Wynn Resorts, Limited (NASDAQ: WYNN) ("Wynn Resorts" or the

"Company") today reported financial results for the second quarter

ended June 30, 2024.

Operating revenues were $1.73 billion for the second quarter of

2024, an increase of $137.1 million from $1.60 billion for the

second quarter of 2023. Net income attributable to Wynn Resorts,

Limited was $111.9 million for the second quarter of 2024, compared

to net income attributable to Wynn Resorts, Limited of $105.2

million for the second quarter of 2023. Diluted net income per

share was $0.91 for the second quarter of 2024, compared to diluted

net income per share of $0.84 for the second quarter of 2023.

Adjusted Property EBITDAR(1) was $571.7 million for the second

quarter of 2024, compared to Adjusted Property EBITDAR of $524.5

million for the second quarter of 2023.

"Our second quarter results, including a new second quarter

record for Adjusted Property EBITDAR, reflect continued strength

throughout our business. I am incredibly proud of our teams in Las

Vegas, Macau and Boston," said Craig Billings, CEO of Wynn Resorts,

Limited. "Importantly, we continue to invest in growing the

business, with construction on Wynn Al Marjan Island in the UAE

progressing at a rapid pace. During the quarter, we also finalized

a transaction to acquire our pro-rata share of the land on Al

Marjan Island Three, including a sizable land bank for potential

future development opportunities for Wynn Resorts or for selected

third parties complementary to Wynn Al Marjan."

Consolidated Results

Operating revenues were $1.73 billion for the second quarter of

2024, an increase of $137.1 million from $1.60 billion for the

second quarter of 2023. For the second quarter of 2024, operating

revenues increased $79.7 million, $35.7 million, $50.6 million at

Wynn Palace, Wynn Macau, and our Las Vegas Operations,

respectively, and decreased $9.3 million at Encore Boston Harbor,

from the second quarter of 2023.

Net income attributable to Wynn Resorts, Limited was $111.9

million for the second quarter of 2024, compared to net income

attributable to Wynn Resorts, Limited of $105.2 million for the

second quarter of 2023. Diluted net income per share was $0.91 for

the second quarter of 2024, compared to diluted net income per

share of $0.84 for the second quarter of 2023. Adjusted net income

attributable to Wynn Resorts, Limited(2) was $124.5 million, or

$1.12 per diluted share, for the second quarter of 2024, compared

to adjusted net income attributable to Wynn Resorts, Limited of

$103.3 million, or $0.91 per diluted share, for the second quarter

of 2023.

Adjusted Property EBITDAR was $571.7 million for the second

quarter of 2024, an increase of $47.2 million compared to Adjusted

Property EBITDAR of $524.5 million for the second quarter of 2023.

For the second quarter of 2024, Adjusted Property EBITDAR increased

$27.9 million, $6.3 million, and $6.2 million at Wynn Palace, Wynn

Macau, and our Las Vegas Operations, respectively, and decreased

$7.0 million at Encore Boston Harbor, from the second quarter of

2023.

Wynn Resorts, Limited also announced today that its Board of

Directors has declared a cash dividend of $0.25 per share, payable

on August 30, 2024 to stockholders of record as of August 19,

2024.

Property Results

Macau Operations

Wynn Palace

Operating revenues from Wynn Palace were $548.0 million for the

second quarter of 2024, an increase of $79.7 million from $468.4

million for the second quarter of 2023. Adjusted Property EBITDAR

from Wynn Palace was $184.5 million for the second quarter of 2024,

compared to $156.6 million for the second quarter of 2023. Table

games win percentage in mass market operations was 23.6%, above the

20.3% experienced in the second quarter of 2023. VIP table games

win as a percentage of turnover was 4.10%, above the property's

expected range of 3.1% to 3.4% and below the 4.24% experienced in

the second quarter of 2023.

