UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material under §240.14a-12 |

VIVAKOR, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials: |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

VIVAKOR, INC.

December 5, 2024

Dear Fellow Vivakor Stockholders:

We invite you to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Vivakor, Inc. (“Vivakor” or the “Company”), to be held on December 27, 2024 at 10 a.m. Central Time at 2278 Monitor Street, Dallas, Texas 75207.

The Notice of the Annual Meeting and Proxy Statement accompanying this letter provide information concerning matters to be considered and acted upon at the meeting. Immediately following the meeting, a report on our operations will be presented, including a question-and-answer and discussion period. Our 2023 results are presented in detail in our Annual Report, which is available for viewing at www.proxyvote.com.

Your vote is very important. We encourage you to read the Proxy Statement and vote your shares as soon as possible. Whether or not you plan to attend, you can be sure your shares are represented at the Annual Meeting by promptly submitting your vote by the Internet, by telephone or, if you request a paper copy of the proxy materials and receive a proxy card, by mail.

On behalf of the Board of Directors, thank you for your continued confidence and investment in Vivakor.

| /s/ James Ballengee |

|

|

James Ballengee

Chief Executive Officer |

|

VIVAKOR, INC.

5220

Spring Valley Road, Suite 500

Dallas,

TX 75242

Telephone: (949) 281-2606

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 27, 2024 at 10 a.m.

To the Stockholders of Vivakor, Inc.

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Vivakor, Inc., a Nevada corporation (“Vivakor,” the “Company,” “us,” “our,” or “we”), will be held on December 27, 2024 at 10 a.m. Central Time at 2278 Monitor Street, Dallas, Texas 75207. The purpose of the Annual Meeting is to consider and act upon the following matters:

| 1. |

To elect five (5) members of the Board of Directors to serve until the 2025 annual meeting of stockholders. |

| |

|

| 2. |

To ratify the selection of Urish Popeck & Co, LLC (“Urish”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. |

| |

|

| 3. |

To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers. |

| |

|

| 4. |

To transact other business as may come before the meeting. |

Our Board of Directors has fixed December 2, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement of the meeting. Only stockholders of record of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

All stockholders are cordially invited to attend the Annual Meeting, which will be held at 2278 Monitor Street, Dallas, Texas 75207. The Notice of Internet Availability of Proxy Materials (the “Notice”) and proxy card will be mailed to shareholders on or about December 5, 2024.

For your convenience, record holders of our Common Stock have FOUR methods of voting:

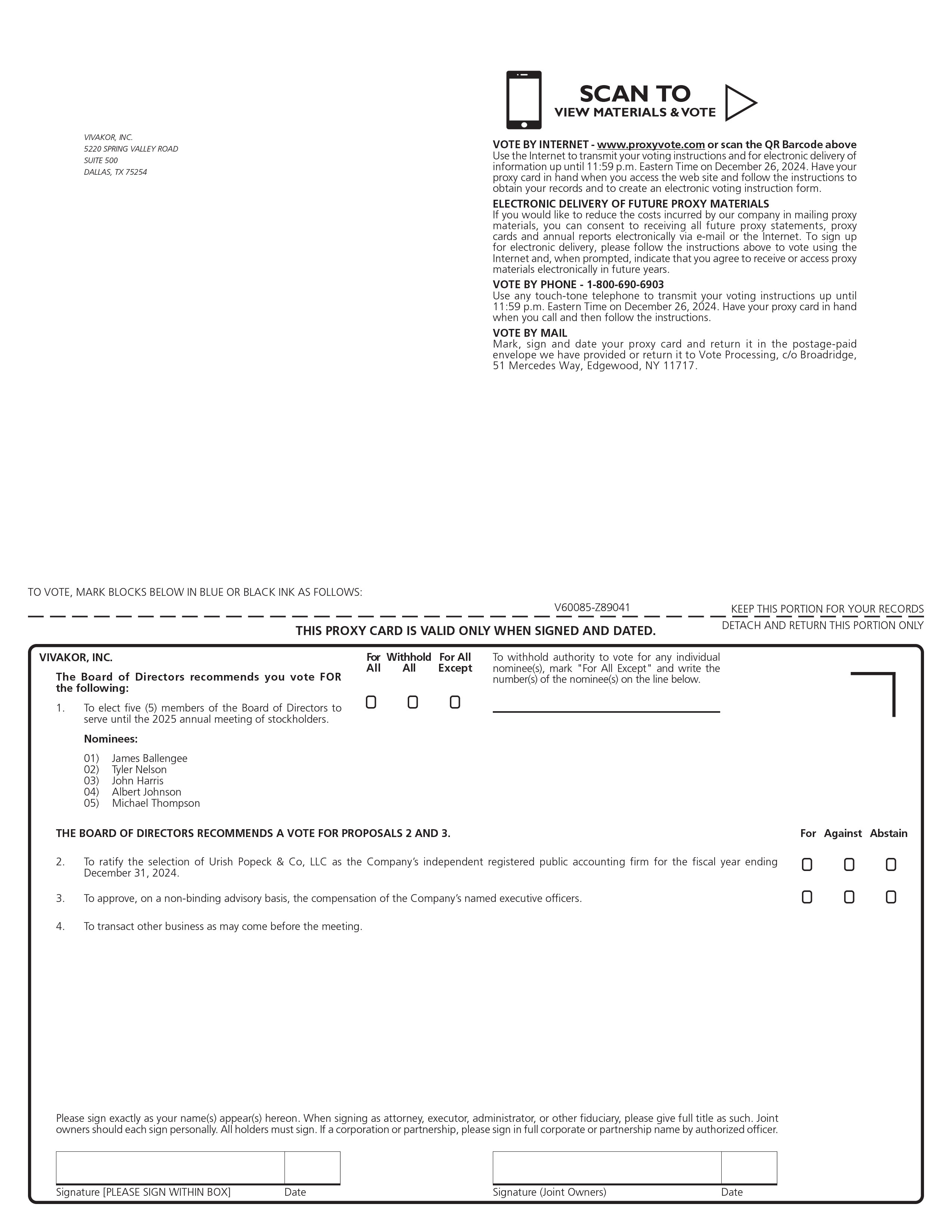

VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode on your proxy card. Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 P.M. ET on December 26, 2024. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

VOTE BY PHONE - 1-800-690-6903. Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 P.M. ET on December 26, 2024. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

VOTE AT THE MEETING. Attend and vote at the Annual Meeting to be held at 2278 Monitor Street, Dallas, Texas 75207 on December 27, 2024 at 10 a.m.

NOTE FOR STREET-NAME HOLDERS. If you hold your shares through a broker, bank or other nominee, you must instruct your nominee how to vote the shares held in your account. The nominee will give you the Notice or voting instruction form. If you do not provide voting instructions, we expect that your nominee will be permitted to vote only on routine matters.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| December 5, 2024 |

/s/ James Ballengee |

| |

James Ballengee

Chief Executive Officer |

Whether or not you expect to attend the Annual Meeting, we urge you to vote your shares via proxy at your earliest convenience. This will ensure the presence of a quorum at the Annual Meeting. Promptly voting your shares will save Vivakor the expenses and extra work of additional solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today!

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 27, 2024

The Notice of the Annual Meeting and Proxy Statement and Annual Report on Form 10-K for the years ended December 31, 2023 and 2022 (the “Annual Report”) are available at www.proxyvote.com.

