TIDMALSP

RNS Number : 7615D

Ace Liberty & Stone PLC

21 October 2022

THE INFORMATION CONTAINED IN THIS ANNOUNCEMENT IS INSIDE

INFORMATION FOR

THE PURPOSES OF ARTICLE 7 OF REGULATION 596/2014

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS

RESTRICTED AND IT

IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY

OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, JAPAN, THE

REPUBLIC OF

SOUTH AFRICA OR AUSTRALIA OR ANY OTHER STATE OR JURISDICTION IN

WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL

Ace Liberty and Stone plc

("Ace" or "the Company")

Proposed Open Offer of up to 18,238,835 New Ordinary Shares at

25 pence per share

Ace Liberty and Stone Plc (AQSE: ALSP), the active property

investment company capitalising on commercial property investment

opportunities across the UK, is pleased to announce that it will

raise up to GBP4,559,708.75 (before fees and expenses) through an

Open Offer by way of the issue of New Ordinary Shares at an Issue

Price of 25 pence per New Ordinary Share. The Issue Price

represents an approximate 60.09 per cent. Discount to the Closing

Price of 64 pence per Ordinary Share on the Latest Practicable

Date. The New Ordinary Shares will automatically be admitted to

trading on the AQSE Growth Market following an announcement by the

Company confirming completion of the Open Offer. It is expected

that Admission will occur on 30 November 2022.

The Open Offer is conditional, inter alia, on the passing of the

Resolutions by Shareholders at the General Meeting, which is to be

held at 11.00am on 16 November 2022 at Finsgate, 5-7 Cranwood

Street, London, EC1V 9EE. The Resolutions are set out in the Notice

of General Meeting being posted to shareholders today.

The Open Offer is being made on the basis that there is no

minimum subscription amount, and accordingly applications may be

accepted and New Ordinary Shares may be allotted notwithstanding

that the Open Offer is not subscribed for in full.

If the Resolutions to be proposed at the General Meeting are not

passed, the Open Offer will not proceed. Those who have applied for

Offer Shares will have their application and the amounts subscribed

for Offer Shares returned.

Each Qualifying Shareholder will be entitled to apply for

additional Offer Shares under the Excess Application Facility. The

entitlement to Excess Shares is subject to the total number of

Offer Shares for which applications are received during the Offer

Period not being greater than the maximum of 18,238,835 New

Ordinary Shares, in which case the Excess Shares for which

Qualifying Shareholders have applied will be scaled back in

proportion to the respective numbers of Offer Shares of those who

have applied for Excess Shares.

The funding will be used to allow the Company to start

implementing the strategy to acquire additional properties as set

out in the section headed Background to and Reasons for the Open

Offer below. The proposals allow existing shareholders to

participate in the fundraising in order to raise equity for the

implementation of this strategy in a cost-effective manner.

The terms and conditions of the Open Offer, including the Excess

Application Facility, will be set out in the circular to

Shareholders. The circular to Shareholders will set out the reasons

for the Open Offer and provide further information on the Open

Offer. It is expected that the circular to Shareholders will be

posted on 21 October 2022 and will also be available on the

Company's website, https://acelibertyandstone.com/. Terms used in

this announcement have the same meanings as set out in the Open

Offer circular unless otherwise defined herein.

Background to and reasons for the Open Offer

The impact of Covid 19 in the period since March 2020 has

resulted in very difficult trading conditions for all companies.

Ace has performed well with a low level of defaults from tenants

and minimal concessions to enable tenants to continue trading. In

many cases, concessions to tenants have been compensated by

improvements to the lease terms which will benefit the Company in

the medium to long term. Where tenants have needed short term

support by deferring rental payments, this has been concluded and

all receipts are now up to date.

During the same period, the Company has repaid the maturing loan

from Lloyds Banking Group with the proceeds of a new facility with

Coutts and Co. This establishes Coutts as the Company's sole

provider of secured finance and is a welcome confirmation of

support which has been in place since 2019.

During the re-finance process, four properties were sold and the

proceeds used to temporarily reduce borrowings. Following the

drawdown of the new loan at a higher Loan to Value ratio, these

funds are available for the acquisition of new properties.