Wynn Macau

Operating revenues from Wynn Macau were $337.3 million for the

second quarter of 2024, an increase of $35.7 million from $301.6

million for the second quarter of 2023. Adjusted Property EBITDAR

from Wynn Macau was $95.9 million for the second quarter of 2024,

compared to $89.6 million for the second quarter of 2023. Table

games win percentage in mass market operations was 17.5%, below the

17.7% experienced in the second quarter of 2023. VIP table games

win as a percentage of turnover was 2.19%, below the property's

expected range of 3.1% to 3.4% and below the 4.16% experienced in

the second quarter of 2023.

Las Vegas Operations

Operating revenues from our Las Vegas Operations were $628.7

million for the second quarter of 2024, an increase of $50.6

million from $578.1 million for the second quarter of 2023.

Adjusted Property EBITDAR from our Las Vegas Operations for the

second quarter of 2024 was $230.3 million, compared to $224.1

million for the second quarter of 2023. Table games win percentage

for the second quarter of 2024 was 21.9%, slightly below the

property's expected range of 22% to 26% and below the 22.9%

experienced in the second quarter of 2023.

Encore Boston Harbor

Operating revenues from Encore Boston Harbor were $212.6 million

for the second quarter of 2024, a decrease of $9.3 million from

$221.9 million for the second quarter of 2023. Adjusted Property

EBITDAR from Encore Boston Harbor for the second quarter of 2024

was $62.1 million, compared to $69.1 million for the second quarter

of 2023. Table games win percentage for the second quarter of 2024

was 19.6%, within the property's expected range of 18% to 22% and

below the 22.3% experienced in the second quarter of 2023.

Wynn Al Marjan Island Development

During the second quarter of 2024, the Company contributed

$356.5 million of cash into a 40%-owned joint venture that is

constructing the Wynn Al Marjan Island development in the UAE,

bringing our life-to-date cash contributions to the project to

$514.4 million. The cash contributed in the quarter was used

primarily to fund our pro rata portion of the purchase of

approximately 155 acres of land underlying the integrated resort

development site, including over 70 acres of land for potential

future development in Ras Al Khaimah. Wynn Al Marjan Island is

currently expected to open in 2027.

Balance Sheet

Our cash and cash equivalents as of June 30, 2024 totaled $2.38

billion, comprised of $1.38 billion held by Wynn Macau, Limited

("WML") and subsidiaries, $281.1 million held by Wynn Resorts

Finance, LLC ("WRF") and subsidiaries excluding WML, and $715.6

million held at Corporate and other. In addition, as of June 30,

2024, we had $500.0 million in short-term investments held at WML.

As of June 30, 2024, the available borrowing capacity under the WRF

Revolver and the WM Cayman II Revolver was $735.3 million and

$312.2 million, respectively.

Total current and long-term debt outstanding at June 30, 2024

was $11.03 billion, comprised of $6.44 billion of Macau related

debt, $1.46 billion of Wynn Las Vegas debt, $2.52 billion of WRF

debt, and $614.4 million of debt held by the retail joint venture

which we consolidate.

During the second quarter of 2024, the Company repurchased

741,340 shares of its common stock under its publicly announced

equity repurchase program at an average price of $91.72 per share,

for an aggregate cost of $68.0 million. As of June 30, 2024, the

Company had $365.4 million in repurchase authority remaining under

the program.

Conference Call and Other Information

The Company will hold a conference call to discuss its results,

including the results of Wynn Resorts Finance, LLC and Wynn Las

Vegas, LLC, on August 6, 2024 at 1:30 p.m. PT (4:30 p.m. ET).

Interested parties are invited to join the call by accessing a live

audio webcast at http://www.wynnresorts.com. On or before August

14, 2024, the Company will make Wynn Resorts Finance, LLC and Wynn

Las Vegas, LLC financial information for the quarter ended June 30,

2024 available to noteholders, prospective investors,

broker-dealers and securities analysts. Please contact our investor

relations office at 702-770-7555 or at

investorrelations@wynnresorts.com, to obtain access to such

financial information.

