Amended Statement of Beneficial Ownership (sc 13d/a)

27 Mars 2018 - 11:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No.

2

to

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Name of Issuer)

Shares of

Common Stock, No Par Value

|

|

|

American Depositary Shares Representing

50 Shares of Common Stock (the “ADSs”)

|

(Title of Class of Securities)

(CUSIP Number)

|

|

|

Enel S.p.A.

Viale Regina Margherita 137

00198 Rome

Italy

Attn: Fabio Bonomo

Head of Corporate Affairs

Tel: +39 06 8305 2081

Fax: +39 06 8305 2129

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐

The information required on the

remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be

subject to all other provisions of the Act.

SCHEDULE 13D/A

|

|

|

|

|

CUSIP No. 29278D105

|

|

Page 2 of 5 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

NAMES

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

Enel S.p.A.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A

MEMBER OF A GROUP*

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

OO (See Item 3)

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Italy

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

42,832,058,393 shares of Common Stock (See Item 5)

|

|

|

8

|

|

SHARED VOTING POWER

0 (See Item 5)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

42,832,058,393 shares of Common Stock (See Item 5)

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0 (See Item 5)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

42,832,058,393 shares of Common Stock (See Item 5)

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT

IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11)

61.9% (See Item 5)

|

|

14

|

|

TYPE OF REPORTING PERSON

CO

|

Page 3 of 5 Pages

Explanatory Note

This Amendment No. 2 (this “

Amendment

”) amends and supplements the Statement on Schedule 13D, which was originally filed

with the U.S. Securities and Exchange Commission (the “

SEC

”) on August 12, 2016, as amended or supplemented on September 1, 2017 (together with this Amendment, the “

Schedule 13D

”), with respect to the

shares of Common Stock, no par value (the “

Common Stock

”), of Enel Chile S.A., a Chilean

sociedad anónima

formerly known as Enersis Chile S.A. (“

Enel Chile

,” “

Enersis Chile

” or the

“

Issuer

”), and American Depositary Shares (“

ADSs

”) of Enel Chile, each representing 50 shares of Common Stock of Enel Chile, as specifically set forth herein.

Item 2.

Identity and Background

.

The first three paragraphs of Item 2 are hereby amended and restated to read as follows:

This Schedule 13D is being filed by Enel S.p.A, an Italian

societá per azioni

(“

Enel

” or the “Reporting

Person”).

Enel is a holding company engaged, through subsidiaries and affiliates, in the integrated production, distribution, and

sale of electricity and gas in 32 countries across 4 continents.

The business addresses of Enel is Viale Regina Margherita 137, 00198

Rome, Italy.

Item 4.

Purpose of Transaction

.

The last paragraph of Item 4(b) is hereby amended and restated to read as follows:

On March 25, 2018, Enel Chile published in Chile a definitive notice of results of its tender offers for all of the outstanding shares of

common stock of Enel Generación Chile, including in the form of ADSs, that are not owned by Enel Chile and its affiliates, and on March 26, 2018, announced that all of the conditions to the Reorganization have been satisfied. As a result, the

merger of EGPL with and into Enel Chile will become effective on April 2, 2018 and Enel will receive 13,069,844,862 shares of Enel Chile Common Stock as consideration for the shares of EGPL.

Page 4 of 5 Pages

Item 5.

Interest in Securities of the Issuer

.

Items 5(a) and (b) are hereby amended and restated to read as follows:

|

|

(a)

|

As of March 25, 2018, Enel beneficially owned 42,832,058,393 shares of Common Stock of Enel Chile, representing approximately 61.9% of the total outstanding Common Stock of Enel Chile based on 69,165,857,540 outstanding

shares of Common Stock of Enel Chile, which gives effect to the Reorganization (including the cancellation of the shares that were authorized but not issued in connection with the tender offer and the capital increase as well as the cancellation of

shares to be purchased by Enel Chile from shareholders of Enel Chile that exercised statutory merger dissenters’ withdrawal rights in the merger).

|

|

|

(b)

|

Enel has the sole voting and dispositive power with respect to all shares of Enel Chile Common Stock that it beneficially owns. The responses of Enel to Rows (7) through (10) of the cover page of this Schedule 13D are

incorporated herein by reference.

|

Item 7.

Material to be Filed as Exhibits

.

Item 7 is hereby and amended and restated to read as follows:

None.

SIGNATURE

After reasonable inquiry and to the best of their knowledge and belief, the undersigned hereby certifies that the information set forth in

this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

Dated: March 27, 2018

|

|

|

|

ENEL S.p.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Joaquin Valcarcel

|

|

|

|

|

|

|

|

Name: Joaquin Valcarcel

|

|

|

|

|

|

|

|

Title: Head of M&A Legal Affairs

|

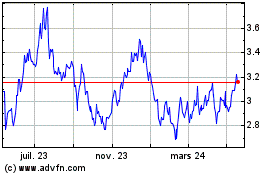

Enel Chile (NYSE:ENIC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

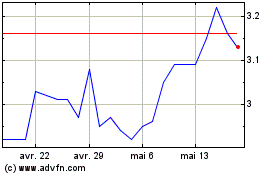

Enel Chile (NYSE:ENIC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025