TIDMLTHM

RNS Number : 2949E

Latham(James) PLC

29 June 2023

James Latham plc

("James Latham" or "the Company")

Preliminary Results

Chairman's statement

I am very pleased to report excellent trading results for the

financial year to 31 March 2023. These results follow the

unprecedented trading results for the year to 31 March 2022 where

we benefitted from our strong relationships with our suppliers and

our balance sheet strength, in navigating the global supply chain

issues and significant increases in the market prices for our

products.

The financial year to 31 March 2023 saw a gradual return to more

normal market conditions, with supply chains becoming easier and

cost prices of our products stabilising. New challenges arose with

inflation increasing rapidly throughout much of the year, with

increased energy costs, due in part to the conflict in Ukraine. The

impact of inflation has been felt throughout the economy with a

reduction in both confidence levels and macroeconomic growth

forecasts. Our markets though remained resilient to these

challenges.

Revenue for the financial year to 31 March 2023 was GBP408.4m,

up 6.0% on last year's GBP385.4m. Like for like volumes taking into

account working days and acquisitions, increased by 5.3%, with the

growth mainly on delivered business from our own warehouses. The

cost price of our products is on average 6.5% higher (2022: 36.2%

higher) than at the start of the financial year.

Gross profit percentage for the financial year to 31 March 2023

was 19.6% compared with 23.8% in the previous financial year, as

the margins return to more normal levels. This figure includes

warehouse costs and seven depots now run extended shift systems to

improve our service levels.

Profit before tax is GBP44.5m, compared with last year's

GBP57.9m. Profit after tax for the year is GBP35.9m compared with

last year's GBP45.6m. Earnings per ordinary share is 179.5p

compared with last year's 229.3p.

As at 31 March 2023 net assets have increased to GBP195.9m

(2022: GBP164.0m). Inventory levels have reduced to GBP67.5m from

GBP74.2m last year as the easing of supply chain conditions meant

we could reduce the investment we made last year in additional

inventories. Trade and other receivables at the year end were

GBP1.5m lower than the previous year with debtor days remaining the

same as the previous year. Despite the challenges of the economic

environment, bad debts have remained small at 0.1% of revenues.

Cash and cash equivalents of GBP62.6m (2022: GBP37.0m) remain

strong with good cash flows from operating activities.

Final dividend

The Board has declared a final dividend of 20.8p per Ordinary

Share (2022: 19.0p) plus a special dividend of 8.0p (2022: 8.0p) to

reflect the exceptional performances both this year and the

previous year. The dividend is payable on 25 August 2023 to

ordinary shareholders on the Company's register at close of

business on 4 August 2023. The ex-dividend date will be 3 August

2023. The total dividend per ordinary share of 36.05p for the year

(2022: 33.5p) is covered 5.0 times by earnings (2022: 6.8

times).

Current and future trading

The gradual trend of a more competitive market place has

continued into the new financial year, with margins having returned

to the longer term average. We have seen price weakness in a few of

our key product areas, as the supply issues have become much

easier, but our product values are still considerably higher than

they were before the COVID-19 pandemic.

Although we have seen some weakness in prices, our manufacturers

still have significant cost pressures on raw materials, energy and

wages which should temper any price weakness. Our overall volumes

have continued to increase compared with the previous financial

year, but there has been a shift in product mix to some lower value

products, in part due to product replacement and value engineering

by our customers.

We are mindful that this year will continue to be affected by

macroeconomic concerns as the year progresses, with inflation

remaining high, and the geopolitical back drop causing uncertainty,

but the fundamentals within the majority of the market sectors in

which we operate are stable at this stage. We have a concern that

the market in Europe is quiet, and this could cause manufacturers

to export cheaper product to the UK market, and negatively affect

product values.

The group has demonstrated its ability to deliver great results

in challenging circumstances due to the ability of the team to work

together to manage the challenges, and seize opportunities as they

present themselves, and this will continue. The board is therefore

very aware that the results for the last two years have been

exceptional, and far beyond the profits earned before the start of

the COVID-19 pandemic. The board's challenge is to navigate the

business towards what is a more normal and realistic profit

achievement which takes into account the market conditions we are

operating in and the inflationary overhead pressures that all

companies are facing.

