TIDMKZG

RNS Number : 9809E

Kazera Global PLC

05 July 2023

5 July 2023

Kazera Global plc ("Kazera" or "the Company")

Corporate And Operational Update

Kazera Global plc, the AIM-quoted investment company, is pleased

to provide an update on key corporate and operational

developments.

Highlights

-- Strategic shareholder African Mineral Sands Pte Ltd Singapore

("AMS") purchased a further tranche of Kazera's Ordinary shares

from an existing shareholder at 1.5p per share, triggering the

transfer of voting rights to AMS over 29.9% of the Company's

Ordinary Shares currently in issue

-- Pilot plant at Whale Head Minerals showing very promising

Heavy Mineral Sand ("HMS") results with sample and test results

forming the basis for informed strategic discussions with potential

offtake partners

-- HMS samples indicate presence of higher value minerals

including rutile, zircon, and monazite . Samples identified to have

raised levels of radioactivity and the Company has engaged with the

National Nuclear Regulator to determine whether any specific

permitting is required

-- Aggregate proceeds received to date of US$4.2 million f rom

Hebei Xinjian Construction ("Xinjian") in respect of the sale of

African Tantalum (Pty) Ltd in Namibia ("Aftan") , as announced on

22 December 2022 . The s ituation remains under review

-- Strengthened relationship and cooperation with Alexkor RMC JV

("Alexkor RMC JV"), a joint venture between Alexkor and the

Richtersveld Mining Company, a company formed to represent the

interests of Alexkor and the Richtersveld community

-- New heavy equipment on site at Deep Blue Minerals diamond

project , providing greater flexibility on mining locations

Dennis Edmonds, Kazera Chief Executive Officer, commented: " The

Company continues to make significant progress at both a corporate

and operational level. Of particular importance is the increased

cooperation and positive relationship between Kazera's subsidiaries

and Alexkor RMC JV , as we work together to create job

opportunities for the local Richtersveld Community.

"The completion of the acquisition of a further tranche of

Kazera shares by AMS is also a significant , positive development

for Kazera . AMS now holds voting rights through shares it has

acquired to date, and via agreements with Catalyse Capital Ltd and

its related parties, of more than 29.9% of the shares in the

Company. Kazera has already begun exploring potential new

investment opportunities put forward to the Company by AMS.

"Whilst the presence of radiation in HMS samples may be seen by

some as an issue, it is a situation that is not uncommon in the

Heavy Mineral Sands sector and has , equally importantly, helped

highlight the presence of higher value minerals in our HMS samples.

The detailed baseline study that has been conducted and other

associated work will allow us to seek clarification on permitting,

as well as tailor our operations and inform our approach to

environmental management and rehabilitation. Whilst on a basic

level any delay is frustrating, the testing and sampling work we

have undertaken has highlighted the economic case for separation as

it will ultimately result in the sale of higher value HMS

constituents, rather than a lower price for the basic HMS

product.

"We will ensure we use the time (whilst gaining clarification

from the relevant authority) to continue with the procurement of

equipment, site preparation and construction, and in progressing

discussions with potential offtake partners , so that we put

ourselves in the strongest possible position for the commencement

of HMS sales ."

New Strategic Shareholder

The Company was notified on 29 June 2023 that African Mineral

Sands Pte Ltd Singapore ("AMS") has completed the purchase of a

further tranche of shares from Catalyse Capital Ltd and its related

parties, including R S & C A Jennings and Align Research Ltd,

and that the completion of this tranche means that voting rights

over all shares still owned by Catalyse Capital Ltd and its related

parties have transferred to AMS.

As per the terms of the transaction referenced in the Company's

RNS dated 16 March 2023 , AMS is purchas ing up to 280 million

Ordinary Shares (representing up to 29.9 % o f the Ordinary Shares

currently in issue) in a series of tranches during 2023 at a price

of 1.5p per Ordinary Share.

The completion of this tranche of shares means AMS now owns

60,00,000 Ordinary Shares in the Company representing 6.4% of

Ordinary Shares in issue.

AMS and its associated partners have extensive experience in

mining and infrastructure projects in Southern Africa and the

Company believes the addition of AMS as a strategic investor is a

positive development, which will provide Kazera with new

opportunities for growth and development. AMS and its partners have

been investors and offtake partners in the HMS business over the

past five years.

Whale Head Minerals ("WHM") (60% interest) - Heavy Mineral

Sands

The Company continues to make good progress on the Heavy Mineral

Sands("HMS") project at Walviskop. The pilot plant, which

incorporates an HMS circuit and double decker Horizontal Vibrating

Screen, was installed in May 2023 and testing has revealed very

promising results which the Company has been continually including

in process alternatives, whilst also allowing the Company to

determine the exact make-up of its HMS and guide its initial

thinking on processing plant design.

Samples and test results from the pilot plant have also formed

the basis for informed strategic discussions with industry experts

and off-take partners on the short and long term potential of the

Company's HMS. From these discussions, initial findings suggest

that the Company's HMS has a heavy mineral content of approximately

62%, with around 55% of the resources classified as "saleable heavy

minerals". Indicative pricing for the basic (unseparated) product

is $160 per ton, but by undertaking further separation the price is

expected to be approximately double this whilst, importantly,

transport costs would remain at the same.

During the Company's testing, several samples were identified to

have raised levels of radioactivity resulting from the presence of

minerals such as rutile, zircon, and monazite, which typically have

a much higher commercial value than ilmenite. Whilst radioactivity

in HMS is not an uncommon occurrence, it does mean that the Company

has engaged with the National Nuclear Regulator ("NRR") to

determine whether any specific permitting is required prior to the

production and sale of the Company's HMS products.

