- Third quarter 2024 revenue of $1.582 billion, up 4% as-reported

and up 5% at constant currency

- Third quarter 2024 diluted earnings per share of $1.38 and

non-GAAP Adjusted diluted earnings per share of $0.87; both

reported and non-GAAP Adjusted diluted earnings per share include

$51 million of expense, or $0.16 per share, for acquired in-process

research and development (IPR&D) and milestones

- Third quarter 2024 net income of $359 million and Adjusted

EBITDA (non-GAAP) of $459 million

- Guidance range for full year 2024 revenue narrowed to $6.375

billion to $6.425 billion, mid-point of the range raised by $50

million; Guidance range for Adjusted EBITDA margin (non-GAAP)

revised to 30.0% to 31.0%, inclusive of the $51 million of

IPR&D expense incurred in the third quarter

Organon (NYSE: OGN) today announced its results for the third

quarter ended September 30, 2024.

"In 2024 our commercial execution has been very strong. Our

largest product, Nexplanon, is well positioned to deliver $1

billion of revenue next year and we've added other notable growth

drivers with Emgality and most recently, VTAMA," said Kevin Ali,

Organon's Chief Executive Officer. "Further, we have been extremely

disciplined on operating costs and driving Adjusted EBITDA growth

in support of achieving $1 billion of free cash flow before

one-time costs for full year 2024."

Third Quarter 2024

Revenue

in $ millions

Q3 2024

Q3 2023

VPY

VPY ex-FX

Women’s Health

$

440

$

418

5%

6%

Biosimilars

165

142

16%

17%

Established Brands

951

935

2%

3%

Other (1)

26

24

4%

7%

Revenues

$

1,582

$

1,519

4%

5%

Totals may not foot due to rounding and

percentages are computed using unrounded amounts.

(1) Other includes manufacturing sales to

third parties.

For the third quarter of 2024, total revenue was $1.582 billion,

up 4% as-reported and up 5% excluding the impact of foreign

currency (ex-FX).

Women's Health revenue increased 5% as-reported and 6% ex-FX in

the third quarter of 2024 compared with the third quarter of 2023

primarily driven by 11% ex-FX growth in Nexplanon® (etonogestrel

implant). Nexplanon's strong performance was primarily due to

increased demand, favorable price and discount rates in the United

States and increased demand in international markets, partially

offset by the timing of tenders in Latin America. The company's

fertility portfolio grew 14% ex-FX as a result of increased demand

in the United States, and to a lesser extent, launches in various

international markets, partially offset by unfavorable discount

rates in the United States.

Performance in the Women's Health franchise was partially offset

by sales of NuvaRing® (etonogestrel / ethinyl estradiol vaginal

ring), a vaginal contraceptive product, which declined 45% ex-FX

during the period due to ongoing generic competition and the

negative impact of increased government discount rates in the

United States.

Biosimilars revenue grew 16% as-reported basis and 17% ex-FX in

the third quarter of 2024, compared with the third quarter of 2023,

primarily due to the uptake of Hadlima® (adalimumab-bwwd) since its

July 2023 launch in the U.S. Sales of Renflexis® (infliximab-abda)

increased 4% ex-FX in the third quarter primarily due to continued

demand growth in the U.S. and Canada partially offset by

unfavorable discount rates in the U.S. Sales of Ontruzant®

(trastuzumab-dttb) declined 49% ex-FX in the period due to the

timing of tenders in Brazil and lower demand in the U.S. and

Europe.

Established Brands revenue grew 2% as-reported 3% ex-FX in the

third quarter of 2024. Contribution from the recent licensing of

Emgality® (galcanezumab-gnlm)(1), growth in China and recovery in

injectable steroids were the strongest drivers of third quarter's

9% volume growth which more than offset unfavorable pricing in

Japan. The company expects revenue growth in the Established Brands

franchise to be approximately flat for full year 2024 on an ex-FX

basis.

(1) Emgality is a trademark registered in the United States in

the name of Eli Lilly and Company (used under license).

