false

424B5

0001478888

0001478888

2024-08-13

2024-08-13

0001478888

nbb:CommonSharesMember

2024-08-08

0001478888

nbb:CommonSharesMember

2024-04-01

2024-06-30

0001478888

nbb:CommonSharesMember

2024-01-01

2024-03-31

0001478888

nbb:CommonSharesMember

2023-10-01

2023-12-31

0001478888

nbb:CommonSharesMember

2023-07-01

2023-09-30

0001478888

nbb:CommonSharesMember

2023-04-01

2023-06-30

0001478888

nbb:CommonSharesMember

2023-01-01

2023-03-31

0001478888

nbb:CommonSharesMember

2022-10-01

2022-12-31

0001478888

nbb:CommonSharesMember

2022-07-01

2022-09-30

0001478888

nbb:CommonSharesMember

2022-04-01

2022-06-30

0001478888

nbb:CommonSharesMember

2024-08-08

2024-08-08

0001478888

nbb:CommonSharesMember

2024-07-31

2024-07-31

0001478888

nbb:CommonSharesAdjustedForOfferingMember

2024-07-31

2024-07-31

0001478888

nbb:CommonSharesMember

2024-07-31

0001478888

nbb:CommonSharesAdjustedForOfferingMember

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-276610

(To Prospectus dated July 16, 2024)

UP TO $120,480,111 COMMON SHARES

$0.01 PAR VALUE PER SHARE

Nuveen Taxable Municipal Income Fund

Nuveen Taxable Municipal Income Fund (the “Fund”), a diversified, closed-end management investment company, is offering up to $120,480,111 of its common shares, $0.01 par value per share (the “Common Shares”), pursuant to this prospectus supplement.

The minimum price on any day at

which Common Shares may be sold will not be less than the current net asset value (“NAV”) per share plus the per share

amount of the commission to be paid to the Fund’s distributor, Nuveen Securities, LLC (“Nuveen Securities”).

Nuveen Securities has entered into a selected dealer agreement with UBS Securities LLC (“Sub-Placement Agent”) pursuant

to which UBS will be acting as Nuveen Securities’ sub-placement agent with respect to the Common Shares offered pursuant to

this prospectus supplement and the accompanying prospectus. The Fund and Nuveen Securities will suspend the sale of Common Shares if

the per share price of the shares is less than such minimum price. The Fund currently intends to distribute the shares offered

pursuant to this prospectus supplement primarily through transactions deemed “at the market,” as defined in Rule 415

under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on the New York Stock

Exchange (the "NYSE") or sales made to or through a market maker other than on an exchange. For information on how Common Shares may

be sold, see the “Plan of Distribution” section of this prospectus supplement.

The Fund will compensate Nuveen Securities with respect to sales of

Common Shares at a commission rate of 1.00% of the gross proceeds of the sale of the Common Shares. Out of this commission, Nuveen Securities

will compensate the Sub-Placement Agent at a rate of up to 0.80% of the gross sales proceeds of the sale of the Common Shares sold by

the Sub-Placement Agent. In connection with the sale of the Common Shares on the Fund’s behalf, Nuveen Securities may be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Nuveen Securities may be deemed to be underwriting commissions or discounts.

Common Shares are listed on the NYSE under the symbol “NBB.” The closing price for the Common Shares on the NYSE on August 8, 2024 was $16.31. The NAV of the Common Shares at the close of business on August 8, 2024 was $16.99 per Common Share.

Common shares of

closed-end

investment companies, such as the Fund, often trade at a discount to their NAV. This creates a risk of loss for an investor purchasing common shares in a public offering.

Investing in the Common Shares involves risks. See “Risk Factors” beginning on page 11 of the accompanying prospectus. You should consider carefully these risks together with all of the other information in this prospectus supplement and the accompanying prospectus before making a decision to purchase Common Shares.

The date of this prospectus supplement is August 13, 2024.

(continued from previous page)

You should read this prospectus supplement, together with the accompanying prospectus, which contains important information about the Fund, before deciding whether to invest in Common Shares and retain it for future reference. A statement of additional information, dated July 16, 2024, and as it may be supplemented (the “SAI”), containing additional information about the Fund, has been filed with the SEC and is incorporated by reference in its entirety into this prospectus supplement and the accompanying prospectus. This prospectus supplement, the accompanying prospectus and the SAI are part of a “shelf” registration statement filed with the SEC. This prospectus supplement describes the specific details regarding this offering, including the method of distribution. If information in this prospectus supplement is inconsistent with the accompanying prospectus or the SAI, you should rely on this prospectus supplement. You may request a free copy of the SAI, annual and semi-annual reports to shareholders, and other information about the Fund, and make shareholder inquiries by calling (800) 257-8787 or by writing to the Fund at 333 West Wacker Drive, Chicago, Illinois 60606, or from the Fund’s website (www.nuveen.com). The information contained in, or that can be accessed through, the Fund’s website is not part of this prospectus supplement, the accompanying prospectus or the SAI, except to the extent specifically incorporated by reference herein. You also may obtain a copy of the SAI (and other information regarding the Fund) from the SEC’s website (www.sec.gov).

You should not construe the contents of this prospectus supplement and the accompanying prospectus as legal, tax or financial advice. You should consult with your own professional advisors as to the legal, tax, financial or other matters relevant to the suitability of an investment in the Common Shares.

Common Shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | |

| |

|

|

|

|

|

|

ii |

|

|

|

|

S-1 |

|

|

|

|

S-4 |

|

|

|

|

S-6 |

|

|

|

|

S-6 |

|

|

|

|

S-7 |

|

|

|

|

S-8 |

|

|

|

|

S-9 |

|

|

|

|

S-9 |

|

You should rely only on the information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus. The Fund has not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The Fund is not making an offer of Common Shares in any state where the offer is not permitted. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate as of any date other than the respective dates on the front covers. The Fund’s business, financial condition and prospects may have changed since that date.

FORWARD-LOOKING STATEMENTS

Any projections, forecasts and estimates contained or incorporated by reference herein are forward looking statements and are based upon certain assumptions. Projections, forecasts and estimates are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any projections, forecasts or estimates will not materialize or will vary significantly from actual results. Actual results may vary from any projections, forecasts and estimates and the variations may be material. Some important factors that could cause actual results to differ materially from those in any forward-looking statements include changes in interest rates, market, financial or legal uncertainties, including changes in tax law, and the timing and frequency of defaults on underlying investments. Consequently, the inclusion of any projections, forecasts and estimates herein should not be regarded as a representation by the Fund or any of its affiliates or any other person or entity of the results that will actually be achieved by the Fund. Neither the Fund nor its affiliates has any obligation to update or otherwise revise any projections, forecasts and estimates including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of unanticipated events, even if the underlying assumptions do not come to fruition. The Fund acknowledges that, notwithstanding the foregoing, the safe harbor for forward-looking statements under the Private Securities Litigation Reform Act of 1995 does not apply to investment companies such as the Fund.

