UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22535

| ARES

DYNAMIC CREDIT ALLOCATION FUND, INC. | |

| | (Exact name of registrant as specified in charter) | |

| 1800 AVENUE OF THE STARS | |

| | SUITE 1400 | |

| | LOS ANGELES, CALIFORNIA 90067 | |

| | (Address of principal executive offices)(Zip code) | |

| |

(Name and Address of Agent for Service) |

|

Copy to: |

|

| |

|

|

|

|

| |

Ian Fitzgerald

1800 Avenue of the Stars, Suite 1400

Los Angeles, California 90067 |

|

P.

Jay Spinola, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019 |

|

Registrant’s telephone number, including area code: (310)

201-4100

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Report to Stockholders.

| (a) | Report to Stockholders is attached

herewith. |

Ares Dynamic Credit Allocation Fund, Inc.

(NYSE: ARDC)

Annual Report

December 31, 2024

Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically at any time by (i) calling 877-855-3434 toll-free or by sending an e-mail request to Ares Dynamic Credit Allocation Fund, Inc. Investor Relations Department at ARDCInvestorRelations@aresmgmt.com, if you invest directly with the Fund, or (ii) contacting your financial intermediary (such as a broker-dealer or bank), if you invest through your financial intermediary. You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by (i) calling 877-855-3434 toll-free or by sending an e-mail request to Ares Dynamic Credit Allocation Fund, Inc. Investor Relations Department at ARDCInvestorRelations@aresmgmt.com, if you invest directly with the Fund, or (ii) contacting your financial intermediary. Your election to receive reports in paper will apply to all funds held in your account, if you invest through your financial intermediary, or all funds held with the fund complex if you invest directly with the Fund.

Ares Dynamic Credit Allocation Fund, Inc.

|

Letter to Shareholders |

|

|

1 |

|

|

|

Fund Profile & Financial Data |

|

|

4 |

|

|

|

Schedule of Investments |

|

|

7 |

|

|

|

Statement of Assets and Liabilities |

|

|

17 |

|

|

|

Statement of Operations |

|

|

18 |

|

|

|

Statements of Changes in Net Assets |

|

|

19 |

|

|

|

Statement of Cash Flows |

|

|

20 |

|

|

|

Financial Highlights |

|

|

21 |

|

|

|

Notes to Financial Statements |

|

|

24 |

|

|

|

Audit Opinion |

|

|

43 |

|

|

|

Proxy & Portfolio Information |

|

|

48 |

|

|

|

Dividend Reinvestment Plan |

|

|

49 |

|

|

|

Renewal of Investment Advisory Agreement |

|

|

50 |

|

|

|

Corporate Information |

|

|

53 |

|

|

|

Privacy Notice |

|

|

54 |

|

|

|

Directors and Officers |

|

|

55 |

|

|

Annual Report 2024

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders

As of December 31, 2024

Dear Shareholders,

We want to thank you for your support of the Ares Dynamic Credit Allocation Fund, Inc. ("ARDC" or the "Fund") and we appreciate the trust and confidence that you have placed in us.

Throughout 2024, the ARDC investment team sought to position the Fund to benefit from the evolving market rate environment while appropriately managing credit risk. This letter provides a recap of the market environment, details surrounding our active portfolio management strategy and the opportunities that we see for the future of ARDC.

Economic Conditions and Market Update

The macroeconomic environment remained resilient in 2024 as unemployment stayed near historic lows and GDP growth continued to support relatively healthy corporate credit performance. While inflation moderated compared to elevated levels seen in 2022 and 2023, it remained elevated throughout the year and above the Federal Reserve's (the "Fed") target of 2%. Specifically, Core PCE, the Fed's preferred inflation measure, fluctuated between 2.6% and 2.9% throughout 2024, and ended the year at 2.8%, resulting in a modest 20-basis- point decline year-over-year.1 Despite persistent levels of inflation, real GDP remained positive throughout the year and grew at an annual rate of 2.8% which was in excess of the original forecast of 2.5%.2 Although the Federal Reserve's monetary policy stance became less restrictive throughout the year, particularly in the second half with three consecutive rate cuts totaling 100 basis points, the forward curve steepened in December following the Fed's hawkish 2025 outlook. The Fed dot plot forecast now anticipates two 25 basis point cuts in 2025, which is down from the four projected cuts in September 2024.3

Corporate credit continued to be well supported by healthy overall economic conditions and strong overall levels of corporate profitability. As measured by the S&P 500 index, corporate earnings increased an estimated 10.1% in 2024.4 Leveraged credit markets also demonstrated strong returns and credit performance in 2024. High yield bonds and leveraged loans generated total returns of 8.2%5 and 9.1%6, respectively, while default rates remained in the range of 1% - 3%, which is consistent with the historical long- term default rate performance for these leveraged credit asset classes.7 High yield bond credit performance was particularly strong in the second half of 2024 with the trailing 12-month default rate declining 141 bps to a multi-year low of 1.47% in December.8

CLOs also benefited from the healthy economic and credit market environment, which resulted in compelling credit and investment performance. For example, BB rated CLOs generated total returns of 19.2% in 2024, outperforming BB-rated corporate loans by over 1,000 bps.9 Furthermore, CLOs demonstrated strong credit performance with only 0.3% of defaulted assets held in CLO market portfolios.10 Against this firm economic and capital markets backdrop and the Fed's easier monetary policy, overall yields for credit assets broadly declined in the second half of 2024. Specifically, high yield bond yields declined from 8.0% at mid-year 2024 to 7.5% at year-end 2024, while leverage loan yields, which are mostly floating rate, declined from 9.6% at mid-year 2024 to 8.6% at year-end 2024.11

As we enter 2025, the macroeconomic and geopolitical conditions continue to evolve. We expect our proactive portfolio management across these asset classes will enable the Fund to further build on its track record of compelling and differentiated long-term returns. We continue to be constructive on credit conditions with high yield bond and leveraged loan default rates forecasted to decline to 1.25% and 2.75%, respectively, over the next 12 months. These levels are well below the long-term historical averages of 3.4% for high yield bonds and 3.0% for leveraged loans.12 However, amidst increasing levels of uncertainty around inflation and the potential effects of new government policies, we believe there will be periods of volatility that will drive attractive relative value opportunities across the markets in which we invest.13

In these markets, we believe our deep credit capabilities and our dynamic allocation strategy position us to proactively manage exposures and identify relative value opportunities created by shifts in sentiment on rates, growth expectations and idiosyncratic credit positions. As part of Ares' scaled, global platform, we believe we benefit from having access to broad market insights across Ares' various product offerings. We remain focused on leveraging our advantages in selecting appropriate investments as we expect the aforementioned economic and political conditions to be sources of potential risk in the coming year.

Portfolio Positioning and Performance

Consistent with the broader credit markets, ARDC delivered strong investment and credit performance throughout 2024. With elevated base rates in the first half of the year, and the market adopting a higher for longer viewpoint in the fourth quarter, we continued to capture attractive risk-adjusted returns in leveraged loans relative to high yield bonds, which generated higher spreads on similarly rated securities. For example, B1 rated loans generated over 150 basis points of

Annual Report 2024

1

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders (continued)

As of December 31, 2024

higher yields relative to B1 rated bonds on average during the second half of the year.14 In 2024, we reduced ARDC's exposure to bonds by -700 basis points and increased the portfolio's loan position by +500 basis points to 31% and 39%, respectively. Importantly, our active management approach and dynamic allocation across asset classes resulted in a 0% annual default rate for both the Fund's high yield bond and leveraged loan holdings.

In terms of CLOs, we remain constructive on this asset class given the non-mark-to-market nature of CLO capital structures, active credit management and flexibility to dynamically manage the portfolio during dislocations. Ultimately, we believe these factors should be accretive to returns for our investors. Underpinning our positive view on CLO assets is Ares' ability to track every underlying loan held within every CLO the Fund holds on a daily basis. With respect to our positioning in CLOs, we rotated out of CLO debt and into CLO equity, increasing our exposure to CLO equity by 400 basis points throughout the year. Spread compression on CLO debt has created compelling near-term opportunities to increase our allocation to CLO equity,15 which we believe will benefit from high cash on cash yields, well-priced locked-up liabilities and long reinvestment periods that enable the manager to take advantage of loan market volatility.

