power and authority necessary to carry out the transactions contemplated by this Agreement. Upon execution and delivery by Holder, this

Agreement is a legal, valid and binding agreement Holder, enforceable against Holder in accordance with its terms, except as such enforceability

may be limited by applicable bankruptcy, insolvency, fraudulent conveyance or similar laws affecting the enforcement of creditors’

rights generally and subject to general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in

equity).

4.04 Experience, Financial Capability and Suitability. Holder

is: (i) sophisticated in financial matters and is able to evaluate the risks and benefits of the investment in the Exchange Shares and

(ii) able to bear the economic risk of its investment in the Exchange Shares for an indefinite period of time because the Exchange Shares

have not been registered under the Securities Act and therefore cannot be sold unless subsequently registered under the Securities Act

or an exemption from such registration is available. Holder is capable of evaluating the merits and risks of its investment in the Company

and has the capacity to protect its own interests. Holder must bear the economic risk of this investment until the Exchange Shares are

sold pursuant to: (i) an effective registration statement under the Securities Act or (ii) an exemption from registration available with

respect to such sale. Holder is able to bear the economic risks of an investment in the Exchange Shares and to afford a complete loss

of such Holder’s investment in the Exchange Shares.

4.05 Accredited Investor. Holder represents that it is an “accredited

investor” as such term is defined in Rule 501(a) of Regulation D under the Securities Act and acknowledges the sale contemplated

hereby is being made in reliance on a private placement exemption to “accredited investors” within the meaning of Section

501(a) of Regulation D under the Securities Act or similar exemptions under state law.

4.06 Investment

Purposes. Holder is acquiring the Exchange Shares solely for investment purposes, for Holder’s own account and not for the

account or benefit of any other person, and not with a view towards the distribution or dissemination thereof. Holder did not decide

to enter into this Agreement as a result of any general solicitation or general advertising within the meaning of Rule 502 under the

Securities Act.

4.07 Restrictions on Transfer. Holder understands the Exchange

Shares are being offered and issued in a transaction not involving a public offering within the meaning of the Securities Act (including,

without limitation, Section 4(a)(2) and/or Regulation 506(b)). Holder understands the Exchange Shares will be “restricted securities”

within the meaning of Rule 144(a)(3) under the Securities Act, and Holder understands that the certificates or book-entries representing

the Exchange Shares will contain a legend in respect of such restrictions. If in the future Holder decides to offer, resell, pledge or

otherwise transfer the Exchange Shares, such Exchange Shares may be offered, resold, pledged or otherwise transferred only pursuant to:

(i) registration under the Securities Act, or (ii) an available exemption from registration. Holder agrees that if any transfer of its

Exchange Shares or any interest therein is proposed to be made, as a condition precedent to any such transfer, Holder may be required

to deliver to the Company an opinion of counsel satisfactory to the Company. Absent registration or an exemption, Holder agrees not to

resell the Exchange Shares.

4.08 No Governmental Consents. No governmental, administrative

or other third party consents or approvals are required, necessary or appropriate on the part of Holder in connection with the transactions

contemplated by this Agreement.

4.09 No Bad Actor. Holder hereby represents that none of the

“Bad Actor” disqualifying events described in Rule 506(d)(1)(i) to (viii) under the Securities Act (a “Disqualification

Event”) is applicable to Holder or any of its Rule 506(d) Related Parties (as defined below), except, if applicable, for a Disqualification

Event as to which Rule 506(d)(2)(ii) or (iii) or (d)(3) is applicable. Holder hereby agrees that it shall notify the Company promptly

in writing in the event a Disqualification Event becomes applicable to Holder or any of its Rule 506(d) Related Parties, except, if applicable,

for a Disqualification Event as to which Rule 506(d)(2)(ii) or (iii) or (d)(3) is applicable. For purposes of this paragraph, “Rule

506(d) Related Party” shall mean a person or entity that is a beneficial owner of the Holder’s securities for purposes of

Rule 506(d) of the Act.

4.10 Anti-Terrorism.

Holder is not an individual, corporation, partnership, joint venture, association, joint stock company, trust, trustee, estate, company,

unincorporated organization, real estate investment trust, government or any agency or political subdivision thereof, or any other form

of entity (“Person”) with whom a United States citizen, entity organized under the laws of the United States or its territories

or entity having its principal place of business within the United States or any of its territories (collectively, a “U.S. Person”),

is prohibited from transacting business of the type contemplated by this Agreement, whether such prohibition arises under United States

law, regulation, executive orders and lists published by the Office of Foreign Assets Control, Department of the Treasury (“OFAC”)

(including those executive orders and lists published by OFAC with respect to Persons that have been designated by executive order or

by the sanction regulations of OFAC as Persons with whom U.S. Persons may not transact business or must limit their interactions to types

approved by OFAC, such Persons, “Specially Designated Nationals and Blocked Persons”) or otherwise. Neither Holder nor any

Person who owns an interest in Holder is a Person with whom a U.S. Person, including a United States financial institution as defined

in 31 U.S.C. 5312, as periodically amended, is prohibited from transacting business of the type contemplated by this Agreement, whether

such prohibition arises under United States law, regulation, executive orders and lists published by OFAC (including those executive

orders and lists published by OFAC with respect to Specially Designated Nationals and Blocked Persons) or otherwise.

