Institutional Property Advisors Advises Rockpoint and The Related Group in $131 Million Multifamily Asset Sale in North Phoenix

11 Février 2025 - 4:01PM

Business Wire

Institutional Property Advisors (IPA), a division of Marcus

& Millichap (NYSE:MMI), announced today that it advised

Rockpoint and The Related Group (Related) on the sale of Town Deer

Valley, a 388-unit multifamily asset in Phoenix, Arizona. The

property sold for $131.1 million, which represents $337,887 per

unit.

“Town Deer Valley is perfectly positioned to capitalize on the

unprecedented economic activity driven by Taiwan Semiconductor

Manufacturing Company’s $65 billion chip manufacturing facility,”

said Cliff David, IPA executive managing director. “The property’s

architectural detailing, sophisticated unit finishes, and

award-winning design deliver an elevated living experience to the

discerning renter demographic allured by the region’s rapid

economic ascent.” David and Steve Gebing, IPA executive managing

director, represented the seller, a venture between Rockpoint and

Related, and procured the buyer, Goodman Real Estate.

The property is minutes from Interstate 17, proximate to the

Deer Valley and Interstate 17 Employment Corridors, home to USAA,

Honeywell, Wells Fargo, Farmers Insurance, Cigna, and HonorHealth.

Approximately 2.7 million square feet of big box and boutique

retail is located within a three-mile radius, including The Shops

at Norterra and Happy Valley Towne Center.

Completed in 2024 on 18 acres, Town Deer Valley has market-best

amenities, including a 5,900-square-foot clubhouse with arts and

crafts room, poker room, and La Galere sundry shop. The

membership-quality fitness center features 3,800 square feet in a

standalone building with TRX Bridge fitness equipment, while the

resort-inspired swimming pool showcases a striking rain curtain

water feature and separate wading pool with submerged loungers.

Apartments have stainless steel side-by-side refrigerators,

single-door access to patios and balconies with exterior storage,

and a smart home automation package. The average unit size is 1,004

square feet.

About Institutional Property Advisors (IPA)

Institutional Property Advisors (IPA) is a division of Marcus

& Millichap (NYSE: MMI), a leading commercial real estate

services firm in North America. IPA’s combination of real estate

investment and capital markets expertise, industry-leading

technology, and acclaimed research offer customized solutions for

the acquisition, disposition and financing of institutional

properties and portfolios. For more information, please visit

www.institutionalpropertyadvisors.com

About Marcus & Millichap, Inc. (NYSE: MMI)

Marcus & Millichap, Inc. is a leading brokerage firm

specializing in commercial real estate investment sales, financing,

research and advisory services with offices throughout the United

States and Canada. As of December 31, 2023, the company had 1,783

investment sales and financing professionals in over 80 offices who

provide investment brokerage and financing services to sellers and

buyers of commercial real estate. The company also offers market

research, consulting and advisory services to clients. Marcus &

Millichap closed 7,546 transactions in 2023, with a sales volume of

approximately $43.6 billion. For additional information, please

visit www.MarcusMillichap.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211723365/en/

Gina Relva, VP of Public Relations

Gina.Relva@MarcusMillichap.com

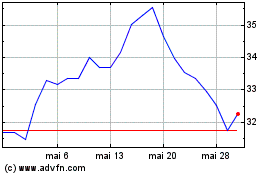

Marcus and Millichap (NYSE:MMI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Marcus and Millichap (NYSE:MMI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025