The Company is in a strong position with a good level of rental

income and a portfolio of properties which has potential for a

further increase in capital value.

International events, as well as the UK political and economic

situation, have created a very uncertain economic situation. The

directors believe this will open up opportunities to acquire

high-yielding properties to strengthen the portfolio and provide

income for the coming years

The directors are conscious of the support provided by

shareholders and believe it is right and fair to offer the

opportunity to participate at the present time on advantageous

terms.

The Board acknowledges the importance of the continuing support

of shareholders. The Open Offer gives smaller Shareholders the

opportunity to participate in the fundraising. The Open Offer also

enables all Qualifying Shareholders to participate in the

fundraising on a pro rata basis and with the ability to apply for

Offer Shares in addition to their proportionate entitlement.

Accordingly, the Directors believe that an Open Offer of New

Ordinary Shares is in the best interests of the Company and

Shareholders as the funds raised should enable the Company to

progress with its strategy to grow the value of the portfolio of

investment properties.

Current trading and outlook

The Company has recently published its results for the year

ended 30 April 2022 which show an increase in profit before tax of

49% compared to the previous year. The accounts show profit before

tax for the year ended 30 April 2022 of GBP2,066,232 compared to

GBP1,386,072 for the comparative period a year earlier. This was

achieved by a reduction in administration and finance costs which

more than offset the slightly lower rental income resulting from

the property sales. Shareholders' funds at 30 April 2022 were up

5.6% from GBP32,196,180 to GBP33,988,485. Furthermore the balance

sheet at 30 April 2022 shows a reduction in the debt to equity

ratio from 176% in 2021 to 132%.

Based on these results, the directors proposed a dividend of 3.4

pence per share payable on or about 21 October 2022, the first such

payment for three years. With the conclusion of the re-finance and

resumption of normal, post-Covid, trading, it is expected that

dividends will continue to be paid dependent of profits earned and

cash generated.

Use of Proceeds

The Company is seeking up to GBP4,559,708.75 to continue to

build its portfolio of properties with good rental income, sound

covenants and potential for capital value increases. The directors

are in continuous touch with the commercial property market and

constantly receive approaches for purchase and sale transactions.

These are evaluated and pursued depending on the quality of the

opportunity and available funds. It is not possible to specify

which properties are to be purchased once the additional funding is

available. The amount that is raised by way of the Open Offer will

put the Company in a better position to take advantage those

opportunities that are most attractive. Future purchases will be

consistent with the existing successful strategy; all property

transactions are announced on the AQSE Growth Market.

Intentions of the Directors in relation to the Open Offer

The Directors intend to take up their Open Offer Entitlements

(relating to Existing Ordinary Shares held by them in their own

name or for which they are beneficial owners (e.g. held in a

nominee account)) in full and subscribe for shares in the Excess

Application Facility to subscribe for an aggregate of 1,021,192

Open Offer Shares as set out below:

Open Offer Entitlement Excess Application Total Number

Shares Facility of Open Offer

Directors Shares

Dr Tony Ghorayeb

(Non-Executive Chairman) 115,095 115,095 230,190

----------------------- ------------------- ---------------

Ismail Ghandour

(Chief Executive) 12,493 12,493 24,986

----------------------- ------------------- ---------------

Ivan Minter (Chief

Financial Officer) 6,781 6,781 13,562

----------------------- ------------------- ---------------

Keith Pankhurst

(Senior Independent

Director) 32,310 32,310 64,620

----------------------- ------------------- ---------------

Kayssar Ghorayeb

(Non-Executive Director) 63,230 63,230 126,460

----------------------- ------------------- ---------------

Hikmat El-Rousstom

(Non-Executive Director) 280,687 280,687 561,374

----------------------- ------------------- ---------------

Expected Timetable of Events

Record Date for entitlement to participate 6.00 p.m. on 20 October

in the Open Offer 2022

Announcement of the General Meeting and

Open Offer and dispatch of the Circular 21 October 2022

and the Application Form

Expected ex-entitlement date for the 8.00 a.m. on 21 October

Open Offer 2022

Basic Entitlements and Excess Open Offer 8.00 a.m. on 24 October

Entitlements credited to Stock Accounts 2022

in CREST of Qualifying CREST Shareholders

Recommended latest time for requesting 4.30 p.m. on 8 November

withdrawal of Basic Entitlements and 2022

Excess Open Offer Entitlements from CREST

Latest time for depositing Basic Entitlements 3.00 p.m. on 9 November

and Excess Open Offer Entitlements into 2022

CREST

Latest time and date for splitting Application

Forms 3.00 p.m. on 10 November

(to satisfy bona fide market claims only) 2022

Latest time and date for receipt of completed

Application Forms 11.00 a.m. on 14 November

and payment in full under the Open Offer 2022

or settlement of relevant CREST instructions

(as appropriate)

Latest time and date for receipt of completed 11.00 a.m. on 14 November

Forms of Proxy or receipt of CREST Proxy 2022

Instructions for the General Meeting

General Meeting 11.00 a.m. on 16 November

2022

Allotment of New Ordinary Shares 8.00 a.m. on 30 November

2022

Admission of the New Ordinary Shares

to trading on 8.00 a.m. on 30 November

AQSE Growth Market 2022

Expected date of dispatch of definitive

share certificates for the by 6 December 2022

New Ordinary Shares in certificated form

(certificated holders only)

Admission, Settlement and dealings

The result of the Open Offer is expected to be announced on 30

November 2022. Admission to trading of the New Ordinary Shares on

the AQSE Growth Market will take place automatically following an

announcement by the Company confirming completion of the Open

Offer. It is expected that Admission will become effective and that

dealings in the Open Offer Shares, fully paid, will commence at

8.00 a.m. on 30 November 2022.

Ismail Ghandour, Chief Executive Officer, commented:

"The directors believe the current political and economic

turmoil in the UK will create opportunities for worthwhile property

investment. Ace is a strong, well-positioned group which, following

a successful Open Offer, will have a war chest to enable it to

respond quickly to market changes for the long term benefit of

shareholders."

-ends-

For further information, please contact:

Ace Liberty & Stone Plc

Ivan Minter, Financial Director Tel: +44 (0) 20 7201 8340

http://acelibertyandstone.com

Alfred Henry Corporate Finance

Ltd,

AQSE Growth Market Corporate Adviser

Jon Isaacs / Nick Michaels Tel: +44 (0) 20 3772 0021

www.alfredhenry.com

SP Angel Corporate Finance LLP

Broker

Vadim Alexandre / Rob Rees Tel: +44 (0)20 3470 0470

www.spangel.co.uk

- ends -

The Directors accept responsibility for this announcement.

Notes to Editors

Ace Liberty & Stone Plc is a property investment company

with a diverse portfolio of properties located across the UK,

predominantly in the midlands and north of England, which are now

the focus of Government incentives. The Company locates commercial

properties which have creditworthy tenants, several years' rental

income and the potential for an increase in value through creative

asset management activity, such as change of tenancy, change of use

or new lease negotiation. Ace has maintained a track record of

generating strong profits at disposal of properties and achieving

better-than average returns on capital. With strong support from

shareholders and mortgage lenders, the Company is currently seeking

to deploy its strong balance sheet and is seeking further

investment opportunities in the UK to create value for existing and

new investors.

Ace is run by a board with extensive property experience, an

excellent network of contacts and relevant professional

qualifications. This sector expertise has allowed the Board to

identify opportunities and act promptly to secure investments.

For more information on the Company please visit

www.acelibertyandstone.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXMBBJTMTITBTT

(END) Dow Jones Newswires

October 21, 2022 09:46 ET (13:46 GMT)

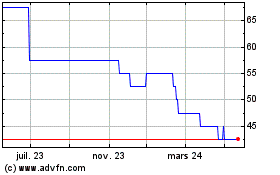

Ace Liberty & Stone (AQSE:ALSP)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Ace Liberty & Stone (AQSE:ALSP)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025