Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Août 2024 - 4:35PM

Edgar (US Regulatory)

Nuveen

Taxable

Municipal

Income

Fund

Portfolio

of

Investments

June

30,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

LONG-TERM

INVESTMENTS

-

145.9%

(100.0%

of

Total

Investments)

X

–

MUNICIPAL

BONDS

-

145

.9

%

(

100

.0

%

of

Total

Investments)

X

708,546,788

ALASKA

-

0.7%

(0.4%

of

Total

Investments)

$

3,025

Port

Lions,

Alaska,

Revenue

Bonds,

Kodiak

Area

Native

Association

Project,

Taxable

Series

2022,

7.500%,

10/01/52

10/32

at

100.00

$

3,151,474

TOTAL

ALASKA

3,151,474

CALIFORNIA

-

28.7%

(19.7%

of

Total

Investments)

ABAG

Finance

Authority

for

Non-Profit

Corporations,

California,

Special

Tax

Bonds,

Community

Facilities

District

2004-1

Seismic

Safety

Improvements

690

&

942

Market

Street

Project,

Taxable

Refunding

Series

2018

:

1,950

5.100%,

9/01/28

No

Opt.

Call

1,900,198

6,125

5.500%,

9/01/38

9/28

at

100.00

5,602,920

5,500

Alameda

Corridor

Transportation

Authority,

California,

Revenue

Bonds,

Taxable

Refunding

Subordinate

Lien

Series

2024,

0.000%,

10/01/39

-

AGM

Insured

10/34

at

73.48

2,273,200

California

Infrastructure

and

Economic

Development

Bank,

Revenue

Bonds,

J.

David

Gladstone

Institutes

Project,

Taxable

Series

2019

:

2,480

4.000%,

10/01/39

10/29

at

100.00

2,122,406

8,260

4.658%,

10/01/59

10/29

at

100.00

6,846,783

1,000

California

Infrastructure

and

Economic

Development

Bank,

Revenue

Bonds,

University

of

California

San

Francisco

Neurosciences

Building,

Build

America

Taxable

Bond

Series

2010B,

6.486%,

5/15/49

No

Opt.

Call

1,084,699

8,010

(c)

California

Municipal

Finance

Authority,

Mobile

Home

Park

Revenue

Bonds,

Windsor

Mobile

Country

Club,

Taxable

Refunding

Series

20202B,

6.375%,

11/15/48

11/30

at

100.00

7,732,854

540

(c)

California

Public

Finance

Authority,

University

Housing

Revenue

Bonds,

National

Campus

Community

Development

-

Claremont

Properties

LLC

Claremont

Colleges

Project,

Taxable

Refunding

Series

2023B,

6.500%,

7/01/32

No

Opt.

Call

526,714

4,530

(d)

California

State

Public

Works

Board,

Lease

Revenue

Bonds,

Various

Capital

Projects,

Build

America

Taxable

Bond

Series

2009G-2,

8.361%,

10/01/34

No

Opt.

Call

5,433,948

7,010

California

State

University,

Systemwide

Revenue

Bonds,

Build

America

Taxable

Bond

Series

2010B,

6.484%,

11/01/41

No

Opt.

Call

7,598,467

2,000

California

State,

General

Obligation

Bonds,

Build

America

Federally

Taxable

Series

2009,

7.550%,

4/01/39

No

Opt.

Call

2,381,110

4,110

(d)

California

State,

General

Obligation

Bonds,

Various

Purpose,

Build

America

Taxable

Bond

Series

2010,

7.600%,

11/01/40

No

Opt.

Call

4,930,624

2,720

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2014B,

6.000%,

12/01/24

No

Opt.

Call

2,706,361

2,000

(c)

California

Statewide

Communities

Development

Authority,

Limited

Obligation

Improvement

Bonds,

300

Lakeside

Drive

Oakland

Property

Assessed

Clean

Energy,

Taxable

Sustainability

Green

Series

2023,

8.000%,

9/02/53

8/23

at

105.00

2,091,395

1,250

California

Statewide

Communities

Development

Authority,

Revenue

Bonds,

Front

Porch

Communities

&

Services,

Taxable

Series

2021B,

2.240%,

4/01/31

No

Opt.

Call

1,011,401

1,280

California

Statewide

Community

Development

Authority,

Health

Revenue

Bonds,

Enloe

Medical

Center,

Refunding

Series

2022B,

7.140%,

8/15/47

-

AGM

Insured

8/32

at

100.00

1,364,067

Nuveen

Taxable

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

June

30,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

CALIFORNIA

(continued)

$

2,025

Chino

Public

Financing

Authority,

California,

Local

Agency

Bonds,

Refunding

Series

2021A,

4.001%,

9/01/38

9/31

at

100.00

$

1,773,538

5,000

Golden

State

Tobacco

Securitization

Corporation,

California,

Enhanced

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Taxable

Series

2021B,

3.293%,

6/01/42

6/31

at

100.00

3,895,700

2,000

Golden

State

Tobacco

Securitization

Corporation,

California,

Tobacco

Settlement

Asset-Backed

Bonds,

Taxable

Senior

Series

2021A-1,

3.714%,

6/01/41

12/31

at

100.00

1,531,711

Los

Angeles

Community

College

District,

California,

General

Obligation

Bonds,

Build

America

Taxable

Bonds,

Series

2010

:

10,000

(e)

6.600%,

8/01/42,

(UB)

No

Opt.