PROSPECTUS SUPPLEMENT SUMMARY

This is only a summary. You should review the more detailed information contained elsewhere in this prospectus supplement (“Prospectus Supplement”), in the accompanying prospectus and in the statement of additional information (“SAI”).

|

Nuveen Taxable Municipal Income Fund (the “Fund”) is a diversified, closed-end management investment company. The Fund’s common shares, $.01 par value per share (the “Common Shares”), are traded on the NYSE under the symbol “NBB”. See “Description of Shares—Common Shares” in the prospectus. |

|

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”) is the Fund’s investment adviser, responsible for overseeing the Fund’s overall investment strategy and its implementation. |

| |

Nuveen Fund Advisors, a registered investment adviser, offers advisory and investment management services to a broad range of investment company clients. Nuveen Fund Advisors has overall responsibility for management of the Fund, oversees the management of the Fund’s portfolio, manages the Fund’s business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary of Nuveen, LLC (“Nuveen”), the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). TIAA is a life insurance company founded in 1918 by the Carnegie Foundation for the Advancement of Teaching and is the companion organization of College Retirement Equities Fund. As of June 30, 2024, Nuveen managed approximately $1.2 trillion in assets, of which approximately $145.5 billion was managed by Nuveen Fund Advisors. |

|

Nuveen Asset Management, LLC serves as the Fund’s investment sub-adviser and is an affiliate of Nuveen Fund Advisors. Nuveen Asset Management is a registered investment adviser. Nuveen Asset Management oversees the investment operations of the Fund. |

|

The Fund has entered into a distribution agreement (the “Distribution Agreement”) with Nuveen Securities, LLC (“Nuveen Securities”), a registered broker-dealer affiliate of Nuveen Fund Advisors and Nuveen Asset Management, to provide for distribution of the Common Shares. Nuveen Securities has entered into a selected dealer agreement with UBS Securities LLC ("UBS") pursuant to which UBS will be acting as Nuveen Securities’ sub-placement agent with respect |

| |

to the Common Shares offered pursuant to this Prospectus Supplement and the accompanying prospectus. The minimum price on any day at which Common Shares may be sold will not be less than the then current NAV per Common Share plus the per Common Share amount of the commission to be paid to Nuveen Securities (the “Minimum Price”). The Fund and Nuveen Securities will determine whether any sales of Common Shares will be authorized on a particular day. The Fund and Nuveen Securities, however, will not authorize sales of Common Shares if the price per Common Share is less than the Minimum Price. The Fund and Nuveen Securities may elect not to authorize sales of Common Shares on a particular day even if the price per Common Share is equal to or greater than the Minimum Price, or may only authorize a fixed number of Common Shares to be sold on any particular day. The Fund and Nuveen Securities will have full discretion regarding whether sales of Common Shares will be authorized on a particular day and, if so, in what amounts. |

| |

The Fund will compensate Nuveen Securities with respect to sales of

the Common Shares at a commission rate of up to 1.00% of the gross proceeds of the sale of Common Shares. Nuveen Securities will compensate

sub-placement agents or other broker-dealers participating in the offering at a rate of up to 0.80% of the gross sales proceeds of the

sale of Common Shares sold by that sub-placement agent or other broker-dealer. Settlements of Common Share sales will occur on the first business day following the date of sale. |

| |

In connection with the sale of the Common Shares on behalf of the Fund, Nuveen Securities may be deemed to be an underwriter within the meaning of the Securities Act of 1933, as amended (the “1933 Act”), and the compensation of Nuveen Securities may be deemed to be underwriting commissions or discounts. Unless otherwise indicated in a further prospectus supplement, Nuveen Securities will act as underwriter on a reasonable efforts basis. |

| |

The offering of Common Shares pursuant to the Distribution Agreement will terminate upon the earlier of (i) the sale of all Common Shares subject thereto or (ii) termination of the Distribution Agreement. The Fund and Nuveen Securities each have the right to terminate the Distribution Agreement in its discretion at any time. See “Plan of Distribution.” |

|

The principal business address of Nuveen Securities is 333 West Wacker Drive, Chicago, Illinois 60606. |

|

See “Risk Factors” in the accompanying prospectus, for a discussion of the principal risks you should carefully consider before deciding to invest in Common Shares. |

The purpose of the table and the example below is to help you understand all fees and expenses that you, as a shareholder of Common Shares (“Common Shareholder”), would bear directly or indirectly. The table shows the expenses of the Fund as a percentage of the average net assets applicable to Common Shares, and not as a percentage of total assets or Managed Assets.

| | | |

Shareholder Transaction Expenses ( as a percentage of offering price) |

|

| | |

Maximum Sales Charge |

|

|

1.00 |

%* |

|

|

|

0.12 |

% |

Dividend Reinvestment Plan Fees (2) |

|

$ |

2.50 |

|

| | |

| |

|

As

a Percentage of Net Assets Attributable to Common Shares(3) |

|

|

|

| |

Management

Fees |

|

0.98 |

% |

| Interest and Other Related Expenses(4) |

|

2.58 |

% |

Other

Expenses(5) |

|

0.07 |

% |

Total

Annual Expenses |

|

3.63 |

% |

| (1) |

Assuming a Common Share offering price of $16.31 (the Fund’s closing price on the NYSE on August 8, 2024). |

| (2) |

You will be charged a $2.50 service charge and pay brokerage charges if you direct ComputerShare as agent for the Common Shareholders (the “Plan Agent”), to sell your Common Shares held in a dividend reinvestment account. |

The following example illustrates the expenses including the applicable transaction fees (referred to as the “Maximum Sales Charge” in the fee table above), if any, and estimated offering costs of $1.20, that a Common Shareholder would pay on a $1,000 investment that is held for the time periods provided in the table. The example assumes that all dividends and other distributions are reinvested in the Fund and that the Fund’s Annual Total Expenses, as provided above, remain the same. The example also assumes a transaction fee of 1.00%, as a percentage of the offering price, and a 5% annual return.

1

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those shown above.

(1) |

The example assumes that all dividends and distributions are reinvested at Common Shares NAV. Actual expenses may be greater or less than those assumed. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% return shown in the example. |

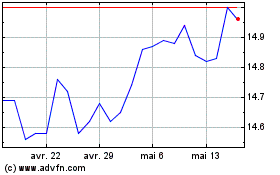

TRADING

AND NET ASSET VALUE INFORMATION

The following table shows for the periods indicated: (i) the high and low sales prices for the Common Shares reported as of the end of the day on the NYSE, (ii) the high and low NAV of the Common Shares, and (iii) the high and low of the premium/(discount) to NAV (expressed as a percentage) of the Common Shares.

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Market Price | | |

NAV | | |

Premium/(Discount)

to NAV | |

| Fiscal

Quarter End | |

High | | |

Low | | |

High | | |

Low | | |

High | |

Low |

| June 2024 | |

$ | 15.52 | | |

$ | 14.56 | | |

$ | 16.86 | | |

$ | 16.03 | | |

| (6.17 | )% | |

| (10.13 | )% |

| March 2024 | |

$ | 16.20 | | |

$ | 15.21 | | |

$ | 17.42 | | |

$ | 16.55 | | |

| (4.26 | )% | |

| (8.86 | )% |

| December 2023 | |

$ | 15.98 | | |

$ | 13.75 | | |

$ | 17.57 | | |

$ | 15.34 | | |

| (6.98 | )% | |

| (10.86 | )% |

| September 2023 | |

$ | 15.71 | | |

$ | 14.21 | | |

$ | 16.98 | | |

$ | 16.01 | | |

| (6.24 | )% | |

| (11.24 | )% |

| June 2023 | |

$ | 16.56 | | |

$ | 15.14 | | |

$ | 17.30 | | |

$ | 16.60 | | |

| (3.50 | )% | |

| (9.42 | )% |

| March 2023 | |

$ | 17.01 | | |

$ | 15.76 | | |

$ | 17.39 | | |

$ | 16.27 | | |

| (0.77 | )% | |

| (6.36 | )% |

| December 2022 | |

$ | 16.66 | | |

$ | 14.72 | | |

$ | 16.93 | | |

$ | 15.30 | | |

| 0.06 | % | |

| (6.15 | )% |

| September 2022 | |

$ | 18.72 | | |

$ | 15.37 | | |

$ | 18.44 | | |

$ | 16.24 | | |

| 3.69 | % | |

| (6.22 | )% |

| June 2022 | |

$ | 19.88 | | |

$ | 16.35 | | |

$ | 19.99 | | |

$ | 17.34 | | |

| 2.89 | % | |

| (7.84 | )% |

The NAV per Common Share, the market price and percentage of premium/(discount) to NAV per Common Share on August 8, 2024, was $16.99, $16.31 and (4.00)%, respectively. As of July 31, 2024, the Fund had 29,394,752 Common Shares outstanding, and net assets applicable to Common Shares of $498,588,811. See “Repurchase of Fund Shares; Conversion to Open-End Fund” in the accompanying prospectus.

