First Trust Advisors Announces Fund Board

Approval of Mergers of First Trust Energy Income and Growth Fund,

First Trust MLP and Energy Income Fund, First Trust New

Opportunities MLP & Energy Fund, and First Trust Energy

Infrastructure Fund into First Trust Energy Income Partners

Enhanced Income ETF

First Trust Advisors L.P. (“FTA”) announced today that the Board

of Trustees of each of First Trust Energy Income and Growth Fund

(NYSE American: FEN), First Trust MLP and Energy Income Fund (NYSE:

FEI), First Trust New Opportunities MLP & Energy Fund (NYSE:

FPL), and First Trust Energy Infrastructure Fund (NYSE: FIF) (the

“Target Funds” or each, individually, a “Target Fund”), each a

closed-end management investment company managed by FTA and

sub-advised by Energy Income Partners, LLC (“EIP”), approved the

Merger of each respective Target Fund into First Trust Energy

Income Partners Enhanced Income ETF, a newly created actively

managed exchange-traded fund (“ETF”) managed by FTA and sub-advised

by EIP (“EIPI”). The Mergers have also been approved by the Board

of Trustees of EIPI. EIPI will be the surviving fund.

Under the terms of the proposed transactions, shareholders of

each Target Fund would receive shares of EIPI with a value equal to

the aggregate net asset value of the Target Fund shares held by

them and would become shareholders of EIPI, with the Target Funds

terminating. It is currently expected that the transactions will be

consummated during the second quarter of 2024, subject to requisite

shareholder approvals and satisfaction of applicable regulatory

requirements and approvals and customary closing conditions. Each

merger is expected to qualify as a tax-free reorganization for

federal income tax purposes. Each transaction is subject to

shareholder approval and is a separate Merger, and no Merger is

contingent upon any other Merger. There is no assurance when or

whether such approvals, or any other approvals required for the

transactions, will be obtained. More information on the proposed

transactions will be contained in proxy materials that the Target

Funds and EIPI anticipate filing in the coming weeks.

In connection with the proposed mergers of FEN, FEI and FPL into

EIPI, each of these Target Funds may be required to recognize a

decrease to its NAV prior to its merger, with another potential

final adjustment to be made to the NAV of EIPI following the

mergers after the receipt of year-end tax information to be

provided by the master limited partnerships (“MLPs”) that had been

held by such Target Funds. The amount and timing of such

adjustments, if any, will depend in part on the market prices and

composition of each such Target Fund’s portfolio securities.

EIPI will be an actively managed ETF that seeks to provide a

high level of total return with an emphasis on current

distributions paid to shareholders. EIPI will pursue its investment

objective by investing in energy companies. EIPI will also deploy a

partial covered call strategy to enhance its income.

FTA is a federally registered investment advisor and serves as

the investment advisor of each Target Fund and EIPI. FTA and its

affiliate First Trust Portfolios L.P. (“FTP”), a FINRA registered

broker-dealer, are privately-held companies that provide a variety

of investment services. FTA has collective assets under management

or supervision of approximately $195 billion as of September 30,

2023 through unit investment trusts, exchange-traded funds,

closed-end funds, mutual funds and separate managed accounts. FTA

is the supervisor of the First Trust unit investment trusts, while

FTP is the sponsor. FTP is also a distributor of mutual fund shares

and exchange-traded fund creation units. FTA and FTP are based in

Wheaton, Illinois.

EIP serves as each Target Funds’ and EIPI’s investment

sub-advisor and provides advisory services to a number of

investment companies and partnerships for the purpose of investing

in MLPs and other energy infrastructure securities. EIP is one of

the early investment advisors specializing in this area. As of

September 30, 2023, EIP managed or supervised approximately $5.0

billion in client assets.