Your vote is important. We encourage you to review all of the important information contained in the proxy materials before voting.

VIVAKOR, INC.

5220

Spring Valley Road

Suite

500

Dallas,

TX 75242

TELEPHONE: (949) 281-2606

PROXY STATEMENT

ANNUAL

MEETING OF STOCKHOLDERS

TO

BE HELD ON DECEMBER 27, 2024

TABLE OF CONTENTS

ABOUT VIVAKOR, INC.

Vivakor, Inc. (“Vivakor” or the “Company”) is a socially responsible operator, acquirer and developer of technologies and assets in the oil and gas industry, as well as related environmental solutions. Currently, our efforts are primarily focused on operating crude oil gathering, storage and transportation facilities, as well as contaminated soil remediation services.

One of our facilities in Delhi, Louisiana sells crude under agreements with a large energy company. A different facility owns crude oil storage tanks near Colorado City, Texas. The storage tank is presently connected to the Lotus pipeline system and an extension to a major pipeline system is being constructed.

Our soil remediation services specialize in the remediation of soil and the extraction of hydrocarbons, such as oil, from properties contaminated by or laden with heavy crude oil and other hydrocarbon-based substances utilizing our Remediation Processing Centers (RPCs). Our patented process allows us to successfully recover the hydrocarbons which we believe could then be used to produce asphaltic cement and/or other petroleum-based products. We are currently focusing our soil remediation efforts on our project in Kuwait and our upcoming project in the Houston, Texas area.

Recent Developments

Acquisition of Endeavor Entities

On October 1, 2024, the Company, Jorgan Development, LLC, a Louisiana limited liability company (“Jorgan”) and JBAH Holdings, LLC, a Texas limited liability company (“JBAH” and, together with Jorgan, the “Sellers”), as the equity holders of Endeavor Crude, LLC, a Texas limited liability company, Equipment Transport, LLC, a Pennsylvania limited liability company, Meridian Equipment Leasing, LLC, a Texas limited liability company, and Silver Fuels Processing, LLC, a Texas limited liability company (collectively, the “Endeavor Entities”) closed the transactions that were the subject of the previously-disclosed Membership Interest Purchase Agreement among them dated March 21, 2024, as amended (the “MIPA”) (the “Closing”). In accordance with the terms of the MIPA, at the Closing, the Company acquired all of the issued and outstanding membership interests in each of the Endeavor Entities (the “Membership Interests”), making them wholly owned subsidiaries of the Company.

The Endeavor Entities own and operate a combined fleet of more than 500 commercial tractors and trailers for the hauling of crude oil and produced water. On a daily basis, the trucking fleet hauls approximately 60,000 barrels of crude oil, tank bottoms, and petroleum wastes, and approximately 30,000 barrels of produced water. In addition, the Endeavor Entities own and operate a crude oil shuttle pipeline and exclusive connected blending and processing facility in Blaine County, Oklahoma.

The purchase price for the Membership Interests is $120 million (the “Purchase Price”), subject to post-closing adjustments, including a reduction for assumed debt and a possible increase for an earn-out adjustment, payable by the Company in a combination of Company common stock, $0.001 par value per share (“Common Stock”) and Company Series A Preferred Stock $0.001 par value per share (“Preferred Stock”). The Preferred Stock will have the terms set forth in the Form of Series A Preferred Stock Certificate of Designations filed herewith as Exhibit 3.1 and incorporated by reference herein, including, but not limited to, liquidation preference over the Common Stock, the payment of a cumulative six percent (6%) annual dividend per share payable quarterly in arrears in shares of Common Stock (so long as such issuances of Common Stock would not result in the Sellers beneficially owning great than 49.99% of the issued and outstanding Common Stock), and the Company having the right to convert the Preferred Stock at any time using the stated value of $1,000 per share of Preferred Stock and the conversion price of one dollar ($1.00) per share of Common Stock. The Sellers are beneficially owned by James Ballengee, the Company’s chairman, chief executive officer and principal shareholder. The Company is currently still calculating the reduction in the Purchase Price as a result of Endeavor Entities debt the Company assumed at Closing.

As a result of the Closing, the Company will issue to the Sellers, (i) a number of shares of Common Stock equal to an undivided nineteen and ninety-nine hundredths percent (19.99%) of all of the Company’s issued and outstanding Common Stock immediately prior to Closing, or a lesser percentage, if such issuance would result, when taking into consideration the percentage of Common Stock owned by Sellers prior to such issuance, in Sellers owning in excess of 49.99% of the Common Stock issued and outstanding on a post-Closing basis, with such shares of Common Stock valued at $1.00 per share (the “Common Stock Consideration”), and (ii) a number of shares of Preferred Stock equal to the Purchase Price, less the value of the Common Stock Consideration (the “Preferred Stock Consideration”). Sellers will enter into 18-month lock-up agreements, in the form filed herewith as Exhibit 10.1 and incorporated by reference herein, at Closing, with regard to the Common Stock Consideration and any Common Stock they receive during the lock-up period in connection with conversions of Preferred Stock or the payment of dividends on the Preferred Stock.

According to our Chief Financial Officer’s previously disclosed employment contract, upon the closing (October 1, 2024) of the Endeavor Entities, he will be paid $200,000, with $100,000 to be paid in cash and the remaining $100,000 to be paid in shares of the Company’s common stock, valued at approximately $1.89 per share.

The MIPA, including the exhibits thereto and related agreements, filed with the Company’s Form 8-K filed with the Commission on March 25, 2024 (the “Execution 8-K”) as Exhibits 2.1. 3.1, 10.1, 10.2, 10.3, and 10.4 are incorporated herein by reference. The disclosure above does not purport to be a complete statement of the terms of the MIPA, or the transactions contemplated thereby, or the exhibits and related documents, and is qualified in their entirety by reference to the Execution 8-K and the full text of the Exhibits filed therewith.

This section contains only a brief description of the material terms of the MIPA and does not purport to be a complete description of the rights and obligations of the parties to the MIPA, and such description is qualified in its entirety by reference to the full text of the MIPA, a copy of which is filed as Exhibit 2.2 to the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024.

Executive Employment Agreements

In connection with the Closing of the Endeavor Entities on October 1, 2024, the Company entered into an executive employment agreement with Russ Shelton (the “Shelton Agreement”) with respect to the Company’s appointment of Mr. Shelton as Executive Vice President and Chief Operating Officer of the Company. Pursuant to the Shelton Agreement, Mr. Shelton will receive (i) base salary compensation of $337,000 USD annually (the “Base Compensation”); (ii) an annual cash and equity incentive compensation of up to $808,000 based upon certain performance criteria as more particularly described therein. As an inducement to enter into the Shelton Agreement, Mr. Shelton shall receive a one-time signing grant of Company common stock equivalent in value to $150,000, which are priced per share based on the volume-weighted average price for the preceding five (5) trading days prior to the day of such grant, subject to an eighteen (18) month lockup period, which shall be granted promptly after the Effective Date, as defined therein. Pursuant to the Shelton Agreement, Mr. Shelton’s employment is at-will under Texas law, except as modified therein. Mr. Shelton’s employment with Vivakor Administration, LLC, a subsidiary of the Company, began on October 1, 2024.