Assuming the sale of all of the Common Shares offered under this Prospectus Supplement and the accompanying prospectus, at the last reported sale price of $16.31 per share for Common Shares on the NYSE as of August 8, 2024, the Fund estimates that the net proceeds of this offering will be approximately $119,130,310 after deducting the estimated sales load and the estimated offering expenses payable by the Fund, if any. There is no guarantee that there will be any sales of Common Shares pursuant to this Prospectus Supplement and the accompanying prospectus. Actual sales, if any, of Common Shares under this Prospectus Supplement and the accompanying prospectus may be less than as set forth above. In addition, the price per share of any such sale may be greater or less than the price set forth above, depending on the market price of Common Shares at the time of any such sale. As a result, the actual net proceeds the Fund receives may be more or less than the amount of net proceeds estimated in this Prospectus Supplement.

The net proceeds from the issuance of Common Shares hereunder will be invested in accordance with the Fund’s investment objectives and policies as set forth in the accompanying prospectus. The Fund currently anticipates that it will be able to invest substantially all of the net proceeds in investments that meet the Fund’s investment objectives and policies within approximately three months of the receipt of such proceeds. Pending investment, it is anticipated that the proceeds will be invested in high-quality, short-term investments.

The Fund will bear the expenses of this offering, including but not limited to, the expenses of preparation of the prospectus, including this Prospectus Supplement, and SAI for this offering and the expense of counsel and auditors in connection with the offering.

The Fund has entered into a distribution agreement (the “Distribution Agreement”) with Nuveen Securities, LLC (“Nuveen Securities”). Subject to the terms and conditions of the Distribution Agreement, the Fund may from time to time issue and sell its Common Shares through Nuveen Securities to certain broker-dealers which have entered into selected dealer agreements with Nuveen Securities. Currently, Nuveen Securities has entered into a selected dealer agreement with UBS Securities LLC ("UBS") pursuant to which UBS will be acting as the exclusive

sub-placement

agent with respect to the Common Shares offered pursuant to this Prospectus Supplement and the accompanying prospectus.

The minimum price on any day at which Common Shares may be sold will not be less than the then current NAV per Common Share plus the per Common Share amount of the commission to be paid to Nuveen Securities (the “Minimum Price”). The Fund and Nuveen Securities will determine whether any sales of Common Shares will be authorized on a particular day. The Fund and Nuveen Securities, however, will not authorize sales of Common Shares if the price per Common Share is less than the Minimum Price. The Fund and Nuveen Securities may elect not to authorize sales of Common Shares on a particular day even if the price per Common Share is equal to or greater than the Minimum Price, or may only authorize a fixed number of Common Shares to be sold on any particular day. The Fund and Nuveen Securities will have full discretion regarding whether sales of Common Shares will be authorized on a particular day and, if so, in what amounts.

The Fund will compensate Nuveen Securities with respect to sales of

the Common Shares at a commission rate of up to 1.00% of the gross proceeds of the sale of Common Shares. Nuveen Securities will compensate

sub-placement agents or other broker-dealers at a rate of up to 0.80% of the gross proceeds of the sale of Common Shares sold by that

sub-placement agent or broker-dealer. Settlements of sales of Common Shares will occur on the second business day following the date on which any such sales are made.

In connection with the sale of the Common Shares on behalf of the Fund, Nuveen Securities may be deemed to be an underwriter within the meaning of the 1933 Act, and the compensation of Nuveen Securities may be deemed to be underwriting commissions or discounts. Unless otherwise indicated in a further prospectus supplement, Nuveen Securities will act as underwriter on a reasonable efforts basis.

The offering of Common Shares pursuant to the Distribution Agreement will terminate upon the earlier of (i) the sale of all Common Shares subject thereto or (ii) termination of the Distribution Agreement. The Fund and Nuveen Securities each have the right to terminate the Distribution Agreement in its discretion at any time.

UBS, its affiliates and

their respective employees hold or may hold in the future, directly or indirectly, investment interests in Nuveen, Nuveen Fund

Advisors, TIAA, or any of their affiliates or funds. The interests held by employees of UBS or its affiliates are not

attributable to, and no investment discretion is held by, UBS or its affiliates.

The principal business address of Nuveen Securities is 333 West Wacker Drive, Chicago, Illinois 60606.

The Fund may offer and sell up to $120,480,111 Common Shares, $0.01 par value per share, from time to time through UBS as sub-placement agent under this Prospectus Supplement and the accompanying prospectus. There is no guarantee that there will be any sales of the Common Shares pursuant to this Prospectus Supplement and the accompanying prospectus. The table below assumes that the Fund will sell 7,386,886 Common Shares at a price of $16.31 per share (which represents the last reported sales price per share of the Common Shares on the NYSE on August 8, 2024). Actual sales, if any, of the Common Shares under this Prospectus Supplement and the accompanying prospectus may be greater or less than $16.31 per share, depending on the market price of the Common Shares at the time of any such sale.

The following table sets forth the

Fund’s capitalization (1) on a historical basis as of July 31, 2024, (unaudited); and (2) on a pro forma

basis as adjusted to reflect the assumed sale of $120,480,111 Common Shares at $16.31

per share (the last reported price per share of the Common Shares on the NYSE on August 8, 2024), in an offering under this

Prospectus Supplement and the accompanying prospectus, after deducting the assumed commission of $1,204,801 (representing an

estimated commission to Nuveen Securities of 1.00% of the gross proceeds of the sale of Common Shares, out of which Nuveen

Securities will compensate UBS at a rate of up to 0.80% of the gross sales proceeds of the sale of the Common Shares sold by

UBS).

| | |

As of July 31, 2024 (unaudited) | | |

As adjusted for Offering (unaudited) | |

| Common Shares | |

| 29,394,752 | | |

| 36,781,638 | |

| Paid in Capital | |

$ | 521,461,044 | | |

$ | 640,736,354 | * |

| Undistributed net investment income | |

$ | (4,688,947 | ) | |

$ | (4,688,947 | ) |

| Accumulated gain/loss | |

$ | 2,111,024 | | |

$ | 2,111,024 | |

| Net appreciation/depreciation | |

$ | (20,294,310 | ) | |

$ | (20,294,310 | ) |

| Net assets | |

$ | 498,588,811 | | |

$ | 617,864,121 | |

| Net asset value | |

$ | 16.96 | | |

$ | 16.80 | |

| * |

Assumes a total of $145,000 of the estimated offering costs will be deferred over the 3-year life of the registration. |

Certain legal matters in connection with the Common Shares will be passed upon for the Fund by Stradley Ronon Stevens & Young, LLP, located at 2005 Market Street, Suite 2600, Philadelphia, Pennsylvania. Stradley Ronon Stevens & Young, LLP may rely as to certain matters of Massachusetts law on the opinion of Morgan, Lewis & Bockius LLP.