Call

11,061,143

7,500

(d),(e)

6.600%,

8/01/42

No

Opt.

Call

8,295,857

Los

Angeles

Community

College

District,

Los

Angeles

County,

California,

General

Obligation

Bonds,

Tender

Option

Bond

Trust

2016-XTG002,

Formerly

Tender

Option

Bond

Trust

TN027

:

2,000

(c),(e)

9.439%,

8/01/49,

(IF)

No

Opt.

Call

3,532,491

Los

Angeles

County

Public

Works

Financing

Authority,

California,

Lease

Revenue

Bonds,

Mulitple

Capital

Projects

I,

Build

America

Taxable

Bond

Series

2010B

:

2,030

(d)

7.488%,

8/01/33

No

Opt.

Call

2,211,677

11,380

(d)

7.618%,

8/01/40

No

Opt.

Call

13,459,643

2,960

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Build

America

Taxable

Bonds,

Series

2009C,

6.582%,

5/15/39

No

Opt.

Call

3,192,379

1,785

(d)

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Federally

Taxable

-

Direct

Payment

-

Build

America

Bonds,

Series

2010D,

6.574%,

7/01/45

No

Opt.

Call

1,984,520

4,000

(c),(e)

Los

Angeles

Department

of

Water

and

Power,

California,

Water

System

Revenue

Bonds,

Tender

Option

Bond

Trust

2016-XFT906,

8.165%,

7/01/50,

(IF)

No

Opt.

Call

6,508,866

4,180

(d)

Sacramento

Public

Financing

Authority,

California,

Lease

Revenue

Bonds,

Golden

1

Center,

Series

2015,

5.637%,

4/01/50

No

Opt.

Call

4,319,353

2,200

San

Diego

County

Regional

Transportation

Commission,

California,

Sales

Tax

Revenue

Bonds,

Build

America

Taxable

Bonds

Series

2010A,

5.911%,

4/01/48

No

Opt.

Call

2,287,936

1,500

San

Francisco

City

and

County

Public

Utilities

Commission,

California,

Water

Revenue

Bonds,

Taxable

Build

America

Bond

Series

2010G,

6.950%,

11/01/50

No

Opt.

Call

1,694,253

1,000

San

Francisco

City

and

County

Redevelopment

Financing

Authority,

California,

Tax

Allocation

Revenue

Bonds,

San

Francisco

Redevelopment

Projects,

Taxable

Series

2009E,

8.406%,

8/01/39

No

Opt.

Call

1,226,511

San

Francisco

City

and

County,

California,

Certificates

of

Participation,

525

Golden

Gate

Avenue,

San

Francisco

Public

Utilities

Commission

Office

Project,

Tender

Option

Bond

2016-XFT901,

Formerly

Tender

Option

Bond

Trust

B001

:

4,000

(c),(e)

8.040%,

11/01/41,

(IF)

No

Opt.

Call

5,579,154

2,000

(c),(e)

8.040%,

11/01/41,

(IF)

No

Opt.

Call

2,789,577

1,270

(c)

San

Francisco

City

and

County,

California,

Development

Special

Tax

Bonds,

Mission

Rock

Facilities

and

Services

Special

Tax

District

2020-1,

Taxable

Series

2021B,

4.000%,

9/01/31

No

Opt.

Call

1,167,468

2,000

(d)

University

of

California

Regents,

Medical

Center

Pooled

Revenue

Bonds,

Taxable

Build

America

Bond

Series

2010H,

6.548%,

5/15/48

No

Opt.

Call

2,198,176

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

CALIFORNIA

(continued)

$

4,260

Vernon,

California,

Electric

System

Revenue

Bonds,

Series

2008A,

8.590%,

7/01/38

No

Opt.

Call

$

5,042,821

TOTAL

CALIFORNIA

139,359,921

COLORADO

-

1.9%

(1.3%

of

Total

Investments)

4,335

(d)

Colorado

Bridge

Enterprise,

Revenue

Bonds,

Federally

Taxable

Build

America

Series

2010A,

6.078%,

12/01/40

No

Opt.

Call

4,554,569

3,100

(d)

Denver

School

District

1,

Colorado,

General

Obligation

Bonds,

Build

America

Taxable

Bonds,

Series

2009C,

5.664%,

12/01/33

No

Opt.

Call

3,152,161

1,230

(d)

Regional

Transportation

District,

Colorado,

Sales

Tax

Revenue

Bonds,

Fastracks

Project,

Build

America

Series

2010B,

5.844%,

11/01/50

No

Opt.

Call

1,287,749

TOTAL

COLORADO

8,994,479

DISTRICT

OF

COLUMBIA

-

3.8%

(2.6%

of

Total

Investments)

Metropolitan

Washington

Airports

Authority,

District

of

Columbia,

Dulles

Toll

Road

Revenue

Bonds,

Dulles

Metrorail

&

Capital

improvement

Projects,

Second

Senior

Lien,

Build

America

Bond

Series

2009D

:

14,365

(d)

7.462%,

10/01/46

No

Opt.

Call

17,363,451

1,000

7.462%,

10/01/46

-

AGM

Insured

No

Opt.