Forward-looking Statements

This release contains forward-looking statements regarding

operating trends and future results of operations. Such

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from those we express in these forward-looking statements,

including, but not limited to, reductions in discretionary consumer

spending, adverse macroeconomic conditions and their impact on

levels of disposable consumer income and wealth, changes in

interest rates, inflation, a decline in general economic activity

or recession in the U.S. and/or global economies, extensive

regulation of our business, pending or future legal proceedings,

ability to maintain gaming licenses and concessions, dependence on

key employees, general global political conditions, adverse tourism

trends, travel disruptions caused by events outside of our control,

dependence on a limited number of resorts, competition in the

casino/hotel and resort industries, uncertainties over the

development and success of new gaming and resort properties,

construction and regulatory risks associated with current and

future projects (including Wynn Al Marjan Island), cybersecurity

risk and our leverage and ability to meet our debt service

obligations. Additional information concerning potential factors

that could affect the Company's financial results is included in

the Company's Annual Report on Form 10-K for the year ended

December 31, 2023, as supplemented by the Company's other periodic

reports filed with the Securities and Exchange Commission from time

to time. The Company is under no obligation to (and expressly

disclaims any such obligation to) update or revise its

forward-looking statements as a result of new information, future

events or otherwise, except as required by law.

Non-GAAP Financial Measures

(1) "Adjusted Property EBITDAR" is net income before interest,

income taxes, depreciation and amortization, pre-opening expenses,

property charges and other, triple-net operating lease rent expense

related to Encore Boston Harbor, management and license fees,

corporate expenses and other (including intercompany golf course,

meeting and convention, and water rights leases), stock-based

compensation, change in derivatives fair value, loss on debt

financing transactions, and other non-operating income and

expenses. Adjusted Property EBITDAR is presented exclusively as a

supplemental disclosure because management believes that it is

widely used to measure the performance, and as a basis for

valuation, of gaming companies. Management uses Adjusted Property

EBITDAR as a measure of the operating performance of its segments

and to compare the operating performance of its properties with

those of its competitors, as well as a basis for determining

certain incentive compensation. We also present Adjusted Property

EBITDAR because it is used by some investors to measure a company's

ability to incur and service debt, make capital expenditures and

meet working capital requirements. Gaming companies have

historically reported EBITDAR as a supplement to GAAP. In order to

view the operations of their casinos on a more stand-alone basis,

gaming companies, including us, have historically excluded from

their EBITDAR calculations pre-opening expenses, property charges,

corporate expenses and stock-based compensation, that do not relate

to the management of specific casino properties. However, Adjusted

Property EBITDAR should not be considered as an alternative to

operating income as an indicator of our performance, as an

alternative to cash flows from operating activities as a measure of

liquidity, or as an alternative to any other measure determined in

accordance with GAAP. Unlike net income, Adjusted Property EBITDAR

does not include depreciation or interest expense and therefore

does not reflect current or future capital expenditures or the cost

of capital. We have significant uses of cash flows, including

capital expenditures, triple-net operating lease rent expense

related to Encore Boston Harbor, interest payments, debt principal

repayments, income taxes and other non-recurring charges, which are

not reflected in Adjusted Property EBITDAR. Also, our calculation

of Adjusted Property EBITDAR may be different from the calculation

methods used by other companies and, therefore, comparability may

be limited.

(2) "Adjusted net income attributable to Wynn Resorts, Limited"

is net income attributable to Wynn Resorts, Limited before

pre-opening expenses, property charges and other, change in

derivatives fair value, loss on debt financing transactions, and

foreign currency remeasurement and other, net of noncontrolling

interests and income taxes calculated using the specific tax

treatment applicable to the adjustments based on their respective

jurisdictions. Adjusted net income attributable to Wynn Resorts,

Limited and adjusted net income attributable to Wynn Resorts,

Limited per diluted share are presented as supplemental disclosures

to financial measures in accordance with GAAP because management

believes that these non-GAAP financial measures are widely used to

measure the performance, and as a principal basis for valuation, of

gaming companies. These measures are used by management and/or

evaluated by some investors, in addition to net income per share

computed in accordance with GAAP, as an additional basis for

assessing period-to-period results of our business. Adjusted net

income attributable to Wynn Resorts, Limited and adjusted net

income attributable to Wynn Resorts, Limited per diluted share may

be different from the calculation methods used by other companies

and, therefore, comparability may be limited.

