- GAAP Net Earnings of $0.07 per share and FFO Before Special

Items of $0.32 per share

- Core Same-Property NOI Growth of 5.9%

- GAAP and Cash New Leasing Spreads of 73% and 46%,

respectively

- Core Signed Not Open Pipeline Increased to $10 million

(Approximately 7% of ABR)

- Completed Approximately $150 million of Accretive Core and

Investment Management Acquisitions and Increased its Pipeline to

$425 million

- Fully-Funded its Completed Acquisitions and

Pipeline with Common Equity Proceeds of Approximately $320

million

- Reduced its Pro-Rata Net Debt-to-EBITDA (Inclusive of

Investment Management Share) to 5.6x

Acadia Realty Trust (NYSE: AKR) (“Acadia” or the “Company”)

today reported operating results for the quarter ended September

30, 2024. All per share amounts are on a fully-diluted basis, where

applicable. Acadia owns and operates a high-quality real estate

portfolio of street and open-air retail properties in the nation's

most dynamic retail corridors ("Core" or "Core Portfolio"), along

with an investment management platform that targets opportunistic

and value-add investments through its institutional co-investment

vehicles ("Investment Management").

Kenneth F. Bernstein, President and CEO

of Acadia, commented:

“Our third-quarter results highlight the

ongoing internal growth from our Core Portfolio now coupled with

the recent acceleration of our accretive acquisition initiatives.

We achieved record acquisition and leasing volumes during the

quarter. With approximately $575 million of accretive Core and

Investment Management acquisitions completed or in advanced stages

of negotiation, along with achieving a record setting volume of $7

million in new Core leases, we have increased confidence in our

earnings growth over the next several years. We continue to see

compelling investment opportunities and remain focused on

acquisitions in our key street markets that provide us with

immediate accretion to our earnings, net asset value creation, and

complement the continuation of our long-term internal growth. We

believe that our highly differentiated platform is well-positioned

to deliver meaningful value and provides us with sustainable growth

for our stakeholders."

FINANCIAL RESULTS

A complete reconciliation, in dollars and per share amounts, of

(i) net income attributable to Acadia to FFO (as defined by NAREIT

and Before Special Items) attributable to common shareholders and

common OP Unit holders and (ii) operating income to NOI is included

in the financial tables of this release. The amounts discussed

below are net of noncontrolling interests and all per share amounts

are on a fully-diluted basis.

Financial Results

2024

2023

3Q

3Q

Net earnings per share attributable to

Acadia

$0.07

($0.02)

Depreciation of real estate and

amortization of leasing costs (net of noncontrolling interest

share)

0.23

0.27

Gain on disposition of properties (net of

noncontrolling interests' share)

(0.02)

—

Noncontrolling interest in Operating

Partnership

—

0.01

NAREIT Funds From Operations per share

attributable to Common Shareholders and Common OP Unit

holders

$0.28

$0.26

Net unrealized holding loss (gain) 1

0.02

(0.01)

Funds From Operations Before Special

Items and Realized Gains and Promotes per share attributable to

Common Shareholders and Common OP Unit holders

$0.30

$0.25

Realized gains and promotes1

0.02

0.02

Funds From Operations Before Special

Items per share attributable to Common Shareholders and Common OP

Unit holders

$0.32

$0.27

________

1.

It is the Company's policy to exclude

unrealized gains and losses from FFO Before Special items and to

include realized gains related to the Company's investment in

Albertsons. The Company realized investment gains of $2.9 million

on 150,000 shares for the quarter ended September 30, 2024 and

investment gains of $2.4 million for the quarter ended September

30, 2023. Refer to the "Notes to Financial Highlights" page 14 of

this document.

Net

Income

- Net income for the quarter ended September 30, 2024, was $8.1

million, or $0.07 per share.

- This compares with net loss of $1.7 million, or $0.02 per share

for the quarter ended September 30, 2023.

