Virco Mfg. Corporation (Nasdaq:VIRC) reported today that net sales

for the Company’s fiscal year ended January 31, 2023 increased

25.0% to $231.1 million compared to $184.8 million in the prior

year. The Company’s revenue and operating margins have now returned

to profitable levels following major market disruptions from the

pandemic and related school closures.

Net revenue in the Company’s seasonally light fourth quarter

declined to $38.8 million compared to $40.1 million in the same

period last year. The modest decline in revenue was attributable to

improved delivery performance in the second and third quarters of

the 2023 fiscal year. In the prior year supply chain issues caused

delayed deliveries extending into the fourth quarter. Despite the

minor decline in revenue, operating margins continued to improve on

a year-over-year basis. For the fourth quarter, gross margin was

33.5% up from 26.5% for the same period in the prior year. This

improvement was due to three factors: price increases implemented

earlier in the year; stabilizing raw material and freight costs;

and improved manufacturing efficiencies.

For the fourth quarter SG&A as a percentage of sales

increased to 44.9% compared to 38.0% in the prior year. Higher

expenses were due primarily to the large number of new business

opportunities being developed by the Company’s sales and marketing

teams in addition to a provision for a bonus payable to all

salaried employees based upon the Company’s financial results. As

of March 31, 2023 many of these opportunities had converted to

actual orders, pushing year-to-date “shipments plus backlog” to an

all-time high of $106.9 million, an increase of 25.7% from the year

ago period, which was also a record. The operating loss in the

seasonally light fourth quarter was $4.4 million versus $4.6

million for the same period last year, again reflecting

improvements in margin and operating efficiencies that more than

offset modest decline in shipments.

As reported above, net sales for the full fiscal year ended

January 31, 2023 was $231.1 million, a 25.0% increase from $184.8

million in the prior fiscal year. Gross margin for the full year

was 36.9% compared to 33.0% last year. SG&A for the full year

was 32.2% compared to 33.1% in the prior year. Operating income for

the full year was $10.8 million compared to a loss of $0.3 million

last year. Interest expense was $2.0 million compared to $1.2

million in the prior year, due to a combination of higher interest

rates and slightly higher seasonal borrowing to support higher

revenues.

For the full year, the inherent reliability and responsiveness

of the Company’s vertically integrated U.S. operations delivered

meaningful improvements across all financial measures and added a

number of new names to the Company’s roster of active

customers.

In the prior year, the Company recorded a valuation allowance

against deferred tax assets, caused primarily by operating losses

incurred in the prior years attributable to COVID and related

supply chain challenges. In the current year, a solid return to

profitability and a record order backlog at January 31, 2023

allowed the Company to reverse the valuation allowance. This

one-time, non-cash, non-operating tax adjustment resulted in an

income tax benefit of $8.5 million compared to prior year income

tax expense of $11.4 million. Management cautions against

misreading this result and views operating results as a more

accurate measure of the Company’s performance.

Commenting on this year’s results, Virco Chairman and CEO Robert

Virtue said, “Our domestic factories and integrated support and

service teams collaborated to deliver and install a record number

of projects, both large and small, during last year’s busy summer

delivery period. We continue to prepare for an even more successful

summer this year. While nothing is guaranteed, I am hopeful that we

have returned to a solid level of revenue and margin that will

allow continued profitability.

Virco President Doug Virtue had these additional comments, “The

pandemic had the unexpected effect of accelerating certain trends

in global sourcing, namely the now popular concept of “reshoring,”

or getting supply and service closer to the customer.

At Virco we’re proud to say: ‘Bring Jobs Home? We Never

Left.’

“The nature of school furniture protected our revenue against

overseas competition to a large degree, but nonetheless, Virco

suffered sufficient competitive erosion in revenue and margin to

put our results on a sawblade for the past decade: some years a

profit, other years a loss. Now, with the post-pandemic

rationalization of the all-in costs of importing, our U.S.-based

operations appear to have returned us to healthy levels of revenue

and operating margin. We know that competition is always evolving.

But we like our current position and believe that our substantial

operating annuity of over two million square feet of U.S.

manufacturing and distribution infrastructure—operated by highly

skilled and highly engaged U.S. workers—has positioned us for

continued success in the future. I look forward to supporting the

ongoing recovery of America’s public and private schools, which we

believe are this country’s single most important investment in the

future.”