Additional Information about the Proposed Mergers and Where

to Find It

This press release is not intended to, and shall not, constitute

an offer to purchase or sell shares of FEN, FEI, FPL, FIF or EIPI;

nor is this press release intended to solicit a proxy from any

shareholder of FEN, FEI, FPL or FIF. The solicitation of the

purchase or sale of securities or of proxies to effect the

transactions may only be made by a final, effective Registration

Statement, which includes a definitive Proxy Statement/Prospectus,

after the Registration Statement is declared effective by the

SEC.

This press release references a Registration Statement, which

includes a Joint Proxy Statement/Prospectus, to be filed by EIPI.

This Registration Statement has yet to be filed with the SEC. After

the Registration Statement is filed with the SEC, it may be amended

or withdrawn and the Joint Proxy Statement/Prospectus will not be

distributed to shareholders of FEN, FEI, FPL or FIF unless and

until the Registration Statement is declared effective by the

SEC.

FEN, FEI, FPL, FIF, EIPI, FTA, FTP, EIP and their respective

trustees, officers and employees, and other persons may be deemed

to be participants in the solicitation of proxies with respect to

the proposed Mergers. Investors and shareholders may obtain more

detailed information regarding the direct and indirect interests of

FEN’s, FEI’s, FPL’s, FIF’s, EIPI’s, FTA’s, FTP’s, and EIP’s

respective directors, trustees, officers and employees by reading

the Joint Proxy Statement/Prospectus regarding the proposed mergers

when it is filed with the SEC.

Investors and security holders of FEN, FEI, FPL and FIF are

urged to read the Joint Proxy Statement/Prospectus and other

documents filed with the SEC carefully in their entirety when they

become available because they will contain important information

about the proposed Mergers. Investors should consider the

investment objectives, risks, charges and expenses of FEN, FEI,

FPL, FIF and EIPI carefully. The Joint Proxy Statement/Prospectus

will contain information with respect to the investment objectives,

risks, charges and expenses of the funds and other important

information about FEN, FEI, FPL, FIF and EIPI. The Joint Proxy

Statement/Prospectus will constitute neither an offer to sell

securities, nor will it constitute a solicitation of an offer to

buy securities, in any state where such offer or sale is not

permitted.

Investors may obtain free copies of the Registration Statement

and Joint Proxy Statement/Prospectus and other documents (when they

become available) filed with the SEC at the SEC’s web site at

www.sec.gov. In addition, free copies of the Joint Proxy

Statement/Prospectus and other documents filed with the SEC may

also be obtained after the Registration Statement becomes effective

by calling FTA toll-free at (800) 621-1675.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA

and the Internal Revenue Code. First Trust has no knowledge of and

has not been provided any information regarding any investor.

Financial advisors must determine whether particular investments

are appropriate for their clients. First Trust believes the

financial advisor is a fiduciary, is capable of evaluating

investment risks independently and is responsible for exercising

independent judgment with respect to its retirement plan

clients.

Forward Looking Statements

Certain statements made in this press release that are not

historical facts are referred to as “forward‑looking statements”

under the U.S. federal securities laws. Actual future results or

occurrences may differ significantly from those anticipated in any

forward‑looking statements due to numerous factors. Generally, the

words “believe,” “expect,” “intend,” “estimate,” “anticipate,”

“project,” “will” and similar expressions identify forward‑looking

statements, which generally are not historical in nature.

Forward‑looking statements are subject to certain risks and

uncertainties that could cause actual results to differ from those

anticipated in any forward-looking statements. You should not place

undue reliance on forward‑looking statements, which speak only as

of the date they are made. FTA, EIP, FEN, FEI, FPL, FIF and EIPI

undertake no responsibility to update publicly or revise any

forward‑looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231023040513/en/

Dan Lindquist – (630) 517-8692 Chris Fallow – (630) 517-7628 Jim

Dykas – (630) 517-7665

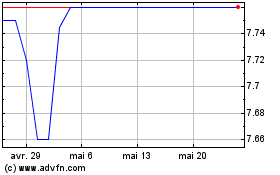

First Trust New Opportun... (NYSE:FPL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

First Trust New Opportun... (NYSE:FPL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024