The Company has included schedules in the tables that accompany

this release that reconcile (i) net income attributable to Wynn

Resorts, Limited to adjusted net income attributable to Wynn

Resorts, Limited, (ii) operating income (loss) to Adjusted Property

EBITDAR, and (iii) net income attributable to Wynn Resorts, Limited

to Adjusted Property EBITDAR.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except per

share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating revenues:

Casino

$

1,008,946

$

912,999

$

2,130,412

$

1,679,991

Rooms

304,521

276,505

631,935

549,034

Food and beverage

281,404

257,036

548,342

489,647

Entertainment, retail and other

138,061

149,282

285,152

300,829

Total operating revenues

1,732,932

1,595,822

3,595,841

3,019,501

Operating expenses:

Casino

614,518

543,643

1,289,957

1,017,028

Rooms

80,538

73,783

162,615

146,485

Food and beverage

221,343

203,922

427,164

384,541

Entertainment, retail and other

62,941

85,999

133,953

178,481

General and administrative

264,727

257,321

536,343

517,093

Provision for credit losses

2,429

(6,640

)

2,516

(7,184

)

Pre-opening

1,558

1,477

3,593

5,955

Depreciation and amortization

176,405

169,962

351,338

338,774

Property charges and other

38,815

16,019

55,763

18,477

Total operating expenses

1,463,274

1,345,486

2,963,242

2,599,650

Operating income

269,658

250,336

632,599

419,851

Other income (expense):

Interest income

34,884

44,127

75,056

84,320

Interest expense, net of amounts

capitalized

(174,596

)

(190,243

)

(357,000

)

(377,983

)

Change in derivatives fair value

15,517

24,336

(2,397

)

47,382

Loss on debt financing transactions

—

(3,375

)

(1,561

)

(15,611

)

Other

8,745

6,959

4,023

(23,655

)

Other income (expense), net

(115,450

)

(118,196

)

(281,879

)

(285,547

)

Income before income taxes

154,208

132,140

350,720

134,304

Provision for income taxes

(7,935

)

(4,305

)

(27,949

)

(5,323

)

Net income

146,273

127,835

322,771

128,981

Less: net income attributable to

noncontrolling interests

(34,330

)

(22,651

)

(66,612

)

(11,465

)

Net income attributable to Wynn

Resorts, Limited

$

111,943

$

105,184

$

256,159

$

117,516

Basic and diluted net income per common

share:

Net income attributable to Wynn Resorts,

Limited:

Basic

$

1.01

$

0.93

$

2.31

$

1.04

Diluted

$

0.91

$

0.84

$

2.30

$

0.84

Weighted average common shares

outstanding:

Basic

110,937

112,889

110,980

112,821

Diluted

111,175

113,198

111,222

113,143

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

ATTRIBUTABLE TO WYNN RESORTS, LIMITED

TO ADJUSTED NET INCOME

ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands, except per

share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income attributable to Wynn Resorts,

Limited

$

111,943

$

105,184

$

256,159

$

117,516

Pre-opening expenses

1,558

1,477

3,593

5,955

Property charges and other

38,815

16,019

55,763

18,477

Change in derivatives fair value

(15,517

)

(24,336

)

2,397

(47,382

)

Loss on debt financing transactions

—

3,375

1,561

15,611

Foreign currency remeasurement and

other

(8,745

)

(6,959

)

(4,023

)

23,655

Income tax impact on adjustments

(9,684

)

1,502

(10,252

)

10

Noncontrolling interests impact on

adjustments

6,135

7,078

(3,892

)

2,830

Adjusted net income attributable to

Wynn Resorts, Limited

$

124,505

$

103,340

$

301,306

$

136,672

Adjusted net income attributable to

Wynn Resorts, Limited per diluted share

$

1.12

$

0.91

$

2.71

$

1.21

Weighted average common shares outstanding

- diluted

111,175

113,198

111,222

113,143

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING

INCOME (LOSS) TO ADJUSTED PROPERTY EBITDAR

(in thousands)

