Mueller Industries, Inc. (NYSE: MLI) announces results for the

first quarter of 2024. Comparisons are to the first quarter of

2023.

- Net Income of $138.4 million versus $173.2 million

- Earnings Before Taxes of $201.6 million versus $237.4

million

- Net Sales of $849.7 million versus $971.2 million

- Diluted EPS* of $1.21 versus $1.54

(*adjusted retroactively to reflect the two-for-one stock split

that took effect on October 20, 2023)

First Quarter Financial and Operating Highlights:

- COMEX copper averaged $3.86 per pound during the quarter, 5.6%

lower than in the first quarter of 2023.

- The decrease in net sales was attributable to lower demand for

our products that are primarily consumed in residential building,

as well as lower selling prices as a result of the lower copper

prices.

- We recorded a $10.3 million loss on our investment in Tecumseh

Products Company, largely driven by restructuring charges in its

international operations.

- Net cash generated from operations was $173.6 million, and our

cash balance was $1.36 billion at quarter end.

- Our current ratio was 6.0 to 1.

Regarding the quarter performance, Greg Christopher, Mueller’s

CEO said, “The first quarter of 2023 represented the tail end of

the period of robust demand we experienced stemming from the

market’s overreaction to the 2022 supply chain crisis. Given this

normalization of demand, as well as the effects persistent

inflation and high interest rates have had on business conditions,

our 2024 first quarter performance was in line with our

expectations. The rationalization actions we took in 2023 had their

intended impact and contributed to the sustained margins.”

Regarding the outlook, Mr. Christopher continued, “As reported

in our annual report, our long-term outlook for our business

remains positive and we are well positioned for the expected

rebound in demand. Additionally, we anticipate another strong year

of cash flow from operations. Our capital allocation priorities

remain reinvestment in our operations to be a low cost producer and

growth through acquisition. As previously reported, we are excited

to complete our acquisition of Nehring Electrical Works, and look

forward to capitalizing on the strong growth and expansion platform

it will provide to us in the critical electrical transmission

infrastructure market.”

Mueller Industries, Inc. (NYSE: MLI) is an industrial

corporation whose holdings manufacture vital goods for important

markets such as air, water, oil and gas distribution; climate

comfort; food preservation; energy transmission; medical;

aerospace; and automotive. It includes a network of companies and

brands throughout North America, Europe, Asia, and the Middle

East.

*********************

Statements in this release that are not strictly historical may

be “forward-looking” statements, which involve risks and

uncertainties. These include economic and currency conditions,

continued availability of raw materials and energy, market demand,

pricing, competitive and technological factors, and the

availability of financing, among others, as set forth in the

Company’s SEC filings. The words “outlook,” “estimate,” “project,”

“intend,” “expect,” “believe,” “target,” “encourage,” “anticipate,”

“appear,” and similar expressions are intended to identify

forward-looking statements. The reader should not place undue

reliance on forward-looking statements, which speak only as of the

date of this report. The Company has no obligation to publicly

update or revise any forward-looking statements to reflect events

after the date of this report.

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

For the Quarter Ended

(In thousands, except per share data)

March 30, 2024

April 1, 2023

Net sales

$

849,654

$

971,192

Cost of goods sold

608,703

678,798

Depreciation and amortization

9,169

10,657

Selling, general, and administrative

expense

48,357

52,631

Operating income

183,425

229,106

Interest expense

(115

)

(143

)

Interest income

17,245

6,235

Realized gains on short-term

investments

365

1,910

Other income, net

630

326

Income before income taxes

201,550

237,434

Income tax expense

(51,834

)

(61,357

)

Loss from unconsolidated affiliates, net

of foreign tax

(8,007

)

(984

)

Consolidated net income

141,709

175,093

Net income attributable to noncontrolling

interests

(3,346

)

(1,854

)

Net income attributable to Mueller

Industries, Inc.

$

138,363

$

173,239

Weighted average shares for basic earnings

per share (1)

111,416

111,386

Effect of dilutive stock-based awards

(1)

2,729

1414

Adjusted weighted average shares for

diluted earnings per share (1)

114,145

112,800

Basic earnings per share (1)

$

1.24

$

1.56

Diluted earnings per share (1)

$

1.21

$

1.54

Dividends per share (1)

$

0.20

$

0.15

(1) Adjusted retroactively to reflect the

two-for-one stock split that occurred on October 20, 2023.