Third Quarter 2024

Profitability

in $ millions, except per share

amounts

Q3 2024

Q3 2023

VPY

Revenues

$

1,582

$

1,519

4%

Cost of sales

659

612

8%

Gross profit

923

907

2%

Non-GAAP Adjusted gross profit (1)

976

951

3%

Net income

359

58

519%

Non-GAAP Adjusted net income (1)

226

223

1%

Diluted Earnings per Share (EPS)

1.38

0.23

500%

Non-GAAP Adjusted diluted EPS (1)

0.87

0.87

—%

Acquired IPR&D and milestones

51

—

NM

Per share impact to diluted EPS from

acquired IPR&D and milestones

(0.16

)

—

NM

Adjusted EBITDA (Non-GAAP) (1,2)

459

447

3%

Q3 2024

Q3 2023

Gross margin

58.3

%

59.7

%

Non-GAAP Adjusted gross margin (1)

61.7

%

62.6

%

Adjusted EBITDA margin (Non-GAAP) (1,

2)

29.0

%

29.4

%

(1)

See Tables 4 and 5 for

reconciliations of GAAP to non-GAAP financial measures.

(2)

Adjusted EBITDA and Adjusted

EBITDA margin included $51 million in the third quarter of 2024

related to Acquired IPR&D and milestones. There was no Acquired

IPR&D in the third quarter of 2023.

Gross margin was 58.3% as-reported and 61.7% on a non-GAAP

adjusted basis in the third quarter of 2024 compared with 59.7%

as-reported and 62.6% on a non-GAAP adjusted basis in the third

quarter of 2023. The lower Adjusted gross margin was primarily

related to unfavorable product mix and price.

Net income for the third quarter of 2024 was $359 million, or

$1.38 per diluted share, compared with $58 million, or $0.23 per

diluted share, in the third quarter of 2023. Non-GAAP Adjusted net

income was $226 million, or $0.87 per diluted share, compared with

$223 million, or $0.87 per diluted share, in 2023. GAAP net income

benefited from the release of a valuation allowance in the amount

of $210 million against a tax asset of one of the company's Swiss

entities.

Non-GAAP Adjusted EBITDA margin was 29.0% in the third quarter

of 2024 compared with 29.4% in the third quarter of 2023 primarily

due to $51 million of IPR&D expense in the third quarter of

2024 compared with no such expense in the prior year period.

Selling, general and administrative and research and development

expenses were down 5% year over year as a result of the company's

cost containment efforts including lower clinical spend and a

reduction in headcount related to restructuring initiatives and

lower cost associated with the implementation of the company's ERP

system.

Capital Allocation

Today, Organon’s Board of Directors declared a quarterly

dividend of $0.28 for each issued and outstanding share of the

company's common stock. The dividend is payable on December 12,

2024, to stockholders of record at the close of business on

November 12, 2024.

As of September 30, 2024, cash and cash equivalents were $763

million, and debt was $8.7 billion.

Full Year Guidance

Organon does not provide GAAP financial measures on a

forward-looking basis because the company cannot predict with

reasonable certainty and without unreasonable effort, the ultimate

outcome of legal proceedings, unusual gains and losses, the

occurrence of matters creating GAAP tax impacts, and

acquisition-related expenses. These items are uncertain, depend on

various factors, and could be material to Organon’s results

computed in accordance with GAAP.

Full year 2024 financial guidance is presented below on a

non-GAAP basis, except revenue.

Previous guidance as

of

August 6, 2024

Current guidance

Revenues

$6.250 B - $6.450 B

$6.375 B - $6.425 B

Adjusted gross margin

61.0% - 63.0%

~61.5%

SG&A

$1.50 B - $1.70 B

$1.55B - $1.60B

R&D

$400M - $500M

$430M - $470M

IPR&D

$30M

$81M*

Total R&D

$430M - $530M

$510M - $550M

Adjusted EBITDA margin (Non-GAAP)

31.0% - 33.0%

30.0% - 31.0%

Interest

~$520M

Unchanged

Depreciation

~$130M

Unchanged

Effective non-GAAP tax rate

18.5% - 20.5%

Unchanged

Fully diluted weighted average shares

outstanding

~259M

Unchanged

*Updated R&D expense guidance includes $51 million of

IPR&D and milestone expense incurred in the quarter ended

September 30, 2024. R&D guidance does not take into

consideration a forward-looking view of IPR&D and milestone

expense.

Webcast Information

Organon will host a conference call at 8:30 a.m. Eastern Time

today to discuss its third quarter 2024 financial results. To

listen to the event and view the presentation slides via webcast,

join from the Organon Investor Relations website at

https://www.organon.com/investor-relations/events-and-presentations/.

A replay of the webcast will be available approximately two hours

after the conclusion of the live event on the company’s website.

Institutional investors and analysts interested in participating in

the call must register in advance by clicking on this link:

https://registrations.events/direct/Q4I58511172

Following registration, participants will receive a confirmation

email containing details on how to join the conference call,

including dial-in information and a unique passcode and registrant

ID. Pre-registration will allow participants to bypass an operator

and be placed directly into the call.

