Dine Brands Global, Inc. (NYSE: DIN), the parent company of

Applebee’s Neighborhood Grill & Bar®, IHOP® and Fuzzy’s Taco

Shop® restaurants, today announced financial results for the third

quarter of fiscal year 2024.

“During the third quarter, we continued to experience consumer

pullback and the pressures of a highly promotional operating

environment. We know we need to do more in the near term to drive

traffic and get back to better top-line performance. For the fourth

quarter, we are enhancing our value proposition for guests and

remain focused on executing our plans across our brands,” said John

Peyton, chief executive officer, Dine Brands Global, Inc.

Vance Chang, chief financial officer, Dine Brands Global, Inc.,

added, “Our third quarter results demonstrated the resiliency of

our business model despite the challenges to our top line. Our cash

flow generation ability through market cycles is supported by our

asset-lite model and the scale of our platform. We are confident in

our ability to drive long-term value for our stakeholders.”

Domestic Restaurant Sales for the Third Quarter of

2024

- Applebee’s year-over-year domestic comparable same-restaurant

sales declined 5.9% for the third quarter of 2024. Off-premise

sales mix accounted for 21.7% in the third quarter of 2024 compared

to 21.5% in the third quarter of 2023.

- IHOP’s year-over-year domestic comparable same-restaurant sales

declined 2.1% for the third quarter of 2024. Off-premise sales mix

accounted for 19.3% in the third quarter of 2024 compared to 19.5%

in the third quarter of 2023.

Third Quarter of 2024 Summary

- Total revenues for the third quarter of 2024 were $195.0

million compared to $202.6 million for the third quarter of 2023.

The decrease was primarily due to the negative comparable

same-restaurant sales growth at Applebee’s and IHOP, partially

offset by increases in the number of effective franchise

restaurants and proprietary product sales at IHOP.

- General and Administrative (“G&A”) expenses for the third

quarter of 2024 were $45.4 million compared to $48.6 million for

the third quarter of 2023. The variance was primarily attributable

to lower compensation-related expenses offset by an increase in

depreciation expense.

- GAAP net income available to common stockholders was $18.5

million, or earnings per diluted share of $1.24, for the third

quarter of 2024 compared to net income available to common

stockholders of $18.0 million, or earnings per diluted share of

$1.19 for the third quarter of 2023. The increase was primarily due

to a decrease in G&A expenses and a decrease in closure and

impairment charges, partially offset by a decrease in segment

profit.

- Adjusted net income available to common stockholders was $21.4

million, or adjusted earnings per diluted share of $1.44, for the

third quarter of 2024 compared to adjusted net income available to

common stockholders of $22.3 million, or adjusted earnings per

diluted share of $1.46, for the third quarter of 2023. The decline

was primarily due to a decrease in segment profit, partially offset

by a decrease in G&A expenses. (See “Non-GAAP Financial

Measures” for definition and reconciliation of GAAP net income

available to common stockholders to adjusted net income available

to common stockholders.)

- Consolidated adjusted EBITDA for the third quarter of 2024 was

$61.9 million compared to $60.6 million for the third quarter of

2023. (See “Non-GAAP Financial Measures” for definition and

reconciliation of GAAP net income to consolidated adjusted

EBITDA.)

- Development activity by Applebee’s and IHOP franchisees for the

third quarter of 2024 resulted in 10 new restaurant openings and 19

restaurant closures.

First Nine Months of 2024 Summary

- Total revenues for the first nine months of 2024 were $607.5

million compared to $624.8 million for the first nine months of

2023. The decline was primarily due to the negative comparable

same-restaurant sales growth at the brands, partially offset by

increases in the number of effective franchise restaurants and

proprietary product sales at IHOP.

- G&A expenses for the first nine months of 2024 were $144.4

million compared to $147.5 million for the first nine months of

2023. The variance was primarily due to the stopping of the IHOP

Flip’d initiative in the prior period, a decrease in professional

services including acquisition costs, a decrease in occupancy costs

and a decrease in compensation-related expenses, partially offset

by an increase in depreciation expense.

- GAAP net income available to common stockholders was $58.0

million, or earnings per diluted share of $3.88, for the first nine

months of 2024 compared to net income available to common

stockholders of $62.6 million, or earnings per diluted share of

$4.09 for the first nine months of 2023. The decline was primarily

due to a decrease in segment profit, partially offset by a decrease

in G&A expenses.

- Adjusted net income available to common stockholders was $66.9

million, or adjusted earnings per diluted share of $4.48, for the

first nine months of 2024 compared to adjusted net income available

to common stockholders of $80.3 million, or adjusted earnings per

diluted share of $5.25, for the first nine months of 2023. The

decline was primarily due to a decrease in segment profit and an

increase in interest expense as a result of our April 2023

refinancing. (See “Non-GAAP Financial Measures” for definition and

reconciliation of GAAP net income available to common stockholders

to adjusted net income available to common stockholders.)