NAREIT

FFO

- NAREIT Funds From Operations ("NAREIT FFO") for the quarter

ended September 30, 2024 was $33.0 million, or $0.28 per

share.

- This compares with NAREIT FFO of $26.8 million, or $0.26 per

share, for the quarter ended September 30, 2023.

FFO Before

Special Items

- Funds From Operations ("FFO") Before Special Items for the

quarter ended September 30, 2024 was $37.1 million, or $0.32 per

share, which includes $2.9 million, or $0.02 per share, of realized

investment gains (150,000 shares of Albertsons' stock sold at an

average price of $19.52 per share).

- This compares with FFO Before Special Items of $27.6 million,

or $0.27 per share for the quarter ended September 30, 2023, which

includes $2.4 million, or $0.02 per share, of realized investment

gains from the sale of Albertsons' stock.

CORE PORTFOLIO PERFORMANCE

Same-Property

NOI

- Same-Property Net Operating Income ("NOI") growth, excluding

redevelopments, increased 5.9% for the third quarter, driven by the

street portfolio.

Leasing and

Occupancy Update

- For the quarter ended September 30, 2024, conforming GAAP and

cash leasing spreads on new leases were 73% and 46%, respectively,

primarily driven by street leases.

- As of September 30, 2024, primarily driven by a new acquisition

with acquired vacancy, the Core Portfolio occupancy percentages

remained constant at 94.7% leased and 91.7% occupied compared to

94.8% leased and 91.8% occupied as of June 30, 2024.

- Core Signed Not Open ("SNO") pipeline (excluding

redevelopments) increased to approximately $10.0 million of

annualized base rent ("ABR") at September 30, 2024, representing

approximately 7% of in-place rents. This is an increase in excess

of 20% from the approximately $8.1 million of SNO as of June 30,

2024.

- During the third quarter of 2024, the Company signed pro-rata

ABR of $7.0 million in new leases for the Core portfolio. This

included a new lease with the European fashion brand, Mango, for

the entirety of its building at 664 North Michigan Avenue in

Chicago, along with leasing the entirety of 50-54 East Walton

Street in Chicago's Gold Coast to a well-known New York City-based

fashion and footwear lifestyle brand.

- Approximately $4.6 million of the $7.0 million above represents

incremental ABR. This consists of approximately $3.0 million of new

leases signed on vacant space and $4.0 million of new leases on

currently occupied space with an increase of approximately $1.6

million in excess of current rents.

ACQUISITION ACTIVITY

As further described below, during the quarter and to date, the

Company increased its Core and Investment Management acquisition

activities to approximately $575 million, consisting of $150

million of completed acquisitions ($120 million and $30 million of

Core and Investment Management acquisitions, respectively) and a

pipeline of $425 million of acquisitions that are subject to

agreements or in advanced stages of negotiation ($150 million and

$275 million of Core and Investment Management acquisitions,

respectively).

Core Portfolio

Acquisitions

Completed: Approximately $120 million | Pipeline:

Approximately $150 million

- Bleecker Street Portfolio, Manhattan, New York. As

previously announced, during the third quarter, the Company

acquired a four-building retail portfolio along the Bleecker Street

retail corridor in the West Village of Manhattan for $20.3 million.

The portfolio offers the potential for both lease up and accretive

mark-to-market re-leasing opportunities. This acquisition is

complementary to its existing Street retail corridors and aligns

with the Company's strategy of targeting high-quality core assets

in markets with high barriers to entry.

- Williamsburg, Brooklyn, New York. In October 2024, the

Company completed the acquisitions of 123-129 N. 6th Street for

$35.0 million and 109 N. 6th Street for $18.3 million in

Williamsburg, Brooklyn. This collection of retail assets is located

in one of New York City's most dynamic and in-demand retail

corridors and offers below-market rents and lease-up opportunities.

These acquisitions expand the Company's existing Williamsburg

portfolio.