This section contains only a brief description of the material terms of the Shelton Agreement and does not purport to be a complete description of the rights and obligations of the parties to the Shelton Agreement, and such description is qualified in its entirety by reference to the full text of the Shelton Agreement, a copy of which is filed as Exhibit 10.24 to the Quarterly Report.

Russ Shelton, 48, Executive Vice President & Chief Operating Officer

Mr. Russ Shelton is a seasoned operations executive with more than three decades of management experience with midstream trucking, terminaling, and marketing companies, including for several of the business units being acquired in the Company’s purchase of the Endeavor Entities. Mr. Shelton was most recently the Chief Operating Officer for Endeavor Crude, LLC, and prior to that served as its Vice President of Transportation since 2023. Prior to Endeavor Crude, he worked as Director of Operations for Senergy Petroleum from 2021-23, and prior to that worked as Director of Transportation for Pilot Travel Centers LLC from 2018-21.

The Board believes that Mr. Shelton’s experience in management and operations and his extensive knowledge in the midstream petroleum industry make him ideally qualified to help lead the Company towards continued growth and success.

Family Relationships

Mr. Shelton does not have a family relationship with any of the current officers or directors of the Company.

Related Party Transactions

In connection with the Shelton Agreement, Mr. Shelton and Ballengee Holdings, LLC, an affiliate of James H. Ballengee, the Company’s Chairman, President, and CEO, have entered into a side letter agreement (the “Shelton Side Letter”) promising Mr. Shelton (i) certain additional Base Compensation equal to the difference between Mr. Shelton’s current salary and $375,000 by January 1, 2025, should the Company not increase Mr. Shelton’s Base Compensation, as defined in the Shelton Agreement, to such level, and (ii) a one-time special cash bonus of $100,000.00 USD upon completion of an equity capital raise, as more particularly set forth therein. A copy of the Shelton Side Letter is filed as Exhibit 10.25 to the Quarterly Report.

On August 22, 2024, we entered into a new executive employment agreement with our Vice President, Marketing. Pursuant to the new employment agreement, our Vice President, Marketing will receive $200,000 annually (the “Base Salary”), which after the first annual anniversary the Base Salary may increase to $350,000 contingent upon the Company achieving net profitability of $500,000 of all commodity trades by the Vice President, Marketing. In addition, the employment agreement provides for annual incentive cash and equity compensation of up to $440,000 based on certain performance goals as further set forth therein. As an inducement to enter into the executive employment agreement, the Vice President, Marketing is entitled to receive a one-time signing grant of Company common stock equivalent in value to $150,000, which are priced per share based on the closing price on the day of such grant (calculated to be 71,090 shares based on the effective date of the executive employment agreement). The signing bonus has not been issued and is due not later than thirty (30) calendar days after we file an amended Registration Statement on Form S-8 with the Securities and Exchange Commission registering shares under a Long-Term Incentive Plan (“LTIP”), and the shares will only vest as set forth in the LTIP.

Amendment to Promissory Notes

As previously disclosed in the Company’s Current Report on Form 8-K filed with the SEC on July 11, 2024, the Company received two loans in the amounts of $350,000 and $500,000 and issued two promissory notes dated July 5, 2024 and July 9, 2024, respectively. On July 19, 2024, the lenders and the Company entered into amendments to the promissory notes in order to extend the maturity date of the promissory notes from December 31, 2024 to September 30, 2025.

Sale of Common Stock

On July 26, 2024, the Company entered into a stock purchase agreement under which the Company agreed to sell an aggregate of 67,568 shares of restricted common stock in exchange for $125,000.

On July 26, 2024, the Company entered into a stock purchase agreement under which the Company agreed to sell an aggregate of 1,600,000 shares of restricted common stock in exchange for $800,000.

On September 5, 2024, the Company entered into a stock purchase agreement under which the Company agreed to sell an aggregate of 1,000,000 shares of restricted common stock in exchange for $500,000.

Finance Lease

On August 9, 2024, our subsidiary White Claw Colorado City, LLC (“WCCC”), entered into a supplement (“Supplement No. 4”) to an existing Master Agreement (the “Master Agreement”) with Maxus Capital Group, LLC (“Maxus”). Under Supplement No. 4, Maxus agreed to finance approximately $2.1 million for the build-out of certain equipment and facilities related to a pipeline extension at our WCCC facility in Texas. Once the relevant equipment is constructed Maxus will own the addition and we will lease these additions from Maxus under the terms of Supplement No. 4. Under the terms of the lease, we expect our lease payments to Maxus to be approximately $32,161 per month over four years, with an early buyout option or option at the end of the base term to purchase the wash plant equipment for approximately $374,702 or lease-end option to purchase the facilities for the fair market value. We anticipate that the lease will commence in the first quarter of 2025.

On June 18, 2024, our subsidiary White Claw Colorado City, LLC (“WCCC”), entered into a supplement (“Supplement No. 3”) to an existing Master Agreement (the “Master Agreement”) with Maxus Capital Group, LLC (“Maxus”). Under Supplement No. 3, Maxus agreed to finance approximately $1 million for the build-out of certain equipment and facilities related to the wash plant we are in the process of constructing on land leased by our subsidiary, VivaVentures Remediation Corp., in Houston, Texas. Once the relevant equipment is constructed Maxus will own the equipment and we will lease these additions to our wash plant facility from Maxus under the terms of Supplement No. 3. Under the terms of the lease, we expect our lease payments to Maxus to be approximately $58,595 per month over four years, with an early buyout option or option at the end of the base term to purchase the wash plant equipment for approximately $683,000, or lease-end option to purchase the facilities for the fair market value. We anticipate that the lease payments, our material obligation under Supplement No. 3, will commence in the first quarter of 2025.

Loan and Security Agreement and Issuance of Secured Promissory Note

On October 31, 2024, Vivakor, Inc. (the “Company”), as the borrower, and certain of its subsidiaries, being Vivaventures Management Company, Inc., Vivaventures Oil Sands, Inc., Silver Fuels Delhi, LLC, White Claw Colorado City, LLC, Vivaventures Remediation Corporation, Vivaventures Energy Group, Inc., Endeavor Crude, LLC, and Meridian Equipment Leasing, LLC, and Silver Fuels Processing, LLC, as guarantors (collectively, the “Guarantors” or “Subsidiaries”, as context requires), Cedarview Opportunities Master Fund LP, as the lender (the “Lender”); and Cedarview Capital Management, LLC, as the agent (the “Agent”), entered into a Loan and Security Agreement (the “Loan Agreement”).

Pursuant to the Loan Agreement, the Company issued a secured promissory note (the “Note”) in the principal amount of $3,670,160.77, and the Lenders agreed to provide such term loan to the Company (the “Term Loan”) with maturity on October 31, 2025. On November 5 and 6, 2024, the Company received the net proceeds from the Term Loan less (i) a 3% origination fee, and (ii) repayment of $2,000,000 in outstanding principal, $68,009 in accrued interest, and a $242,991 prepayment fee pursuant to that certain Loan and Security Agreement dated February 5, 2024, by and between the Company, as borrower thereunder, certain of its Subsidiaries, as guarantors thereunder, and Lender and Agent (the “Previous Cedarview Loan”).

The amounts borrowed under the Loan Agreement will bear interest at a rate per annum of 22%. As a result, the Company will be obligated to make 12 equal monthly payments of $343,506.42 beginning November 30, 2024.