About Organon

Organon is an independent global healthcare company with a

mission to help improve the health of women throughout their lives.

Organon’s diverse portfolio offers more than 60 medicines and

products in women’s health, biosimilars, and a large franchise of

established medicines across a range of therapeutic areas. In

addition to Organon’s current products, the company invests in

innovative solutions and research to drive future growth

opportunities in women’s health and biosimilars. In addition,

Organon is pursuing opportunities to collaborate with

biopharmaceutical partners and innovators looking to commercialize

their products by leveraging its scale and agile presence in fast

growing international markets.

Organon has geographic scope with significant reach, world-class

commercial capabilities, and approximately 10,000 employees with

headquarters located in Jersey City, New Jersey.

For more information, visit http://www.organon.com and connect

with us on LinkedIn, Instagram, X (formerly known as Twitter) and

Facebook.

Cautionary Note Regarding Non-GAAP

Financial Measures

This press release contains “non-GAAP financial measures,” which

are financial measures that either exclude or include amounts that

are correspondingly not excluded or included in the most directly

comparable measures calculated and presented in accordance with

U.S. generally accepted accounting principles (“GAAP”).

Specifically, the company makes use of the non-GAAP financial

measures Adjusted EBITDA, Adjusted EBITDA margin, Adjusted gross

margin, Adjusted gross profit, Adjusted net income, and Adjusted

diluted EPS, which are not recognized terms under GAAP and are

presented only as a supplement to the company’s GAAP financial

statements. This press release also provides certain measures that

exclude the impact of foreign exchange. We calculate foreign

exchange by converting our current-period local currency financial

results using the prior period average currency rates and comparing

these adjusted amounts to our current-period results. The company

believes that these non-GAAP financial measures help to enhance an

understanding of the company’s financial performance. However, the

presentation of these measures has limitations as an analytical

tool and should not be considered in isolation, or as a substitute

for the company’s results as reported under GAAP. Because not all

companies use identical calculations, the presentations of these

non-GAAP measures may not be comparable to other similarly titled

measures of other companies. Please refer to Table 4 and Table 5 of

this press release for additional information, including relevant

definitions and reconciliations of non-GAAP financial measures

contained herein to the most directly comparable GAAP measures.

In addition, the company’s full-year 2024 guidance measures

(other than revenue) are provided on a non-GAAP basis because the

company is unable to reasonably predict certain items contained in

the GAAP measures. Such items include, but are not limited to,

acquisition related expenses, restructuring and related expenses,

stock-based compensation, the ultimate outcome of legal

proceedings, unusual gains and losses, the occurrence of matters

creating GAAP tax impacts and other items not reflective of the

company's ongoing operations.

The company’s management uses the non-GAAP financial measures

described above to evaluate the company’s performance and to guide

operational and financial decision making. Further, the company’s

management believes that these non-GAAP financial measures, which

exclude certain items, help to enhance its ability to meaningfully

communicate its underlying business performance, financial

condition and results of operations.

Cautionary Note Regarding

Forward-Looking Statements

Except for historical information, this press release includes

“forward-looking statements” within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995, including, but not limited to, statements about management’s

expectations about Organon’s future financial performance and

prospects, including full-year 2024 guidance estimates and

predictions regarding other financial information and metrics, and

franchise and product performance and strategy expectations for

future periods. Forward-looking statements may be identified by

words such as “will,” “pursuing,” “expects,” “intends,” “plans,”

“believes,” “seeks,” “estimates,” “will” or words of similar

meaning. These statements are based upon the current beliefs and

expectations of the company’s management and are subject to

significant risks and uncertainties. If underlying assumptions

prove inaccurate or risks or uncertainties materialize, actual

results may differ materially from those set forth in the

forward-looking statements.

