GEN Restaurant Group, Inc. (“GEN” or the “Company”), owner of GEN

Korean BBQ, a fast-growing cook-it-yourself casual dining concept,

is announcing financial results for the first quarter ended March

31, 2024.

First Quarter 2024 Financial and Recent

Operational Highlights

- Total revenue increased 16% to $50.8 million compared to the

first quarter of 2023.

- Income from operations was $108 thousand and 0.2% of

revenue.

- Restaurant-level adjusted EBITDA(1) was $8.4 million and 16.6%

of revenue.

- Net Income was $3.7 million and 7.3% of revenue.

- Adjusted EBITDA(1) was $6.4 million and 12.5% of revenue

inclusive of pre-opening expense of approximately $1.9

million.

- Cash and cash equivalents at March 31, 2024 was $28.1

million.

- Opened two new locations during the first quarter of 2024 in

Seattle, Washington and Dallas, Texas. Opened a third location in

Jacksonville, Florida during April 2024.

- Launched new Premium Menu at all 40 nationwide locations

featuring 10 gourmet protein options at an additional cost of $20

per guest.

- Completed an acquisition to buy out the Company’s 50% partner

in GKBH Restaurant LLC, which included acquiring the rights the

partner had to participate in future GEN restaurants in the State

of Hawaii, on February 19, 2024. The Company now wholly owns all 40

of its locations.

(1) Adjusted EBITDA and restaurant-level adjusted EBITDA are

non-GAAP measures. For reconciliations of adjusted EBITDA and

restaurant-level adjusted EBITDA to the most directly comparable

GAAP measure see the accompanying financial tables. For definitions

and a discussion of why we consider them useful, see “Non-GAAP

Measures” below.

Management Commentary“Our first

quarter performance reflects continued execution on our strategic

growth initiatives to rapidly expand GEN’s geographic coverage,”

said David Kim, Co-Chief Executive Officer of GEN. “We opened two

new restaurants during the first quarter that have been performing

at or above our initial expectations and helped drive our 16%

revenue increase. In addition, our third new location this year has

also been performing well in the initial weeks since opening.

“In February, we bought out our partner in

Hawaii and now own 100% of our 40 locations nationwide. As we move

further into 2024, we remain focused on growing our restaurant

count and providing a superior customer experience, like the recent

launch of our new premium menu. Supported by a strong cash position

and cost-efficient business model, we believe we are well

positioned to continue increasing market share and maximize

shareholder value over the long-term.”

First Quarter 2024 Financial ResultsTotal

revenue increased 16% to $50.8 million in the first quarter of 2024

compared to $43.9 million in the first quarter of 2023. Comparable

restaurant sales decreased 1.8% in the first quarter of 2024

compared to the same period last year.

Total restaurant operating expenses (excluding

pre-opening expenses) as a percentage of revenue increased 327

basis points to 86.8% in the first quarter of 2024 from 83.5% in

the first quarter of 2023, primarily driven by the

following:

- Cost of goods sold increased 81 basis points primarily due to

more restaurants in operation and the introduction of the Company's

new premium menu.

- Payroll and benefits increased 70 basis points due to increases

in minimum wage rates in certain markets in which the Company

operates, primarily California; higher short-term labor costs in

newly open restaurants as the Company trains staff and management;

and an increase in manager training in preparation for the

Company’s ramp-up in new restaurant development. On a sequential

basis, payroll and benefits decreased by 26 basis points compared

to the fourth quarter of 2023.

- Occupancy costs increased 63 basis points primarily due to new

restaurant openings over the last twelve months.

- Other operating costs increased 64 basis points. On a

sequential basis, other operating costs decreased 112 basis points

compared to the fourth quarter of 2023.

- Depreciation and amortization increased 49 basis points.

- Restaurant pre-opening expenses increased to $1.9 million for

the first quarter of 2024 from $0.5 million in the first quarter of

2023 due to the timing of new store openings.

General and administrative expenses increased by

$3.9 million, excluding non-cash stock compensation expense, for

the first quarter of 2024 including the addition of new personnel

necessary for new restaurant development, along with public company

costs which weren’t present in the prior year period. As a

percentage of revenues, general and administrative expenses were

9.2% in the first quarter of 2024.

Net income was $3.7 million or 7.3% of revenue

for the first quarter of 2024 compared to $4.5 million or 10.3% of

revenue in the first quarter of 2023. The decline was largely due

to increased expenses related to new restaurant development and

increased general and administrative expenses associated with being

a public company, partially offset by the $3.4 million gain on

purchase related to the acquisition to buy out the Company’s 50%

partner in GKBH Restaurant LLC.