The Fund is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the 1940 Act and is required to file reports, proxy statements and other information with the SEC. Reports, proxy statements, and other information about the Fund can be inspected at the offices of the NYSE.

This Prospectus Supplement does not contain all of the information in the Fund’s Registration Statement, including amendments, exhibits, and schedules. Additional information about the Fund and the Common Shares can be found in the Fund’s Registration Statement (including amendments, exhibits, and schedules) on Form

N-2

filed with the SEC. The SEC maintains a website (www.sec.gov) that contains the Fund’s Registration Statement, other documents incorporated by reference, and other information the Fund has filed electronically with the SEC, including proxy statements and reports filed under the Exchange Act.

BASE PROSPECTUS

$120,480,111

Common Shares

Preferred Shares

Rights to Purchase Common Shares

Nuveen Taxable Municipal Income Fund

The Offering. Nuveen

Taxable Municipal Income Fund (the “Fund”) is offering, on an immediate, continuous or delayed basis, in one or more

offerings, with a maximum aggregate dollar offering price of up to $120,480,111, common shares (“Common Shares”),

preferred shares (“Preferred Shares”), and/or subscription rights to purchase Common Shares (“Rights,”

and collectively with Common Shares and Preferred Shares, “Securities”), in any combination. The Fund may offer and

sell such Securities directly to one or more purchasers, to or through underwriters, through dealers or agents that the Fund designates

from time to time, or through a combination of these methods. The prospectus supplement relating to any offering of Securities

will describe such offering, including, as applicable, the names of any underwriters, dealers or agents and information regarding

any applicable purchase price, fee, commission or discount arrangements made with those underwriters, dealers or agents or the

basis upon which such amount may be calculated. The prospectus supplement relating to any Rights offering will set forth the number

of Common Shares issuable upon the exercise of each Right (or number of Rights) and the other terms of such Rights offering. For

more information about the manners in which the Fund may offer Securities, see “Plan of Distribution.”

The Fund. The Fund is

a diversified, closed-end management investment company. The Fund’s primary investment objective is to provide

current income through investments in taxable municipal securities. As a secondary objective, the Fund seeks to enhance portfolio

value and total return. There can be no assurance that the Fund will achieve its investment objectives or that the Fund’s

investment strategies will be successful.

This Prospectus, together with any

related prospectus supplement, sets forth concisely information about the Fund that a prospective investor should know before

investing, and should be retained for future reference. Investing in Securities involves risks, including the risks associated

with the Fund’s use of leverage. You could lose some or all of your investment. You should consider carefully these risks

together with all of the other information in this Prospectus and any related prospectus supplement before making a decision to

purchase any of the Securities. See “Risk Factors” beginning on page 19.

Common Shares are listed on the New

York Stock Exchange (the “NYSE”). The trading or “ticker” symbol of the Common Shares is “NBB.”

The closing price of the Common Shares, as reported by the NYSE on July 5, 2024, was $15.57 per Common Share. The net asset value of

the Common Shares at the close of business on that same date was $16.64 per Common Share. Preferred Shares and/or Rights issued

by the Fund may also be listed on a securities exchange.

* * *

You should read this Prospectus, together with any related

prospectus supplement, which contains important information about the Fund, before deciding whether to invest and retain it for

future reference. A Statement of Additional Information, dated July 16, 2024 (the “SAI”), containing

additional information about the Fund has been filed with the U.S. Securities and Exchange Commission (the “SEC”)

and is incorporated by reference in its entirety into this Prospectus. You may request a free copy of the SAI, the table of contents

of which is on the last page of this Prospectus, annual and semi-annual reports to shareholders and other information about the

Fund and make shareholder inquiries by calling (800) 257-8787, by writing to the Fund at 333 West Wacker Drive,

Chicago, Illinois 60606 or from the Fund’s website (http://www.nuveen.com). The information contained in, or that can be

accessed through, the Fund’s website is not part of this Prospectus, except to the extent specifically incorporated by reference

herein. You also may obtain a copy of the SAI (and other information regarding the Fund) from the SEC’s web site (http://www.sec.gov).

The date of this Prospectus is July

16, 2024.

The Securities do not represent a deposit

or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally

insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency.

Neither the SEC nor any state securities

commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated

by reference into this Prospectus and any related prospectus supplement. The Fund has not authorized anyone to provide you with

different information. The Fund is not making an offer of these securities in any state where the offer is not permitted. You should

not assume that the information contained in this Prospectus and any related prospectus supplement is accurate as of any date other

than the dates on their covers. The Fund will update this Prospectus to reflect any material changes to the disclosures herein.

FORWARD-LOOKING STATEMENTS

Any projections, forecasts and estimates

contained or incorporated by reference herein are forward looking statements and are based upon certain assumptions. Projections,

forecasts and estimates are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying

any projections, forecasts or estimates will not materialize or will vary significantly from actual results. Actual results may

vary from any projections, forecasts and estimates and the variations may be material. Some important factors that could cause

actual results to differ materially from those in any forward looking statements include changes in interest rates, market, financial

or legal uncertainties, including changes in tax law, and the timing and frequency of defaults on underlying investments. Consequently,

the inclusion of any projections, forecasts and estimates herein should not be regarded as a representation by the Fund or any

of its affiliates or any other person or entity of the results that will actually be achieved by the Fund. Neither the Fund nor

its affiliates has any obligation to update or otherwise revise any projections, forecasts and estimates including any revisions

to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of

unanticipated events, even if the underlying assumptions do not come to fruition. The Fund acknowledges that, notwithstanding the

foregoing, the safe harbor for forward-looking statements under the Private Securities Litigation Reform Act of 1995 does not apply

to investment companies such as the Fund.

PROSPECTUS SUMMARY

This is only a summary. You should review

the more detailed information contained elsewhere in this Prospectus and any related prospectus supplement and in the Statement

of Additional Information (the “SAI”).

| The Fund |

Nuveen Taxable Municipal Income Fund (the “Fund”) is a diversified, closed-end management investment company.

See “The Fund.” The Fund’s common shares, $0.01 par value per share (“Common Shares”), are traded

on the New York Stock Exchange (the “NYSE”) under the symbol “NBB.” Preferred Shares and/or Rights

issued by the Fund may also be listed on a securities exchange. |

|

The closing price of the Common Shares, as reported by the NYSE on July 5, 2024, was $15.57

per Common Share. The net asset value (“NAV”) of the Common Shares at the close of business on that same date was

$16.64

per Common Share. As of June 30, 2024 the Fund had 29,394,752

Common Shares outstanding and net assets of $485,760,956. See “Description of Shares.” |

| The Offering |

The Fund may offer, from time to time, in one or more offerings, with a maximum aggregate dollar

offering price of up to $120,480,111, Common Shares, preferred shares (“Preferred Shares”), and/or subscription

rights to purchase Common Shares (“Rights,” and collectively with Common Shares and Preferred Shares, “Securities”),

in any combination, on terms to be determined at the time of the offering. The Fund may offer and sell such Securities directly

to one or more purchasers, to or through underwriters, through dealers or agents that the Fund designates from time to time,

or through a combination of these methods. The prospectus supplement relating to any offering of Securities will describe

such offering, including, as applicable, the names of any underwriters, dealers or agents and information regarding any applicable

purchase price, fee, commission or discount arrangements made with those underwriters, dealers or agents or the basis upon

which such amount may be calculated. For more information about the manners in which the Fund may offer Securities, see “Plan

of Distribution.” The prospectus supplement relating to any Rights offering will set forth the number of Common Shares

issuable upon the exercise of each Right (or number of Rights) and the other terms of such Rights offering. The minimum price

on any day at which the Common Shares may be sold will not be less than the NAV per Common Share at the time of the offering

plus the per share amount of any underwriting commission or discount; provided that Rights offerings that meet certain conditions

may be offered at a price below the then current NAV. See “Rights Offerings.” |

|

The Fund may not sell any Securities through agents, underwriters or dealers without delivery, or deemed delivery, of a prospectus,

including the appropriate prospectus supplement, describing the method and terms of the particular offering of such Securities.

