Eagle Materials Inc. (NYSE: EXP) today reported financial

results for the third quarter of fiscal 2025 ended December 31,

2024. Notable items for the quarter are highlighted below (unless

otherwise noted, all comparisons are with the prior year’s fiscal

third quarter):

Third Quarter Fiscal 2025 Highlights

- Revenue of $558.0 million

- Net Earnings of $119.6 million

- Net Earnings per share of $3.56

- Adjusted net earnings per share (Adjusted EPS) of $3.59

- Adjusted EPS is a non-GAAP financial measure calculated by

excluding non-routine items in the manner described in Attachment

6

- Adjusted EBITDA of $208.8 million

- Adjusted EBITDA is a non-GAAP financial measure calculated by

excluding non-routine items and certain non-cash expenses in the

manner described in Attachment 6

- Repurchased approximately 195,000 shares of Eagle’s common

stock for $55 million

Commenting on the third quarter results, Michael Haack,

President and CEO, said, “Eagle’s portfolio of businesses continued

to perform well despite ongoing adverse weather in our Midwest and

Great Plains markets, where rainfall in November was 250% higher

than normal. The excessive rainfall affected sales volume in our

Cement and Concrete and Aggregates businesses, although we achieved

higher sales volume in Gypsum Wallboard and Recycled Paperboard. On

a company-wide basis, we generated revenue of $558 million and

achieved a gross profit margin of 31.9%. We also continued

advancing our long-term growth and value-creation strategies:

during the quarter, we announced the acquisition of Bullskin Stone

and Lime, LLC, a pure-play aggregates business in Western

Pennsylvania; returned $63 million of cash to shareholders through

share repurchases and dividends; and maintained our balance sheet

strength, ending the quarter with debt of $1.0 billion and a net

leverage ratio (net debt to Adjusted EBITDA) of 1.2x.” (Net debt is

a non-GAAP financial measure calculated by subtracting cash and

cash equivalents from debt as described in Attachment 6).

Mr. Haack continued, “While the path to lower interest rates and

improved home-buying affordability is less certain today, we remain

optimistic about our businesses and our ability to execute on the

opportunities in front of us. Steady employment, housing supply

that remains chronically short, and our cost-structure advantages

continue to provide favorable conditions for our Gypsum Wallboard

business in this dynamic environment. On the cement side, spending

from the Infrastructure Investment and Jobs Act (IIJA) is still in

the beginning phases, which should support multiple years of strong

cement demand.”

“Our balance sheet and cash-flow generation remain healthy,

supporting our capital allocation priorities, and our consistent,

disciplined operational and strategic approach should position us

to continue to perform well through economic cycles and deliver

value over the long term.”

Segment Financial Results

Heavy Materials: Cement, Concrete and Aggregates

Revenue in the Heavy Materials sector, which includes Cement,

Concrete and Aggregates, as well as Joint Venture and intersegment

Cement revenue, was down 4% to $351.8 million. Heavy Materials

operating earnings decreased 20% to $85.4 million. Both declines

resulted from lower sales volume partially offset by higher sales

prices.

Cement revenue for the quarter, including Joint Venture and

intersegment revenue, was down 4% to $295.4 million, and operating

earnings were down 18% to $86.8 million. These declines reflect

lower Cement sales volume and an $8 million increase in Cement

maintenance costs, partially offset by higher Cement net sales

prices. The increase in Cement maintenance costs primarily relates

to nontypical planned outages at our Oklahoma and Texas cement

plants that were necessary to maintain and extend plant

reliability. This maintenance was completed during the quarter. The

average net sales price for the quarter was up 4% to $156.82 per

ton, a result of Cement price increases implemented earlier this

calendar year. Cement sales volume decreased 7% to 1.7 million

tons. Sales volume was affected by ongoing adverse weather during

the quarter, particularly in our Midwest and Great Plains markets

during November.

Concrete and Aggregates revenue decreased 2% to $56.4 million,

reflecting lower Concrete and Aggregates sales volume, partially

offset by higher Concrete and Aggregates pricing and $3.1 million

of revenue contribution from the recently acquired aggregates

business in Kentucky. The third quarter operating loss of $1.4

million reflects lower Concrete and Aggregates sales volume.

