- Subsea inbound orders of $2.8 billion; book-to-bill of

1.4x

- Total Company backlog reached new record of $13.9

billion

- Cash flow from operations of $231 million; free cash flow of

$180 million

- Full-year financial guidance increased to reflect strong

operational performance

TechnipFMC plc (NYSE: FTI) (the “Company” or “TechnipFMC”) today

reported second quarter 2024 results.

Summary Financial Results from

Continuing Operations

Reconciliation of U.S. GAAP to non-GAAP

financial measures are provided in financial schedules.

Three Months Ended

Change

(In millions, except per share

amounts)

Jun. 30, 2024

Mar. 31, 2024

Jun. 30, 2023

Sequential

Year-over- Year

Revenue

$2,325.6

$2,042.0

$1,972.2

13.9%

17.9%

Net income (loss)

$186.5

$157.1

$(87.2)

18.7%

n/m

Net income (loss) margin

8.0%

7.7%

(4.4%)

30 bps

n/m

Diluted earnings (loss) per

share

$0.42

$0.35

$(0.20)

20.0%

n/m

Adjusted EBITDA

$361.4

$252.6

$205.9

43.1%

75.5%

Adjusted EBITDA margin

15.5%

12.4%

10.4%

310 bps

510 bps

Adjusted net income

$188.9

$97.6

$44.8

93.5%

321.7%

Adjusted diluted earnings per

share

$0.43

$0.22

$0.10

95.5%

330.0%

Inbound orders

$3,092.2

$2,774.4

$4,447.3

11.5%

(30.5%)

Backlog

$13,898.8

$13,492.5

$13,278.6

3.0%

4.7%

n/m - not meaningful

Total Company revenue in the second quarter was $2,325.6

million. Net income attributable to TechnipFMC was $186.5 million,

or $0.42 per diluted share. These results included after-tax

charges and credits totaling $2.4 million of expense, or $0.01 per

share (Exhibit 6).

Adjusted net income was $188.9 million, or $0.43 per diluted

share (Exhibit 6).

Adjusted EBITDA, which excludes pre-tax charges and credits, was

$361.4 million; adjusted EBITDA margin was 15.5 percent (Exhibit

8).

Included in total Company results was a foreign exchange loss of

$17.7 million, or $17.8 million after-tax. When excluding the

after-tax impact of foreign exchange, net income was $204.3

million. Adjusted EBITDA, excluding foreign exchange, was $379.1

million (Exhibit 7).

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “Our

quarterly results reflect strong operational performance throughout

the Company. Revenue was $2.3 billion with adjusted EBITDA of $379

million when excluding foreign exchange impacts.”

“Results were particularly strong in Subsea, where operating

profit margin improved 480 basis points sequentially to 13.8

percent. Adjusted EBITDA margin improved 370 basis points

sequentially to 17.7 percent – a level of performance we expect to

continue in the third quarter. Given the strength of our execution,

we now expect Subsea adjusted EBITDA margin to exceed the high-end

of our guidance for the full year.”

Pferdehirt continued, “Subsea inbound orders were $2.8 billion,

representing a book-to-bill of 1.4. Partner collaboration and

longstanding relationships were key drivers of our success in the

quarter. Inbound included iEPCI™ projects for Woodside’s Xena Phase

3 and Energean’s Katlan development, both repeat clients of our

integrated model. We were also awarded over 100 kilometers of

flexible pipe from Petrobras, which is incremental to the volume

associated with our existing frame agreements.”

“Further expansion in Guyana also contributed significantly to

inbound with the award of the Whiptail project. This is the sixth

project sanctioned by ExxonMobil in the Stabroek Block in just

seven years. We are honored to have been awarded the subsea

production systems for all of these projects.”

Pferdehirt added, “Through our success in Guyana, we have

established a strong reputation for meeting the accelerated

schedule requirements of an emerging basin. Importantly, it is our

strategic commitment to the region and its people, collaboration

with our global and local partners, and innovative mindset that

have created a winning playbook for the development of our business

in Guyana. This formula will also be utilized in new frontiers,

including Suriname and Namibia.”

“At quarter end, total Company backlog was $13.9 billion, a

record level for TechnipFMC, with orders exceeding revenue in 10 of

the last 11 quarters. We are well positioned for Subsea orders to

approach $10 billion for the year, also giving us continued

confidence in achieving $30 billion in orders over the three-year

period ending 2025. We expect this activity will drive further

growth in backlog.”

“In Surface Technologies, we also demonstrated solid

performance. We are seeing tangible benefits from the targeted

actions taken to optimize our business in the Americas. In the

Middle East, the growth we anticipated is now occurring, allowing

us to further utilize our new in-country capacity.”

Pferdehirt concluded, “The strong financial performance in the

period clearly demonstrates the solid momentum we are experiencing

in our execution. Our success reflects the bold steps we took to

create a new business model that reshaped the subsea industry and

to deliver innovative technologies that further improve project

economics. These actions continue to provide sustainable

differentiation for TechnipFMC, driving results higher than what

could be achieved through a market recovery alone.”