- SoHo Manhattan, New York. In October 2024, the Company

closed on 92-94 Greene Street for $43.4 million which is adjacent

to its existing property located on the corner of Spring and Green

Street in SoHo. This acquisition expands the Company's SoHo

portfolio to 12 buildings, eight of which are on Greene Street. The

property provides an opportunity for near-term opportunity for

accretive re-leasing.

- Core Portfolio Pipeline. The Company is also under

agreements or in advanced stages of negotiations relating to

potential investments with an aggregate purchase price of

approximately $150.0 million to acquire Street retail assets within

its existing markets, including the Georgetown corridor of

Washington D.C., SoHo Manhattan, New York, and Henderson Avenue in

Dallas, Texas.

Investment Management

Acquisitions

Completed: Approximately $30 million | Pipeline:

Approximately $275 million

- The Walk at Highwoods Preserve, Tampa, Florida. As

previously announced, in July 2024, the Company completed the

acquisition of a 141,000 square foot open-air shopping center

anchored by Home Goods and Michaels. In October 2024, the Company

entered into a joint venture with funds managed by the Private Real

Estate Group of Cohen & Steers to own the property. The Company

will be entitled to an asset management fee and an opportunity to

earn a promote upon the ultimate disposition of the investment.

Additionally, the Company will manage the day-to-day operations of

the investment entitling it to earn management, leasing, and

construction fees.

- Investment Management Pipeline. The Company is in

advanced stages of negotiation involving a potential investment

with an aggregate purchase price of approximately $275.0 million of

gross asset value (including the Company's share). The Company

anticipates acquiring a minority interest along with a leading

global alternative asset management firm. Upon closing, the Company

will be entitled to an asset management fee and an opportunity to

earn a promote upon the ultimate disposition of the investment.

Additionally, the Company will manage day-to-day operations

entitling it to earn management, leasing, and construction

fees.

The pending Core and Investment Management transactions

described within the Pipeline above are subject to final agreement

between the parties, customary closing conditions and market

uncertainty. Thus, no assurances can be given that the Company will

successfully close on any of these transactions on the anticipated

timeline or at all.

DISPOSITION ACTIVITY

Investment Management

Disposition

- Frederick Crossing, Frederick, Maryland. In the third

quarter, the Company, in partnership with DLC Management Corp.,

completed the sale of Frederick Crossing, a Fund V asset, for $47.2

million, and repaid the related $23.2 million mortgage loan. This

sale generated a 27% IRR, 2.1x multiple on the Fund's equity

investment and a $11.6 million gain, of which $2.3 million was the

Company's share.

PORTFOLIO EXPANSION

Core Portfolio

- Henderson Avenue Corridor Expansion. In October 2024,

the Company, in partnership with Ignite-Rebees, commenced

construction on a major expansion to its existing 14 building

portfolio on Henderson Avenue in Dallas, Texas. Upon completion,

the project will add up to an additional 10 buildings and

approximately 160,000 square feet to its existing 121,385 square

feet retail portfolio, which was acquired by the Company in 2022.

The expansion will accelerate the transformation of this corridor

into a vibrant, walkable, street retail destination, positioning

the asset to be one of the most exciting urban retail hubs in the

Dallas-Fort Worth Metroplex. The project is scheduled for

completion in late 2026 and stabilization in 2027.

BALANCE SHEET

- Equity Activity: Raised net proceeds during the quarter

and through October 28, 2024 of $318.8 million from the sale of

14.3 million shares of its common stock consisting of $187.0

million (8.5 million shares) through the Company's at-the-market

issuance program and $131.8 million (5.75 million shares, inclusive

of the underwriters exercised option to purchase 750,000 additional

shares) through an underwritten public offering in connection with

forward sales agreements. Subsequent to the quarter end, the

Company physically settled the forward sales agreements in its

entirety to fund its acquisition activities.

