Sky Harbour Reports Record Q1 2024 Revenues, Achieves Cash Flow Break-Even at Sky Harbour Capital and Prepares for Accelerated Construction Activity

15 Mai 2024 - 4:54AM

Business Wire

Sky Harbour Group Corporation (NYSE American: SKYH, SKYH WS)

(“SHG” or the “Company”), an aviation infrastructure company

building the first nationwide network of Home-Basing campuses for

business aircraft, announced the release of its unaudited financial

results for the quarter ended March 31, 2024 on Form 10-Q. The

Company also announced the filing of its unaudited financial

results for the quarter ended March 31, 2024 for Sky Harbour

Capital (Obligated Group) with MSRB/EMMA. Please see the following

links to access the SEC filings:

10-Q:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001823587/000143774924016606/ysac20240331_10q.htm

MSRB/EMMA:

https://emma.msrb.org/P11753880-P11348073-P11784121.pdf

Financial Highlights include:

- 2024 Q1 revenues increased 117% as compared to Q1 2023.

- 2024 Q1 SG&A expenses increased 38% as compared to Q1

2023.

- Net cash used in operating activities on a consolidated basis

during Q1 decreased from $4.5 million to $4.4 million.

- At Sky Harbour Capital (Obligated Group), cash flow provided by

operating activities reached $1.2 million, an improvement versus

$1.0 million used in operating activities during Q1 2023.

- The Company continues to maintain strong liquidity and capital

resources. As of March 31, 2024, cash, restricted cash, and US

Treasury investments amounted to approximately $160 million.

Recent noteworthy events include:

- All operating campuses are fully leased, with several

initiatives underway to surpass 100% occupancy.

- New campus at San Jose Mineta began operations and is now 58%

leased.

- Construction of Phases 1 in Denver, Phoenix, and Dallas is back

on track after previously announced delays.

Site Acquisition Update

The Company expects to have executed ground leases at four

additional airports by the end of 2024 and an additional six

airports by end of year 2025.

Construction Update

New construction managers led by COO Will Whitesell onboarded at

the Company are on track to deliver on our revised plan for

existing construction sites and ramp up development at recently

executed ground leases. Parallel initiatives are underway to reduce

costs while shortening development and construction timelines at

new projects.

Leasing Update

Sky Harbour’s first three campus phases (SGR, BNA and OPF 1) are

approximately 95% occupied. Total potential economic occupancy is

expected to exceed 100% due to successes in semi-private

leasing.

Our campus at SJC commenced operations on April 1, 2024, and is

approximately 58% leased. SJC tenant rents are reflective of Sky

Harbour’s tier-1 target markets, with revenues from certain initial

tenants exceeding $80 per rentable square foot.

CEO Remarks

Tal Keinan, Chairman and Chief Executive Officer, commented on

2024 Q1 results and other recent events:

“Sky Harbour continues to execute its 2024 business plan on

pace. Our Site Acquisition team’s focus is tier-1 airports. Our

Development team’s focus is process-standardization to expand

capacity and pursue economies of scale. Our Airfield Operations

team is refining Sky Harbour’s highly-differentiated

Resident-centric service offering. We expect the results of these

efforts to become manifest over the coming quarters.”

2024 Q1 Webcast Conference Replay Link

https://events.q4inc.com/attendee/458580371

About Sky Harbour Group Corporation

Sky Harbour Group Corporation is an aviation infrastructure

company developing the first nationwide network of Home-Basing

campuses for business aircraft. The company develops, leases and

manages general aviation hangars across the United States. Sky

Harbour’s Home-Basing offering aims to provide private and

corporate customers with the best physical infrastructure in

business aviation, coupled with dedicated service tailored to based

aircraft, offering the shortest time to wheels-up in business

aviation. To learn more, visit www.skyharbour.group.

Forward Looking Statements

Certain statements made in this release are "forward looking

statements" within the meaning of the "safe harbor" provisions of

the United States Private Securities Litigation Reform Act of 1995,

including statements about the financial condition, results of

operations, earnings outlook and prospects of SHG may include

statements for the period following the first quarter of 2024. When

used in this press release, the words “plan,” “believe,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,”

“project,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict,” “should,” “would” and other similar words

and expressions (or the negative versions of such words or

expressions) are intended to identify forward-looking statements,

but the absence of these words does not mean that a statement is

not forward-looking. The forward-looking statements are based on

the current expectations of the management of SHG as applicable and

are inherently subject to uncertainties and changes in

circumstances and their potential effects and speak only as of the

date of such statement. There can be no assurance that future

developments will be those that have been anticipated. These

forward-looking statements involve a number of risks, uncertainties

or other assumptions that may cause actual results or performance

to be materially different from those expressed or implied by these

forward-looking statements. These risks and uncertainties include,

but are not limited to, those discussed and identified in the

public filings made or to be made with the SEC by SHG, including

the filings described above, regarding the following: expectations

regarding SHG’s strategies and future financial performance,

including its future business plans, expansion plans or objectives,

prospective performance and opportunities and competitors,

revenues, products and services, pricing, operating expenses,

market trends, liquidity, cash flows and uses of cash, capital

expenditures, and SHG’s ability to invest in growth initiatives;

SHG’s ability to scale and build the hangars currently under

development or planned in a timely and cost-effective manner; the

implementation, market acceptance and success of SHG’s business

model and growth strategy; the success or profitability of SHG’s

hangar facilities; SHG’s future capital requirements and sources

and uses of cash; SHG’s ability to obtain funding for its

operations and future growth; developments and projections relating

to SHG’s competitors and industry; the ability to recognize the

anticipated benefits of the business combination; geopolitical risk

and changes in applicable laws or regulations; the possibility that

SHG may be adversely affected by other economic, business, and/or

competitive factors; operational risk; risk that the COVID-19

pandemic, and local, state, and federal responses to addressing the

pandemic may have an adverse effect on SHG’s business operations,

as well as SHG’s financial condition and results of operations.

Should one or more of these risks or uncertainties materialize or

should any of the assumptions made by the management of SHG prove

incorrect, actual results may vary in material respects from those

projected in these forward-looking statements. SHG undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514162560/en/

SKYH Investor Relations: investors@skyharbour.group Attn:

Francisco X. Gonzalez, CFO

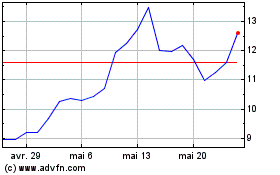

Sky Harbour (AMEX:SKYH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Sky Harbour (AMEX:SKYH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025