Light Materials: Gypsum Wallboard and Recycled

Paperboard

Revenue in the Light Materials sector, which includes Gypsum

Wallboard and Recycled Paperboard, increased 6% to $241.7 million,

reflecting higher Wallboard and Paperboard sales volume and prices.

Gypsum Wallboard sales volume was up 2% to 737 million square feet

(MMSF), and the average Gypsum Wallboard net sales price increased

4% to $236.11 per MSF.

Paperboard sales volume for the quarter was up 7% to 90,000

tons. The average Paperboard net sales price was $627.04 per ton,

up 12%, consistent with the pricing provisions in our long-term

sales agreements that factor in changes to input costs.

Operating earnings in the sector were $97.4 million, an increase

of 18%, reflecting higher Wallboard and Paperboard sales volume and

pricing.

Corporate General and Administrative Expenses

Corporate General and Administrative Expenses increased by

approximately 47% compared with the prior year. The increase was

primarily related to increases in information technology spending

of $1.9 million for technology upgrades, and $1.3 million of costs

associated with business-development and transaction-related

activities.

Details of Financial Results

We conduct one of our cement plant operations through a 50/50

joint venture, Texas Lehigh Cement Company LP (the Joint Venture).

We use the equity method of accounting for our 50% interest in the

Joint Venture. For segment reporting purposes only, we

proportionately consolidate our 50% share of the Joint Venture’s

revenue and operating earnings, which is consistent with the way

management organizes the segments within the Company for making

operating decisions and assessing performance.

In addition, for segment reporting purposes, we report

intersegment revenue as part of a segment’s total revenue.

Intersegment sales are eliminated on the consolidated income

statement. Refer to Attachment 3 for a reconciliation of these

amounts.

About Eagle Materials Inc.

Eagle Materials Inc. is a leading U.S. manufacturer of heavy

construction products and light building materials. Eagle’s primary

products, Portland Cement and Gypsum Wallboard, are essential for

building, expanding, and repairing roads and highways and for

building and renovating residential, commercial, and industrial

structures across America. Eagle manufactures and sells its

products through a network of more than 70 facilities spanning 21

states and is headquartered in Dallas, Texas. Visit

eaglematerials.com for more information.

Eagle’s senior management will conduct a conference call to

discuss the financial results, forward-looking information, and

other matters at 8:30 a.m. Eastern Time (7:30 a.m. Central Time) on

Thursday, January 29, 2025. The conference call will be webcast on

the Eagle website, eaglematerials.com.

A replay of the webcast and the presentation will be archived on

the website for one year.

Forward-Looking Statements. This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the context of the

statements and generally arise when the Company is discussing its

beliefs, estimates or expectations as to future events. These

statements are not historical facts or guarantees of future

performance but instead represent only the Company’s belief at the

time the statements were made regarding future events which are

subject to certain risks, uncertainties and other factors, many of

which are outside the Company’s control. Actual results and

outcomes may differ materially from what is expressed or forecast

in such forward-looking statements. The principal risks and

uncertainties that may affect the Company’s actual performance

include the following: the cyclical and seasonal nature of the

Company’s businesses; fluctuations in public infrastructure

expenditures; the effects of adverse weather conditions on

infrastructure and other construction projects as well as our

facilities and operations; the fact that our products are

commodities and that prices for our products are subject to

material fluctuation due to market conditions and other factors

beyond our control; the availability of and fluctuations in the

cost of raw materials; changes in the costs of energy, including,

without limitation, natural gas, coal and oil (including diesel),

and the nature of our obligations to counterparties under energy

supply contracts, such as those related to market conditions (for

example, spot market prices), governmental orders and other

matters; changes in the cost and availability of transportation;

unexpected operational difficulties, including unexpected

maintenance costs, equipment downtime and interruption of

production; material nonpayment or non-performance by any of our

key customers; consolidation of our customers; inability to timely

execute announced capacity expansions; difficulties and delays in

the development of new business lines; governmental regulation and

changes in governmental and public policy (including, without

limitation, climate change and other environmental regulation);

possible losses or other adverse outcomes from pending or future

litigation or arbitration proceedings; changes in economic

conditions or the nature or level of activity in any one or more of

the markets or industries in which the Company or its customers are

engaged; competition; cyber-attacks or data security breaches,

together with the costs of protecting our systems against such

incidents and the possible effects thereof on our operations;

