Civitas Issues Statement in Conjunction with Debt Offering

10 Octobre 2023 - 2:09PM

Business Wire

Civitas Resources’ (NYSE: CIVI) (“Civitas” or the “Company”) CEO

Chris Doyle today issued the following statement in conjunction

with the Company’s recently announced debt offering:

“Today’s debt offering is expected to successfully finance our

accretive Vencer acquisition. There is inherent flexibility in our

capital structure, and we see tremendous value in our equity at

today’s levels. With expectations for $300 million or more in

non-core asset sales, we anticipate maintaining a strong capital

structure rapidly advancing towards our 0.75x mid-cycle leverage

target.”

“Our Vencer transaction was purposely structured with

optionality, including a $550 million deferred payment due in

January 2025. This flexibility allowed us to navigate recent oil

price volatility and ensure we maintain low leverage.”

“We are transforming Civitas into a balanced, well capitalized

enterprise with an enviable portfolio of oil assets in the U.S.’

top three oil basins.”

This press release does not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Civitas Resources, Inc.

Civitas Resources, Inc. is an independent, domestic oil and gas

producer focused on development of its premier assets in the

Denver-Julesburg (DJ) and Permian basins. The Company has a proven

business model combining capital discipline, a strong balance

sheet, cash flow generation, and sustainable cash returns to

shareholders. The Company employs leading Environmental, Social,

and Governance practices throughout the Company and was Colorado’s

first carbon neutral oil and gas producer. The Company’s common

stock is listed for trading on the New York Stock Exchange under

the symbol: “CIVI.”

Cautionary Statement Regarding Forward-Looking

Information

Certain statements in the foregoing, including those that

express belief, expectation or intention, are “forward-looking”

statements based on assumptions currently believed to be valid.

Forward-looking statements are all statements other than statements

of historical facts. The words “anticipate,” “believe,” “ensure,”

“expect,” “if,” “intend,” “estimate,” “probable,” “project,”

“forecasts,” “predict,” “outlook,” “aim,” “will,” “could,”

“should,” “would,” “potential,” “may,” “might,” “anticipate,”

“likely,” “plan,” “positioned,” “strategy,” and similar expressions

or other words of similar meaning, and the negatives thereof, are

intended to identify forward-looking statements. Specific

forward-looking statements include statements regarding the

Company’s plans and expectations with respect to the debt offering,

including the anticipated use of the proceeds therefrom, and the

pending transactions contemplated by that certain Purchase and Sale

Agreement, dated as of October 3, 2023, by and between the Company

and Vencer Energy, LLC (the “Purchase Agreement” and such

transactions, the “Acquisition”). The forward-looking statements

are intended to be subject to the safe harbor provided by Section

27A of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, and the Private Securities

Litigation Reform Act of 1995.

The Company cautions investors that any forward-looking

statements are subject to known and unknown risks and

uncertainties, many of which are outside the Company’s control, and

which may cause actual results and future trends to differ

materially from those matters expressed in, or implied or projected

by, such forward-looking statements, which speak only as of the

date they are made. Investors are cautioned not to place undue

reliance on these forward-looking statements. Risks and

uncertainties that could cause actual results to differ from those

described in forward-looking statements include, without

limitation, the following:

- the Purchase Agreement relating to the Acquisition may be

terminated in accordance with its terms and the Acquisition may not

be completed;

- the parties may not be able to satisfy the conditions to the

completion of the Acquisition in a timely manner or at all;

- the Acquisition may not be accretive, and may be dilutive, to

the Company’s earnings per share, which may negatively affect the

market price of the Company’s common stock;

- the Company may incur significant transaction and other costs

in connection with the Acquisition in excess of those anticipated

by the Company;

- the Company may fail to realize anticipated synergies or other

benefits expected from the Acquisition in the timeframe expected or

at all;

- the ultimate timing, outcome, and results of integrating the

assets related to the Acquisition into the Company’s business;

- the risk related to disruption of management time from ongoing

business operations due to the Acquisition;

- the effects of the Acquisition, including the Company’s future

financial condition, results of operations, strategy, and

plans;

- changes in capital markets and the ability of the Company to

finance operations in the manner expected;

- any litigation relating to the Acquisition; and

- disruptions to our business due to other significant

transactions.

Additional information concerning other factors that could cause

results to differ materially from those described above can be

found under Item 1A. “Risk Factors” and “Management’s Discussion

and Analysis” sections in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2022, subsequently filed Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K, and other

filings made with the SEC, each of which is on file with the

SEC.

All forward-looking statements speak only as of the date they

are made and are based on information available at the time they

were made. The Company assumes no obligation to update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements were made or to

reflect the occurrence of unanticipated events except as required

by federal securities laws. As forward-looking statements involve

significant risks and uncertainties, caution should be exercised

against placing undue reliance on such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231010520571/en/

Investor Relations: John Wren, ir@civiresources.com

Media: Rich Coolidge, info@civiresources.com

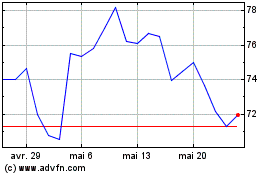

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025