(unaudited)

Three Months Ended June 30,

2024

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Corporate and Other

Total

Operating income (loss)

$

108,249

$

61,172

$

(7,486

)

$

161,935

$

124,738

$

(17,827

)

$

812

$

269,658

Pre-opening expenses

—

—

—

—

334

515

709

1,558

Depreciation and amortization

55,316

20,035

390

75,741

61,885

31,733

7,046

176,405

Property charges and other

272

883

2

1,157

1,906

(174

)

35,926

38,815

Management and license fees

17,360

10,486

—

27,846

29,675

10,395

(67,916

)

—

Corporate expenses and other

2,005

1,999

5,983

9,987

7,957

1,752

14,014

33,710

Stock-based compensation

1,257

1,336

1,111

3,704

3,838

395

8,230

16,167

Triple-net operating lease rent

expense

—

—

—

—

—

35,342

—

35,342

Adjusted Property EBITDAR

$

184,459

$

95,911

$

—

$

280,370

$

230,333

$

62,131

$

(1,179

)

$

571,655

Three Months Ended June 30,

2023

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Corporate and Other

Total

Operating income (loss)

$

80,275

$

47,267

$

(5,855

)

$

121,687

$

123,270

$

(11,003

)

$

16,382

$

250,336

Pre-opening expenses

—

—

—

—

—

336

1,141

1,477

Depreciation and amortization

53,908

20,527

380

74,815

57,521

30,198

7,428

169,962

Property charges and other

1,534

6,603

12

8,149

6,938

804

128

16,019

Management and license fees

15,074

9,487

—

24,561

27,441

10,746

(62,748

)

—

Corporate expenses and other

2,885

2,894

4,428

10,207

7,330

1,949

13,262

32,748

Stock-based compensation

2,931

2,812

1,035

6,778

1,621

443

9,443

18,285

Triple-net operating lease rent

expense

—

—

—

—

—

35,631

—

35,631

Adjusted Property EBITDAR

$

156,607

$

89,590

$

—

$

246,197

$

224,121

$

69,104

$

(14,964

)

$

524,458

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING

INCOME (LOSS) TO ADJUSTED PROPERTY EBITDAR

(in thousands)

(unaudited)

Six Months Ended June 30,

2024

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Corporate and Other

Total

Operating income (loss)

$

221,841

$

162,176

$

(16,099

)

$

367,918

$

271,187

$

(34,919

)

$

28,413

$

632,599

Pre-opening expenses

—

—

—

—

736

647

2,210

3,593

Depreciation and amortization

110,443

40,079

770

151,292

120,629

63,076

16,341

351,338

Property charges and other

11,692

446

112

12,250

2,175

170

41,168

55,763

Management and license fees

36,288

23,345

—

59,633

59,917

21,023

(140,573

)

—

Corporate expenses and other

4,388

4,501

13,120

22,009

15,951

3,718

31,937

73,615

Stock-based compensation

2,177

2,550

2,097

6,824

6,000

805

16,907

30,536

Triple-net operating lease rent

expense

—

—

—

—

—

70,746

—

70,746

Adjusted Property EBITDAR

$

386,829

$

233,097

$

—

$

619,926

$

476,595

$

125,266

$

(3,597

)

$

1,218,190

Six Months Ended June 30,

2023

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Corporate and Other

Total

Operating income (loss)

$

120,143

$

59,516

$

(10,838

)

$

168,821

$

261,772

$

(25,952

)

$

15,210

$

419,851

Pre-opening expenses

—

—

—

—

81

1,247

4,627

5,955

Depreciation and amortization

108,075

41,177

760

150,012

114,202

60,132

14,428

338,774

Property charges and other

3,829

7,078

13

10,920

7,151

222

184

18,477

Management and license fees

26,904

16,762

—

43,666

55,253

21,249

(120,168

)