Development Strategy

Our business, like many others, have faced numerous challenges

over the past two years, and these challenges have helped the board

identify opportunities to develop the business. The service levels

and product mix that we offer our customers are becoming ever more

critical, so we are currently focusing on a comprehensive end to

end review of our supply chain in order to future proof our

business and ensure that we can meet and exceed our future customer

expectations.

We have invested in some melamine racking at IJK Timber, our

recent acquisition in Belfast, to allow them to increase their

product offering. The longer term objective is to relocate this

business to a modern facility to allow them to stock the full range

of our products and grow their market share. The Yate site

development was completed in mid August 2022, which resulted in a

25% increase in capacity that will allow the depot to further

develop the business and grow market share. Our largest timber site

in Purfleet is now operating a 24/5 warehouse which will enable

increased volumes through the business, and now seven sites are

operating 24 hours a day, 5 days a week.

During the year we will be upgrading our ERP computer system

which will create efficiencies for the business, enable us to

integrate a modern warehouse management system, and provide further

opportunities to introduce best in class computer software.

We are planning to purchase our site at Abbey Woods in Dublin in

the autumn of 2023, with the plan to modernise the site and allow

us to use part of the warehouse that was used by the previous

landlord, which will give us about 15% more capacity.

Environmental, Social and Governance (ESG) issues have always

been important to the board, and we plan to integrate our ESG

values into all of our strategic decisions and incorporate

performance measures to monitor our success. We are planning to

increase use of electric vehicles and will start adding solar

panels to our depots in order to accelerate the move to a net zero

carbon position.

The board remains focused on identifying acquisitions that

either help develop sales in specific market sectors, enable the

business to sell a wider product range to our existing customers,

or any geographical opportunities that arise.

Nick Latham

Chairman

28 June 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European (Withdrawal)

Act 2018

For further information please visit www.lathamtimber.co.uk or

contact:

James Latham plc Tel: 01442 849 100

Nick Latham, Chairman

David Dunmow, Finance Director

SP Angel Corporate Finance LLP

Matthew Johnson / Charlie Bouverat (Corporate Tel: 0203 470 0470

Finance)

Abigail Wayne / Rob Rees (Corporate Broking)

JAMES LATHAM PLC

CONSOLIDATED INCOME STATEMENT

For the year to 31 March 2023

unaudited audited

--------------------------------------- ----------------- -----------------

Year to 31 March Year to 31 March

2023 2022

--------------------------------------- ----------------- -----------------

GBP000 GBP000

--------------------------------------- ----------------- -----------------

Revenue 408,370 385,368

Cost of sales (including warehouse

costs) (328,361) (293,839)

--------------------------------------- ----------------- -----------------

Gross profit 80,009 91,529

Selling and distribution costs (24,214) (22,151)

Administrative expenses (12,097) (11,213)

Operating Profit 43,698 58,165

Finance income 1,071 29

Finance costs (258) (242)

--------------------------------------- ----------------- -----------------

Profit before tax 44,511 57,952

Tax expense (8,593) (12,310)

--------------------------------------- ----------------- -----------------

Profit after tax attributable

to owners of the parent company 35,918 45,642

======================================= ================= =================

Earnings per ordinary share (basic) 179.5p 229.3p

======================================= ================= =================

Earnings per ordinary share (diluted) 179.2p 228.3p

======================================= ================= =================

All results relate to continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year to 31 March 2023

unaudited audited

------------------------------------------- ---------- ---------

2023 2022

------------------------------------------- ---------- ---------

GBP000 GBP000

------------------------------------------- ---------- ---------

Profit after tax attributable to owners

of the parent company 35,918 45,642

Other comprehensive income

Actuarial gain on defined benefit pension

scheme 1,407 3,625

Deferred tax relating to components

of other comprehensive income (632) (424)

Foreign translation charge 233 (29)