increases in capacity in the gypsum wallboard and cement

industries; changes in the demand for residential housing

construction or commercial construction or construction projects

undertaken by state or local governments; the availability of

acquisitions or other growth opportunities that meet our financial

return standards and fit our strategic focus; risks related to

pursuit of acquisitions, joint ventures and other transactions or

the execution or implementation of such transactions, including the

integration of operations acquired by the Company; general economic

conditions, including inflation and recessionary conditions; and

changes in interest rates and the resulting effects on the Company

and demand for our products. For example, increases in interest

rates, decreases in demand for construction materials or increases

in the cost of energy (including, without limitation, natural gas,

coal and oil) or the cost of our raw materials can be expected to

adversely affect the revenue and operating earnings of our

operations. In addition, changes in national or regional economic

conditions and levels of infrastructure and construction spending

could also adversely affect the Company’s results of operations.

Finally, any forward-looking statements made by the Company are

subject to the risks and impacts associated with natural disasters,

the outbreak, escalation or resurgence of health emergencies,

pandemics or other unforeseen events, including, without

limitation, the COVID-19 pandemic and responses thereto designed to

contain its spread and mitigate its public health effects, as well

as their impact on our operations and on economic conditions,

capital and financial markets. These and other factors are

described in the Company’s Annual Report on Form 10-K for the

fiscal year ended March 31, 2024, and subsequent quarterly and

annual reports upon filing. These reports are filed with the

Securities and Exchange Commission. All forward-looking statements

made herein are made as of the date hereof, and the risk that

actual results will differ materially from expectations expressed

herein will increase with the passage of time. The Company

undertakes no duty to update any forward-looking statement to

reflect future events or changes in the Company’s expectations.

Attachment 1 Statement of Consolidated Earnings Attachment 2

Revenue and Earnings by Business Segment Attachment 3 Sales Volume,

Average Net Sales Prices and Intersegment and Cement Revenue

Attachment 4 Consolidated Balance Sheets Attachment 5 Depreciation,

Depletion and Amortization by Business Segment Attachment 6

Reconciliation of Non-GAAP Financial Measures

Attachment 1

Eagle Materials Inc.

Statement of Consolidated

Earnings

(dollars in thousands, except

per share data)

(unaudited)

Quarter Ended

December 31,

Nine Months Ended

December 31,

2024

2023

2024

2023

Revenue

$

558,025

$

558,833

$

1,790,333

$

1,782,590

Cost of Goods Sold

380,212

378,205

1,221,808

1,216,949

Gross Profit

177,813

180,628

568,525

565,641

Equity in Earnings of Unconsolidated

JV

4,987

9,285

21,979

22,790

Corporate General and Administrative

Expenses

(20,818

)

(14,201

)

(54,346

)

(42,456

)

Other Non-Operating Income

1,381

1,019

4,788

2,837

Earnings before Interest and Income

Taxes

163,363

176,731

540,946

548,812

Interest Expense, net

(9,061

)

(10,128

)

(30,459

)

(32,571

)

Earnings before Income Taxes

154,302

166,603

510,487

516,241

Income Tax Expense

(34,728

)

(37,465

)

(113,551

)

(115,701

)

Net Earnings

$

119,574

$

129,138

$

396,936

$

400,540

NET EARNINGS PER SHARE

Basic

$

3.59

$

3.75

$

11.85

$

11.47

Diluted

$

3.56

$

3.72

$

11.75

$

11.38

AVERAGE SHARES OUTSTANDING

Basic

33,317,168

34,466,141

33,493,382

34,931,378

Diluted

33,608,538

34,749,721

33,771,660

35,201,658

Attachment 2

Eagle Materials Inc.

Revenue and Earnings by

Business Segment

(dollars in thousands)

(unaudited)

Quarter Ended

December 31,

Nine Months Ended

December 31,

2024

2023

2024

2023

Revenue*

Heavy Materials:

Cement (Wholly Owned)

$

259,890

$

274,167

$

873,033

$

888,532

Concrete and Aggregates

56,405

57,772

183,373

191,291

316,295

331,939

1,056,406

1,079,823

Light Materials:

Gypsum Wallboard

209,493

200,969

642,294

629,299

Recycled Paperboard

32,237

25,925

91,633

73,468

241,730

226,894

733,927

702,767

Total Revenue

$

558,025

$

558,833

$

1,790,333

$

1,782,590

Segment Operating Earnings

Heavy Materials:

