AP Alternative Assets, L.P. Announces the Sale of its remaining interests in Athene Holdings, Ltd and its Intention to Commen...

11 Septembre 2020 - 3:13PM

AP Alternative Assets, L.P. Announces the Sale of its remaining

interests in Athene Holdings, Ltd and its Intention to Commence a

Liquidation Process

Guernsey, Channel Islands, September 11, 2020: AP Alternative

Assets, L.P. (“AAA”; Euronext Amsterdam: AAA) announces that Athene

Holding, Ltd (“Athene”) will be repurchasing AAA’s remaining

interests in Athene as a step towards the eventual liquidation of

AAA.

The Board of Directors of AAA Guernsey Limited

(the “Board”), the general partner of AAA, has determined that as

part of the remaining steps to achieve the voluntary solvent

liquidation of AAA it has today entered into an agreement with

Athene pursuant to which Athene has agreed to purchase for cash all

of the 605,554 common shares in Athene (“Athene Shares”) indirectly

held by AAA. The purchase price per Athene Share payable by

Athene is $35.70 (which price equals the market price of the Athene

Shares as at close of trading on September 10, 2020) resulting in

an aggregate proceeds of $21,618,277.80 payable by Athene.

The proceeds of this sale will be used to settle

outstanding liabilities and expenses (including expenses relating

to ultimately winding up AAA). After payment of these expenses the

remaining cash of AAA (if any) will be distributed to AAA

unitholders (unless the cash, on a per unit basis, is de minimis,

in which case it is expected to be given to charity). This

distribution which, based on information now available to AAA, is

currently estimated to be between USD 7 cents and 9 cents per AAA

unit, is expected to be distributed to unitholders by the end of

this calendar year. A further announcement in this regard will be

made at the relevant time.

After all liabilities are settled and any

remaining assets distributed or given to charity as set out above,

it is expected that AAA will apply for the units in AAA to be

delisted from Euronext Amsterdam and AAA will subsequently be

liquidated.

This press release shall not constitute

an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About AP Alternative Assets,

L.P.

AP Alternative Assets was established by Apollo

Global Management, Inc. and its subsidiaries (“Apollo”) and is a

closed-end limited partnership established under the laws of

Guernsey. Apollo is a leading global alternative investment manager

with 30 years of experience investing across the capital structure

of leveraged companies. AAA is managed by Apollo Alternative

Assets, L.P. For more information about AP Alternative Assets,

please visit www.apolloalternativeassets.com.

|

Contact Ann Dai (New York) |

+1 (212) 822 0678 |

This announcement does not constitute or form

part of an offer to sell or solicitation of an offer to purchase or

subscribe for securities in the United States or in any other

jurisdiction.

This press release contains forward-looking

statements. Forward-looking statements involve risks and

uncertainties because they relate to future events and

circumstances. Such statements are based on currently available

operating, financial and competitive information and are subject to

various risks and uncertainties that could cause actual results and

developments to differ materially from the historical experience

and expressed or implied expectations of AAA. Undue reliance should

not be placed on such forward-looking statements. Forward looking

statements speak only as of the date on which they are made and AAA

does not undertake to update its forward-looking statements unless

required by law.

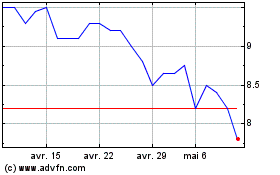

Alan Allman Associates (EU:AAA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Alan Allman Associates (EU:AAA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025