- Consolidated adjusted EBITDA for the first nine months of 2024

was $189.7 million compared to $194.2 million for the first nine

months of 2023. (See “Non-GAAP Financial Measures” for definition

and reconciliation of GAAP net income to consolidated adjusted

EBITDA.)

- Cash flows provided by operating activities for the first nine

months of 2024 were $77.7 million. This compares to cash flows

provided by operating activities of $79.3 million for the first

nine months of 2023. The decline was primarily due to a decrease in

segment profit, partially offset by a decrease in G&A expenses

and a favorable increase in working capital.

- Adjusted free cash flow was $77.8 million for the first nine

months of 2024. This compares to adjusted free cash flow of $54.0

million for the first nine months of 2023. (See “Non-GAAP Financial

Measures” for definition and reconciliation of the Company’s cash

provided by operating activities to adjusted free cash flow.)

- Development activity by Applebee’s and IHOP franchisees for the

first nine months of 2024 resulted in 35 new restaurant openings

and 64 restaurant closures.

Key Balance Sheet Metrics (as of September 30, 2024)

- Total cash, cash equivalents and restricted cash of

approximately $235.1 million, of which approximately $169.6 million

was unrestricted cash.

- Available borrowing capacity under the Variable Funding Senior

Secured Notes is over $224 million.

GAAP Effective Tax Rate

The Company's effective tax rate was 26.9% for the nine months

ended September 30, 2024, as compared to 25.0% for the nine months

ended September 30, 2023. The effective tax rate for the nine

months ended September 30, 2024 was higher than the rate of the

prior comparable period primarily due to a lower tax deduction

related to stock-based compensation.

Capital Returns to Equity Holders

During the third quarter of 2024, paid quarterly cash dividends

totaling approximately $7.8 million.

Financial Performance Guidance for 2024

The Company’s fiscal year 2024 guidance items have been updated

as follows:

- Reiterated: Applebee’s domestic system-wide comparable

same-restaurant sales performance is expected to range between

negative 4% and negative 2%.

- Reiterated: IHOP’s domestic system-wide comparable

same-restaurant sales performance is expected to range between

negative 2% and 0%.

- Reiterated: Domestic development activity for Applebee’s

franchisees is between 25 and 35 net fewer restaurants.

- Reiterated: Domestic development activity by IHOP franchisees

and area licensees is expected to be between 0 and 10 net new

openings.

- Reiterated: Consolidated adjusted EBITDA is expected to range

between approximately $245 million and $255 million.

- Reduced: G&A expenses are expected to range between

approximately $195 million and $200 million (versus between $200

million and $205 million previously). This total includes non-cash

stock-based compensation expense and depreciation of approximately

$35 million.

- Reiterated: Gross capital expenditures are expected to range

between approximately $14 million and $16 million.

Dine Brands does not provide forward-looking guidance for GAAP

net income because it is unable to predict certain items contained

in the GAAP measure without unreasonable efforts. These items may

include closure and impairment charges, loss on extinguishment of

debt, gain or loss on disposition of assets, other non-income-based

taxes and other items deemed not reflective of current

operations.

Third quarter of 2024 Earnings Conference Call

Details

Dine Brands will host a conference call to discuss its results

on November 6, 2024, at 9:00 a.m. Eastern time. To access

the call, please click this conference call registration link, and

you will be provided with dial in details. A live webcast of the

call, along with a replay, will be available for a limited time at

https://investors.dinebrands.com. Participants should allow

approximately ten minutes prior to the call’s start time to visit

the site and download any streaming media software needed to listen

to the webcast. An online archive of the webcast will also be

available on Events and Presentations under the Investors section

of the Company’s website.

About Dine Brands Global, Inc.

Based in Pasadena, California, Dine Brands Global, Inc. (NYSE:

DIN), through its subsidiaries and franchisees, supports and

operates restaurants under the Applebee's Neighborhood Grill +

Bar®, IHOP®, and Fuzzy’s Taco Shop® brands. As of September 30,

2024, these three brands consisted of over 3,500 restaurants across

19 international markets. Dine Brands is one of the largest

full-service restaurant companies in the world and in 2022 expanded

into the Fast Casual segment. For more information on Dine Brands,

visit the Company’s website located at www.dinebrands.com.