About Virco Mfg. Corporation

Founded in 1950, Virco Mfg. Corporation is the largest

manufacturer and supplier of moveable educational furniture and

equipment for the preschool through 12th grade market in the United

States. The Company manufactures a wide assortment of products,

including mobile tables, mobile storage equipment, desks, computer

furniture, chairs, activity tables, folding chairs and folding

tables. Along with serving customers in the education market -

which in addition to preschool through 12th grade public and

private schools includes: junior and community colleges; four-year

colleges and universities; trade, technical and vocational schools

- Virco is a furniture and equipment supplier for convention

centers and arenas; the hospitality industry with respect to

banquet and meeting facilities; government facilities at the

federal, state, county and municipal levels; and places of worship.

The Company also sells to wholesalers, distributors, traditional

retailers and catalog retailers that serve these same markets. With

operations entirely based in the United States, Virco designs,

manufactures, and ships its furniture and equipment from one

facility in Torrance, CA and three facilities in Conway, AR. More

information on the Company can be found at www.virco.com.

Contact:Virco Mfg. Corporation (310)

533-0474Robert A. Virtue, Chairman and Chief Executive OfficerDoug

Virtue, PresidentRobert Dose, Chief Financial Officer

Non-GAAP Financial Information

This press release includes a statement of shipments plus

unshipped backlog as of March 31, 2023 compared to the same date in

the prior fiscal year. Shipments represent the dollar amount of net

sales actually shipped during the period presented. Unshipped

backlog represents the dollar amount of net sales that we expect to

recognize in the future from sales orders that have been received

from customers in the ordinary course of business. The Company

considers shipments plus unshipped backlog a relevant and preferred

supplemental measure for production and delivery planning. However,

such measure has inherent limitations, is not required to be

uniformly applied or audited and other companies may use

methodologies to calculate similar measures that are not

comparable. Readers should be aware of these limitations and should

be cautious as to their use of such measure.

Statement Concerning Forward-Looking

Information

This news release contains “forward-looking statements” as

defined by the Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements

regarding: our future financial results and growth in our business;

business strategies; market demand and product development;

estimates of unshipped backlog; order rates and trends in

seasonality; product relevance; economic conditions and patterns;

the educational furniture industry generally, including the

domestic market for classroom furniture; cost control initiatives;

absorption rates; and supply chain challenges. Forward-looking

statements are based on current expectations and beliefs about

future events or circumstances, and you should not place undue

reliance on these statements. Such statements involve known and

unknown risks, uncertainties, assumptions and other factors, many

of which are out of our control and difficult to forecast. These

factors may cause actual results to differ materially from those

that are anticipated. Such factors include, but are not limited to:

uncertainties surrounding the severity, duration and effects of the

COVID-19 pandemic; changes in general economic conditions including

raw material, energy and freight costs; state and municipal bond

funding; state, local, and municipal tax receipts; order rates; the

seasonality of our markets; the markets for school and office

furniture generally, the specific markets and customers with which

we conduct our principal business; the impact of cost-saving

initiatives on our business; the competitive landscape, including

responses of our competitors and customers to changes in our

prices; demographics; and the terms and conditions of available

funding sources. See our Annual Report on Form 10-K for the year

ended January 31, 2023, our Quarterly Reports on Form 10-Q, and

other reports and material that we file with the Securities and

Exchange Commission for a further description of these and other

risks and uncertainties applicable to our business. We assume no,

and hereby disclaim any, obligation to update any of our

forward-looking statements. We nonetheless reserve the right to

make such updates from time to time by press release, periodic

reports, or other methods of public disclosure without the need for

specific reference to this press release. No such update shall be

deemed to indicate that other statements which are not addressed by

such an update remain correct or create an obligation to provide

any other updates.