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME, CONTINUED

(Unaudited)

For the Quarter Ended

(In thousands)

March 30, 2024

April 1, 2023

Summary Segment Data:

Net sales:

Piping Systems Segment

$

590,168

$

662,479

Industrial Metals Segment

156,067

165,234

Climate Segment

116,810

152,954

Elimination of intersegment sales

(13,391

)

(9,475

)

Net sales

$

849,654

$

971,192

Operating income:

Piping Systems Segment

$

142,680

$

163,854

Industrial Metals Segment

24,271

27,215

Climate Segment

32,575

53,988

Unallocated income (expenses)

(16,101

)

(15,951

)

Operating income

$

183,425

$

229,106

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

March 30, 2024

December 30, 2023

ASSETS

Cash and cash equivalents

$

1,357,952

$

1,170,893

Short-term investments

—

98,146

Accounts receivable, net

424,406

351,561

Inventories

356,869

380,248

Other current assets

45,379

39,173

Total current assets

2,184,606

2,040,021

Property, plant, and equipment, net

390,517

385,165

Operating lease right-of-use assets

33,819

35,170

Other assets

285,300

298,945

Total assets

$

2,894,242

$

2,759,301

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current portion of debt

$

705

$

796

Accounts payable

160,133

120,485

Current portion of operating lease

liabilities

8,072

7,893

Other current liabilities

192,371

187,964

Total current liabilities

361,281

317,138

Long-term debt

130

185

Pension and postretirement liabilities

11,361

12,062

Environmental reserves

14,919

15,030

Deferred income taxes

22,687

19,134

Noncurrent operating lease liabilities

25,451

26,683

Other noncurrent liabilities

10,043

10,353

Total liabilities

445,872

400,585

Total Mueller Industries, Inc.

stockholders’ equity

2,424,374

2,337,445

Noncontrolling interests

23,996

21,271

Total equity

2,448,370

2,358,716

Total liabilities and equity

$

2,894,242

$

2,759,301

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

For the Quarter Ended

(In thousands)

March 30, 2024

April 1, 2023

Cash flows from operating

activities

Consolidated net income

$

141,709

$

175,093

Reconciliation of consolidated net income

to net cash provided by operating activities:

Depreciation and amortization

9,250

10,746

Stock-based compensation expense

6,231

5,637

Provision for doubtful accounts

receivable

1

(15

)

Loss from unconsolidated affiliates

8,007

984

Dividends from unconsolidated

affiliates

2,024

—

Insurance proceeds - noncapital

related

15,000

—

Gain on disposals of properties

(1,567

)

(115

)

Gain on sales of securities

(365

)

—

Deferred income tax expense

940

372

Changes in assets and liabilities, net of

effects of business sold:

Receivables

(75,200

)

(111,547

)

Inventories

22,502

(581

)

Other assets

11,984

(17,950

)

Current liabilities

33,948

50,842

Other liabilities

(907

)

(2,275

)

Other, net

68

427

Net cash provided by operating

activities

$

173,625

$

111,618

Cash flows from investing

activities

Capital expenditures

$

(16,406

)

$

(7,556

)

Insurance proceeds - capital related

—

8,000

Purchase of short-term investments

—

50,000

Proceeds from the sale of securities

96,465

—

Issuance of notes receivable

(12,500

)

—

Proceeds from sales of properties

2,878

118

Dividends from unconsolidated

affiliates

—

644

Net cash provided by investing

activities

$

70,437

$

51,206

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

For the Quarter Ended

(In thousands)

March 30, 2024

April 1, 2023

Cash flows from financing

activities

Dividends paid to stockholders of Mueller

Industries, Inc.

$

(22,255

)

$

(16,729

)

Repurchase of common stock

(27,930

)

—

Repayments of debt

(56

)

(56

)

(Repayment) issuance of debt by

consolidated joint ventures, net

(77

)

297

Net cash used to settle stock-based

awards

(2,489

)

(2,611

)

Net cash used in financing activities

$

(52,807

)

$

(19,099

)

Effect of exchange rate changes on

cash

(670

)

2,573

Increase in cash, cash equivalents, and

restricted cash

190,585

146,298

Cash, cash equivalents, and restricted

cash at the beginning of the period

1,174,223

465,296

Cash, cash equivalents, and restricted

cash at the end of the period

$

1,364,808

$

611,594

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240422090496/en/

Jeffrey A. Martin (901) 753-3226

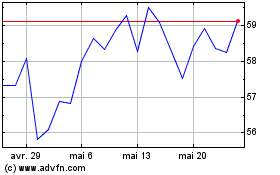

Mueller Industries (NYSE:MLI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Mueller Industries (NYSE:MLI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025