Forward-Looking Statements

Statements contained in this press release may constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. You can identify these

forward-looking statements by words such as “may,” “will,” “would,”

“should,” “could,” “expect,” “anticipate,” “believe,” “estimate,”

“intend,” “plan,” “goal” and other similar expressions. These

statements involve known and unknown risks, uncertainties and other

factors, which may cause actual results to be materially different

from those expressed or implied in such statements. These factors

include, but are not limited to: general economic conditions,

including the impact of inflation, particularly as it may impact

our franchisees directly; our level of indebtedness; compliance

with the terms of our securitized debt; our ability to refinance

our current indebtedness or obtain additional financing; our

dependence on information technology; potential cyber incidents;

the implementation of restaurant development plans; our dependence

on our franchisees; the concentration of our Applebee’s franchised

restaurants in a limited number of franchisees; the financial

health of our franchisees including any insolvency or bankruptcy;

credit risks from our IHOP franchisees operating under our previous

IHOP business model in which we built and equipped IHOP restaurants

and then franchised them to franchisees; insufficient insurance

coverage to cover potential risks associated with the ownership and

operation of restaurants; our franchisees’ and other licensees’

compliance with our quality standards and trademark usage; general

risks associated with the restaurant industry; potential harm to

our brands’ reputation; risks of food-borne illness or food

tampering; possible future impairment charges; trading volatility

and fluctuations in the price of our stock; our ability to achieve

the financial guidance we provide to investors; successful

implementation of our business strategy; the availability of

suitable locations for new restaurants; shortages or interruptions

in the supply or delivery of products from third parties or

availability of utilities; the management and forecasting of

appropriate inventory levels; development and implementation of

innovative marketing and use of social media; changing health or

dietary preference of consumers; risks associated with doing

business in international markets; the results of litigation and

other legal proceedings; third-party claims with respect to

intellectual property assets; delivery initiatives and use of

third-party delivery vendors; our allocation of human capital and

our ability to attract and retain management and other key

employees; compliance with federal, state and local governmental

regulations; risks associated with our self-insurance; natural

disasters, pandemics, epidemics, or other serious incidents; our

success with development initiatives outside of our core business;

the adequacy of our internal controls over financial reporting and

future changes in accounting standards; and other factors discussed

from time to time in the Corporation’s Annual and Quarterly Reports

on Forms 10-K and 10-Q and in the Corporation’s other filings with

the Securities and Exchange Commission. The forward-looking

statements contained in this press release are made as of the date

hereof and the Corporation does not intend to, nor does it assume

any obligation to, update or supplement any forward-looking

statements after the date hereof to reflect actual results or

future events or circumstances.

Non-GAAP Financial Measures

This press release includes references to the Company's non-GAAP

financial measure “adjusted net income available to common

stockholders”, “adjusted earnings per diluted share (Adjusted

EPS)”, “Adjusted EBITDA” and “Adjusted free cash flow.” Adjusted

EPS is computed for a given period by deducting from net income or

loss available to common stockholders for such period the effect of

any closure and impairment charges, any intangible asset

amortization, any non-cash interest expense, any gain or loss

related to the disposition of assets, any gain or loss related to

debt extinguishment, and other items deemed not reflective of

current operations. This is presented on an aggregate basis and a

per share (diluted) basis. Adjusted EBITDA is computed for a given

period by deducting from net income or loss for such period the

effect of any interest expense, any income tax provision or

benefit, any depreciation and amortization, any non-cash

stock-based compensation, any closure and impairment charges, any

gain or loss related to debt extinguishment, any gain or loss

related to the disposition of assets, and other items deemed not

reflective of current operations. “Adjusted free cash flow” for a

given period is defined as cash provided by operating activities,

plus receipts from notes and equipment contracts receivable, less

capital expenditures. Management may use certain of these non-GAAP

financial measures along with the corresponding U.S. GAAP measures

to evaluate the performance of the business and to make certain

business decisions. Management uses adjusted free cash flow in its

periodic assessments of, among other things, the amount of cash

dividends per share of common stock and repurchases of common stock

and we believe it is important for investors to have the same

measure used by management for that purpose. Adjusted free cash

flow does not represent residual cash flow available for

discretionary purposes. Management believes that these non-GAAP

financial measures provide additional meaningful information that

should be considered when assessing the business and the Company’s

performance compared to prior periods and the marketplace. Adjusted

EPS and adjusted free cash flow are supplemental non-GAAP financial

measures and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

U.S. GAAP.