4.11 Accredited Investor Verification. Upon request by the Company,

Holder shall deliver to the Company a letter from its legal counsel verifying its status as an accredited investor as such term is defined

in Rule 501(a) of Regulation D under the Securities Act, and such letter to be made in a form acceptable to the Company and its counsel.

4.12 Sophistication. The

Holder warrants and represents that it is sophisticated and experienced in acquiring the securities of small public companies that has

allowed it to evaluate the risks and uncertainties involved in acquiring said securities and thereby make an informed investment decision.

5.00 Restrictions on Transfer.

5.01 Securities Law Restrictions. Holder agrees not to sell,

transfer, pledge, hypothecate or otherwise dispose of all or any part of the Exchange Shares unless, prior thereto (a) such Holder received

prior written consent of the Company, (b) a registration statement on the appropriate form under the Securities Act and applicable state

securities laws with respect to the Exchange Shares proposed to be transferred shall then be effective or (c) the Company has received

an opinion from counsel reasonably satisfactory to the Company, that such registration is not required because such transaction is exempt

from registration under the Securities Act and the rules promulgated by the Securities and Exchange Commission thereunder and with all

applicable state securities laws.

5.02 Restrictive Legends. Any certificates representing the

Securities shall have endorsed thereon legends substantially as follows:

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER

THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS AND NEITHER THE SECURITIES NOR ANY INTEREST THEREIN MAY BE OFFERED,

SOLD, TRANSFERRED, PLEDGED OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT OR SUCH LAWS

OR AN EXEMPTION FROM REGISTRATION UNDER SUCH ACT AND SUCH LAWS WHICH, IN THE OPINION OF COUNSEL, IS AVAILABLE.”

6.00 Miscellaneous.

6.01 Counterparts. This Agreement may be executed in two or

more counterparts and by facsimile signature, delivery of PDF images of executed signature pages by email or otherwise, and each of such

counterparts shall be deemed an original and all of such counterparts together shall constitute one and the same agreement.

6.02 Effect of Invalidity. If any provision of this Agreement

is prohibited by law or otherwise determined to be invalid or unenforceable by a court of competent jurisdiction, the provision that would

otherwise be prohibited, invalid or unenforceable shall be deemed amended to apply to the broadest extent that it would be valid and enforceable,

and the invalidity or unenforceability of such provision shall not affect the validity of the remaining provisions of this Agreement so

long as this Agreement as so modified continues to express, without material change, the original intentions of the Parties as to the

subject matter hereof and the prohibited nature, invalidity or unenforceability of the provision(s) in question does not substantially

impair the respective expectations or reciprocal obligations of the Parties or the practical realization of the benefits that would otherwise

be conferred upon the Parties. The Parties will endeavor in good faith negotiations to replace the prohibited, invalid or unenforceable

provision(s) with a valid provision(s), the effect of which comes as close as possible to that of the prohibited, invalid or unenforceable

provision(s).

6.03 Matter of Further

Assurances & Cooperation. The Holder and the Company hereby agree and the Company further agrees that it shall provide further

assurances that it will, in the future, execute and deliver any and all further agreements, certificates, instruments and documents and

do and perform or cause to be done and performed, all acts and things as may be necessary or appropriate to carry out the intent and

accomplish the purposes of this Agreement without unreasonable delay and in no event later than one (1) business after it receives any

reasonable written request from the Holder.

6.04 Successors. The

provisions of this Agreement shall be deemed to obligate, extend to and inure to the benefit of the successors, assigns, transferees,

grantees, and indemnitees of each of the Parties to this Agreement; provided, that neither this Agreement nor any of the rights,

interests, or obligations hereunder may be assigned by either Party without the prior written consent of the other Party.

6.05 Integration. This Agreement, after full execution, acknowledgment

and delivery, memorializes and constitutes the entire agreement and understanding between the parties and supersedes and replaces all

prior negotiations and agreements of the Parties, whether written or unwritten with the exception of the Company's profit-sharing plan

and any agreements related thereto.

6.06 Severance. If any provision of this Agreement is held to

be illegal or invalid by a court of competent jurisdiction, such provision shall be deemed to be severed and deleted; and neither such

provision, nor its severance and deletion, shall affect the validity of the remaining provisions.

6.07 Governing

Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware, without

giving effect to any of the conflicts of law principles which would result in the application of the substantive law of another

jurisdiction. This Agreement shall not be interpreted or construed with any presumption against the party causing this Agreement to

be drafted.