In the event of any prepayment, the Company shall pay a prepayment premium in the amount of ten percent (10%) of the balance of the Term Loan outstanding prior to such prepayment. Notwithstanding the foregoing, if and when the Company raises in the aggregate $10,000,000 or more from the sale of its equity in sales (other than in connection with any acquisition, merger, or like transaction), the Company shall immediately offer to prepay the entire outstanding balance of the Term Loan, which offer may be accepted or rejected by the Agent.

The amounts borrowed pursuant to the terms of the Loan Agreement are secured by substantially all of the present and after-acquired assets of the Company and the Subsidiaries, except for certain after-acquired assets as provided by the Loan Agreement. Additionally, the Company’s obligations under the Loan Agreement are jointly and severally guaranteed by the Subsidiaries.

The Loan Agreement contains customary representations, warranties and affirmative and negative financial and other covenants for a loan of this type. The closing was subject to customary closing conditions.

In connection with the Loan Agreement, and as additional consideration for the Lender agreeing to loan funds to the Company thereunder, the Company issued an irrevocable letter to its transfer agent (the “Transfer Agent”) to reserve 3,000,000 shares of the Company’s common stock (the “Collateral Securities”) until the Term Loan is repaid in full. In the event the Term Loan is not paid in full by the Maturity Date, the Agent may instruct the Transfer Agent to issue the Collateral Securities to the Agent, which the Agent may then sell until such time the amounts due under the Term Loan are repaid in full, after which any shares of Collateral Securities remaining shall be returned to the Company.

As a result of the Term Loan, and the use of proceeds of the Term Loan, the Previous Cedarview Loan has been paid in full and the irrevocable letter to the transfer agent regarding the Previous Cedarview Loan has been withdrawn.

This section contains only a brief description of the material terms of the Cedarview Loan and Security Agreement, and ancillary documents, and does not purport to be a complete description of, the rights and obligations of the parties to the agreements in connection with the Loan Agreement, and such description is qualified in its entirety by reference to the full text of the Loan Agreement and its exhibits, which are as Exhibits 4.1, 10.1, 10.2, 10.3 and 10.4 to our Amendment No. 1 to Current Report on Form 8-K/A filed on November 15, 2024.

Pilot Agreement

In connection with the Closing of the Endeavor Entities on October 1, 2024, a certain Secured Promissory Note dated December 31, 2023, made by Meridian Equipment Leasing, LLC, as Borrower (“Borrower”), to the order of Pilot OFS Holdings LLC, as Lender (“Lender”), in the original principal amount of $12,500,000.00 USD plus the sum of $500,000 (the “Note”) will be contained in our consolidated financial statements going forward. On October 1, 2024 the parties entered into a Letter Agreement regarding the Secured Promissory Note and related Loan Documents, which stipulates and agrees to the amount outstanding pursuant to a certain AR Assignment (also acquired through the close of the Endeavor Entities) is equal to $2,910,574. Upon the full and final closing and initial funding of a revolving line of credit, Borrower shall cause to be paid to Lender the outstanding AR balance of $2,910,574, plus interest at a rate of one and one-half percent (1.5%) per month on all amounts outstanding from July 1, 2024 through the date of repayment, no later than the close of business two (2) business days thereafter. Borrower shall also cause to be paid $57,750, representing all amounts currently due and owing under the Truck Yard Leases (as defined below), all of which is stipulated and agreed to in exchange for the Lender entering into an amended secured promissory note that extends the maturity date of the loans to December 31, 2024, and the agree that the Truck Yard Leases are considered terminated effective as of September 30, 2024, which includes (a) that certain Lease Agreement dated effective December 31, 2023, by and between Borrower, as Tenant, and Pilot Travel Centers LLC, as Landlord, covering certain real property located at 306 E. Greene St., Carlsbad, New Mexico 88220, as amended, (b) that certain Lease Agreement dated effective December 31, 2023, by and between Borrower, as Tenant, and Pilot Travel Centers LLC, as Landlord, covering certain real property located at 2260 US 181, Hobson, Texas 78117, as amended, and (c) that certain Lease Agreement dated effective December 31, 2023, by and between Borrower, as Tenant, and Pilot Travel Centers LLC, as Landlord, covering certain real property located at 620 S CR 153, Kenedy, Texas 78119, as amended (collectively, the "Truck Yard Leases").

This section contains only a brief description of the material terms of the Pilot Agreements and does not purport to be a complete description of, the rights and obligations of the parties to the agreements in connection with the Pilot Agreement, and such description is qualified in its entirety by reference to the full text of the Pilot Agreement and its exhibits, which are filed as Exhibits 10.35, 10.36, and 10.37 to the Quarterly Report.

Meridian Equipment Leasing Lease Agreement

On October 29, 2024, our subsidiary Meridian Equipment Leasing LLC (“MEL”), which subsidiary was acquired on October 1, 2024 in the acquisition of the Endeavor Entities, entered into a supplement (“Supplement No. 21”) to an existing Master Agreement (the “Master Agreement”) with Maxus Capital Group, LLC (“Maxus”). Under Supplement No. 21, Maxus agreed to finance approximately $1.5 million for the build-out of a pipeline at our acquired pipeline facility in Oklahoma. Once the pipeline is constructed Maxus will own the addition and we will lease these additions from Maxus under the terms of Supplement No. 21. Under the terms of the lease, we expect our lease payments to Maxus to be approximately $41,522 per month over four years, with an early buyout option or option at the end of the base term to purchase the wash plant equipment for approximately $484,111 or lease-end option to purchase the facilities for the fair market value. We anticipate that the lease will commence in the first quarter of 2025.

Agile

Upon the Closing of our acquisition of the Endeavor Entities, a certain Subordinated Business Loan and Security Agreement by and between Agile Capital Funding, LLC and Agile Lending, LLC (the lenders and Endeavor Crude, LLC, Meridian Equipment Leasing, LLC, and Silver Fuels Processing, LLC (the borrowers) dated September 27, 2024 (the “Agile Agreement”) will be contained in our consolidated financial statements going forward. Under the Agile Agreement, the listed borrowers received $1,420,000 in October 2024.

This section contains only a brief description of the material terms of the Agile Agreements and does not purport to be a complete description of, the rights and obligations of the parties to the agreements in connection with the Agile Agreement, and such description is qualified in its entirety by reference to the full text of the Agile Agreement, which is filed as Exhibit 10.44 to the Quarterly Report.

White Claw Crude, LLC

During the third quarter of 2024, the Company entered into a Crude Petroleum Sales Agreement with White Claw Crude, LLC (“WC Crude”). Both the WC Crude Crude Petroleum Sales Agreement and the existing WC Crude Crude Petroleum Supply Agreement(s) are cash net settled at market prices.

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because our Board of Directors (the “Board”) is soliciting your proxy to vote at the Annual Meeting of Shareholders. According to our records, you were a shareholder of the Company as of the end of business on December 2, 2024.

You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card or vote via telephone or over the Internet.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the U.S. Securities and Exchange Commission, or “SEC,” we may furnish proxy materials, including this Proxy Statement and our Annual Report on Form 10-K, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (the “Notice”), which was mailed to the holders of our common stock, par value $0.001 per share (the “Common Stock”), will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

The Notice of the Annual Meeting and Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com.