FBN-R

Dine Brands Global, Inc. and

Subsidiaries

Consolidated Statements of

Comprehensive Income

(In thousands, except per

share amounts)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenues:

Franchise revenues:

Royalties, franchise fees and other

$

96,565

$

99,135

$

299,161

$

303,998

Advertising revenues

69,789

73,385

219,568

226,401

Total franchise revenues

166,354

172,520

518,729

530,399

Company restaurant sales

267

308

840

1,839

Rental revenues

27,991

29,128

86,546

90,519

Financing revenues

422

628

1,421

2,009

Total revenues

195,034

202,584

607,536

624,766

Cost of revenues:

Franchise expenses:

Advertising expenses

69,789

73,385

219,568

226,401

Bad debt (credit) expense

151

(51

)

(395

)

2,593

Other franchise expenses

9,787

9,804

31,980

29,790

Total franchise expenses

79,727

83,138

251,153

258,784

Company restaurant expenses

304

323

915

1,833

Rental expenses:

Interest expense from finance leases

729

668

2,208

2,072

Other rental expenses

20,879

21,066

63,005

63,538

Total rental expenses

21,608

21,734

65,213

65,610

Financing expenses

76

91

241

283

Total cost of revenues

101,715

105,286

317,522

326,510

Gross profit

93,319

97,298

290,014

298,256

General and administrative expenses

45,390

48,618

144,435

147,545

Interest expense, net

18,369

19,059

54,291

51,549

Closure and impairment charges

366

1,774

1,442

3,088

Amortization of intangible assets

2,724

2,709

8,169

8,202

Loss on extinguishment of debt

—

—

—

10

Loss (gain) on disposition of assets

6

191

(57

)

2,309

Income before income taxes

26,464

24,947

81,734

85,553

Income tax provision

(7,403

)

(6,468

)

(22,018

)

(21,416

)

Net income

19,061

18,479

59,716

64,137

Other comprehensive income (loss) net

of tax:

Foreign currency translation

adjustment

2

(2

)

(3

)

(2

)

Total comprehensive income

$

19,063

$

18,477

$

59,713

$

64,135

Net income available to common

stockholders:

Net income

$

19,061

$

18,479

$

59,716

$

64,137

Less: Net income allocated to unvested

participating restricted stock

(553

)

(431

)

(1,760

)

(1,551

)

Net income available to common

stockholders

$

18,508

$

18,048

$

57,956

$

62,586

Net income available to common

stockholders per share:

Basic

$

1.24

$

1.19

$

3.88

$

4.10

Diluted

$

1.24

$

1.19

$

3.88

$

4.09

Weighted average shares

outstanding:

Basic

14,897

15,217

14,940

15,275

Diluted

14,897

15,220

14,940

15,289

Dine Brands Global, Inc. and

Subsidiaries

Consolidated Balance

Sheets

(In thousands)

September 30, 2024

December 31, 2023

Assets

(Unaudited)

Current assets:

Cash and cash equivalents

$

169,636

$

146,034

Receivables, net of allowance

83,414

127,937

Restricted cash

45,974

35,058

Prepaid gift card costs

23,493

29,545

Prepaid income taxes

806

3,445

Other current assets

8,108

15,759

Total current assets

331,431

357,778

Non-current restricted cash

19,500

19,500

Property and equipment, net

154,932

161,891

Operating lease right-of-use assets

282,202

275,214

Deferred rent receivable

26,721

33,326

Long-term receivables, net of

allowance

33,508

35,602

Goodwill

254,062

254,062

Other intangible assets, net

578,309

586,033

Other non-current assets, net

18,874

16,881

Total assets

$

1,699,539

$

1,740,287

Liabilities and Stockholders’

Deficit

Current liabilities:

Current maturities of long-term debt

$

100,000

$

100,000

Accounts payable

35,455

36,193

Gift card liability

137,020

175,640

Current maturities of operating lease

obligations

61,181

63,498

Current maturities of finance lease and

financing obligations

6,713

7,243

Accrued employee compensation and

benefits

12,063

23,211

Accrued advertising expenses

3,616

9,446

Dividends payable

7,790

7,827

Other accrued expenses

23,012

37,394

Total current liabilities

386,850

460,452

Long-term debt, net, less current

maturities

1,086,026

1,084,502

Operating lease obligations, less current

maturities

271,283

269,097

Finance lease obligations, less current

maturities

35,720

34,389

Financing obligations, less current

maturities

24,940

26,984

Deferred income taxes, net

57,493

60,829

Deferred franchise revenue, long-term

37,681

38,658

Other non-current liabilities

16,216

16,350

Total liabilities

1,916,209

1,991,261

Commitments and contingencies

Stockholders’ deficit:

Common stock

248

249

Additional paid-in-capital

252,994

256,542

Retained earnings

186,237

150,008

Accumulated other comprehensive loss

(67

)

(64

)

Treasury stock, at cost

(656,082

)

(657,709

)

Total stockholders’ deficit

(216,670

)

(250,974

)