Call

1,218,231

TOTAL

DISTRICT

OF

COLUMBIA

18,581,682

FLORIDA

-

4.6%

(3.1%

of

Total

Investments)

15,515

(c)

Charlotte

County

Industrial

Development

Authority,

Florida,

Utility

System

Revenue

Bonds,

Town

&

Country

Utilities

Project,

Taxable

Series

2021B,

5.000%,

10/01/36

10/31

at

100.00

13,767,971

1,400

(c)

Miami,

Florida,

Special

Obligation

Revenue

Bonds,

Street

&

Sidewalk

Improvement

Program,

Taxable

Refunding

Series

2018B,

4.808%,

1/01/39

-

AGM

Insured

1/28

at

100.00

1,321,139

6,570

Miami-Dade

County,

Florida,

Seaport

Revenue

Bonds,

Taxable

Series

2023,

6.224%,

11/01/55

11/33

at

100.00

6,992,388

TOTAL

FLORIDA

22,081,498

GEORGIA

-

7.4%

(5.1%

of

Total

Investments)

2,264

Georgia

Municipal

Electric

Authority,

Plant

Vogtle

Units

3

&

4

Project

M

Bonds,

Taxable

Build

America

Bonds

Series

2010A,

6.655%,

4/01/57

No

Opt.

Call

2,471,775

Georgia

Municipal

Electric

Authority,

Plant

Vogtle

Units

3

&

4

Project

P

Bonds,

Refunding

Taxable

Build

America

Bonds

Series

2010A

:

19,222

(d)

7.055%,

4/01/57

No

Opt.

Call

21,468,023

5,668

7.055%,

4/01/57

-

AGM

Insured

No

Opt.

Call

6,501,105

5,012

Municipal

Electric

Authority

of

Georgia,

Plant

Vogtle

Units

3

&

4

Project

J

Bonds,

Taxable

Build

America

Bonds

Series

2010A,

6.637%,

4/01/57

No

Opt.

Call

5,461,016

TOTAL

GEORGIA

35,901,919

ILLINOIS

-

12.6%

(8.7%

of

Total

Investments)

2,210

Bellwood

Illinois,

Tax

Increment

Revenue

Bonds,

Senior

Apartments

Project,

Series

2022,

6.000%,

12/01/50

12/32

at

100.00

2,168,415

4,030

(d)

Chicago

Board

of

Education,

Illinois,

General

Obligation

Bonds,

Dedicated

Revenues,

Series

2010C,

6.319%,

11/01/29

-

BAM

Insured

No

Opt.

Call

4,214,462

12,715

(d)

Chicago

Transit

Authority,

Illinois,

Sales

Tax

Receipts

Revenue

Bonds,

Federally

Taxable

Build

America

Bonds,

Series

2010B,

6.200%,

12/01/40

No

Opt.

Call

13,360,945

1,000

Chicago

Transit

Authority,

Illinois,

Sales

Tax

Receipts

Revenue

Bonds,

Taxable

Refunding

Series

2020B,

3.912%,

12/01/40

No

Opt.

Call

847,423

355

Chicago,

Illinois,

General

Airport

Revenue

Bonds,

O'Hare

International

Airport,

Third

Lien,

Taxable

Build

America

Bond

Series

2010B,

6.395%,

1/01/40

No

Opt.

Call

382,309

Nuveen

Taxable

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

June

30,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

ILLINOIS

(continued)

$

1,935

Chicago,

Illinois,

Wastewater

Transmission

Revenue

Bonds,

Build

America

Taxable

Bond

Series

2010B,

6.900%,

1/01/40

No

Opt.

Call

$

2,134,157

3,495

Chicago,

Illinois,

Water

Revenue

Bonds,

Taxable

Second

Lien

Series

2010B,

6.742%,

11/01/40

No

Opt.

Call

3,846,016

1,950

Cook

County,

Illinois,

General

Obligation

Bonds,

Build

America

Taxable

Bonds,

Series

2010D,

6.229%,

11/15/34

No

Opt.

Call

2,053,481

2,980

(c)

Illinois

International

Port

District,

Revenue

Bonds,

Taxable

Refunding

Series

2020,

5.000%,

1/01/35

1/26

at

101.00

2,675,165

1,714

Illinois

State,

General

Obligation

Bonds,

Build

America

Taxable

Bonds,

Series

2010-5,

7.350%,

7/01/35

No

Opt.

Call

1,840,748

11,876

(d)

Illinois

State,

General

Obligation

Bonds,

Taxable

Build

America

Bonds,

Series

2010-3,

6.725%,

4/01/35

No

Opt.

Call

12,487,154

10,312

(d)

Illinois

Toll

Highway

Authority,

Toll

Highway

Revenue

Bonds,

Taxable

Build

America

Bond

Senior

Lien

Series

2009A,

6.184%,

1/01/34

No

Opt.

Call

10,802,040

2,420

(d)

Illinois

Toll

Highway

Authority,

Toll

Highway

Revenue

Bonds,

Taxable

Build

America

Bond

Senior

Lien

Series

2009B,

5.851%,

12/01/34

No

Opt.

Call

2,476,414

400

Northern

Illinois

Municipal

Power

Agency, Power

Project

Revenue

Bonds,

Prairie

State

Project,

Build

America

Bond

Series

2009C,

6.859%,

1/01/39

No

Opt.

Call

430,658

1,375

Northern

Illinois

Municipal

Power

Agency, Power

Project

Revenue

Bonds,

Prairie

State

Project,

Build

America

Taxable

Bond

Series

2010A,

7.820%,

1/01/40

No

Opt.