In the aggregate, we believe ARDC's portfolio is well positioned in this environment due to our highly diversified portfolio and low duration16. Reflecting this disciplined approach to risk management, our portfolio is diversified across 255 issuers and 23 industries. The average position size across ARDC is 0.3% and the largest position is 1.3%.17 ARDC's effective duration of 1.2 years was approximately one-third of the high yield index at December 31, 2024, which reflects our approach of operating with low interest rate risk in the Fund.

Supported by ARDC's credit selection and portfolio investment allocations, the Fund delivered strong performance throughout 2024. ARDC's year-to-date stock based total returns of 21.13% compared favorably to our peer set median of 18.66%,18 and its year-to-date portfolio net investment total returns of 11.77% were also higher than the peer set median of 9.87%.19 Since its inception and also over the past three and five years ended December 31, 2024, ARDC has outperformed the peer set median on both stock- based total returns and portfolio net investment total returns.16,18

Looking Ahead

As we look further into 2025, we believe the U.S. economy is positioned to keep expanding on the growth it experienced in 2024, and consumer spending and corporate earnings are expected to remain resilient.20 We will continue to assess the rate environment and monitor the impacts of potential new government policies, particularly regarding trade tariffs and inflation. We believe ARDC is well positioned in this environment as we continue to leverage the strengths of the Ares platform, including our tenured portfolio managers and quantitative risk team. We also maintain a conservative balance sheet posture with a low leverage profile to remain active and tactical in our rotation among asset classes, sectors and specific credits. It remains our goal to continue to deliver compelling returns to our investors primarily through attractive monthly dividends.

We appreciate the trust and confidence you have demonstrated in Ares through your investment in ARDC.

Best Regards,

Ares Capital Management II LLC

Ares Dynamic Credit Allocation Fund, Inc.

ARDC is a closed-end fund that trades on the New York Stock Exchange under the symbol "ARDC" and is externally managed by Ares Capital Management II LLC (the "Adviser"), a subsidiary of Ares Management Corporation. ARDC's investment objective is to provide an attractive level of total return, primarily through current income and, secondarily, through capital appreciation by investing in a broad, dynamically-managed portfolio of below investment grade senior secured loans, high yield corporate bonds and collateralized loan obligation securities. Thank you again for your continued support of ARDC. If you have any questions about the Fund, please call 1-877-855-3434, or visit the Fund's website at www.arespublicfunds.com.

Note: The opinions of the Adviser expressed herein are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. This communication is distributed for informational purposes only and should not be considered investment advice or an offer of any security for sale. This material may contain "forward-looking" information that is not purely historical in nature. No representations are made as to the accuracy of such information or that such information will be realized. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed. Past performance is not indicative of future results. Ares does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise, except as required by law.

Indices are provided for illustrative purposes only and not indicative of any investment. They have not been selected to represent appropriate benchmarks or targets for ARDC. Rather, the indices shown are provided solely to illustrate the performance of well-known and widely recognized

Annual Report 2024

2

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders (continued)

As of December 31, 2024

indices. Any comparisons herein of the investment performance of ARDC to an index are qualified as follows: (i) the volatility of such index will likely be materially different from that of ARDC; (ii) such index will, in many cases, employ different investment guidelines and criteria than ARDC and, therefore, holdings in ARDC will differ significantly from holdings of the securities that comprise such index and ARDC may invest in different asset classes altogether from the illustrative index, which may materially impact the performance of ARDC relative to the index; and (iii) the performance of such index is disclosed solely to allow for comparison on ARDC's performance to that of a well-known index. Comparisons to indices have limitations because indices have risk profiles, volatility, asset composition and other material characteristics that will differ from ARDC. The indices do not reflect the deduction of fees or expenses. You cannot invest directly in an index. No representation is being made as to the risk profile of any benchmark or index relative to the risk profile of ARDC. There can be no assurance that the future performance of any specific investment, or product will be profitable, equal any corresponding indicated historical performance, or be suitable for a portfolio.

This may contain information sourced from Bank of America, used with permission. Bank of America's Global Research division's fixed income index platform is licensing the ICE BofA Indices and related data "as is," makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or any data included in, related to, or derived therefrom, assumes no liability in connection with their use and does not sponsor, endorse, or recommend Ares, or any of its products or services.

The ICE BofA US High Yield Index ("H0A0") tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one-year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. No changes are made to constituent holdings other than on month end rebalancing dates. Inception date: August 31, 1986.

The Credit Suisse Institutional Leveraged Loan Index ("CSLLI") is designed to mirror the investable universe of the $US-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly. New loans are added to the index on their effective date if they qualify according to the following criteria: 1) Loan facilities must be rated "5B" or lower. That is, the highest Moody's/S&P ratings are Baa1/BB+ or Ba1/BBB+. If unrated, the initial spread level must be Libor plus 125 basis points or higher. 2) Only fully-funded term loan facilities are included. 3) The tenor must be at least one year. 4) Issuers must be domiciled in developed countries; issuers from developing countries are excluded.

The Standard & Poor's 500, often abbreviated as the S&P 500, or just "the S&P", is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices.

REF: TC-04217

1 U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Excluding Food and Energy, December 20, 2024.

2 U.S. Bureau of Economic Analysis, Gross Domestic Product, Full Year 2024 (Advance Estimate), January 15, 2025.

3 Board of Governors of the Federal Reserve System, "Summary of Economic Projections", September 18, 2024.

4 Yardeni S&P 500 Earnings Forecast, January 18, 2025. Long-term defined as occurring since 2008.

5 Measured by the ICE BofA High Yield Master II Index ("H0A0").

6 Measured by the Credit Suisse Leveraged Loan Index ("CSLLI").

7 UBS "December US/EU Credit Default Analysis: Recapping 2024", January 7, 2025. Historical average of monthly default rates calculated on a last- twelve-month basis.

8 J.P. Morgan Default Monitor, January 3, 2025. Represents the par weighted default rate for the respective asset classes.

9 J.P. Morgan CLOIE Monitor for BB CLOs and Pitchbook U.S. BB Leveraged Loan Index as of December 31, 2024.

10 Includes CLOs in their reinvestment period. BofA Global Research, "BAML CLO Factbook," with data from Bloomberg, Intex as of December 20, 2024.

11 Measured by yields on B1 securities in the Credit Suisse Leveraged Loan Index ("CSLLI") and ICE BofA High Yield Constrained Index ("HUC0").

12 J.P. Morgan Default Monitor, January 3, 2025. Represents the par weighted default rate for the respective asset classes. Historical averages based on the 25-year average default rate for high yield bonds and leveraged loans.

13 U.S. Bureau of Labor Statistics, January 7, 2025.

14 Measured by yields on B1 securities in the Credit Suisse Leveraged Loan Index ("CSLLI") and ICE BofA High Yield Constrained Index ("HUC0").

15 BofA Global Research, "BAML CLO Factbook," as of December 20, 2024.

16 Diversification does not assure profit or protect against loss.

17 As of December 31, 2024. Diversification does not assure profit or protect against market loss.

18 Market price-based total returns reflect annualized stock-based total returns assuming dividend reinvestment. Peer set includes the following closed end funds: ACP, AIF, BGB, BGH, DHF, DSU, GHY, HFRO, HNW, KIO and XFLT. Past performance is not indicative of future results.

19 Net investment total returns reflect annualized NAV-based total returns assuming dividend reinvestment. Peer set includes the following closed end funds: ACP, AIF, BGB, BGH, DHF, DSU, GHY, HFRO, HNW, KIO and XFLT. Past performance is not indicative of future results.

20 Yardeni S&P 500 Earnings Forecast, December 31, 2024.

Annual Report 2024

3

Ares Dynamic Credit Allocation Fund, Inc.

Fund Profile & Financial Data

December 2024

Seeks attractive risk-adjusted total returns with a focus on high current income and an opportunity for capital appreciation.

Fund Highlights as of 12.31.24

|

Distribution Rate1 |

|

|

9.33 |

% |

|

|

Managed Assets2 |

|

|

$553M |

|

|

|

Weighted Average Coupon |

|

|

8.39 |

% |

|

1 Dividend per share annualized and divided by the December 31, 2024 market price per share. The distribution rate alone is not indicative of Fund performance.

2 Total assets of the Fund (including any assets attributable to financial leverage) minus accrued liabilities (other than debt representing financial leverage).

