UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

_______________________

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

Date: March 4, 2024

Commission File Number: 001-37946

_______________________

| | |

|

| Algonquin Power & Utilities Corp. |

(Translation of registrant’s name into English)

_______________________

354 Davis Road

Oakville, Ontario, L6J 2X1, Canada

(Address of principal executive offices)

_______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F □ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): □

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): □

EXHIBIT INDEX

The following exhibits are filed as part of this Form 6-K:

| | | | | |

| Exhibit | Description |

| 99.1 | Press Release dated March 4, 2024 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

|

| |

| ALGONQUIN POWER & UTILITIES CORP. |

| (registrant) |

| |

| |

| Date: March 4, 2024 | By: /s/ Darren Myers |

| Name: Darren Myers |

| Title: Chief Financial Officer |

Algonquin Power & Utilities Corp. Announces Dividend Rates on Cumulative Rate Reset Preferred Shares, Series D, and Cumulative Floating Rate Preferred Shares, Series E

OAKVILLE, Ontario, March 4, 2024 – Further to the news release of Algonquin Power & Utilities Corp. (“AQN” or the “Company”) (TSX: AQN) (NYSE: AQN) dated February 20, 2024, the Company announced today the applicable dividend rates, determined as of March 1, 2024, for its Cumulative Rate Reset Preferred Shares, Series D (the “Series D Preferred Shares”) and Cumulative Floating Rate Preferred Shares, Series E (the “Series E Preferred Shares”).

With respect to any Series D Preferred Shares that remain outstanding after April 1, 2024, holders thereof will be entitled to receive quarterly fixed cumulative preferential cash dividends, if, as and when declared by the board of directors of the Company (the “Board”). The dividend rate for the 5-year period from and including March 31, 2024 to but excluding March 31, 2029 will be 6.853%, being equal to the 5-year Government of Canada bond yield determined as of March 1, 2024 plus 3.28%, in accordance with the terms of the Series D Preferred Shares.

With respect to any Series E Preferred Shares that may be issued on April 1, 2024, holders thereof will be entitled to receive quarterly floating rate cumulative preferential cash dividends, if, as and when declared by the Board. The dividend rate for the 3-month floating rate period from and including March 31, 2024 to but excluding June 30, 2024 will be 8.261%, being equal to the 3-month Government of Canada Treasury Bill yield determined as of March 1, 2024 plus 3.28%, calculated on the basis of the actual number of days in such quarterly period divided by 365, in accordance with the terms of the Series E Preferred Shares.

Beneficial owners of Series D Preferred Shares who wish to exercise their conversion right should communicate with their broker or other nominee to ensure their instructions are followed so that the registered holder of the Series D Preferred Shares can meet the deadline to exercise such conversion right, which is 5:00 p.m. (EST) on March 18, 2024.

About Algonquin Power & Utilities Corp.

Algonquin Power & Utilities Corp., parent company of Liberty, is a diversified international generation, transmission, and distribution utility with approximately $18 billion of total assets. AQN is committed to providing safe, secure, reliable, cost-effective, and sustainable energy and water solutions through its portfolio of generation, transmission, and distribution utility investments to over one million customer connections, largely in the United States and Canada. In addition, AQN owns, operates, and/or has net interests in over 4 GW of installed renewable energy capacity.

AQN's common shares, preferred shares, Series A, and preferred shares, Series D are listed on the Toronto Stock Exchange under the symbols AQN, AQN.PR.A, and AQN.PR.D, respectively. AQN's common shares, Series 2019-A subordinated notes and equity units are listed on the New York Stock Exchange under the symbols AQN, AQNB, and AQNU, respectively.

Visit AQN at www.algonquinpower.com and follow us on Twitter @AQN_Utilities.

Investor Inquiries:

Brian Chin

Vice President, Investor Relations

Algonquin Power & Utilities Corp.

E-mail: InvestorRelations@APUCorp.com

Telephone: (905) 465-4500

Media Inquiries:

Stephanie Bose

Director, Corporate Communications

Liberty

E-mail: Corporate.Communications@libertyutilities.com

Telephone: (905) 465-4500

Caution Regarding Forward-Looking Information

Certain statements included in this press release constitute “forward-looking information” within the meaning of applicable securities laws in each of the provinces and territories of Canada and the respective policies, regulations and rules under such laws and “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). The words “will” and “expects” (and grammatical variations of such terms) and similar expressions are often intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Specific forward-looking statements in this press release include, but are not limited to, the declaration of quarterly dividends. These statements are based on factors or assumptions that were applied in drawing a conclusion or making a forecast or projection, including assumptions based on historical trends, current conditions and expected future developments. Since forward-looking statements relate to future events and conditions, by their very nature they require making assumptions and involve inherent risks and uncertainties. AQN cautions that although it is believed that the assumptions are reasonable in the circumstances, these risks and uncertainties give rise to the possibility that actual results may differ materially from the expectations set out in the forward-looking statements. Forward-looking statements contained herein are provided for the purposes of presenting information about management's current expectations and plans relating to the future and such information may not be appropriate for other purposes. Material risk factors and assumptions include those set out in AQN's Annual Information Form and Management Discussion & Analysis for the year ended December 31, 2022, and in AQN's Management Discussion & Analysis for the three and nine months ended September 30, 2023, each of which is available on SEDAR+ and EDGAR.

Given these risks, undue reliance should not be placed on these forward-looking statements, which apply only as of their dates. Other than as specifically required by law, AQN undertakes no obligation to update any forward-looking statements to reflect new information, subsequent or otherwise.

Algonquin Power (NYSE:AQN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

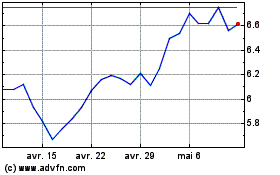

Algonquin Power (NYSE:AQN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024