Call

1,623,360

TOTAL

ILLINOIS

61,342,747

INDIANA

-

1.2%

(0.8%

of

Total

Investments)

1,000

Indianapolis

Local

Public

Improvement

Bond

Bank,

Indiana,

Build

America

Taxable

Bonds,

Series

2010B-2,

6.116%,

1/15/40

No

Opt.

Call

1,050,080

5,000

Knox

County,

Indiana,

Economic

Development

Revenue

Bonds,

Good

Samaritan

Hospital

Project,

Taxable

Series

2012B,

5.900%,

4/01/34

No

Opt.

Call

4,841,549

TOTAL

INDIANA

5,891,629

KENTUCKY

-

1.6%

(1.1%

of

Total

Investments)

5

Kentucky

Municipal

Power

Agency,

Power

System

Revenue

Bonds,

Prairie

State

Project,

Build

America

Bond

Series

2010B,

6.490%,

9/01/37

-

AGM

Insured

7/24

at

100.00

5,003

5,450

(d)

Louisville

and

Jefferson

County

Metropolitan

Sewer

District,

Kentucky,

Sewer

and

Drainage

System

Revenue

Bonds,

Build

America

Taxable

Bonds

Series

2010A,

6.250%,

5/15/43

No

Opt.

Call

5,834,574

2,170

Newport,

Kentucky,

Industrial

Building

Revenue

Bonds,

South

Beach

1,

LLC

Project,

Taxable

Refunding

Series

2022,

4.125%,

3/01/33

No

Opt.

Call

1,967,939

TOTAL

KENTUCKY

7,807,516

MARYLAND

-

3.1%

(2.2%

of

Total

Investments)

3,500

Maryland

Economic

Development

Corporation,

Economic

Development

Revenue

Bonds,

Terminal

Project,

Refunding

Series

2017B,

4.550%,

6/01/35

No

Opt.

Call

3,193,201

Maryland

Economic

Development

Corporation,

Parking

Facilities

Revenue

Bonds

Baltimore

City

Project,

Senior

Parking

Facilities

Revenue,

Series

2018B

:

1,500

4.580%,

6/01/33

6/28

at

100.00

1,380,739

2,945

4.790%,

6/01/38

6/28

at

100.00

2,577,037

4,285

5.050%,

6/01/43

6/28

at

100.00

3,624,969

5,350

5.320%,

6/01/51

6/28

at

100.00

4,497,046

TOTAL

MARYLAND

15,272,992

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

MASSACHUSETTS

-

0.9%

(0.6%

of

Total

Investments)

$

4,000

(c),(e)

Massachusetts,

Transporation

Fund

Revenue

Bonds,

Accelerated

Bridge

Program,

Tender

Option

Bond

Trust

2016-XFT907,

4.136%,

6/01/40,

(IF)

No

Opt.

Call

$

4,304,988

TOTAL

MASSACHUSETTS

4,304,988

MINNESOTA

-

0.4%

(0.3%

of

Total

Investments)

1,855

Western

Minnesota

Municipal

Power

Agency,

Minnesota,

Power

Supply

Revenue

Bonds,

Build

America

Taxable

Bond

Series

2010C,

6.770%,

1/01/46

No

Opt.

Call

2,075,891

TOTAL

MINNESOTA

2,075,891

MISSISSIPPI

-

0.4%

(0.3%

of

Total

Investments)

2,085

Mississippi

State,

General

Obligation

Bonds,

Taxable

Build

America

Bond

Series

2010F,

5.245%,

11/01/34

No

Opt.

Call

2,073,152

TOTAL

MISSISSIPPI

2,073,152

MISSOURI

-

0.2%

(0.2%

of

Total

Investments)

1,000

Missouri

Joint

Municipal

Electric

Utility

Commission,

Power

Project

Revenue

Bonds,

Pairie

State

Power

Project,

Federally

Taxable

Build

America

Bonds

-

Direct

Pay,

Series

2009A,

6.890%,

1/01/42

No

Opt.

Call

1,110,513

TOTAL

MISSOURI

1,110,513

NEW

HAMPSHIRE

-

0.4%

(0.3%

of

Total

Investments)

2,000

(c)

National

Finance

Authority,

New

Hampshire,

Utility

Revenue

Bonds,

Wheeling

Power

Company

Project,

Taxable

Refunding

Series

2024A,

6.890%,

4/01/34

1/34

at

100.00

2,050,049

TOTAL

NEW

HAMPSHIRE

2,050,049

NEW

JERSEY

-

4.1%

(2.8%

of

Total

Investments)

3,320

New

Jersey

Educational

Facilities

Authority,

Revenue

Bonds,

Seton

Hall

University,

Taxable

Series

2020D,

3.958%,

7/01/48

-

AGM

Insured

7/30

at

100.00

2,605,723

3,000

New

Jersey

Turnpike

Authority,

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2009F,

7.414%,

1/01/40

No

Opt.

Call

3,523,804

8,805

New

Jersey

Turnpike

Authority,

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2010A,

7.102%,

1/01/41

No

Opt.

Call

10,071,255

2,000

Rutgers

State

University,

New

Jersey,

Revenue

Bonds,

Taxable

Build

America

Bond

Series

2010H,

5.665%,

5/01/40

No

Opt.

Call

2,012,675

870

South

Jersey

Port

Corporation,

New

Jersey,

Marine

Terminal

Revenue

Bonds,

Taxable

Build

America

Bond

Series

2009P-3,

7.365%,

1/01/40

No

Opt.