Total liabilities and stockholders’

deficit

$

1,699,539

$

1,740,287

Dine Brands Global, Inc. and

Subsidiaries

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Nine Months Ended

September 30,

2024

2023

Cash flows from operating

activities:

Net income

$

59,716

$

64,137

Adjustments to reconcile net income to

cash flows provided by operating activities:

Depreciation and amortization

29,049

26,221

Non-cash closure and impairment

charges

1,442

3,088

Non-cash stock-based compensation

expense

12,572

8,167

Non-cash interest expense

2,448

2,714

Loss on extinguishment of debt

—

10

Deferred income taxes

(3,335

)

(3,582

)

Deferred revenue

(3,431

)

(2,590

)

(Gain) loss on disposition of assets

(57

)

2,309

Other

(2,894

)

(1,577

)

Changes in operating assets and

liabilities:

Receivables, net

6,937

6,354

Deferred rent receivable

6,605

6,792

Current income tax receivable and

payable

1,352

(186

)

Gift card receivable and payable

(13,060

)

(13,588

)

Other current assets

7,624

6,358

Accounts payable

(2,100

)

(15,527

)

Operating lease assets and liabilities

(9,716

)

2,438

Accrued employee compensation and

benefits

(11,033

)

(4,447

)

Accrued advertising

(1,827

)

(9,750

)

Other current liabilities

(2,598

)

1,965

Cash flows provided by operating

activities

77,694

79,306

Cash flows from investing

activities:

Principal receipts from notes, equipment

contracts and other long-term receivables

10,388

6,686

Additions to property and equipment

(10,305

)

(31,968

)

Proceeds from sale of property and

equipment

305

—

Additions to long-term receivables

(649

)

(1,237

)

Other

(400

)

(113

)

Cash flows used in investing

activities

(661

)

(26,632

)

Cash flows from financing

activities:

Proceeds from issuance of long-term

debt

—

500,000

Repayment of long-term debt

—

(651,713

)

Borrowing from revolving credit

facility

—

30,000

Repayment of revolving credit facility

—

(30,000

)

Payment of debt issuance costs

—

(8,044

)

Dividends paid on common stock

(23,513

)

(31,740

)

Repurchase of common stock

(12,000

)

(20,017

)

Principal payments on finance lease and

financing obligations

(4,396

)

(5,329

)

Proceeds from stock options exercised

—

3,812

Repurchase of restricted stock for tax

payments upon vesting

(2,573

)

(4,139

)

Tax payments for share settlement of

restricted stock units

(30

)

(859

)

Other

(3

)

—

Cash flows used in financing

activities

(42,515

)

(218,029

)

Net change in cash, cash equivalents and

restricted cash

34,518

(165,355

)

Cash, cash equivalents and restricted cash

at beginning of period

200,592

324,984

Cash, cash equivalents and restricted cash

at end of period

$

235,110

$

159,629

Dine Brands Global, Inc. and

Subsidiaries Non-GAAP Financial Measures (In

thousands, except per share amounts) (Unaudited)

Reconciliation of net income available to common stockholders to

net income available to common stockholders, as adjusted for the

following items: Closure and impairment charges; amortization of

intangible assets; non-cash interest expenses; loss on

extinguishment of debt; gain or loss on disposition of assets;

acquisition costs; IHOP Flip'd initiative; other EBITDA

adjustments; and the combined tax effect of the preceding

adjustments, as well as related per share data:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income available to common

stockholders

$

18,508

$

18,048

$

57,956

$

62,586

Closure and impairment charges

366

1,774

1,442

3,088

Amortization of intangible assets

2,724

2,709

8,169

8,202

Non-cash interest expense

829

779

2,448

2,714

Loss (gain) on disposition of assets

6

191

(57

)

2,309

Loss on extinguishment of debt

—

—

—

10

Acquisition costs

—

—

—

804

IHOP Flip'd initiative

—

—

—

5,121

Other EBITDA adjustments

119

361

484

2,232

Net income tax provision for above

adjustments

(1,051

)

(1,512

)

(3,246

)

(6,365

)

Net income allocated to unvested

participating restricted stock

(89

)

(99

)

(274

)

(439

)

Net income available to common

stockholders, as adjusted

$

21,412

$

22,251

$

66,922

$

80,262

Diluted net income available to common

stockholders per share (a):

Net income available to common

stockholders

$

1.24

$

1.19

$

3.88

$

4.09

Closure and impairment charges

0.02

0.09

0.07

0.15

Amortization of intangible assets

0.14

0.13

0.40

0.40

Non-cash interest expense

0.04

0.04

0.12

0.13

Loss (gain) on disposition of assets

0.00

0.01

0.00

0.11

Loss on extinguishment of debt

—

—

—

0.00

Acquisition costs

—

—

—

0.04

IHOP Flip'd initiative

—

—

—

0.25

Other EBITDA adjustments

0.01

0.02

0.02

0.11

Net income allocated to unvested

participating restricted stock

(0.01

)