Risks and uncertainties include, but are not limited to, pricing

pressures globally, including rules and practices of managed care

groups, judicial decisions and governmental laws and regulations

related to Medicare, Medicaid and health care reform,

pharmaceutical reimbursement and pricing in general; an inability

to fully execute on our product development and commercialization

plans in the United States, Europe, and elsewhere internationally;

an inability to adapt to the industry-wide trend toward highly

discounted channels; difficulties implementing or executing on

Organon’s acquisition strategy, difficulties integrating such

acquisitions (including its recent acquisition of Dermavant

Sciences Ltd.) or any other failure to recognize the benefits of

such acquisitions; changes in tax laws or other tax guidance which

could adversely affect our cash tax liability, effective tax rates,

and results of operations and lead to greater audit scrutiny;

expanded brand and class competition in the markets in which the

company operates; global tensions, which may result in disruptions

in the broader global economic environment; governmental

initiatives that adversely impact our marketing activities,

particularly in China; volatility in our stock price; political and

social pressures, or regulatory developments, that adversely impact

demand for, availability of, or patient access to contraception or

fertility products; recent Supreme Court decisions and other

developments impacting regulatory agencies and their rule making,

including related financial market reactions, tax planning and

international trade practices; difficulties with performance of

third parties we rely on for our business growth; the failure of

any supplier to provide substances, materials, or services as

agreed; the increased cost of supply, manufacturing, packaging, and

operations; difficulties developing and sustaining relationships

with commercial counterparties; competition from generic products

as our products lose patent protection; any failure by us to obtain

an additional period of market exclusivity in the United States for

Nexplanon subsequent to the expiration of certain current patents

in 2027; the impact of the 2024 United States presidential election

and any resulting public policy changes affecting women and their

health care decisions, including changes in financial outcomes

resulting from candidate positions on healthcare topics and the

possible impact on related laws, regulations and policies following

the election; the impact of higher selling and promotional costs;

and the impact of cyberattacks or other events that may affect

Organon’s information technology systems or those of third

parties.

The company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise. Additional factors that could cause

results to differ materially from those described in the

forward-looking statements can be found in the company’s filings

with the Securities and Exchange Commission ("SEC"), including the

company’s most recent Annual Report on Form 10-K and subsequent SEC

filings, available at the SEC’s Internet site (www.sec.gov).

TABLE 1

Organon & Co.

Condensed Consolidated

Statement of Income

(Unaudited, $ in millions except

shares in thousands and per share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues

$

1,582

$

1,519

$

4,811

$

4,665

Cost of sales

659

612

1,992

1,832

Gross Profit

923

907

2,819

2,833

Selling, general and administrative

422

538

1,290

1,424

Research and development

111

137

339

394

Acquired in-process research and

development and milestones

51

—

81

8

Restructuring costs

—

—

23

4

Interest expense

126

134

388

398

Exchange losses

6

14

11

25

Other expense, net

—

4

9

11

Income before income taxes

207

80

678

569

Tax (benefit) expense

(152

)

22

(77

)

92

Net income

$

359

$

58

$

755

$

477

Earnings per share:

Basic

$

1.39

$

0.23

$

2.94

$

1.87

Diluted

$

1.38

$

0.23

$

2.92

$

1.86

Weighted average shares outstanding:

Basic

257,498

255,588

256,830

255,112

Diluted

259,757

256,349

258,908

256,162

TABLE 2

Organon & Co.

Sales by top products

(Unaudited, $ in millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

U.S.

Int’l

Total

U.S.

Int’l

Total

U.S.

Int’l

Total

U.S.

Int’l

Total

Women’s Health

Nexplanon/Implanon NXT

$

172

$

70

$

243

$

146

$

74

$

220

$

497

$

207

$

704

$

418

$

181

$

599

Follistim AQ

26

37

63

22

32

54

59

113

171

74

105

179

NuvaRing (1)

7

17

23

23

20

43

33

57

90

70

67

137

Ganirelix Acetate Injection

5

20

26

4

21

25

16

65

82

15

74

88

Marvelon/Mercilon

—

29

29

—

30

30

—

103

103

—

97

97

Jada

15

—

16

12

—

13

42

1

43

30

—

31

Other Women’s Health (1) (2)

14

28

40

11

22

33

41

78

119

32

74

106

Biosimilars

Renflexis

56

16

72

57

12

69

167

43

210

172

29

201

Ontruzant

5

15

20

11

28

40

23

84

107

36

57

93

Brenzys

—

27

27

—

13

13

—

63

63

—

45

45

Aybintio

—

7

7

—

12

12

—

22

22

—

34

34

Hadlima

29

11

40

2

6

8

71

27

98

2

18

20

Established Brands

Cardiovascular

Zetia (1)

2

80

81

2

68

69

5

235

240

5

248

253

Vytorin

1

25

26

2

31

33

4

78

82

5

95

100

Atozet

—

125

125

—

126

126

—

396

396

—

397

397

Rosuzet

—

11

11

—

17

17

—

36

36

—

52

52

Cozaar/Hyzaar

2

57

59

3

65

68

7

179

186

8

217

225

Other Cardiovascular (1) (2)