Call

972,937

530

South

Jersey

Transportation

Authority,

New

Jersey,

Transportation

System

Revenue

Bonds,

Build

America

Bond

Series

2009A-5,

7.000%,

11/01/38

No

Opt.

Call

573,656

TOTAL

NEW

JERSEY

19,760,050

NEW

YORK

-

26.5%

(18.2%

of

Total

Investments)

420

Babylon

Local

Development

Corporation

II,

New

York,

Education

Revenue

Bonds,

The

Academy

Charter

School

Project,

Taxable

Series

2023B,

7.250%,

2/01/27

No

Opt.

Call

420,295

Dormitory

Authority

of

the

State

of

New

York,

Revenue

Bonds,

Montefiore

Obligated

Group,

Taxable

Series

2018B

:

10,000

5.096%,

8/01/34

No

Opt.

Call

9,276,084

1,415

4.946%,

8/01/48

-

AGM

Insured

8/28

at

100.00

1,277,574

25,000

Dormitory

Authority

of

the

State

of

New

York,

State

Personal

Income

Tax

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2010D,

5.600%,

3/15/40,

(UB)

No

Opt.

Call

25,222,238

Dormitory

Authority

of

the

State

of

New

York,

State

Personal

Income

Tax

Revenue

Bonds,

Tender

Option

Bond

Trust

30020

:

Nuveen

Taxable

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

June

30,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

NEW

YORK

(continued)

$

2,000

(c)

3.746%,

3/15/40,

(IF)

No

Opt.

Call

$

2,088,895

5,100

(d)

Long

Island

Power

Authority,

New

York,

Electric

System

Revenue

Bonds,

Build

America

Taxable

Bond

Series

2010B,

5.850%,

5/01/41

No

Opt.

Call

5,231,501

680

Metropolitan

Transportation

Authority,

New

York,

Dedicated

Tax

Fund

Bonds,

Build

America

Taxable

Bonds,

Series

2010C,

7.336%,

11/15/39

No

Opt.

Call

806,663

7,000

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2009A-1,

5.871%,

11/15/39

No

Opt.

Call

7,214,072

2,090

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2010B-1,

6.548%,

11/15/31

No

Opt.

Call

2,200,592

10,925

(d)

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Federally

Taxable

Build

America

Bonds,

Series

2010E,

6.814%,

11/15/40

No

Opt.

Call

11,988,608

11,390

(d)

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Federally

Taxable

Issuer

Subsidy

Build

America

Bonds,

Series

2010A,

6.668%,

11/15/39

No

Opt.

Call

12,368,853

440

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Taxable

Green

Climate

Certified

Series

2020C-2,

5.175%,

11/15/49

No

Opt.

Call

397,488

3,675

Monroe

County

Industrial

Development

Corporation,

New

York,

Revenue

Bonds,

Rochester

Regional

Health

Project,

Taxable

Series

2020B,

4.600%,

12/01/46

No

Opt.

Call

2,963,726

New

York

City

Industrial

Development

Agency,

New

York,

Installment

Purchase

and

Lease

Revenue

Bonds,

Queens

Baseball

Stadium

Project,

Series

2006

:

2,000

6.027%,

1/01/46

-

AGM

Insured

No

Opt.

Call

2,045,061

890

(c)

6.027%,

1/01/46

-

AMBAC

Insured

No

Opt.

Call

910,052

475

(c)

New

York

City

Industrial

Development

Authority,

New

York,

Rental

Revenue

Bonds,

Yankee

Stadium

Project,

Taxable

Series

2009,

11.000%,

3/01/29

-

AGM

Insured

No

Opt.

Call

541,574

1,500

(d)

New

York

City

Municipal

Water

Finance

Authority,

New

York,

Water

and

Sewer

System

Revenue

Bonds,

Second

Generation

Resolution,

Build

America

Taxable

Bonds,

Fiscal

2011

Series

AA,

5.440%,

6/15/43

No

Opt.

Call

1,457,054

2,595

(e)

New

York

City

Municipal

Water

Finance

Authority,

New

York,

Water

and

Sewer

System

Revenue

Bonds,

Second

Generation

Resolution,

Build

America

Taxable

Bonds,

Series

2010DD,

5.952%,

6/15/42

No

Opt.

Call

2,685,569

2,025

(e)

New

York

City

Municipal

Water

Finance

Authority,

New

York,

Water

and

Sewer

System

Revenue

Bonds,

Second

Generation

Resolution,

Build

America

Taxable

Bonds,

Series

2010DD,

5.952%,

6/15/42,

(UB)

No

Opt.

Call

2,095,675

New

York

City

Municipal

Water

Finance

Authority,

New

York,

Water

and

Sewer

System

Revenue

Bonds,

Second

Generation

Resolution,

Taxable

Tender

Option

Bonds

Trust

T30001-2

:

3,595

(c),(e)

5.595%,

6/15/44,

(IF)

No

Opt.

Call

3,939,759

10,520

(d)

New

York

City

Transitional

Finance

Authority,

New

York,

Building

Aid

Revenue

Bonds,

Fiscal

2011

Taxable

Build

America

Bond

Series

2010S-1B,

6.828%,

7/15/40

No

Opt.

Call

11,571,216

10,000

(d)

New

York

City

Transitional

Finance

Authority,

New

York,

Future

Tax

Secured

Bonds,

Build

America

Taxable

Bonds,

Series

2010G-1,

5.467%,

5/01/40

No

Opt.