Cement (Wholly Owned)

$

81,776

$

96,281

$

269,842

$

278,266

Cement (Joint Venture)

4,987

9,285

21,979

22,790

Concrete and Aggregates

(1,397

)

1,760

588

13,434

85,366

107,326

292,409

314,490

Light Materials:

Gypsum Wallboard

86,393

75,063

270,510

251,625

Recycled Paperboard

11,041

7,524

27,585

22,316

97,434

82,587

298,095

273,941

Sub-total

182,800

189,913

590,504

588,431

Corporate General and Administrative

Expense

(20,818

)

(14,201

)

(54,346

)

(42,456

)

Other Non-Operating Income

1,381

1,019

4,788

2,837

Earnings before Interest and Income

Taxes

$

163,363

$

176,731

$

540,946

$

548,812

* Excluding Intersegment and Joint Venture

Revenue listed on Attachment 3

Attachment 3

Eagle Materials Inc.

Sales Volume, Average Net

Sales Prices and Intersegment and Cement Revenue

(unaudited)

Sales Volume

Quarter Ended

December 31,

Nine Months Ended

December 31,

2024

2023

Change

2024

2023

Change

Cement (M Tons):

Wholly Owned

1,541

1,663

-7

%

5,156

5,470

-6

%

Joint Venture

161

161

0

%

517

496

+4

%

1,702

1,824

-7

%

5,673

5,966

-5

%

Concrete (M Cubic Yards)

298

308

-3

%

989

1,055

-6

%

Aggregates (M Tons)

893

1,034

-14

%

2,671

3,362

-21

%

Gypsum Wallboard (MMSFs)

737

722

+2

%

2,246

2,218

+1

%

Recycled Paperboard (M Tons):

Internal

37

37

0

%

111

110

+1

%

External

53

47

+13

%

155

137

+13

%

90

84

+7

%

266

247

+8

%

Average Net Sales

Price*

Quarter Ended

December 31,

Nine Months Ended

December 31,

2024

2023

Change

2024

2023

Change

Cement (Ton)

$

156.82

$

151.32

+4

%

$

156.46

$

150.20

+4

%

Concrete (Cubic Yard)

$

147.53

$

149.54

-1

%

$

148.46

$

145.29

+2

%

Aggregates (Ton)

$

13.19

$

11.18

+18

%

$

12.83

$

11.20

+15

%

Gypsum Wallboard (MSF)

$

236.11

$

227.78

+4

%

$

237.49

$

232.79

+2

%

Recycled Paperboard (Ton)

$

627.04

$

559.49

+12

%

$

606.68

$

546.21

+11

%

*Net of freight and delivery costs billed

to customers.

Intersegment and Cement

Revenue

Quarter Ended

December 31,

Nine Months Ended

December 31,

2024

2023

2024

2023

Intersegment Revenue:

Cement

$

9,084

$

7,804

$

29,748

$

27,192

Concrete and Aggregates

4,311

3,414

12,138

10,235

Recycled Paperboard

23,921

21,128

69,542

61,929

$

37,316

$

32,346

$

111,428

$

99,356

Cement Revenue:

Wholly Owned

$

259,890

$

274,167

$

873,033

$

888,532

Joint Venture

26,426

26,683

84,561

82,713

$

286,316

$

300,850

$

957,594

$

971,245

Attachment 4

Eagle Materials Inc.

Consolidated Balance

Sheets

(dollars in thousands)

(unaudited)