“We are confident that our strong execution and competitive

differentiation, when combined with the proven success of our

subsea playbook, will allow us to capitalize on the expanding

opportunities that extend beyond the decade.”

Operational and Financial Highlights

Subsea

Financial Highlights

Reconciliation of U.S. GAAP to non-GAAP

financial measures are provided in financial schedules.

Three Months Ended

Change

(In millions)

Jun. 30, 2024

Mar. 31, 2024

Jun. 30, 2023

Sequential

Year-over- Year

Revenue

$2,009.1

$1,734.8

$1,618.4

15.8%

24.1%

Operating profit

$277.7

$156.6

$153.4

77.3%

81.0%

Operating profit margin

13.8%

9.0%

9.5%

480 bps

430 bps

Adjusted EBITDA

$356.5

$242.4

$233.8

47.1%

52.5%

Adjusted EBITDA margin

17.7%

14.0%

14.4%

370 bps

330 bps

Inbound orders

$2,838.0

$2,403.8

$4,114.5

18.1%

(31.0%)

Backlog1,2,3

$12,925.9

$12,455.5

$12,088.5

3.8%

6.9%

Estimated Consolidated Backlog

Scheduling

(In millions)

Jun. 30, 2024

2024 (6 months)

$3,086

2025

$4,460

2026 and beyond

$5,380

Total

$12,926

1 Backlog as of June 30, 2024 was

decreased by a foreign exchange impact of $358 million.

2 Backlog does not capture all revenue

potential for Subsea Services.

3 Backlog as of June 30, 2024 does not

include total Company non-consolidated backlog of $201 million.

Subsea reported second quarter revenue of $2,009.1 million, an

increase of 15.8 percent from the first quarter. The sequential

revenue improvement was largely driven by increased iEPCI™ project

activity in the North Sea and Gulf of Mexico. Services revenue also

increased primarily due to seasonal improvement.

Subsea reported an operating profit of $277.7 million, an

increase of 77.3 percent from the first quarter. Operating results

increased sequentially due to strong execution, improved earnings

mix from backlog, and higher project and services activity.

Operating profit margin increased 480 basis points to 13.8

percent.

Subsea reported adjusted EBITDA of $356.5 million, an increase

of 47.1 percent when compared to the first quarter. The factors

impacting operating profit also drove the sequential increase in

adjusted EBITDA. Adjusted EBITDA margin increased 370 basis points

to 17.7 percent.

Subsea inbound orders were $2.8 billion for the quarter.

Book-to-bill was 1.4x. The following awards were included in the

period:

- ExxonMobil Whiptail project (Guyana) Large* contract

award by ExxonMobil Guyana to supply subsea production systems for

the Whiptail project in Guyana’s Stabroek Block. TechnipFMC will

provide project management, engineering, and manufacturing to

deliver 48 subsea trees and associated tooling, as well as 12

manifolds and associated controls and tie-in equipment. Whiptail is

TechnipFMC’s most recent award from ExxonMobil Guyana, where the

Company has been awarded subsea production system contracts since

the first contract award in 2017 for Liza Phase 1. *A “large”

contract is between $500 million and $1 billion.

- Woodside Energy Xena Phase 3 iEPCI™ project (Australia)

Significant* integrated Engineering, Procurement, Construction, and

Installation (iEPCI™) contract by Woodside Energy to design,

manufacture, and install the subsea production system, flexible

pipe, and umbilicals for the Xena Infill well (XNA03) to support

ongoing production from the Pluto LNG Project. The award follows an

integrated front end engineering design (iFEED™) study. The project

will use the Company’s Subsea 2.0® production system. Xena Phase 3

will be tied back to existing subsea infrastructure previously

supplied by TechnipFMC. The contract is the latest call-off on the

framework agreement between Woodside Energy and TechnipFMC. *A

“significant” contract is between $75 million and $250

million.

- Energean Katlan iEPCI™ project (Israel) Large* iEPCI™

contract by Energean for its Katlan development in the

Mediterranean Sea. This is Energean’s first project to use

TechnipFMC’s configure-to-order Subsea 2.0® production systems. The

award follows an iFEED™ study by TechnipFMC, which optimized the

commercial and technological solution for the field. The contract

covers the design, manufacture, and installation of the production

systems, pipe, umbilicals, and subsea structures. The subsea

infrastructure will tie back to the Energean Power floating

production, storage, and offloading vessel (FPSO), which currently

serves the Karish and Karish North developments. TechnipFMC also

delivered fully integrated subsea solutions utilizing our iEPCI™

execution model for both of these developments. *A “large” contract

is between $500 million and $1 billion.

- Petrobras Flexible Pipe contract (Brazil) Substantial*

contract by Petrobras to supply flexible pipe for the pre-salt

fields offshore Brazil. The contract covers the design,

engineering, and manufacture of flexible pipe for water injection

and gas lift. *A “substantial” contract is between $250 million and

$500 million.

Surface Technologies

Financial Highlights

Reconciliation of U.S. GAAP to non-GAAP

financial measures are provided in financial schedules.