(0.01

)

(0.02

)

(0.03

)

Rounding

—

(0.01

)

0.01

—

Diluted net income available to common

stockholders per share, as adjusted

$

1.44

$

1.46

$

4.48

$

5.25

Numerator for basic EPS - net income

available to common stockholders, as adjusted

$

21,412

$

22,251

$

66,922

$

80,262

Effect of unvested participating

restricted stock using the two-class method

—

—

0

—

Numerator for diluted EPS - net income

available to common stockholders, as adjusted

$

21,412

$

22,251

$

66,922

$

80,262

Denominator for basic EPS -

weighted-average shares

14,897

15,217

14,940

15,275

Dilutive effect of stock options

—

3

—

14

Denominator for diluted EPS -

weighted-average shares

14,897

15,220

14,940

15,289

_________________________________

(a)

Diluted net income available to

common stockholders per share for the three and nine months ended

September 30, 2024 and 2023 presented on an after-tax basis.

Dine Brands Global, Inc. and

Subsidiaries Non-GAAP Financial Measures

(Unaudited)

Reconciliation of the Company's cash flows provided by operating

activities to “adjusted free cash flow” (cash flows provided by

operating activities, plus receipts from notes and equipment

contracts receivable, less additions to property and equipment).

Management uses this liquidity measure in its periodic assessments

of, among other things, the amount of cash dividends per share of

common stock and repurchases of common stock. We believe it is

important for investors to have the same measure used by management

for that purpose. Adjusted free cash flow does not represent

residual cash flow available for discretionary purposes.

Nine Months Ended September

30,

2024

2023

(In thousands)

Cash flows provided by operating

activities

$

77,694

$

79,306

Principal receipts from notes and

equipment contracts

10,388

6,686

Net additions to property and

equipment

(10,305

)

(31,968

)

Adjusted free cash flow

77,777

54,024

Repayment of long-term debt, net

—

(151,713

)

Dividends paid on common stock

(23,513

)

(31,740

)

Repurchase of common stock

(12,000

)

(20,017

)

$

42,264

$

(149,446

)

Dine Brands Global, Inc. and

Subsidiaries Non-GAAP Financial Measures (in

thousands) (Unaudited)

Reconciliation of the Company's net income to “adjusted EBITDA.”

The Company defines adjusted EBITDA as net income or loss, adjusted

for the effect of interest expense, income tax provision or

benefit, depreciation and amortization, non-cash stock-based

compensation, closure and impairment charges, loss on

extinguishment of debt, gain or loss on disposition of assets, and

other items deemed not reflective of current operations. Management

may use certain non-GAAP measures along with the corresponding U.S.

GAAP measures to evaluate the performance of the Company and to

make certain business decisions.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income, as reported

$

19,061

$

18,479

$

59,716

$

64,137

Interest expense on finance leases

729

668

2,208

2,072

All other interest expense

20,748

21,178

62,260

58,672

Income tax provision

7,403

6,468

22,018

21,416

Depreciation and amortization

9,654

8,587

29,049

26,221

Non-cash stock-based compensation

3,816

2,858

12,572

8,167

Closure and impairment charges

366

1,774

1,442

3,088

Loss on extinguishment of debt

—

—

—

10

Loss (gain) on disposition of assets

6

191

(57

)

2,309

IHOP Flip'd initiative

—

—

—

5,121

Other

119

361

484

3,036

Adjusted EBITDA

$

61,902

$

60,564

$

189,692

$

194,249

Dine Brands Global, Inc. and

Subsidiaries Restaurant Data (Unaudited)

The following table sets forth, for the three and nine months

ended September 30, 2024, the number of “Effective Restaurants” in

the Applebee’s, IHOP and Fuzzy's systems and information regarding

the percentage change in sales at those restaurants compared to the

same periods in the prior year and, as such, the percentage change

in sales at Effective Restaurants is based on non-GAAP sales data.

Sales at restaurants that are owned by franchisees and area

licensees are not attributable to the Company. However, we believe

that presentation of this information is useful in analyzing our

revenues because franchisees and area licensees pay us royalties

and advertising fees that are generally based on a percentage of

their sales, and, where applicable, rental payments under leases

that partially may be based on a percentage of their sales.