Ares Credit Group as of 12.31.24

|

AUM** |

|

|

$349 billion |

|

|

|

Credit Investment Team |

|

|

545 |

+ |

|

|

Portfolio Companies |

|

|

~3,500 |

|

|

**AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and registered investment adviser. Past performance is not indicative of future results. As of December 31, 2024, employees of Ares Management owned approximately 1.9% of the Fund's outstanding shares.

Investment Approach

● Dynamically allocates across investment opportunities primarily in high yield bonds, senior loans and CLO securities

● Designed to navigate evolving market conditions through deep fundamental credit analysis and in-depth due diligence

● Tenured team with 20+ year track record benefits from the market intelligence, relationships and resources of the Ares platform

Current Portfolio Mix as of 12.31.24

64.5% Floating Rate3

3 Calculated as a percentage of debt securities only.

This data is subject to change on a daily basis. As of 12.31.24, the Fund held a negative traded cash balance of -1.6%.

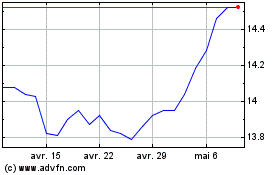

Fund Overview and Characteristics as of 12.31.24

|

Ticker |

|

ARDC |

|

|

Market/Share |

|

$15.11 |

|

|

NAV/Share |

|

$14.74 |

|

|

Monthly Dividend |

|

$0.1175 |

|

|

Number of Issuers |

|

255 |

|

|

Number of Instruments |

|

294 |

|

|

Average Position Size |

|

0.34% |

|

|

Weighted Average Loan YTM4 |

|

7.45% |

|

|

Weighted Average Bond YTM5 |

|

6.91% |

|

|

Weighted Average CLO YTM6 |

|

10.42% |

|

|

Effective Duration7 |

|

1.15 |

|

|

Month-End Leverage8 |

|

37.42% |

|

|

Asset Coverage9 |

|

5.17 |

|

|

Preferred Stock Asset Coverage10 |

|

2.67 |

|

|

Expense Ratio11 |

|

4.90% |

|

|

Excess Taxable Income12 |

|

$15.5 million |

|

|

Inception Date |

|

11/27/2012 |

|

|

Common Shares Outstanding |

|

22.9 million |

|

|

NAV Ticker |

|

XADCX |

|

|

CUSIP |

|

04014F102 |

|

4 The weighted-average gross yield to maturity on the pool of loans.

5 The weighted-average gross yield to maturity on the pool of bonds.

6 The weighted-average gross yield to maturity on the pool of CLO debt securities.

7 The effective duration measures a bond's sensitivity to interest rates.

8 As a percentage of total managed assets. The Fund utilizes leverage as part of its investment strategy and currently has borrowings under a credit facility as well as mandatory redeemable preferred shares. The Fund's leverage under the credit facility without the use of mandatory redeemable preferred shares was 19.34%.

9 Calculated pursuant to the Investment Company Act of 1940. Represents the ratio of the total assets of the Fund, less all liabilities and indebtedness not represented by senior securities, divided by total senior securities outstanding. The Fund has $107 million aggregate principal outstanding on a $212 million revolving funding facility with an institutional lender, pursuant to which the Fund expects to borrow funds to make additional investments, subject to available borrowing base and leverage limitations.

10 Calculated pursuant to the Investment Company Act of 1940. Represents the ratio of the total assets of the Fund, less all liabilities and indebtedness not represented by senior securities, divided by sum of total outstanding debt and aggregate value of the involuntary liquidation preference of the preferred stock of $100 million.

11 Represents the ratio of annualized expenses, inclusive of interest expense and amortization of debt issuance, to net assets for the year ended December 31, 2024.

12 Represents the estimated excess taxable income from the year ended 2024 for distribution to stockholders in 2025. Based on the number of shares outstanding at 12/31/2024.

Performance as of 12.31.24

|

|

|

Year to Date |

|

3 Years |

|

5 Years |

|

Since Inception* |

|

|

ARDC NAV |

|

|

11.77 |

% |

|

|

5.33 |

% |

|

|

5.83 |

% |

|

|

5.87 |

% |

|

|

ARDC Market |

|

|

21.13 |

% |

|

|

7.57 |

% |

|

|

9.41 |

% |

|

|

6.55 |

% |

|

*Since Inception of fund (11/27/2012).

Source: Ares

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The NAV total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. Since Inception returns assume a purchase of common shares at the initial offering price of $20.00 per share for market price returns or initial net asset value (NAV) of $19.10 per share for NAV returns. Returns for periods of less than one year are not annualized. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan (DRIP) for market price returns or NAV for NAV returns.

|

www.arespublicfunds.com |

|

Not FDIC-Insured. Not Bank Guaranteed, May Lose Value |

|

Annual Report 2024

4

Ares Dynamic Credit Allocation Fund, Inc.

Fund Profile & Financial Data (continued)

December 2024

Investment Strategy

The Fund invests primarily in a broad, dynamically managed portfolio of (i) senior secured loans ("Senior Loans") made primarily to companies whose debt is rated below investment grade; (ii) corporate bonds ("Corporate Bonds") that are primarily high yield issues rated below investment grade; (iii) other fixed-income instruments of a similar nature that may be represented by derivatives; and (iv) securities of collateralized loan obligations ("CLOs") and other asset-backed issuers. The Fund utilizes leverage as part of its investment strategy and may incur leverage in an aggregate amount of up to 33 1/3% of the Fund's Managed Assets by borrowing under a credit facility. Ares Capital Management II LLC, the Fund's investment adviser (the "Adviser"), is an affiliate of Ares Management Corporation ("Ares"). The Adviser will seek to implement the Fund's investment strategy through the application of several techniques, including: (i) investing in a diversified portfolio of loans and other debt investments across a broad range of industries with varying characteristics and return profiles; (ii) adhering to the established credit underwriting processes of Ares and doing substantial pre-investment credit analysis, utilizing publicly available credit and industry information as well as other information about the borrowers and issuers; (iii) monitoring the credit quality of the obligors in the Fund's investments and, as appropriate, on a risk adjusted return basis, selling investments in underperforming issuers; and (iv) holding cash and engaging in derivative credit and interest rate hedges. The Adviser will allocate the Fund's portfolio dynamically among investments in the various targeted credit markets to seek to manage interest rate and credit risk and the duration of the Fund's portfolio.

Top 10 Holdings14 as of 12.31.24

|

ATRM 14 |

|

|

1.28 |

% |

|

|

Sprint |

|

|

0.99 |

% |

|

|

Ford Motor Credit Company |

|

|

0.94 |

% |

|

|

HCA Healthcare Inc |

|

|

0.88 |

% |

|

|

Autodata, Inc. |

|

|

0.87 |

% |

|

|

Williams Cos Inc/The |

|

|

0.87 |

% |

|

|

OAKC 2018-1 |

|

|

0.87 |

% |

|

|

Qualtrics Acquireco, LLC |

|

|

0.82 |

% |

|

|

Culligan |

|

|

0.82 |

% |

|

|

Crown Holdings, Inc. |

|

|

0.82 |

% |

|

14 Market value percentage may represent multiple instruments by the named issuer and/or multiple issuers being consolidated to the extent they are owned by the same parent company. These values may be different than the issuer concentrations in certain regulatory filings.

Industry Allocation12 as of 12.31.24

12 Credit Suisse industry classifications weighted by market value. These values may be different than industry classifications in certain regulatory filings.

Ratings Distribution13 as of 12.31.24

13 Based on S&P and/or Moody's rating. Credit quality is an assessment of the credit worthiness of an issuer of a security. AAA is the highest rating, meaning the obligor's capacity to meet its financial commitments is strong. As ratings decrease, the obligor is considered more speculative by market participants. Credit ratings apply only to the bonds and preferred securities in the portfolio and not to the shares of the fund which are not rated and will fluctuate in value.

This data is subject to change on a daily basis. As of 12.31.24, the Fund held a negative traded cash balance of -1.6%.

Annual Report 2024

5

Ares Dynamic Credit Allocation Fund, Inc.

Performance Summary

December 31, 2024

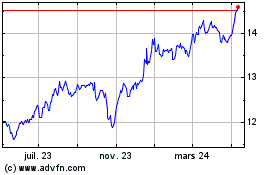

The following graph shows the value, as of December 31, 2024, of a $10,000 investment made at the offering price last calculated on December 31, 2014. The net asset value ("NAV") total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan for market price returns or NAV for NAV returns. For comparative purposes, the performance of the Credit Suisse Leveraged Loan Index ("CSLLI") is shown. CSLLI is designed to mirror the investable universe of the U.S. Dollar-denominated leveraged loan market and is deemed to be an appropriate broad-based securities market index for the Fund. Past performance is no guarantee of future results.

