→ Birth of a new major player in enterprise software,

achieving critical scale with a bold 2025 ambition of c.€700m

revenue and c.€100m profit on operating activities1; → A

secured leadership position, with unique strengths in banking and

financial services, thanks to a diversified product portfolio

extending across geographies, clients, and industries, capturing a

variety of profitable niche markets; → A reaffirmed

pure-player vision founded on a shared DNA, driven by an

experienced management team and backed by a reference shareholding

base in support of an independent long-term company

project.

Regulatory News:

Axway (Paris:AXW) announces the successful completion of the

acquisition of Sopra Banking Software, establishing one of France's

top enterprise software publishers, with leading positions in

banking and financial services. This major step in the company's

development not only marks a change in dimension, but also

initiates a transformative alliance project aimed at delivering

substantial value to all its stakeholders.

First announced at the end of February, Axway's proposed

acquisition of Sopra Banking Software was made possible by the

successful execution of several critical operations in recent

months. With strong support from its shareholders and the addition

of new investors, over the summer the company carried out a share

capital increase with preferential subscription rights for a gross

amount of c.€131m, which it combined with the securing of new

credit facilities (c.€200m) from partner banks, in order to finance

the acquisition for an enterprise value of €330m.

The completion of Axway's acquisition of Sopra Banking Software

has received the approval of the relevant regulatory authorities

and the integration of the two entities is beginning. The latter

part of 2024 and into 2025 will be instrumental in the ramp-up of

the new Group and will enable the expected cost optimizations to

materialize.

The Group will be headed by Patrick Donovan, as CEO, and Eric

Bierry, who will take on the role of Deputy CEO.

Patrick Donovan, Chief Executive Officer, said:

" We are at a pivotal moment in our company’s history. The

completion of the tie-up between Axway and Sopra Banking Software

embodies a unique development opportunity, and the ambitious

industrial project we have been working towards can finally come to

life. We will be fully committed to this project and I am convinced

that, together, our teams will achieve outstanding success. Our

brands are strong, our flagship products are recognized among the

best in their markets, and our customer-centric business model,

refined over several years of transformation, has proven its

effectiveness. The operational work begins now, with the unwavering

priority for both Axway and Sopra Banking Software remaining, as

always, the success of our customers' projects.”

Eric Bierry, Deputy Chief Executive Officer, added:

" We are incredibly excited to be part of creating a new global

powerhouse in enterprise software. Our industry-leading technology

platforms and business software have a long and successful track

record of driving the transformation of some of the world’s largest

banking and financial institutions, and this alliance significantly

strengthens our positions, offerings, technologies and

perspectives. This operation provides a major opportunity to

accelerate our value creation for all our stakeholders through a

new Group of critical size with tenfold capabilities. I am

particularly pleased that our 5,000 employees, from 26 countries

around the world, are seeing our entrepreneurial culture thrive

through a project filled with compelling opportunities.”

Targets and Outlook

The consolidation of Sopra Banking Software is effective today

and Axway will therefore integrate the acquired activities for the

last 4 months of the 2024 financial year. On this basis, the Group

is targeting 2024 revenue of around €460m and an operating margin

of between 13% and 17%.

By 2025, pursuing its development at an annual organic growth

rate of between 2% and 4%, Axway targets revenue of around €700m

and a margin on operating activities of between 14% (around €100m)

and 16% which will reflect the full materialization of cost

optimizations, of the order of €15m, expected on a full-year 2025

basis.

By 2027, Axway ambitions to achieve revenue above €750m and a

margin on operating activities of more than 17%. By 2028, the Group

is aiming for a margin on operating activities at around 20% of

revenue.

At year-end 2024, Axway expects its net debt to EBITDA ratio to

exceed 2.5x. By the end of 2025, this ratio should be below 2.0x,

and by 2027 it is expected to be below 1.0x.

Financial Calendar

The Group will detail its medium-term strategic plan at a

Capital Markets Meeting to be held in Q1 2025, the date of which

has yet to be confirmed.

In the meantime, Q3 2024 revenue will be published on Thursday

October 24, 2024, before market opening.

About Axway

Axway enables enterprises to securely open everything by

integrating and moving data across a complex world of new and old

technologies. Axway’s API-driven B2B integration and MFT software,

refined over 20 years, complements Axway Amplify, an open API

management platform that makes APIs easier to discover and reuse

across multiple teams, vendors, and cloud environments. Axway has

helped over 11,000 businesses unlock the full value of their

existing digital ecosystems to create brilliant experiences,

innovate new services, and reach new markets.

About Sopra Banking Software

Sopra Banking Software (SBS) is a global financial technology

company that is helping banks and the financial services industry

to reimagine how to operate in an increasingly digital world. SBS

is a trusted partner of more than 1,500 financial institutions and

large-scale lenders in 80 countries worldwide. Its cloud platform

offers clients a composable architecture to digitize operations,

ranging from banking, lending, compliance, to payments, and

consumer and asset finance. SBS is recognized as a Top 10 European

Fintech company by IDC and as a leader in Omdia’s Universe: Digital

Banking Platforms.

Forward-looking statements

This document contains certain forward-looking statements about

Axway Software and its subsidiaries. These statements include

financial projections and estimates and their underlying

assumptions, statements regarding plans, objectives, intentions and

anticipated results as well as events, operations, future services

or product development and potential or future performance.

Forward-looking statements are generally identified by the words

“expects”, “anticipates”, “believes”, “intends,” “estimates,”

“anticipates,” “projects,” “seeks,” “endeavors,” “strives,” “aims,”

“hopes,” “plans,” “may,” “goal,” “objective,” “projection,”

“outlook” and similar expressions. Although the management of Axway

Software believes that these forward-looking statements are

reasonably made, investors and holders of the group’s securities

are cautioned that these forward-looking statements are subject to

a number of known and unknown risks, uncertainties and other

factors, a large number of which are difficult to predict and

generally outside the control of Axway Software, that may cause

actual results, performance or achievements to be materially

different from any future results, performance or achievement

expressed or implied by these forward-looking statements. These

risks and uncertainties include those developed or identified in

any public documents approved by the French financial markets

authority (the Autorité des marchés financiers – the “AMF”) made or

to be made by the group, in particular those described in Chapter

2.1 “Risk Factors” of the 2023 universal registration document

filed with the AMF under number D. 24-0175 on March 25, 2024 and in

Chapter 3 of the 2023 universal registration document amendment

filed with the AMF under number D. 24-0175-A01 on July 22, 2024.

These forward-looking statements are given only as of the date of

this document and Axway Software expressly declines any obligation

or commitment to publish updates or corrections of the

forward-looking statements included in this document in order to

reflect any change affecting the forecasts or events, conditions or

circumstances on which these forward-looking statements are based.

Any information relating to past performance contained herein is

not a guarantee of future performance. Nothing herein should be

construed as an investment recommendation or as legal, tax,

investment or accounting advice.

__________________________________ 1 Profit from recurring

operations adjusted for the non-cash share-based payment expense,

as well as the amortization of allocated intangible assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240902158252/en/

Investor Relations: Arthur Carli – +33 (0)1 47 17 24 65 –

acarli@axway.com

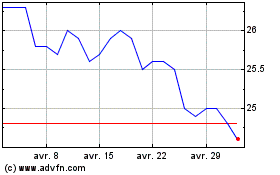

Axway Software (EU:AXW)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Axway Software (EU:AXW)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024