- Expansion of Unsecured Credit Facility and Repayment of $175

Million Term Loan: In September 2024, the Company increased the

borrowing capacity of its credit facility from $350.0 million to

$525.0 million along with increasing the facility's accordion

feature from $900.0 million to $1.1 billion. Additionally, the

Company repaid, in full, its $175.0 million term loan.

- Debt-to-EBITDA Metrics: Pro-rata Core and Investment

Management Net Debt-to-EBITDA improved to 5.6x at September 30,

2024 as compared to 6.3x and 6.7x at June 30, 2024, and December

31, 2023, respectively. Refer to the third quarter 2024

Supplemental Information package for reconciliations and details on

financial ratios.

- $100 Million of Private Unsecured Notes: In August 2024,

the Company closed on its previously reported inaugural private

placement of $100 million of senior unsecured notes comprised of an

$80 million and $20 million note with a five- and three- year term,

respectively. The five-year and three-year notes bear interest at

fixed annual rates of 5.94% and 5.86%, respectively, based on

credit spreads of 150 and 125 basis points over the five- and

three-year U.S. Treasury bonds as of the date of pricing (May 21,

2024), respectively.

- No Significant Core Debt Maturities until 2028: 3.4%,

0.3%, 6.9% and 5.6% of Core debt maturing in 2024, 2025, 2026, and

2027, respectively.

CONFERENCE CALL

Management will conduct a conference call on Monday, October 28,

2024 at 11:00 AM ET to review the Company’s earnings and operating

results. Participant registration and webcast information is listed

below.

Live Conference Call:

Date:

Monday, October 28, 2024

Time:

11:00 AM ET

Participant call:

Third Quarter 2024 Dial-In

Participant webcast:

Third Quarter 2024 Webcast

Webcast Listen-only and Replay:

www.acadiarealty.com/investors under

Investors, Presentations & Events

The Company uses, and intends to use, the Investors page of its

website, which can be found at

https://www.acadiarealty.com/investors, as a means of disclosing

material nonpublic information and of complying with its disclosure

obligations under Regulation FD, including, without limitation,

through the posting of investor presentations and certain portfolio

updates. Additionally, the Company also uses its LinkedIn profile

to communicate with its investors and the public. Accordingly,

investors are encouraged to monitor the Investors page of the

Company's website and its LinkedIn profile, in addition to

following the Company’s press releases, SEC filings, public

conference calls, presentations and webcasts.

About Acadia Realty Trust

Acadia Realty Trust is an equity real estate investment trust

focused on delivering long-term, profitable growth. Acadia owns and

operates a high-quality core real estate portfolio ("Core" or "Core

Portfolio") of street and open-air retail properties in the

nation's most dynamic retail corridors, along with an investment

management platform that targets opportunistic and value-add

investments through its institutional co-investment vehicles. For

further information, please visit www.acadiarealty.com.

Safe Harbor Statement

Certain statements in this press release may contain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements, which are based on certain assumptions and describe the

Company's future plans, strategies and expectations are generally

identifiable by the use of words, such as “may,” “will,” “should,”

“expect,” “anticipate,” “estimate,” “believe,” “intend” or

“project,” or the negative thereof, or other variations thereon or

comparable terminology. Forward-looking statements involve known

and unknown risks, uncertainties and other factors that could cause

the Company's actual results and financial performance to be

materially different from future results and financial performance

expressed or implied by such forward-looking statements, including,

but not limited to: (i) macroeconomic conditions, including due to

geopolitical conditions and instability, which may lead to a

disruption of or lack of access to the capital markets, disruptions

and instability in the banking and financial services industries

and rising inflation; (ii) the Company’s success in implementing

its business strategy and its ability to identify, underwrite,

finance, consummate and integrate diversifying acquisitions and

investments; (including the potential acquisitions discussed in

this press release); (iii) changes in general economic conditions

or economic conditions in the markets in which the Company may,

from time to time, compete, and their effect on the Company’s

revenues, earnings and funding sources; (iv) increases in the

Company’s borrowing costs as a result of rising inflation, changes

in interest rates and other factors; (v) the Company’s ability to

pay down, refinance, restructure or extend its indebtedness as it

becomes due; (vi) the Company’s investments in joint ventures and

unconsolidated entities, including its lack of sole decision-making

authority and its reliance on its joint venture partners’ financial

condition; (vii) the Company’s ability to obtain the financial

results expected from its development and redevelopment projects;