Ares Dynamic Credit Allocation Fund's 10-Year Performance

Performance of a $10,000 investment from December 31, 2014 through December 31, 2024

Average Annual Total Returns through December 31, 2024*

|

|

|

NAV Total Returns* |

|

MV Total Returns* |

|

|

1 year |

|

|

10.50 |

% |

|

|

23.1 |

% |

|

|

5 year |

|

|

5.56 |

% |

|

|

8.93 |

% |

|

|

10 year |

|

|

6.14 |

% |

|

|

8.33 |

% |

|

* All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan for market price returns or NAV for NAV returns.

Annual Report 2024

6

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments

December 31, 2024

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans 61.0%(b)(c)(d)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Automobiles and Components 2.9% |

|

Clarios Global, LP, 1st Lien Term Loan

(Canada), 1M SOFR + 2.50%,

6.86%, 05/06/2030 |

|

$ |

2,805 |

|

|

$ |

2,814 |

|

|

LTI Holdings, Inc., 1st Lien Term Loan,

1M SOFR + 4.75%, 9.11%, 07/29/2029 |

|

|

3,933 |

|

|

|

3,935 |

|

|

Wand NewCo 3, Inc., 1st Lien Term Loan,

1M SOFR + 3.25%, 7.61%, 01/30/2031 |

|

|

3,418 |

|

|

|

3,429 |

|

|

|

|

|

|

|

|

10,178 |

|

|

|

Capital Goods 10.1% |

|

AI Aqua Merger Sub, Inc.,

1st Lien Term Loan, 07/31/2028(e) |

|

|

999 |

|

|

|

999 |

|

|

Alliance Laundry Systems, LLC, 1st Lien

Term Loan, 1M SOFR + 3.50%,

7.84%, 08/19/2031 |

|

|

4,339 |

|

|

|

4,362 |

|

|

Chart Industries, Inc., 1st Lien Term Loan,

3M SOFR + 2.50%, 6.81%, 03/15/2030 |

|

|

1,000 |

|

|

|

1,003 |

|

|

Crown Equipment Corporation, 1st Lien

Term Loan, 1M SOFR + 2.50%,

6.94%, 10/10/2031 |

|

|

1,500 |

|

|

|

1,508 |

|

|

Crown Subsea Communications Holding,

Inc., 1st Lien Term Loan, 3M SOFR +

4.00%, 8.34%, 01/30/2031 |

|

|

3,612 |

|

|

|

3,663 |

|

|

Kaman Corp., 1st Lien Term Loan, 3M

SOFR + 3.50%, 7.83%, 04/21/2031 |

|

|

1,995 |

|

|

|

2,006 |

|

|

Kodiak Building Partners, Inc., 1st Lien

Term Loan, 1M SOFR + 3.75%,

8.05%, 11/26/2031 |

|

|

3,500 |

|

|

|

3,499 |

|

|

Osmosis Buyer Ltd., 1st Lien Term Loan,

1M SOFR + 3.75%, 8.05%, 07/31/2028 |

|

|

4,478 |

|

|

|

4,478 |

|

|

Pike Corp., 1st Lien Term Loan, 1M

SOFR + 3.00%, 7.47%, 01/21/2028 |

|

|

1,283 |

|

|

|

1,292 |

|

|

TransDigm, Inc., 1st Lien Term Loan, 3M

SOFR + 2.50%, 6.83%, 02/28/2031 |

|

|

3,476 |

|

|

|

3,481 |

|

|

TransDigm, Inc., 1st Lien Term Loan, 3M

SOFR + 2.75%, 7.08%, 08/24/2028 |

|

|

497 |

|

|

|

499 |

|

|

Traverse Midstream Partners, LLC,

1st Lien Term Loan, 3M SOFR + 3.00%,

7.59%, 02/16/2028 |

|

|

2,747 |

|

|

|

2,757 |

|

|

Tutor Perini Corp., 1st Lien Term Loan,

1M SOFR + 4.75%, 9.22%, 08/18/2027 |

|

|

495 |

|

|

|

496 |

|

|

White Cap Supply Holdings, LLC,

1st Lien Term Loan, 1M SOFR + 3.25%,

7.61%, 10/19/2029(e) |

|

|

3,000 |

|

|

|

3,002 |

|

|

Wilsonart, LLC, 1st Lien Term Loan,

3M SOFR + 4.25%, 8.58%, 08/05/2031 |

|

|

1,995 |

|

|

|

1,997 |

|

|

|

|

|

|

|

|

35,042 |

|

|

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Commercial and Professional Services 0.7% |

