Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

09 Janvier 2024 - 10:07PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Nos. 333-267440 and

333-267440-01

January 9, 2024

Kilroy Realty, L.P.

$400,000,000

6.250%

Senior Notes due 2036

Guaranteed by

Kilroy Realty Corporation

This free writing prospectus relates only to the securities described below and should be read together with Kilroy Realty, L.P.’s and

Kilroy Realty Corporation’s preliminary prospectus supplement dated January 9, 2024 (the “preliminary prospectus supplement”) and the accompanying prospectus dated September 15, 2022 and the documents incorporated and deemed

to be incorporated by reference therein.

|

|

|

| Issuer: |

|

Kilroy Realty, L.P. (the “operating partnership”) |

|

|

| Guarantor: |

|

Kilroy Realty Corporation (the “Company”) |

|

|

| Security: |

|

6.250% Senior Notes due 2036 |

|

|

| Aggregate Principal Amount Offered: |

|

$400,000,000 aggregate principal amount |

|

|

| Maturity Date: |

|

January 15, 2036 |

|

|

| Expected Ratings:1 |

|

Baa2 by Moody’s Investors Service, Inc. (negative outlook)

BBB by S&P Global Ratings (negative outlook) |

|

|

| Interest Rate: |

|

6.250% per year, accruing from January 12, 2024 |

|

|

| Interest Payment Dates: |

|

January 15 and July 15, commencing July 15, 2024 |

|

|

| Price to Public: |

|

98.879% of the aggregate principal amount, plus accrued interest, if any |

|

|

| Yield to Maturity: |

|

6.385% |

|

|

| Benchmark Treasury: |

|

4.500% due November 15, 2033 |

|

|

| Spread to Benchmark Treasury: |

|

+237.5 basis points |

|

|

| Benchmark Treasury Price / Yield: |

|

103-30+ / 4.010% |

| 1 |

Note: The securities ratings above are not recommendations to buy, sell or hold the securities. The ratings are

subject to revision or withdrawal at any time. Each of the ratings above should be evaluated independently of any other security rating. |

1

|

|

|

|

|

| Optional Redemption: |

|

Prior to October 15, 2035 (the “Par Call Date”), make-whole redemption at the Treasury Rate (as defined) plus 40 basis points, plus accrued and unpaid interest. On or after the Par Call Date, at a redemption price

equal to 100% of the principal amount plus accrued and unpaid interest. See the preliminary prospectus supplement for the definition of “Treasury Rate” and for further terms and provisions applicable to optional redemption and the

calculation of the redemption price. |

|

|

| Trade Date: |

|

January 9, 2024 |

|

|

| Settlement Date: |

|

January 12, 2024 (T+3). See “Underwriting (Conflicts of Interest)—Delayed Settlement” in the preliminary prospectus supplement for information regarding T+3 settlement. |

|

|

| CUSIP: |

|

49427R AS1 |

|

|

| ISIN: |

|

US49427RAS13 |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc. J.P. Morgan Securities

LLC Wells Fargo Securities, LLC

PNC Capital Markets LLC

Scotia Capital (USA) Inc. Barclays Capital Inc.

BMO Capital Markets Corp. KeyBanc Capital Markets Inc.

SMBC Nikko Securities America, Inc. U.S. Bancorp Investments,

Inc. |

|

|

| Co-Manager: |

|

BNY Mellon Capital Markets, LLC

|

|

|

| Use of Proceeds: |

|

The Company expects that the net proceeds from this offering will be approximately $391,816,000, after deducting the underwriting discount and its estimated expenses of $1,000,000. |

|

|

| Other: |

|

U.S. Bancorp Investments, Inc., one of the underwriters, is an affiliate of the trustee under the indenture pursuant to which the notes will be issued. |

The issuer and the guarantor have filed a registration statement (including a prospectus) with the Securities

and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and related prospectus in that registration statement and other documents the

issuer and the guarantor have filed with the SEC for more complete information about the issuer, the

2

guarantor and this offering. You may get these documents for free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, the issuer, the guarantor, any underwriter or any dealer participating in the offering will arrange to send you the preliminary prospectus supplement and related prospectus if you request it by calling BofA Securities,

Inc. toll-free at 1-800-294-1322, J.P. Morgan Securities LLC collect at 1-212-834-4533, Wells Fargo Securities, LLC toll-free at

1-800-645-3751, PNC Capital Markets LLC toll-free at 1-855-881-0697 or Scotia Capital (USA) Inc. toll-free at 1-800-372-3930.

3

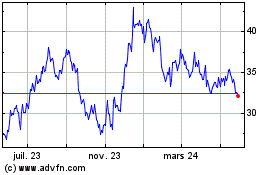

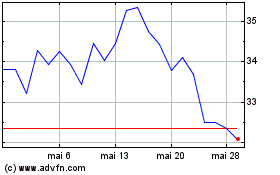

Kilroy Realty (NYSE:KRC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Kilroy Realty (NYSE:KRC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024