To access the materials, you must enter the control number included on your Notice.

The Notice is being made available to you by the Company in connection with its solicitation of proxies for use at the 2024 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held at 2278 Monitor Street, Dallas, Texas 75207 and/or any adjournments or postponements thereof. The Notice was first given or sent to shareholders on or about December 5, 2024. This Proxy Statement gives you information on these proposals so that you can make an informed decision.

What is a proxy?

A proxy is the legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card.

What is a proxy card?

By completing a proxy card, as more fully described herein, you are designating James Ballengee, our Chief Executive Officer and/or Tyler Nelson, our Chief Financial Officer, as your proxies for the Annual Meeting and you are authorizing them to vote your shares at the Annual Meeting as you have instructed them on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we urge you to vote in one of the ways described below so that your vote will be counted even if you are unable or decide not to attend the Annual Meeting.

What is a proxy statement?

A proxy statement is a document that we are required by regulations of the U.S. Securities and Exchange Commission, or “SEC,” to give you when we ask you to sign a proxy card designating Messrs. Ballengee and Nelson as proxies to vote on your behalf.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign, and return each proxy card to ensure that all of your shares are voted.

I share the same address with another Vivakor, Inc. shareholder. Why has our household only received one set of proxy materials?

The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our shareholders. This practice, known as “householding,” is intended to reduce the Company’s printing and postage costs. We have delivered only one set of proxy materials to shareholders who hold their shares through a bank, broker or other holder of record and share a single address, unless we received contrary instructions from any shareholder at that address. However, any such street name holder residing at the same address who wishes to receive a separate copy of the proxy materials may make such a request by contacting the bank, broker or other holder of record, or, the Company at 5220 Spring Valley Road, Suite 500, Dallas, TX 75242, Attn: Corporate Secretary. Street name holders residing at the same address who would like to request householding of Company materials may do so by contacting the bank, broker or other holder of record or the Corporate Secretary at the telephone number or address listed above.

How do I attend the Annual Meeting?

The Annual Meeting will be held in-person on December 27, 2024, 10 a.m. Central Time at 2278 Monitor Street, Dallas, Texas 75207.

Who is entitled to vote?

The Board has fixed the close of business on December 2, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Only stockholders of record of the Common Stock at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. On the Record Date, there were 41,008,013 shares of Common Stock outstanding. Each share of Common Stock represents one vote that may be voted on each proposal that may come before the Annual Meeting. The Company has no voting shares other than the Common Stock.

What is the difference between holding shares as a record holder and as a beneficial owner (holding shares in street name)?

If your shares are registered in your name with our transfer agent, Empire Stock Transfer, you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who may attend the Annual Meeting?

Only record holders and beneficial owners of our Common Stock, or their duly authorized proxies, may attend the Annual Meeting.

What am I voting for?

There are three (3) matters scheduled for a vote:

| 1. |

To elect five (5) members of the Board of Directors to serve until the 2025 annual meeting of stockholders. |

| |

|

| 2. |

To ratify the selection of Urish Popeck & Co, LLC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. |

| |

|

| 3. |

To approve, on a non-binding advisory basis, the compensation of Vivakor’s named executive officers. |

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

For your convenience, record holders of our Common Stock have FOUR methods of voting:

VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode on your proxy card. Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by December 26, 2024, at 11:59pm ET. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

VOTE BY PHONE - 1-800-690-6903. Use any touch-tone telephone to transmit your voting instructions. Vote by December 26, 2024, at 11:59 ET. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

VOTE AT THE MEETING. Attend and vote at the Annual Meeting to be held at 2278 Monitor Street, Dallas, Texas 75207 on December 27, 2024 at 10 a.m. Central Time.

NOTE FOR STREET-NAME HOLDERS. If you hold your shares through a broker, bank or other nominee, you must instruct your nominee how to vote the shares held in your account. The nominee will give you the Notice or voting instruction form. If you do not provide voting instructions, we expect that your nominee will be permitted to vote only on Proposal 2, but not on Proposals 1 and 3.

All shares entitled to vote and represented by a properly completed and executed proxy received before the Annual Meeting and not revoked will be voted at the Annual Meeting as instructed in a proxy delivered before the Annual Meeting. We provide telephone and Internet proxy voting to allow you to vote your shares via phone or online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your telephone or Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

For Common Stockholders, on each matter to be voted upon, you have one vote for each share of Common Stock you own as of the close of business on the Record Date.

Is my vote confidential?

Yes, your vote is confidential. Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

What constitutes a quorum?

To carry on business at the Annual Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as of the Record Date, are represented in person or by proxy. Thus, 20,504,007 shares must be represented in person or by proxy to have a quorum at the Annual Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by us are not considered outstanding or considered to be present at the Annual Meeting. If there is not a quorum at the Annual Meeting, either the chairperson of the Annual Meeting or our stockholders entitled to vote at the Annual Meeting may adjourn the Annual Meeting.

How will my shares be voted if I give no specific instruction?

We must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally to vote the shares, they will be voted as follows:

| 1. |

“For” the election of five (5) members of the Board of Directors to serve until the 2025 annual meeting of stockholders; |

| |

|

| 2. |

“For” ratifying the selection of Urish Popeck & Co, LLC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. |

| |

|

| 3. |

“For” the approval of, on a non-binding advisory basis, the compensation of Vivakor’s named executive officers. |

If other matters properly come before the Annual Meeting and you do not provide specific voting instructions, your shares will be voted at the discretion of Messrs. Ballengee and Nelson, the Board’s designated proxies.

If your shares are held in street name, see “What is a Broker Non-Vote?” below regarding the ability of banks, brokers and other such holders of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

Uninstructed Shares

All proxies that are executed or are otherwise submitted over the internet, by mail or in person will be voted on the matters set forth in the accompanying notice of Annual Meeting in accordance with the instructions set forth herein. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the Board’s recommendations on such proposals as set forth in this Proxy Statement.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the election of directors, “For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and “Against,” abstentions and broker non-votes. Abstentions and broker non-votes will not be included in the tabulation of the voting results of any of the proposals and, therefore, will have no effect on such proposals.

What is a broker non-vote?

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at their discretion.

Proposal No. 1 for the election of directors is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal. Broker non-votes will not have any effect on the outcome of the voting on this proposal.

Proposal No. 2 for the ratification of the selection of Urish Popeck & Co, LLC as our independent registered public accounting firm for our fiscal year ending December 31, 2024 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on the proposal. As such, there will not be any broker non-votes regarding this proposal.

Proposal No. 3 for the approval of, on a non-binding advisory basis, the compensation of Vivakor’s named executive officers is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal. Broker non-votes will not have any effect on the outcome of the voting on this proposal.

How many votes are required to approve each proposal?

The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

| Proposal |

|

Votes Required |

|

Voting Options |

| Proposal No. 1: Election of Directors |

|

The plurality of the votes cast. This means that the nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. |

|

“FOR ALL”

“WITHHOLD ALL”

“FOR ALL EXCEPT_____” |

| |

|

|

|

|

| Proposal No. 2: Ratification of Selection of Urish Popeck & Co, LLC as the Company’s Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2024 |

|

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

|

“FOR”

“AGAINST”

“ABSTAIN” |

| |

|

|

|

|

| Proposal No. 3: Approval of, on a non-binding advisory basis, the compensation of Vivakor’s named executive officers |

|

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. |

|

“FOR”

“AGAINST”

“ABSTAIN” |

What is an abstention?