|

iSolved, Inc., 1st Lien Term Loan,

1M SOFR + 3.25%, 7.61%, 10/15/2030 |

|

$ |

2,522 |

|

|

$ |

2,551 |

|

|

|

Consumer Discretionary Distribution and Retail 1.1% |

|

Peer Holding III B.V., 1st Lien Term Loan

(Netherlands), 3M SOFR + 3.25%,

7.58%, 10/28/2030 |

|

|

3,970 |

|

|

|

3,990 |

|

|

|

Consumer Durables and Apparel 2.2% |

|

Recess Holdings, Inc., 1st Lien Term

Loan, 3M SOFR + 4.50%,

9.09%, 02/20/2030 |

|

|

4,099 |

|

|

|

4,134 |

|

|

Varsity Brands, Inc., 1st Lien Term Loan,

3M SOFR + 3.75%, 8.27%, 08/26/2031 |

|

|

3,500 |

|

|

|

3,501 |

|

|

|

|

|

|

|

|

7,635 |

|

|

|

Consumer Services 3.8% |

|

Belfor Holdings, Inc., 1st Lien Term Loan,

1M SOFR + 3.75%, 8.11%, 11/01/2030(f) |

|

|

1,186 |

|

|

|

1,198 |

|

|

Betclic Everest Group, 1st Lien Term Loan

(France), 3M EURIBOR + 3.25%,

6.26%, 12/05/2031 |

|

€ |

1,600 |

|

|

|

1,662 |

|

|

Century De Buyer, LLC, 1st Lien Term

Loan, 3M SOFR + 3.50%,

7.90%, 10/30/2030 |

|

$ |

3,483 |

|

|

|

3,509 |

|

|

Fugue Finance B.V., 1st Lien Term Loan

(Netherlands), 01/09/2032(e) |

|

|

1,500 |

|

|

|

1,512 |

|

|

Fugue Finance B.V., 1st Lien Term Loan

(Netherlands), 3M SOFR + 3.75%,

8.25%, 02/26/2031 |

|

|

1,244 |

|

|

|

1,250 |

|

|

Ontario Gaming GTA, LP, 1st Lien Term

Loan (Canada), 3M SOFR + 4.25%,

8.58%, 08/01/2030 |

|

|

3,960 |

|

|

|

3,966 |

|

|

|

|

|

|

|

|

13,097 |

|

|

|

Energy 2.7% |

|

CPPIB OVM Member U.S., LLC, 1st Lien

Term Loan, 3M SOFR + 3.25%,

7.58%, 08/20/2031 |

|

|

2,494 |

|

|

|

2,509 |

|

|

Freeport LNG Investments, LLLP, 1st Lien

Term Loan, 11/17/2026(e) |

|

|

3,968 |

|

|

|

3,961 |

|

|

Prairie ECI Acquiror, L.P., 1st Lien Term

Loan, 1M SOFR + 4.25%,

8.61%, 08/01/2029 |

|

|

345 |

|

|

|

347 |

|

|

TransMontaigne Operating Company, LP,

1st Lien Term Loan, 1M SOFR + 3.25%,

7.61%, 11/17/2028 |

|

|

2,481 |

|

|

|

2,499 |

|

|

|

|

|

|

|

|

9,316 |

|

|

Annual Report 2024

7

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

December 31, 2024

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Financial Services 1.3% |

|

Albion Financing 3 SARL, 1st Lien Term

Loan (Luxembourg), 3M SOFR + 4.25%,

9.10%, 08/17/2029 |

|

$ |

1,244 |

|

|

$ |

1,254 |

|

|

Athena Holdco S.A.S., 1st Lien Term

Loan (France), 3M EURIBOR + 3.50%,

6.18%, 04/14/2031 |

|

€ |

3,020 |

|

|

|

3,138 |

|

|

|

|

|

|

|

|

4,392 |

|

|

|

Food and Beverage 1.3% |

|

Chobani, LLC, 1st Lien Term Loan,

1M SOFR + 3.25%, 7.72%, 10/25/2027 |

|

$ |

2,931 |

|

|

|

2,951 |

|

|

Chobani, LLC, 1st Lien Term Loan,

1M SOFR + 3.75%, 8.11%, 10/25/2027 |

|

|

1,485 |

|

|

|

1,496 |

|

|

|

|

|

|

|

|

4,447 |

|

|

|

Healthcare Equipment and Services 8.0% |

|

Bausch + Lomb Corp., 1st Lien Term

Loan (Canada), 1M SOFR + 3.25%,

7.69%, 05/10/2027 |

|

|

1,477 |

|

|

|

1,482 |

|

|

Bausch + Lomb Corp., 1st Lien Term

Loan (Canada), 3M SOFR + 4.00%,

8.33%, 09/29/2028 |

|

|

1,975 |

|

|

|

1,982 |

|

|

CNT Holdings I Corp., 1st Lien Term

Loan, 3M SOFR + 3.50%,

8.09%, 11/08/2027 |

|

|

2,402 |

|

|

|

2,414 |

|

|

Confluent Medical Technologies, Inc.,

1st Lien Term Loan, 3M SOFR +

3.25%, 7.56%, 02/16/2029 |

|

|

2,487 |

|

|

|

2,497 |

|

|

Electron BidCo, Inc., 1st Lien Term

Loan, 1M SOFR + 2.75%,

7.11%, 11/01/2028(g) |

|

|

3,000 |

|

|

|

3,009 |

|

|

Ensemble RCM, LLC, 1st Lien Term

Loan, 3M SOFR + 3.00%,

7.59%, 08/01/2029 |

|

|

3,809 |

|

|

|

3,833 |

|

|

LifePoint Health, Inc., 1st Lien Term

Loan, 3M SOFR + 3.75%,

8.41%, 05/16/2031 |

|

|

3,000 |

|

|

|

3,008 |

|

|

Mamba Purchaser, Inc., 1st Lien Term

Loan, 1M SOFR + 3.00%,

7.36%, 10/16/2028(g) |

|

|

2,961 |

|

|

|

2,972 |

|

|

Medline Borrower, LP, 1st Lien Term

Loan, 1M SOFR + 2.25%,

6.61%, 10/23/2028 |

|

|

2,237 |

|

|

|

2,243 |

|

|

Resonetics, LLC, 1st Lien Term Loan,

3M SOFR + 3.25%,

7.60%, 06/18/2031 |

|

|

2,630 |

|

|

|

2,644 |

|

|

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Sotera Health Holdings, LLC, 1st Lien

Term Loan, 3M SOFR + 3.25%,

7.84%, 05/30/2031 |

|

$ |

1,746 |

|

|

$ |

1,747 |

|

|

|

|

|

|

|

|

27,831 |

|

|

|

Insurance 2.2% |

|

Acrisure, LLC, 1st Lien Term Loan,

1M SOFR + 3.00%, 7.36%, 11/06/2030 |

|

|

1,248 |

|

|

|

1,247 |

|

|

Howden Group Holdings, Ltd., 1st Lien Term

Loan (Luxembourg), 1M SOFR + 3.00%,

7.36%, 02/15/2031 |

|

|

2,980 |

|

|

|

2,997 |

|

|

HUB International, Ltd., 1st Lien Term

Loan, 3M SOFR + 2.75%, 7.37%,

06/20/2030 |

|

|

3,489 |

|

|

|

3,507 |

|

|

|

|

|

|

|

|

7,751 |

|

|

|

Materials 2.3% |

|

AAP Buyer, Inc., 1st Lien Term Loan,

3M SOFR + 3.25%, 7.61%, 09/09/2031 |

|

|

1,685 |

|

|

|

1,695 |

|

|

Nouryon Finance B.V., 1st Lien Term

Loan (Netherlands), 6M SOFR + 3.25%,

7.66%, 04/03/2028 |

|

|

3,007 |

|

|

|

3,029 |

|

|

WR Grace Holdings, LLC, 1st Lien Term

Loan, 3M SOFR + 3.25%, 7.58%,

09/22/2028 |

|

|

3,243 |

|

|

|

3,269 |

|

|

|

|

|

|

|

|

7,993 |

|

|

|

Media and Entertainment 3.9% |

|

Creative Artists Agency, LLC, 1st Lien

Term Loan, 1M SOFR + 2.75%,

7.11%, 10/01/2031 |

|

|

4,275 |

|

|

|

4,290 |

|

|

Gray Television, Inc., 1st Lien Term

Loan, 1M SOFR + 3.00%,

7.45%, 12/01/2028 |

|

|

3,225 |

|

|

|

2,973 |

|

|

NEP Group, Inc., 1st Lien Term Loan,

3M SOFR + 5.50%,

10.09%, 08/19/2026(g) |

|

|

2,613 |

|

|

|

2,384 |

|

|

Univision Communications, Inc.,

1st Lien Term Loan, 3M SOFR + 4.25%,

8.58%, 06/24/2029 |

|

|

977 |

|

|

|

980 |

|

|

Virgin Media Bristol, LLC, 1st Lien Term

Loan, 6M SOFR + 3.18%, 7.72%,

03/31/2031 |

|

|

3,000 |

|

|

|

2,967 |

|

|

|

|

|

|

|

|

13,594 |

|

|

Annual Report 2024

8

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

December 31, 2024

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Pharmaceuticals, Biotechnology and Life Sciences 1.6% |

|

Packaging Coordinators Midco, Inc.,

1st Lien Term Loan, 3M SOFR + 3.25%,

7.84%, 11/30/2027 |

|

$ |

2,880 |

|

|

$ |

2,890 |

|

|

Precision Medicine Group, LLC,

1st Lien Term Loan, 3M SOFR + 3.00%,

7.43%, 11/18/2027 |

|

|

2,494 |

|

|

|

2,490 |

|

|

|

|

|

|

|

|

5,380 |

|

|

|

Real Estate Management and Development 0.8% |

|

Forest City Enterprises, LP, 1st Lien

Term Loan, 1M SOFR + 3.50%, 7.96%,

12/08/2025 |

|

|

3,000 |

|

|

|

2,933 |

|

|

|

Software and Services 10.0% |

|

Access CIG, LLC, 1st Lien Term Loan,

3M SOFR + 5.00%, 9.59%,

08/18/2028 |

|

|

2,227 |

|

|

|

2,247 |

|

|

Asurion, LLC, 1st Lien Term Loan,

1M SOFR + 3.25%, 7.71%, 07/31/2027 |

|

|

995 |

|

|

|

992 |

|

|

Asurion, LLC, 1st Lien Term Loan,

1M SOFR + 4.00%, 8.46%, 08/19/2028 |

|

|

2,462 |

|

|

|

2,454 |

|

|

BEP Intermediate Holdco, LLC,

1st Lien Term Loan, 1M SOFR + 3.25%,

7.61%, 04/25/2031 |

|

|

3,065 |

|

|

|

3,082 |

|

|

Boost Newco Borrower, LLC,

1st Lien Term Loan, 3M SOFR + 2.50%,

6.83%, 01/31/2031 |

|

|

2,993 |

|

|

|

3,004 |

|

|

Conservice Midco, LLC, 1st Lien Term

Loan, 1M SOFR + 3.50%,

7.86%, 05/13/2027 |

|

|

2,488 |

|

|

|

2,503 |

|

|

Databricks, Inc., 1st Lien Term Loan,

12/20/2030(e)(f)(h) |

|

|

4,091 |

|

|

|

4,065 |

|

|

Genesys Cloud Services Holdings II, LLC,

1st Lien Term Loan, 1M SOFR + 3.00%,

7.85%, 12/01/2027 |

|

|

2,977 |

|

|

|

3,000 |

|

|

Ivanti Software, Inc., 1st Lien Revolving

Loan, 3M SOFR + 3.75%,

8.11%, 12/01/2025(f)(h) |

|

|

96 |

|

|

|

16 |

|

|

Project Boost Purchaser, LLC, 1st Lien

Term Loan, 3M SOFR + 3.50%, 8.15%,

07/16/2031 |

|

|

4,713 |

|

|

|

4,741 |

|

|

Proofpoint, Inc., 1st Lien Term Loan,

1M SOFR + 3.00%, 7.36%, 08/31/2028 |

|

|

3,960 |

|

|

|

3,976 |

|

|

Quartz Acquireco, LLC, 1st Lien Term

Loan, 3M SOFR + 2.75%, 7.08%,

06/28/2030 |

|

|

4,456 |

|

|

|

4,484 |

|

|

|

|

|

|

|

|

34,564 |

|

|

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Telecommunication Services 1.5% |