—

27

29

1

39

41

2

97

99

2

110

112

Respiratory

Singulair

2

83

85

3

88

91

7

268

275

8

282

290

Nasonex (1)

—

63

63

—

60

60

—

200

200

—

197

197

Dulera

38

10

48

40

9

49

120

31

151

116

28

144

Clarinex

1

26

27

2

26

28

2

97

100

4

103

107

Other Respiratory (1) (2)

11

3

14

17

3

20

26

10

35

42

10

52

Non-Opioid Pain, Bone and Dermatology

Arcoxia

—

69

69

—

64

64

—

211

211

—

207

207

Fosamax

1

37

38

1

40

41

3

109

112

2

121

123

Diprospan

—

37

37

—

31

31

—

102

102

—

58

58

Other Non-Opioid Pain, Bone and

Dermatology (2)

5

69

74

4

70

74

15

212

227

11

196

207

Other

Emgality/Rayvow

—

29

29

—

—

—

—

69

69

—

—

—

Proscar

—

23

23

—

25

25

1

72

73

1

76

77

Propecia

2

27

28

2

21

22

5

74

79

5

86

92

Other (2)

3

80

84

5

72

76

12

229

241

10

231

240

Other (3)

1

26

26

—

24

24

(2

)

87

85

(1

)

103

102

Revenues

$

398

$

1,184

$

1,582

$

370

$

1,149

$

1,519

$

1,156

$

3,655

$

4,811

$

1,067

$

3,598

$

4,665

Totals may not foot due to rounding.

Trademarks appearing above in italics are trademarks of, or are

used under license by, the Organon group of companies.

(1) Sales of the authorized generic versions of

NuvaRing,

Zetia and

Nasonex were previously included in other and

have been reclassified to their respective brand name product.

(2) Includes sales of products not listed

separately.

(3) Includes manufacturing sales to third

parties.

TABLE 3

Organon & Co.

Sales by geographic

area

(Unaudited, $ in millions)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Europe and Canada

$

436

$

392

$

1,343

$

1,259

United States

398

370

1,156

1,067

Asia Pacific and Japan

260

284

806

869

China

212

202

634

661

Latin America, Middle East, Russia, and

Africa

243

239

768

687

Other (1)

33

32

104

122

Revenues

$

1,582

$

1,519

$

4,811

$

4,665

(1) Primarily reflects manufacturing sales

to third parties.

TABLE 4

Organon & Co.

Reconciliation of GAAP

Reported to Non-GAAP Adjusted Metrics

(Unaudited, $ in millions)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Gross Profit

$

923

$

907

$

2,819

$

2,833

Adjusted for:

Spin-related costs (1)

—

10

6

30

Manufacturing network costs (2)

14

—

39

—

Stock-based compensation

4

5

13

13

Amortization

35

29

102

88

Other

—

—

—

2

Adjusted Non-GAAP Gross Profit

$

976

$

951

$

2,979

$

2,966

(1) Spin-related costs include costs from

the separation of Merck & Co., Inc., Rahway, NJ, US. For

additional details refer to Table 5.

(2) Manufacturing network related costs

include costs from exiting manufacturing and supply agreements with

Merck & Co., Inc., Rahway NJ, US. For additional details refer

to Table 5.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Gross Margin

58.3

%

59.7

%

58.6

%

60.7

%

Total impact of Non-GAAP adjustments

3.4

%

2.9

%

3.3

%

2.9

%

Adjusted Non-GAAP Gross Margin

61.7

%

62.6

%

61.9

%

63.6

%

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Selling, general and

administrative expenses

$

422

$

538

$

1,290

$

1,424

Adjusted for:

Spin-related costs (1)

(10

)

(41

)

(79

)

(131

)

Stock-based compensation

(17

)

(18

)

(53

)

(50

)

Other

(4

)

(87

)

(4

)

(88

)

Adjusted Non-GAAP Selling, general and

administrative expenses

$

391

$

392

$

1,154

$

1,155

(1) Spin-related costs include costs from

the separation of Merck & Co., Inc., Rahway, NJ, US. For

additional details refer to Table 5.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Research and development

expenses

$

111

$

137

$

339

$

394

Adjusted for:

Spin-related costs (1)

(2

)

(4

)

(5

)

(10

)

Stock-based compensation

(4

)

(4

)

(13

)

(11

)

Adjusted Non-GAAP Research and development

expenses

$

105

$

129

$

321

$

373

(1) Spin-related costs include costs from

the separation of Merck & Co., Inc., Rahway, NJ, US. For

additional details refer to Table 5.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Reported Net Income