Call

9,938,089

Westchester

County

Health

Care

Corporation,

New

York,

Senior

Lien

Revenue

Bonds, Refunding

Series

2010A

:

5,495

8.572%,

11/01/40

No

Opt.

Call

5,355,228

3,450

8.572%,

11/01/40

No

Opt.

Call

3,362,537

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

NEW

YORK

(continued)

$

2,970

Westchester

County

Health

Care

Corporation,

New

York,

Senior

Lien

Revenue

Bonds,

Series

2010-C1,

8.572%,

11/01/40

-

AGM

Insured

No

Opt.

Call

$

3,448,270

TOTAL

NEW

YORK

128,806,673

OHIO

-

6.4%

(4.4%

of

Total

Investments)

American

Municipal

Power

Inc.,

Ohio,

Combined

Hydroelectric

Projects

Revenue

Bonds,

Build

America

Bond

Series

2010B

:

6,350

(d)

7.834%,

2/15/41

No

Opt.

Call

7,678,084

1,000

8.084%,

2/15/50

No

Opt.

Call

1,305,501

1,475

American

Municipal

Power

Inc.,

Ohio,

Meldahl

Hydroelectric

Projects

Revenue

Bonds,

Build

America

Bond

Series

2010B,

7.499%,

2/15/50

No

Opt.

Call

1,761,482

7,040

American

Municipal

Power

Ohio

Inc.,

Prairie

State

Energy

Campus

Project

Revenue

Bonds,

Build

America

Bond

Series

2009C,

6.053%,

2/15/43

No

Opt.

Call

7,316,150

1,700

Cincinnati

City

School

District,

Ohio,

Certificates

of

Participation,

School

Energy

Conservation

Improvement

Project,

Taxable

Series

2012,

5.150%,

6/15/32

No

Opt.

Call

1,690,014

2,300

Columbus

Regional

Airport

Authority,

Ohio,

Customer

Facility

Charge

Revenue

Bonds,

Taxable

Series

2019,

4.199%,

12/15/48

12/29

at

100.00

1,899,621

10,575

Port

of

Greater

Cincinnati

Development

Authority,

Ohio,

Special

Obligation

Tax

Increment

Financing

Revenue

Bonds,

Cooperative

Township

Public

Parking

Project,

Kenwood

Collection

Redevelopment,

Refunding

Senior

Lien

Series

2016A,

6.600%,

1/01/39

1/26

at

100.00

9,520,780

TOTAL

OHIO

31,171,632

OKLAHOMA

-

4.1%

(2.8%

of

Total

Investments)

21,200

Oklahoma

Development

Finance

Authority,

Health

System

Revenue

Bonds,

OU

Medicine

Project,

Taxable

Series

2018D,

5.450%,

8/15/28

No

Opt.

Call

19,965,204

TOTAL

OKLAHOMA

19,965,204

OREGON

-

1.1%

(0.7%

of

Total

Investments)

Hillsboro

Economic

Development

Council,

Oregon,

Tax

Increment

Revenue

Bonds,

North

Hillsboro

Industrial

Renew

Area,

Taxable

Series

2024

:

1,590

5.815%,

6/01/38

-

AGM

Insured

6/33

at

100.00

1,627,456

1,600

5.865%,

6/01/39

-

AGM

Insured

6/33

at

100.00

1,637,411

2,450

Port

of

Portland,

Oregon,

Portland

International

Airport

Customer

Facility

Charge

Revenue

Bonds,

Taxable

Series

2019,

4.237%,

7/01/49

7/29

at

100.00

2,033,949

TOTAL

OREGON

5,298,816

PENNSYLVANIA

-

1.3%

(0.9%

of

Total

Investments)

1,915

Commonwealth

Financing

Authority,

Pennsylvania,

State

Appropriation

Lease

Bonds,

Build

America

Taxable

Bonds,

Series

2009D,

6.218%,

6/01/39

No

Opt.

Call

2,016,751

1,640

Pennsylvania

Turnpike

Commission,

Turnpike

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2009A,

6.105%,

12/01/39

No

Opt.

Call

1,741,300

2,715

(d)

Pennsylvania

Turnpike

Commission,

Turnpike

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2010B,

5.511%,

12/01/45

No

Opt.

Call

2,676,189

TOTAL

PENNSYLVANIA

6,434,240

SOUTH

CAROLINA

-

3.4%

(2.3%

of

Total

Investments)

South

Carolina

Public

Service

Authority,

Electric

System

Revenue

Bonds,

Santee

Cooper,

Federally

Taxable

Build

America

Series

2010C

:

8,985

6.454%,

1/01/50,

(UB)

No

Opt.

Call

9,597,515

2,000

6.454%,

1/01/50

-

AGM

Insured

No

Opt.

Call

2,195,141

1,550

(e)

6.454%,

1/01/50

No

Opt.

Call

1,655,665

Nuveen

Taxable

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

June

30,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

SOUTH

CAROLINA

(continued)

$

205

(c)

South

Carolina

Public

Service

Authority,

Electric

System

Revenue

Bonds,

Santee

Cooper,

Federally

Taxable

Build

America

Tender

Option

Bond

Trust

T30002,

7.520%,

1/01/50,

(IF)

No

Opt.