|

Delta TopCo, Inc., 1st Lien Term Loan,

6M SOFR + 3.50%, 8.20%,

11/30/2029 |

|

$ |

1,741 |

|

|

$ |

1,754 |

|

|

Lumen Technologies, Inc., 1st Lien

Term Loan, 1M SOFR + 6.00%, 10.36%,

06/01/2028 |

|

|

889 |

|

|

|

889 |

|

|

QualityTech, L.P., 1st Lien Term Loan,

1M SOFR + 3.50%, 8.02%, 11/04/2031(f) |

|

|

2,500 |

|

|

|

2,506 |

|

|

|

|

|

|

|

|

5,149 |

|

|

|

Transportation 1.7% |

|

AAdvantage Loyality IP, Ltd., 1st Lien

Term Loan, 3M SOFR + 4.75%, 9.63%,

04/20/2028 |

|

|

2,692 |

|

|

|

2,761 |

|

|

Apple Bidco, LLC, 1st Lien Term Loan,

1M SOFR + 3.50%, 7.86%, 09/22/2028 |

|

|

2,211 |

|

|

|

2,223 |

|

|

SkyMiles IP, Ltd., 1st Lien Term Loan

(Cayman Islands), 3M SOFR + 3.75%,

8.37%, 10/20/2027 |

|

|

736 |

|

|

|

748 |

|

|

|

|

|

|

|

|

5,732 |

|

|

|

Utilities 2.9% |

|

CPV Fairview, LLC, 1st Lien Term Loan,

1M SOFR + 3.50%, 7.86%, 08/14/2031 |

|

|

1,469 |

|

|

|

1,483 |

|

|

Hamilton Projects Acquiror, LLC, 1st

Lien Term Loan, 05/22/2031(e) |

|

|

300 |

|

|

|

302 |

|

|

Hamilton Projects Acquiror, LLC,

1st Lien Term Loan, 1M SOFR + 3.75%,

8.11%, 05/31/2031 |

|

|

1,958 |

|

|

|

1,969 |

|

|

South Field, LLC, 1st Lien Term Loan,

3M SOFR + 3.75%, 8.08%, 08/29/2031 |

|

|

2,954 |

|

|

|

2,972 |

|

|

Thunder Generation Funding, LLC, 1st

Lien Term Loan, 3M SOFR + 3.00%,

7.33%, 10/03/2031 |

|

|

3,404 |

|

|

|

3,422 |

|

|

|

|

|

|

|

|

10,148 |

|

|

Total Senior Loans

(Cost: $210,690) |

|

|

|

|

211,723 |

|

|

Corporate Bonds 49.2%

|

Automobiles and Components 0.6% |

|

|

Clarios Global, LP, 8.50%, 05/15/2027(d) |

|

|

1,500 |

|

|

|

1,502 |

|

|

Wand NewCo 3, Inc., 7.63%,

01/30/2032(d) |

|

|

500 |

|

|

|

514 |

|

|

|

|

|

|

|

|

2,016 |

|

|

Annual Report 2024

9

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

December 31, 2024

(in thousands, except shares, percentages and as otherwise noted)

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Capital Goods 5.1% |

|

Allison Transmission, Inc., 5.88%,

06/01/2029(d) |

|

$ |

2,500 |

|

|

$ |

2,483 |

|

|

Bombardier, Inc., (Canada), 8.75%,

11/15/2030(d) |

|

|

2,500 |

|

|

|

2,687 |

|

|

Builders FirstSource, Inc., 6.38%,

03/01/2034(d) |

|

|

3,150 |

|

|

|

3,109 |

|

|

Chart Industries, Inc., 7.50%,

01/01/2030(d) |

|

|

1,000 |

|

|

|

1,040 |

|

|

Chart Industries, Inc., 9.50%,

01/01/2031(d) |

|

|

250 |

|

|

|

268 |

|

|

OneSky Flight, LLC, 8.88%,

12/15/2029(d) |

|

|

3,000 |

|

|

|

3,002 |

|

|

Standard Building Solutions, Inc., 6.50%,

08/15/2032(d) |

|

|

2,250 |

|

|

|

2,254 |

|

|

United Rentals, Inc., 6.13%,

03/15/2034(d) |

|

|

2,000 |

|

|

|

1,984 |

|

|

|

Wilsonart, LLC, 11.00%, 08/15/2032(d) |

|

|

1,000 |

|

|

|

980 |

|

|

|

|

|

|

|

|

17,807 |

|

|

|

Consumer Distribution and Retail 1.9% |

|

Albertsons Cos., Inc., 7.50%,

03/15/2026(d) |

|

|

1,500 |

|

|

|

1,505 |

|

|

Bath & Body Works, Inc., 6.63%,

10/01/2030(d) |

|

|

1,000 |

|

|

|

1,008 |

|

|

Bath & Body Works, Inc., 9.38%,

07/01/2025(d) |

|

|

1,151 |

|

|

|

1,170 |

|

|

Constellation Automotive Financing PLC,

(Great Britain), 4.88%, 07/15/2027 |

|

£ |

2,500 |

|

|

|

2,960 |

|

|

|

|

|

|

|

|

6,643 |

|

|

|

Consumer Durables and Apparel 0.7% |

|

Ashton Woods USA, LLC, 6.63%,

01/15/2028(d) |

|

$ |

2,500 |

|

|

|

2,503 |

|

|

|

Consumer Services 4.1% |

|

Caesars Entertainment, Inc., 8.13%,

07/01/2027(d) |

|

|

1,940 |

|

|

|

1,959 |

|

|

Hilton Domestic Operating Co., Inc.,

5.75%, 05/01/2028(d) |

|

|

3,500 |

|

|

|

3,499 |

|

|

International Game Technology PLC,

(Great Britain), 6.25%, 01/15/2027(d) |

|

|

1,000 |

|

|

|

1,006 |

|

|

Lottomatica SpA, (Italy), 7.13%,

06/01/2028(d) |

|

€ |

2,482 |

|

|

|

2,696 |

|

|

MGM Resorts International, 6.50%,

04/15/2032 |

|

$ |

2,500 |

|

|

|

2,491 |

|

|

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Six Flags Theme Parks, Inc., 7.00%,