------------------------------------------- ---------- ---------

Other comprehensive income for the year,

net of tax 1,008 3,172

------------------------------------------- ---------- ---------

Total comprehensive income attributable

to owners of the parent company 36,926 48,814

=========================================== ========== =========

JAMES LATHAM PLC COMPANY REGISTRATION NUMBER 65619

CONSOLIDATED BALANCE SHEET

For the year to 31 March 2023

unaudited audited

--------------------------------------- ---------- ---------

2023 2022

--------------------------------------- ---------- ---------

GBP000 GBP000

--------------------------------------- ---------- ---------

Assets

Non-current assets

Goodwill 1,193 1,372

Other intangible assets 1,319 1,487

Property, plant and equipment 37,440 36,935

Right-of-use-assets 5,817 4,154

Retirement and other benefit

obligation 7,221 1,119

Deferred tax asset - 154

Total non-current assets 52,990 45,221

Current assets

Inventories 67,489 74,230

Trade and other receivables 66,782 68,332

Cash and cash equivalents 62,609 37,030

Tax receivable 490 -

Total current assets 197,370 179,592

--------------------------------------- ---------- ---------

Total assets 250,360 224,813

--------------------------------------- ---------- ---------

Current liabilities

Lease liabilities 879 1,275

Trade and other payables 41,066 50,876

Tax payable - 400

Total current liabilities 41,945 52,551

Non-current liabilities

Interest bearing loans and borrowings 592 592

Lease liabilities 5,130 3,133

Deferred tax liabilities 7,118 4,566

--------------------------------------- ---------- ---------

Total non-current liabilities 12,840 8,291

--------------------------------------- ----------

Total liabilities 54,785 60,842

--------------------------------------- ---------- ---------

Net assets 195,575 163,971

======================================= ========== =========

Capital and reserves

Issued capital 5,040 5,040

Share-based payment reserve 124 387

Own shares - (873)

Capital reserve 398 398

Retained earnings 190,013 159,019

--------------------------------------- ---------- ---------

Total equity attributable to

equity shareholders of the parent

company 195,575 163,971

163,971 163,971

======================================= ========== =========

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to the owners of the parent company

Share-based

Issued payment Own shares Capital Retained Total

capital reserve reserve earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April

2021 - audited 5,040 167 (471) 398 113,950 119,084

Profit for the year - - - - 45,642 45,642

Other comprehensive

income:

Actuarial gain/(loss)

on defined benefit

pension scheme - - - - 3,625 3,625

Deferred tax relating

to components of other

comprehensive income - - - - (424) (424)

Foreign translation

charge - - - - (29) (29)

---------- ------------ ------------- ---------- ----------- ---------

Total comprehensive

income for the year - - - - 48,814 48,814

Transactions with

owners:

Dividends - - - - (4,379) (4,379)

Exercise of options - (24) 228 - 4 208

Deferred tax on share

options - 75 - - - 75

Transfer of treasury

shares - - (630) - 630 -

Share-based payment

expense - 169 - - - 169

---------- ------------ ------------- ---------- ----------- ---------

Total transactions

with owners - 220 (402) - (3,745) (3,927)

Balance at 31 March

2022 - audited 5,040 387 (873) 398 159,019 163,971

Profit for the year - - - - 35,918 35,918

Other comprehensive

income:

Actuarial gain/(loss)

on defined benefit

pension scheme - - - - 1,407 1,407

Deferred tax relating

to components of other

comprehensive income - - - - (632) (632)

Foreign translation

charge - - - - 233 233

---------- ------------ ------------- ---------- ----------- ---------

Total comprehensive

income for the year - - - - 36,926 36,926

Transactions with

owners:

Dividends - - - - (6,825) (6,825)

Exercise of options - (386) 1,397 - 369 1,380

Deferred tax on share

options - (59) - - - (59)

Transfer to retained

earnings - - (524) - 524 -

Share-based payment

expense - 182 - - - 182

---------- ------------ ------------- ---------- ----------- ---------

Total transactions

with owners - (263) 873 - (5,932) (5,322)

Balance at 31 March

2023 - unaudited 5,040 124 - 398 190,013 195,575

========== ============ ============= ========== =========== =========

JAMES LATHAM PLC

CONSOLIDATED CASH FLOW STATEMENT

For the year to 31 March 2023

unaudited audited

--------------------------------------- ---------- ---------

2023 2022

--------------------------------------- ---------- ---------

GBP000 GBP000

--------------------------------------- ---------- ---------

Net cash flow from operating

activities

Cash generated from operations 43,864 30,983

Interest paid (53) (59)

Income tax paid (7,498) (10,259)

--------------------------------------- ---------- ---------

Net cash inflow from operating

activities 36,313 20,665

--------------------------------------- ---------- ---------

Cash flows from investing activities

Interest received and similar

income 822 29

Acquisition of businesses net

of cash and cash equivalents

acquired - (2,238)