(viii) the ability and willingness of the Company's tenants to

renew their leases with the Company upon expiration, the Company’s

ability to re-lease its properties on the same or better terms in

the event of nonrenewal or in the event the Company exercises its

right to replace an existing tenant, and obligations the Company

may incur in connection with the replacement of an existing tenant;

(ix) the Company’s potential liability for environmental matters;

(x) damage to the Company’s properties from catastrophic weather

and other natural events, and the physical effects of climate

change; (xi) the economic, political and social impact of, and

uncertainty surrounding, any public health crisis, such as the

COVID-19 Pandemic, which adversely affected the Company and its

tenants’ business, financial condition, results of operations and

liquidity; (xii) uninsured losses; (xiii) the Company’s ability and

willingness to maintain its qualification as a REIT in light of

economic, market, legal, tax and other considerations; (xiv)

information technology security breaches, including increased

cybersecurity risks relating to the use of remote technology; (xv)

the loss of key executives; and (xvi) the accuracy of the Company’s

methodologies and estimates regarding environmental, social and

governance (“ESG”) metrics, goals and targets, tenant willingness

and ability to collaborate towards reporting ESG metrics and

meeting ESG goals and targets, and the impact of governmental

regulation on its ESG efforts.

The factors described above are not exhaustive and additional

factors could adversely affect the Company’s future results and

financial performance, including the risk factors discussed under

the section captioned “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K and other periodic or current reports

the Company files with the SEC. Any forward-looking statements in

this press release speak only as of the date hereof. The Company

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

to reflect any changes in the Company’s expectations with regard

thereto or changes in the events, conditions or circumstances on

which such forward-looking statements are based.

ACADIA REALTY TRUST AND

SUBSIDIARIES

Condensed Consolidated

Statements of Operations (1)

(Unaudited, Dollars and Common

Shares and Units in thousands, except per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

Rental income

$

86,288

$

79,961

$

257,951

$

248,839

Other

1,457

1,431

8,404

4,340

Total revenues

87,745

81,392

266,355

253,179

Expenses

Depreciation and amortization

34,500

33,726

103,721

100,955

General and administrative

10,215

10,309

30,162

30,898

Real estate taxes

11,187

11,726

33,514

34,586

Property operating

14,351

15,254

49,228

44,597

Impairment charges

—

3,686

—

3,686

Total expenses

70,253

74,701

216,625

214,722

Loss on disposition of properties

—

—

(441

)

—

Operating income

17,492

6,691

49,289

38,457

Equity in earnings (losses) of

unconsolidated affiliates

11,784

(4,865

)

15,952

(6,273

)

Interest income

7,859

5,087

18,510

14,875

Realized and unrealized holding (losses)

gains on investments and other

(1,503

)

1,664

(5,918

)

30,236

Interest expense

(23,363

)

(24,885

)

(70,653

)

(68,561

)

Income (loss) from continuing operations

before income taxes

12,269

(16,308

)

7,180

8,734

Income tax (provision) benefit

(15

)

40

(201

)

(248

)

Net income (loss)

12,254

(16,268

)

6,979

8,486

Net loss attributable to redeemable

noncontrolling interests

1,672

2,495

6,518

5,661

Net (income) loss attributable to

noncontrolling interests

(5,512

)

12,347

(371

)

7,063

Net income (loss) attributable to Acadia

shareholders

$

8,414

$

(1,426

)