Adjusted EBITDA increased to $6.4 million or

12.5% of revenue, inclusive of pre-opening expense of approximately

$1.9 million for the first quarter of 2024, compared to $5.8

million or 13.3% of revenue, inclusive of pre-opening expenses of

$0.5 million in the prior year period.

Non-GAAP MeasuresRestaurant-level

adjusted EBITDA represents income (loss) from operations

plus adjustments to add-back the following expenses: depreciation

and amortization, pre-opening costs, general and administrative

expenses, related party consulting fees, management fees and

non-cash lease expense. Management believes that restaurant-level

adjusted EBITDA is useful to investors because this measure

highlights trends in our core business that may not otherwise be

apparent to investors when relying solely on GAAP financial

measures and enabling investors to more effectively compare the

Company’s performance to prior and future periods.

Adjusted EBITDA represents net

income (loss) before net interest expense, income taxes,

depreciation and amortization, and consulting fees paid to a

related party and we also exclude non-recurring items, such as

stock-based compensation expense, gain on extinguishment of debt,

and Restaurant Revitalization Fund, or RRF, grants, employee

retention credits, litigation accruals, aborted deferred IPO costs

written off, non-cash lease expenses and non-cash lease expense

related to pre-opening costs. Management believes that

restaurant-level adjusted EBITDA is useful to investors because

this measure highlights trends in our core business that may not

otherwise be apparent to investors when relying solely on GAAP

financial measures and enabling investors to more effectively

compare the Company’s performance to prior and future periods.

Conference CallGEN will conduct a conference

call today at 5:00 p.m. Eastern time to discuss its results for the

first quarter ended March 31, 2024.

David Kim, Co-Chief Executive Officer, and Tom

Croal, Chief Financial Officer will host the conference call,

followed by a question-and-answer session.

Date: Tuesday, May 14, 2024Time: 5:00 p.m.

Eastern time (2:00 p.m. Pacific time)Toll-free dial-in number:

1-844-825-9789International dial-in number:

1-412-317-5180Conference ID: 10188729

Please call the conference telephone number 5-10

minutes prior to the start time. An operator will register your

name and organization. If you have any difficulty connecting with

the conference call, please contact Gateway Group at

949-574-3860.

The conference call will be broadcast live here and available

for replay via the investor relations section of the Company’s

website at www.genkoreanbbq.com.

A telephonic replay of the conference call will

also be available after 8:00 p.m. Eastern time on the same day

through May 21, 2024.

Toll-free replay number: 1-844-512-2921International replay

number: 1-412-317-6671Replay ID: 10188729

About GEN Restaurant Group, Inc.GEN Korean BBQ

is a fast-growing cook-it-yourself casual dining concept with over

40 locations in 8 states. The Company offers guests a unique dining

experience where guests serve as their own chefs preparing meals on

embedded grills in the center of each table. The extensive menu

consists of traditional Korean and Korean-American food, including

high-quality meats, poultry, seafood and mixed vegetables. With its

unique culinary experience alongside its modern décor and lively

atmosphere, GEN Korean BBQ delivers an engaging and interactive

dining experience. For more information, please visit GEN’s website

at www.genkoreanbbq.com.

Forward-Looking StatementsThis press release

contains forward-looking statements. Forward-looking statements may

be identified by the use of words such as “believe,” “intend,”

“expect”, “will,” “may”, and other similar words or expressions

that predict or indicate future events. All statements that are not

statements of historical fact are forward-looking statements,

including any statements regarding our strategy, future operations,

and growth prospects, any statements regarding future economic

conditions or performance, any statements of belief or expectation,

and any statements of assumptions underlying any of the foregoing

or other future events. Forward-looking statements are based on

current information available at the time the statements are made

and on management’s reasonable belief or expectations with respect

to future events, and are subject to risks and uncertainties, many

of which are beyond the Company’s control, that could cause actual

performance or results to differ materially from the belief or

expectations expressed in or suggested by the forward-looking

statements. Additional factors or events that could cause actual

results to differ may also emerge from time to time, and it is not

possible for the Company to predict all of them. Forward-looking

statements speak only as of the date on which they are made, and

the Company undertakes no obligation to update any forward-looking

statement to reflect future events, developments or otherwise,

except as may be required by applicable law. Investors are referred

to the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, and in our subsequent filings with the

Securities and Exchange Commission (“SEC”), which are available on

the SEC’s website at www.sec.gov, for additional information

regarding the risks and uncertainties that may cause actual results

to differ materially from those expressed in any forward-looking

statement.