To guide this discussion and any possible application for

exemption / additional permitting, a comprehensive baseline study

of radioactivity has been conducted across all areas of Walviskop,

including areas where the Company's HMS will be stored, processed,

and transported. In addition, a Workers Safety Report and Operating

Procedures are being compiled by a third party and should be

completed by mid-August 2023 at the latest.

If a permit is required, the application could take between

three and nine months whereupon the Company will immediately

commence production and sales of the higher value HMS products.

The Company is using this time to undertake more sampling to

confirm previous results and continue construction and area

preparation for both the plants in Walviskop Bay. This includes the

erection of a Trommel screening plant which is under construction

by a third party in South Africa and remains on track for

completion by the end of September 2023.

Further, the Company is in the process of creating drying,

bagging, and loading facilities within a secure area recently

supplied to the Company by Alexkor RMC JV. Alexkor RMC JV

recognises the value of the project in terms of opportunities for

the local community and the Company's increasingly positive and

collaborative relationship with Alexkor RMC JV has also resulted in

it being provid ed administration buildings, entrance /exit facilit

ies and a sheltered and secure workshop facility for the repair,

maintenance and storage of the Company's plant and machinery.

The provision of these secure sites and facilities will benefit

both the Company's HMS operation and diamond project and should

result in significant cost savings going forward.

Sale of Aftan

Under the terms of the agreement announced on 20 December 2022

in respect of the sale of the Company's interest in Aftan (the

"Agreement"), Xinjian was due to have paid US$3.0 million not later

than 31 January 2023 and a further US$3.1 million (excluding

interest) by the end of June 2023 (aggregate c.$6.1 million).

To date, Hebei Xinjian Construction ("Xinjian") has arranged

aggregate payments of US$4.2 million (including c.US$0.6 million

deemed to have been paid in respect of a Contribution and Exclusive

Marketing and Sales Agency Agreement).

Xinjian is currently not in compliance with the Agreement, with

payment arrears of c.US$1.9 million (excluding interest).

Nonetheless, at this time the Company has elected not to exercise

its contractual rights to terminate the contract given that:

-- Under the terms of the sale agreement with Xinjian, Kazera

retains ownership of 100% of the shares in Aftan as security until

all amounts owed by Xinjian have been paid in full.

-- All ongoing operation costs in respect of the Aftan business

have been borne by Xinjian since the beginning of 2023

-- Communication between Kazera and Xinjian remains positive and

constructive, with the Company believing that outstanding balances

will be forthcoming

-- Outstanding balances are accruing interest at a rate of 8% per annum.

Nonetheless, the Company is also exploring alternatives avenues

for the future of Aftan should Xinjian not be able to fulfil its

contractual obligations, including seeking an alternative

buyer.

Payments from Xinjian to date have been received, and are held

in, multiple currency denominations. In determining the amounts

stated as received, the Company has applied the exchange rate of

18.8275 being the NAD:USD exchange rate quoted as at 30 June 2023.

The weighted average exchange rate quoted for the period, was

17.6212. The exchange rate quoted on a given date is not usually

the actual exchange rate achieved.

Deep Blue Minerals (60% interest) - Diamonds

The Company has purchased new heavy plant, including a F ront -

end L oader and a 75 ton L ow-bed transporter, to allow the sharing

of equipment between Deep Blue Minerals' diamond project and Whale

Head Minerals' HMS project . Whist clarification is sought on the

next steps on its HMS project , this equipment will be used to

target areas which contain prospective high quantities of diamond

gravel.

Deep Blue Minerals will then bring in its 70 ton excavator to

remove overburden , which is several meters deep in places, and

move it on to do the same at the next site. A smaller excavator

will then follow to remove the gravels and place them in Deep Blue

Minerals ' screening proces s, which is now in operation, with

screened product then being subject to secondary screening at

Alexkor RMC JV' Muisvlak plant befo re going to the Final Sorting

Plant in Alexander Bay .

The Company believes that t his will create a very

cost-effective approach to focussing on potentially rich diamond

deposits which the Company anticipates will contribute

substantially to cashflow and cover operating costs of WHM.

In the meantime, diamond production continues from the existing

site and plant with processing of DMS concentrates being undertaken

a t Muisvlak , for final sorting at Alexkor. The most recent

Alexkor cycle close d on 4 July 2023 ; processed diamond stocks

will now be sold by Alexkor on open tender, on behalf of Deep Blue

Minerals , per Alexkor's usual process.

ENDS

For further information on the Company, visit: www. kazeraglobal

.com

Kazera Global plc (c/o St Brides) kazera@stbridespartners.co.uk

Dennis Edmonds (CEO)

finnCap (Nominated Adviser and Broker)

Christopher Raggett / Fergus Sullivan Tel: +44 (0)207 220 0500

(Corporate Finance)

St Brides (PR)

Paul Dulieu / Isabel de Salis / kazera@stbridespartners.co.uk

Susie Geliher

Notes

Kazera is a global investment company focused on developing

early-stage assets towards meaningful cashflow and production in

the resource sector. Its current assets include a diamond mine and

heavy mineral sands production in South Africa. The Company intends

to leverage its unique board expertise, investment capability and

operational proficiency, to facilitate exceptional cash generation

and shareholder growth.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAEXLEDDDEAA

(END) Dow Jones Newswires

July 05, 2023 02:00 ET (06:00 GMT)

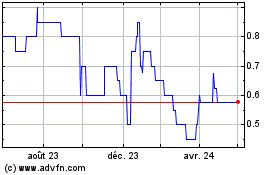

Kennedy Ventures (AQSE:KZG.GB)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Kennedy Ventures (AQSE:KZG.GB)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025