Three Months Ended

Change

(In millions)

Jun. 30, 2024

Mar. 31, 2024

Jun. 30, 2023

Sequential

Year-over- Year

Revenue

$316.5

$307.2

$353.8

3.0%

(10.5%)

Operating profit

$30.6

$103.4

$25.7

(70.4%)

19.1%

Operating profit margin

9.7%

33.7%

7.3%

(2,400 bps)

240 bps

Adjusted EBITDA

$46.0

$41.4

$46.9

11.1%

(1.9%)

Adjusted EBITDA margin

14.5%

13.5%

13.3%

100 bps

120 bps

Inbound orders

$254.2

$370.6

$332.8

(31.4%)

(23.6%)

Backlog

$972.9

$1,037.0

$1,190.1

(6.2%)

(18.3%)

Surface Technologies reported second quarter revenue of $316.5

million, an increase of 3 percent from the first quarter. The

sequential revenue improvement was primarily driven by increased

activity in the Middle East, largely offset by the absence of

revenue from the Measurement Solutions business disposed of in

March of 2024.

Surface Technologies reported operating profit of $30.6 million,

a decrease of 70.4 percent versus the first quarter. Operating

profit in the prior quarter benefited from a $75.2 million gain on

the disposal of the Measurement Solutions business. Excluding the

gain on the disposal, operating profit increased $2.4 million

sequentially. The increase was primarily due to higher volume in

the Middle East, largely offset by the absence of operating profit

from Measurement Solutions.

Surface Technologies reported adjusted EBITDA of $46 million.

Adjusted EBITDA increased 11.1 percent when compared to the first

quarter. The improvement was driven by higher volume in the Middle

East, largely offset by the absence of Measurement Solutions.

Adjusted EBITDA margin increased 100 basis points sequentially to

14.5 percent.

Inbound orders for the quarter were $254.2 million, a sequential

decrease of 31.4 percent. Backlog ended the period at $972.9

million.

Corporate and Other Items (three months ended June 30,

2024)

Corporate expense was $23.7 million.

Foreign exchange loss was $17.7 million.

Net interest expense was $21.4 million.

The provision for income taxes was $59.2 million.

Total depreciation and amortization was $92.1 million.

Cash provided by operating activities was $230.9 million.

Capital expenditures were $50.8 million. Free cash flow was $180.1

million (Exhibit 11).

During the quarter, the Company repurchased 3.9 million of its

ordinary shares for total consideration of $100 million. When

including a dividend payment of $21.5 million, total shareholder

distributions in the quarter were $121.5 million.

The Company ended the period with cash and cash equivalents of

$708.2 million; net debt decreased $66.8 million sequentially to

$260.2 million (Exhibit 10).

On June 27, 2024, Fitch Ratings assigned a first-time Long-Term

Issuer Default Rating of ‘BBB-’ with a Stable Outlook to the

Company and its subsidiary, FMC Technologies Inc. Fitch Ratings

also assigned ‘BBB-’ ratings to the Company’s revolving credit

facility and senior unsecured notes. This follows a rating upgrade

in early March by S&P Global Ratings, which elevated both the

issuer credit and the issue-level ratings on the Company’s senior

unsecured notes to investment grade (‘BBB-’).

With investment grade ratings from two credit rating agencies,

the Company will benefit from lower interest rates and fees and

eliminate all collateral requirements for its $1.25 billion

Revolving Credit Facility and $500 million Letter of Credit

Facility. Additionally, the Company will gain access to the

lower-cost investment grade bond market for future term debt

needs.

2024 Full-Year Financial Guidance1

The Company’s full-year financial guidance for 2024 can be found

in the table below. Updates to the previous guidance issued on

February 22, 2024 are as follows:

- Subsea revenue in a range of $7.6 - 7.8 billion, which

increased from the previous guidance range of $7.2 - 7.6

billion.

- Subsea adjusted EBITDA margin in a range of 16.5 - 17%, which

increased from the previous guidance range of 15.5 - 16.5%.

- Free cash flow in a range of $425 - 575 million, which

increased from the previous guidance range of $350 - 500

million.

Financial results prior to the completion of the sale of the

Measurement Solutions business, which was completed on March 11,

2024, are included in full-year guidance for Surface

Technologies.

2024 Guidance (As of July 25,

2024)

Subsea

Surface Technologies

Revenue in a range of $7.6 - 7.8

billion

Revenue in a range of $1.2 - 1.35

billion

Adjusted EBITDA margin in a range of 16.5

- 17%

Adjusted EBITDA margin in a range of 13 -

15%

TechnipFMC

Corporate expense, net $115 - 125

million

(includes depreciation and amortization of

~$3 million; excludes charges and credits)

Net interest expense $70 - 80

million

Tax provision, as reported $280 -

290 million

Capital expenditures approximately

$275 million

Free cash flow2 $425 - 575

million

(includes payment for legal settlement of

~$170 million)

1

Our guidance measures of adjusted EBITDA

margin, free cash flow and adjusted corporate expense, net are

non-GAAP financial measures. We are unable to provide a

reconciliation to comparable GAAP financial measures on a

forward-looking basis without unreasonable effort because of the

unpredictability of the individual components of the most directly

comparable GAAP financial measure and the variability of items

excluded from each such measure. Such information may have a

significant, and potentially unpredictable, impact on our future

financial results.