December 31,

March 31,

2024

2023

2024*

ASSETS

Current Assets –

Cash and Cash Equivalents

$

31,173

$

48,912

$

34,925

Accounts and Notes Receivable, net

182,379

192,982

202,985

Inventories

392,266

333,828

373,923

Federal Income Tax Receivable

1,743

2,917

9,910

Prepaid and Other Assets

10,901

9,092

5,950

Total Current Assets

618,462

587,731

627,693

Property, Plant and Equipment, net

1,736,159

1,667,915

1,676,217

Investments in Joint Venture

135,672

104,822

113,478

Operating Lease Right-of-Use Assets

34,227

20,670

19,373

Goodwill and Intangibles

487,388

488,088

486,117

Other Assets

31,762

21,114

24,141

$

3,043,670

$

2,890,340

$

2,947,019

LIABILITIES AND

STOCKHOLDERS’ EQUITY

Current Liabilities –

Accounts Payable

$

118,718

$

117,270

$

127,183

Accrued Liabilities

86,999

88,178

94,327

Income Taxes Payable

3,090

1,848

-

Current Portion of Long-Term Debt

10,000

10,000

10,000

Operating Lease Liabilities

5,074

8,217

7,899

Total Current Liabilities

223,881

225,513

239,409

Long-term Liabilities

85,647

63,016

70,979

Bank Credit Facility

85,000

107,000

170,000

Bank Term Loan

165,000

175,000

172,500

2.500% Senior Unsecured Notes due 2031

741,749

740,482

740,799

Deferred Income Taxes

246,254

246,168

244,797

Stockholders’ Equity –

Preferred Stock, Par Value $0.01;

Authorized 5,000,000 Shares; None Issued

-

-

-

Common Stock, Par Value $0.01; Authorized

100,000,000 Shares; Issued and Outstanding 33,391,155; 34,474,435

and 34,143,945 Shares, respectively

334

345

341

Capital in Excess of Par Value

-

-

-

Accumulated Other Comprehensive Losses

(3,238

)

(3,403

)

(3,373

)

Retained Earnings

1,499,043

1,336,219

1,311,567

Total Stockholders’ Equity

1,496,139

1,333,161

1,308,535

$

3,043,670

$

2,890,340

$

2,947,019

*From audited financial statements

Attachment 5

Eagle Materials Inc.

Depreciation, Depletion and

Amortization by Business Segment

(dollars in thousands)

(unaudited)

The following table presents

Depreciation, Depletion and Amortization by lines of business for

the quarters ended December 31, 2024 and 2023:

Depreciation, Depletion and

Amortization

Quarter Ended

December 31,

2024

2023

Cement

$

23,029

$

22,514

Concrete and Aggregates

5,261

4,857

Gypsum Wallboard

6,414

5,611

Paperboard

3,723

3,694

Corporate and Other

807

792

$

39,234

$

37,468

Attachment 6

Eagle Materials Inc.

Reconciliation of Non-GAAP

Financial Measures

(unaudited)

(dollars in thousands, other

than earnings per share amounts, and number of shares in

thousands)

Adjusted Earnings per Diluted Share

(Adjusted EPS) Adjusted EPS is a non-GAAP financial measure and

represents net earnings per diluted share excluding the impacts

from non-routine items, such as the impact of selling acquired

inventory after its markup to fair value as part of acquisition

accounting and business development costs and litigation losses

(Non-routine Items). Management uses measures of earnings excluding

the impact of Non-routine Items as a performance measure to compare

operating results of the Company from period to period and for

purposes of its budgeting and planning processes. Although

management believes that Adjusted EPS is useful in evaluating the

Company’s business, this information should be considered as

supplemental in nature and is not meant to be considered in

isolation, or as a substitute for, earnings per diluted share and

the related financial information prepared in accordance with GAAP.

In addition, our presentation of Adjusted EPS may not be the same

as similarly titled measures reported by other companies, limiting

its usefulness as a comparative measure. The following shows the

calculation of Adjusted EPS and reconciles Adjusted EPS to net

earnings per diluted share in accordance with GAAP for the quarters

ended December 31, 2024 and 2023:

Quarter Ended

December 31,

2024

2023

Net Earnings, as reported

$

119,574

$

129,138

Non-routine Items:

Acquisition accounting and related

expenses 1

$

1,341

$

-

Total Non-routine Items before Taxes

$

1,341

$

-

Tax Impact on Non-routine Items

(302

)

-

After-tax Impact of Non-routine Items

$

1,039

$

-

Adjusted Net Earnings

$

120,613

$

129,138

Diluted Average Shares Outstanding

33,609

34,750

Net earnings per diluted share, as

reported

$

3.56

$

3.72

Adjusted net earnings per diluted share

(Adjusted EPS)

$

3.59

$

3.72

1 Represents the impact of selling

acquired inventory after its markup to fair value as part of

acquisition accounting and business development costs

Attachment 6, continued

Eagle Materials Inc.