Call

$

274,875

2,585

South

Carolina

Public

Service

Authority,

Santee

Cooper

Revenue

Obligations,

Refunding

Series

2013C,

5.784%,

12/01/41

-

AGM

Insured

No

Opt.

Call

2,662,304

TOTAL

SOUTH

CAROLINA

16,385,500

TENNESSEE

-

4.9%

(3.3%

of

Total

Investments)

1,500

Jackson,

Tennessee,

Hospital

Revenue

Bonds,

Jackson-Madison

County

General

Hospital

Project,

Series

2018B,

5.308%,

4/01/48

No

Opt.

Call

1,449,340

Memphis/Shelby

County

Economic

Development

Growth

Engine

Industrial

Development

Board,

Tennessee,

Tax

Increment

Revenue

Bonds,

Graceland

Project,

Senior

Taxable

Series

2017B

:

415

4.700%,

7/01/27

No

Opt.

Call

391,854

7,915

5.200%,

7/01/37

7/27

at

100.00

6,630,844

1,515

5.450%,

7/01/45

7/27

at

100.00

1,145,329

5,010

(d)

Metropolitan

Government

Nashville

&

Davidson

County

Convention

Center

Authority,

Tennessee,

Tourism

Tax

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

2010A-2,

7.431%,

7/01/43

No

Opt.

Call

5,911,031

7,350

(d)

Metropolitan

Government

Nashville

&

Davidson

County

Convention

Center

Authority,

Tennessee,

Tourism

Tax

Revenue

Bonds,

Build

America

Taxable

Bonds,

Subordinate

Lien

Series

2010B,

6.731%,

7/01/43

No

Opt.

Call

8,019,921

TOTAL

TENNESSEE

23,548,319

TEXAS

-

10.4%

(7.1%

of

Total

Investments)

2,520

Dallas

Area

Rapid

Transit,

Texas,

Sales

Tax

Revenue

Bonds,

Taxable

Build

America

Bonds,

Series

2009B,

5.999%,

12/01/44

No

Opt.

Call

2,615,813

16,460

(d)

Dallas

Convention

Center

Hotel

Development

Corporation,

Texas,

Hotel

Revenue

Bonds,

Build

America

Taxable

Bonds,

Series

09B,

7.088%,

1/01/42

No

Opt.

Call

18,516,324

1,000

Fort

Worth,

Tarrant,

Denton,

Parker,

Johnson,

and

Wise

Counties,

Texas,

Special

Tax

Revenue

Bonds,

Taxable

Series

2017B,

4.238%,

3/01/47

9/24

at

100.00

841,373

1,500

Greater

Texas

Cultural

Educational

Facilities

Finance

Corporation,

Texas,

Revenue

Bonds,

Biomedical

Research

Institute

Taxable

Series

2024B,

6.250%,

6/01/37,

(WI/DD)

No

Opt.

Call

1,476,978

1,925

Houston,

Texas,

Airport

System

Special

Facilities

Revenue

Bonds,

Consolidated

Rental

Car

Facility

Project,

Taxable

Series

2001,

6.880%,

1/01/28

-

NPFG

Insured

No

Opt.

Call

1,983,875

10,285

(d)

North

Texas

Tollway

Authority,

System

Revenue

Bonds,

Taxble

Build

America

Bond

Series

2009B,

6.718%,

1/01/49

No

Opt.

Call

11,721,666

San

Antonio,

Texas,

Customer

Facility

Charge

Revenue

Bonds,

Rental

Car

Special

Facilities

Project,

Series

2015

:

7,545

5.671%,

7/01/35

7/25

at

100.00

7,548,351

2,000

5.871%,

7/01/45

7/25

at

100.00

1,939,970

1,000

San

Antonio,

Texas,

Electric

and

Gas

System

Revenue

Bonds,

Junior

Lien,

Build

America

Taxable

Bond

Series

2010A,

5.808%,

2/01/41

No

Opt.

Call

1,021,558

10

San

Antonio,

Texas,

Electric

and

Gas

System

Revenue

Bonds,

Series

2012,

4.427%,

2/01/42

No

Opt.

Call

9,432

Tarrant

County

Cultural

Education

Facilities

Finance

Corporation,

Texas,

Hospital

Revenue

Bonds,

Hendrick

Medical

Center,

Taxable

Series

2021

:

1,000

3.292%,

9/01/40

-

AGM

Insured

9/30

at

100.00

789,796

1,400

3.422%,

9/01/50

-

AGM

Insured

9/30

at

100.00

987,270

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

TEXAS

(continued)

$

1,000

Texas

Private

Activity

Bond

Surface

Transporation

Corporation,

Revenue

Bonds,

NTE

Mobility

Partners

LLC

North

Tarrant

Express

Managed

Lanes

Project,

Taxable

Refunding

Senior

Lien

Series

2019B,

3.922%,

12/31/49

No

Opt.