You should read this Prospectus and the applicable prospectus supplement carefully before you invest in our Securities. |

Investment Objectives

and Policies |

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current

Investment Objectives, Investment Policies and Principal Risks of the Fund—Investment Objectives” and “—Investment

Policies,” as such investment objectives and investment policies may be supplemented from time to time, which are incorporated

by reference herein, for a discussion of the Fund’s investment objectives and policies. |

|

There can be no assurance that such strategies will be successful. For a more complete discussion of the Fund’s portfolio

composition and its corresponding risks, see “The Fund’s Investments” and “Risk Factors.” |

| Investment Adviser |

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”), the Fund’s investment adviser,

is responsible for overseeing the Fund’s overall investment strategy and its implementation. Nuveen Fund Advisors offers

advisory and investment management services to a broad range of investment company clients. Nuveen Fund Advisors has overall

responsibility for management of the Fund, oversees the management of the Fund’s portfolio, manages the Fund’s

business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located

at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary of Nuveen, LLC (“Nuveen”),

the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). TIAA is a life

insurance company founded in 1918 by the Carnegie Foundation for the Advancement of Teaching and is the companion organization

of College Retirement Equities Fund. As of March 31, 2024, Nuveen managed approximately $1.2 trillion in assets, of which

approximately $143.2 billion was managed by Nuveen Fund Advisors. |

| Sub-Adviser | Nuveen Asset Management, LLC (“Nuveen Asset Management”) serves as the Fund’s sub-adviser. Nuveen

Asset Management, a registered investment adviser, is a wholly-owned subsidiary of Nuveen Fund Advisors. Nuveen Asset Management

oversees the day-to-day investment operations of the Fund. |

| Use of Leverage |

The Fund uses leverage to pursue its investment objectives. The Fund may use leverage to the extent permitted by the Investment

Company Act of 1940, as amended (the “1940 Act”). The Fund may source leverage through a number of methods, including

reverse repurchase agreements (effectively a secured borrowing), investments in inverse floating rate securities of tender option

bond trusts, borrowings (including loans from financial institutions), issuances of debt securities, and issuances of Preferred

Shares. The Fund may also use other forms of leverage including, but not limited to, portfolio investments that have the economic

effect of leverage. |

|

Currently, the Fund employs leverage through its use of reverse repurchase agreements. The Fund

also currently invests in residual interest certificates of tender option bond trusts, also called inverse floating rate securities,

that have the economic effect of leverage because the Fund’s investment exposure to the underlying bonds held by the

Fund have been effectively financed by the Fund’s issuance of floating rate certificates. As of May 31, 2024, the Fund’s

leverage through reverse repurchase agreements and through investments in inverse floating rate securities was approximately

41% of its Managed Assets. |

|

The Fund may also borrow for temporary purposes as permitted by the 1940 Act. |

|

The Fund may reduce or increase leverage based upon changes in market conditions and anticipates that its leverage ratio will

vary from time to time based upon variations in the value of the Fund’s holdings. So long as the rate of net income received

on the Fund’s investments exceeds the then current expense on any leverage, leverage will generate more net income than

if the Fund had not used leverage. If so, the excess net income will be available to pay higher distributions to holders of Common

Shares (“Common Shareholders”). However, if the rate of net income received from the Fund’s portfolio investments

is less than the then current expense on outstanding leverage, the Fund may be required to utilize other Fund assets to make expense

payments on outstanding leverage, which may result in a decline in Common Share NAV and reduced net investment income available

for distribution to Common Shareholders. |

|

The Fund pays a management fee to Nuveen Fund Advisors (which in turn pays a portion of its fee to Nuveen Asset Management) based

on a percentage of Managed Assets. Managed Assets for this purpose includes the proceeds realized and managed from the Fund’s

use of leverage as set forth in the Fund’s investment management agreement. Because Managed Assets include the Fund’s

net assets as well as assets that are attributable to the Fund’s use of leverage, it is anticipated that the Fund’s

Managed Assets will be greater than its net assets. Nuveen Fund Advisors and Nuveen Asset Management are responsible for using

leverage to pursue the Fund’s investment objectives, and base their decision regarding whether and how much leverage to

use for the Fund on their assessment of whether such use of leverage will advance the Fund’s investment objectives. However,

a decision to employ or increase the Fund’s leverage will have the effect, all other things being equal, of increasing Managed

Assets and therefore Nuveen Fund Advisors’ and Nuveen Asset Management’s fees. Thus, Nuveen Fund Advisors and Nuveen

Asset Management may have a conflict of interest in determining whether the Fund should use or increase leverage. Nuveen Fund

Advisors and Nuveen Asset Management will seek to manage that potential conflict by only employing or increasing the Fund’s

use of leverage when they determine that such increase is in the best interest of the Fund and is consistent with the Fund’s

investment objectives, and by periodically reviewing the Fund’s performance and use of leverage with the Fund’s Board

of Trustees (the “Board”). |

|

The use of leverage creates additional risks for Common Shareholders, including increased variability of the Fund’s NAV,

net income and distributions in relation to market changes. There is no assurance that the Fund will continue to use leverage

or that the Fund’s use of leverage will work as planned or achieve its goals. |

| Distributions | The Fund pays regular monthly cash distributions to Common Shareholders (stated in terms of a fixed cents per Common Share

dividend distribution rate which may be set from time to time). The Fund intends to distribute all or substantially all of its

net investment income each year through its regular monthly distributions and to distribute realized capital gains at least annually.

In addition, in any monthly period, to maintain its declared per common share distribution amount, the Fund may distribute more

or less than its net investment income during the period. In the event the Fund distributes more than its net investment income,

such distributions may also include realized gains and/or a return of capital. To the extent that a distribution includes a return

of capital the NAV per share may erode. If a distribution includes anything other than net investment income, the Fund provides

a notice of the best estimate of its distribution sources at the time. See “Distributions.” |

|

The Fund reserves the right to change its distribution policy and the basis for establishing the rate of its monthly distributions

at any time and may do so without prior notice to Common Shareholders. |

Custodian and

Transfer Agent |

State Street Bank and Trust Company serves as the Fund’s custodian, and Computershare Inc. and Computershare Trust Company,

N.A. serves as the Fund’s transfer agent for the Common Shares. The corresponding agent for any Preferred Shares will be

identified in the related prospectus supplement. See “Custodian and Transfer Agent.” |

| Risk Factors |

Investment in the Fund involves risk. The Fund is designed as a long-term investment and not as a trading vehicle. The Fund is

not intended to be a complete investment program. Please refer to the section of the Fund’s most recent annual report on

Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of

the Fund—Principal Risks of the Fund,” as such principal risks may be supplemented from time to time, which is incorporated

by reference herein, for a discussion of the principal risks you should consider before making an investment in the Fund. The

specific risks applicable to a particular offering of Securities will be set forth in the related prospectus supplement. |

| Use of Proceeds |

Unless otherwise specified in a prospectus supplement, the Fund will use the net proceeds from any offering of Securities, pursuant

to this Prospectus, to make investments in accordance with the Fund’s investment objectives. See “Use of Proceeds.” |

| Federal Income Tax |

The Fund has elected to be treated, and intends to qualify each year, as a regulated investment company (“RIC”) under

Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). To qualify for the favorable U.S. federal

income tax treatment generally accorded to a RIC under Subchapter M of the Code the Fund must, among other requirements, derive

in each taxable year at least 90% of its gross income from certain prescribed sources and satisfy a diversification test on a

quarterly basis. If the Fund fails to satisfy the qualifying income or diversification requirements in any taxable year, the Fund

may be eligible for relief provisions if the failures are due to reasonable cause and not willful neglect and if a penalty tax

is paid with respect to each failure to satisfy the applicable requirements. Additionally, relief is provided for certain de

minimis failures of the diversification requirements where the Fund corrects the failure within a specified period. In

order to be eligible for the relief provisions with respect to a failure to meet the diversification requirements, the Fund may

be required to dispose of certain assets. If these relief provisions were not available to the Fund and it were to fail to qualify

for treatment as a RIC for a taxable year, all of its taxable income (including its net capital gain) would be subject to tax

at the 21% regular corporate rate without any deduction for distributions to shareholders, and such distributions would be taxable

as ordinary dividends to the extent of the Fund’s current and accumulated earnings and profits. To qualify to pay exempt-interest

dividends, which are treated as items of interest excludable from gross income for federal income tax purposes, at least 50% of

the value of the total assets of the Fund must consist of obligations exempt from regular income tax as of the close of each quarter

of the Fund’s taxable year. If the proportion of taxable investments held by the Fund exceeds 50% of the Fund’s total

assets as of the close of any quarter of any Fund taxable year, the Fund will not for that taxable year satisfy the general eligibility

test that otherwise permits it to pay exempt-interest dividends. While the Fund may invest in municipal securities the interest

income from which is exempt from regular federal income tax, the Fund does not expect to satisfy the requirements to pay exempt-interest

dividends to shareholders. |

|

See “Fund Tax Risk,” as contained in the section of the Fund’s most recent annual report on Form N-CSR entitled

“Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Fund—Principal

Risks of the Fund—Fund Level and Other Risks,” and “Tax Matters.” |

| Governing Law |

The Fund’s Declaration of Trust (the “Declaration of Trust”) is, and each Statement and Statement Supplement

for Preferred Shares will be, governed by the laws of the Commonwealth of Massachusetts. |

SUMMARY OF FUND EXPENSES

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment

Policies and Principal Risks of the Fund—Updated Disclosures for the Fund’s Effective Shelf Offering Registration Statement—Summary

of Fund Expenses,” which is incorporated by reference herein, for a discussion of fees and expenses of the Fund.

FINANCIAL HIGHLIGHTS

The Fund’s financial highlights

for the fiscal years ended March 31, 2024, March 31, 2023, March 31, 2022, March 31, 2021, and March 31, 2020, are incorporated

by reference from the Fund’s Annual

Report for the fiscal year ended March 31, 2024 (File No. 811-22391), as filed with the SEC on Form N-CSR on June 4, 2024.

The financial highlights for each of these fiscal years have been derived from financial statements audited by KPMG LLP (“KPMG”),

the Fund’s independent registered public accounting firm, for the last five fiscal years. The Fund’s financial highlights

for the fiscal years ended March 31, 2019, March 31, 2018, March 31, 2017, March 31, 2016, and March 31, 2015, are incorporated

by reference from the Fund’s Annual

Report for the fiscal year ended March 31, 2019 (File No. 811-22391), as filed with the SEC on Form N-CSR on June 6, 2019.

TRADING AND NET ASSET VALUE INFORMATION

Please refer to the section of the

Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment

Policies and Principal Risks of the Fund—Updated Disclosures for the Fund’s Effective Shelf Offering Registration

Statement—Trading and Net Asset Value Information,” which is incorporated by reference herein, for a discussion of

the following information for the periods indicated: (i) the high and low market prices for Common Shares reported as of

the end of the day on the NYSE, (ii) the high and low net asset values of Common Shares, and (iii) the high and low

of the premium/(discount) to net asset value (expressed as a percentage) of Common Shares.

The net

asset value per Common Share, the market price, and percentage of premium/(discount) to net asset value per Common Share on July

5, 2024, was $16.64,

$15.57

and (6.43)%,

respectively. As of June 30, 2024, the Fund had 29,394,752 Common Shares outstanding and net assets of $485,760,956.

THE FUND

The Fund is a diversified, closed-end management

investment company registered under the 1940 Act. The Fund was organized as a Massachusetts business trust on December 4, 2009,

pursuant to the Declaration of Trust, which is governed by the laws of the Commonwealth of Massachusetts. The Fund’s Common

Shares are listed on the NYSE under the symbol “NBB.” Preferred Shares and/or Rights issued by the Fund may also be

listed on a securities exchange.

The following provides information

about the Fund’s outstanding Common Shares and Preferred Shares as of June 30, 2024:

| Title of Class |

|

Amount

Authorized |

|

Amount Held

by the Fund or

for its Account |

|

Amount

Outstanding |

|

| Common Shares |

|

|

Unlimited |

|

|

0 |

|

|

29,394,752 |

|

| Preferred Shares |

|

|

Unlimited |

|

|

0 |

|

|

0 |

|

USE OF PROCEEDS

Unless otherwise specified in a prospectus

supplement, the net proceeds from any offering will be invested in accordance with the Fund’s investment objectives and policies

as stated below. Pending investment, the timing of which may vary depending on the size of the investment but in no case is expected

to exceed 30 days, it is anticipated that the proceeds will be invested in short-term or long-term securities issued by the U.S.

Government or its agencies or instrumentalities or in high-quality, short-term money market instruments. See “Use of Leverage.”

THE FUND’S INVESTMENTS

Investment Objectives and Policies

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Investment Objectives” and “—Investment Policies,” as such investment

objectives and investment policies may be supplemented from time to time, which is incorporated by reference herein, for a discussion

of the Fund’s investment objectives and policies.

Portfolio Composition and Other Information

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Investment Policies—Portfolio Contents,” as such portfolio contents may be supplemented

from time to time, which is incorporated by reference herein, for a discussion of the investments principally included in the Fund’s

portfolio. More detailed information about the Fund’s portfolio investments are contained in the SAI under “The Fund’s

Investments.”

Portfolio Turnover

The Fund may engage in portfolio trading

when considered appropriate, but short-term trading will not be used as the primary means of achieving the Fund’s investment

objectives. For the fiscal year ended March 31, 2024, the Fund’s portfolio turnover rate was 2%. However, there are no limits

on the Fund’s rate of portfolio turnover, and investments may be sold without regard to length of time held when, in Nuveen

Asset Management’s opinion, investment considerations warrant such action. A higher portfolio turnover rate would result

in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Although these commissions

and expenses are not reflected in the Fund’s “Total Annual Expenses” disclosed in this the Fund’s most

recent annual report on Form N-CSR, they will be reflected in the Fund’s total return. In addition, high portfolio turnover

may result in the realization of net short-term capital gains by the Fund which, when distributed to shareholders, will be taxable

as ordinary income. See “Tax Matters.”

Other Policies

Certain investment policies specifically identified in the SAI as such are considered

fundamental and may not be changed without shareholder approval. See “Investment Restrictions” in the SAI.