An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Nevada law, abstentions are counted as shares present and entitled to vote at the Annual Meeting. Generally, unless provided otherwise by applicable law, our Bylaws provide that an action of our stockholders (other than the election of directors) is approved if a majority of the number of shares of stock entitled to vote thereon and present (either in person or by proxy) vote in favor of such action. Therefore, votes that are “WITHHELD” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. A vote marked as “ABSTAIN” is not considered a vote cast and will, therefore, not affect the outcome of Proposal’s No. 2 or 3.

What are the voting procedures?

In voting by proxy regarding the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. Regarding the other proposals, you may vote in favor of or against the proposal, or you may abstain from voting on the proposals. You should specify your respective choices on the accompanying proxy card or your vote instruction form.

Is my proxy revocable?

If you are a registered stockholder, you may revoke or change your vote at any time before the proxy is voted by filing with our Corporate Secretary, at 5220 Spring Valley Road, Suite 500 Dallas, TX 75264, either a written notice of revocation or a duly executed proxy bearing a later date. If you attend the Annual Meeting, you may revoke your proxy or change your proxy vote by voting at the meeting. Your attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

If your shares are held in street name or you hold shares through a retirement or savings plan or other similar plan, please check your voting instruction card or contact your broker, nominee, trustee or administrator to determine whether you will be able to revoke or change your vote.

Who is paying for the expenses involved in preparing this Proxy Statement?

All of the expenses involved in preparing and assembling these proxy materials and mailing the Notice (and any paper materials, if requested) and all costs of soliciting proxies will be paid by us. In addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials.

Do I have dissenters’ rights of appraisal?

The Company’s stockholders do not have appraisal rights under Nevada law or under the Company’s governing documents with respect to the matters to be voted upon at the Annual Meeting.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

When are stockholder proposals due for the 2025 Annual Meeting?

Stockholders who intend to have a proposal considered for inclusion in our proxy materials for presentation at our 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”) must submit the proposal to us at our corporate headquarters no later than March 31, 2025, which proposal must be made in accordance with the provisions of Rule 14a-8 of the Exchange Act. Pursuant to our Amended and Restated Bylaws, nothing in the procedure described in the sentence above shall be deemed to affect the rights of stockholders to request inclusion of proposals in our proxy statement pursuant to Rule l4a-8 under the Exchange Act.

Stockholders who intend to present a proposal at our 2025 Annual Meeting without inclusion of the proposal in our proxy materials are required to provide notice of such proposal to our Corporate Secretary so that such notice is received by our Corporate Secretary at our principal executive offices on or after February 1, 2025, but no later than March 31, 2025. We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

Excluding Proposal No. 1 and No. 3 (Election of Directors and Compensation of Directors, respectively), do the Company’s executive officers and Directors have an interest in any of the matters to be acted upon at the Annual Meeting?

Members of the Board and executive officers of the Company do not have any substantial interest, direct or indirect, in Proposal No. 2 (the ratification of the selection of Urish Popeck & Co, LLC as our independent registered public accounting firm for our fiscal year ending December 31, 2024).

Are any of the proposals conditioned on one another?

No.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Our Board currently consists of five (5) directors, and their terms will expire at the Annual Meeting. Directors are elected at the Annual Meeting of stockholders each year and hold office until such director’s successor is elected and qualified, or until such director’s earlier death, resignation or removal.

James Ballengee, Tyler Nelson, John R. Harris, Albert Johnson, and Michael Thompson have each been nominated to serve as directors and have agreed to stand for election. If these nominees are elected at the Annual Meeting, then each nominee will serve for a term expiring at the 2025 Annual Meeting and until his or her successor is duly elected and qualified. Directors are elected by a plurality of the votes cast at the election. This means that the nominees receiving the highest number of affirmative “FOR” votes will be elected as directors.

If no contrary indication is made, proxies will be voted “FOR” all nominees listed below or, in the event that any such individual is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our Board to fill the vacancy.

Nominees for Election to the Board for a Term Expiring at the 2025 Annual Meeting of Stockholders

| Name |

|

Age |

|

Positions |

| James Ballengee |

|

59 |

|

Chief Executive Officer and Director |

| Tyler Nelson |

|

44 |

|

Chief Financial Officer and Director |

| John R. Harris |

|

76 |

|

Director |

| Albert Johnson |

|

49 |

|

Director |

| Michael Thompson |

|

55 |

|

Director |

James H. Ballengee joined Vivakor as Chief Executive Officer and Chairman of the Board in 2022. Prior to joining the Company, Mr. Ballengee had more than two decades of experience in midstream oil and gas senior management roles. Previously, he had been involved in two major private equity portfolio companies holding positions including Chief Commercial Officer, Chief Financial Officer, Chief Executive Officer, and Chairman of the Board. From 1997 through 2010, Mr. Ballengee served first as Chief Financial Officer, then Chief Executive Officer, then Chief Commercial Officer of Taylor Logistics, LLC, a Halifax Group-backed private equity portfolio company focused on crude oil marketing and logistics, which he led through a successful sale to Gibson Energy, Inc. (TSX: GEI). From 2010 to 2013, he was Chief Executive Officer and Chairman of the Board of Bridger Group, LLC, a private crude oil marketing firm. From 2013 to 2015, he was a board member and Chief Commercial Officer of Bridger, LLC, a Riverstone Holdings-backed private equity portfolio company focused on crude oil marketing and logistics, which he led through a successful sale to Ferrellgas Partners, LP (NYSE: FGP). Mr. Ballengee currently manages an exempt family office, which in turn holds and manages investments principally in the oil and gas, sports and entertainment, and real estate sectors. He has an undergraduate degree in accounting from Louisiana State University-Shreveport.

Tyler Nelson joined Vivakor on a part-time basis as Chief Financial Officer in 2014 and has served as full-time Chief Financial Officer since September 2020. Mr. Nelson joined the Board of Directors of Vivakor in January 2023. Mr. Nelson is a CPA who worked from 2006 to 2011 in Audit and Enterprise Risk Services at Deloitte LLP (USA) and later at KSJG, LLP (later acquired by Withum+Brown, PC). He worked with clients with assets of more than $100 billion and annual revenues of more than $15 billion, which are considered some of the most respected financial institutions in the world. In 2011, Mr. Nelson began working for LBL Professional Consulting, Inc. where he provided merger and acquisition, initial public offering, and interim chief financial officer services to clients. Mr. Nelson continues to sit on the Board of Directors and remains an officer of LBL Professional Consulting, Inc. Mr. Nelson earned a Master’s Degree in Accountancy from the University of Illinois- Urbana-Champaign, and a Bachelor’s Degree in Economics with a minor in Business Management from Brigham Young University.