Management also uses this information to make decisions about

future plans for the development of additional restaurants as well

as evaluation of current operations.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Applebee's Restaurant Data

Global Effective Restaurants(a)

Franchise

1,620

1,654

1,627

1,663

Company

—

—

—

—

Total

1,620

1,654

1,627

1,663

System-wide(b)

Domestic sales percentage change(c)

(7.1

)%

(3.2

)%

(5.3

)%

0.3

%

Domestic same-restaurant sales percentage

change(d)

(5.9

)%

(2.4

)%

(4.1

)%

0.9

%

Franchise(b)

Domestic sales percentage change(c)

(7.1

)%

0.4

%

(5.3

)%

4.0

%

Domestic same-restaurant sales percentage

change(d)

(5.9

)%

(2.4

)%

(4.1

)%

0.9

%

Average weekly domestic unit sales (in

thousands)

$

49.5

$

52.1

$

52.7

$

54.4

IHOP Restaurant Data

Global Effective Restaurants(a)

Franchise

1,645

1,631

1,645

1,626

Area license

155

156

155

156

Total

1,800

1,787

1,800

1,782

System-wide(b)

Sales percentage change(c)

(1.6

)%

4.2

%

(0.5

)%

6.6

%

Domestic same-restaurant sales percentage

change, including area license restaurants(d)

(2.1

)%

2.0

%

(1.7

)%

4.2

%

Franchise(b)

Sales percentage change(c)

(1.3

)%

4.5

%

(0.4

)%

6.9

%

Domestic same-restaurant sales percentage

change(d)

(1.9

)%

2.0

%

(1.7

)%

4.2

%

Average weekly unit sales (in

thousands)

$

37.0

$

37.8

$

37.7

$

38.3

Area License(b)

Sales percentage change(c)

(3.8

)%

1.1

%

(1.6

)%

4.0

%

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Fuzzy's Restaurant Data

(Unaudited)

Global Effective Restaurants(a)

Franchise

120

136

124

135

Company

1

1

1

2

Total

121

137

125

137

System-wide(b)

Domestic sales percentage change(c)

(15.8

)%

(5.2

)%

(13.7

)%

(1.1

)%

Domestic same-restaurant sales percentage

change(d)

(9.6

)%

(6.1

)%

(8.9

)%

(3.6

)%

Franchise(b)

Domestic sales percentage change(c)

(15.8

)%

(3.8

)%

(13.3

)%

(0.3

)%

Domestic same-restaurant sales percentage

change(d)

(9.6

)%

(6.1

)%

(8.9

)%

(3.7

)%

Average weekly domestic unit sales (in

thousands)

$

29.4

$

30.7

$

30.0

$

31.6

_________________________________

(a)

“Effective Restaurants” are the

weighted average number of restaurants open in each fiscal period,

adjusted to account for restaurants open for only a portion of the

period. Information is presented for all Effective Restaurants in

the Applebee’s and IHOP systems, which consist of restaurants owned

by franchisees and area licensees as well as those owned by the

Company. Effective Restaurants do not include units operated as

ghost kitchens (small kitchens with no store-front presence, used

to fill off-premise orders).

(b)

“System-wide sales” are retail

sales at Applebee’s and Fuzzy's restaurants operated by franchisees

and IHOP restaurants operated by franchisees and area licensees, as

reported to the Company, in addition to retail sales at

company-operated Fuzzy's restaurants. System-wide sales do not

include retail sales of ghost kitchens. Sales at restaurants that

are owned by franchisees and area licensees are not attributable to

the Company. An increase in franchisees' reported sales will result

in a corresponding increase in our royalty revenue, while a

decrease in franchisees' reported sales will result in a

corresponding decrease in our royalty revenue. Unaudited reported

sales for Applebee's and Fuzzy's domestic franchise restaurants,

Fuzzy's company-operated restaurants, IHOP franchise restaurants

and IHOP area license restaurants were as follows:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Reported sales (in millions)

Applebee's franchise restaurant sales

$

1,007.7

$

1,085.3

$

3,230.5

$

3,411.5

IHOP franchise restaurant sales

790.3

801.0

2,416.2

2,425.9

IHOP area license restaurant sales

71.4

74.3

224.4

228.1

Fuzzy's franchise restaurant sales

45.8

54.4

144.9

167.1

Fuzzy's company-operated restaurants

0.3

0.3

0.9

1.9

Total

$

1,915.5

$

2,015.3

$

6,016.9

$

6,234.5

(c)

“Sales percentage change”

reflects, for each category of restaurants, the percentage change

in sales in any given fiscal period compared to the prior period

for all restaurants in that category.

(d)

“Domestic same-restaurant sales

percentage change” reflects the percentage change in sales in any

given fiscal period, compared to the same weeks in the prior

period, for domestic restaurants that have been operated during

both periods that are being compared and have been open for at

least 18 months. Because of new restaurant openings and restaurant

closures, the domestic restaurants open throughout both fiscal

periods being compared may be different from period to period.