6.08 Consent to Jurisdiction. Each of the Company and the Holder

(i) hereby irrevocably submits to the exclusive jurisdiction of the State of New York for the purposes of any suit, action or proceeding

arising out of or relating to this Agreement and (ii) hereby waives, and agrees not to assert in any such suit, action or proceeding,

any claim that it is not personally subject to the jurisdiction of such court, that the suit, action or proceeding is brought in an inconvenient

forum or that the venue of the suit, action or proceeding is improper.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, this Agreement is executed as of the date

first set forth above.

FOR THE COMPANY:

HNR ACQUISITION CORP

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| FOR THE HOLDER: |

|

| |

|

| |

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

Signature Page to Exchange Agreement

Exhibit 99.1

HNR Acquisition Corp Announces

Business Combination Approved

HOUSTON, TX / November 13, 2023 / HNR Acquisition

Corp (NYSE American: HNRA) (the “Company” or “HNRA”) a special purpose acquisition company, announced today

that its stockholders have approved the proposed business combination (the “Business Combination”) with Pogo Resources, LLC

and its subsidiaries, and to acquire the Grayburg-Jackson oil field in the prolific Permian Basin in Eddy County, New Mexico (“Pogo”)

at a special meeting of HNRA stockholders that was held on Monday November 13, 2023.

Each of the proposals presented at the special

meeting was approved, and the Business Combination is expected to be consummated as soon as practicable following the satisfaction or

waiver of the remaining closing conditions described in the proxy statement for the special meeting. Following the closing of the Business

Combination, the common stock of the Company is expected to begin trading on the NYSE American under the current symbol “HNRA”.

In connection with the meeting, stockholders

holding 4,063,777 shares out of a possible 4,509,403 shares of HNRA’s common stock (the “Public Shares”) exercised

their right to redeem their shares for a pro rata portion of the funds in HNRA’s trust account (the “Trust Account”).

The trustee of the Trust Account is calculating the final amount of the funds to be removed from the Trust Account in connection with

such redemptions, but the current preliminary calculations are that approximately $44.1 million (approximately $10.86 per Public Share)

will be removed from the Trust Account to pay such holders.

About HNR Acquisition Corp

HNRA is a blank check company (otherwise known

as a special purpose acquisition company or SPAC) formed for the purpose of effecting a merger, share exchange, asset acquisition, share

purchase, reorganization or similar business combination with one or more businesses or entities.

For more information on HNRA, the acquisition

and the transaction, please visit the Company website: https://www.hnra-nyse.com/

Forward-Looking Statements

This press release includes “forward-looking

statements” that involve risks and uncertainties that could cause actual results to differ materially from what is expected, including

the funding of the Trust Account to further extend the period for the Company to consummate an initial business combination, if needed.

Words such as “expects,” “believes,” “anticipates,” “intends,” “estimates,” “seeks,”

“may,” “might,” “plan,” “possible,” “should” and variations and similar words and expressions

are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Such forward-looking statements relate to future events or future results, based on currently available information and reflect the Company’s

management’s current beliefs. A number of factors could cause actual events or results to differ materially from the events and results

discussed in the forward-looking statements. Important factors - including the availability of funds, the results of financing efforts

and the risks relating to our business - that could cause actual results to differ materially from the Company’s expectations are disclosed

in the Company’s documents filed from time to time on EDGAR (see www.edgar-online.com) and with the Securities and Exchange Commission

(see www.sec.gov). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the

date of this press release. In addition, please refer to the Risk Factors section of the Company’s Form 10-K as filed with the SEC on

March 31, 2023 and the Risk Factors section of the preliminary proxy statement filed on Schedule 14A on September 11, 2023 for additional

information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking

statements. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new information, future events or otherwise.

Investor Relations

Michael J. Porter, President

PORTER, LEVAY & ROSE, INC.

mike@plrinvest.com

Key search words

HNRA, Pogo, oil and gas, reserves, Pogo Resources, HNR Acquisition,

Permian Basin, Eddy County, New Mexico, SPAC, HNRAW

v3.23.3

Cover

|

Nov. 13, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity File Number |

001-41278

|

| Entity Registrant Name |

HNR ACQUISITION CORP

|

| Entity Central Index Key |

0001842556

|

| Entity Tax Identification Number |

85-4359124

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3730 Kirby Drive

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77098

|

| City Area Code |

713

|

| Local Phone Number |

834-1145

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

HNRA

|

| Security Exchange Name |

NYSEAMER

|

| Redeemable warrants, exercisable for three quarters of one share of common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for three quarters of one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HNRAW

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

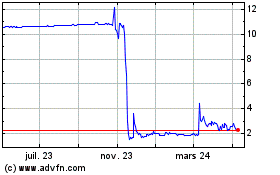

HNR Acquisition (AMEX:HNRA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

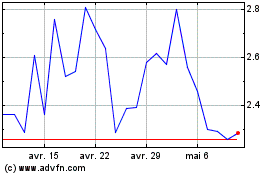

HNR Acquisition (AMEX:HNRA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025