Investor Relations Contact:Cody Slach and Cody

CreeGateway Group, Inc.1-949-574-3860GENK@gateway-grp.com

|

GEN RESTAURANT GROUPCondensed Consolidated

Income Statements(in thousands, except per share

amounts) |

| |

| |

|

Three months ended March 31, |

|

| (in thousands, except

per share amounts) |

|

2024 |

|

|

2023 |

|

| |

|

(unaudited) |

|

|

Revenue |

|

$ |

50,760 |

|

|

$ |

43,862 |

|

| Restaurant operating

expenses: |

|

|

|

|

|

|

|

Food cost |

|

|

16,968 |

|

|

|

14,305 |

|

|

Payroll and benefits |

|

|

16,152 |

|

|

|

13,652 |

|

|

Occupancy expenses |

|

|

4,293 |

|

|

|

3,432 |

|

|

Operating expenses |

|

|

5,098 |

|

|

|

4,126 |

|

|

Depreciation and amortization |

|

|

1,537 |

|

|

|

1,113 |

|

|

Pre-opening costs |

|

|

1,901 |

|

|

|

519 |

|

|

Total restaurant operating expenses |

|

|

45,949 |

|

|

|

37,147 |

|

| General and

administrative |

|

|

4,674 |

|

|

|

2,055 |

|

| Consulting fees - related

party |

|

|

— |

|

|

|

880 |

|

| Management fees |

|

|

— |

|

|

|

588 |

|

| Depreciation and amortization

- corporate |

|

|

29 |

|

|

|

18 |

|

|

Total costs and expenses |

|

|

50,652 |

|

|

|

40,688 |

|

|

Income from operations |

|

|

108 |

|

|

|

3,174 |

|

|

Employee retention credits |

|

|

— |

|

|

|

1,165 |

|

|

Gain on remeasurement of previously held interest |

|

|

3,402 |

|

|

|

— |

|

| Interest income (expense),

net |

|

|

276 |

|

|

|

(189 |

) |

| Equity in income (loss) of

equity method investee |

|

|

(17 |

) |

|

|

381 |

|

|

Net income before income taxes |

|

|

3,769 |

|

|

|

4,531 |

|

|

Provision for income taxes |

|

|

(71 |

) |

|

|

— |

|

|

Net income |

|

|

3,698 |

|

|

|

4,531 |

|

|

Less: Net income attributable to noncontrolling interest |

|

|

3,202 |

|

|

|

397 |

|

|

Net income attributable to GEN Restaurant Group, Inc. |

|

|

496 |

|

|

|

4,134 |

|

| |

|

|

|

|

|

|

|

Net income attributable to Class A common stock per share - basic

and diluted (1) |

|

$ |

496 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

Weighted-average shares of Class A common stock outstanding - basic

(1) |

|

|

4,324 |

|

|

|

— |

|

|

Weighted-average shares of Class A common stock outstanding -

diluted (2) |

|

|

4,324 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

Net income per share of Class A common stock - basic |

|

$ |

0.11 |

|

|

|

— |

|

|

Net income per share of Class A common stock - diluted |

|

$ |

0.11 |

|

|

|

— |

|

| (1) (2) Basic and

diluted net income per share of Class A common stock is presented

only for the period after the Company’s organization

transactions. |

| |

|

GEN RESTAURANT GROUPSelected Balance Sheet

Data and Selected Operating Data(in thousands,

except restaurants and percentages) |

|

|

|

|

|

For the period ending |

|

|

|

|

31-Mar-24 |

|

|

31-Dec-23 |

|

| (amounts in

thousands) |

|

(unaudited) |

|

| Selected Balance Sheet

Data: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

28,122 |

|

|

$ |

32,631 |

|

| Total assets |

|

$ |

214,511 |

|

|

$ |

183,870 |

|

| Total liabilities |

|

$ |

172,649 |

|

|

$ |

146,352 |

|

| Total Stockholders'