2

Free cash flow is calculated as cash flow

from operations less capital expenditures.

Teleconference

The Company will host a teleconference on Thursday, July 25,

2024 to discuss the second quarter 2024 financial results. The call

will begin at 1:30 p.m. London time (8:30 a.m. New York time).

Webcast access and an accompanying presentation can be found at

www.TechnipFMC.com.

An archived audio replay will be available after the event at

the same website address. In the event of a disruption of service

or technical difficulty during the call, information will be posted

on our website.

About TechnipFMC

TechnipFMC is a leading technology provider to the traditional

and new energy industries; delivering fully integrated projects,

products, and services.

With our proprietary technologies and comprehensive solutions,

we are transforming our clients’ project economics, helping them

unlock new possibilities to develop energy resources while reducing

carbon intensity and supporting their energy transition

ambitions.

Organized in two business segments — Subsea and Surface

Technologies — we will continue to advance the industry with our

pioneering integrated ecosystems (such as iEPCI™, iFEED™ and

iComplete™), technology leadership and digital innovation.

Each of our approximately 21,000 employees is driven by a

commitment to our clients’ success, and a culture of strong

execution, purposeful innovation, and challenging industry

conventions.

TechnipFMC uses its website as a channel of distribution of

material company information. To learn more about how we are

driving change in the industry, go to www.TechnipFMC.com and follow

us on X (formerly Twitter) @TechnipFMC.

This communication contains “forward-looking statements” as

defined in Section 27A of the United States Securities Act of 1933,

as amended, and Section 21E of the United States Securities

Exchange Act of 1934, as amended. Forward-looking statements

usually relate to future events, market growth, and recovery,

growth of our New Energy business and anticipated revenues,

earnings, cash flows, or other aspects of our operations or

operating results. Forward-looking statements are often identified

by words such as “commit,” “guidance,” “confident,” “believe,”

“expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,”

“would,” “could,” “may,” “will,” “likely,” “predicated,”

“estimate,” “outlook,” and similar expressions, including the

negative thereof. The absence of these words, however, does not

mean that the statements are not forward-looking. These

forward-looking statements are based on our current expectations,

beliefs, and assumptions concerning future developments and

business conditions and their potential effect on us. While

management believes these forward-looking statements are reasonable

as and when made, there can be no assurance that future

developments affecting us will be those that we anticipate. All of

our forward-looking statements involve risks and uncertainties

(some of which are significant or beyond our control) and

assumptions that could cause actual results to differ materially

from our historical experience and our present expectations or

projections, including unpredictable trends in the demand for and

price of oil and natural gas; competition and unanticipated changes

relating to competitive factors in our industry, including ongoing

industry consolidation; our inability to develop, implement, and

protect new technologies and services and intellectual property

related thereto, including new technologies and services for our

New Energy business; the cumulative loss of major contracts,

customers or alliances and unfavorable credit and commercial terms

of certain contracts; disruptions in the political, regulatory,

economic, and social conditions of the countries in which we

conduct business; the refusal of DTC to act as depository and

clearing agency for our shares; the impact of our existing and

future indebtedness and the restrictions on our operations by terms

of the agreements governing our existing indebtedness; the risks

caused by our acquisition and divestiture activities; additional

costs or risks from increasing scrutiny and expectations regarding

ESG matters; uncertainties related to our investments in New Energy

business; the risks caused by fixed-price contracts; our failure to

timely deliver our backlog; our reliance on subcontractors,

suppliers, and our joint venture partners; a failure or breach of

our IT infrastructure or that of our subcontractors, suppliers or

joint venture partners, including as a result of cyber-attacks;

risks of pirates and maritime conflicts endangering our maritime

employees and assets; any delays and cost overruns of new capital

asset construction projects for vessels and manufacturing

facilities; potential liabilities inherent in the industries in

which we operate or have operated; our failure to comply with

existing and future laws and regulations, including those related

to environmental protection, climate change, health and safety,

labor and employment, import/export controls, currency exchange,

bribery and corruption, taxation, privacy, data protection and data

security; the additional restrictions on dividend payouts or share

repurchases as an English public limited company; uninsured claims

and litigation against us; tax laws, treaties and regulations and

any unfavorable findings by relevant tax authorities; potential

departure of our key managers and employees; adverse seasonal,

weather, and other climatic conditions; unfavorable currency

exchange rates; risk in connection with our defined benefit pension

plan commitments; our inability to obtain sufficient bonding

capacity for certain contracts, and other risks as discussed in

Part I, Item 1A, “Risk Factors” of our Annual Report on Form 10-K

for the fiscal year ended December 31, 2023 and our other reports

subsequently filed with the Securities and Exchange Commission.

We caution you not to place undue reliance on any

forward-looking statements, which speak only as of the date hereof.

We undertake no obligation to publicly update or revise any of our

forward-looking statements after the date they are made, whether as

a result of new information, future events or otherwise, except to

the extent required by law.