07/01/2025(d) |

|

$ |

1,379 |

|

|

$ |

1,378 |

|

|

Station Casinos, LLC, 6.63%,

03/15/2032(d) |

|

|

1,200 |

|

|

|

1,193 |

|

|

|

|

|

|

|

|

14,222 |

|

|

|

Energy 11.2% |

|

Antero Resources Corp., 7.63%,

02/01/2029(d) |

|

|

2,222 |

|

|

|

2,275 |

|

|

Ascent Resources Utica Holdings, LLC,

8.25%, 12/31/2028(d) |

|

|

2,501 |

|

|

|

2,553 |

|

|

Blue Racer Midstream, LLC, 6.63%,

07/15/2026(d) |

|

|

1,500 |

|

|

|

1,498 |

|

|

Blue Racer Midstream, LLC, 7.00%,

07/15/2029(d) |

|

|

1,500 |

|

|

|

1,532 |

|

|

Citgo Petroleum Corp., 7.00%,

06/15/2025(d) |

|

|

3,500 |

|

|

|

3,504 |

|

|

DCP Midstream Operating, LP, 8.13%,

08/16/2030 |

|

|

3,330 |

|

|

|

3,773 |

|

|

Kodiak Gas Services, LLC, 7.25%,

02/15/2029(d) |

|

|

1,150 |

|

|

|

1,173 |

|

|

Moss Creek Resources Holdings, Inc.,

8.25%, 09/01/2031(d) |

|

|

3,685 |

|

|

|

3,603 |

|

|

Occidental Petroleum Corp., 8.88%,

07/15/2030 |

|

|

3,500 |

|

|

|

3,997 |

|

|

Parkland Corp., (Canada), 6.63%,

08/15/2032(d) |

|

|

2,000 |

|

|

|

1,979 |

|

|

|

Sunoco, LP, 7.25%, 05/01/2032(d) |

|

|

3,125 |

|

|

|

3,228 |

|

|

Tallgrass Energy Partners, LP, 7.38%,

02/15/2029(d) |

|

|

1,500 |

|

|

|

1,505 |

|

|

Transocean, Inc., (Cayman Islands),

6.80%, 03/15/2038 |

|

|

1,061 |

|

|

|

869 |

|

|

Transocean, Inc., (Cayman Islands),

8.75%, 02/15/2030(d) |

|

|

638 |

|

|

|

658 |

|

|

Western Midstream Operating, LP,

5.25%, 02/01/2050 |

|

|

2,125 |

|

|

|

1,819 |

|

|

Williams Cos., Inc., 8.75%,

03/15/2032 |

|

|

4,000 |

|

|

|

4,724 |

|

|

|

|

|

|

|

|

38,690 |

|

|

|

Equity Real Estate Investment Trusts (REITs) 2.0% |

|

HAT Holdings I, LLC, 8.00%,

06/15/2027(d) |

|

|

3,778 |

|

|

|

3,937 |

|

|

VICI Properties LP, 5.75%,

02/01/2027(d) |

|

|

3,000 |

|

|

|

3,026 |

|

|

|

|

|

|

|

|

6,963 |

|

|

Annual Report 2024

10

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

December 31, 2024

(in thousands, except shares, percentages and as otherwise noted)

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Financial Services 3.2% |

|

|

Ally Financial, Inc., 8.00%, 11/01/2031 |

|

$ |

2,000 |

|

|

$ |

2,212 |

|

|

CHS/Community Health Systems, Inc.,

10.88%, 01/15/2032(d) |

|

|

1,500 |

|

|

|

1,548 |

|

|

Ford Motor Credit Co., LLC, 6.80%,

05/12/2028 |

|

|

2,500 |

|

|

|

2,583 |

|

|

Ford Motor Credit Co., LLC, 6.95%,

06/10/2026 |

|

|

1,000 |

|

|

|

1,022 |

|

|

Ford Motor Credit Co., LLC, 7.35%,

11/04/2027 |

|

|

1,465 |

|

|

|

1,534 |

|

|

Summit Midstream Holdings, LLC, 8.63%,

10/31/2029(d) |

|

|

2,200 |

|

|

|

2,282 |

|

|

|

|

|

|

|

|

11,181 |

|

|

|

Healthcare Equipment and Services 2.1% |

|

|

HCA, Inc., 7.69%, 06/15/2025 |

|

|

4,750 |

|

|

|

4,806 |

|

|

Molina Healthcare, Inc., 6.25%,

01/15/2033(d) |

|

|

2,500 |

|

|

|

2,471 |

|

|

|

|

|

|

|

|

7,277 |

|

|

|

Insurance 0.7% |

|

|

Acrisure, LLC, 7.50%, 11/06/2030(d) |

|

|

1,081 |

|

|

|

1,113 |

|

|

Howden U.K. Refinance PLC, (Great

Britain), 7.25%, 02/15/2031(d) |

|

|

1,400 |

|

|

|

1,423 |

|

|

|

|

|

|

|

|

2,536 |

|

|

|

Materials 2.9% |

|

Crown Cork & Seal Co., Inc., 7.38%,

12/15/2026 |

|

|

4,350 |

|

|

|

4,463 |

|

|

Kobe U.S. Midco 2, Inc., 9.25% PIK,

11/01/2026(d) |

|

|

1,544 |

|

|

|

1,309 |

|

|

Summit Materials, LLC, 6.50%,

03/15/2027(d) |

|

|

2,750 |

|

|

|

2,747 |

|

|

Trident TPI Holdings, Inc., 12.75%,

12/31/2028(d) |

|

|

1,500 |

|

|

|

1,654 |

|

|

|

|

|

|

|

|

10,173 |

|

|

|

Media and Entertainment 3.8% |

|

|

Belo Corp., 7.25%, 09/15/2027 |

|

|

3,250 |

|

|

|

3,356 |

|

|

Charter Communications Operating, LLC,

6.10%, 06/01/2029 |

|

|

1,650 |

|

|

|

1,684 |

|

|

Charter Communications Operating, LLC,

6.55%, 06/01/2034 |

|

|

1,650 |

|

|

|

1,688 |

|

|

Live Nation Entertainment, Inc., 6.50%,

05/15/2027(d) |

|

|

3,250 |

|

|

|

3,286 |

|

|

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Univision Communications, Inc., 6.63%,

06/01/2027(d) |

|

$ |

1,000 |

|

|

$ |

996 |

|

|

Univision Communications, Inc., 8.00%,

08/15/2028(d) |

|

|

2,000 |

|

|

|

2,036 |

|

|

|

|

|

|

|

|

13,046 |

|

|

|

Semiconductors and Semiconductor Equipment 0.7% |

|

Amkor Technology, Inc., 6.63%,

09/15/2027(d) |

|

|

2,500 |

|

|

|

2,499 |

|

|

|

Software and Services 2.0% |

|

|

Leidos, Inc., 7.13%, 07/01/2032 |

|

|

2,500 |

|

|

|

2,731 |

|

|

Open Text Corp., (Canada), 6.90%,

12/01/2027(d) |

|

|

1,500 |

|

|

|

1,550 |

|

|

SS&C Technologies, Inc., 6.50%,

06/01/2032(d) |

|

|

2,500 |

|

|

|

2,522 |

|

|

|

|

|

|

|

|

6,803 |

|

|

|

Technology Hardware and Equipment 1.8% |

|

Dell International, LLC, 6.02%,

06/15/2026 |

|

|

875 |

|

|

|

888 |

|

|

Dell International, LLC, 6.10%,

07/15/2027 |

|

|

1,500 |

|

|

|

1,544 |

|

|

Diebold Nixdorf, Inc., 7.75%,

03/31/2030(d) |

|

|

2,250 |

|

|

|

2,310 |

|

|

Insight Enterprises, Inc., 6.63%,

05/15/2032(d) |

|

|

1,500 |

|

|

|

1,508 |

|

|

|

|

|

|

|

|

6,250 |

|

|

|

Telecommunication Services 2.5% |

|

Altice France Holding S.A., (Luxembourg),

10.50%, 05/15/2027(d) |

|

|

2,000 |

|

|

|

583 |

|

|

Altice France S.A., (France), 8.13%,

02/01/2027(d) |

|

|

500 |

|

|

|

406 |

|

|

Iliad Holding S.A.S, (France), 7.00%,

10/15/2028(d) |

|

|

1,000 |

|

|

|

1,013 |

|

|

Level 3 Financing, Inc., 11.00%,

11/15/2029(d) |

|

|

1,250 |

|

|

|

1,406 |

|

|

|

Sprint, LLC, 7.63%, 03/01/2026 |

|

|

5,250 |

|

|

|

5,365 |

|

|

|

|

|

|

|

|

8,773 |

|

|

|

Transportation 1.9% |

|

|

GLP Capital, LP, 5.38%, 04/15/2026 |

|

|

3,000 |

|

|

|

3,000 |

|

|

Mileage Plus Holdings, LLC, 6.50%,

06/20/2027(d) |

|

|

2,875 |

|

|

|

2,893 |

|

|

Annual Report 2024

11

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

December 31, 2024

(in thousands, except shares, percentages and as otherwise noted)

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Uber Technologies, Inc., 7.50%,