Call

$

821,900

TOTAL

TEXAS

50,274,306

UTAH

-

1.5%

(1.0%

of

Total

Investments)

8,500

(c)

Salt

Lake

County,

Utah,

Convention

Hotel

Revenue

Bonds,

Taxable

Series

2019,

5.750%,

10/01/47

10/29

at

100.00

7,406,467

TOTAL

UTAH

7,406,467

VIRGINIA

-

3.2%

(2.2%

of

Total

Investments)

1,840

(c)

Fredericksburg

Economic

Development

Authority,

Virginia,

Revenue

Bonds,

Fredericksburg

Stadium

Project,

Taxable

Series

2019A,

5.500%,

9/01/49

9/29

at

100.00

1,739,413

10,380

Tobacco

Settlement

Financing

Corporation

of

Virginia,

Tobacco

Settlement

Asset

Backed

Bonds,

Refunding

Senior

Lien

Series

2007A,

6.706%,

6/01/46

6/25

at

100.00

8,788,218

5,160

(c)

Virginia

Small

Business

Finance

Authority,

Tourism

Development

Financing

Program

Revenue

Bonds,

Downtown

Norfolk

and

Virginia

Beach

Oceanfront

Hotel

Projects,

Series

2018B,

12.000%,

4/01/48

4/28

at

117.16

5,186,155

TOTAL

VIRGINIA

15,713,786

WASHINGTON

-

6.9%

(4.7%

of

Total

Investments)

4,000

(c),(e)

Seattle,

Washington,

Municipal

Light

and

Power

Revenue

Bonds,

Federally

Taxable

Build

America

Bonds,

Tender

Option

Bond

Trust

2016-XFT905,

Formerly

Tender

Option

Bond

Trust

T0001,

3.055%,

2/01/40,

(IF)

No

Opt.

Call

4,244,494

27,155

(d)

Washington

State

Convention

Center

Public

Facilities

District,

Lodging

Tax

Revenue

Bonds,

Build

America

Taxable

Bond

Series

2010B,

6.790%,

7/01/40

No

Opt.

Call

29,266,971

TOTAL

WASHINGTON

33,511,465

WEST

VIRGINIA

-

3.2%

(2.2%

of

Total

Investments)

Tobacco

Settlement

Finance

Authority,

West

Virginia,

Tobacco

Settlement

Asset-Backed

Bonds,

Taxable

Refunding

Class

1

Senior

Series

2020A

:

8,500

4.006%,

6/01/40

12/30

at

100.00

6,950,729

10,800

4.306%,

6/01/49

12/30

at

100.00

8,723,496

TOTAL

WEST

VIRGINIA

15,674,225

WISCONSIN

-

1.0%

(0.7%

of

Total

Investments)

480

(c)

Fond

du

Lac

County,

Wisconsin,

Revenue

Bonds,

Bug

Tussel

1

LLC

Project,

Taxable

Social

Series

2022A,

5.569%,

11/01/51

-

BAM

Insured

11/31

at

100.00

451,420

2,360

(c)

Fond

du

Lac

County,

Wisconsin,

Revenue

Bonds,

Bug

Tussel

1

LLC

Project,

Taxable

Social

Series

2023,

6.434%,

11/01/52

-

BAM

Insured

11/33

at

100.00

2,424,117

2,000

Wisconsin

Center

District,

Dedicated

Tax

Revenue

Bonds,

Supported

by

State

Moral

Obligation

Taxable

Senior

Series

2020A,

4.473%,

12/15/47

-

AGM

Insured

12/30

at

100.00

1,720,118

TOTAL

WISCONSIN

4,595,655

TOTAL

MUNICIPAL

BONDS

(cost

$746,820,276)

708,546,788

TOTAL

LONG-TERM

INVESTMENTS

(cost

$746,820,276)

708,546,788

FLOATING

RATE

OBLIGATIONS

-

(7.6)%

(

36,810,000

)

REVERSE

REPURCHASE

AGREEMENTS,

INCLUDING

ACCRUED

INTEREST

-

(40.9)%(f)

(

198,496,857

)

OTHER

ASSETS

&

LIABILITIES,

NET

- 2.6%

12,521,134

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

485,761,065

Nuveen

Taxable

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

June

30,

2024

(Unaudited)

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Futures

Contracts

-

Short

Description

Number

of

Contracts

Expiration

Date

Notional

Amount

Value

Unrealized

Appreciation

(Depreciation)

U.S.

Treasury

Ultra

Bond

(973)

9/24

$

(

120,189,141

)

$

(

121,959,469

)

$

(

1,770,328

)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

708,546,788

$

–

$

708,546,788

Investments

in

Derivatives:

Futures

Contracts*

(

1,770,328

)

–

–

(

1,770,328

)

Total

$

(

1,770,328

)

$

708,546,788

$

–

$

706,776,460

*

Represents

net

unrealized

appreciation

(depreciation).

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(c)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$83,255,052

or

11.8%

of

Total

Investments.

(d)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$241,256,635

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(e)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

inverse

floating

rate

transactions.

(f)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

28.0%.

IF

Inverse

floating

rate

security

issued

by

a

tender

option

bond

(“TOB”)

trust,

the

interest

rate

on

which

varies

inversely

with

the

Securities

Industry

Financial

Markets

Association

(SIFMA)

short-term

rate,

which

resets

weekly,

or

a

similar

short-term

rate,

and

is

reduced

by

the

expenses

related

to

the

TOB

trust.

UB

Underlying

bond

of

an

inverse

floating

rate

trust

reflected

as

a

financing

transaction.

Inverse

floating

rate

trust

is

a

Recourse

Trust

unless

otherwise

noted.

WI/DD

When-issued

or

delayed

delivery

security.

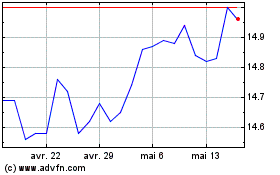

Nuveen Taxable Municipal... (NYSE:NBB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Nuveen Taxable Municipal... (NYSE:NBB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024