USE OF LEVERAGE

The Fund uses leverage to pursue its investment

objectives. The Fund may use leverage to the extent permitted by the 1940 Act. The Fund may source leverage through a number of

methods including reverse repurchase agreements (effectively a secured borrowing), investments in inverse floating rate securities

of tender option bond trusts, the issuance of Preferred Shares, and borrowings (subject to certain investment restrictions). See

“The Fund’s Investments—Portfolio Composition—Municipal Securities—Inverse Floating Rate Securities”

and “Investment Restrictions” in the SAI. For a discussion of risks, see “Portfolio Level Risks—Inverse

Floating Rate Securities Risk” and “Fund Level and Other Risks—Reverse Repurchase Agreement Risk,” as each

such risk is contained in the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current

Investment Objectives, Investment Policies and Principal Risks of the Fund—Principal Risks of the Fund.” The Fund may

also use certain derivatives and other forms of leverage that have the economic effect of leverage by creating additional investment

exposure.

Currently, the Fund employs leverage

through its use of reverse repurchase agreements. The Fund also currently invests in residual interest certificates of tender option

bond trusts, also called inverse floating rate securities, that have the economic effect of leverage because the Fund’s

investment exposure to the underlying bonds held by the trust have been effectively financed by the trust’s issuance of

floating rate certificates. As of May 31, 2024, the Fund’s leverage through reverse repurchase agreements and through

investments in inverse floating rate securities was approximately 41% of its Managed Assets.

To date, the Fund has not issued Preferred

Shares. The Fund may in the future issue certain types of Preferred Shares to increase the Fund’s leverage.

The Fund may reduce or increase leverage

based upon changes in market conditions and anticipates that its leverage ratio will vary from time to time based upon variations

in the value of the Fund’s holdings. So long as the net rate of income received on the Fund’s investments purchased

with leverage proceeds exceeds the then current expense on any leverage, the investment of leverage proceeds will generate more

net income than if the Fund had not used leverage. If so, the excess net income will be available to pay higher distributions to

Common Shareholders. However, if the rate of net income received from the Fund’s portfolio investments purchased with leverage

is less than the then current expense on outstanding leverage, the Fund may be required to utilize other Fund assets to make expense

payments on outstanding leverage, which may result in a decline in Common Share NAV and reduced net investment income available

for distribution to Common Shareholders. See “Leverage Risk,” as such risk is contained in the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Principal Risks of the Fund—Fund Level and Other Risks.”

Following an offering of additional Common

Shares from time to time, the Fund’s leverage ratio will decrease as a result of the increase in net assets attributable

to Common Shares. The Fund’s leverage ratio may decline further to the extent that the net proceeds of an offering of Common

Shares are used to reduce the Fund’s leverage. A lower leverage ratio may result in lower (higher) returns to Common Shareholders

over a period of time to the extent that net returns on the Fund’s investment portfolio exceed (fall below) its cost of leverage

over that period, which lower (higher) returns may impact the level of the Fund’s distributions. See “Leverage Risk,”

as such risk is contained in the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder

Update—Current Investment Objectives, Investment Policies and Principal Risks of the Fund—Principal Risks of the Fund—Fund

Level and Other Risks.”

The Fund may use derivatives, such as interest

rate swaps with varying terms, in order to manage the interest rate expense associated with all or a portion of its leverage. Interest

rate swaps are bi-lateral agreements whereby parties agree to exchange future payments, typically based upon the differential of

a fixed rate and a variable rate, on a specified notional amount. Interest rate swaps can enable the Fund to effectively convert

its variable leverage expense to fixed, or vice versa. For example, if the Fund issues leverage having a short-term floating rate

of interest, the Fund could use interest rate swaps to hedge against a rise in the short-term benchmark interest rates associated

with its outstanding leverage. In doing so, the Fund would seek to achieve lower leverage costs, and thereby enhance Common Share

distributions, over an extended period, which would be the result if short-term interest rates on average exceed the fixed interest

rate over the term of the swap. To the extent the fixed swap rate is greater than short-term market interest rates on average over

the period, overall costs associated with leverage will increase (and thereby reduce distributions to Common Shareholders) than

if the Fund had not entered into the interest rate swap(s).

The Fund pays a management fee to Nuveen

Fund Advisors (which in turn pays a portion of such fee to Nuveen Asset Management) based on a percentage of Managed Assets. Managed

Assets include the proceeds realized and managed from the Fund’s use of most types of leverage (excluding the leverage exposure

attributable to the use of futures, swaps and similar derivatives). Because Managed Assets include the Fund’s net assets

as well as assets that are attributable to the Fund’s investment of the proceeds of its leverage (including instruments like

inverse floating rate securities and reverse repurchase agreements), it is anticipated that the Fund’s Managed Assets will

be greater than its net assets. Nuveen Fund Advisors will be responsible for using leverage to pursue the Fund’s investment

objectives. Nuveen Fund Advisors will base its decision regarding whether and how much leverage to use for the Fund, and the terms

of that leverage, on its assessment of whether such use of leverage is in the best interests of the Fund. However, a decision to

employ or increase leverage will have the effect, all other things being equal, of increasing Managed Assets, and in turn Nuveen

Fund Advisors’ and Nuveen Asset Management’s management fees. Thus, Nuveen Fund Advisors may have a conflict of interest

in determining whether to use or increase leverage. Nuveen Fund Advisors will seek to manage that potential conflict by using leverage

only when it determines that it would be in the best interests of the Fund and its Common Shareholders, and by periodically reviewing

the Fund’s performance with the Board, the Fund’s degree of overall use of leverage and the impact of the use of leverage

on that performance.

The 1940 Act generally defines a “senior

security” as any bond, debenture, note, or similar obligation or instrument constituting a security and evidencing indebtedness,

and any stock of a class having priority over any other class as to distribution of assets or payment of dividends; however, the

term does not include any promissory note or other evidence of indebtedness issued in consideration of any loan, extension, or

renewal thereof, made for temporary purposes and in an amount not exceeding five percent of the value of the Fund’s total

assets. A loan shall be presumed to be for temporary purposes if it is repaid within 60 days and is not extended or renewed.

Under the 1940 Act, the Fund is not permitted

to issue “senior securities representing indebtedness” if, immediately after the issuance of such senior securities

representing indebtedness, the asset coverage ratio with respect to such senior securities would be less than 300%. “Senior

securities representing indebtedness” include borrowings (including loans from financial institutions); debt securities;

and other derivative investments or transactions such as reverse repurchase agreements and investments in inverse floating rate

securities to the extent the Fund has not fully covered, segregated or earmarked cash or liquid assets having a market value at

least equal to its future obligation under such instruments. With respect to any such senior securities representing indebtedness,

asset coverage means the ratio which the value of the total assets of the Fund, less all liabilities and indebtedness not represented

by senior securities (as defined in the 1940 Act), bears to the aggregate amount of such borrowing represented by senior securities

representing indebtedness issued by the Fund.

Under the 1940 Act, the Fund is not permitted

to issue “senior securities” that are Preferred Shares if, immediately after the issuance of Preferred Shares, the

asset coverage ratio with respect to such Preferred Shares would be less than 200%. With respect to any such Preferred Shares,

asset coverage means the ratio which the value of the total assets of the Fund, less all liabilities and indebtedness not represented

by senior securities, bears to the aggregate amount of senior securities representing indebtedness of the Fund plus the aggregate

liquidation preference of such Preferred Shares.

The Fund is limited by certain investment

restrictions and may only issue senior securities that are Preferred Shares except the Fund may borrow money from a bank for temporary

or emergency purposes or for repurchase of its shares only in an amount not exceeding one-third of the Fund’s total assets

(including the amount borrowed) less the Fund’s liabilities (other than borrowings). See “Investment Restrictions”

in the SAI. These restrictions are fundamental and may not be changed without the approval of Common Shares and Preferred Shares

voting together as a single class.