09/15/2027(d) |

|

$ |

545 |

|

|

$ |

555 |

|

|

|

|

|

|

|

|

6,448 |

|

|

|

Utilities 2.0% |

|

|

CQP Holdco, LP, 7.50%, 12/15/2033(d) |

|

|

1,750 |

|

|

|

1,840 |

|

|

|

NRG Energy, Inc., 6.25%, 11/01/2034(d) |

|

|

2,000 |

|

|

|

1,962 |

|

|

Vistra Operations Co, LLC, 7.75%,

10/15/2031(d) |

|

|

3,000 |

|

|

|

3,147 |

|

|

|

|

|

|

|

|

6,949 |

|

|

Total Corporate Bonds

(Cost: $171,503) |

|

|

|

|

170,779 |

|

|

Collateralized Loan Obligations 49.4%(d)(f)

|

Collateralized Loan Obligations — Debt 28.8%(b)(c) |

|

|

Investment Funds and Vehicles 28.8% |

|

AMMC CLO XI, Ltd., (Cayman Islands),

3M LIBOR + 6.06%, 10.65%, 04/30/2031 |

|

|

2,000 |

|

|

|

2,010 |

|

|

Atrium XIV, LLC, (Cayman Islands), 3M

LIBOR + 6.50%, 11.40%, 10/16/2037 |

|

|

2,800 |

|

|

|

2,856 |

|

|

Atrium XV, (Cayman Islands), 3M LIBOR +

6.50%, 11.15%, 07/16/2037 |

|

|

1,188 |

|

|

|

1,205 |

|

|

Bain Capital Credit CLO 2020-1, Ltd.,

(Cayman Islands), 3M LIBOR + 7.15%,

11.78%, 04/18/2033 |

|

|

1,000 |

|

|

|

1,009 |

|

|

Bain Capital Credit CLO, Ltd. 2021-5,

(Cayman Islands), 3M LIBOR + 6.76%,

11.39%, 10/23/2034 |

|

|

2,000 |

|

|

|

2,011 |

|

|

Ballyrock CLO 26, Ltd., (Cayman Islands),

3M LIBOR + 6.10%, 11.43%, 07/25/2037 |

|

|

950 |

|

|

|

958 |

|

|

Benefit Street Partners CLO XIV, Ltd.,

(Cayman Islands), 3M LIBOR + 6.15%,

10.74%, 10/20/2037 |

|

|

2,750 |

|

|

|

2,817 |

|

|

Benefit Street Partners CLO XXXIV, Ltd.,

(Cayman Islands), 3M LIBOR + 6.70%,

11.33%, 07/25/2037 |

|

|

500 |

|

|

|

515 |

|

|

Benefit Street Partners CLO XXXV, Ltd.,

(Jersey), 3M LIBOR + 6.10%, 10.73%,

04/25/2037 |

|

|

750 |

|

|

|

764 |

|

|

Brookhaven Park CLO, Ltd., (Cayman

Islands), 3M LIBOR + 6.50%, 11.12%,

04/19/2037 |

|

|

500 |

|

|

|

512 |

|

|

Captree Park CLO, Ltd., (Jersey), 3M

LIBOR + 6.00%, 10.62%, 07/20/2037 |

|

|

875 |

|

|

|

901 |

|

|

Collateralized Loan Obligations(d)(f) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Carlyle US CLO 2024-1, Ltd., (Cayman

Islands), 3M LIBOR + 6.92%, 11.58%,

04/15/2037 |

|

$ |

548 |

|

|

$ |

563 |

|

|

Carlyle US CLO 2024-2, Ltd., (Cayman

Islands), 3M LIBOR + 6.85%, 11.48%,

04/25/2037 |

|

|

1,000 |

|

|

|

1,029 |

|

|

Carlyle US CLO 2024-3, Ltd., (Cayman

Islands), 3M LIBOR + 6.40%, 11.70%,

07/25/2036 |

|

|

1,600 |

|

|

|

1,650 |

|

|

Carlyle US CLO, 2019-3 Ltd., (Cayman

Islands), 3M LIBOR + 7.34%, 11.96%,

04/20/2037 |

|

|

1,650 |

|

|

|

1,689 |

|

|

Carlyle US CLO, 2021 11A Ltd., (Cayman

Islands), 3M LIBOR + 6.50%, 11.13%,

07/25/2037 |

|

|

500 |

|

|

|

509 |

|

|

Carlyle US CLO, 2022-5 Ltd., (Cayman

Islands), 3M LIBOR + 7.10%, 12.20%,

10/15/2037 |

|

|

2,095 |

|

|

|

2,161 |

|

|

Cedar Funding CLO II, Ltd., (Cayman

Islands), 3M LIBOR + 7.56%, 12.18%,

04/20/2034 |

|

|

1,750 |

|

|

|

1,761 |

|

|

CIFC Funding Ltd. 2021-1A, (Cayman

Islands), 3M LIBOR + 6.00%, 10.63%,

07/25/2037 |

|

|

1,150 |

|

|

|

1,171 |

|

|

CIFC Funding, Ltd. 2019-4A, (Cayman

Islands), 3M LIBOR + 6.86%, 11.52%,

10/15/2034 |

|

|

1,500 |

|

|

|

1,512 |

|

|

CIFC Funding, Ltd. 2021-VI, (Cayman

Islands), 3M LIBOR + 6.51%, 11.17%,

10/15/2034 |

|

|

2,000 |

|

|

|

2,014 |

|

|

CIFC Funding, Ltd. 2021-VII, (Cayman

Islands), 3M LIBOR + 6.61%, 11.24%,

01/23/2035 |

|

|

2,406 |

|

|

|

2,421 |

|

|

Crestline Denali CLO XIV, Ltd., (Cayman

Islands), 3M LIBOR + 6.61%, 11.24%,

10/23/2031 |

|

|

2,000 |

|

|

|

2,016 |

|

|

Denali Capital CLO XII, Ltd., (Cayman

Islands), 3M LIBOR + 6.16%, 10.82%,

04/15/2031 |

|

|

2,500 |

|

|

|

2,529 |

|

|

Dryden 104 CLO, Ltd., (Cayman Islands),

3M LIBOR + 7.40%, 11.92%, 08/20/2034 |

|

|

2,878 |

|

|

|

2,907 |

|

|

Dryden 115 CLO, Ltd., (Jersey), 3M

LIBOR + 7.10%, 11.73%, 04/18/2037 |

|

|

1,000 |

|

|

|

1,022 |

|

|

Elmwood CLO 20, Ltd., (Cayman Islands),

3M LIBOR + 6.00%, 10.65%,

01/17/2037 |

|

|

2,000 |

|

|

|

2,058 |

|

|

Elmwood CLO 28, Ltd., (Cayman

Islands), 3M LIBOR + 6.00%, 11.34%,

04/17/2037 |

|

|

500 |

|

|

|

515 |

|

|

Annual Report 2024

12

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

December 31, 2024

(in thousands, except shares, percentages and as otherwise noted)

Collateralized Loan Obligations(d)(f) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Elmwood CLO I, Ltd., (Cayman Islands),

3M LIBOR + 6.40%, 11.02%, 04/20/2037 |

|

$ |

3,000 |

|

|

$ |

3,103 |

|

|

Elmwood CLO IV, Ltd., (Cayman Islands),

3M LIBOR + 6.15%, 10.78%, 04/18/2037 |

|

|

1,257 |

|

|

|

1,296 |

|

|

Elmwood CLO VIII, Ltd., (Cayman Islands),

3M LIBOR + 6.25%, 10.87%, 04/20/2037 |

|

|

2,514 |

|

|

|

2,569 |

|

|

Flatiron CLO 21 Ltd., (Cayman Islands),

3M LIBOR + 5.90%, 10.52%, 10/19/2037 |

|

|

250 |

|

|

|

255 |

|

|

Generate Clo 11, Ltd., (Cayman Islands),

3M LIBOR + 7.30%, 12.14%, 10/20/2037 |

|

|

1,129 |

|

|

|

1,160 |

|

|

Generate CLO 14, Ltd., (Cayman Islands),

3M LIBOR + 6.75%, 11.38%, 04/22/2037 |

|

|

500 |

|

|

|

512 |

|

|

Generate CLO 16, Ltd., (Cayman Islands),

3M LIBOR + 6.15%, 11.16%, 07/20/2037 |

|

|

500 |

|

|

|

510 |

|

|

Generate CLO 4, Ltd., (Cayman Islands),

3M LIBOR + 6.90%, 11.52%, 07/20/2037 |

|

|

1,200 |

|

|

|

1,230 |

|

|

Golub Capital Partners CLO 60B, Ltd.,

(Cayman Islands), 3M LIBOR + 6.00%,

10.63%, 10/25/2034 |

|

|

1,250 |

|

|

|

1,245 |

|

|

Invesco CLO, Ltd., (Cayman Islands),

3M LIBOR + 6.41%, 11.07%, 07/15/2034 |

|

|

1,000 |

|

|

|

985 |

|

|

KKR CLO 45A Ltd, (Cayman Islands),

3M LIBOR + 7.30%, 11.96%, 04/15/2035 |

|

|

1,000 |

|

|

|

1,007 |

|

|