Purchase of property, plant

and equipment (3,304) (4,319)

Proceeds from sale of property,

plant and equipment 72 62

Net cash outflow from investing

activities (2,410) (6,466)

--------------------------------------- ---------- ---------

Cash flows from financing activities

Lease liability payments (1,499) (1,408)

Equity dividends paid (6,825) (4,379)

Net cash outflow from financing

activities (8,324) (5,787)

--------------------------------------- ---------- ---------

Increase in cash and cash equivalents

for the year 25,579 8,412

======================================= ========== =========

Cash and cash equivalents at

beginning of the year 37,030 28,618

--------------------------------------- ---------- ---------

Cash and cash equivalents at

end of the year 62,609 37,030

======================================= ========== =========

JAMES LATHAM PLC

Notes to the unaudited preliminary financial information

1. The preliminary financial information presented in this

report is unaudited and has been prepared in accordance with the

recognition and measurement principles of UK adopted International

Accounting Standards in conformity with the requirements of the

Companies Act 2006 set out in the Group accounts for the years

ended 31 March 2022 and 31 March 2023, and does not contain all the

information to be disclosed in financial statements prepared in

accordance with IFRS.

2. The directors propose a final dividend of 28.8p per ordinary

share, which will absorb GBP5,789,000 (2022: 27.0p absorbing

GBP5,379,000), payable on 25 August 2023 to shareholders on the

Register at the close of business on 4 August 2023. The ex-dividend

date is 3 August 2023.

3. The figures for the year ended 31 March 2023 are unaudited.

The figures relating to 31 March 2022 have been extracted from the

statutory accounts for that year. The statutory accounts for the

year ended 31 March 2023 have yet to be delivered to the Registrar

of Companies and have been prepared in accordance with UK-adopted

International Accounting Standards. The preliminary financial

information does not constitute statutory accounts within the

meaning of Section 434 of the Companies Act 2006, and does not

contain all the information required to be disclosed in a full set

of IFRS financial statements.

Statutory accounts for the year ended 31 March 2023 will be

delivered to the Registrar of Companies and sent to Shareholders in

due course. The Annual Report and Accounts may also be viewed in

due course on James Latham plc's website at

www.lathamtimber.co.uk

Statutory accounts for the year ended 31 March 2022 have been

filed with the Registrar of Companies. The auditor's report on

those accounts was unqualified and did not include reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying the report and did not contain a statement under

section 498(2) and (3) of the Companies Act 2006.

4. This announcement was approved and authorised for issue by

the Board of Directors on 28 June 2023.

5. Net cash flow from operating activities

Year to Year to 31

31 March March 2022

2023 unaudited audited

GBP000 GBP000

Profit before tax 44,511 57,952

Adjustment for finance income and cost (813) 213

Depreciation and amortisation 4,173 4,128

Impairment 179 -

(Profit)/loss on disposal of property,

plant and equipment (46) 50

Decrease/(increase) in inventories 6,741 (23,990)

Decrease/(increase) in receivables 1,550 (18,034)

(Decrease)/increase in payables (8,167) 13,940

Retirement benefits (4,446) (3,445)

Share-based payments non cash amounts 182 169

Cash generated from operations 43,864 30,983

---------------- ------------

6. Earnings per ordinary share is calculated by dividing the net

profit for the period attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period.

Year to Year to 31

31 March March 2022

2023 unaudited audited

GBP000 GBP000

Net profit attributable to ordinary shareholders 35,918 45,642

================ ============

Number '000 Number '000

Weighted average share capital 20,009 19,905

Add: diluted effect of share capital

options issued 31 85

Weighted average share capital for diluted

earnings per ordinary share calculation 20,040 19,990

---------------- ------------

7. The Annual General Meeting of James Latham plc will be held

at the Leverstock Suite, Holiday Inn, Breakspear Way, Hemel

Hempstead, Hertfordshire, HP2 4UA on Wednesday 23 August 2023 at

12.30pm.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BLGDLXUDDGXI

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

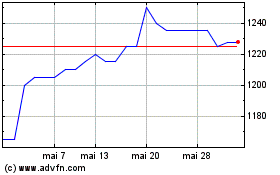

Latham (james) (LSE:LTHM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Latham (james) (LSE:LTHM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025