$

13,126

$

21,210

Less: earnings attributable to unvested

participating securities

(306

)

(244

)

(883

)

(734

)

Income from continuing operations net of

income attributable to participating securities for diluted

earnings per share

$

8,108

$

(1,670

)

$

12,243

$

20,476

Weighted average shares for basic earnings

per share

108,351

95,320

104,704

95,257

Weighted average shares for diluted

earnings per share

108,351

95,320

104,704

95,257

Net earnings per share - basic

(2)

$

0.07

$

(0.02

)

$

0.12

$

0.21

Net earnings per share - diluted

(2)

$

0.07

$

(0.02

)

$

0.12

$

0.21

ACADIA REALTY TRUST AND

SUBSIDIARIES

Reconciliation of Consolidated

Net Income to Funds from Operations (1,3)

(Unaudited, Dollars and Common

Shares and Units in thousands, except per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income (loss) attributable to

Acadia

$

8,414

$

(1,426

)

$

13,126

$

21,210

Depreciation of real estate and

amortization of leasing costs (net of noncontrolling interests'

share)

26,407

27,351

79,785

82,043

Impairment charges (net of noncontrolling

interests' share)

—

852

—

852

Gain on disposition of properties (net of

noncontrolling interests' share)

(2,324

)

—

(1,481

)

—

Income attributable to Common OP Unit

holders

398

(55

)

704

1,313

Funds from operations attributable to

Common Shareholders and Common OP Unit holders - Basic and

Diluted

67

123

274

369

Funds from operations attributable to

Common Shareholders and Common OP Unit holders - Diluted

$

32,962

$

26,845

$

92,408

$

105,787

Adjustments for Special Items:

Unrealized holding loss (gain) (net of

noncontrolling interest share) (4)

1,242

(1,631

)

5,565

(3,410

)

Realized gain

2,923

2,371

10,503

2,371

Funds from operations before Special

Items attributable to Common Shareholders and Common OP Unit

holders

$

37,127

$

27,585

$

108,476

$

104,748

Funds From Operations per Share -

Diluted

Basic weighted-average shares outstanding,

GAAP earnings

108,351

95,320

104,704

95,257

Weighted-average OP Units outstanding

7,223

6,962

7,340

6,980

Assumed conversion of Preferred OP Units

to common shares

256

464

256

464

Assumed conversion of LTIP units and

restricted share units to common shares

1,174

—

964

—

Weighted average number of Common Shares

and Common OP Units

117,004

102,746

113,264

102,701

Diluted Funds from operations, per Common

Share and Common OP Unit

$

0.28

$

0.26

$

0.82

$

1.03

Diluted Funds from operations before

Special Items, per Common Share and Common OP Unit

$

0.32

$

0.27

$

0.96

$

1.02

ACADIA REALTY TRUST AND

SUBSIDIARIES

Reconciliation of Consolidated

Operating Income to Net Property Operating Income (“NOI”)

(1)

(Unaudited, Dollars in

thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Consolidated operating income

$

17,492

$

6,691

$

49,289

$

38,457

Add back:

General and administrative

10,215

10,309

30,162

30,898

Depreciation and amortization

34,500

33,726

103,721

100,955

Impairment charges

—

3,686

—

3,686

Loss on disposition of properties

—

—

441

—

Less:

Above/below market rent, straight-line

rent and other adjustments

(5,498

)

(3,336

)

(12,975

)

(18,666

)

Consolidated NOI

56,709

51,076

170,638

155,330

Redeemable noncontrolling interest in

consolidated NOI

(1,711

)

(861

)

(4,133

)

(3,260

)

Noncontrolling interest in consolidated

NOI

(17,060

)

(14,927

)

(52,314

)

(43,132

)

Less: Operating Partnership's interest in

Investment Management NOI included above

(6,940

)

(4,656

)

(18,413

)

(14,458

)

Add: Operating Partnership's share of

unconsolidated joint ventures NOI (5)