John R. Harris, age 75, combines over 35 years of experience in Board of Directors, CEO and Senior Management positions in a variety of industries including technology services, telecommunications, healthcare, and business process outsourcing. He currently serves on the board of directors for the Hackett Group, Hifu Prostate Services, GenHemp, and Everservice. Since 2009 Mr. Harris has primarily been a private investor, advisor, and board member for both public and privately held companies. From 2006 to 2009 he was CEO of Etelecare Global solutions a leading provider of offshore teleservices to Fortune 1,000 companies. From 2003 to 2005 he served as the CEO of Seven Worldwide, a digital content management company where he was previously a member of the board of directors of the company. From 2001 to 2003, Mr. Harris consulted with a variety of venture-backed early-stage companies. Previously Mr. Harris spent 25 years with Electronic Data Systems in a variety of senior executive positions to include President of the 4 strategic business units serving the telecommunications and media industries world-wide. He was elected as a Corporate Vice-President and Officer of the company. During his tenure with EDS, he gained extensive international experience working and living in the Middle East, Europe and Asia. Mr. Harris has extensive public company board experience through prior services on the boards of Premier Global Services, Cap Rock Communications, Genuity, Ventiv Health, Startek, Sizmek, Mobivity and Applied Graphic Technologies and served in a variety of positions to include board member, committee chairman, lead director and chairman. Mr. Harris received his BBA and MBA from the University of West Georgia where he serves on the Board of Advisors to the Richards School of Business.

Albert Johnson, age 48, brings over 25 years of experience in operations and senior management in the midstream and downstream sectors of the oil and gas industry. Previously, Mr. Johnson had been involved in public and privately held companies holding various positions in senior management and serving as a member of boards of directors. From 2014 to 2015, he was Director of Business Development for Sunoco Logistics, LP., a publicly traded master limited partnership involved in the marketing, trading, transportation and terminalling of crude oil, products and NGLS. From July 2015 through May 2017, Mr. Johnson was the Vice President of Business Development for Navigator Energy Services, LLC., a private equity backed company involved in the gathering, transportation and terminalling of crude oil. From March 2018 to November 2022, Mr. Johnson served as Executive Vice President Business Development for ARX Energy, LLC. Since November 2022, Mr. Johnson has served as Chief Commercial Officer for ARX Energy, LLC., a privately held company involved in building a world class clean fuels facility in the Port of Brownsville, Texas. Mr. Johnson served on the Board of Directors for West Texas Gulf Pipe Line Company and on the Management Committee of SunVit Pipeline, LLC. He has an undergraduate degree in History from the University of Texas at Austin and an MBA finance concentration from Jones Graduate School of Business at Rice University.

Michael

Thompson, age 55, combines over 25 years of experience in company directorship. Previously, he had been involved in four

companies and two nonprofit organizations, holding positions including President, Representative Director, and board member.

Mr. Thompson presently serves as the Global Head of Multi-Vendor Solutions at HP. From 2016 to 2021, Mr. Thompson has

served on the Board of Directors as the Chair of the Audit Committee and Conflicts Committee of Rhino Resources, LTD, a company

concentrated on coal and energy-related assets and activities. From 2014 to 2016, Mr. Thompson was a Director and Chair of the

Strategic Planning Committee of Idaho Aquarium, a nonprofit aquarium. From 2010 to 2012, Mr. Thompson was a member of the board

of Asister, a nonprofit organization focused on designing and distributing appliances in Latin America. From 2005 to 2009,

Mr. Thompson served on the Board of Directors for Environmental Energy Services, Inc. and Blaze Energy, Inc., energy services

and asset accumulation companies. From 1996 to 1999, he served as President and Representative Director of Micron Electronics Japan,

K.K. and Micron Electronics China. Mr. Thompson has a bachelor’s degree in Business and Japanese from Brigham Young

University and a master’s degree in Organizational Leadership from Gonzaga University. Mr. Thompson is a member of the

National Association of Corporate Directors and brings to our Board over 25 years of experience in corporate governance, compliance

and turnaround.

Family Relationships

There are no family relationships among any of our directors or executive officers.

Director Terms; Qualifications

Members of our Board of Directors serve until the next Annual Meeting of stockholders, or until their successors have been duly elected.

When considering whether directors and nominees have the experience, qualifications, attributes and skills to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Board of Directors focuses primarily on the industry and transactional experience, and other background, in addition to any unique skills or attributes associated with a director.

Director or Officer Involvement in Certain Legal Proceedings

There are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is averse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. None of the directors and executive officers has been involved in any legal proceedings as listed in Regulation S-K, Section 401(f) material to an evaluation of the ability or integrity of any director or executive officer.

Directors and Officers Liability Insurance

The Company has directors’ and officers’ liability insurance insuring its directors and officers against liability for acts or omissions in their capacities as directors or officers, subject to certain exclusions. Such insurance also insures the Company against losses, which it may incur in indemnifying its officers and directors. In addition, officers and directors also have indemnification rights under applicable laws, and the Company’s Articles of Incorporation, as amended and Bylaws.

Board Composition, Committees, and Independence

Composition. Our Board has five members. Our Chief Executive Officer, James H. Ballengee, is a member of the Board and is a full-time employee of the Company. Tyler Nelson is our Chief Financial Officer, a member of the Board and is a full-time employee of the Company. John R. Harris, Albert Johnson and Michael Thompson are non-employee directors, and the Board has determined that these persons (who constitute a majority of the Board) are “independent directors” under the criteria set forth in Rule 5605(a)(2) of the Nasdaq Listing Rules.

Meetings. During the year ended December 31, 2023, the Board held four meetings, the Audit Committee held three meetings, the Compensation Committee held several meetings and the Nominating and Corporate Governance Committee held one meeting. All directors attended more than seventy-five percent (75%) of the meetings of the Board and committee meetings of which such director was a member held during 2023.

Compensation Committee. Our Compensation Committee is currently comprised of Michael Thompson, Albert Johnson, and John Harris, each of whom qualify as an independent director under applicable Nasdaq rules. John Harris serves as the chairman of the Compensation Committee.

In considering and determining executive and director compensation, the Compensation Committee reviews compensation that is paid by other similar public companies to its officers and takes that into consideration in determining the compensation to be paid to our officers. The Compensation Committee also determines and approves any non-cash compensation paid to any employee. We do not engage any compensation consultants to assist in determining or recommending the compensation to our officers or employees.

Audit Committee. Our Audit Committee is currently comprised of Michael Thompson, Albert Johnson and John Harris, each of whom qualify as an independent director under applicable Nasdaq and SEC rules, and “financially literate” under applicable Nasdaq rules. Our board has determined that Michael Thompson, qualifies as an “audit committee financial expert”, as such term is defined in Item 407(d)(5) of Regulation S-K. Michael Thompson serves as the chairman of the Audit Committee.

The Audit Committee’s duties are to recommend to the Board the engagement of independent auditors to audit our financial statements and to review its accounting and auditing principles. The Audit Committee will review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent public accountants, including their recommendations to improve the system of accounting and internal controls. The Audit Committee will at all times be composed exclusively of directors who are, in the opinion of the Board, free from any relationship which would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is currently comprised of Michael Thompson, Albert Johnson, and John Harris, each of whom qualify as an independent director under applicable Nasdaq rules. Albert Johnson serves as the chairman of the Nominating and Corporate Governance Committee.

The responsibilities of the Nominating and Corporate Governance Committee include the identification of individuals qualified to become Board members, the selection of nominees to stand for election as directors, the oversight of the selection and composition of committees of the Board, establishing procedures for the nomination process, oversight of possible conflicts of interests involving the Board and its members, developing corporate governance principles, and the oversight of the evaluations of the Board and management. The Nominating and Corporate Governance Committee has not established a policy regarding the consideration of any candidates recommended by stockholders. If we receive any stockholder recommended nominations, the Nominating and Corporate Governance Committee will carefully review the recommendation(s) and consider such recommendation(s) in good faith.