Exhibit 1

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(In millions, except per share

data, unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

2024

2024

2023

2024

2023

Revenue

$

2,325.6

$

2,042.0

$

1,972.2

$

4,367.6

$

3,689.6

Costs and expenses

2,017.2

1,883.0

1,813.7

3,900.2

3,480.1

308.4

159.0

158.5

467.4

209.5

Other income (expense), net including

income from equity affiliates

(41.5

)

(10.9

)

(181.2

)

(52.4

)

(168.3

)

Gain on disposal of Measurement Solutions

business

—

75.2

—

75.2

—

Income (loss) before net interest expense

and income taxes

266.9

223.3

(22.7

)

490.2

41.2

Net interest expense

(21.4

)

(12.7

)

(30.3

)

(34.1

)

(49.0

)

Income (loss) before income taxes

245.5

210.6

(53.0

)

456.1

(7.8

)

Provision for income taxes

59.2

49.7

43.3

108.9

80.7

Net income (loss)

186.3

160.9

(96.3

)

347.2

(88.5

)

(Income) loss attributable to

non-controlling interests

0.2

(3.8

)

9.1

(3.6

)

1.7

Net income (loss) attributable to

TechnipFMC plc

$

186.5

$

157.1

$

(87.2

)

$

343.6

$

(86.8

)

Earnings (loss) per share attributable to

TechnipFMC plc

Basic

$

0.43

$

0.36

$

(0.20

)

$

0.80

$

(0.20

)

Diluted

$

0.42

$

0.35

$

(0.20

)

$

0.78

$

(0.20

)

Weighted average shares outstanding:

Basic

430.2

433.6

440.1

431.9

441.1

Diluted

440.1

446.3

440.1

443.2

441.1

Cash dividends declared per share

$

0.05

$

0.05

$

—

$

0.10

$

—

Exhibit 2

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

BUSINESS

SEGMENT DATA

(In millions,

unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

2024

2024

2023

2024

2023

Segment

revenue

Subsea

$

2,009.1

$

1,734.8

$

1,618.4

$

3,743.9

$

3,006.0

Surface Technologies

316.5

307.2

353.8

623.7

683.6

Total segment revenue

$

2,325.6

$

2,042.0

$

1,972.2

$

4,367.6

$

3,689.6

Segment operating

profit

Subsea

$

277.7

$

156.6

$

153.4

$

434.3

$

220.2

Surface Technologies

30.6

103.4

25.7

134.0

48.1

Total segment operating profit

$

308.3

$

260.0

$

179.1

$

568.3

$

268.3

Corporate

items

Corporate expense(1)

$

(23.7

)

$

(32.2

)

$

(153.5

)

$

(55.9

)

$

(180.9

)

Net interest expense

(21.4

)

(12.7

)

(30.3

)

(34.1

)

(49.0

)

Foreign exchange losses

(17.7

)

(4.5

)

(48.3

)

(22.2

)

(46.2

)

Total corporate items

$

(62.8

)

$

(49.4

)

$

(232.1

)

$

(112.2

)

$

(276.1

)

Income (loss) before income taxes(2)

$

245.5

$

210.6

$

(53.0

)

$

456.1

$

(7.8

)

(1)

Corporate expense primarily includes

corporate staff expenses, share-based compensation expenses, and

other employee benefits. For the three and six months ended June

30, 2023, corporate expense includes the non-recurring legal

settlement charge of $126.5 million.

(2)

Includes amounts attributable to

non-controlling interests.

Exhibit 3

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

BUSINESS

SEGMENT DATA

(In millions,

unaudited)

Three Months Ended

Six Months Ended

Inbound

Orders(1)

June 30,

March 31,

June 30,

June 30,

2024

2024

2023

2024

2023

Subsea

$

2,838.0

$

2,403.8

$

4,114.5

$

5,241.8

$

6,651.0

Surface Technologies

254.2

370.6

332.8

624.8

655.2

Total inbound orders

$

3,092.2

$

2,774.4

$

4,447.3

$

5,866.6

$

7,306.2

Order

Backlog(2)

June 30, 2024

March 31, 2024

June 30, 2023

Subsea

$

12,925.9

$

12,455.5

$

12,088.5

Surface Technologies

972.9

1,037.0

1,190.1

Total order backlog

$

13,898.8

$

13,492.5

$

13,278.6

(1)

Inbound orders represent the estimated

sales value of confirmed customer orders received during the

reporting period.

(2)

Order backlog is calculated as the

estimated sales value of unfilled, confirmed customer orders at the

reporting date.

Exhibit 4

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions,

unaudited)

June 30, 2024

December 31,

2023

Cash and cash equivalents

$

708.2

$

951.7

Trade receivables, net

1,163.2

1,138.1

Contract assets, net

1,118.6

1,010.1

Inventories, net

1,132.8

1,100.3

Other current assets

761.6

995.2

Total current assets

4,884.4

5,195.4

Property, plant and equipment, net

2,162.0

2,270.9

Intangible assets, net

559.4

601.6

Other assets

1,636.8

1,588.7

Total assets

$

9,242.6

$

9,656.6

Short-term debt and current portion of

long-term debt

$

321.6

$

153.8

Accounts payable, trade

1,446.2

1,355.8

Contract liabilities

1,401.7

1,485.8

Other current liabilities

1,283.7

1,473.2

Total current liabilities

4,453.2

4,468.6

Long-term debt, less current portion

646.8

913.5

Other liabilities

1,133.0

1,102.4

TechnipFMC plc stockholders’ equity

2,972.4

3,136.7

Non-controlling interests

37.2

35.4

Total liabilities and equity

$

9,242.6

$

9,656.6

Exhibit 5

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions,

unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2024

2023

Cash provided (required) by operating

activities

Net income (loss)