2,291

3,163

8,504

11,263

Core Portfolio NOI

$

33,289

$

33,795

$

104,282

$

105,743

Reconciliation of

Same-Property NOI

(Unaudited, Dollars in

thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Core Portfolio NOI

$

33,289

$

33,795

$

104,282

$

105,743

Less properties excluded from

Same-Property NOI

(1,516

)

(3,780

)

(8,340

)

(15,014

)

Same-Property NOI

$

31,773

$

30,015

$

95,942

$

90,729

Percent change from prior year period

5.9

%

5.7

%

Components of Same-Property NOI:

Same-Property Revenues

$

45,101

$

43,228

$

136,891

$

130,286

Same-Property Operating Expenses

(13,328

)

(13,213

)

(40,949

)

(39,557

)

Same-Property NOI

$

31,773

$

30,015

$

95,942

$

90,729

ACADIA REALTY TRUST AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets (1)

(Unaudited, Dollars in thousands,

except shares)

As of

September 30, 2024

December 31, 2023

ASSETS

Investments in real estate, at cost

Buildings and improvements

$

3,121,177

$

3,128,650

Tenant improvements

291,401

257,955

Land

854,487

872,228

Construction in progress

21,212

23,250

Right-of-use assets - finance leases

61,366

58,637

4,349,643

4,340,720

Less: Accumulated depreciation and

amortization

(899,068

)

(823,439

)

Operating real estate, net

3,450,575

3,517,281

Real estate under development

109,778

94,799

Net investments in real estate

3,560,353

3,612,080

Notes receivable, net ($1,835 and $1,279

of allowance for credit losses as of September 30, 2024 and

December 31, 2023, respectively)

126,576

124,949

Investments in and advances to

unconsolidated affiliates

187,363

197,240

Other assets, net

196,920

208,460

Right-of-use assets - operating leases,

net

26,820

29,286

Cash and cash equivalents

46,207

17,481

Restricted cash

23,088

7,813

Marketable securities

17,503

33,284

Rents receivable, net

55,615

49,504

Assets of properties held for sale

35,878

11,057

Total assets

$

4,276,323

$

4,291,154

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND EQUITY

Liabilities:

Mortgage and other notes payable, net

$

954,371

$

930,127

Unsecured notes payable, net

569,242

726,727

Unsecured line of credit

56,000

213,287

Accounts payable and other liabilities

221,506

229,375

Lease liability - operating leases

29,013

31,580

Dividends and distributions payable

22,995

18,520

Distributions in excess of income from,

and investments in, unconsolidated affiliates

7,797

7,982

Liabilities of properties held for

sale

5,435

—

Total liabilities

1,866,359

2,157,598

Commitments and contingencies

Redeemable noncontrolling interests

35,037

50,339

Equity:

Common shares, $0.001 par value per share,

authorized 200,000,000 shares, issued and outstanding 113,902,348

and 95,361,676 shares, respectively

114

95

Additional paid-in capital

2,304,534

1,953,521

Accumulated other comprehensive income

17,251

32,442

Distributions in excess of accumulated

earnings

(395,172

)

(349,141

)

Total Acadia shareholders’ equity

1,926,727

1,636,917

Noncontrolling interests

448,200

446,300

Total equity

2,374,927

2,083,217

Total liabilities, redeemable

noncontrolling interests, and equity

$

4,276,323

$

4,291,154

ACADIA REALTY TRUST AND SUBSIDIARIES

Notes to Financial Highlights:

- For additional information and analysis concerning the

Company’s balance sheet and results of operations, reference is

made to the Company’s quarterly supplemental disclosures for the

relevant periods furnished on the Company's Current Report on Form

8-K, which is available on the SEC's website at www.sec.gov and on

the Company’s website at www.acadiarealty.com.