$

359

$

58

$

755

$

477

Adjusted for:

Cost of sales adjustments

53

44

160

133

Selling, general and administrative

adjustments

31

146

136

269

Research and development adjustments

6

8

18

21

Restructuring

—

—

23

4

Other expense, net

4

3

14

13

Tax impact on adjustments above(1)

(227

)

(36

)

(276

)

(82

)

Non-GAAP Adjusted Net Income

$

226

$

223

$

830

$

835

(1) For the three months ended September

30, 2024 and 2023, the GAAP income tax rates were (73.7)% and

27.0%, respectively, the non-GAAP income tax rates were 24.7% and

20.8%, respectively. For the nine months ended September 30, 2024

and 2023, the GAAP income tax rates were (11.3)% and 16.1%,

respectively, the non-GAAP income tax rates were 19.3% and 17.3%,

respectively. These adjustments represent the estimated tax impacts

on the reconciling items by applying the statutory rate and

applicable law of the originating territory of the non-GAAP

adjustments.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Diluted Earnings per Share

$

1.38

$

0.23

$

2.92

$

1.86

Total impact of Non-GAAP adjustments

$

(0.51

)

$

0.64

$

0.29

$

1.40

Non-GAAP Diluted Earnings per Share

$

0.87

$

0.87

$

3.21

$

3.26

TABLE 5

Organon & Co.

Reconciliation of GAAP Net

Income to Non-GAAP Adjusted EBITDA

(Unaudited, $ in millions)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net income

$

359

$

58

$

755

$

477

Depreciation (1)

32

32

93

88

Amortization

35

29

102

88

Interest expense

126

134

388

398

Tax (benefit) expense

(152

)

22

(77

)

92

EBITDA

$

400

$

275

$

1,261

$

1,143

Restructuring costs

—

—

23

4

Spin-related costs (2)

16

58

104

184

Manufacturing network related (3)

14

—

39

—

Other costs (4)

4

87

4

90

Stock-based compensation

25

27

79

74

Adjusted EBITDA (Non-GAAP)

$

459

$

447

$

1,510

$

1,495

Adjusted EBITDA margin (Non-GAAP)

29.0

%

29.4

%

31.4

%

32.0

%

(1) Excludes accelerated depreciation

included in one-time costs.

(2) Spin-related costs reflect certain

costs incurred in connection with activities taken to separate

Organon from Merck & Co., Inc., Rahway, NJ, US. These costs

include, but are not limited to, $7 million and $32 million for the

three months ended September 30, 2024 and 2023, respectively, and

$47 million and $100 million for the nine months ended September

30, 2024 and 2023, respectively, for information technology

infrastructure, primarily related to the implementation of a

stand-alone enterprise resource planning system and redundant

software licensing costs, as well as $6 million for the three

months ended September 30, 2023 and $20 million and $20 million for

the nine months ended September 30, 2024 and 2023, respectively,

associated with temporary transition service agreements with Merck

& Co., Inc., Rahway, NJ, US.

(3) Manufacturing network related costs,

including exiting of temporary manufacturing and supply agreements

with Merck & Co., Inc., Rahway, NJ, US, reflect accelerated

depreciation, exit premiums, technology transfer costs, stability

and qualification batch costs, and third-party contractor

costs.

(4) Other costs for the three and nine

months ended September 30, 2024 and 2023, respectively, include $4

million related to transaction costs associated with the Dermavant

transaction incurred in 2024 and $80 million related to the

Microspherix legal matter incurred in 2023.

As the costs described in (1) through (4)

above are directly related to the separation of Organon and

therefore arise from a one-time event outside of the ordinary

course of the company’s operations, the adjustment of these items

provides meaningful, supplemental, information that the company

believes will enhance an investor's understanding of the company's

ongoing operating performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031897698/en/

Media Contacts:

Karissa Peer (614) 314-8094 Kate Vossen (732) 675-8448

Investor Contacts:

Jennifer Halchak (201) 275-2711 Renee McKnight (551)

204-6129

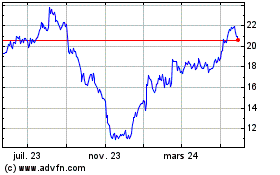

Organon (NYSE:OGN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

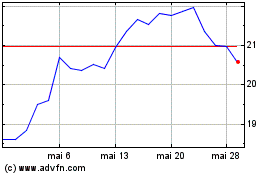

Organon (NYSE:OGN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025