Reconciliation of Non-GAAP

Financial Measures

(dollars in thousands)

(unaudited)

EBITDA and Adjusted EBITDA We

present Earnings before Interest, Taxes, Depreciation and

Amortization (EBITDA) and Adjusted EBITDA to provide additional

measures of operating performance and allow for more consistent

comparison of operating performance from period to period. EBITDA

is a non-GAAP financial measure that provides supplemental

information regarding the operating performance of our business

without regard to financing methods, capital structures or

historical cost basis. Adjusted EBITDA is also a non-GAAP financial

measure that further excludes the impact from Non-routine Items and

stock-based compensation. Management uses EBITDA and Adjusted

EBITDA as alternative bases for comparing the operating performance

of Eagle from period to period and for purposes of its budgeting

and planning processes. Adjusted EBITDA may not be comparable to

similarly titled measures of other companies because other

companies may not calculate Adjusted EBITDA in the same manner.

Neither EBITDA nor Adjusted EBITDA should be considered in

isolation or as an alternative to net income, cash flow from

operations or any other measure of financial performance or

liquidity in accordance with GAAP. The following shows the

calculation of EBITDA and Adjusted EBITDA and reconciles them to

net earnings in accordance with GAAP for the quarters and nine

months ended December 31, 2024 and 2023, and the trailing twelve

months ended December 31, 2024 and March 31, 2024:

Quarter Ended

Nine Months Ended

December 31,

December 31,

2024

2023

2024

2023

Net Earnings, as reported

$

119,574

$

129,138

$

396,936

$

400,540

Income Tax Expense

34,728

37,465

113,551

115,701

Interest Expense

9,061

10,128

30,459

32,571

Depreciation, Depletion and

Amortization

39,234

37,468

116,661

111,347

EBITDA

$

202,597

$

214,199

$

657,607

$

660,159

Acquisition accounting and related

expenses 1

1,341

-

2,959

4,568

Litigation Loss

-

-

700

-

Stock-based Compensation

4,818

4,357

14,221

15,356

Adjusted EBITDA

$

208,756

$

218,556

$

675,487

$

680,083

Twelve Months Ended

December 31,

March 31,

2024

2024

Net Earnings, as reported

$

474,035

$

477,639

Income Tax Expense

138,148

140,298

Interest Expense

40,145

42,257

Depreciation, Depletion and

Amortization

155,146

149,832

EBITDA

$

807,474

$

810,026

Acquisition accounting and related

expenses 1

2,959

4,568

Litigation loss

700

-

Stock-based Compensation

18,765

19,900

Adjusted EBITDA

$

829,898

$

834,494

1 Represents the impact of selling

acquired inventory after its markup to fair value as part of

acquisition accounting and business development costs

Attachment 6, continued

Reconciliation of Net Debt to Adjusted

EBITDA GAAP does not define “Net Debt” and it should not be

considered as an alternative to debt as defined by GAAP. We define

Net Debt as total debt minus cash and cash equivalents to indicate

the amount of total debt that would remain if the Company applied

the cash and cash equivalents held by it to the payment of

outstanding debt. The Company also uses “Net Debt to Adjusted

EBITDA,” which it defines as Net Debt divided by Adjusted EBITDA

for the trailing twelve months, as an alternative metric to assist

it in understanding its leverage position. We present this metric

for the convenience of the investment community and rating agencies

who use such metrics in their analysis, and for investors who need

to understand the metrics we use to assess performance and monitor

our cash and liquidity positions.

As of

As of

December 31, 2024

March 31, 2024

Total debt, excluding debt issuance

costs

$

1,010,000

$

1,102,500

Cash and cash equivalents

31,173

34,925

Net Debt

$

978,827

$

1,067,575

Trailing Twelve Months Adjusted EBITDA

$

829,898

834,494

Net Debt to Adjusted EBITDA

1.2x

1.3x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129091177/en/

For additional information, contact at

214-432-2000:

Michael R. Haack President and Chief Executive

Officer

D. Craig Kesler Executive Vice President and Chief

Financial Officer

Alex Haddock Senior Vice President, Investor Relations,

Strategy and Corporate Development

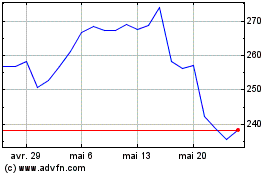

Eagle Materials (NYSE:EXP)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Eagle Materials (NYSE:EXP)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025