—

Corporate expenses and other

5,111

5,219

8,052

18,382

13,886

3,813

31,157

67,238

Stock-based compensation

3,603

4,583

2,013

10,199

3,373

893

18,530

32,995

Triple-net operating lease rent

expense

—

—

—

—

—

70,914

—

70,914

Adjusted Property EBITDAR

$

267,665

$

134,335

$

—

$

402,000

$

455,718

$

132,518

$

(36,032

)

$

954,204

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

ATTRIBUTABLE TO WYNN RESORTS, LIMITED TO

ADJUSTED PROPERTY

EBITDAR

(in thousands)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income attributable to Wynn Resorts,

Limited

$

111,943

$

105,184

$

256,159

$

117,516

Net income attributable to noncontrolling

interests

34,330

22,651

66,612

11,465

Pre-opening expenses

1,558

1,477

3,593

5,955

Depreciation and amortization

176,405

169,962

351,338

338,774

Property charges and other

38,815

16,019

55,763

18,477

Triple-net operating lease rent

expense

35,342

35,631

70,746

70,914

Corporate expenses and other

33,710

32,748

73,615

67,238

Stock-based compensation

16,167

18,285

30,536

32,995

Interest income

(34,884

)

(44,127

)

(75,056

)

(84,320

)

Interest expense, net of amounts

capitalized

174,596

190,243

357,000

377,983

Change in derivatives fair value

(15,517

)

(24,336

)

2,397

(47,382

)

Loss on debt financing transactions

—

3,375

1,561

15,611

Other

(8,745

)

(6,959

)

(4,023

)

23,655

Provision for income taxes

7,935

4,305

27,949

5,323

Adjusted Property EBITDAR

$

571,655

$

524,458

$

1,218,190

$

954,204

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

Percent Change

2024

2023

Percent Change

Wynn Palace Supplemental

Information

Operating revenues

Casino

$

444,964

$

365,277

21.8

$

918,745

$

635,964

44.5

Rooms

50,206

50,092

0.2

104,142

97,002

7.4

Food and beverage

29,829

25,260

18.1

61,899

48,813

26.8

Entertainment, retail and other

23,050

27,721

(16.9

)

50,164

55,934

(10.3

)

Total

$

548,049

$

468,350

17.0

$

1,134,950

$

837,713

35.5

Adjusted Property EBITDAR (6)

$

184,459

$

156,607

17.8

$

386,829

$

267,665

44.5

Casino statistics:

VIP:

Average number of table games

57

57

—

58

54

7.4

VIP turnover

$

2,810,016

$

3,042,338

(7.6

)

$

6,731,100

$

5,335,696

26.2

VIP table games win (1)

$

115,297

$

129,030

(10.6

)

$

244,712

$

191,478

27.8

VIP table games win as a % of turnover

4.10

%

4.24

%

3.64

%

3.59

%

Table games win per unit per day

$

22,092

$

24,728

(10.7

)

$

23,195

$

19,697

17.8

Mass market:

Average number of table games

243

240

1.3

244

239

2.1

Table drop (2)

$

1,738,260

$

1,507,148

15.3

$

3,520,444

$

2,689,146

30.9

Table games win (1)

$

409,409

$

305,817

33.9

$

846,732

$

566,683

49.4

Table games win %

23.6

%

20.3

%

24.1

%

21.1

%

Table games win per unit per day

$

18,484

$

13,980

32.2

$

19,039

$

13,125

45.1

Average number of slot machines

607

586

3.6

590

587

0.5

Slot machine handle

$

642,713

$

579,626

10.9

$

1,238,334

$

1,126,224

10.0

Slot machine win (3)

$

25,590

$

27,583

(7.2

)

$

56,560

$

53,008

6.7

Slot machine win per unit per day

$

464

$

517

(10.3

)

$

527

$

499

5.6

Poker rake

$

736

$

—

NM

$

736

$

—

NM

Room statistics:

Occupancy

98.9

%

96.5

%

98.9

%

92.2

%

ADR (4)

$

316

$

318

(0.6

)

$

326

$

319

2.2

REVPAR (5)