If the asset coverage with respect to any

senior securities issued by the Fund declines below the required ratios discussed above (as a result of market fluctuations or

otherwise), the Fund may sell portfolio securities when it may be disadvantageous to do so.

Certain types of leverage used by the Fund

may result in the Fund being subject to certain covenants, asset coverage and, or other portfolio composition limits by its lenders,

Preferred Share purchasers, rating agencies that may rate Preferred Shares, or reverse repurchase agreement counterparties. Such

limitations may be more stringent than those imposed by the 1940 Act and may affect whether the Fund is able to maintain its desired

amount of leverage. At this time, Nuveen Fund Advisors does not believe that any such potential investment limitations will impede

it from managing the Fund’s portfolio in accordance with its investment objectives and policies.

Any borrowings of the Fund, including pursuant

to reverse repurchase agreements, will have seniority over Common Shares and Preferred Shares, and any Preferred Shares will have

seniority over Common Shares.

Obligations under reverse repurchase agreements

are fully secured by eligible portfolio securities of the Fund. In reverse repurchase agreements, the Fund retains the risk of

loss associated with the sold security. Reverse repurchase agreements also involve the risk that the purchaser fails to return

the securities as agreed upon, files for bankruptcy or becomes insolvent. Upon a bankruptcy or insolvency of a counterparty, the

Fund is considered to be an unsecured creditor with respect to excess collateral and as such the return of excess collateral may

be delayed.

So long as any Preferred Shares are outstanding,

the Fund will not be permitted to declare a dividend or distribution to Common Shareholders (other than a dividend in Common Shares

of the Fund) or purchase outstanding Common Shares unless all accumulated dividends on Preferred Shares have been paid and unless

the asset coverage, as defined in the 1940 Act, with respect to its Preferred Shares at the time of the declaration of such dividend

or distribution or at the time of such purchase would be at least 200% after giving effect to the dividend or distribution or purchase

price.

Utilization of leverage is a speculative

investment technique and involves certain risks to the Common Shareholders, including increased variability of the Fund’s

net income, distributions and NAV in relation to market changes. See “Leverage Risk,” as such risk is contained in

the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment

Objectives, Investment Policies and Principal Risks of the Fund—Principal Risks of the Fund—Fund Level and Other Risks.”

There is no assurance that the Fund will use leverage or that the Fund’s use of leverage will work as planned or achieve

its goals.

Effects of Leverage

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Effects of Leverage,” as such may be supplemented from time to time, which is incorporated

by reference herein, for a discussion of the effects of leverage.

RISK FACTORS

Risk is inherent in all investing. Investing

in any investment company security involves risk, including the risk that you may receive little or no return on your investment

or even that you may lose part or all of your investment. Please refer to the section of the Fund’s most recent annual report

on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of

the Fund—Principal Risks of the Fund,” as such principal risks may be supplemented from time to time, which is incorporated

by reference herein, for a discussion of the principal risks you should consider before making an investment in the Fund. The specific

risks applicable to a particular offering of Securities will be set forth in the related prospectus supplement.

MANAGEMENT OF THE FUND

Trustees and Officers

The Board is responsible for the management

of the Fund, including supervision of the duties performed by Nuveen Fund Advisors and Nuveen Asset Management. The names and business

addresses of the trustees and officers of the Fund and their principal occupations and other affiliations during the past five years

are set forth under “Management of the Fund” in the SAI.

Investment Adviser, Sub-Adviser and Portfolio Managers

Investment Adviser. Nuveen

Fund Advisors, LLC, the Fund’s investment adviser, is responsible for overseeing the Fund’s overall investment strategy

and implementation. Nuveen Fund Advisors offers advisory and investment management services to a broad range of investment company

clients. Nuveen Fund Advisors has overall responsibility for management of the Fund, oversees the management of the Fund’s

portfolio, manages the Fund’s business affairs and provides certain clerical, bookkeeping and other administrative services.

Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary

of Nuveen, the investment management arm of TIAA. TIAA is a life insurance company founded in 1918 by the Carnegie Foundation

for the Advancement of Teaching and is the companion organization of College Retirement Equities Fund. As of March 31, 2024, Nuveen

managed approximately $1.2 trillion in assets, of which approximately $143.2 billion was managed by Nuveen Fund Advisors.

Sub-Adviser. Nuveen Asset Management,

LLC, 333 West Wacker Drive, Chicago, Illinois 60606, serves as the Fund’s sub-adviser pursuant to a sub-advisory agreement

between Nuveen Fund Advisors and Nuveen Asset Management (the “Sub-Advisory Agreement”). Nuveen Asset Management, a

registered investment adviser, is a wholly owned subsidiary of Nuveen Fund Advisors. Nuveen Asset Management oversees day-to-day

investment operations of the Fund. Pursuant to the Sub-Advisory Agreement, Nuveen Asset Management is compensated for the services

it provides to the Fund with a portion of the management fee Nuveen Fund Advisors receives from the Fund. Nuveen Fund Advisors

and Nuveen Asset Management retain the right to reallocate investment advisory responsibilities and fees between themselves in

the future.

Portfolio Managers. Nuveen Asset

Management is responsible for the execution of specific investment strategies and day-to-day investment operations of the Fund.

Nuveen Asset Management manages the Nuveen funds using a team of analysts and portfolio managers that focuses on a specific group

of funds. The day-to-day operation of the Fund and the execution of its specific investment strategies is the primary responsibility

of Daniel J. Close and Kristen M. DeJong, the designated portfolio managers of the Fund, who have served as portfolio managers

of the Fund since 2010 and 2023, respectively.

Daniel J. Close, CFA, Managing Director at Nuveen Asset Management,

leads the municipal fixed income strategic direction and investment perspectives for Nuveen. He serves as lead portfolio manager for high

yield municipal strategies, along with tax-exempt and taxable municipal strategies that include customized institutional portfolios, open-end

funds and closed-end funds. Prior to his current role, in 2010, helped establish and expand the platform as Head of Taxable Municipals,

and he has deep experience serving clients worldwide. He helps set direction for custom fixed income solutions and asset allocation across

multi-sector portfolios. As a leading expert on taxable municipals, he serves as a trusted voice on the complexities of the taxable municipal

market. After joining Nuveen in 2000, he was a municipal fixed income research analyst covering the corporate-backed, energy, transportation

and utility sectors. He began working in the investment industry in 1998 as an analyst at Banc of America Securities. He received his

BS in Business from Miami University and his MBA from Northwestern University’s J. L. Kellogg School of Management. Mr. Close has

earned the Chartered Financial Analyst designation and is a member of the CFA Institute and the CFA Society of Chicago.

Kristen M. DeJong, CFA, Managing Director at Nuveen Asset Management,

is a portfolio manager responsible for managing taxable municipal fixed income strategies for customized institutional portfolios and

closed-end funds. She began her career in the investment industry in 2005 and joined Nuveen Asset Management in 2008. Prior to her current

role, she served as senior research analyst for Nuveen Asset Management’s municipal fixed income team, responsible for conducting

credit analysis and providing trade recommendations for separately managed accounts. Previously, she worked as a research associate at

Nuveen in the wealth management services area, where she provided research and developed reports on various topics involving retirement,

tax and investment planning. Before joining Nuveen, she was a financial advisor at Ameriprise Financial. She received her B.S. in Business

from Miami University. Ms. DeJong holds the Chartered Financial Analyst designation and is a member of the CFA Institute and the CFA Society

of Chicago.

Additional information about the Portfolio

Managers’ compensation, other accounts managed by the Portfolio Managers and the Portfolio Managers’ ownership of