TIDMTMOR

RNS Number : 4322A

More Acquisitions PLC

23 September 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (596/2014/EU) AS THE

SAME HAS BEEN RETAINED IN UK LAW AS AMENDED BY THE MARKET ABUSE

(AMENDMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK MAR"). UPON

THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS

NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

23 September 2022

More Acquisitions plc ("More " or the "Company")

Proposed Acquisition of Megasteel Limited and Suspension of

Trading

More Acquisitions plc, a company formed for the purpose of

undertaking one or more acquisitions of a majority interest in a

company or business, is pleased to announce that it has signed

conditional Heads of Terms in relation to the proposed acquisition

of 100% of the issued share capital of Megasteel Limited

("Megasteel"), one of the largest stockholders and distributors of

steel for the prestressing and post-tensioning of concrete in the

UK (the "Proposed Acquisition").

Key Proposed Terms;

-- Dependent on the exercise of warrants by More Acquisition

shareholders as part of the Proposed Acquisition, and therefore the

balance sheet of the enlarged Company on completion, Megasteel will

be valued at between GBP49.5million- GBP63million;

-- Consideration for the Proposed Acquisition will involve the

issue of between 2.2 billion -2.8 billion new shares in More at an

issue price of 2.25p per share (the "Issue Price").

-- Proposed Issue Price represents a premium of approximately

214 per cent. to the Closing Mid- Price of 0.9 pence per More

Acquisition share on 22 September 2022 (being the last Business Day

prior to the date of this announcement).

-- Proposed Acquisition values the current issued share capital

of More at GBP2.81 million (vs GBP1.19 million at closing on 22

September 2022) or over 2.3 times the Company's current net

cash

Background

Megasteel (www.megasteel.co.uk ), has traded for more than 30

years in the United Kingdom, and is one of the largest stockholders

and distributors of high-quality steel for the prestressing and

post-tensioning of concretes in the UK. Prestressed concrete is a

critical building product used in the UK construction market, from

house floors to bridge beams and from railway sleepers to high rise

buildings in the City of London. In its financial year ended 31

October 2021, Megasteel made audited pre-tax profits of GBP3m on

turnover of GBP19.7m.

Megasteel also operates a sub-contract engineering business

based in Malmesbury, Wiltshire, having acquired Sweetnam and

Bradley Limited in 2019. Sweetnam and Bradley support several

clients including Renishaw plc, Siemens plc, Rotork plc and the

London Underground.

The Proposed Acquisition remains subject, amongst other things,

to completion of customary due diligence and there is therefore no

certainty that the Proposed Acquisition will proceed.

If the Proposed Acquisition is completed, it will constitute a

reverse takeover under the Listing Rules. Accordingly, the Company

has requested that the listing of its Ordinary Shares be suspended

with effect from today. The Company intends, as soon as

practicable, to publish a prospectus and to make an application for

the Company, as enlarged by the Proposed Acquisition, to have its

Ordinary Shares admitted to the Official List and to trading on the

Main Market for listed securities on the London Stock Exchange.

Further announcements will be made regarding the Proposed

Acquisition when appropriate.

Roderick McIllree, Executive Director of More Acquisitions

commented:

"We have reviewed a large number of assets and businesses in

many different sectors during the last six months as possible

acquisitions for More Acquisitions. After undertaking intensive due

diligence, we believe that Megasteel stands out as a high-value,

profitable investment for our shareholders. Megasteel is

well-established and a leading player in its sector, with a long

history of profitability and industry excellence, and we believe

that it has the potential to deliver long term value to More

Acquisitions and its shareholders."

Nigel Roberts, CEO of Megasteel Ltd added:

"We have built Megasteel over the last 30 years to be one of the

biggest suppliers in the UK of prestressing wire and strand, a

product used in almost every construction project in the country,

and we have been considering a listing of the business for many

years. We are pleased to be working with More Acquisitions as the

vehicle that will enable us to do this.

Over many years we have been able to grow our sales, generate

revenues, make profits and turn those profits into cash which we

have reinvested into the business to keep the cycle going. Applied

over a long period of time these business methods have produced a

profitable business that I am proud to have started.

Three years ago, we acquired Sweetnam and Bradley, a business

that has for over 60 years followed the same principles as

Megasteel. This acquisition has been successful for us. Our

intention is to continue to grow our business organically and

through further acquisitions of other successful businesses.

We were attracted to More Acquisitions as our vehicle to list

because we liked the simplicity and cost-effective way in which it

had been set up with its 'one price for all', no advisory or

broking fees, capped listing and on-going costs and no director

salaries, the Company and its key stakeholders fitted very well

with our views on how a business should be run!"

Enquiries

More Acquisitions plc

Rod McIllree / Charles Goodfellow

Peterhouse Capital Limited +44 (0)20 7469 0930

Financial Adviser

Narisha Ragoonanthun / Brefo Gyasi / Guy Miller

Corporate Broker

Lucy Williams / Duncan Vasey

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDZGZLVFDGZZG

(END) Dow Jones Newswires

September 23, 2022 02:45 ET (06:45 GMT)

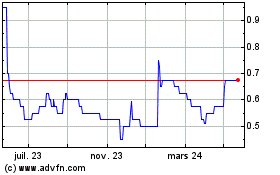

More Acquisitions (LSE:TMOR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

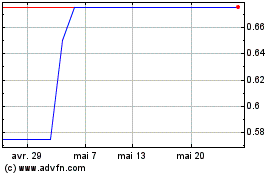

More Acquisitions (LSE:TMOR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025