$

186.3

$

347.2

$

(88.5

)

Adjustments to reconcile income (loss) to

cash required by operating activities

Depreciation and amortization

92.1

191.6

190.0

Gain on disposal of Measurement Solutions

business

—

(75.2

)

—

Income from equity affiliates, net of

dividends received

(2.0

)

(3.4

)

(15.4

)

Other non-cash items, net

(37.0

)

(4.5

)

11.9

Working capital(1)

(82.3

)

(473.3

)

(286.8

)

Other non-current assets and liabilities,

net

73.8

121.8

(41.2

)

Cash provided (required) by operating

activities

230.9

104.2

(230.0

)

Cash provided (required) by investing

activities

Capital expenditures

(50.8

)

(102.8

)

(110.1

)

Proceeds from sale of Measurement

Solutions business

—

186.1

—

Other investing activities

1.6

3.8

30.7

Cash provided (required) by investing

activities

(49.2

)

87.1

(79.4

)

Cash required by financing activities

Net decrease in short-term debt

(38.0

)

(65.4

)

(26.1

)

Net increase in revolving credit

facility

—

—

50.0

Dividends paid

(21.5

)

(43.2

)

—

Share repurchases

(100.0

)

(250.1

)

(100.0

)

Payments related to taxes withheld on

share-based compensation

—

(49.7

)

(17.2

)

Other financing activities

(2.2

)

(9.5

)

(48.5

)

Cash required by financing activities

(161.7

)

(417.9

)

(141.8

)

Effect of changes in foreign exchange

rates on cash and cash equivalents

(8.6

)

(16.9

)

(20.7

)

Change in cash and cash equivalents

11.4

(243.5

)

(471.9

)

Cash and cash equivalents, beginning of

period

696.8

951.7

1,057.1

Cash and cash equivalents, end of

period

$

708.2

$

708.2

$

585.2

(1)

Working capital includes receivables,

payables, inventories and other current assets and liabilities.

Exhibit 6

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In

millions, except per share data, unaudited)

In addition to financial results determined in accordance with

U.S. generally accepted accounting principles (GAAP), the second

quarter 2024 Earnings Release also includes non-GAAP financial

measures (as defined in Item 10 of Regulation S-K of the Securities

Exchange Act of 1934, as amended) and describes performance on a

year-over-year or sequential basis. Net income attributable to

TechnipFMC plc, excluding charges and credits, as well as measures

derived from it (including Diluted EPS, excluding charges and

credits; Earnings before net interest expense, income taxes,

depreciation and amortization, excluding charges and credits

(“Adjusted EBITDA”); and Adjusted EBITDA, excluding foreign

exchange gains or losses, net; Adjusted EBITDA margin; Adjusted

EBITDA margin, excluding foreign exchange, net); Corporate expense,

excluding charges and credits; Foreign exchange, net and other,

excluding charges and credits; and net debt are non-GAAP financial

measures.

Non-GAAP adjustments are presented on a gross basis and the tax

impact of the non-GAAP adjustments is separately presented in the

applicable reconciliation table. Estimates of the tax effect of

each adjustment is calculated item by item, by reviewing the

relevant jurisdictional tax rate to the pretax non-GAAP amounts,

analyzing the nature of the item and/or the tax jurisdiction in

which the item has been recorded, the need of application of a

specific tax rate, history of non-GAAP taxable income positions

(i.e. net operating loss carryforwards) and concluding on the

valuation allowance positions.

Management believes that the exclusion of charges, credits and

foreign exchange impacts from these financial measures provides a

useful perspective on the Company’s underlying business results and

operating trends, and a means to evaluate TechnipFMC’s operations

and consolidated results of operations period-over-period. These

measures are also used by management as performance measures in

determining certain incentive compensation. The foregoing non-GAAP

financial measures should be considered by investors in addition

to, not as a substitute for or superior to, other measures of

financial performance prepared in accordance with GAAP. The

following is a reconciliation of the most comparable financial

measures under GAAP to the non-GAAP financial measures.

Three Months Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net income (loss) attributable to

TechnipFMC plc

$

186.5

$

157.1

$

(87.2

)

$

343.6

$

(86.8

)

Charges and (credits):

Restructuring, impairment and other

charges

2.4

5.0

5.1

7.4

5.7

Gain on disposal of Measurement Solutions

business

—

(75.2

)

—

(75.2

)

—

Non-recurring legal settlement

charges*

—

—

126.5

—

126.5

Tax impact of the charges and (credits)

above

—

10.7

0.4

10.7

0.4

Adjusted net income attributable to

TechnipFMC plc

$

188.9

$

97.6

$

44.8

$

286.5

$

45.8

Weighted diluted average shares

outstanding

440.1

446.3

440.1

443.2

441.1

Reported earnings (loss) per share -

diluted

$

0.42

$

0.35

$

(0.20

)

$

0.78

$

(0.20

)

Adjusted earnings per share - diluted

$

0.43

$

0.22

$

0.10

$

0.65

$

0.10

*The non-recurring legal settlement

charges reflect the impact of the resolution of all outstanding

matters with the PNF (reference to Note 15 of the 10-Q). For

taxation purposes the charges are treated as a penalty and as such,

do not trigger tax charges or benefits.