$

312

$

307

1.6

$

323

$

294

9.9

NM - Not meaningful.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

(continued)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

Percent Change

2024

2023

Percent Change

Wynn Macau Supplemental

Information

Operating revenues

Casino

$

280,717

$

242,950

15.5

$

627,070

$

419,333

49.5

Rooms

23,742

26,130

(9.1

)

52,361

48,101

8.9

Food and beverage

20,003

14,666

36.4

41,022

28,968

41.6

Entertainment, retail and other

12,807

17,847

(28.2

)

28,560

35,917

(20.5

)

Total

$

337,269

$

301,593

11.8

$

749,013

$

532,319

40.7

Adjusted Property EBITDAR (6)

$

95,911

$

89,590

7.1

$

233,097

$

134,335

73.5

Casino statistics:

VIP:

Average number of table games

30

48

(37.5

)

30

50

(40.0

)

VIP turnover

$

1,164,075

$

1,390,272

(16.3

)

$

2,753,760

$

2,534,496

8.7

VIP table games win (1)

$

25,473

$

57,828

(56.0

)

$

79,379

$

88,579

(10.4

)

VIP table games win as a % of turnover

2.19

%

4.16

%

2.88

%

3.49

%

Table games win per unit per day

$

9,449

$

13,257

(28.7

)

$

14,629

$

9,808

49.2

Mass market:

Average number of table games

222

209

6.2

222

213

4.2

Table drop (2)

$

1,602,920

$

1,223,311

31.0

$

3,286,071

$

2,213,299

48.5

Table games win (1)

$

280,830

$

216,405

29.8

$

607,150

$

384,831

57.8

Table games win %

17.5

%

17.7

%

18.5

%

17.4

%

Table games win per unit per day

$

13,905

$

11,388

22.1

$

15,048

$

9,997

50.5

Average number of slot machines

617

533

15.8

600

532

12.8

Slot machine handle

$

801,813

$

519,807

54.3

$

1,532,202

$

989,576

54.8

Slot machine win (3)

$

25,978

$

15,452

68.1

$

52,170

$

31,749

64.3

Slot machine win per unit per day

$

463

$

319

45.1

$

478

$

330

44.8

Poker rake

$

3,607

$

5,376

(32.9

)

$

8,626

$

9,312

(7.4

)

Room statistics:

Occupancy

99.4

%

96.8

%

99.4

%

93.9

%

ADR (4)

$

236

$

269

(12.3

)

$

260

$

256

1.6

REVPAR (5)

$

234

$

260

(10.0

)

$

258

$

240

7.5

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

(continued)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

Percent Change

2024

2023

Percent Change

Las Vegas Operations Supplemental

Information

Operating revenues

Casino

$

129,674

$

137,946

(6.0

)

$

264,837

$

292,476

(9.5

)

Rooms

205,872

177,765

15.8

429,948

362,874

18.5

Food and beverage

208,418

195,146

6.8

402,028

367,629

9.4

Entertainment, retail and other

84,690

67,215

26.0

168,389

141,857

18.7

Total

$

628,654

$

578,072

8.8

$

1,265,202

$

1,164,836

8.6

Adjusted Property EBITDAR (6)

$

230,333

$

224,121

2.8

$

476,595

$

455,718

4.6

Casino statistics:

Average number of table games

234

235

(0.4

)

234

233

0.4

Table drop (2)

$

536,461

$

559,701

(4.2

)

$

1,140,635

$

1,160,447

(1.7

)

Table games win (1)

$

117,496

$

128,012

(8.2

)

$

274,107

$

274,022

—

Table games win %

21.9

%

22.9

%

24.0

%

23.6

%

Table games win per unit per day

$

5,529

$

5,997

(7.8

)

$

6,444

$

6,490

(0.7

)

Average number of slot machines

1,598

1,651

(3.2

)

1,608

1,660

(3.1

)

Slot machine handle

$

1,648,364

$

1,522,525

8.3

$

3,144,442

$

3,095,260

1.6

Slot machine win (3)

$

110,017

$

103,357

6.4

$

209,773

$

210,145

(0.2

)