- Diluted earnings per share reflects the potential dilution that

could occur if securities or other contracts to issue common shares

of the Company were exercised or converted into common shares. The

effect of the conversion of units of limited partnership interest

(“OP Units”) in Acadia Realty Limited Partnership, the operating

partnership of the Company (the “Operating Partnership”), is not

reflected in the above table; OP Units are exchangeable into common

shares on a one-for-one basis. The income allocable to such OP

units is allocated on the same basis and reflected as

noncontrolling interests in the consolidated financial statements.

As such, the assumed conversion of these OP Units would have no net

impact on the determination of diluted earnings per share.

- The Company considers funds from operations (“FFO”) as defined

by the National Association of Real Estate Investment Trusts

(“NAREIT”) and net property operating income (“NOI”) to be

appropriate supplemental disclosures of operating performance for

an equity REIT due to their widespread acceptance and use within

the REIT and analyst communities. In addition, the Company believes

that given the atypical nature of certain unusual items (as further

described below), “FFO Before Special Items” is also an appropriate

supplemental disclosure of operating performance. FFO, FFO Before

Special Items and NOI are presented to assist investors in

analyzing the performance of the Company. The Company believes they

are helpful as they exclude various items included in net income

(loss) that are not indicative of operating performance, such as

(i) gains (losses) from sales of real estate properties; (ii)

depreciation and amortization and (iii) impairment of depreciable

real estate properties. In addition, NOI excludes interest expense

and FFO Before Special Items excludes certain unusual items (as

further described below). The Company’s method of calculating FFO,

FFO Before Special Items and NOI may be different from methods used

by other REITs and, accordingly, may not be comparable to such

other REITs. Neither FFO nor FFO Before Special Items represent

cash generated from operations as defined by generally accepted

accounting principles (“GAAP”), or are indicative of cash available

to fund all cash needs, including distributions. Such measures

should not be considered as an alternative to net income (loss) for

the purpose of evaluating the Company’s performance or to cash

flows as a measure of liquidity.

- Consistent with the NAREIT definition, the Company defines FFO

as net income (computed in accordance with GAAP) excluding:

- gains (losses) from sales of real estate properties;

- depreciation and amortization;

- impairment of real estate properties;

- gains and losses from change in control; and

- after adjustments for unconsolidated partnerships and joint

ventures.

- Also consistent with NAREIT’s definition of FFO, the Company

has elected to include: the impact of the unrealized holding gains

(losses) incidental to its main business, including those related

to its RCP investments such as Albertsons in FFO.

- FFO Before Special Items begins with the NAREIT definition of

FFO and adjusts FFO (or as an adjustment to the numerator within

its earnings per share calculations) to take into account FFO

without regard to certain unusual items including:

- charges, income and gains that management believes are not

comparable and indicative of the results of the Company’s operating

real estate portfolio;

- the impact of the unrealized holding gains (losses) incidental

to its main business, including those related to its Retailer

Controlled Property Venture ("RCP") investments such as Albertsons;

and

- any realized income or gains from the Company’s investment in

Albertsons.

- The Company defines Special Items to include (i) unrealized

holding losses or gains (net of noncontrolling interest share) on

investments and (ii) other costs that do not occur in the ordinary

course of our underwriting and investing business.

- The pro-rata share of NOI is based upon the Operating

Partnership’s stated ownership percentages in each venture or

Investment Management’s operating agreement and does not include

the Operating Partnership's share of NOI from unconsolidated

partnerships and joint ventures within Investment Management.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028806586/en/

Sandra Liang (914) 288-3356

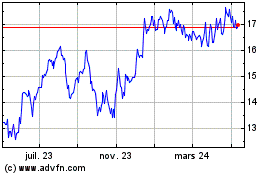

Acadia Realty (NYSE:AKR)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

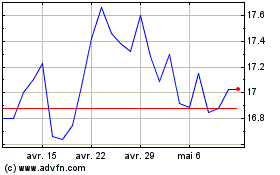

Acadia Realty (NYSE:AKR)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024