Fantom Q2 Performance: Financial Metrics React To Sonic Blockchain Anticipation

10 Août 2024 - 4:00AM

NEWSBTC

The Fantom blockchain saw mixed performance in the second quarter

(Q2) of the year, with key financial metrics cooling amid the

broader cryptocurrency market downturn and the Fantom Foundation’s

announcement to rebrand as Sonic Labs, according to a new report

from data intelligence firm Messari. FTM Market Cap, Revenue, And

Token Economics After outperforming in Q1, Fantom’s

circulating market cap decreased 41% quarter-over-quarter (QoQ)

from $2.8 billion to $1.7 billion. However, the token’s market cap

is still 94% higher year-over-year (YoY) compared to Q2 2023.

Related Reading: Dogecoin Price Could Soar 900%: Analyst Predicts

What Needs To Happen Revenue, which measures gas fees collected by

the network, fell 42% QoQ from 1.8 million FTM to 1.0 million FTM.

In USD terms, revenue decreased 38% QoQ from $1.2 million to $0.8

million. This decline follows a spike in Q3 2023 due to

activity around non-fungible token (NFT) inscriptions, but

according to Messari, revenue is expected to rebound as on-chain

activity picks up across the broader crypto space. The report also

highlights changes to Fantom’s token economics during the second

quarter. The Ecosystem Vault and Gas Monetization program were

introduced in Q4 2022, reducing the burn rate of transaction fees

from 30% to 5% and reallocating the remaining 25%. By the end

of the second quarter, the circulating supply of the protocol’s

native token FTM reached 2.8 billion, with an annualized inflation

rate of 3% – up 25% quarter-over-quarter. Fantom On-Chain Activity

Slows Fantom’s on-chain activity also trended lower in Q2. Daily

transactions averaged over 223,000, down 10% QoQ from 247,000.

Daily active addresses fell 21% QoQ to 31,900, though the report

notes a reversal of this trend towards the end of the

quarter. New address growth also slowed, dropping 47% QoQ to

5,000 per day on average. However, the report highlighted some

positive developments, including an increase in the number of

active validators on the network. Related Reading: OKX Takes

Action: Accounts Involving Tornado Cash To Be Banned After a

governance proposal reduced the staking requirement from 500,000

FTM to 50,000 FTM, the number of active validators grew 6% QoQ to

58, with 14 having less than 500,000 FTM self-staked. Staked FTM

also saw inflows for the second straight quarter, increasing 5% QoQ

to 1.3 billion tokens. But the total dollar value of staked FTM

decreased 39% QoQ to $780.4 million due to the token’s price

depreciation. Fantom’s total value locked (TVL) in decentralized

finance (DeFi) applications decreased 28% QoQ to $91.2 million,

ranking it 42nd among blockchain networks. However, TVL denominated

in FTM increased 22% QoQ, suggesting capital inflows despite the

token’s price decline. At the time of writing, FTM was trading at

$0.3345, up just 1% over the past 24 hours. In the monthly time

frame, the coin is down 27% over the past month amid the broader

market decline. Featured image from Shutterstock, chart from

TradingView.com

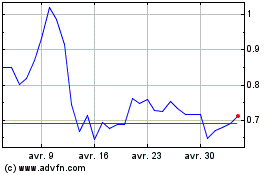

Fantom Token (COIN:FTMUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Fantom Token (COIN:FTMUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024