Director Independence. We have determined, after considering all the relevant facts and circumstances, that Michael Thompson, Albert Johnson, and John Harris are independent directors as defined by the listing standards of the Nasdaq Stock Exchange and by the SEC because they have no relationship with us that would interfere with their exercise of independent judgment in carrying out their responsibilities as a director. James Ballengee and Tyler Nelson are not “independent” as defined by the listing standards as Mr. Ballengee and Mr. Nelson are executive officers of the Company.

Compensation Committee Interlocks and Insider Participation

None of the Company’s executive officers serves, or in the past has served, as a member of the Board of Directors’ compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of the Company’s Board or its Compensation Committee. None of the members of the Company’s Compensation Committee is, or has ever been, an officer or employee of the company.

Code of Ethics and Business Conduct

We have adopted a code of business conduct and ethics applicable to our principal executive, financial and accounting officers and all persons performing similar functions. A copy of that code is available on our corporate website at www.vivakor.com. We expect that any amendments to such code, or any waivers of its requirements, will be disclosed on our website.

| Board Diversity Matrix |

| |

|

|

|

|

|

|

|

|

| |

As of December 5, 2024 |

As of December 31, 2023 |

| Total No. of Directors |

5 |

4 |

| |

|

|

|

|

|

|

|

|

| Gender Identity |

Female |

Male |

Non-Binary |

Did Not

Disclose |

Female |

Male |

Non-Binary |

Did Not

Disclose |

| |

|

|

|

|

|

|

|

|

| Directors |

|

5 |

|

|

|

4 |

|

|

| |

|

|

|

|

|

|

|

|

| Part II: Demographic Background |

| |

|

|

|

|

|

|

|

|

| African American or Black |

|

1 |

|

|

|

1 |

|

|

| Alaskan Native or Native American |

|

|

|

|

|

|

|

|

| Asian |

|

|

|

|

|

|

|

|

| Hispanic or Latinx |

|

|

|

|

|

|

|

|

| Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

| White |

|

4 |

|

|

|

3 |

|

|

| Two or More Races or Ethnicities |

|

|

|

|

|

|

|

|

| LGBTQ+ |

|

|

| Did Not Disclose Demographic Background |

|

|

EXECUTIVE OFFICERS

The following is a biographical summary of our executive officers and their ages, except for Mr. Ballengee and Mr. Nelson, whose biographies are included under the heading “Proposal No. 1: Election of Directors” set forth above:

| Directors and Executive Officers |

|

Position/Title |

|

Age |

| James H. Ballengee |

|

Chief Executive Officer and Director |

|

59 |

| Tyler Nelson |

|

Chief Financial Officer and Director |

|

44 |

| Russ Shelton |

|

Chief Operating Officer |

|

48 |

| Patrick Knapp |

|

Vice President, General Counsel, & Secretary |

|

39 |

Russ Shelton joined Vivakor as Chief Operating Officer in 2024. Mr. Shelton is a seasoned operations executive with more than three decades of management experience with midstream trucking, terminaling, and marketing companies, including for several of the business units being acquired in the Company’s purchase of the Endeavor Entities. Mr. Shelton was most recently the Chief Operating Officer for Endeavor Crude, LLC, and prior to that served as its Vice President of Transportation since 2023. Prior to Endeavor Crude, he worked as Director of Operations for Senergy Petroleum from 2021-23, and prior to that worked as Director of Transportation for Pilot Travel Centers LLC from 2018-21.

Patrick Knapp joined Vivakor as Vice President, General Counsel & Secretary in 2024. Mr. Knapp is an accomplished corporate securities lawyer whose practice has focused on M&A, financings, and complex commercial transactions principally relating to midstream liquids such as crude oil, refined products, and oilfield produced water. He has represented oil and gas producers, marketers, refiners, midstream infrastructure providers, OFS companies, and oilfield waste recyclers in billions of dollars’ worth of transactions in the United States, Canada, and Mexico. Prior to Vivakor, he was a partner in the energy practice at Jackson Walker LLP from 2021-2024, where he organized and led the firm’s oilfield produced water working group. From 2019-2021, he was a partner at the international law firm McGuireWoods LLP. Knapp holds a bachelor’s degree in economics and marketing from the University of Notre Dame and a juris doctor from Southern Methodist University. He is Chairman of the Sister Loyola Foundation, a nonprofit supporting Catholic education through scholarships and grants. Mr. Knapp is admitted to practice law in Texas.

EXECUTIVE COMPENSATION

Summary Compensation Table

The particulars of compensation paid to the following persons:

| |

(a) |

all individuals serving as our principal executive officer during the year ended December 31, 2023; |

| |

|

|

| |

(b) |

each of our two most highly compensated executive officers other than our principal executive officer who were serving as executive officers at December 31, 2023 who had total compensation exceeding $100,000 (if applicable); and |

| |

|

|

| |

(c) |

up to two additional individuals for whom disclosure would have been provided under (b) but for the fact that the individual was not serving as our executive officer at December 31, 2023 (if applicable), |

who we will collectively refer to as the named executive officers, for the years ended December 31, 2023 and 2022, are set out in the following summary compensation table:

Executive Officers and Directors

The Summary Compensation Table shows certain compensation information for services rendered in all capacities for the fiscal years ended December 31, 2023 and 2022. Other than as set forth herein, no executive officer’s salary and bonus exceeded $100,000 in any of the applicable years. The following information includes the dollar value of base salaries, bonus awards, the estimated fair value of stock options granted and certain other compensation, if any, whether paid or deferred.

SUMMARY COMPENSATION TABLE

| Name

and Principal Position | |

Year | | |

Salary ($) | | |

Bonus ($) | | |

Stock Awards ($) | | |

Option

Awards ($) | | |

Non-Equity Incentive Plan Compensation ($) | | |

Nonqualified Deferred Compensation Earnings ($) | | |

All

Other Compensation ($) | | |

Total ($) | |

| James Ballengee | |

2023 | | |

| 1,000,000 | (2) | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| 76,923 | (6) | |

| 1,076,923 | |

| CEO and Chairman(1) | |

2022 | | |

| 178,082 | (2) | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| 13,313 | (6) | |

| 191,395 | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tyler Nelson | |

2023 | | |

| 350,000 | | |

| 700,000 | (4) | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| 57,631 | (6) | |

| 1,107,631 | |

| CFO and Secretary | |

2022 | | |

| 219,315 | (3) | |

| 605,467 | (4) | |

| -0- | | |

| 1,652,085 | (5) | |

| -0- | | |

| -0- | | |

| 35,220 | (6) | |

| 2,512,087 | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Leslie D. Patterson | |

2023 | | |

| 75,000 | | |

| -0- | | |

| 175,000 | (11) | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| 250,000 | |

| Executive Vice President, Operations

& Construction | |

2022 | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Matthew Nicosia | |

2022 | | |

| 138,904 | (8) | |

| 125,000 | (9) | |

| -0- | | |

| 1,053,224 | (10) | |

| -0- | | |

| -0- | | |

| 11,044 | (6) | |

| 1,328,172 | |

| Former CEO and Former Chairman(7) | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) |

Mr. Ballengee was hired as our Chief Executive Officer on October 28, 2022. |

| (2) |