Dine Brands Global, Inc. and

Subsidiaries

Restaurant Data

(Unaudited)

Restaurant Development Activity

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Applebee's

Summary - beginning of period:

Franchise

1,625

1,661

1,642

1,678

Company

—

—

—

—

Beginning of period

1,625

1,661

1,642

1,678

Franchise restaurants opened:

Domestic

—

2

—

3

International

4

2

9

5

Total franchise restaurants opened

4

4

9

8

Franchise restaurants permanently

closed:

Domestic

(9

)

(12

)

(25

)

(28

)

International

(2

)

(1

)

(8

)

(6

)

Total franchise restaurants permanently

closed

(11

)

(13

)

(33

)

(34

)

Net franchise restaurant

reduction

(7

)

(9

)

(24

)

(26

)

Summary - end of period:

Franchise

1,618

1,652

1,618

1,652

Company

—

—

—

—

Total Applebee's restaurants, end of

period

1,618

1,652

1,618

1,652

Domestic

1,511

1,544

1,511

1,544

International

107

108

107

108

IHOP

Summary - beginning of period:

Franchise

1,656

1,634

1,657

1,625

Area license

155

156

157

156

Total IHOP restaurants, beginning of

period

1,811

1,790

1,814

1,781

Franchise/area license restaurants

opened:

Domestic franchise

4

5

14

27

Domestic area license

—

—

1

2

International franchise

2

5

11

11

Total franchise/area license restaurants

opened

6

10

26

40

Franchise/area license restaurants

permanently closed:

Domestic franchise

(7

)

(5

)

(24

)

(23

)

Domestic area license

—

—

(3

)

(2

)

International franchise

(1

)

(1

)

(4

)

(2

)

Total franchise/area license restaurants

permanently closed

(8

)

(6

)

(31

)

(27

)

Net increase (decrease) in

franchise/area license restaurants

(2

)

4

(5

)

13

Summary - end of period:

Franchise

1,654

1,638

1,654

1,638

Area license

155

156

155

156

Total IHOP restaurants, end of

period

1,809

1,794

1,809

1,794

Domestic

1,684

1,681

1,684

1,681

International

125

113

125

113

Dine Brands Global, Inc. and

Subsidiaries

Restaurant Data

(Unaudited)

Restaurant Development Activity

(continued)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Fuzzy's

Summary - beginning of period:

Franchise

124

137

131

134

Company

1

1

1

3

Beginning of period

125

138

132

137

Franchise restaurants opened:

Domestic

1

1

1

3

Franchise restaurants permanently

closed:

Domestic

(7

)

(1

)

(14

)

(2

)

Net franchise restaurant addition

(reduction)

(6

)

—

(13

)

1

Refranchised from Company restaurants

—

—

—

2

Net franchise restaurant addition

(reduction)

(6

)

—

(13

)

3

Summary - end of period:

Franchise

118

137

118

137

Company

1

1

1

1

Total Fuzzy's restaurants, end of

period

119

138

119

138

Domestic

119

138

119

138

International

—

—

—

—

The restaurant counts and activity presented above include 13

dual-branded international Applebee's and IHOP restaurants at

September 30, 2024, and six dual-branded international Applebee’s

and IHOP restaurants at September 30, 2023, which are tabulated in

both brands’ activities. Dual-branded restaurants are defined as

restaurants that run two of our concepts and share an entrance,

front of the house staff and a kitchen.

The restaurant counts and activity presented above do not

include one domestic Applebee's ghost kitchen (small kitchens with

no store-front presence, used to fill off-premise orders), seven

international Applebee's ghost kitchens and 34 international IHOP

ghost kitchens at September 30, 2024, and one domestic Applebee's

ghost kitchen, 10 international Applebee's ghost kitchens and 38

international IHOP ghost kitchens at September 30, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106969589/en/

Investor Contact Matt Lee

Sr. Vice President, Finance and Investor Relations Dine Brands

Global, Inc. IR@dinebrands.com Media

Contact Susan Nelson Sr. Vice President, Global

Communications Dine Brands Global, Inc.

Mediainquiries@dinebrands.com

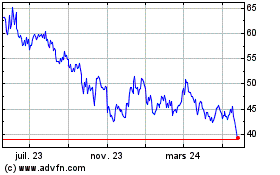

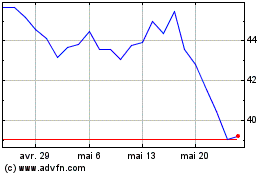

Dine Brands Global (NYSE:DIN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Dine Brands Global (NYSE:DIN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024