equity |

|

$ |

40,362 |

|

|

$ |

36,018 |

|

| |

|

Three months ended March 31, |

|

| (in

thousands) |

|

2024 |

|

|

2023 |

|

| Selected Operating

Data |

|

(unaudited) |

|

|

Restaurants at end of period |

|

|

39 |

|

|

|

31 |

|

| Comparable restaurant sales

performance |

|

|

-1.8 |

% |

|

|

3.9 |

% |

| Net income |

|

|

3,698 |

|

|

|

4,531 |

|

|

Net income margin |

|

|

7.3 |

% |

|

|

10.3 |

% |

| |

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

6,366 |

|

|

|

5,845 |

|

|

Adjusted EBITDA margin |

|

|

12.5 |

% |

|

|

13.3 |

% |

| |

|

|

|

|

|

|

|

Income from operations |

|

|

108 |

|

|

|

3,174 |

|

|

Income from operations margin |

|

|

0.2 |

% |

|

|

7.2 |

% |

| |

|

|

|

|

|

|

| Restaurant level Adjusted

EBITDA |

|

|

8,433 |

|

|

|

8,407 |

|

| Restaurant level Adjusted

EBITDA margin |

|

|

16.6 |

% |

|

|

19.2 |

% |

| |

|

GEN RESTAURANT GROUPReconciliation of Net

Income to EBITDA and Adjusted EBITDA(in

thousands) |

| |

| (amounts in

thousands) |

|

Three months ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

(unaudited) |

|

| EBITDA: |

|

|

|

|

|

|

|

Net income |

|

$ |

3,698 |

|

|

$ |

4,531 |

|

| Net Income Margin |

|

|

7.3 |

% |

|

|

10.3 |

% |

| Interest income (expense),

net |

|

|

(276 |

) |

|

|

189 |

|

| Provision for income

taxes |

|

|

71 |

|

|

|

— |

|

| Depreciation and

amortization |

|

|

1,566 |

|

|

|

1,131 |

|

| EBITDA |

|

$ |

5,059 |

|

|

$ |

5,851 |

|

| EBITDA

Margin |

|

|

10.0 |

% |

|

|

13.3 |

% |

| |

|

|

|

|

|

|

| Adjustments to

EBITDA: |

|

|

|

|

|

|

| EBITDA |

|

$ |

5,059 |

|

|

$ |

5,851 |

|

| Stock-based compensation

expense (1) |

|

|

759 |

|

|

|

— |

|

| Consulting fees - related

party (2) |

|

|

— |

|

|

|

880 |

|

| Employee retention credits

(3) |

|

|

— |

|

|

|

(1,165 |

) |

| Non-cash lease expense

(4) |

|

|

184 |

|

|

|

60 |

|

| Non-cash lease expense related

to pre-opening costs (5) |

|

|

364 |

|

|

|

219 |

|

| Adjusted

EBITDA |

|

$ |

6,366 |

|

|

$ |

5,845 |

|

| Adjusted EBITDA

Margin |

|

|

12.5 |

% |

|

|

13.3 |

% |

| |

|

Reconciliation of Income from Operations to

Restaurant-level Adjusted EBITDA(in

thousands) |

| |

| (amounts in

thousands) |

|

Three months ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

(unaudited) |

|

|

Income from Operations |

|

$ |

108 |

|

|

$ |

3,174 |

|

| Income Margin from

Operations |

|

|

0.2 |

% |

|

|

7.2 |

% |

| Depreciation and

amortization |

|

|

1,566 |

|

|

|

1,131 |

|

| Pre-opening costs |

|

|

1,901 |

|

|

|

519 |

|

| General and

administrative |

|

|

4,674 |

|

|

|

2,055 |

|

| Consulting fees - related

party |

|

|

— |

|

|

|

880 |

|

| Management Fees |

|

|

— |

|

|

|

588 |

|

| Non-cash lease expense |

|

|

184 |

|

|

|

60 |

|

| Restaurant-Level

Adjusted EBITDA |

|

$ |

8,433 |

|

|

$ |

8,407 |

|

| Restaurant-Level

Adjusted EBITDA Margin |

|

|

16.6 |

% |

|

|

19.2 |

% |

|

(1) |

Stock-based compensation expense: During the first quarter of 2024,

we incurred expenses related to the granting of Restricted Stock

Units (“RSUs”") to employees. |

| (2) |

Consulting fees—related party:

These costs ended following the completion of the IPO. |

| (3) |

Employee retention credits: These

are refundable credits recognized under the provisions of the CARES

Act. |

| (4) |

Non-cash lease expense: This

reflects the extent to which lease expense is greater than or less

than contractual rent. |

| (5) |

Non-cash lease expense related to

pre-opening costs: Cost for stores in development in which the

lease expense is greater than the contractual rent. |

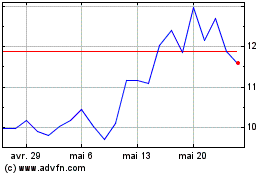

GEN Restaurant (NASDAQ:GENK)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

GEN Restaurant (NASDAQ:GENK)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025