Financial Tables Follow

|

Virco Mfg. Corporation |

|

|

|

Consolidated Balance Sheets |

| |

| |

January 31, |

|

2023 |

|

2022 |

|

(In thousands, except share and par value

data) |

| |

|

|

|

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash |

$ |

1,057 |

|

$ |

1,359 |

| Trade accounts receivables (net

of allowance for doubtful accounts of $200 at January 31, 2023 and

2022) |

|

18,435 |

|

|

17,769 |

| Other receivables |

|

68 |

|

|

118 |

| Income tax receivable |

|

19 |

|

|

152 |

| Inventories |

|

67,406 |

|

|

47,373 |

| Prepaid expenses and other

current assets |

|

2,083 |

|

|

2,076 |

| Total current assets |

|

89,068 |

|

|

68,847 |

| Property, plant, and

equipment |

|

|

|

| Land |

|

3,731 |

|

|

3,731 |

| Land improvements |

|

686 |

|

|

653 |

| Buildings and building

improvements |

|

51,310 |

|

|

51,334 |

| Machinery and equipment |

|

113,662 |

|

|

113,315 |

| Leasehold improvements |

|

983 |

|

|

1,009 |

| Total property, plant, and

equipment |

|

170,372 |

|

|

170,042 |

| Less accumulated depreciation and

amortization |

|

135,810 |

|

|

134,715 |

| Net property, plant, and

equipment |

|

34,562 |

|

|

35,327 |

| Operating lease right-of-use

assets |

|

10,120 |

|

|

13,870 |

| Deferred income tax assets,

net |

|

7,800 |

|

|

399 |

| Other assets |

|

8,576 |

|

|

8,002 |

| Total assets |

$ |

150,126 |

|

$ |

126,445 |

|

Virco Mfg. Corporation |

|

|

|

Consolidated Balance Sheets |

| |

|

| |

January 31, |

| |

2023 |

|

2022 |

| |

(In thousands, except share and par value

data) |

| |

|

|

|

| Liabilities |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

19,448 |

|

|

|

19,785 |

|

| Accrued compensation and employee

benefits |

|

9,554 |

|

|

|

5,596 |

|

| Current portion of long-term

debt |

|

7,360 |

|

|

|

340 |

|

| Current portion of operating

lease liability |

|

5,082 |

|

|

|

4,734 |

|

| Other accrued liabilities |

|

7,081 |

|

|

|

5,829 |

|

| Total current liabilities |

|

48,525 |

|

|

|

36,284 |

|

| Non-current liabilities |

|

|

|

| Accrued self-insurance |

|

1,050 |

|

|

|

965 |

|

| Accrued retirement benefits |

|

10,676 |

|

|

|

15,430 |

|

| Income tax payable |

|

79 |

|

|

|

71 |

|

| Long-term debt, less current

portion |

|

14,384 |

|

|

|

14,173 |

|

| Operating lease liability, less

current portion |

|

6,796 |

|

|

|

11,437 |

|

| Other long-term liabilities |

|

555 |

|

|

|

639 |

|

| Total non-current

liabilities |

|

33,540 |

|

|

|

42,715 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity |

|

|

|

| Preferred stock: |

|

|

|

| Authorized 3,000,000 shares,

$0.01 par value; none issued or outstanding |

|

— |

|

|

|

— |

|

| Common stock: |

|

|

|

| Authorized 25,000,000 shares,

$0.01 par value; issued and outstanding 16,210,985 shares in 2023

and 16,102,023 shares in 2022 |

|

162 |

|

|

|

161 |

|

| Additional paid-in capital |

|

120,890 |

|

|

|

120,492 |

|

| Accumulated deficit |

|

(50,631 |

) |

|

|

(67,178 |

) |

| Accumulated other comprehensive

loss |

|

(2,360 |

) |

|

|

(6,029 |

) |

| Total stockholders’ equity |

|

68,061 |

|

|

|

47,446 |

|

| Total liabilities and

stockholders’ equity |

$ |

150,126 |

|

|

$ |

126,445 |

|

|

Virco Mfg. Corporation |

|

|

|

Consolidated Statements of Operations |

| |

| |

Year ended January 31, |

| |

2023 |

|

2022 |

| |

(In thousands, except per share data) |

| |

|

|

|

|

Net sales |

$ |

231,064 |

|

|

$ |

184,828 |

|

| Costs of goods sold |

|

145,723 |

|

|

|

123,899 |

|

| Gross profit |

|

85,341 |

|

|

|

60,929 |

|

| Selling, general, and

administrative expenses |

|

74,503 |

|

|

|

61,265 |

|

| Operating income (loss) |

|

10,838 |

|

|

|

(336 |

) |

| Pension expense |

|

816 |

|

|

|

2,197 |

|

| Interest expense, net |

|

1,979 |

|

|

|

1,195 |

|

| Income (loss) before income

taxes |

|

8,043 |

|

|

|

(3,728 |

) |

| Income tax (benefit) expense |

|

(8,504 |

) |

|

|

11,408 |

|

| Net income (loss) |

$ |

16,547 |

|

|

$ |

(15,136 |

) |

| |

|

|

|

| Net income (loss) per common

share: |

|

|

|

| Basic |

$ |

1.03 |

|

|

$ |

(0.95 |

) |

| Diluted |

$ |

1.02 |

|

|

$ |

(0.95 |

) |

| Weighted average shares

outstanding: |

|

|

|

| Basic |

|

16,142 |

|

|

|

15,954 |

|

| Diluted |

|

16,192 |

|

|

|

15,954 |

|

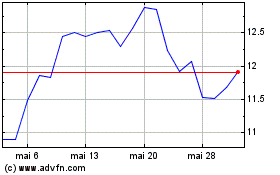

Virco Manufacturing (NASDAQ:VIRC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Virco Manufacturing (NASDAQ:VIRC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024