Exhibit 7

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net income (loss) attributable to

TechnipFMC plc

$

186.5

$

157.1

$

(87.2

)

$

343.6

$

(86.8

)

Income (loss) attributable to

non-controlling interests

(0.2

)

3.8

(9.1

)

3.6

(1.7

)

Provision for income tax

59.2

49.7

43.3

108.9

80.7

Net interest expense

21.4

12.7

30.3

34.1

49.0

Depreciation and amortization

92.1

99.5

97.0

191.6

190.0

Restructuring, impairment and other

charges

2.4

5.0

5.1

7.4

5.7

Gain on disposal of Measurement Solutions

business

—

(75.2

)

—

(75.2

)

—

Non-recurring legal settlement

charges*

—

—

126.5

—

126.5

Adjusted EBITDA

$

361.4

$

252.6

$

205.9

$

614.0

$

363.4

Foreign exchange, net

17.7

4.5

48.3

22.2

46.2

Adjusted EBITDA, excluding foreign

exchange, net

$

379.1

$

257.1

$

254.2

$

636.2

$

409.6

*The non-recurring legal settlement

charges reflect the impact of the resolution of all outstanding

matters with the PNF (reference to Note 15 of the 10-Q). For

taxation purposes the charges are treated as a penalty and as such,

do not trigger tax charges or benefits.

Exhibit 8

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

June 30, 2024

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

2,009.1

$

316.5

$

—

$

—

$

2,325.6

Operating profit (loss), as reported

(pre-tax)

$

277.7

$

30.6

$

(23.7

)

$

(17.7

)

$

266.9

Charges and (credits):

Restructuring, impairment and other

charges

(0.2

)

2.6

—

—

2.4

Subtotal

(0.2

)

2.6

—

—

2.4

Depreciation and amortization

79.0

12.8

0.3

—

92.1

Adjusted EBITDA

$

356.5

$

46.0

$

(23.4

)

$

(17.7

)

$

361.4

Foreign exchange, net

—

—

—

17.7

17.7

Adjusted EBITDA, excluding foreign

exchange, net

$

356.5

$

46.0

$

(23.4

)

$

—

$

379.1

Operating profit margin, as reported

13.8

%

9.7

%

11.5

%

Adjusted EBITDA margin

17.7

%

14.5

%

15.5

%

Adjusted EBITDA margin, excluding foreign

exchange, net

17.7

%

14.5

%

16.3

%

Exhibit 8

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

March 31, 2024

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

1,734.8

$

307.2

$

—

$

—

$

2,042.0

Operating profit (loss), as reported

(pre-tax)

$

156.6

$

103.4

$

(32.2

)

$

(4.5

)

$

223.3

Charges and (credits):

Restructuring, impairment and other

charges

—

(0.2

)

5.2

—

5.0

Gain on disposal of Measurement Solutions

business

—

(75.2

)

—

—

(75.2

)

Subtotal

—

(75.4

)

5.2

—

(70.2

)

Depreciation and amortization

85.8

13.4

0.3

—

99.5

Adjusted EBITDA

$

242.4

$

41.4

$

(26.7

)

$

(4.5

)

$

252.6

Foreign exchange, net

—

—

—

4.5

4.5

Adjusted EBITDA, excluding foreign

exchange, net

$

242.4

$

41.4

$

(26.7

)

$

—

$

257.1

Operating profit margin, as reported

9.0

%

33.7

%

10.9

%

Adjusted EBITDA margin

14.0

%

13.5

%

12.4

%

Adjusted EBITDA margin, excluding foreign

exchange, net

14.0

%

13.5

%

12.6

%

Exhibit 8

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

June 30, 2023

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

1,618.4

$

353.8

$

—

$

—

$

1,972.2

Operating profit (loss), as reported

(pre-tax)

$

153.4

$

25.7

$

(153.5

)

$

(48.3

)

$

(22.7

)

Charges and (credits):

Restructuring and other charges

0.5

4.6

—

—

5.1

Non-recurring legal settlement

charges*

—

—

126.5

—

126.5

Subtotal

0.5

4.6

126.5

—

131.6

Depreciation and amortization

79.9

16.6

0.5

—

97.0

Adjusted EBITDA

$

233.8

$

46.9

$

(26.5

)

$

(48.3

)

$

205.9

Foreign exchange, net

—

—

—

48.3

48.3

Adjusted EBITDA, excluding foreign

exchange, net

$

233.8

$

46.9

$

(26.5

)

$

—

$

254.2

Operating profit margin, as reported

9.5

%

7.3

%

-1.2

%

Adjusted EBITDA margin

14.4

%

13.3

%

10.4

%

Adjusted EBITDA margin, excluding foreign

exchange, net

14.4

%

13.3

%

12.9

%

*The non-recurring legal settlement

charges reflect the impact of the resolution of all outstanding

matters with the PNF (reference to Note 15 of the 10-Q). For

taxation purposes the charges are treated as a penalty and as such,

do not trigger tax charges or benefits.