Slot machine win per unit per day

$

757

$

688

10.0

$

717

$

700

2.4

Poker rake

$

7,501

$

6,460

16.1

$

12,023

$

10,574

13.7

Room statistics:

Occupancy

90.9

%

90.6

%

89.4

%

89.7

%

ADR (4)

$

532

$

462

15.2

$

563

$

477

18.0

REVPAR (5)

$

484

$

418

15.8

$

504

$

428

17.8

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR, and REVPAR)

(unaudited)

(continued)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

Percent Change

2024

2023

Percent Change

Encore Boston Harbor Supplemental

Information

Operating revenues

Casino

$

153,591

$

166,826

(7.9

)

$

319,760

$

332,218

(3.7

)

Rooms

24,701

22,518

9.7

45,484

41,057

10.8

Food and beverage

23,154

21,964

5.4

43,393

44,237

(1.9

)

Entertainment, retail and other

11,162

10,624

5.1

21,755

20,726

5.0

Total

$

212,608

$

221,932

(4.2

)

$

430,392

$

438,238

(1.8

)

Adjusted Property EBITDAR (6)

$

62,131

$

69,104

(10.1

)

$

125,266

$

132,518

(5.5

)

Casino statistics:

Average number of table games

185

190

(2.6

)

184

194

(5.2

)

Table drop (2)

$

358,857

$

354,365

1.3

$

725,668

$

720,406

0.7

Table games win (1)

$

70,471

$

79,072

(10.9

)

$

153,449

$

158,615

(3.3

)

Table games win %

19.6

%

22.3

%

21.1

%

22.0

%

Table games win per unit per day

$

4,186

$

4,573

(8.5

)

$

4,576

$

4,512

1.4

Average number of slot machines

2,590

2,561

1.1

2,613

2,540

2.9

Slot machine handle

$

1,420,607

$

1,300,237

9.3

$

2,823,454

$

2,596,664

8.7

Slot machine win (3)

$

105,558

$

106,726

(1.1

)

$

210,223

$

210,799

(0.3

)

Slot machine win per unit per day

$

448

$

458

(2.2

)

$

442

$

459

(3.7

)

Poker rake

$

5,307

$

5,211

1.8

$

11,088

$

10,893

1.8

Room statistics:

Occupancy

96.5

%

92.7

%

93.1

%

91.4

%

ADR (4)

$

422

$

400

5.5

$

403

$

372

8.3

REVPAR (5)

$

407

$

371

9.7

$

375

$

340

10.3

(1)

Table games win is shown before

discounts, commissions and the allocation of casino revenues to

rooms, food and beverage and other revenues for services provided

to casino customers on a complimentary basis.

(2)

In Macau, table drop is the

amount of cash that is deposited in a gaming table's drop box plus

cash chips purchased at the casino cage. In Las Vegas, table drop

is the amount of cash and net markers issued that are deposited in

a gaming table's drop box. At Encore Boston Harbor, table drop is

the amount of cash and gross markers that are deposited in a gaming

table's drop box.

(3)

Slot machine win is calculated as

gross slot machine win minus progressive accruals and free

play.

(4)

ADR is average daily rate and is

calculated by dividing total room revenues including

complimentaries (less service charges, if any) by total rooms

occupied.

(5)

REVPAR is revenue per available

room and is calculated by dividing total room revenues including

complimentaries (less service charges, if any) by total rooms

available.

(6)

Refer to accompanying

reconciliations of Operating Income (Loss) to Adjusted Property

EBITDAR and Net Income Attributable to Wynn Resorts, Limited to

Adjusted Property EBITDAR.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806344291/en/

Price Karr 702-770-7555 investorrelations@wynnresorts.com

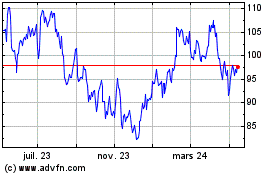

Wynn Resorts (NASDAQ:WYNN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

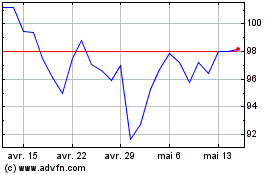

Wynn Resorts (NASDAQ:WYNN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024