Exhibit 9

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Six Months Ended

June 30, 2024

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

3,743.9

$

623.7

$

—

$

—

$

4,367.6

Operating profit (loss), as reported

(pre-tax)

$

434.3

$

134.0

$

(55.9

)

$

(22.2

)

$

490.2

Charges and (credits):

Restructuring, impairment and other

charges

(0.2

)

2.4

5.2

—

7.4

Gain on disposal of Measurement Solutions

business

—

(75.2

)

—

—

(75.2

)

Subtotal

(0.2

)

(72.8

)

5.2

—

(67.8

)

Depreciation and amortization

164.8

26.2

0.6

—

191.6

Adjusted EBITDA

$

598.9

$

87.4

$

(50.1

)

$

(22.2

)

$

614.0

Foreign exchange, net

—

—

—

22.2

22.2

Adjusted EBITDA, excluding foreign

exchange, net

$

598.9

$

87.4

$

(50.1

)

$

—

$

636.2

Operating profit margin, as reported

11.6

%

21.5

%

11.2

%

Adjusted EBITDA margin

16.0

%

14.0

%

14.1

%

Adjusted EBITDA margin, excluding foreign

exchange, net

16.0

%

14.0

%

14.6

%

Exhibit 9

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Six Months Ended

June 30, 2023

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

3,006.0

$

683.6

$

—

$

—

$

3,689.6

Operating profit (loss), as reported

(pre-tax)

$

220.2

$

48.1

$

(180.9

)

$

(46.2

)

$

41.2

Charges and (credits):

Restructuring and other charges

0.4

5.3

—

—

5.7

Non-recurring legal settlement

charges*

—

—

126.5

—

126.5

Subtotal

0.4

5.3

126.5

—

132.2

Depreciation and amortization

155.1

33.8

1.1

—

190.0

Adjusted EBITDA

$

375.7

$

87.2

$

(53.3

)

$

(46.2

)

$

363.4

Foreign exchange, net

—

—

—

46.2

46.2

Adjusted EBITDA, excluding foreign

exchange, net

$

375.7

$

87.2

$

(53.3

)

$

—

$

409.6

Operating profit margin, as reported

7.3

%

7.0

%

1.1

%

Adjusted EBITDA margin

12.5

%

12.8

%

9.8

%

Adjusted EBITDA margin, excluding foreign

exchange, net

12.5

%

12.8

%

11.1

%

*The non-recurring legal settlement

charges reflect the impact of the resolution of all outstanding

matters with the PNF (reference to Note 15 of the 10-Q). For

taxation purposes the charges are treated as a penalty and as such,

do not trigger tax charges or benefits.

Exhibit 10

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

June 30, 2024

March 31, 2024

June 30, 2023

Cash and cash equivalents

$

708.2

$

696.8

$

585.2

Short-term debt and current portion of

long-term debt

(321.6

)

(136.6

)

(429.5

)

Long-term debt, less current portion

(646.8

)

(887.2

)

(999.7

)

Net debt

$

(260.2

)

$

(327.0

)

$

(844.0

)

Net (debt) cash is a non-GAAP financial measure reflecting cash

and cash equivalents, net of debt. Management uses this non-GAAP

financial measure to evaluate our capital structure and financial

leverage. We believe net debt, or net cash, is a meaningful

financial measure that may assist investors in understanding our

financial condition and recognizing underlying trends in our

capital structure. Net (debt) cash should not be considered an

alternative to, or more meaningful than, cash and cash equivalents

as determined in accordance with U.S. GAAP or as an indicator of

our operating performance or liquidity.

Exhibit 11

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2024

2023

Cash provided (required) by operating

activities

$

230.9

$

104.2

$

(230.0

)

Capital expenditures

(50.8

)

(102.8

)

(110.1

)

Free cash flow (deficit)

$

180.1

$

1.4

$

(340.1

)

Free cash flow (deficit), is a non-GAAP financial measure and is

defined as cash provided (required) by operating activities less

capital expenditures. Management uses this non-GAAP financial

measure to evaluate our financial condition. We believe free cash

flow (deficit) is a meaningful financial measure that may assist

investors in understanding our financial condition and results of

operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725007944/en/

Investor relations

Matt Seinsheimer Senior Vice President, Investor Relations and

Corporate Development Tel: +1 281 260 3665 Email: Matt

Seinsheimer

James Davis Director, Investor Relations Tel: +1 281 260 3665

Email: James Davis

Media relations

David Willis Senior Manager, Public Relations Tel: +44 7841

492988 Email: David Willis

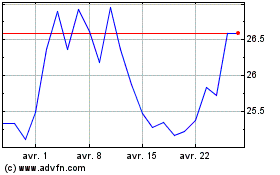

TechnipFMC (NYSE:FTI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

TechnipFMC (NYSE:FTI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024